|

|

|

报告导航:研究报告—

制造业—汽车

|

|

2018-2022年中国电动汽车驱动电机行业研究报告 |

|

字数:5.5万 |

页数:150 |

图表数:124 |

|

中文电子版:9000元 |

中文纸版:7200元 |

中文(电子+纸)版:9500元 |

|

英文电子版:3000美元 |

英文纸版:3200美元 |

英文(电子+纸)版:3300美元 |

|

编号:LT047

|

发布日期:2018-12 |

附件:下载 |

|

|

|

2017年,中国电机+电机控制器市场规模达202亿元,2020年将接近300亿元,若未来推广集成化电驱动方案,将电机、减速器、电机控制器“三合一”集成在一起,或将“电机、减速器、电机控制器、DC/DC、配电单元”等各种功能“N合一”集成在一起,则可以拥有更高的市场规模,这也是电机电控企业普遍的发展方向。

2018年上半年全国新能源汽车用电机装机量达40.5万套,参与配套的企业多达160多家。整体来看,尽管目前电机市场的参与企业依旧很多,但是从装机量情况可以看出,2018年电机市场的集中度正在大幅提升。

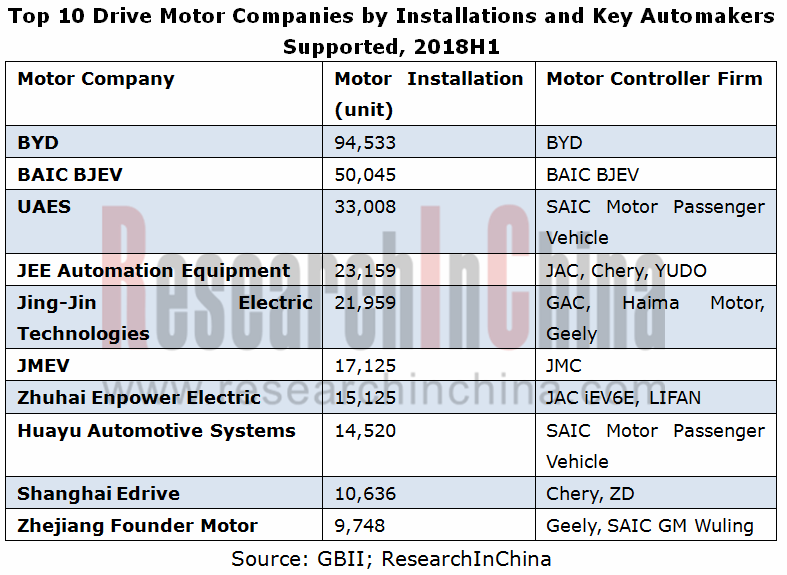

2018年上半年电机出货量排名前十的企业占据了71.53%的市场份额,同比2017年上半年提升了13.97%。其中,装机量最高达到9.45万套,而装机量在1000套以下的企业多达110多家。随着市场集中度的提升,电机企业间的差距也正在拉开。除车企自配外,联合汽车电子、安徽巨一动力、精进电动、上海电驱动、方正电机等企业的优势正在凸显。

国内大部分电机电控企业主要是依靠新能源商用车市场起家和发展,技术门槛相对较低,同时进入的企业也较多。随着市场逐渐趋于集中,加上补贴下降,电机企业面临了原材料上涨、利润下滑的双重压力。

从电机类型市场结构来看,以永磁同步电机为主,2017年我国新能源汽车电机装机车辆中,永磁同步电机装机占比78.4%,主要应用在乘用车领域,异步交流电机装机占比21.5%,主要应用在商用车领域,其他类型电机占比约0.1%。永磁同步电机是目前电动乘用车的首选电机,并且市场份额在逐步加大。

总体而言:未来几年随新能源汽车补贴退坡,电机电控供应商竞争激烈,产品毛利率在中期将承压。在行业格局方面,在中期中国新能源汽车市场以整车厂为中心,电池及电机电控环节生产企业作为核心部件供应商的行业格局不会改变。

中国新能源汽车驱动电机行业发展状况分析,包括产业链、成本分析、商业模式、竞争格局、主流生产厂商的竞争情况,并对乘用车、商用车驱动电机竞争格局进行了分别阐述;此外,对驱动电机技术现状和发展趋势进行了分析; 中国新能源汽车驱动电机行业发展状况分析,包括产业链、成本分析、商业模式、竞争格局、主流生产厂商的竞争情况,并对乘用车、商用车驱动电机竞争格局进行了分别阐述;此外,对驱动电机技术现状和发展趋势进行了分析;

