|

|

|

报告导航:研究报告—

制造业—汽车

|

|

2018-2023年全球及中国汽车座椅产业研究报告 |

|

字数:2.2万 |

页数:133 |

图表数:181 |

|

中文电子版:8500元 |

中文纸版:6800元 |

中文(电子+纸)版:9000元 |

|

英文电子版:2800美元 |

英文纸版:3000美元 |

英文(电子+纸)版:3100美元 |

|

编号:CYH080

|

发布日期:2018-12 |

附件:下载 |

|

|

|

2018年全球汽车座椅市场规模约779亿美元,中国汽车座椅市场规模约1132亿元人民币。随着汽车市场饱和,全球及中国汽车座椅市场进入平稳增长阶段,预计2018-2023年,全球和中国汽车座椅市场规模平均增速分别为3.6%和1.9%,安全智能化座椅将成为未来汽车座椅主要发展主要推动力。

目前,全球90%以上的市场份额被Adient 、Lear、丰田纺织、Faurecia等前10大座椅生产商所占据,其中Adient是全球最大汽车座椅生产商, 其主要通过与车企设立合资厂等方式与整车厂建立长期合作关系,客户分布广泛,几乎所有车厂都是其客户;Lear客户集中在福特、通用、宝马、FCA四大客户上,市场集中在北美和欧洲等。

在中国汽车座椅市场,美系、德系基本上由Adient和Lear垄断,日系中本田全部由TS供应,丰田绝大部分由丰田纺织供应,日产的供应商则比较多。自主汽车品牌也大多采用合资厂的座椅配套,长城、比亚迪、奇瑞和吉利汽车基本选择了部分自主、部分合资的模式。合资厂依靠规模效应和完整的供应链,价格具有很大优势,性能也更好,而自主品牌为了保证拥有足够的话语权,增加供应链弹性才保留了内部的座椅事业部。

