|

|

|

报告导航:研究报告—

TMT产业—电子半导体

|

|

2012-2013年全球及中国GaAs行业研究报告 |

|

字数:2.1万 |

页数:112 |

图表数:106 |

|

中文电子版:8000元 |

中文纸版:4000元 |

中文(电子+纸)版:8500元 |

|

英文电子版:2200美元 |

英文纸版:2300美元 |

英文(电子+纸)版:2500美元 |

|

编号:ZYW150

|

发布日期:2013-05 |

附件:下载 |

|

|

|

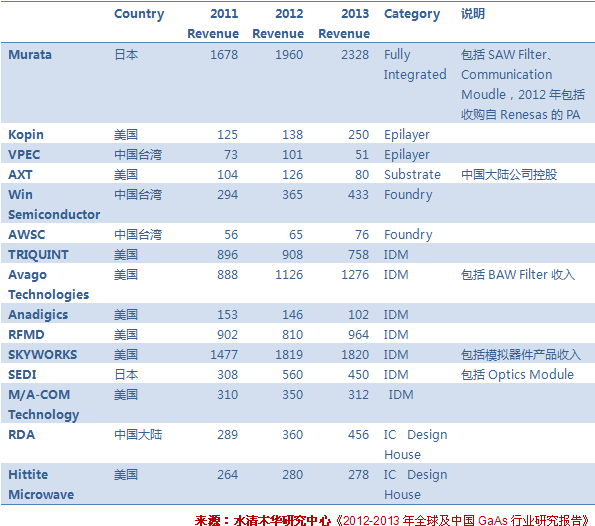

2012-2013年全球及中国GaAs行业研究报告包括以下内容:1、GaAs简介 2、GaAs产业概况 3、GaAs下游市场 4、手机RF系统分析 5、19家GaAs厂家研究 2013年上半年GaAs产业最大的新闻就是高通在2月份推出可以对应LTE的CMOS PA,这再一次点燃了CMOS与GaAs之间的战火。但是大部分人认为高通此举不是为了抢占GaAs厂家的市场,而只是为了增加自己Baseband的竞争力。 CMOS PA在2000年前就已经出现,但是一直都处于少量出货阶段,主要是成本和性能难以平衡,目前局限在2G领域,而高通的RF360似乎想打破这一限定。高通是手机Baseband大厂, 其主要收入来自3G、4G通讯专利和Baseband。2013年高通的收入预计为245亿美元,其Baseband出货量预计达到700百万片,也就是大约135亿美元。 手机PA的毛利率不及高通Baseband毛利率的一半,但手机PA市场风险很高。PA是手机第二重要的零部件,决定了通话质量,也很大程度上左右待机时间与通话时间,企业一旦选定PA供应商,极少更换。 高通推出RF360主要是针对联发科和展讯目标市场是中国山寨机Whitebox厂家。一直以来whitebox厂家都只采用联发科或展讯的平台,基本不采用高通的平台,其原因就是联发科和展讯提供的整体设计方案更加简单,集成度更高。高通的专长是设计Baseband而不是提供整体设计方案,因此高通始终无法进入山寨机市场,而这个市场规模在1亿台以上。为了进入此市场,高通特别推出RF360,这个芯片大大降低了手机设计难度,让山寨机Whitebox厂家有能力单独设计手机,高通会将RF360与其低端Baseband捆绑销售。 另一方面,高通几乎垄断了除中国山寨机Whitebox厂家外智能手机的Baseband市场,作为全球第一大手机厂家的三星一直对高通的垄断地位心有不甘,每年三星都差不多为高通贡献50亿美元的收入。三星也在开发自己的Baseband,在Galaxy S3上已经有使用,高通推出RF360,则是提高产业门槛,打消三星继续自制Baseband的念头。三星在RF系统领域很差,实力甚至不如中国厂家。 多家初创公司一直致力用CMOS PA替代砷化镓PA,其中AXIOM已经在2G手机上实现了千万级的出货量,而Javelin也宣称今年6月份将量产CMOS工艺的3G PA。 和初创公司的高调相比,RFMD、Anadigics和英飞凌等现有供应商仍对CMOS PA持怀疑态度,认为CMOS PA很难在成本和性能上取得平衡,即使是收购了AXIOM的Skyworks也认为CMOS PA在3G和4G等高端应用市场空间有限。 目前CMOS PA仍然难以在成本和性能间取得平衡,CMOS PA既达不到砷化镓功放的性能,成本优势也并非绝对。 虽然目前来看CMOS PA并无优势,但是GaAS大厂也纷纷收购CMOS PA公司做好技术储备,2013年4月30日, Avago Technologies 完成对Javelin Semiconductor的收购,但收购价格没有公开。RF Micro Devices收购CMOS PA初创公司Amalfi。再之前的就是2009年Skyworks收购Axiom Microdevices。几周前,Peregrine Semiconductor宣布与Murata结成合作伙伴关系,针对前端手机模组的潜在应用,共同开发CMOS silicon-on-sapphire PAs。 2011-2013年全球GaAs厂家收入排名