中国22家企业、全球6家电驱动企业分析,包括企业经营状况、发展战略、供应链、新能源汽车驱动电机业务等; 中国22家企业、全球6家电驱动企业分析,包括企业经营状况、发展战略、供应链、新能源汽车驱动电机业务等;

新能源汽车驱动电机行业概述,包括汽车驱动电机的定义、分类、上下游产业链分析; 新能源汽车驱动电机行业概述,包括汽车驱动电机的定义、分类、上下游产业链分析;

中国新能源汽车驱动电机行业运行环境分析,包括政策环境、新能源汽车市场的发展状况及对汽车驱动电机行业的影响。 中国新能源汽车驱动电机行业运行环境分析,包括政策环境、新能源汽车市场的发展状况及对汽车驱动电机行业的影响。

The Chinese market size of electric motors and motor controllers posted RMB20.2 billion in 2017 and is projected to approach RMB30 billion in 2020. The market will be expanding if the integrated electric drive solutions grow popular and the three including electric motor, reducer and motor controller are increasingly fused into one or if the N-to-1 integration of functions like electric motor, reducer, motor controller, DC/DC and power distribution unit is brought into a reality, at which the majority of electric motor and motor controller companies are attempting.

In the first half of 2018, a total of 405,000 electric motors were equipped by more than 160 suppliers to the new energy vehicle (NEV) in China. Despite there are numerous firms in the electric motor market for the moment, the electric motor market concentration is on a rapidly rise in 2018 judging from installations.

In the first half of 2018, the top ten players by motor shipments held a lion’s share of 71.53% together, a jump of 13.97 percentage points from the same period of 2017. Elaborately, the highest installation touched 94,500 units, while over 110 firms were each with motor shipment of less than 1,000 units. As the market concentration climbs, the gap between motor companies is broadening. Besides the automakers that supply electric motors by themselves, such competitors are growing advantageous, as United Automotive Electronic Systems (UAES), JEE Automation Equipment, Jing-Jin Electric Technologies, Shanghai Edrive, and Zhejiang Founder Motor.

Most Chinese electric motor and motor controller manufacturers have sprung up from the new energy commercial vehicle market with a low entry barrier and harboring numerous enterprises. While the market becomes concentrated and subsidies descend, the electric motor makers are confronted with the amounting pressure from the rising prices of raw materials and a fall in profits.

By types, permanent magnet synchronous motor plays a key part in the electric motor market, with its installations (mainly for passenger cars) finding a 78.4% share in all motor installations to new energy vehicle in China in 2017, asynchronous AC motor swept 21.5% by installations and got primarily utilized in commercial vehicle, and other types of electric motors seized 0.1% or so. Permanent magnet synchronous motor is currently the best choice for electric passenger cars and sees a burgeoning market share.

In general, competition between electric motor and motor controller suppliers will prick up and gross margin of products will be volatile as the subsidies for new energy vehicle are going down in the next a few years. In the medium term, the industrial pattern will remain unchanged in Chinese new energy vehicle market (key roleplaying by automakers as well as the battery, electric motor and motor controller producers as the suppliers of core components).

The report highlights the following:

Development of new energy vehicle (NEV) drive motor industry in China (including industrial chains, cost analysis, business model, competitive landscape and key players competing each other, and elaboration on competitive patterns of passenger vehicle and commercial vehicle drive motors), and analysis on status quo and development tendencies of drive motor technologies; Development of new energy vehicle (NEV) drive motor industry in China (including industrial chains, cost analysis, business model, competitive landscape and key players competing each other, and elaboration on competitive patterns of passenger vehicle and commercial vehicle drive motors), and analysis on status quo and development tendencies of drive motor technologies;

22 Chinese and 6 global drive motor companies (operation, development strategy, supply chain, NEV drive motor business, etc.); 22 Chinese and 6 global drive motor companies (operation, development strategy, supply chain, NEV drive motor business, etc.);

New energy vehicle (NEV) drive motor industry (definition and classification of vehicle drive motors, analysis on upstream and downstream industry chains); New energy vehicle (NEV) drive motor industry (definition and classification of vehicle drive motors, analysis on upstream and downstream industry chains);

Environments for industry operation (policy climate, NEV market development and impact to the vehicle drive motor industry). Environments for industry operation (policy climate, NEV market development and impact to the vehicle drive motor industry).