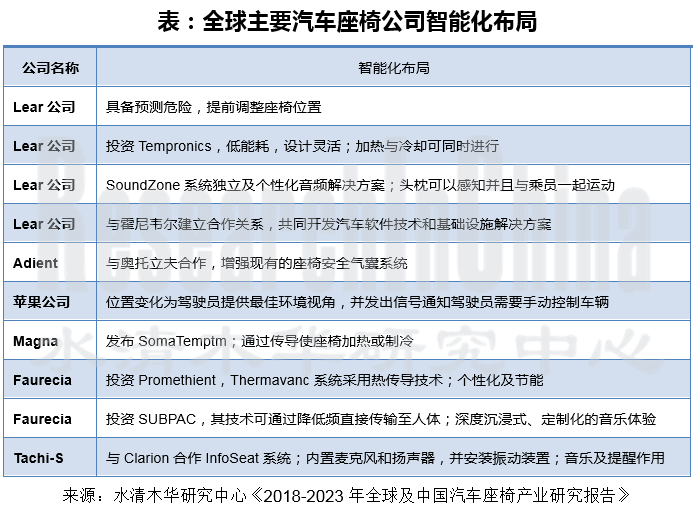

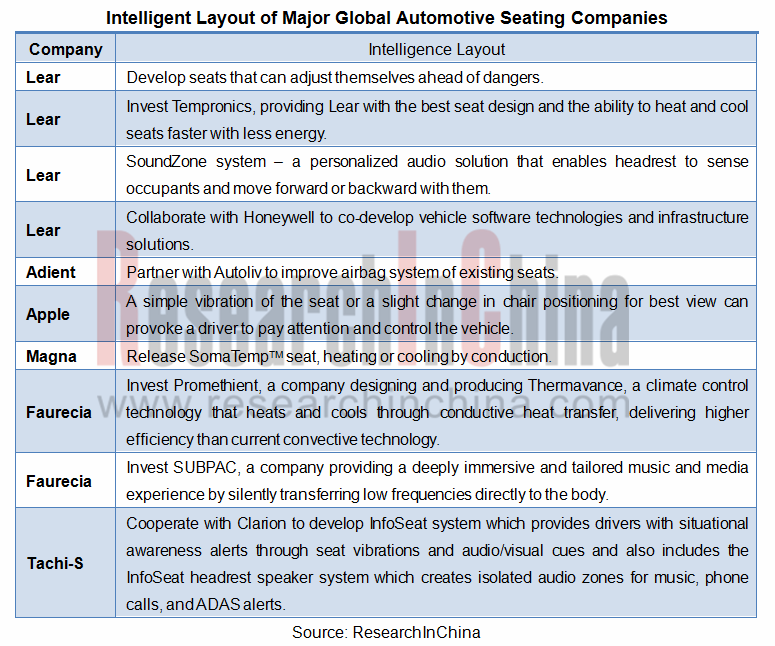

在汽车“智能化、电动化、网联化和共享化”等四化发展背景下,安全智能化、个性化、轻量化和环保舒适将成为未来汽车座椅主要发展趋势。Lear、Adient、Faurecia等多家企业已对智能化座椅进行布局,未来,智能座椅将于与车联网深度融合,为乘客提供智能化驾驶安全性和舒适感知性体验。

另外,除技术发展升级外,产业发展方面,座椅企业提供整套座椅解决方案将是未来产业主要发展方向,则座椅企业合并收购将会不断增多。

水清木华研究中心《2018-2023年全球及中国汽车座椅产业研究报告》着重研究了以下内容:

汽车座椅简介、构成、功能、分类与产业链等; 汽车座椅简介、构成、功能、分类与产业链等;

全球汽车座椅市场规模、企业竞争格局及主要整车汽车厂座椅供应格局及发展趋势等; 全球汽车座椅市场规模、企业竞争格局及主要整车汽车厂座椅供应格局及发展趋势等;

中国汽车座椅市场规模、企业竞争格局以及主要整车汽车厂座椅供应格局及发展趋势等; 中国汽车座椅市场规模、企业竞争格局以及主要整车汽车厂座椅供应格局及发展趋势等;

全球及中国主要汽车座椅生产商经营情况、座椅业务及发展趋势等。 全球及中国主要汽车座椅生产商经营情况、座椅业务及发展趋势等。

In 2018, global automotive seating market size remained at around USD77.9 billion, of which the Chinese market was worth RMB113.2 billion (approximately USD16.45 billion by USD to RMB 1:6.8779). As automotive market is saturated, global and Chinese automotive seating markets will level out, with market size expectedly growing at a respective annual average of 3.6% and 1.9% between 2018 and 2023. Safe intelligent seating will be a major driver for the market growth.

In global market, the top10 automotive seating giants like Adient, Lear, Toyota Boshoku and Faurecia currently grab a combined share of over 90%. Among them, Adient, the biggest player, forges long-term partnerships with automakers by establishing joint ventures with them, with a large client base almost covering all OEMs; Lear has four major clients, i.e., Ford, GM, BMW and FCA for targeting North American and European markets.

In China, Adient and Lear are the two suppliers of seating systems for American and German automobiles; for Japanese auto brands, TS is the only supplier of Honda and Toyota Boshoku supplies most seating products for Toyota while Nissan has more suppliers. Most Chinese auto brands also use products of joint venture manufacturers, for example, Great Wall Motor, BYD, Chery and Geely produce some themselves but also purchase from suppliers. Co-funded auto brands have their upsides in price and performance, boasting scale effects and complete supply chain; homegrown automakers set up their own seating divisions just for a say in market and a more flexible supply chain.

Automotive seats trend to be safe, intelligent, personalized, lightweight, green and comfortable in the era of “intelligent, electrified, connected and shared” vehicles. Many a seating manufacturer like Lear, Adient and Faurecia already makes layout of intelligent seating which will be deeply integrated into connected vehicles, providing passengers with intelligent, safe and comfortable driving experience.

In addition to technological upgrades, seating companies’ complete seating solutions will be the megatrend of the industry, leading to frequent M&As among seating vendors.

Global and China Automotive Seating Industry Report, 2018-2023 highlights the following:

Automotive seating (overview, composition, functions, classification, industry chain, etc.); Automotive seating (overview, composition, functions, classification, industry chain, etc.);

Global automotive seating industry (market size, competitive pattern, supply pattern of major automakers, development trends, etc.); Global automotive seating industry (market size, competitive pattern, supply pattern of major automakers, development trends, etc.);

China automotive seating industry (market size, competitive pattern, supply pattern of major automakers, development trends, etc.); China automotive seating industry (market size, competitive pattern, supply pattern of major automakers, development trends, etc.);

Major global and Chinese automotive seating companies (operation, seating business, development tendencies, etc.). Major global and Chinese automotive seating companies (operation, seating business, development tendencies, etc.).