Global and China GaAs Industry Report, 2012-2013 covers the followings: 1 Brief introduction to GaAs 2 Industry overview of GaAs 3 Downstream market of GaAs 4 Analysis on mobile phone RF system 5 Study on 19 GaAs vendors In

2013H1, the biggest news in GaAs industry lay in QUALCOMM’s

introduction of CMOS PA in Feb, corresponding to LTE. That once again

initiated the war between CMOS and GaAs. Yet, most people believe that,

QUALCOMM did that only to increase competitiveness of its Baseband, not

grab market of GaAs vendors. CMOS PA showed up before 2000, but

has not been available in volume and only used in 2G field presently,

mainly due to the difficulty to find balance between costs and

performance. Yet, it seems that RF360 of QUALCOMM wants to break through

the limitation. QUALCOMM is a large mobile phone Baseband vendor, whose

revenue comes mainly from 3G and 4G telecommunication patent and

Baseband, and is expected to get USD24.5 billion in 2013. Among that,

shipment of Baseband is anticipated to reach 700 million units, valuing

about USD13.5 billion. Gross margin of mobile phone PA is less

than half of that of QUALCOMM’s Baseband, and running very high market

risk. PA is the second important part of mobile phone, which not only

decides the voice quality but also determines the stand-by time and

talking time. The enterprise seldom changes PA suppliers, once they were

selected. RF360 of QUALCOMM is mainly to deal with MTK and

Spreadtrum, and aiming at knock-off digital product Whitebox vendors.

Vendors of Whitebox adopt the platform of MTK or Spreadtrum instead of

QUALCOMM, for the simpler design and higher level of integration of

overall solution of the former two. As for QUALCOMM, it is expert in

Baseband design, not integrated solution. So QUALCOMM can’t enter the

knock-off digital product market, which contains more than 100 million

sets. So as to set foot in the field, QUALCOMM introduces the RF360 on

purpose, and this chip lowers the mobile phone design difficulty to a

large extent. Bundle sales of RF360 and Baseband of QUALCOMM will equip

Whitebox vendors with ability to design mobile phone independently. On

the other side, as the No.1 mobile phone vendor, SAMSUNG contributes

about USD5 billion to QUALCOMM each year, though unwillingly, since the

market of Basebands for smartphone (except Chinese knock-off digital

product Whitebox) is monopolized by QUALCOMM. So, SAMSUNG is developing

Baseband presently, and some have already been used for the Galaxy S3.

However, QUALCOMM introduced RF360 to raise the industry threshold and

stop SAMSUNG from developing its own Baseband. SAMSUNG is very weak in

RF field, even weaker than Chinese vendors. Lots of start-ups

are dedicated to replacing GaAs PA with CMOS PA, among which, AXIOM has

already realized a shipment of over 10 million sets for 2G mobile

phones. In addition, Javelin announced to mass-produce 3G PA with CMOS

technique this June. Unlike the start-ups, RFMD, Anadigics,

Infineon and other existing suppliers showed skepticism about CMOS PA,

believing that it is hard for CMOS PA to strike balance between costs

and performance. Even Skyworks, who acquired AXIOM, thinks that

application of CMOS PA in high-end market like 3G and 4G is very

limited. Presently, CMOS PAS still has difficulties to achieve

balance between costs and performance. It is inferior to GaAs in

amplifier performance, further doesn’t have absolute advantage of costs.