第一章 电动汽车驱动电机行业概述

1.1 驱动电机介绍

1.2 驱动电机控制器介绍

1.3 驱动电机应用领域

1.3.1 纯电动汽车

1.3.2 混合动力汽车

第二章 中国电动汽车行业分析

2.1 行业政策

2.1.1 财政补贴政策

2.1.2 蓄电池回收利用政策

2.1.3 税收优惠政策

2.1.4 生产许可政策

2.2 电动汽车市场

2.2.1 全球市场

2.2.2 中国市场

第三章 中国电动汽车驱动电机行业分析

3.1 产业链

3.2 市场规模

3.3 主要厂商及竞争格局

3.3.1整体竞争格局

3.3.2 乘用车驱动电机竞争格局

3.3.3 客车驱动电机竞争格局

3.4 技术发展趋势

3.4.1 技术现状

3.4.2 技术趋势—永磁化

3.4.3 技术趋势—集成化

3.4.4 技术趋势—数字化

3.4.5 技术趋势—轮毂电机

3.4.6 电动汽车混合驱动与混合制动系统现状及展望

第四章 中国驱动电机行业主要企业

4.1大洋电机

4.1.1 企业简介

4.1.2 经营情况

4.1.3 发展战略

4.1.4 电动汽车电机业务

4.1.5 驱动电机投资与产能

4.2 上海电驱动

4.2.1公司简介

4.2.2 经营情况

4.2.3 供应链分析

4.2.4 驱动电机产品及技术

4.2.5 驱动电机投资与产能

4.3中车时代电动

4.3.1 企业简介

4.3.2 经营情况

4.3.3 驱动电机产品

4.3.4 研发

4.3.5 驱动电机投资与产能

4.4 万向钱潮

4.4.1 企业简介

4.4.2 经营情况

4.4.3 电动汽车电机业务

4.5 上海大郡

4.5.1 企业简介

4.5.2 经营情况

4.5.3 供应链分析

4.5.4 驱动电机产品

4.6 精进电动

4.6.1 企业简介

4.6.2 经营情况

4.6.3 电动汽车电机业务

4.7 方正电机

4.7.1 企业简介

4.7.2 经营情况

4.7.3 供应链

4.7.4 驱动电机产品

4.7.5 驱动电机投资

4.7.6 驱动电机产能

4.8 卧龙电气

4.8.1 企业简介

4.8.2 经营情况

4.8.3 电动汽车电机业务

4.9 信质电机

4.9.1 企业简介

4.9.2 经营情况

4.9.3 电动汽车电机业务

4.10 江特电机

4.10.1企业简介

4.10.2 经营情况

4.10.3 电动汽车电机业务

4.11 北京中纺锐力机电

4.11.1 企业简介

4.11.2 经营情况

4.11.3 电动汽车电机业务

4.12 尤奈特电机

4.12.1 企业简介

4.12.2 经营情况

4.12.3 电动汽车电机业务

4.13 其他厂商

4.13.1 大连电机

4.13.2 深圳大地和

4.13.3 联合汽车电子

4.13.4 兰基电动汽车

4.13.5 华域汽车电动系统

4.13.6 江苏微特利电机制造

4.13.7 无锡迈为电子技术

4.13.8 上海赢双电机

4.13.9 锦州汉拿电机

第五章 全球驱动电机行业主要企业

5.1 罗伯特博世(Robert Bosch)

5.1.1 企业简介

5.1.2 经营情况

5.1.3 电动汽车电机业务

5.2 采埃孚(ZF Friedrichshafen AG)

5.2.1 企业简介

5.2.2 经营情况

5.2.3 电动汽车电机业务

5.3 大陆集团(Continental AG)

5.3.1 企业简介

5.3.2 经营情况

5.3.3 电动汽车电机业务

5.4 爱信精机(Aisin AW)

5.4.1 企业简介

5.4.2 经营情况

5.4.3 电动汽车电机业务

5.5 现代摩比斯(MOBIS)

