|

报告导航:研究报告—

制造业—建筑

|

|

2008年中国中密度纤维板(中纤板)投资分析报告 |

|

字数:2.4万 |

页数:51 |

图表数:35 |

|

中文电子版:4500元 |

中文纸版:2250元 |

中文(电子+纸)版:5000元 |

|

英文电子版:1500美元 |

英文纸版:1400美元 |

英文(电子+纸)版:1800美元 |

|

编号:AB015

|

发布日期:2008-06 |

附件:下载 |

|

|

|

中(高)密度纤维板(MDF-Medium Density Fiberboard,以下简称中纤板)制造业属于人造板制造业的子行业。由于中纤板具有材质细密、性能稳定等优点,在中国应用领域不断扩大,中纤板的生产和消费量逐年上升,已成为人造板市场需求的主流。

由于具有原料来源广泛、物理稳定性强,能使劣质原料变成幅面宽阔的优质板材,人造板已逐步成为木材的主要替代品。到2007年底,中国已有人造板企业6000多家,生产规模超过8000万立方米,成为世界人造板生产和消费第一大国。据中国林产工业协会预测,依照人造板工业历史产量的平均增长速度,“十一五”期间,中国人造板工业将以高于同期国民经济3-5 个百分点的速度增长。

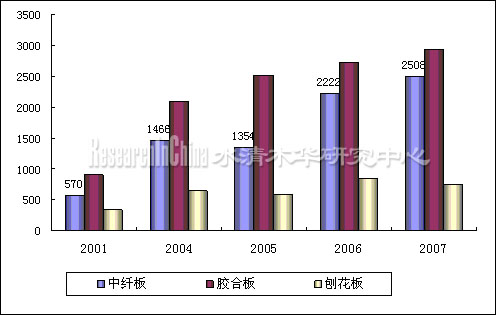

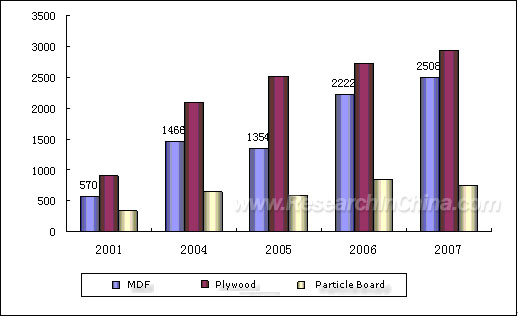

随着行业的快速增长,人造板主要产品产能也在迅速扩张。在三大主要板材中,胶合板以约占三大主要板材总产量50%的份额长期保持主导地位。然而,由于胶合板以优质大径级木材为主要原料,受国家对实木制品消费税及出口退税政策调整的影响,产品份额明显下降。预计“十一五”末期,其份额将下降至三大板材总产量的40%左右。中纤板和刨花板则以林区剩余物和次小薪材为原材料,受国家产业政策的鼓励。但是,刨花板由于产品质量普遍不高且在家具制造中用量较少,近年发展较缓。比较而言,中纤板的生产资源利用率高,产品材质细密、性能稳定、边缘紧密便于加工,近年来在产量迅速增加的同时,在人造板产品结构中的份额也越来越高。

图 2001-2007年中国中纤板产量及其他人造板的对比

资料来源:中国林产工业协会、国家林业局

单位:万立方米

中国的中纤板行业将随着人民生活水平的不断提高,尤其是随着中央的“三农”问题的不断解决,西部大开发、东北的振兴和中部的屈起等战略措施不断实现,中国的国民经济发展,尤其是房地产将保持一定的发展速度,这样,对家具、音响设备、装修和装饰、包装、汽车等的需求量必然增大,这些行业的发展必然带动中纤板的消费量,预计到2010年中国中纤板需求量将达到2700万立方米,而到2015年,中国的中纤板需求量将达到3570万立方米左右。因此,中纤板市场的发展空间仍较大,但是,原材料供应不足将一定程度地限制中纤板的产量。

Medium Density Fiberboard (MDF) manufacturing industry is the sub-industry of manmade board manufacturing industry. Due to the advantages of MDF, like finer material and steady performance, its application in China is increasingly becoming wider and wider and China MDF output and consumption are also continuously expanding, which has made MDF the mainstream market demand for manmade board in China.

Since the features of manmade board, including wide source of raw materials, strong physical stability, enable producers to make wide high-quality board out of poor raw materials, manmade board has become the main substitution of timber gradually. By the end of 2007, China has had more than 6,000 manmade board manufacturers with a production capacity exceeding 80 million cubic meters, making China the largest country in the world in terms of production and consumption of manmade board. According to the forecast by China National Forest Product Industry Association, during the Eleventh Five-Year Plan period (2006-2010), China’s manmade board sector is expected to have a higher growth rate than the national economy by 3-5 percentage points in the same period.