However, many large GaAs vendors acquired CMOS PA companies one after

another to make technical reserves. On Apr. 30, 2013, Avago Technologies

finished the acquisition of Javelin Semiconductor, without revealing

the price. RF Micro Devices took over CMOS PA start-up Amalfi. In 2009,

Skyworks acquired Axiom Microdevices. Several weeks ago, Peregrine

Semiconductor declared to cooperate with Murata in developing CMOS

silicon-on-sapphire PAs for potential applications of front-end mobile

phone modules. Revenue of Global GaAs Vendors, 2011-2013

第一章、GaAs简介

1.1、GaAs简介

1.2、GaAs应用

1.3、GaAs、GaN、SiGe对比

1.4、GaAs制造工艺

第二章、GaAs产业

2.1、GaAs产业链

2.2、全球GaAs产能

2.3、GaAs供需分析

2.4、GaAs厂家排名

第三章、GaAs下游市场

3.1、网络设备市场

3.2、手机市场

3.3、全球手机市场规模

3.4、手机品牌市场占有率

3.5、智能手机市场与产业

3.6、中国手机产业地域分布

3.7、中国手机出口规模

3.8、中国手机出口特点

3.9、中国手机出口地域分布

第四章、无线射频系统前端分析

4.1、最新的手机和平板电脑的RF系统的分析

4.2、手机射频前段系统

4.3、手机滤波器

4.3.1、TDK-EPC

4.4、手机天线开关

4.5、手机PA

4.6、手机PA与手机品牌配套关系

4.6、高通 RF 360

4.7、GaAs PA、RF Mems、CMOS PA之争

第五章、GaAs厂家研究

5.1、村田制作所(Murata)

5.2、Kopin

5.3、住友电气半导体分部

5.4、Freiberger

5.5、AXT

5.6、IQE

5.7、稳懋

5.8、宏捷科技AWSC

5.9、全新光电

5.10、GCS

5.11、Triquint

5.12、AVAGO

5.13、Anadigics

5.14、RFMD

5.15、锐迪科RDA

5.16、Skyworks

5.17、SEDI

5.18、Hittite Microwave

5.19、M/A-COM Technology

1 Overview of GaAs

1.1 Profile of GaAs

1.2 Application of GaAs

1.3 Comparison among GaAs, GaN and SiGe

1.4 Manufacturing Technique of GaAs

2 GaAs Industry

2.1 Industry Chain of GaAs

2.2 Global Capacity of GaAs

2.3 GaAs Supply and Demand

2.4 Ranking of GaAs Vendors

3 Downstream Market of GaAs

3.1 Network Devices

3.2 Mobile Phone

3.3 Global Mobile Phone Market Size

3.4 Mobile Phone Market Structure by Brands

3.5 Smart Phone Market and Industry

3.6 China Mobile Phone Industry by Region

3.7 China Mobile Phone Export Scale

3.8 China Mobile Phone Export Characteristics

3.9 China Mobile Phone Export by Region

4 Wireless RF System Front-End

4.1 RF System of Latest Mobile Phones and Tablets

4.2 Mobile Phone RF Front-End System

4.3 Mobile Phone Filter

4.3.1 TDK-EPC

4.4 Mobile Phone Antenna Switch

4.5 Mobile Phone PA

4.6 Supply Relationship between Mobile Phone PA and Brands

4.7 QUALCOMM RF 360

4.8 Competition among GAAS PA, RF MEMS and XMOS PA

5 GaAs Vendors

5.1 MURATA

5.2 KOPIN

5.3 SEMICONDUCTOR DIVISION OF SUMITOMO ELECTRIC

5.4 FREIBERGER

5.5 AXT

5.6 IQE

5.7 WIN SEMICONDUCTOR

5.8 AWSC

5.9 VPEC

5.10 GCS

5.11 TRIQUINT

5.12 AVAGO

5.13 ANADIGICS

5.14 RFMD

5.15 RDA

5.16 SKYWORKS

5.17 SEDI

5.18 HITTITE MICROWAVE

5.19 M/A-COM TECHNOLOGY

GaAs产业链主要厂家

2008年-2013年全球主要GaAs IDM厂家产能

2008年-2013年全球主要GaAs Foundry厂家产能

2010-2015全球GaAs需求分析

全球GaAs厂家产能市场占有率

2011-2013年全球GaAs厂家收入排名

2010-2015全球无线家用网络设备出货量(k)