5.5.1 企业简介

5.5.2 经营情况

5.5.3 电动汽车电机业务

5.6 AC Propulsion(ACP)

5.6.1 企业简介

5.6.2 电动汽车电机业务

5.7 西门子(SIEMENS)

5.7.1 企业简介

5.7.2 经营情况

5.7.3 电动汽车电机业务

1 Electric Vehicle (EV) Drive Motor Industry

1.1 Introduction to Drive Motor

1.2 Introduction to Drive Motor Controller

1.3 Applications of Drive Motor

1.3.1 Battery Electric Vehicle (BEV)

1.3.2 Hybrid Electric Vehicle (HEV)

2 China Electric Vehicle (EV) Industry

2.1 Policies

2.1.1 Policy on Fiscal Subsidies

2.1.2 Policy on Battery Recycling

2.1.3 Preferential Tax Policy

2.1.4 Production License Policy

2.2 EV Market

2.2.1 Global Market

2.2.2 Chinese Market

3 China Electric Vehicle (EV) Drive Motor Industry

3.1 Industrial Chain

3.2 Market Size

3.3 Major Manufacturers and Competition

3.3.1 Competitive Landscape

3.3.2 Competition in Passenger Vehicle Drive Motor

3.3.3 Competition in Bus Drive Motor

3.4 Technology Trends

3.4.1 Status Quo of Technologies

3.4.2 Trend – Permanent Magnetization

3.4.3 Trend -- Integration

3.4.4 Trend -- Digitalization

3.4.5 Trend – Hub Motor

3.4.6 Status Quo and Outlook of Electric Vehicle (EV) Hybrid Drive and Hybrid Braking Systems

4 Major Chinese Drive Motor Companies

4.1 Zhongshan Broad-Ocean Motor Co., Ltd.

4.1.1 Profile

4.1.2 Operation

4.1.3 Development Strategy

4.1.4 EV Motor Business

4.1.5 Investments in and Production Capacity of Drive Motor

4.2 Shanghai Edrive Co., Ltd.

4.2.1 Profile

4.2.2 Operation

4.2.3 Supply Chain

4.2.4 Drive Motors and Technologies

4.2.5 Investments in and Production Capacity of Drive Motor

4.3 Hunan CRRC Times Electric Vehicle Co., Ltd.

4.3.1 Profile

4.3.2 Operation

4.3.3 Drive Motors

4.3.4 R&D

4.3.5 Investments in and Production Capacity of Drive Motor

4.4 Wanxiang Qianchao Co., Ltd.

4.4.1 Profile

4.4.2 Operation

4.4.3 EV Motor Business

4.5 Shanghai DAJUN Technologies

4.5.1 Profile

4.5.2 Operation

4.5.3 Supply Chain

4.5.4 Drive Motors

4.6 Jing-Jin Electric Technologies

4.6.1 Profile

4.6.2 Operation

4.6.3 EV Motor Business

4.7 Zhejiang Founder Motor

4.7.1 Profile

4.7.2 Operation

4.7.3 Supply Chain

4.7.4 Drive Motors

4.7.5 Investments in Drive Motor

4.7.6 Production Capacity of Drive Motor

4.8 Wolong Electric Group Co., Ltd.

4.8.1 Profile

4.8.2 Operation

4.8.3 EV Motor Business

4.9 Xinzhi Motor Co., Ltd.

4.9.1 Profile

4.9.2Operation

4.9.3 EV Motor Business

4.10Jiangxi Special Electric Motor Co., Ltd. (JSMC)

