|

Chapter one: Overview of automotive electronic industry

1.1 The status of development of foreign automotive electronic

industry.

1.1.1 The history of industrial development and the current conditions

1.1.2 Market development and current condition

1.1.3 The current conditions of technological development

1.2 The current conditions of development for domestic automotive

¡¡ ¡¡electronic industry

1.2.1 The overview of automobile industry

1.2.2 The current situation of automotive electronic industry

1.3 The analysis on the needs and supplies in the market of automotive

electronic industry

1.3.1 The analysis on the needs and supplies in global market

of automotive electronic industry

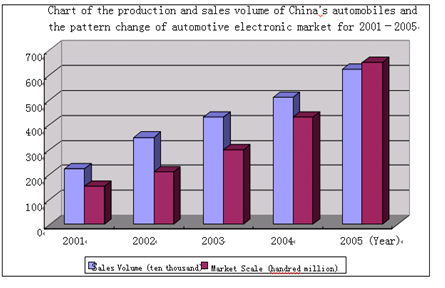

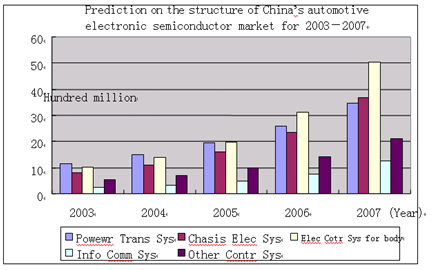

1.3.2 The analysis on the needs and supplies of automobile market

1.3.3 The analysis on China's automotive electronic market

Chapter Two: The entire vehicle manufacturers

2.1 Car manufacturers

2.1.1 Shanghai Volkswagen

2.1.2 FAW_VOLKSWAGEN

2.1.3 Shanghai GM

2.1.4 GuangZhou-Honda

2.1.5 TIANJIN FAW XIALI AUTOMOBILE

2.1.6 CHANGAN SUZUKI

2.1.7 Shanghai Automotive

2.1.8 Chery Automobile

2.1.9 Greely Automotive

2.1.10 Dongfeng Nissandiesel

2.1.11 Other manufacturers

2.2 Passenger car manufacturers

2.2.1 Zhengzhou Yutong

2.2.2 Golden Dragon

2.2.3 KING LONG (Shuzhou)

2.2.4 Mudan Automobile

2.2.5 Henan Shaolin

2.2.6 Xiamen Golden Dragon

2.2.7 Jiangsu Youyi

2.2.8 Dandong Huanghai

2.2.9 Yangzhou Yaxing

2.2.10 Zhong Tong Bus

2.2.11 Other manufactures

2.3 Truck manufacturers

2.3.1 FAW

2.3.2 Dong Feng

2.3.3 Beiqi Foton

2.3.4 Jianghuai

2.3.5 Qingling

2.3.6 Liuzhou Wuling

2.3.7 Changhe

2.3.8 Jiangling Motors

2.3.9 Changan Automobile

2.3.10 Other manufacturers

Chapter three Manufactures of accessories to match entire vehicle

3.1 Delphi

3.2 Bosch

3.3 Visteon

3.4 Denso

3.5 Other manufacturers

Chapter four: Manufacturers of onboard electronics

4.1 Overview of the market

4.2 Vendors of automotive audio devices

4.2.1 Sony

4.2.2 Clarion

4.2.3 Pioneer

4.2.4 ALPINE

4.2.5 KENWOOD

4.2.6 PANASONIC

4.2.7 JVC

4.2.8 Rockford

4.2.9 KICKER