2010-2015全球企业级网络设备出货量(k)

2010-2014年全球Wi-Fi设备出货量

2010-2015年4G手机所占比例

2010-2015年平均每部手机PA使用量

2007-2014年全球手机出货量

2010-2013年全球CDMA/WCDMA手机出货量地域分布

2010-2011年每季度全球主要手机品牌出货量

2011-2012年全球主要手机厂家出货量

2012年4季度全球智能手机操作系统分布

2011-2012中国主要智能手机厂家出货量

2012年中国手机产量地域分布

2000-2012年中国手机出口量与增幅

2002-2012年中国手机出口额与增幅

2002-2012年中国手机出口量与ASP

2011-2012年我手机出口前10大市场 出货量

手机和平板电脑 –RF 架构

HTC ONE RF 系统

黑莓 Z10 RF 系统

三星 GALAXY S4 RF 系统

谷歌 NEXUS 4 RF 系统

IPHONE 5 RF 系统

三星 S3 RF 系统

2010-2016年手机中滤波器与双工器市场规模

2011年BAW、SAW主要厂家市场占有率

2008-2011年TDK-EPC收入与EBIT

2008-2011年TDK-EPC收入产品分布

2010-2016年手机天线开关出货量技术分布

2012年全球手机天线开关主要厂家市场占有率

2010-2012年全球主要手机PA厂家收入

2011年3G、4G手机PA主要厂家市场占有率

2012年3G、4G手机PA主要厂家市场占有率

2011年2G手机PA主要厂家市场占有率

2010-2012年诺基亚手机PA主要供应厂家比例

2010-2012年三星手机PA主要供应厂家比例

2010-2012年LG手机PA主要供应厂家比例

2011-2012年中国白牌(Grey Brand)手机PA市场主要厂家市场占有率

2011-2012年APPLE PA主要供应厂家比例

Rf 360 架构

FY2009-FY2014 村田制作所销售额和营运利润率

FY2009-FY2013 村田制作所各地区销售额

2009财年3季度-2012财年4季度村田制作所收入、新订单与Backlog

2009年3季度-2012年4季度村田制作所运营利润、净利润

FY11Q1-FY12Q4 村田制作所分产品订单

2011-2014财年村田制作所收入产品分布

2011-2014财年村田制作所收入下游应用分布

2010-2011年全球GaAs Epilayer厂家市场占有率

Kopin全球分布

2006-2011年KOPIN收入与运营利润率

2008-2011年KOPIN收入业务分布

2008-2011年KOPIN收入客户分布

2004-2012年AXT收入与运营利润率

2006-2012年AXT收入产品分布

2006-2012年AXT收入地域分布

2005-2013年IQE收入与运营利润率

2008-2012年IQE收入业务分布

2008-2012年IQE收入地域分布

2006-2013年稳懋收入与运营利润率

2009年1季度-2011年3季度稳懋毛利率\净利率\运营利润率

2009-2012年稳懋毛利率与营业利润率

2011年4月-2013年4月稳懋月度收入

2005-2013年稳懋产能

2009-2013年稳懋产量

稳懋核心竞争力

2006-2013年宏捷科技收入与毛利率

2011年4月-2013年4月宏捷科技月度收入

2005-2013年VPEC收入与运营利润率

2011年4月-2013年4月VPEC月度收入

2012年1季度-2013年4季度VPEC收入产品分布

2001-2013年TRIQUNIT收入与毛利率

2005-2012年TRIQUINT收入业务分布

2005-2012年TRIQUINT手机业务收入制式分布

TRIQUINT Network事业部收入产品分布

2009年1季度-2011年4季度TRIQUINT德州厂GaAs产能

2009年1季度-2011年4季度TRIQUINT德州厂BAW产能

2009年1季度-2011年4季度TRIQUINT佛罗里达厂FLSAW产能

2009年1季度-2011年4季度TRIQUINT哥斯达黎加厂FLIP CHIP产能

智能手机RF架构趋势

FY2004-FY2013 AVAGO 收入和运营利润率

FY2007-FY2013 AVAGO 各部门收入

2003-2013年ANADIGICS收入与毛利率

2007-2012年ANADIGICS收入客户分布

2005-2012年ANADIGICS收入业务分布

2008-2012年ANADIGICS收入地域分布

2002-2013财年RFMD收入与运营利润率

2009-2013财年RFMD收入部门分布

2010-2012财年RFMD收入地域分布

2007-2013年锐迪科收入与运营利润率

2009年1季度-2012年1季度锐迪科收入

锐迪科Baseband 产品路线图

锐迪科产品路线图

锐迪科主要客户

2011年1季度-2013年1季度锐迪科毛利率

锐迪科产品中国市场占有率

锐迪科产品时间表

锐迪科收入产品分布

2002-2013财年SKYWORKS收入与毛利率

2007-2012财年SKYWORKS各项支出

2010财年1季度-2013财年2季度SKYWORKS收入与运营利润率

2005-2012财年SKYWORKS收入地域分布

2007-2012财年SKYWORKS收入客户分布

2007-2013年Hittite Microwave收入与运营利润

2007-2013年M/A-COM收入与运营利润

2010-2012年M/A-COM收入产品分布

Major Producers in GaAs Industry Chain

Capacity of Major Global GaAs IDM Vendors, 2008-2013

Capacity of Major Global GaAs Foundries, 2008-2013