With the rapid growth of industry, the production capacity of main manmade board products is also expanding rapidly. Among the three main boards, plywood has maintained the leading position for long by taking up 50% share of the total output of the three main boards. However, the market share of plywood has dropped dramatically, due to the factors that its main raw material is high quality and large-diameter lumber and policy adjustments by the central government to consumption tax and export rebate on solid wood products. It is forecasted that its share will fall to about 40% of the total output by the end of 2010. MDF and flakeboard take forest residues and sub-quality & small fuelwood as their raw materials, so they are encouraged by the national industry policy. Nevertheless, flakeboard has developed slowly in recent years, since its quality is generally not high and its application in furniture manufacturing is not big. Relatively, MDF output has increased rapidly in recent years, and meanwhile, its share in manmade board product mix has become increasingly larger and larger, thanks to its high production resource utilization, fine materials and steady performance.

Output Comparison between China MDF and Other Manmade Board, 2001-2007 (Unit: 10,000 cubic meters)

Source: China Forestry Industry Association; State Forestry Administration

With the improvement of living standard, China’s MDF sector will surely continue to grow, boosted powerfully by continuous execution of several key government development plans, including the China Western Development Program, the Plan of Revitalizing Northeast China, the Rise of Central China as well as the policy on solving the Problems of “Agriculture, Villages and Farmers”. China’s economic growth, especially its sustained development of real estate industry, will inevitably stimulate a big growth in the demand for furniture, audio equipment, renovation & decoration, packaging and automobile, which will certainly propel the growth in the MDF consumption. It is forecasted that China’s demand for MDF will reach 27 million cubic meters in 2010 and about 35.7 million cubic meters in 2015. Therefore, there is still a large space for the development of MDF market. However, its output will be restricted, to some extent, by the short supply of raw materials.

