|

报告导航:研究报告—

TMT产业—消费电子

|

|

2008年远望谷信息技术股份有限公司研究 |

|

字数:1.8万 |

页数:41 |

图表数:37 |

|

中文电子版:4500元 |

中文纸版:2250元 |

中文(电子+纸)版:5000元 |

|

英文电子版:1200美元 |

英文纸版:1100美元 |

英文(电子+纸)版:1500美元 |

|

编号:BY002

|

发布日期:2008-04 |

附件:下载 |

|

|

|

无线射频识别(RFID)产业是国家优先发展的产业之一。目前,RFID产业已经被列入了中国“十一五”规划和“863计划”。

信息产业部于2007年4月正式发布了《800/900MHz频段射频识别(RFID)技术应用规定(试行)》的通知,规定了800/900MHz频段RFID技术的具体使用频率为840-845MHz和920-925MHz。这项规定扫除了RFID正式商用的技术障碍,预示着RFID市场全面启动。

随着RFID技术的发展和国家产业政策的大力支持,RFID技术的应用将在我国呈现快速发展的势头,特别是在政府垄断性行业用户应用的带动下,RFID技术应用将会很快拓展到其它行业。水清木华行业研究中心的RFID行业报告显示,中国RFID产业的规模逐年大幅增长,其中超高频RFID产业2010年的产业规模将达37.3亿元,这对于在超高频RFID产业具有绝对竞争优势的远望谷来说,前景十分广阔。

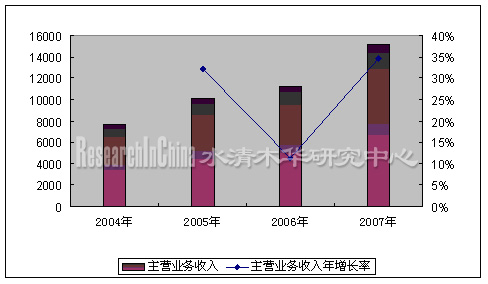

2004-2007年远望谷主营业务收入增长率

(单位:万元RMB)

来源:远望谷 水清木华研究中心

2005年以来,远望谷的主营业务收入一直保持高速增长,到2007年这三年的复合增长率为25.57%。

远望谷公司较早就进入了RFID行业,在项目差异化方案设计、项目实施经验和实施成本等方面更具备优势,凭借研发优势有能力为不同市场提供自主知识产权产品及差异化服务,因此在应用市场的数量和项目质量上均领先于竞争对手。同时,经过了多年的积累加之公司2007年的成功上市,与竞争对手相比,远望谷具有明显的资源和品牌优势。

本研究报告依据远望谷公司招股说明书、远望谷公司2007年年报、2007财务报表审计报告、水清木华RFID行业分析报告等权威渠道数据,对远望谷公司的经营各个方面的现状与前景进行了分析。

In China, Radio Frequency Identification (RFID) industry is one of several industries supported preferentially by the central government. RFID industry has been included in China’s Eleventh Five-Year Plan and National 863 Plan.

In April 2007, the Ministry of Information Industry officially released the notification on publication of the Trial Regulation on 800/900MHz Band Radio Frequency Identification (RFID) Technology Application, which stipulates that specific application bands of 800/900MHz band RFID technology are 840-845MHz and 920-925MHz. This regulation has removed technical barriers to the official, commercial use of RFID technology, indicating that the RFID market has fully initiated.

With the development of RFID technology and the great support from national industry policy, RFID technology application in China will keep a momentum of rapid development. China’s RFID technology application, propelled especially by the application of clients in the industries monopolized by governments, will soon expand to other industries. This report shows that the size of China’s RFID industry is growing rapidly and the market scale of China’s ultra-high RFID industry is expected to reach CNY3.73 billion in 2010. Invengo Information Technology Co., Invengo, with absolute competitive advantage in ultra-high RFID industry, will be bound to have fairly promising prospects,

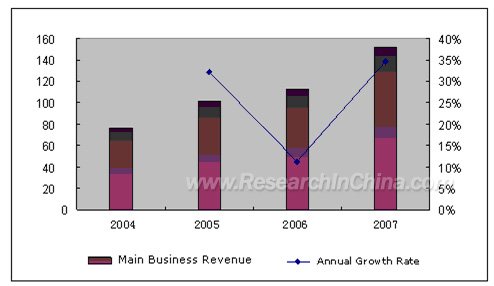

Growth Rate of Invengo’s Main Business Revenue, 2004-2007 (Unit: CNY million)

Source: Invengo

Ever since 2005, Invengo’s main business revenue has been growing rapidly. The average annual compound growth rate in the period 2003 to 2007 was 25.57%.