Global GaAs Demand, 2010-2015

Capacity and Market Share of Global GaAs Vendors

Revenue Ranking of Global GaAs Vendors, 2011-2013

Shipment of Global Household Wireless Network Equipment, 2010-2015

Global Enterprise-Level Network Device Shipment, 2010-2015

Global Wi-Fi Device Shipment, 2010-2014

Proportion of 4G Mobile Phone, 2010-2015

Average PA Consumption per Mobile Phone, 2010-2015

Global Mobile Phone Shipment, 2007-2014

Global CDMA/WCDMA Mobile Phone Shipment by Region, 2010-2013

Quarterly Shipment of Global Mobile Phone by Brand, 2010-2011

Shipment of Major Global Mobile Phone Vendors, 2011-2012

Operating System of Global Smart Phone, 2012Q4

Shipment of Major Chinese Smart Phone Vendors, 2011-2012

China Mobile Phone Output by Region, 2012

Export Volume and Growth Rate of China Mobile Phone, 2000-2012

Export Value and Growth Rate of China Mobile Phone, 2002-2012

Export Volume and ASP of China Mobile Phone, 2002-2012

China’s Top 10 Mobile Phone Export Destinations by Shipment, 2011-2012

Mobile Phone and Tablet - RF Framework

HTC ONE RF System

Blackberry Z10 RF System

SAMSUNG GALAXY S4 RF System

Google NEXUS 4 RF System

IPHONE 5 RF System

SAMSUNG S3 RF System

Market Size of Filters and Duplexers of Mobile Phone, 2010-2016

Market Share of Major BAW, SAW Vendors, 2011

Revenue and EBIT of TDK-EPC, 2008-2011

Revenue of TDK-EPC by Product, 2008-2011

Shipment of Antenna Switches of Mobile Phone by Technology, 2010-2016

Market Share of Major Mobile Phone Antenna Switches Producers, 2012

Revenue of Major Global Mobile Phone PA Producers, 2010-2012

Market Share of 3G and 4G Mobile Phone PA Producers, 2011

Market Share of 3G and 4G Mobile Phone PA Producers, 2012

Market Share of 2G Mobile Phone PA Producers, 2011

Proportion of Major PA Suppliers of Nokia, 2010-2012

Proportion of Major PA Suppliers of Samsung, 2010-2012

Proportion of Major PA Suppliers of LG, 2010-2012

Proportion of Major PA Suppliers of China-based Grey Brands, 2011-2012

Proportion of Major PA Suppliers of APPLE, 2011-2012

RF 360 Framework

Sales and Operating Margin of Murata, FY2009-FY2014

Sales of Murata by Region, FY2009-FY2013

Revenue, New Orders and Backlog of Murata, FY2009Q3-FY2012Q4

Operating Income and Net Income of Murata, FY2009Q3-FY2012Q4

Orders of Murata by Product, FY2011Q1-FY2012Q4

Revenue of Murata by Product, FY2011-FY2014

Revenue of Murata by Downstream Application, FY2011-FY2014

Market Share of Global GaAs Epilayer Vendors, 2010-2011

Kopin Global Distribution

Revenue and Operating Margin of KOPIN, 2006-2011