4.10.1 Profile

4.10.2 Operation

4.10.3 EV Motor Business

4.11 China Tex Mechanical & Electrical Engineering Ltd.

4.11.1 Profile

4.11.2Operation

4.11.3 EV Motor Business

4.12 Zhejiang Unite Motor Co., Ltd.

4.12.1 Profile

4.12.2Operation

4.12.3 EV Motor Business

4.13 Others

4.13.1 Dalian Motor Group Co., Ltd.

4.13.2 Shenzhen Greatland Electrics Inc.

4.13.3 United Automotive Electronic Systems Co.,Ltd. (UAES)

4.13.4 Shandong Lanji New Energy Vehicle Co., Ltd.

4.13.5 HUAYU Automotive Systems Co., Ltd.

4.13.6 Jiangsu Weiteli Motor Limited By Share Ltd.

4.13.7 Wuxi Myway Electronic Technologies Co., Ltd.

4.13.8 Shanghai Yingshuang Electric Machinery Co., Ltd

4.13.9 Jinzhou Halla Electrical Equipment Co., Ltd.

5 Global Drive Motor Companies

5.1 Robert Bosch

5.1.1 Profile

5.1.2 Operation

5.1.3 EV Motor Business

5.2 ZF Friedrichshafen AG

5.2.1 Profile

5.2.2Operation

5.2.3 EV Motor Business

5.3 Continental AG

5.3.1 Profile

5.3.2Operation

5.3.3 EV Motor Business

5.4 Aisin AW

5.4.1 Profile

5.4.2Operation

5.4.3 EV Motor Business

5.5 MOBIS

5.5.1 Profile

5.5.2Operation

5.5.3 EV Motor Business

5.6 AC Propulsion (ACP)

5.6.1 Profile

5.6.2 EV Motor Business

5.7 SIEMENS

5.7.1 Profile

5.7.2Operation

5.7.3 EV Motor Business

图:驱动电机驱动系统的基本构成

表:电动汽车驱动电机和传统电机的主要参数对比

表:电动汽车驱动电机分类

表:不同类别电动汽车驱动电机技术特点

表:不同类别电动汽车驱动电机性能参数

图:驱动电机控制器结构图

图:不同类型驱动电机的控制策略及应用现状

图:纯电动汽车驱动电机系统结构

图:混合动力汽车驱动电机系统工作原理及应用

图:轻度混合动力汽车驱动电机系统结构

图:增程式动力系统结构

图:比亚迪插电式混合动力汽车“唐”驱动电机系统

图:丰田普锐斯双电机混合动力发动机

中国新能源乘用车补贴标准,2018

2018年中国电动客车补贴标准比较(中央财政)

Monthly Sales of NEVs (EV&PHEV) Worldwide, 2014-2018

Ranking of Global NEV Enterprises by Sales, Jan-Sept 2018

Sales of Electric Passenger Cars (EV&PHEV) Worldwide, 2014-2022E

Production and Sales of EVs in China, 2011-2018.1-9

Monthly Production of EVs (Special Vehicles & Commercial Vehicles) in China, 2016-2017

China’s Production of Electric Buses, 2016-2017

China’s Production of Battery Electric Trucks, 2015-2017

Market Share of Battery Electric Passenger Car Enterprises in China, 2018.1-9

Monthly Sales of Electric Passenger Cars in China, 2017-2018.1-9

Ranking of New Energy Passenger Car Sales in China by Auto Model, Jan-Sep 2018

Sales of New Energy Passenger Car (EV&PHEV) Enterprises in China, 2016-2018.1-9

图:永磁同步驱动电机的价格构成

图:电机控制器成本占比

图:全球车用驱动电机和逆变器市场规模,2015-2030

图:全球BEV驱动电机市场规模,2015-2030

图:2014-2020年中国电动汽车驱动电机系统市场规模

图:2013-2018年上半年中国新能源汽车驱动电机出货量

表:驱动电机及系统企业主要类型

表:2017年TOP10驱动电机生产企业及TOP10控制器生产企业装机量

表:2017年TOP10驱动电机生产企业(不含整车厂)主要配套车企及车型

表:2018年上半年TOP10驱动电机生产企业装机量及主要配套车企

表:国内主要驱动电机及控制器厂商

图:国内电机及控制器厂商的7种供应模式

表:全球电机控制器IBGT生产商

表:电机产业分布及配套关系

图:2017年中国生产的纯电动乘用车采用的电机类型

图:2015年中国生产的纯电动乘用车采用的电机类型

图:中国主要电动客车驱动电机及控制器配套关系

表:集中式和轮毂电机驱动对比

表:2016年上半年全球销量前十的电动汽车电驱动系统构型

表:中国电动汽车“十二五” (2011-2015年)专项规划

表:电机及控制器集成化方法及效果

图:博格华纳(左)与采埃孚(右)的驱动电机与单级减速器集成

图:电机控制系统数字化

图:IGBT技术发展路径

图:内转子结构的轮毂电机驱动系统结构图

图:轮毂电机可匹配各种新能源车型

图:2014-2018第三季度大洋电机经营情况

表:2018年上半年大洋电机(分行业)营收构成

图:2013-2018上半年大洋电机(分地区)营收占比

图:2009-2016上半年大洋电机毛利率

图:2015-2016上半年大洋电机(分产品)毛利率

图:大洋电机十年发展战略

表:大洋电机十年发展战略及实施主体

图:2014-2017年大洋电机新能源汽车动力总成产销量

表:大洋电机主要子公司

图:上海电驱动股权结构图(收购前)