4.2.10 JL

¡¡¡¡

4.2.30 HEYUAN HAOLILAI TELECOM., LTD.

4.2.31 HANGZHOU YUSONG ELECTRONIC TECHNOLOGY

4.2.32 Winners Technology Development Co., LTD.

4.2.33 Shenzhen SUNFLOWER Technology Co., LTD.

4.2.34 Shenzhen Kaiser Electronics Co., Ltd.

4.2.35 BOSSTAR TECHNOLOGY CO. ,LTD.

4.2.36 Other vendors

4.3 Domestic vendors of onboard GPS

4.3.1 SHENZHEN SEG SCIENTIFIC NAVIGATIONS CO.,LTD.

4.3.2 Shanghai Yongge Electronics Tech. Co., LTD.

4.3.3 Beijing Shengji Hengxin Technology Development Co., LTD.

4.3.4 Beijing BDStar Navigation Tech. Co., LTD.

4.3.5 Beijing TRAILHEAD Information Tech. Co., LTD.

4.3.6 Shanghai Zhichuan Tech. Co., LTD.

4.3.7 Shandong Wucheng Electronics Tech. Co., LTD.

4.3.8 Guangzhou Zihe Electronics Tech. Co., LTD.

4.3.9 Hangzhou Qiujing Tech. Co., LTD.

¡¡¡¡

4.3.27 Shanghai Quanrun Information

4.3.28 Shenzhen SEG Communication Co., Ltd.

4.3.29 Shanghai Llingyu Automotive Electronics

4.3.30 Shenzhen Maxwell Tech. Co., LTD.

4.3.31 Taiwan Boshuo

4.3.32 Beijing SECUGIS HITECH CO., Ltd.

4.3.33 Taiwan MiTAC

4.3.34 Taiwan J&J Technology Inc.

4.3.35 Taiwan Junbang

4.4 Foreign vendors of onboard GPS

4.4.1 Clarion

4.4.2 TOPCON

4.4.3 ICOM

4.4.4 Alpine Electronics

4.4.5 Denso

4.4.6 Kenwood

4.4.7 Sony

4.4.8 Fujitsu

4.4.9 Pioneer

4.4.10 Panasonic

4.4.11 Aisin AW

¡¡¡¡

4.4.25 Javad

4.4.26 CSI

4.4.27 Sychip

4.4.28 Trimble

4.4.29 Honeywell

4.4.30 DDS

4.5 Vendors of onboard communication devices (mobile station)

4.5.1 BEIJING HUAXUN GOLDWAVE COMMUNICATION TECH.CO.,LTD.

4.5.2 Beijing Xinghe Telecom

4.5.3 Beijing Heruitong Tech. Co., LTD.

4.5.4 Guangzhou Shuangteng

4.5.5 Motorola£¨China£©Electronics Co., LTD.

4.5.6 Beifeng Electronic Communication Facility Co., Ltd

4.5.7 Texgar (Holdings) Ltd.

4.5.8 Shanghai Guanghan Telecom

4.5.9 Shenzhen Friendcom Technology Development Co. Ltd.

4.6 Vendors of Onboard Walkie Talkie Sets

4.6.1 Shenzhen CXD company

4.6.2 Guangzhou Dibo Telecommunication Equipment

4.6.3 Fujian Quanzhou Baojia Communication Equipment

4.6.4 ICOM

4.6.5 Shenzhen HYT Science & Tech. Co., ltd.

4.6.6 Zhejiang RAINBOW ELECTRONICS CO., LTD.

4.6.7Shenzhen Hoffer Electronics Co., ltd.

