|

报告导航:研究报告—

制造业—汽车

|

|

2017-2022年全球及中国T-box行业研究报告 |

|

字数:2.7万 |

页数:122 |

图表数:133 |

|

中文电子版:12000元 |

中文纸版:6000元 |

中文(电子+纸)版:12500元 |

|

英文电子版:2800美元 |

英文纸版:3000美元 |

英文(电子+纸)版:3100美元 |

|

编号:LT039

|

发布日期:2017-11 |

附件:无 |

|

|

|

T-box是基于车规级对可靠性、工作温度、抗干扰等方面的严格要求,通过4G远程无线通讯、GPS卫星定位、加速度传感和CAN通讯功能,实现车辆远程监控、远程控制、安全监测和报警、远程诊断等多种在线应用的车联网标准终端。

车联网硬件的安装方式分为前装和后装,前装车联网主要以TCU 技术为主导,而后装车联网大部分通过OBD 接口联接衍生设备的方式实现。从目前来看,虽然OBD系统普及率高,但车企私有协议难破解,OBD后装设备数据获取能力依然有限。

随着车联网的逐步渗透,以及新能源汽车企业对车辆电池和整车状态信息的实时需求,全球T-box市场在2020年将达到38亿美元的市场规模,年复合增长率约27%。互联网行业的进入也将带动该市场增长。

2016年全球整体IC市场规模约3094亿美元,汽车IC市场份额占比7.4%,2017年市场规模同比上升22.4%到达280亿美元;主要原因是汽车IC的成本以及价格逐步降低,尤其是MCU、模拟元件以及特殊应用逻辑元件等。

在汽车电子系统中,车载电子产品市场份额逐年攀升,挤占了动力控制电子系统所占份额。普通汽车的汽车电子系统在整车成本中占比不超过30%,而新兴的新能源汽车的汽车电子系统成本占整车成本超过50%,纯电动汽车更是超过60%。根据总体规划,2016-2020年中国新能源汽车销量年均增长率有望达到46%,将是带动国内汽车电子市场发展的强劲动力,到2020年中国汽车电子市场规模将到达8720亿元左右。

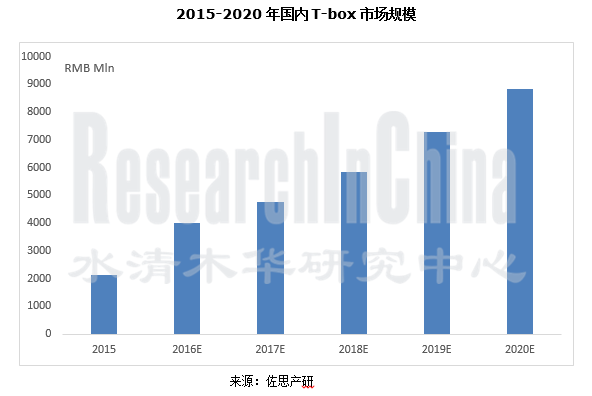

根据工信部《新能源汽车生产企业及产品准入管理规定》,自2017年1月1日起对新生产的全部新能源汽车安装车载控制单元,新能源汽车的TBOX前装率将得到大幅度提升。新能源和中高档汽车将率先拉动前装T-BOX市场。从目前来看,车联网嵌入式平台系统终端单价约950元,随着前装终端的量产和市场竞争的加剧,T-BOX的成本和价格有望逐步下降。2016年,前装车联网设备渗透率约15%,预计2020年将达到36%, T-BOX仅终端市场规模达88亿元。

国内主流T-box企业有华为、慧翰微电子、速锐得等,但目前主要竞争还是来自国外企业,如Bosch、Continental、Harman以及Denso、 LG 等日韩企业。国内自主品牌汽车企业寻求与汽车电子公司合作开发T-box产品,以最低的成本迅速获取市场竞争力,占据有利地位,如长安汽车、广汽传祺等。