第一章 汽车座椅简介

1.1 汽车座椅构成

1.2 汽车座椅分类

1.3 产业链

第二章 全球汽车座椅市场与产业

2.1 市场规模

2.2 汽车座椅企业TOP10(按收入)

2.3 地区结构

2.4 主机厂配套汽车座椅供应商

2.5 发展趋势

第三章 中国汽车座椅市场与产业

3.1 市场规模

3.2 竞争格局

3.3 主机厂配套汽车座椅供应商分布

第四章 全球及中国汽车市场

4.1 全球

4.1.1 产量

4.1.2 销量

4.2 中国

4.2.1 规模

4.2.2 格局

第五章 座椅厂家研究

5.1 Adient

5.1.1 企业简介

5.1.2 经营情况

5.1.3 座椅业务

5.1.4 在华发展

5.1.5 延锋安道拓

5.1.6 长春富维安道拓汽车饰件系统

5.2 Lear

5.2.1 企业简介

5.2.2 经营情况

5.2.3 座椅业务

5.2.4 在华发展

5.2.5 发展趋势

5.3 TOYOTA BOSHKOU

5.3.1 企业简介

5.3.2 经营情况

5.3.3 在华发展

5.3.4 天津英泰汽车饰件有限公司

5.3.5 发展规划

5.4 Faurecia

5.4.1 企业简介

5.4.2 经营情况

5.4.3 座椅业务

5.4.4 在华发展

5.5 TS Tech

5.5.1 企业简介

5.5.2 经营情况

5.5.3 在华发展

5.5.4 广州提爱思汽车内饰系统有限公司

5.5.5 武汉提爱思全兴汽车零部件有限公司

5.5.6 发展规划

5.6 TACHI-S

5.6.1 企业简介

5.6.2 经营情况

5.6.3 在华发展

5.7 Magna

5.7.1 企业简介

5.7.2 经营情况

5.7.3 座椅业务

5.7.4 在华发展

5.8 Brose

5.8.1 企业简介

5.8.2 经营情况

5.8.3 座椅业务

5.8.4 在华发展

5.9 NHK Spring

5.9.1 企业简介

5.9.2 经营情况

5.9.3 座椅业务

5.9.4 在华发展

5.10 SITECH

5.11 武汉新云鹤

5.12 全兴GSK

5.13 DAS

5.13.1 企业简介

5.13.2 经营情况

5.13.3 在华发展

5.14 DAEWON

5.14.1 企业简介

5.14.2 经营情况

5.14.3 座椅业务

5.14.4 在华发展

5.15 DYMOS

5.15.1 企业简介

5.15.2 经营情况

5.15.3 座椅业务

5.15.4 在华发展

5.15.5 北京李尔岱摩斯汽车系统有限公司

1 Brief Introduction to Automotive Seating

1.1 Structure

1.2 Classification

1.3 Industry Chain

2 Global Automotive Seating Market

2.1 Market Size

2.2 Top10 Automotive Seating Companies

2.3 Regional Structure

2.4 Automotive Seating Suppliers for OEMs

2.5 Development Trend

3 China Automotive Seating Market

3.1 Market Size

3.2 Competitive Landscape

3.3 Automotive Seating Suppliers for OEMs

4. Global and China Automotive Market

4.1 Global

4.1.1 Output

4.1.2 Sales

4.2 China

4.2.1 Market Size

4.2.2 Structure

5. Automotive Seating Companies

5.1 Adient

5.1.1 Profile

5.1.2 Operation

5.1.3 Seating Business

5.1.4 Development in China

5.1.5 Yanfeng Adient

5.1.6 Changchun Faway Adient Automotive System Co., Ltd. (CFAA)

5.2 Lear

5.2.1 Profile

5.2.2 Operation

5.2.3 Seating Business

5.2.4 Development in China

5.2.5 Development Trend

5.3 TOYOTA BOSHKOU

5.3.1 Profile

5.3.2 Operation

5.3.3 Development in China

5.3.4 Tianjin Intex Auto Parts Co., Ltd.

5.3.5 Development Planning

5.4 Faurecia

5.4.1 Profile

5.4.2 Operation