Revenue of KOPIN by Business, 2008-2011

Revenue of KOPIN by Client, 2008-2011

Revenue and Operating Margin of AXT, 2004-2012

Revenue of AXT by Product, 2006-2012

Revenue of AXT by Region, 2006-2012

Revenue and Operating Margin of IQE, 2005-2013

Revenue of IQE by Business, 2008-2012

Revenue of IQE by Region, 2008-2012

Revenue and Operating Margin of WIN Semiconductors, 2006-2013

Gross Margin, Net Income and Operating Margin of WIN Semiconductors, 2009Q1-2011Q3

Gross Margin and Operating Margin of WIN Semiconductors, 2009-2012

Monthly Revenue of WIN Semiconductors, Apr. 2011-Apr. 2013

Capacity of WIN Semiconductors, 2005-2013

Output of WIN Semiconductors, 2009-2013

Core Competitiveness of WIN Semiconductors

Revenue and Gross Margin of AWSC, 2006-2013

Monthly Revenue of AWSC, Apr. 2011-Apr. 2013

Revenue and Operating Margin of VPEC, 2005-2013

Monthly Revenue of VPEC, Apr. 2011-Apr. 2013

Quarterly Revenue of VPEC by Product, 2012Q1-2013Q4

Revenue and Gross Margin of TRIQUINT, 2001-2013

Revenue of THIRQUINT by Business, 2005-2012

Mobile Phone Revenue of TRIQUINT by System, 2005-2012

Revenue of Network Division of TRIQUINT by Product

GaAs Capacity of TRIQUINT’s Texas Plant, 2009Q1-2011Q4

BAW Capacity of TRIQUINT’s Texas Plant, 2009Q1-2011Q4

FLSAW Capacity of TRIQUINT’s Florida Plant, 2009Q1-2011Q4

FLIPCHIP Capacity of TRIQUINT’s Costa Rica Plant, 2009Q1-2011Q4

RF Framework Trend of Smart Phone

Revenue and Operating Margin of AVAGO, FY2004-FY2013

Revenue of AVAGO by Division, FY2007-FY2013

Revenue and Gross Margin of ANADIGICS, 2003-2013

Revenue of ANADIGICS by Client, 2007-2012

Revenue of ANADIGICS by Business, 2005-2012

Revenue of ANADIGICS by Region, 2008-2012

Revenue and Operating Margin of RFMD, FY2002-2013

Revenue of RFMD by Division, FY2009-2013

Revenue of RFMD by Region, FY2010-2012

Revenue and Operating Margin of RDA, 2007-2013

Revenue of RDA, 2009Q1-2012Q1

Baseband Product Roadmap of RDA

Product Roadmap of RDA

Major Clients of RDA

Gross Margin of RDA, 2011Q1-2013Q1

China Market Share of RDA’s Products

Product Schedule of RDA

Revenue of RDA by Product

Revenue and Gross Margin of SKYWORKS, FY2002-FY2013

Expenditures of SKYWORKS, FY2007-FY2012

Revenue and Operating Margin of SKYWORKS, FY2012Q1-FY2013Q2

Revenue of SKYWORKS by Region, FY2005-FY2012

Revenue of SKYWORKS by Client, FY2007-FY2012

Revenue and Operating Income of Hittite Microwave, 2007-2013

Revenue and Operating Income of M/A-COM, 2007-2013

Revenue of M/A-COM by Product, 2010-2012

如果这份报告不能满足您的要求,我们还可以为您定制报告,请 留言说明您的详细需求。

|