水清木华研究中心《2017-2022年全球及中国T-box行业研究报告》着重研究了以下内容:

全球及中国T-box市场规模、份额以及发展趋势,T-box未来技术路线; 全球及中国T-box市场规模、份额以及发展趋势,T-box未来技术路线;

全球各国家和地区的T-box厂商以及应用情况对比分析; 全球各国家和地区的T-box厂商以及应用情况对比分析;

T-box上游产业链:汽车IC和汽车传感器市场的分析; T-box上游产业链:汽车IC和汽车传感器市场的分析;

国内汽车电子市场的发展情况分析; 国内汽车电子市场的发展情况分析;

国内T-box市场环境以及政策环境等方面分析; 国内T-box市场环境以及政策环境等方面分析;

国外6大主要T-box品牌以及4家T-box相关生产厂商的技术方案、T-box业务情况等; 国外6大主要T-box品牌以及4家T-box相关生产厂商的技术方案、T-box业务情况等;

中国12家T-box厂商经营、技术、发展规划及车型配套。 中国12家T-box厂商经营、技术、发展规划及车型配套。

T-box is a connected-car-standard terminal that meets stringent car-grade requirements on reliability, working temperature and anti-interference and delivers multiple online applications including vehicle remote monitoring, remote control, safety monitoring & warning and remote diagnosis via 4G remote wireless communication, GPS satellite positioning, acceleration sensing and CAN communication.

Connected car hardware is in general installed in the OEM market (dominated by TCU technology) and the aftermarket (mostly via OBD port + derivative device). For now, despite high penetration of OBD system, the proprietary protocol of carmakers is hard to be cracked, limiting the capability of aftermarket OBD devices to acquire data.

As connected car gradually penetrates and new energy vehicle manufacturers have to know real-time state of battery and the vehicle, global T-box market size will reach USD3.8 billion in 2020, representing a CAGR of roughly 27%. The entry of the internet giants will drive the growth of such market as well.

Global IC market size was about USD309.4 billion in 2016, 7.4% of which was constituted by automotive IC market. The world’s automotive IC market ballooned by 22.4% to USD28 billion in 2017, largely due to reduced cost and price of automotive IC, particularly MCU, analog components and special purpose logic.

Among automotive electronic systems, in-vehicle electronics sees a rising share year after year, squeezing the portion of power-control electronic systems. Automotive electronic systems make up no more than 30% of the cost of a conventional car, compared with over 50% for a new energy vehicle and even above 60% for a battery electric vehicle. According to overall planning, new energy vehicle sales in China will show an AAGR of 46% between 2016 and 2020, a strong driver for the development of Chinese automotive electronics market which will register around RMB872 billion in 2020.

According to the Regulations on Access of New Energy Vehicle Manufacturers and Products issued by the Ministry of Industry and Information Technology (MIIT), all new energy vehicles produced from Jan 1, 2017 on must carry vehicle control unit, greatly boosting pre-installation of T-BOX on new energy vehicles. New energy vehicles and mid- and high-end cars will first stimulate OEM T-BOX market. Currently, the terminal of connected car embedded platform system costs about RMB950 per unit. As more OEM terminals are mass-produced and market competition pricks up, the cost and price of T-BOX are anticipated to decline. The penetration of OEM connected-car devices was 15% or so in 2016 and is expected to reach 36% in 2020 when T-BOX terminal market size will be RMB8.8 billion.

Major Chinese T-box firms are Huawei Technologies, Flaircomm Microelectronics and Shenzhen Thread Tech which face rivalry mainly from foreign players including Bosch, Continental, Harman, Denso and LG. Homegrown brand carmakers, like Chang’an Automobile and Trumpchi, seek to co-develop T-box products with automotive electronics companies with the aim of rapidly gaining market competitiveness and a good position at the least cost.