表:2013-2017年驱动电机系统产能及销量

图:2009-2018上半年上海电驱动经营业绩

表:上海电驱动已生产的驱动电机系统类型及参数

表:上海电驱动驱动电机系统尺寸及外观

表:2017年公交客车月度销量排名

表:中车时代电动已生产的驱动电机类型及参数

图:2013-2018上半万向钱潮营业收入及净利润

图:2011-2016上半年万向钱潮(分产品)营收占比

表:2011-2016上半年万向钱潮(分产品)营收情况

图:2011-2016上半年万向钱潮(分地区)营收占比

表:2015年万向钱潮来自前五名客户的营业收入情况

图:2012-2016上半万向钱潮毛利率

图:2011-2016上半年万向钱潮(分产品)毛利率

图:2012-2017年上海大郡经营业绩

表:大郡产品主要客户

图:上海大郡驱动电动产品体系

图:上海大郡驱动电动产品性能参数及应用

表:精进电动已生产的驱动电机主要规格

精进电动ISG混联 - 免维护插电混合动力系统

精进电动电磁换挡变速器(EMAT)驱动总成

图:2012-2018年前三季度方正电机营业收入及净利润

图:2014-2018上半年方正电机(分产品)营收

图:2012-2018上半年方正电机(分地区)营收占比

图:2012-2018H1方正电机毛利率

图 :电动汽车驱动控制领域架构及布局

图:2011-2018前三季度卧龙电气营业收入及净利润

图:2011-2018年上半年卧龙电气研发投入

图:2011-2017年卧龙电气(分产品)营收占比

图:2012-2017年卧龙电气(分地区)营收占比

图:2011-2018上半年卧龙电气毛利率

图:2011-2017年卧龙电气(分产品)毛利率

图:2010-2016年前三季度年信质电机营业收入及净利润

图:2015-2018上半年信质电机(分产品)营收占比

图:2011-2016上半年信质电机(分地区)营收占比

表:2015年信质电机来自前五名客户的营业收入情况

图:2011-2018前三季度信质电机毛利率

表:2015-2016上半年信质电机(分产品)毛利率

图:2011-2018年前三季度江特电机营业收入及净利润

图:2018上半年江特电机(分产品)营收占比

图:2013-2018上半年江特电机(分地区)营收占比

图:2012-2018前三季度江特电机毛利率

表:2015-2016上半年江特电机(分产品)毛利率

表:江特电机主营电动汽车业务的子公司

表:江特电机在研电机产品

表:北京中纺锐力机电已生产的电动汽车SRD电机主要规格

图:2013-2017博世营业收入及净利润

图:2013-2017年博世研发投入

图:2017年博世(分业务)营收占比

图:2016-2017年采埃孚(分业务)营业收入

表:2013-2017年采埃孚研发支出

图:2016-2017年采埃孚(分地区)营收

图:2016-2018Q3大陆集团营业收入

表:2017年大陆集团(分部门)营收构成

图:FY2015-FY2018爱信精机季度营业收入及营业利润

表:FY2017-FY2018爱信精机(分部门)营收构成及主要客户营收占比

图: FY2018爱信精机(分地区)营收占比

图:2017-2018年上半年现代摩比斯营业收入及净利润

图:2018年上半年现代摩比斯订单分析

图:2018年上半年现代摩比斯客户和产品进展

图:FY2014-FY2018西门子盈利及资产负债情况

表:西门子乘用车驱动电机规格和外观

表:西门子商用车ELFA驱动系统的构成

Composition of Drive Motor’s Driving System

Comparison of Parameters between EV Drive Motor and Conventional Motors

Classification of EV Drive Motor

Technical Features of EV Drive Motors by Type

Parameters of EV Drive Motors by Type

Block Diagram of Drive Motor Controller

Control Strategies and Current Application of Drive Motors by Type

Structure of BEV Drive Motor System

Working Principle and Application of HEV Drive Motor System

Structure of MHEV Drive Motor System

Structure of Range-extended Power System

Drive Motor System of BYD Tang PHEV

Dual-motor Hybrid Engine of Toyota Prius

China’s New Energy Passenger Car Subsidy Standards, 2018

Comparison of Subsidy Standards among Electric Buses in China (Central Finance), 2018