4.6.8 Guangzhou Weierwei Electronic Science & Tech. Co. ,ltd.

4.6.9 Fujian Quanzhou Puxing Electron

4.6.10 Shenzhen Odessa Industrial Co., ltd.

4.6.11 Shenzhen Huatong Communication Co., ltd.

4.7 Vendors of car phones

4.7.1 Shenzhen SEG Science Navigations Co., ltd.

4.8 Vendors of Car PC

4.8.1 Microsoft

4.8.2 sun

4.8.3 WindRiver

Chapter five: Vendors of automotive semiconductors

5.1 Overview of automotive semiconductors industry

5.2 Vendors of automotive ECU/MCU

5.2.1 Motorola

5.2.2 infineon

5.2.3 ST

5.2.4 Renesas

5.2.5 Toshiba

5.2.6 NEC

5.2.7 Philips

5.2.8 Bosch

5.2.9 TI

5.2.10 Intel

5.2.11 Beijing Hengrun Science & Technology Co., ltd.

5.2.12 Other vendors

5.3 Vendors of automotive transducers

5.3.1 Honeywell Inc

5.3.2 Mianyang Weibo Electronics Co., ltd.

5.3.3 Collilligh

5.3.4 Fujitsu

5.3.5 Maxim

5.3.6 Ningbo Galaxy Auto Electron Co., Ltd.

¡¡¡¡

5.3.21 Guangzhou Taizhen Electronics Co., ltd.

5.3.22 Wenzhou Xintian Group

5.3.23 Ningbo Shunjiang Auto Parts

5.3.24 Zhangjiagang leda Automobile Electric Appliance Co., Ltd.

5.2.25 Heilongjiang Sensitivity Technology Industry

5.3.26 Liaoning Linghe Auto Engine Manufactory

5.3.27 Other vendors

Chapter Six: The classification and market of automotive electronics

6.1 The automotive electronics for engine

6.1.1 EFI system

6.1.2 Electronic ignition system

6.1.3 EGAS system

6.1.4 Electronic Controlled Variable Displacement System

6.1.5 Electronic Controlled Variable Induction System

6.1.6 Electronic Controlled Variable Valve Timing and Lift System

6.1.7 Electrical EGR

6.1.8 Electronic Controlled Electrical Fun

6.2 Automotive electronics for chassis

6.2.1 ABS

6.2.2 TCS

6.2.3 EPS

6.2.4 EBD

6.2.5 EBS

6.2.6 ASR

6.2.7 VDC

6.2.8 EDS

6.2.9 DSC

6.2.10 ADS

6.2.11 Tire Monitoring System

6.3 Automotive electronics for vehicle body

6.3.1 Antenna

6.3.2 Air bag Supplemental Restraint System£¨SRS£©

6.3.3 Three Points Safety Belt

6.3.4 Electrical Door Lock

6.3.5 Electrical Windows

6.3.6 Electronic Controlled Inside-Car Environmental Monitoring

System

6.4 Automotive Communication and Navigation

6.4.1 GPS Receiving Devices

6.4.2 E-Map

6.4.3 GSM Receiving System

6.4.4 Communication Equipments

6.4.5 On-vehicle GPS Monitoring System

6.4.6 Automotive Software

6.4.7 Automotive System for Office Work

6.4.8 Network Equipments

6.4.9 CCS

6.5 Automotive devices for entertainment and safety

6.5.1 Onboard Audio and Video devices

6.5.2 Air Conditioning

6.5.3 Alarming devices

6.5.4 Anti-theft devices

6.5.5 Car Reversing Radar

6.5.6 Anti-collision Radar

6.5.7 Video Inspection System

6.5.8 Automobile Communication System

6.5.9 Auto-driving system

6.5.10 Driver Conditions Supervision System

6.5.11 Intelligent Security System

6.6 Vehicle Maintenance and Diagnoses and Test Equipments

6.6.1 Electronic Four-wheel Locator

6.6.2 Comprehensive Fault Diagnoser

6.6.3 Revolving Drum Test Table

6.6.4 Vehicle Overall Performance Tester

6.6.5 Displacement Analyzer

6.6.6 Decoder

6.6.7 Vehicle Test Line

Chapter Seven The cooperative relations among vendors of automotive

electronic industrial chains

7.1 The cooperative relations between vendors of entire vehicles

and vendors of accessories to match entire vehicles

7.2 The cooperative relations between the providers of entire

vehicles and other providers of automotive electronics.

7.3 Vendors of engine and their partners

7.4 Vendors of chassis electronics and their partners

7.5 Vendors of vehicle body electronics and their partners

7.6 Vendors of onboard electronics and their partners

7.7 Venders of vehicle maintenance equipments and their partners

Chapter Eight Law and regulation on automobile industry

8.1 Automobile Emissions Standard and Policies

8.1.1 Contents of the Standards

8.1.2 National First Phase Motor Vehicle Emission Standard

8.1.3 National Second Phase Motor Vehicle Emission Standard

8.1.4 National Third Phase Motor Vehicle Emission Standard

8.1.5 Introductions to the main national standards on motor vehicle

emission

8.1.6 Beijing Motor Vehicle Emission Standards and Implementation

Time Table

8.1.7 Shanghai Motor Vehicle Emission Standards and Implementation

Time Table

8.1.8 Guangzhou Motor Vehicle Emission Standards and Implementation

Time Table

8.1.9 Europe Motor Vehicle Emission Standards and Implementation

Time Table

8.1.10 Other countries' Motor Vehicle Emission Standards and Implementation

Time Table

8.2 Law and regulation on car loan

8.2.1 Rules of law on "Car loan management measures",

promulgated in 2004

8.2.2 Rules of law on "Car consuming loan management measures",

promulgated in 1998

8.2.3 Analysis on the highlights of newly promulgated management

measures

Appendix: Introductions to associations and standardization organization

related to automotive industry

|