Global and China Telematics Box (T-box) Industry Report, 2017-2022 highlights the followings:

Global and Chinese T-box market size, share and development trends, and future technical routes for T-box; Global and Chinese T-box market size, share and development trends, and future technical routes for T-box;

Comparative analysis of T-box makers and applications in countries/regions worldwide; Comparative analysis of T-box makers and applications in countries/regions worldwide;

Global T-box companies and comparison of applications; Global T-box companies and comparison of applications;

Upstream industry chain of T-box: automotive IC and automotive sensor markets; Upstream industry chain of T-box: automotive IC and automotive sensor markets;

Development of automotive electronics market in China; Development of automotive electronics market in China;

T-box market environment, policy climate, etc. in China; T-box market environment, policy climate, etc. in China;

Six major foreign T-box brands and four T-box-related manufacturers (technical solutions, T-box business, etc.); Six major foreign T-box brands and four T-box-related manufacturers (technical solutions, T-box business, etc.);

12 Chinese T-box manufacturers (operation, technology, development planning) as well as their support for vehicle models. 12 Chinese T-box manufacturers (operation, technology, development planning) as well as their support for vehicle models.

第一章 T-BOX概述

1.1 T-BOX定义

1.2 分类

1.3 工作原理

1.4 组成结构

1.5 功能

1.6 用途

第二章 全球T-box行业

2.1 全球T-box市场

2.1.1 市场规模

2.1.2 市场份额

2.1.3 发展趋势

2.2 全球主要地区T-box发展情况

2.2.1 北美洲

2.2.2 欧洲

2.2.3 亚太地区

2.3 上游产业链

2.3.1 汽车IC

2.3.2 汽车传感器

2.4 国外主要T-box品牌

2.4.1 On-Star

2.4.2 ATX

2.4.3 G-BOOK

2.4.4 Carwings

2.4.5 Bluelink

2.4.6 Sensus

第三章 国外T-BOX企业

3.1 Telit

3.1.1 公司简介

3.1.2 T-box芯片方案及规格

3.1.3 T-box模块研发团队人数

3.1.4 T-box模块研发团队所在城市

3.2 Sierra

3.2.1 公司简介

3.2.2 T-box芯片方案及规格

3.2.3 T-box模块研发团队所在城市

3.3 U-blox

3.3.1 公司简介

3.3.2 T-box芯片方案及规格

3.3.3 T-box模块研发团队所在城市

3.3.4 T-box模块销售收入

3.3.5 T-box模块未来Roadmap

3.4 Harman

3.4.1 公司简介

3.4.2 T-box业务

第四章 国内T-box行业

4.1 国内汽车电子发展情况

4.2 国内T-box发展情况

4.2.1 市场规模

4.2.2 市场环境

4.2.3 用户环境

4.2.4 政策环境

第五章 国内T-BOX企业

5.1 华为技术有限公司

5.1.1 公司简介

5.1.2 运营情况

5.1.3 T-box业务

5.2深圳市中兴物联科技有限公司

5.2.1 T-box芯片方案及规格

5.2.2 T-box模块研发团队人数

5.2.3 T-box模块研发团队所在城市

5.2.4 T-box模块销售收入

5.3 速锐得

5.3.1 公司简介

5.3.2 产品

5.3.3 T-box业务

5.3.4 配套客户

5.4 福建慧翰微电子有限公司

5.4.1 公司简介

5.4.2 经营情况

5.4.3 T-box业务

5.4.4 配套客户

5.4.5 核心竞争力

5.5 雅讯网络

5.5.1 公司简介

5.5.2 产品