5.4.3 Seating Business

5.4.4 Development in China

5.5 TS Tech

5.5.1 Profile

5.5.2 Operation

5.5.3 Development in China

5.5.4 Guangzhou TS Automotive Interior Systems Co., Ltd.

5.5.5 Wuhan TS-GSK Auto Parts Co., Ltd.

5.5.6 Development Planning

5.6 TACHI-S

5.6.1 Profile

5.6.2 Operation

5.6.3 Development in China

5.7 Magna

5.7.1 Profile

5.7.2 Operation

5.7.3 Seating Business

5.7.4 Development in China

5.8 Brose

5.8.1 Profile

5.8.2 Operation

5.8.3 Seating Business

5.8.4 Development in China

5.9 NHK Spring

5.9.1 Profile

5.9.2 Operation

5.9.3 Seating Business

5.9.4 Development in China

5.10 SITECH

5.11 Wuhan Xinyunhe Automotive Seating Co., Ltd.

5.12 GSK

5.13 DAS

5.13.1 Profile

5.13.2 Operation

5.13.3 Development in China

5.14 DAEWON

5.14.1 Profile

5.14.2 Operation

5.14.3 Seating Business

5.14.4 Development in China

5.15 DYMOS

5.15.1 Profile

5.15.2 Operation

5.15.3 Seating Business

5.15.4 Development in China

5.15.5 Beijing Lear Dymos Automotive Systems Co., Ltd.

图:汽车座椅的构成

图:Cushion Frame

图:Back Frame

图:Head Restaint

图:Lever Control

图:Slide

图:Covering ASSY

图:Pad Foam ASSY

图:Recliner ASSY

图:Lumbar Support ASSY

图:汽车座椅调节系统及所用电机

图:汽车座椅的分类

图:汽车座椅产业链主要企业

图:汽车座椅产业链

图:2013-2023年全球汽车座椅市场规模

表:2014-2018年全球汽车座椅企业TOP10

图:2017年北美乘用车汽车座椅市场主要厂家市场占有率

图:2017年欧洲乘用车汽车座椅市场主要厂家市场占有率

图:2018年日本乘用车汽车座椅市场主要厂家市场占有率

图:2018年TOYOTA汽车座椅供应商分布

图:2018年HONDA汽车座椅供应商分布

图:2018年NISSAN汽车座椅供应商分布

图:2018年VW汽车座椅供应商分布

图:2018年BMW汽车座椅供应商分布

图:2018年BENZ汽车座椅供应商分布

图:2018年GM汽车座椅供应商分布

图:2018年FORD汽车座椅供应商分布

图:2018年HYUNDAI汽车座椅供应商分布

图:汽车座椅发展方向

表:全球主要座椅公司智能化布局

图:Lear公司智能化座椅布局

2015-2023年中国汽车座椅市场规模

图:2018年中国乘用车汽车座椅市场主要厂家市场占有率

图:2018年SAIC公司配套座椅供应商

图:2018年FAW公司配套座椅供应商

图:2018年CHANGAN公司配套座椅供应商

图:2018年东风公司配套座椅供应商

图:2018年BAIC公司配套座椅供应商

图:2013-2023年全球汽车产量

图:2010-2017年全球汽车产量结构

表:2012-2017年全球汽车(分地区)产量

表:2017年全球主要国家汽车产量TOP20

图:2013-2023年全球汽车销量

表:2012-2017年全球汽车(分地区)销量

表:2012-2017年全球主要国家汽车销量TOP10

图:2013-2023年中国汽车销量及增速

图:2010-2018年中国乘用车销量

图:2010-2018年中国商用车销量

图:2016-2017年中国SUV(分价格)销量构成

图:2016-2017年中国轿车(分价格)销量构成

图:2017年中国乘用车生产企业销量Top10

表:2017年中国乘用车(分车型)品牌销量Top10

表:2018年1-10月中国乘用车(分车型)品牌销量Top10

图:2017年中国乘用车(分国别)销量构成

图:Adient全球分布

表:2018财年Adinet生产基地数量及分布