Monthly Sales of NEVs (EV&PHEV) Worldwide, 2014-2018

Ranking of Global NEV Enterprises by Sales, Jan-Sept 2018

Sales of Electric Passenger Cars (EV&PHEV) Worldwide, 2014-2022E

Production and Sales of EVs in China, 2011-2018.1-9

Monthly Production of EVs (Special Vehicles & Commercial Vehicles) in China, 2016-2017

China’s Production of Electric Buses, 2016-2017

China’s Production of Battery Electric Trucks, 2015-2017

Market Share of Battery Electric Passenger Car Enterprises in China, 2018.1-9

Monthly Sales of Electric Passenger Cars in China, 2017-2018.1-9

Ranking of New Energy Passenger Car Sales in China by Auto Model, Jan-Sep 2018

Sales of New Energy Passenger Car (EV&PHEV) Enterprises in China, 2016-2018(Jan.-Sept.)

Price Structure of Permanent Magnet Synchronous Drive Motor

Cost Structure of Motor Controller

Global Automotive Drive Motor/Inverter Market Size, 2015-2030E

Global BEV Drive Motor Market Size, 2015-2030E

China’s EV Drive Motor System Market Size, 2014-2020E

China’s New Energy Vehicle Drive Motor Shipments, 2013-2018H1

Main Types of Drive Motor and System Enterprises

Installations of Top10 Drive Motor Manufacturers and Top10 Controller Manufacturers, 2017

Automakers and Vehicle Models Backed by Top10 Drive Motor Manufacturers (Excluding OEMs), 2017

Installations and Supported Automakers of Top10 Drive Motor Manufacturers, 2018H1

Main Drive Motor and Controller Manufacturers in China

Seven Supply Modes of Motor and Controller Manufacturers in China

Motor Controller IGBT Manufacturers Worldwide

Motor Industry Distribution and Supply Relationship

Types of Motors Adopted by China-made Battery Electric Passenger Cars, 2017

Types of Motors Adopted by China-made Battery Electric Passenger Cars, 2015

Supply Relationship between Major Electric Bus Drive Motors and Controllers in China

Drive Comparison between Centralized and Hub Motors

Structure of Electric Drive Systems of Top10 Best-selling EVs Worldwide, 2016H1

Special Plan for China Electric Vehicle Industry during the 12th Fiver-year Plan Period (2011-2015)

Methods and Effects of Motor and Controller Integration

BorgWarner (Left) and ZF (Right)’s Drive Motor and Single-stage Reducer Integration

Digitalization of Motor Control System

IGBT Technology Roadmap

Block Diagram of Driving System of Hub Motor with Inner Rotor Structure

Hub Motor Applicable to Various New Energy Vehicle Models

Operation of Zhongshan Broad-Ocean Motor, 2014-2018Q3

Revenue Structure of Zhongshan Broad-Ocean Motor (by Sector), 2018H1

Revenue Structure of Zhongshan Broad-Ocean Motor (by Region), 2013-2018H1

Gross Margin of Zhongshan Broad-Ocean Motor, 2009-2016H1

Gross Margin of Zhongshan Broad-Ocean Motor (by Product), 2015-2016H1

Ten-year Development Strategy of Zhongshan Broad-Ocean Motor

Ten-year Development Strategy and Executors of Zhongshan Broad-Ocean Motor

Production and Sales of New Energy Vehicle Powertrains of Zhongshan Broad-Ocean Motor, 2014-2017

Major Subsidiaries of Zhongshan Broad-Ocean Motor

Equity Structure of Shanghai Edrive (before Acquisition)