5.6 广联赛讯

5.6.1 公司简介

5.6.2 产品

5.6.3 T-box配套车型

5.7 飞驰镁物

5.7.1 公司介绍

5.7.2 业务分布

5.7.3 合作伙伴

5.7.4 产品

5.8 博泰集团

5.8.1 公司简介

5.8.2 T-box业务

5.8.3 配套车型

5.9 广州汽车集团股份有限公司

5.9.1 公司简介

5.9.2 运营情况

5.9.3 产能

5.9.4 T-box业务

5.9.5 配套车型

5.10 东软集团股份有限公司

5.10.1 公司简介

5.10.2 运营情况

5.10.3 T-box业务

5.10.4 竞争优势

5.11 INTEST

5.11.1 公司简介

5.11.2 业务分布

5.11.3 T-box业务

5.12 江苏天安智联科技股份有限公司

5.12.1 公司简介

5.12.2 运营情况

1 Overview of T-box

1.1 Definition

1.2 Classification

1.3 Working Principle

1.4 Composition

1.5 Function

1.6 Application

2 Global T-box Industry

2.1 Global T-box Market

2.1.1 Market Size

2.1.2 Market Share

2.1.3 Development Trend

2.2 T-box Development in Major Regions Worldwide

2.2.1 North America

2.2.2 Europe

2.2.3 Asia-Pacific

2.3 Upstream Industry Chain

2.3.1 Automotive IC

2.3.2 Automotive Sensor

2.4 Major Foreign T-box Brands

2.4.1 On-Star

2.4.2 ATX

2.4.3 G-BOOK

2.4.4 Carwings

2.4.5 Bluelink

2.4.6 Sensus

3 Foreign T-box Companies

3.1 Telit

3.1.1 Profile

3.1.2 T-box Chip Solution and Specifications

3.1.3 T-box Module R&D Team Staffs

3.1.4 Cities where T-box Module R&D Teams are Located

3.2 Sierra

3.2.1 Profile

3.2.2 T-box Chip Solution and Specifications

3.2.3 Cities where T-box Module R&D Teams are Located

3.3 U-blox

3.3.1 Profile

3.3.2 T-box Chip Solution and Specifications

3.3.3 Cities where T-box Module R&D Teams are Located

3.3.4 T-box Module Sales

3.3.5 Future Roadmap of T-box Module

3.4 Harman

3.4.1 Profile

3.4.2 T-box Business

4 China T-box Industry

4.1 Development of Automotive Electronics in China

4.2 T-box Development in China

4.2.1 Market Size

4.2.2 Market Environment

4.2.3 User Environment

4.2.4 Policy Environment

5 Chinese T-box Companies

5.1 Huawei Technologies Co., Ltd.

5.1.1 Profile

5.1.2 Operation

5.1.3 T-box Business

5.2 ZTE Welink Technology Co., Ltd.

5.2.1 T-box Chip Solution and Specifications

5.2.2 T-box Module R&D Team Staffs

5.2.3 Cities where T-box Module R&D Teams are Located

5.2.4 T-box Module Sales

5.3 Shenzhen Thread Tech Co., Ltd.

5.3.1 Profile

5.3.2 Products

5.3.3 T-box Business

5.3.4 Clients

5.4 Flaircomm Microelectronics, Inc.

5.4.1 Profile

5.4.2 Operation

5.4.3 T-box Business

5.4.4 Clients

5.4.5 Core Competitiveness

5.5 Yaxon Network

5.5.1 Profile

5.5.2 Products

5.6 Shenzhen Autonet Co., Ltd.

5.6.1 Profile

5.6.2 Products

5.6.3 Vehicle Models Equipped with T-box

5.7 FutureMove Telematics Co., Ltd.

5.7.1 Profile

5.7.2 Business

5.7.3 Partners

5.7.4 Products

5.8 PATEO Corporation