Invengo entered the RFID industry earlier, so it has more advantages in designing differentiated projects solutions, project execution and execution cost. With the help of its advantage in research and development, the company is able to offer products with independent intellectual property rights and differentiated services to different markets. Therefore, it took the leading place in both quality and quantity in the application market. Finally, its successful initial public offerings in 2007 and efforts made in the past several years have made Invengo in obvious advantages in resources and brands compared to its rivalries.

Based on the authoritative data, such as Invengo’s prospectus, its annual financial report in 2007, its financial audit report in 2007, the report makes an in-depth analysis of the current situation of business operation and the development prospect of the company.

第一章 公司基本情况

1.1 公司简介

1.2 公司主营业务范围

1.2.1 主营业务收入构成

1.2.2 主营业务毛利率分析

1.2.3 主营业务增长情况

第二章 公司治理

2.1 股东结构及股东情况

2.1.1 远望谷公司股权结构

2.1.2 远望谷公司股权变动情况

2.2 关联公司

第三章 产业分析

3.1 RFID技术简介

3.2 全球RFID产业分析

3.3 中国RFID产业分析

3.4 中国RFID产业需求预测

3.5 中国超高频RFID各应用市场分析

3.5.1 铁路RFID应用市场

3.5.2 烟草RFID市场分析

3.5.3 军事RFID应用市场

3.5.4图书管理市场

3.5.5集装箱RFID市场

3.5.6 物流零售RFID市场

3.5.7畜牧生产RFID市场

第四章 企业竞争能力分析

4.1 竞争对手分析

4.1.1 铁路RFID市场的竞争分析

4.1.2 其它超高频RFID市场的竞争分析

4.2 产品的可替代性

4.3 新竞争者进入壁垒

4.3.1 技术壁垒

4.3.2 市场准入壁垒

4.3.3 资金与品牌壁垒

4.4 与客户议价的能力

4.5 与供应商议价的能力

4.6企业竞争能力分析结论

第五章 公司财务分析

5.1 竞争能力分析

5.2 成长能力分析

5.3 盈利能力分析

5.4 财务健康状况分析

5.4.1 偿债能力指标分析

5.4.2 偿债能力的经营活动现金流量分析

5.5 经营效率分析

第六章 公司营运分析

6.1 公司营销分析

6.1.1 市场推广

6.1.2 产品销售渠道

6.1.3 售后服务

6.2 公司生产分析

6.3 研发创新能力分析

第七章 企业面临的风险分析

7.1 政策风险

7.2 技术风险

7.3 市场竞争的风险

7.4 主营业务收入波动的风险

7.4.1 业务集中主要客户的风险

7.4.2 主营业务收入季节性波动风险

第八章 投资决策

8.1 募集资金运用

8.2 项目简介

版权声明

免责声明

1. Company Profile

1.1 Brief Introduction

1.2 Primary Businesses

1.2.1 Structure of Mina Business Revenue

1.2.2 Gross Profits Margin of Main Business

1.2.3 Growth of Main Businesses

2. Corporate Governance

2.1 Shareholding Structure and Shareholders

2.1.1 Equity Structure

2.1.2 Changes in Equity

2.2. Affiliated Companies

3. RFID Industry

3.1 Brief Introduction to RFID Technology

3.2 Global RFID Industry

3.3. China RFID Industry

3.4 Forecast of China RFID Industry Demand

3.5 China Ultra-High RFID Application Market

3.5.1 RFID Application in Railway Market

3.5.2 RFID Application in Tobacco Market

3.5.3 RFID Application in Military Market

3.5.4 RFID Application in Library Management Market

3.5.5 RFID Application in Container Market

3.5.6 RFID Application in Logistics and Retail Market

3.5.7 RFID Application in Livestock Market

4. Competitive Edge

4.1 Rivalries

4.1.1 Competition in RFID Application in Railway Market

4.1.2 Competition in Other Ultra-High RFID Markets

4.2 Substitution of the Products

4.3 Entry Barriers to New Comers

4.3.1 Technical Threshold

4.3.2 Market Access Barriers

4.3.3 Capital and Brand Barriers

4.4. Bargaining Power with Clients

4.5 Bargaining Power with Suppliers

4.6 Conclusions

5. Corporate Finance

5.1 Competitiveness

5.2 Growing Ability

5.3 Profitability

5.4 Financial Status

5.4.1 Solvency Indicators

5.4.2 Solvency Cash Flows

5.5 Management Efficiency

6. Business Operation

6.1 Marketing

6.1.1 Market Promotion

6.1.2 Distribution Channels

6.1.3 After-Sales Service

6.2 Production

6.3 R & D and Innovations

7. Company Risks

