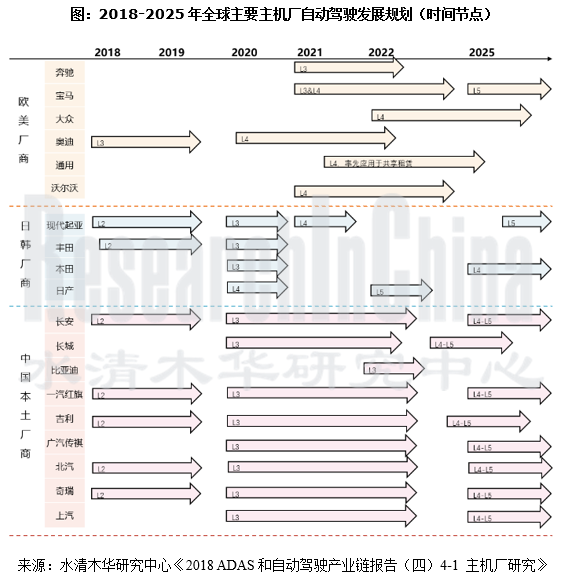

从全球范围看,主流主机厂均已投入到ADAS和自动驾驶系统开发。分地区来看,欧美主机厂自动驾驶整体发展较为领先,已大规模实现L2/L3级别高级辅助驾驶,并已基本锁定在2021年左右实现L3/L4级别自动驾驶;日韩主机厂对自动驾驶态度相对保守。例如丰田,其规划两条自动驾驶开发路径,“Guardian(高级安全驾驶辅助)”和“Chauffeur(自动驾驶)”,但是对于具体实现L4/L5并无具体时间规划;中国本土主机厂迎头赶上,根据规划2018年将有一批搭载L2级ADAS功能的车型量产,主机厂有长安、一汽红旗、吉利、北汽、奇瑞。其中本土厂商规划实现L4/L5级别都锁定时间在2025-2030年。

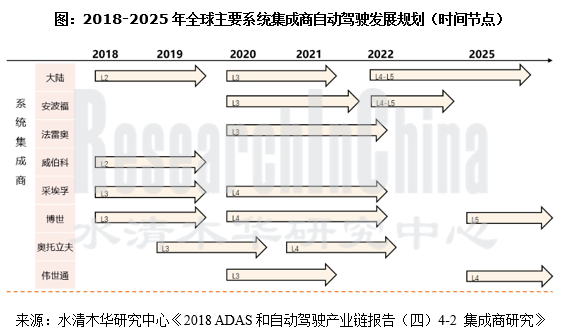

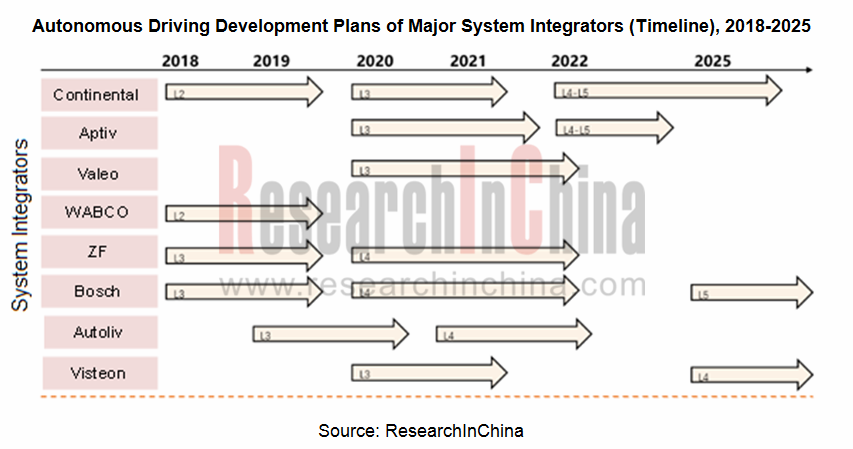

全球ADAS及自动驾驶系统集成商主要有大陆、安波福、法雷奥、采埃孚、博世等。2018年其系统集成商的发展特点有:

1,随着技术发展,系统集成商正在向融合解决方案供应商转型。例如博世,在开发新一代传感器(包括下一代毫米波雷达、下一代前置摄像头、下一代环视系统,以及正在研发的激光雷达)的同时,于2017年开始成立团队专门研发域控制器,以解决未来传感器融合所带来的大量运算需求,向合作伙伴提供整体打包方案。在国外,博世正在与戴姆勒进行L4级自动驾驶开发,在中国其已经向吉利等主机厂提供ADAS解决方案,并将向国内一家主机厂提供L2级高速巡航解决方案,并于2020年实现量产。