5.8.1 Profile

5.8.2 T-box Business

5.8.3 Supported Vehicle Models

5.9 Guangzhou Automobile Group Co., Ltd (GAC)

5.9.1 Profile

5.9.2 Operation

5.9.3 Capacity

5.9.4 T-box Business

5.9.5 Supported Vehicle Models

5.10 Neusoft Corporation

5.10.1 Profile

5.10.2 Operation

5.10.3 T-box Business

5.10.4 Competitive Edge

5.11 Wuhan Intest Electronic Technology Co., Ltd. (INTEST)

5.11.1 Profile

5.11.2 Business

5.11.3 T-box Business

5.12 Jiangsu CAS-TIANAN Smart Science & Technology Co., Ltd.

5.12.1 Profile

5.12.2 Operation

报警服务功能表

云端服务功能表

远程控制功能表

信息反馈功能表

系统与自检

2015-2020年全球T-box市场规模

2010-2020年全球T-box(分地区)出货量

全球主要T-box厂商市场份额

全球主要T-box厂商客户配套

全球主要T-box市场对比分析

北美T-box使用区域

2010-2020年美国T-box销量预测

日本主要T-box品牌

韩国主要T-box厂商

IC Market Growth Rates by End-Use Application (2016-2021F CAGR)

2016-2019年全球IC市场占比

图:2014-2017年全球汽车IC市场规模

2016-2017年全球汽车IC(分产品)市场规模

Auto IC Market Growth Rates by Region (2016-2021F CAGR)

2016年全球主要汽车IC厂商排名

汽车传感器分类

汽车搭载传感器数量发展历程

2016-2022年全球汽车传感器市场规模

2017-2027年全球汽车传感器(雷达/图像传感)市场规模

2015-2020年中国车载毫米波雷达销量及市场规模

2015-2020年中国车载摄像头市场规模

Sensor Technology Roadmap and Autonomous Functions Associated

全球汽车传感器(分类型)主要供应商

2017年全球TOP20车用MEMS传感器供应商排名

On-star发展进程

安吉星手机操作界面

On-Star主要功能介绍

安吉星服务套餐包

安吉星配套厂商及车型

ATX针对汽车制造商的服务

ATX针对用户的服务

使用ATX服务的主要车型

G-BOOK系统构成

LEXUS G-BOOK智能副驾服务项目

雷克萨斯G-book手机操作界面

G-book主要服务功能介绍

支持G路径检索城市

G-book收费标准

雷克萨斯手机版G-book服务内容

G-book配套车型

Carwings智行+系统功能

日产CARWINGS系统主要参数

Carwings收费标准

Carwings配套车型

Bluelink主要功能

Bluelink收费标准

Bluelink付费方式

沃尔沃Sensus Connect 智能在线主要功能

沃尔沃On Call随车管家主要功能

STA8088TG Teseo Ⅱ Tracker规格

Key Features Of STA8088TG Teseo Ⅱ Tracker

MT3337规格

Key Features Of MT3337

高通QSC6270芯片方案

Key Features Of QSC6270

AirPrime AR系列解决方案

Qualcomm Gobi MDM9x15系列规格表

图:2014-2017年上半年U-blox营收

图:图:2014-2017年上半年U-blox分地区营收

2016年第一季度 Harman车联业务收入情况

汽车电子系统分布

2015年中国汽车电子应用结构

汽车电子在电动汽车成本中占比

1970-2020年汽车电子在整车(含传统/电动汽车)成本中占比

2008-2017年中国乘用电动汽车年产量

2015-2020年中国汽车电子市场规模测算

2015-2020年国内T-box市场规模

国内T-box厂商与整车企业合作情况

国内不同人群对T-box认知情况

四部委总则概要

2011-2015年 华为运营情况

图:2016年华为(分业务)销售收入

图:2016年华为(分地区)销售收入

图:中兴物联业务构成

图:2016年中兴物联收入结构

速锐得T-box发展历程

速锐得T-box平台功能

速锐得T-box技术路线

速锐得未来市场规划

速锐得E6 T-box新能源分时租赁支持车型

2012年-2016年慧翰微电子营业情况

V2.0系统T-box

慧翰微电子T-box发展路线

配套T-box的OEM汽车厂商

配套蓝牙/WiFi或T-box的汽车电子厂商

合作TSP的服务商

已合作的运营商

搭载V1.0系统车型

搭载V2.0系统车型

搭载V3.0系统车型

嘀嘀虎云导航功能

嘀嘀虎汽车云盒功能

嘀嘀虎汽车云盒参数

驾宝盒子基本参数

驾宝盒子功能

智能云镜功能

广联赛讯T-box配套车型

飞驰镁物、苏打网络阶段性任务

飞驰镁物核心业务

博泰集团架构

博泰集团主营业务板块

平台体系

图:博泰主机厂客户群

2011-2015年广汽集团运营情况

广汽集团现有产能(截止2017年6月)