表:2017-2018财年Adient经营情况

图:2017财年收入客户与地域分布

图:2017财年Adient(分地区)收入占比

图:Adient全球市场占有率

图:FY18-FY20年Adient座椅业务订单

图:Adient座椅业务(分地区)占有率

图:FY2017-FY2021年Adient(分汽车品牌)座椅市场占有率

图:2017年Adient收购FUTURis

图:2018年Adient中国区分布

图:2013-2017年Adient在中国主要经营数据

图:Adient Seating China

图:Adient Joint venture structure

图:Adient China’s current seating market share

图:延峰汽车内饰简介

图:延锋安道拓生产基地及子公司分布

图:2017年延锋安道拓经营数据

图:延锋安道拓主要客户

表:安道拓主要子公司介绍

图:2018年Lear公司全球分布

图:2012-2018年Lear公司营业收入与毛利率

表:2018Q3年Lear公司经营情况

图:2017年Lear公司(分客户)销售额

图:2014-2017年Lear(分业务)营业收入

表:2018Q3年Lear公司(分业务)经营数据

图:2012-2022年Lear公司(分业务)销售额

图:2018-2020年Lear公司Sales Backlog

图:2018年Lear公司座椅业务(分地区)发展

图:2018-2019年Lear公司座椅业务主要新配套车型

图:2018年Lear公司座椅业务在全球分布

图:2017年Lear公司座椅业务(分地区)销售额构成

图:2017年Lear公司座椅业务(分产品)销售额构成

图:2017年Lear公司座椅业务(分客户)销售额构成

图:2018年Lear公司座椅业务在全球主要地区市场占有率

图:2018年Q3Lear公司座椅业务发展现状

图:Lear公司座椅业务全球研发发展情况

图:Lear公司座椅产品发展趋势

图:2023年Lear公司预计销售额

图:FY2010-FY2019年TOYOTA BOSHKOU公司销售额与营业利润率

图:FY2011-FY2019年TOYOTA BOSHKOU公司(分地区)销售额

图:FY2011-FY2019年TOYOTA BOSHKOU公司(分地区)出货量

图:FY2019H1财年TOYOTA BOSHKOU公司座椅(分地区)出货量

图:FY2011-FY2019年TOYOTA BOSHKOU公司(分地区)营业利润

图:FY2011-FY2019年TOYOTA BOSHKOU公司座椅出货量(单位:万套)

表:TOYOTA BOSHKOU公司在中国子公司

图:2020年TOYOTA BOSHKOU在中国发展布局

图:2030年TOYOTA BOSHKOU公司发展新技术和新产品

图:2020年TOYOTA BOSHKOU公司完善座椅业务链

图:2019-2022年TOYOTA BOSHKOU公司座椅业务产能扩充计划

图 :2008-2017年Faurecia公司营业收入与营业利润率

表:2015-2018年Faurecia(分业务)销售额

图:2017年佛吉亚(分业务)销售额占比

图:2015-2017年Faurecia公司(分国家/地区)销售额

图:2017年Faurecia(分客户)销售额构成

表:2015-2017年Faurecia(分客户)销售额构成

表:2018-2021年Faurecia公司座椅业务配套车型

图:2018年TS Tech公司新成立销售办事处

图:FY2009-FY2019年 TS Tech公司销售额与营业利润率

表:FY2016-FY2018年TS Tech公司(分业务)销售额

图:FY2010-FY2019年TS Tech公司(分地区)销售额

图:FY2010-FY2019年TS Tech公司(分地区)营业利润

图:FY2017-FY2018年TS Tech公司汽车座椅销量

图:FY2017-FY2018年TS Tech公司摩托车座椅产量

图:2018-2019年TS Tech公司座椅对应车型

图:FY2019H1财年TS Tech公司在中国发展情况

图:FY2017-FY2019Q2年TS Tech公司在中国销售额

图:TS Tech公司发展规划

图:TS Tech公司座椅发展方向

图:TACHI-S公司全球分布

图:2020年TACHI-S公司全球研发中心

图:FY2009-FY2019年TACHI-S公司净销售额与营业利润率

图:FY2016-FY2019年TACHI-S公司(分国家/地区)销售额

图:FY2016-FY2019年TACHI-S公司(分国家/地区)营业利润

图:FY2016-FY2019年TACHI-S公司(分客户)销售额

图:FY2014-FY2018年TACHI-S座椅销量

表:2018年TACHI-S公司座椅主要配套车型

图:2020年TACHI-S公司Strengthen Competitiveness of Components/Monozukuri (Frame)