7.1 Policy Risks

7.2 Technical Risks

7.3 Market Risks of Market Competition

7.4 Risks of Fluctuation in Main Business Revenue

7.4.1 Risks of Business with Focus on Key Clients

7.4.2 Risks of Seasonal Fluctuation in Main Businesses

8. Investment Decision

8.1 Use of Funds Raised

8.2 Project Introduction

图1.1 2005-2007年远望谷公司主营业务收入分产品构成

图1.2 2004-2007年远望谷公司铁路市场占主营业务收入的比例

图1.3 2004-2007年远望谷公司主营产品的毛利率趋势图

图1.4 2005-2007年远望谷公司销售综合毛利率

图1.5 2004-2007年远望谷公司主营业务收入增长趋势

图2.1 公司与实际控制人的产权和控制关系

图3.1:全球RFID在各应用市场占比

图3.2:2005年全球RFID产业链的产品构成

图3.3 2004-2010年中国RFID产业规模及预测(单位:亿元)

图4.1 2004-2007年远望谷销售费用占营业收入的比重

图5.1 2004-2007年远望谷自由现金流及其与销售收入比

图5.2 2004-2007年远望谷净资产报酬率

图5.3 2004-2007年远望谷销售净利率

图5.4 2004-2007年远望谷营业利润率

图5.5 每股经营活动现金净流量与每股收益(净利润/总股本)的比较

图6.1 远望谷的营销体系

图6.2 2004-2007年远望谷研发支出

图7.1 2004-2007年远望谷税收优惠占净利润的比例

图7.2 前五名客户销售收入总额占同期销售收入的比率

图7.3 2004-2007年远望谷1-2与3-4季度主营业务收入占全年主营业务收入比例

表1.1 公司基本资料

表1.2 2004-2007年远望谷公司分产品的毛利率

表2.1 公司公开发行股票前、后的股权结构

表2.2 远望谷主要控股公司和参股公司

表3.1:中国RFID产业发展远景规划

表4.1 远望谷公司主要产品及其用途

表5.1 远望谷竞争能力指标

表5.2 2004-2007年远望谷主营业务收入增长率

表5.3 2004-2007年远望谷净利润增长率

表5.4 2005-2007年远望谷偿债能力指标分析

表5.5 2005-2007年远望谷所收到现金与营业收入的比较

表5.6 2005-2007年远望谷经营活动产生的现金流量净额与主营业务利润的比较

表5.7 远望谷经营效率指标

表6.1 2006年远望谷主要产品产能、产量、销量情况

表8.1 远望谷2007年发行企业债及募股资金运用计划

表8.2 远望谷IPO募集资金2007年使用情况

表8.3 远望谷募集资金投资项目预计效益

The Company’s Prime Business Revenue Structure, by Products, 2005-2007

Proportion of The Company’s Railway Market to Prime Operation Revenue, 2004-2007

The Company’s Gross Profit Margin from Primary Business, 2004-2007

The Company’s Gross Profit Margin from Comprehensive Sales, 2005-2007

Growth Trend of the Company’s Prime Operation Revenue, 2004-2007

The Company and the Real Controller of the Company

Global RFID Application Proportion

Product Structure of Global RFID Industry Chain in 2005

China RFID Industry Scale and Forecast, 2004-2010

Proportion of Sales Cost of the Company to Total Operation Revenue, 2004-2007

The Company’s Cash Flows and the Proportions to the Sales Revenue

The Company’s Return on Net Assets 2004-2007

The Company’s Net Profit Margin from Sales 2004-2007

Comparison of Net Cash Flow per Stock and Net Profit/Capital Stock

The Company’s Marketing System

The Company’s Research & Development Expenditure, 2004-2007

Proportion of Tax Preferential to Net Profit

Sales Revenue of Top Five Clients to the Total Sales Revenue

Prime Operation Revenue of 1-2 Quarter and 3-4 Quarter to the Yearly Total

Company Profile

The Company’s Gross Profit Margin by Products, 2004-2007

Shareholding Structure of the Company before and after Publicly Issuing Stocks

The Company’s Main Shareholders

RFID Industry Development Plan in China

The Company’s Main Products and Main Application Fields

The Company’s Competitiveness Indexes

Growth Rate of the Company’s Prime Operation Revenue, 2004-2007

Growth Rate of the Company’s Net Profit 2004-2007

The Company’s Solvency Ability Indexes 2005-2007

The Company’s Cash in and Operation Revenue 2005-2007

The Company’s Net Value of Cash Flow in Management Activities and Prime Operation Revenue

The Company’s Operation Efficiency Indexes

Production Capacity, Production and Sales Volume of the Company’s Main Products, 2006

Corporate Debt Issued by the Company in 2007 and Capital Application Plan

Fund Raised through IPO and the Use of the Fund in 2007

如果这份报告不能满足您的要求,我们还可以为您定制报告,请 留言说明您的详细需求。

|