广汽集团在建产能(截止2016年12月)

2016年广汽集团整车产销量

智慧传祺T-box功能

东软集团汽车电子业务发展历程

东软集团汽车电子人员全球分布情况

图:东软集团车联网整体解决方案

东软集团2015年运营情况

东软集团2016年主营业务构成

东软集团T-box功能

T-box手机APP界面

东软集团T-box生态系统

图:东软集团T-box产品线

东软汽车电子业务布局

英泰斯特业务发展历程

英泰斯特主营业务

测试与信息化业务

新能源信息化业务

T-box(无线)解决方案

Inbox方案架构

Inbox接口图

inBOX硬件功能

2013-2017H1 天安智联运营情况

2015年上半年天安智联主要客户营收分布

Table of Alerting Services

Table of Cloud Services

Table of Remote Control Functions

Table of Information Feedback Functions

System and Self-check

Global T-box Market Size, 2015-2020E

Global T-box Shipments by Region, 2010-2020E

Market Share of World’s Major T-box Vendors

Supply Relationship of World’s Major T-box Vendors

Comparative Analysis of Major T-box Markets Worldwide

T-box Application Areas in North America

T-box Sales in United Sates, 2010-2020E

Main T-box Brands from Japan

Main T-box Vendors from South Korea

IC Market Growth Rates by End-Use Application (2016-2021F CAGR)

Global IC Market Structure, 2016-2019

Global Automotive IC Market Size, 2014-2017

Global Automotive IC Market Size by Product, 2016-2017

Auto IC Market Growth Rates by Region (2016-2021F CAGR)

Ranking of World’s Major Automotive IC Makers, 2016

Classification of Automotive Sensors

Evolution of Sensor Quantity Equipped to a Vehicle

Global Automotive Sensor Market Size, 2016-2022E

Global Automotive Sensor (Radar/Image Sensor) Market Size, 2017-2027E

Sales Volume and Market Size of Automotive Millimeter Wave Radar in China, 2015-2020E