1 行业背景分析

1.1 中国林业资源背景分析

1.1.1 森林资源状况

1.1.2 速生丰产林发展状况

1.1.3 林业产业的供求状况

1.2 人造板行业运行分析

1.2.1 人造板供需分析及预测

1.2.2 投资人造板行业风险分析

1.3 中纤板行业概况

1.4 政策环境分析

2. 中纤板行业投资特性

2.1 行业竞争特点分析

2.2 行业市场区域格局

2.3 行业盈利能力分析

2.4 行业技术水平分析

2.5 上下游行业关联性

2.6 行业进入壁垒分析

2.7 行业发展趋势分析

2.7.1行业竞争焦点已集中到对林木资源的拥有上

2.7.2应用新技术,提高木材综合利用率

2.7.3产品向绿色环保型发展

2.7.4 产品将朝多品种、功能化方向发展

2.7.5 生产规模从中小型向大中型转化

3. 中纤板行业供需分析

3.1 全球中纤板供给

3.2 中国中纤板供给

3.3 全球中纤板市场需求

3.4 中国中纤板市场需求

3.5 供需对比分析

4. 中纤板行业影响因素

4.1 中纤板行业发展的有利因素

4.1.1 国家产业政策扶持

4.1.2行业管理体制不断完善

4.1.3相关行业快速发展

4.1.4原材料替代

4.1.5产品升级和技术替代

4.2 中纤板行业发展的不利因素

4.2.1原材料资源紧张

4.2.2技术装备水平较低

4.2.3产品品种结构失衡

4.2.4行业规则不完善,市场竞争不规范

4.2.5某些企业的中纤板质量有待提高

4.2.6林业经营的资金需求量大,周期长

5. 行业企业分析

5.1 大亚科技

5.1.1 企业概况

5.1.2 主营业务收入及利润构成

5.1.3 企业竞争力分析

5.2 威华股份

5.2.1 企业概况

5.2.2企业盈利能力分析

5.2.3企业竞争力分析

5.3 永安林业

5.3.1 企业概况

5.3.2 产品及营业收入分析

5.3.3 企业竞争力分析

5.4 其他主要公司

5.4.1 浙江绿源木业股份有限公司

5.4.2 浙江丽人木业集团有限公司

5.4.3上海绿洲实业有限公司

5.4.4 广西高峰林场人造板企业集团

5.4.5 山东贺友集团有限公司

5.4.6 广西三威林产工业(集团)有限公司

5.4.7 上海捷成白鹤木工机械有限公司

5.4.8 佛山市顺德顺龙木业有限公司

5.4.9 南海佳顺木业有限公司

5.4.10 广东五联木业集团有限公司

1. Industry Background

1.1 China’s Forest Resource

1.1.1 Overview

1.1.2 Development of Fast-growing and High-yielding Forest

1.1.3 Supply and Demand

1.2 Operation of Manmade Board Industry

1.2.1 Forecast of Supply and Demand in Manmade Board Industry

1.2.2 Investment Risk inManmade Board Industry

1.3 Overview of MDF Industry

1.4 Policy Environment

2. Features of Investment in MDF Industry

2.1 Competition Features

2.2 Regional Market Layout

2.3 Profitability

2.4 Technology

2.5 Relevance of Upstream and Downstream Sectors

2.6 Entry Barrier

2.7 Development Trend

2.7.1 Industry Competition Focus: Ownership of Forest Resource

2.7.2 New Technology Application to Improve Comprehensive Utilization of Timber

2.7.3 Products Moving towards Environment-friendly

2.7.4 Products Evolving towards Diversification and Multi-function

2.7.5 A Shift to Large & Medium Business from Medium & Small Business

3. Supply and Demand in MDF Industry

3.1 Global MDF Supply

3.2 China’s MDF Supply

3.3 Demand of Global Market

3.4 Demand of China’s Market

4. Factors Affecting MDF Industry

4.1 Favorable Factors

4.1.1 National Policy Support

4.1.2 Increasingly Improved Industry Management System

4.1.3 Rapid Development of Relevant Industries

4.1.4 Substitution of Raw Materials

4.1.5 Product Upgrading and Technology Substitution

4.2 Unfavorable Factors

4.2.1 Shortage of Raw Materials Source

4.2.2 A Low Level of Technology and Equipment

4.2.3 Imbalance of Product Variety Structure

4.2.4 Imperfect Industry Rules and Irregular Market Competition

4.2.5 MDF Quality of Some Companies to be Improved

4.2.6 A Big Demand for Funds and Long Cycle In Forest Operation

5. Key Companies

5.1 Dare Technology Group

5.1.1 Overview

5.1.2 Structure of Main Business Revenue and Profit

5.1.3 Competitiveness

5.2 Guangdong Huawei Co., Ltd

5.2.1 Overview

5.2.2 Profitability

5.2.3 Competitiveness

5.3 Fujian Yong’an Forestry Co., Ltd

5.3.1 Overview

5.3.2 Products and Operating Revenue

5.3.3 Competitiveness

5.4 Other Key Companies

5.4.1 Zhejiang Lvyuan Wood Industry Co., Ltd

5.4.2 Zhejiang Liren Wood Group Co., Ltd

5.4.3 Shanghai Green Continent Investment Co., Ltd

5.4.4 Guangxi Gaofeng Forestry Manmade Board Group

5.4.5 Shandong Heyou Group Co., Ltd

5.4.6 Guangxi Sanwei Forestry Industry (Group) Co., Ltd

5.4.7 Shanghai Jiecheng Baihe Woodworking Machinery Co., Ltd

5.4.8 Foshan Shunde Shunlong Wood Co., Ltd

5.4.9 Nanhai Jiashun Wood Co., Ltd

5.4.10 Guangdong Wulian Wood Industry Group Co., Ltd

图 2001-2006 年营造林面积结构示意图

图 2006 年速生丰产用材林结构示意图

图 中国人造板生产能力及预测

图 2001-2007年人造板主要产品产量变化

图 人造板主要产品结构变动趋势及预测

图 2006年前10位省区中纤板产量

图 中(高)密度纤维板市场分布

图 全球中纤板生产能力

图 2006 年前10 位省区中纤板生产线及生产能力对比

图 2001—2007年中国中纤板产量

图 2001-2007 年中国中纤板产量与需求量对比

表 中国2008年第一季度林产品进出口统计表

表 广东省2008年第一季度林产品进出口统计表

表 威华股份公司主营业务收入及主营业务利润按行业分布的构成情况

表 威华股份公司主营业务收入及主营业务利润按产品分布的构成情况

表 威华股份公司主营业务收入及主营业务利润按地区分布的构成情况

表 威华股份公司主营业务分地区情况

表 威华股份公司公司最近三年主要产品的产量表

表 威华股份公司平均销售价格的变动情况

表 威华股份公司2004 年-2007 年市场份额

表 大亚科技2007 年度主营业务构成情况

表 大亚科技2007 年主营业务分地区情况

Structure of Afforestation Area, 2001-2006

Fast-growing and High-yielding Forest Structure, 2006

Production Capacity and Forecast of China Manmade Board

Changes in Output of Main Manmade Board Products, 2001-2007

Trend and Forecast of Changes in Main Manmade Board Product Mix

China Top Ten Provinces and Regions in Terms of MDF Output, 2006

Distribution of MDF and HDF Market

Global MDF Production Capacity

China Top Ten Provinces & Regions in MDF Product Lines and Production Capacity, 2006

China MDF Output, 2001-2007

China MDF Output and Demand for MDF, 2001-2007

China Import and Export of Forest Products, Q1 2008

Import and Export of Forest Products in Guangdong Province, China, Q1 2008

Structure of Main Business Revenue & Profit by Sector, Guangdong Huawei Co., Ltd.

Structure of Main Business Revenue & Profit by Product, Guangdong Huawei Co., Ltd

Structure of Main Business Revenue & Profit by Region, Guangdong Huawei Co., Ltd

Main Business Revenue by Region, Guangdong Huawei Co., Ltd

Output of Main Products in Recent Three Years, Guangdong Huawei Co., Ltd.

Changes in Average Selling Price of Guangdong Huawei Co., Ltd

Market Shares of Guangdong Huawei Co., Ltd, 2004-2007

Main Business Structure of Dare Technology Group, 2007

Main Business by Region, Dare Technology Group, 2007

如果这份报告不能满足您的要求,我们还可以为您定制报告,请 留言说明您的详细需求。

|