2,系统集成商的抱团发展趋势比较明显。例如大陆集团,基于英伟达DRIVE平台开发控制器,并与HERE、easyMILE、宝马-英特尔-Mobileye联盟、华为、百度、中国联通等多家企业开展合作,形成以自身为主导的自动驾驶生态圈;采埃孚,通过一系列的投资和合作,集结了TRW、IBEO、ASTYX、e.Go、HELLA、英伟达、百度等一大批合作伙伴,形成系统开发、传感器、软件决策、高精地图、车辆开发、智能座舱全面布局。

在中国,随着ADAS和自动驾驶发展,出现了以百度、经纬恒润、东软等为代表的系统集成商,其中百度发展最为瞩目。截至2018年7月,百度Apollo自动驾驶平台已获得116家合作伙伴,主机厂共计26家,涵盖了中国本土大部分主机厂和戴姆勒、福特、现代、本田4家外资主机厂。百度Apollo目前已发展到3.0量产园区自动驾驶,更加关注L2-L3级自动驾驶方案落地。其与主机厂合作的自动驾驶项目,开始从2018年起陆续落地。

水清木华研究中心《2018 ADAS和自动驾驶产业链报告(四)主机厂与系统集成商》主要包含以下内容:

欧美主机厂的ADAS及自动驾驶发展现状、已实现功能、发展规划、发展战略、系统方案、主要合作伙伴等;

欧美主机厂的ADAS及自动驾驶发展现状、已实现功能、发展规划、发展战略、系统方案、主要合作伙伴等;

日韩主机厂的ADAS及自动驾驶发展现状、已实现功能、发展规划、发展战略、系统方案、主要合作伙伴等;

日韩主机厂的ADAS及自动驾驶发展现状、已实现功能、发展规划、发展战略、系统方案、主要合作伙伴等;

中国本土主机厂的ADAS及自动驾驶发展现状、已实现功能、发展规划、发展战略、系统方案、主要合作伙伴等。

中国本土主机厂的ADAS及自动驾驶发展现状、已实现功能、发展规划、发展战略、系统方案、主要合作伙伴等。

全球ADAS及自动驾驶方案集成商发展现状、产品布局、发展策略、发展规划、主要客户、合作伙伴等内容;

全球ADAS及自动驾驶方案集成商发展现状、产品布局、发展策略、发展规划、主要客户、合作伙伴等内容;

中国ADAS及自动驾驶方案集成商发展现状、产品布局、发展策略、发展规划、主要客户、合作伙伴等内容。

中国ADAS及自动驾驶方案集成商发展现状、产品布局、发展策略、发展规划、主要客户、合作伙伴等内容。

Globally, all major OEMs now develop ADAS and autonomous driving systems. Regionally, European and American OEMs take a lead in the development of autonomous driving, having achieved L2/L3 advanced driver assistance on large scale and expected to seal the accomplishment of L3/L4 autonomous driving around 2021; Japanese and South Korean OEMs hold a relatively conservative attitude to autonomous driving. Take Toyota for example, it designs two development paths for autonomous driving: Guardian (advanced safe driving assistance) and Chauffeur (autonomous driving), but without specific timetable for L4/L5; China’s home-grown OEMs are catching up, as an array of models with L2 ADAS functions will be mass-produced in 2018 according to plans of OEMs including Changan Automobile, FAW Hongqi, Geely, BAIC and Chery. Local carmakers plan to achieve L4/L5 during 2025-2030.

.png)

The world-renowned ADAS and autonomous driving system integrators consist of Continental, Aptiv, Valeo, ZF, Bosch, etc., and they are featured in 2018 as follows:

1) The system integrators are gearing towards the suppliers of fusion solutions along with technological advances. Bosch, for instance, set up in 2017 a team engrossed in the development of domain controller whilst developing new-generation sensors (next-generation MMW radar, next-generation front camera, next-generation around view system, and the LiDAR under way), in a bid to meet the massive computing demand to be brought by fusion of sensors in future and to provide its partners with overall package. Abroad, Bosch together with Daimler is pushing forward the L4 autonomous driving development, and in China it has provided ADAS solutions to the carmakers like Geely. Besides, Bosch is to provide L2 high-speed cruise solutions to a Chinese OEM, and mass-production is to be realized in 2020.

2) It grows evident that system integrators seek for collaboration. For example, Continental develops controllers based on NVIDIA DRIVE platform and carries cooperation with many companies like HERE, easyMILE, BMW-Intel-Mobileye Alliance, Huawei, Baidu and China Unicom, leading to a Continental-led autonomous driving ecosystem. Via investments and collaboration, ZF boasts a great many partners such as TRW, IBEO, ASTYX, e.Go, HELLA, NVIDIA and Baidu and has business covering system development, sensors, software decision, HD map, vehicle development and smart cockpit.