Automotive Camera Market Size in China, 2015-2020E

Sensor Technology Roadmap and Autonomous Functions Associated

World’s Major Automotive Sensor (by Type) Suppliers

Ranking of World’s Top20 Automotive MEMS Sensor Suppliers, 2017

Development History of On-Star

Mobile User Interface of On-Star

Key Functions of On-Star

On-Star Service Packages

Manufacturers Supported by and Vehicle Models Equipped with On-Star

ATX’s Services Aimed at Auto Makers

ATX’s Services Aimed at Users

Main Vehicle Models Using ATX’s Services

G-BOOK System Structure

LEXUS G-BOOK Smart Copilot Service

Mobile User Interface of LEXUS G-book

Introduction to G-book Service Functions

Support for G Track Searching City

Charging Standards of G-book

Content of LEXUS Mobile Version G-book Services

Vehicle Models Equipped with G-book

Carwings Smart Driving Plus System Function

Main Parameters of Nissan CARWINGS System

Charging Standards of Carwings

Vehicle Models Equipped with Carwings

Main Functions of Bluelink

Charging Standards of Bluelink

Payment Methods of Bluelink

Main Functions of Volvo Sensus Connect

Main Functions of Volvo On Call

Specifications of STA8088TG Teseo II Tracker

Key Features of STA8088TG Teseo II Tracker

Specifications of MT3337

Key Features of MT3337

Qualcomm’s QSC6270 Chip Solution

Key Features of QSC6270

AirPrime AR Series Solutions

Specifications of Qualcomm Gobi MDM9x15 Series

U-blox’s Revenue, 2014-2017H1

U-blox’s Revenue Breakdown by Region, 2014-2017H1

Connected Car Business Revenue of Harman, 2016Q1

Distribution of Automotive Electronic System

Application Structure of Automotive Electronics in China, 2015

Automotive Electronics as a Percentage of Total Costs of an Electric Vehicle

Automotive Electronics as a Percentage of Total Costs of a Vehicle (including Conventional/Electric Vehicles), 1970-2020E

Yearly Output of Electric Passenger Cars in China, 2008-2017

Automotive Electronics Market Size in China, 2015-2020E

T-box Market Size in China, 2015-2020E

Cooperation between T-box Vendors and Automakers

Different Groups’ Recognition of T-box in China

Outline of General Rules Put Forward by Four Ministries

Operation of Huawei Technologies, 2011-2015

Revenue Breakdown of Huawei Technologies by Business, 2016

Revenue Breakdown of Huawei Technologies by Region, 2016

Business Structure of ZTE Welink Technology

Revenue Structure of ZTE Welink Technology, 2016

T-box Development History of Shenzhen Thread Tech

T-box Platform Functions of Shenzhen Thread Tech

T-box Technology Roadmap of Shenzhen Thread Tech

Future Market Planning of Shenzhen Thread Tech

New Energy Models for Car Sharing Supported by E6 T-box of Shenzhen Thread Tech

Operation of Flaircomm Microelectronics, 2012-2016

V2.0 System T-box

T-box Development Roadmap of Flaircomm Microelectronics

OEM Automakers Equipped with T-box

Automotive Electronics Manufacturers Equipped with Bluetooth/WiFi or T-box

Service Providers in TSP Cooperation

Operators with Whom have been in Partnership

Vehicle Models Equipped with V1.0 System

Vehicle Models Equipped with V2.0 System

Vehicle Models Equipped with V3.0 System

Cloud Navigation Function of Di Di Hu

Functions of DD Box

Parameters of DD Box

Basic Parameters of Jiabao Box

Functions of Jiabao Box

Functions of Smart Cloud Mirror

Vehicle Models Equipped with Shenzhen Autonet’s T-box

Periodic Tasks of FutureMove Telematics and Soda Mobility Technologies

Core Business of FutureMove Telematics

Structure of PATEO Corporation

Main Business Segments of PATEO Corporation

Platform System

OEM Clients of PATEO Corporation

Operation of GAC, 2011-2015

Existing Capacity of GAC as of June 2017

Capacity under Construction of GAC as of December 2016

Vehicle Production and Sales Volume of GAC, 2016

Trumpchi T-box Functions

Development History of Neusoft Corporation’s Automotive Electronics Business

Distribution of Neusoft’s Automotive Electronics Staffs Worldwide

Overall Telematics Solutions of Neusoft Corporation

Operation of Neusoft Corporation, 2015

Main Business Structure of Neusoft Corporation, 2016

T-box Functions of Neusoft Corporation

Mobile APP Interface of T-box

T-box Eco-system of Neusoft Corporation

T-box Production Lines of Neusoft Corporation

Automotive Electronics Business Layout of Neusoft Corporation

Business Development History of Wuhan Intest Electronic Technology

Main Business of Wuhan Intest Electronic Technology

Testing and Informationization Business

New Energy Informationization Business

T-box (Wireless) Solutions

Framework of Inbox Solution

Inbox Interface Graph

inBOX Hardware Functions

Operation of Jiangsu CAS-TIANAN Smart Science & Technology, 2013-2017H1

Structure of Revenue from Key Clients of Jiangsu CAS-TIANAN Smart Science & Technology, 2015H1

如果这份报告不能满足您的要求,我们还可以为您定制报告,请 留言说明您的详细需求。

|