图:2020年TACHI-S公司Strengthen Competitiveness of Components/Monozukuri (Sewing)

图:TACHI-S公司为吉利EV450车型提供座椅

图:Honda Motor N-VAN

表:2018-2019年TACHI-S公司座椅配套车型

表:2018年TACHI-S公司在中国子公司分布

图:2020年TACHI-S公司在中国布局

图:Magna公司全球分布

图:2015-2018E年Magna公司销售额与营业利润

图:2016-2017年Magna公司(分地区)销售额

表:2015-2017年Magna公司(分客户)销售额

图:Magna公司座椅事业部

图:2017-2020年Magna公司座椅事业部经营情况

图:2017年Magna公司座椅业务(分车型)市场份额

图:Magna公司座椅发展历程

图:Magna公司座椅业务新客户

图:Magna公司座椅事业部Continued Vertical Integration

图:2009-2018E年Brose公司营业收入与投资额

图:2014-2017年Brose公司(分业务)营业收入

图:Brose公司主要客户

表:2018年Brose公司座椅配套

表:Brose在中国子公司分布

图:NHK Spring公司业务分布

图:FY2009-FY2019年NHK Spring公司净销售额与营业利润率

图:FY2009-FY2019年NHK Spring公司(分业务)销售额

图:FY2009-FY2019年NHK Spring公司(分业务)营业利润

图:FY2009-FY2019年NHK Spring公司(分地区)销售额

表:2016-2018财年NHK Spring(分客户)销售额构成

图:FY2015-FY2019年NHK Spring公司座椅业务销售额

表:2018年NHK Spring公司座椅投资项目

表:NHK Spring在中国的子公司

图:GSK公司主要客户

图:DAS公司主要客户

图:2013-2016年DAS公司销售额

表:2018年DAS公司座椅相关产品配套车型情况

图:DAEWON企业简介

图:DAEWON主要业务

图:DAEWON主要汽车零部件产品

图:DAEWON高铁列车零部件产品

图:DAEWON公司主要客户

图:DAEWON在中国的分布

图:DYMOS全球分布

图:DYMOS Fact Figure

图:DYMOS公司介绍

图:2013-2017年DYMOS营业收入

图:2013-2017年DYMOS公司净利润

图:2012-2020年DYMOS座椅业务收入

图:DYMOS座椅事业部全球分布

图:DYMOS主要客户

图:DYMOS在中国的分布

Composition of Automotive Seating

Cushion Frame

Back Frame

Head Restraint

Lever Control

Slide

Covering ASSY

Pad Foam ASSY

Recliner ASSY

Lumbar Support ASSY

Automotive Seat Regulating System and Motors Utilized

Classification of Automotive Seating

Major Players in Automotive Seating Industry Chain

Automotive Seating Industry Chain

Global Automotive Seating Market Size, 2013-2023E

Ranking of Global Top 10 Automotive Seating Manufacturers by Revenue 2014-2018

Market Share of Major Seating Manufacturers for Passenger Car in North America, 2017

Market Share of Major Seating Manufacturers for Passenger Car in Europe, 2017

Market Share of Major Seating Manufacturers for Passenger Car in Japan, 2018

Share of Automotive Seating Suppliers for TOYOTA, 2018

Share of Automotive Seating Suppliers for HONDA, 2018

Share of Automotive Seating Suppliers for NISSAN, 2018

Share of Automotive Seating Suppliers for VW, 2018

Share of Automotive Seating Suppliers for BMW, 2018

Share of Automotive Seating Suppliers for BENZ, 2018

Share of Automotive Seating Suppliers for GM, 2018

Share of Automotive Seating Suppliers for FORD, 2018

Share of Automotive Seating Suppliers for HYUNDAI, 2018

Development Direction of Automotive Seating

Intelligent Layout of Global Major Seating Companies

Intelligent Seating Layout of Lear

China Automotive Seating Market Size, 2015-2023E

Market Share of Major Manufacturers in Chinese Passenger Car Seating Market, 2018