Capacity and Sales of Drive Motor System of Shanghai Edrive, 2013-2017

Operating Results of Shanghai Edrive, 2009-2018H1

Types and Parameters of Drive Motor System of Shanghai Edrive

Dimensions and Appearance of Drive Motor System of Shanghai Edrive

Ranking by Monthly Sales of Public Buses, 2017

Types and Parameters of Drive Motors Made by Hunan CRRC Times Electric Vehicle

Revenue and Net Income of Wanxiang Qianchao, 2013-2018H1

Revenue Structure of Wanxiang Qianchao (by Product), 2011-2016H1

Revenue Breakdown of Wanxiang Qianchao (by Product), 2011-2016H1

Revenue Structure of Wanxiang Qianchao (by Region), 2011-2016H1

Wanxiang Qianchao’s Revenue from Top 5 Customers, 2015

Gross Margin of Wanxiang Qianchao, 2012-2016H1

Gross Margin of Wanxiang Qianchao (by Product), 2011-2016H1

Operating Performance of Shanghai DAJUN Technologies, 2012-2017

Major Customers of Shanghai DAJUN Technologies

Drive Motor Product System of Shanghai DAJUN Technologies

Parameters and Application of Drive Motor s of Shanghai DAJUN Technologies

Specifications of Drive Motors Made by JJE

ISG Hybrid - Maintenance-Free Plug-In Hybrid System of JJE

EMAT Drive Assembly of JJE

Revenue and Net Income of Zhejiang Founder Motor, 2012-2018Q1-Q3

Revenue of Zhejiang Founder Motor (by Product), 2014-2018H1

Revenue Structure of Zhejiang Founder Motor (by Region), 2012-2018H1

Gross Margin of Zhejiang Founder Motor, 2012-2018H1

Framework and Layout in EV Drive Control Field

Revenue and Net Income of Wolong Electric Group, 2011-2018Q1-Q3

R&D Expenditure of Wolong Electric Group, 2011-2018H1

Revenue Structure of Wolong Electric Group (by Product), 2011-2017

Revenue Structure of Wolong Electric Group (by Region), 2012-2017

Gross Margin of Wolong Electric Group, 2011-2018 H1

Gross Margin of Wolong Electric Group (by Product), 2011-2017

Revenue and Net Income of Xinzhi Motor, 2010-2016Q1-Q3

Revenue Structure of Xinzhi Motor (by Product), 2015-2018H1

Revenue Structure of Xinzhi Motor (by Region), 2011-2016H1

Xinzhi Motor’s Revenue from Top 5 Customers, 2015

Gross Margin of Xinzhi Motor, 2011-2018H1

Gross Margin of Xinzhi Motor (by Product), 2015-2016H1

Revenue and Net Income of Jiangxi Special Electric Motor, 2011-2018Q1-Q3

Revenue Structure of Jiangxi Special Electric Motor (by Product), 2018H1

Revenue Structure of Jiangxi Special Electric Motor (by Region), 2013-2018H1

Gross Margin of Jiangxi Special Electric Motor, 2012-2018Q1-Q3

Gross Margin of Jiangxi Special Electric Motor (by Product), 2015-2016H1

Jiangxi Special Electric Motor’s Subsidiaries Involved in EV Business

Drive Motor R&D of Jiangxi Special Electric Motor

Specifications of EV SRD Motor Made by China Tex MEE

Revenue and Net Income of Bosch, 2013-2017

R&D Expenditure of Bosch, 2013-2017

Revenue Structure of Bosch (by Business), 2017

Revenue of ZF Friedrichshafen AG (by Business), 2016-2017

R&D Expenditure of ZF Friedrichshafen AG, 2013-2017

Revenue of ZF Friedrichshafen AG (by Region), 2016-2017

Revenue of Continental AG, 2016-2018Q3

Revenue Structure of Continental AG (by Division), 2017

Revenue and Operating Income of Aisin AW, FY2015-FY2018

Revenue Structure of Aisin AW (by Division) and Aisin AW’s Revenue from Main Customers, FY2017-FY2018

Revenue Structure of Aisin AW (by Region), FY2018

Revenue and Net Income of Hyundai Mobis, 2017-2018H1

Order Analysis of Hyundai Mobis, 2018H1

Customers and Product Progress of Hyundai Mobis, 2018H1

Profit, Assets and Liabilities of Siemens, FY2014-FY2018

Specifications and Appearance of Passenger Car Drive Motor of Siemens

Composition of Commercial Vehicle ELFA Drive System of Siemens

如果这份报告不能满足您的要求,我们还可以为您定制报告,请 留言说明您的详细需求。

|