In China, the system integrators spring up, represented by Baidu, Neusoft and HiRain Technologies among which Baidu’s development is most impressive. As of July 2018, Baidu’s Apollo autonomous driving platform has attracted 116 partners and 26 carmakers (most of local Chinese carmakers and four foreign peers, i.e., Daimler, Ford, Hyundai and Honda). Apollo 3.0 ushers in mass-production of autonomous driving vehicle in parks and Baidu focuses more on the implementation of L2-L3 autonomous driving solutions. Baidu’s autonomous driving projects in tandem with the automakers starts practical application from 2018 on.

ADAS and Autonomous Driving Industry Chain Report 2018 (IV) OEMs and Integrators by ResearchInChina highlights the following:

European and American OEMs’ ADAS and autonomous driving (status quo, functions achieved, development planning, development strategy, system solutions, major partners, etc.);

European and American OEMs’ ADAS and autonomous driving (status quo, functions achieved, development planning, development strategy, system solutions, major partners, etc.);

Japanese and South Korean OEMs’ ADAS and autonomous driving (status quo, functions achieved, development planning, development strategy, system solutions, major partners, etc.);

Japanese and South Korean OEMs’ ADAS and autonomous driving (status quo, functions achieved, development planning, development strategy, system solutions, major partners, etc.);

Chinese OEMs’ ADAS and autonomous driving (status quo, functions achieved, development planning, development strategy, system solutions, major partners, etc.)

Chinese OEMs’ ADAS and autonomous driving (status quo, functions achieved, development planning, development strategy, system solutions, major partners, etc.)

Global integrators of ADAS and autonomous driving solutions (status quo, product portfolios, development strategies and plans, major customers, partners, etc.);

Global integrators of ADAS and autonomous driving solutions (status quo, product portfolios, development strategies and plans, major customers, partners, etc.);

Chinese integrators of ADAS and autonomous driving solutions (status quo, product portfolios, development strategies and plans, major customers, partners, etc.).

Chinese integrators of ADAS and autonomous driving solutions (status quo, product portfolios, development strategies and plans, major customers, partners, etc.).

第一章 欧美主机厂的ADAS/自动驾驶动向

1.1 戴姆勒

1.2 宝马

1.3 大众

1.4 奥迪

1.5 通用

1.6 沃尔沃

1.7 福特

1.8 欧美主机厂总结

第二章 日韩主机厂的ADAS/自动驾驶动向

2.1 现代起亚

2.2 丰田

2.3 本田

2.4 日产

2.5 日韩主机厂总结

第三章 中国主机厂的ADAS/自动驾驶动向

3.1 长安

3.2 长城

3.3 比亚迪

3.4 一汽

3.5 吉利

3.6 广汽

3.7 北汽

3.8 上汽

3.9 奇瑞

3.10 中国主机厂总结

第四章 全球ADAS/自动驾驶的系统和方案企业

4.1 大陆

4.2 Aptiv

4.3 法雷奥

4.4 威伯科

4.5 采埃孚

4.6 博世

4.7 奥托立夫

4.8 伟世通

4.9 全球集成商总结

第五章 中国ADAS/自动驾驶的系统和方案企业

5.1 百度

5.2 恒润科技

5.3 东软

5.4 布谷鸟

5.5 海高汽车

5.6 环宇智行

I. ADAS/Autonomous Driving Developments of European and American OEMs

1.1 Daimler

1.2 BMW

1.3 Volkswagen

1.4 Audi

1.5 GM

1.6 Volvo

1.7 Ford

1.8 Summary

II. ADAS/Autonomous Driving Developments of Japanese and South Korean OEMs

2.1 Hyundai-Kia

2.2 Toyota

2.3 Honda

2.4 Nissan

2.5 Summary

III. ADAS/Autonomous Driving Developments of Chinese OEMs

3.1 Changan

3.2 Great Wall

3.3 BYD

3.4 FAW

3.5 Geely

3.6 GAC

3.7 BAIC

3.8 SAIC

3.9 Chery

3.10 Summary

IV. Providers of ADAS/Autonomous Driving System and Solutions in the World

4.1 Continental

4.2 Aptiv

4.3 Valeo

4.4 WABCO

4.5 ZF

4.6 Bosch

4.7 Autoliv

4.8 Visteon

4.9 Summary of World’s Integrators

V. Providers of ADAS/Autonomous Driving System and Solutions in China

5.1 Baidu

5.2 HiRain

5.3 Neusoft

5.4 Cuckoo

5.5 HiGo Automotive

5.6 In-driving