Share of Automotive Seating Suppliers for SAIC, 2018

Share of Automotive Seating Suppliers for FAW, 2018

Share of Automotive Seating Suppliers for CHANGAN, 2018

Share of Automotive Seating Suppliers for Dongfeng, 2018

Share of Automotive Seating Suppliers for BAIC, 2018

Global Automobile Output, 2013-2023E

Global Automobile Output Structure, 2010-2017

Global Automobile Output by Region, 2012-2017

Top 20 Countries by Automotive Output, 2017

Global Automobile Sales Volume, 2013-2023E

Global Automobile Sales Volume by Region, 2012-2017

Top 10 Countries by Automobile Sales, 2012-2017

China Automobile Sales Volume, 2013-2023E

China Passenger Car Sales Volume, 2010-2018

China Commercial Vehicle Sales Volume, 2010-2018

Sales Volume Structure of SUVs in China (by Price), 2016-2017

Sales Volume Structure of Sedans in China (by Price), 2016-2017

Top10 Passenger Car Makers by Sales Volume, 2017

Sales Volume of Top10 Passenger Car Brands by Model in China, 2017

Sales Volume of Top10 Passenger Car Brands by Model in China, 2018(Jan.-Oct.)

Sales Structure of Passenger Car (by Country) in China, 2017

Global Footprint of Adient

Global Presence of ADIENT Production Bases, FY2018

Operation of Adient, FY2017-FY2018

Revenue Structure of Adient by Region/Customer, FY2017

Revenue Structure of Adient by Region, FY2017

Market Share of Adient

Seating Business Orders of Adient, FY2018-FY2020

Market Share of Adient Seating Business among Each OEM Group

Market Share of Adient Seating by Automotive Brand, FY2017& FY2021

Adient's Purchase of Futuris in 2017

Footprint of Adient in China, 2018

Operation of Adient in China, 2013-2017

Adient Seating China

Adient Joint Venture Structure

Adient China’s Current Seating Market Share

Company Overview of Yanfeng Automotive Interiors

Distribution of Production Bases and Subsidiaries of Yanfeng Adient

Operation of Yanfeng Adient, 2017

Major Clients of Yanfeng Adient

Major Subsidiaries of Adient

Global Footprints of Lear, 2018

Net Sales and Gross Margin of Lear, 2012-2018

Key Financials of Lear, 2018Q3

Net Sales of Lear by Customer, 2017

Net Sales of Lear by Business, 2014-2017

Operation of Lear by Segment, 2018Q3

Revenue of Lear by Business, 2012-2022E

Sales Backlog of Lear, 2018-2020E

Seating Component Capabilities of Lear, 2018

Key Seating Launches of Lear, 2018-2019

Automotive Seating Operations of Lear Worldwide, 2018

Revenue Structure of Lear Seating Business by Region, 2017

Revenue Structure of Lear Seating Business by Product, 2017

Revenue Structure of Lear Seating Business by Customer, 2017

Market Share of Lear Seating Business by Region, 2018

Seating Business Quarter Sales and Margin Drivers, 201Q3

Global Engineering Development of Lear Seating Business

Development Trend of Lear Seating Products

Sales and Operating Margins of Lear, 2023E

Net Sales and Operating Margin of TOYOTA BOSHKOU, FY2010-FY2019

Net Sales of TOYOTA BOSHKOU by Region, FY2010-FY2019

Shipment of TOYOTA BOSHKOU by Region, FY2011-FY2019

Shipment of TOYOTA BOSHKOU Seat Assembly by Region, FY2019H1

Operating Profit of TOYOTA BOSHKOU by Region, FY2011-FY2019

Seat Shipment of TOYOTA BOSHKOU, FY2011-FY2019

Subsidiaries of TOYOTA BOSHKOU in China

Development Layout of TOYOTA BOSHKOU in China, 2020E

New Technologies and New Products of TOYOTA BOSHKOU, 2030E

Integration of Seating Industry Chain of TOYOTA BOSHKOU, 2020E

Seating Business Capacity Expansion Plan of TOYOTA BOSHKOU, 2019-2022E

Revenue and Operating Margin of Faurecia, 2008-2017

Revenue of Faurecia by Business, 2015-2018

Revenue Structure of Faurecia by Business, 2017

Revenue Breakdown of Faurecia by Country/Region, 2015-2017

Revenue Structure of Faurecia by Customer, 2017

Revenue Structure of Faurecia by Customer, 2015-2017

Seating Supporting of Faurecia, 2018-2021E

Sales Offices Newly Established by TS Tech in 2018

Net Sales and Operating Margin of TS Tech, FY2009-FY2019

Revenue Breakdown of TS Tech by Business, FY2016-FY2018

Revenue Breakdown of TS Tech by Region, FY2010-FY2019

Operating Profit of TS Tech by Region, FY2010-FY2019

Automotive Seating Sales Volume of TS Tech, FY2017-FY2018

Motorcycle Seat Production of TS Tech, FY2017-FY2018

Key Models Supported by TS Tech Seat, 2018-2019

Development of TS Tech in China, FY2019H1

Sales of TS Tech in China, FY2017-FY2019Q2

Development Planning of TS Tech

Seating Development Orientation of TS Tech

Global Footprint of TACHI-S

R&D Centers of TACHI-S Worldwide, 2020

Net Sales and Operating Margin of TACHI-S, FY2009-FY2019

Net Sales of TACHI-S by Country/Region, FY2016-FY2019

Operating Profit of TACHI-S by Country/Region, FY2016-FY2019

Revenue of TACHI-S by Customer, FY2016-FY2019

Seat Sales Volume of TACHI-S, FY2014-FY2018

Vehicle Models Supported by Seats of TACHI-S, 2018

TACHI-S Strengthens Competitiveness of Components/Monozukuri (Frame), 2020

TACHI-S Strengthens Competitiveness of Components/Monozukuri (Sewing), 2020

TACHI-S as a Provider of Seats for Geely EV450

Honda Motor N-VAN

Vehicle Models Supports by Seats of TACHI-S, 2018-2019

Presence of TACHI-S’ Subsidiaries in China, 2018

Presence of TACHI-S in China, 2020

Global Footprint of Magna

Sales and Operating Margin of Magna, 2015-2018E

Sales of Magna by Region, 2016-2017

Sales of Magna by Customer, 2015-2017

Seating Systems of Magna

Magna Development of Seating Systems, 2017-2020E

Seating Business (by Vehicle Model) Market Share of Magna, 2017

Seating Development History of Magna

New Clients for Magna’s Seating Business

Continued Vertical Integration of Magna Seating Segment

Revenue and Investment of Brose, 2009-2018E

Revenue of Brose by Business, 2014-2017

Major Customers of Brose

Seat Supply of Brose, 2018

Presence of Brose’s Subsidiaries in China

Business Distribution of NHK Spring

Net Sales and Operating Margin of NHK Spring, FY2009-FY2019

Sales of NHK Spring by Business, FY2009-FY2019

Operating Profit of NHK Spring by Business, FY2009-FY2019

Sales of NHK Spring by Region, FY2009-FY2019

Sales Structure of NHK Spring by Customer, FY2016-FY2018

Automotive Seating Sales of NHK Spring, FY2015-FY2019

Seating Investment Projects of NHK Spring, 2018

Subsidiaries of NHK Spring in China

Major Customers of GSK

Major Clients of DAS

Revenue of DAS, 2013-2016

Vehicle Models Supported by Seating-related Products of DAS, 2018

Profile of DAEWON

Operations of DAEWON

Key Auto Parts of DAEWON

DAEWON’s Components for High-speed Trains

Major Clients of DAEWON

Presence of DAEWON in China

Global Network of DYMOS

DYMOS Fact Figure

Profile of DYMOS

Revenue of DYMOS, 2013-2017

Net Income of DYMOS, 2013-2017

Seat Sales of DYMOS, 2012-2020

Seating Operations of DYMOS Worldwide

Major Customers of DYMOS

Presence of DYMOS in China

如果这份报告不能满足您的要求,我们还可以为您定制报告,请 留言说明您的详细需求。

|