|

|

|

报告导航:研究报告—

制造业—建筑

|

|

2012-2013年全球及中国石膏板行业研究报告 |

|

字数:1.8万 |

页数:47 |

图表数:58 |

|

中文电子版:5000元 |

中文纸版:2500元 |

中文(电子+纸)版:5500元 |

|

英文电子版:1200美元 |

英文纸版:1300美元 |

英文(电子+纸)版:1500美元 |

|

编号:WEW046

|

发布日期:2013-07 |

附件:下载 |

|

|

|

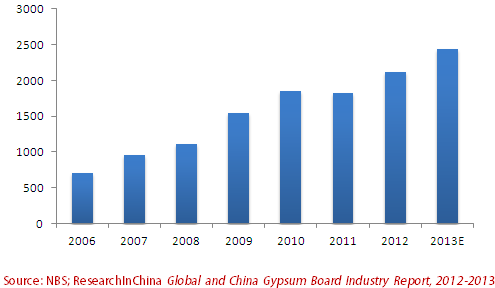

2006 年起,中国先后颁布十余部有关推广新型建材的法律法规及政策。石膏板符合绿色建筑的要求,不仅使房屋功能得到改善以满足居住和办公的特定需求,也与节能环保经济发展方向相一致,因此得到国家政策大力支持。2003-2012 年,中国石膏板产量从1.73 亿平方米快速增长至21.21 亿平方米,年复合增速28.48%。 由于房屋竣工面积对石膏板市场需求有直接的拉动作用,2012年,在全国房屋竣工面积同比增速明显下滑的情况下,全年中国石膏板市场需求规模达到约25亿平方米,同比增速下滑至12%左右。受此影响,2012年中国石膏板产量同比增速下滑至14.37%。未来中国石膏板市场需求仍将保持在10%-15%左右,其中增量市场来自于城市化率提升、市场渗透率提升;存量市场来自于房屋重新装修。 图:2006-2013年中国石膏板产量(单位:百万平方米)

目前,中国石膏板市场中,北新建材的市场竞争优势比较明显,其他企业中,具备与北新建材有竞争实力的主要是外资企业,包括德国可耐福、澳大利亚博罗集团、法国圣戈班等企业,而国内大部分石膏板生产企业生产规模普遍偏小,市场竞争力不足。2012年,北新建材石膏板产量达到10.44亿平方米,已经占到国内石膏板产量的49.2%。其中,公司龙牌石膏板主要定位于高端产品市场,市场占有率超过50%;而公司旗下的另一品牌——泰山牌石膏板主要定位于中低端产品市场,而凭借规模及产品线优势,泰山牌石膏板在这一市场也具备明显的竞争优势。 《2012-2013年全球及中国石膏板行业研究报告》主要在分析全球及中国石膏板市场供需规模的基础上,对国内外主要石膏板企业进行重点分析。 圣戈班集团是最早进入中国市场的跨国建材企业之一,集团至今已在华设立了54家企业及公司。其中,在石膏板产品领域,公司已在华设立上海、常州、葫芦岛三个生产基地,合计石膏板产能已达到9000万平方米,公司石膏板业务也已从中国华东地区拓展到东北及华北地区。 北新建材仍在加快在全国产能布局的步伐,2012年,公司石膏板产能16.5 亿平方米,其中龙牌产能4.5 亿平方米,泰山石膏产能12 亿平方米。目前公司在建生产线7 条,合计2.6 亿平方米,预计公司2015 年实现石膏板产能20 亿平方米的规划能提前实现。

Since 2006, China has issued a dozen of laws & regulations and

policies on promoting new building materials. As a kind of ideal

material to construct green building, the gypsum board can not only

maximize housing functions to meet the specific needs for living and

working, but also go with the tide of developing green economy. In

2003-2012, China’s gypsum board output soared from 173 million sq meters

to 2.121 billion sq meters, with the CAGR of 28.48%. The floor

space of buildings completed determines the demand for gypsum boards in a

direct way. In 2012, the floor space of buildings completed nationwide

saw a steep decline year-on-year, leading to the nationwide growth in

demand for gypsum boards dropping by roughly 12% year-on-year to 2.5

billion sq meters. As a result, the gypsum board output growth rate was

on a year-on-year dive by 14.37%. It is estimated that China’s demand

for gypsum boards will keep up with the growth by around 10%-15% with

the synergy of increasing urbanization rate and market penetration rate

as well as house remolding. China Gypsum Board Output, 2006-2013 (mln sq meters)

In

the gypsum board market of China, Beijing New Building Material (Group)

holds precedence under the severe competition circumstances. And no

other domestic counterparts featuring small production scale but foreign

industrial players including Germany-based Knauf, Australia-based Boral

and France-based Saint-Gobain, are in the position to compete with

Beijing New Building Material (Group). In 2012, the gypsum board output

of Beijing New Building Material (Group) hit 1.044 billion sq meters,

accounting for 49.2% of China’s total. In particular, the company’s

“dragon” gypsum board products are oriented to high-end product market

with the market occupancy surpassing 50%, while its “Taishan” gypsum

board products are targeted at low- and medium-end markets. With the

advantages in scale and product line, the “Taishan” gypsum board

products are more competitive in the market. The report analyzes

the supply and demand scale in global and China gypsum board market,

and highlights major industrial players both at home and abroad. Saint-Gobain

is one of the first transnational building material corporations that

have marched into the Chinese market, with 54 subsidiaries all across

China. In the gypsum board product field, in particular, it has

established three production bases in China respectively in Shanghai,

Changzhou and Huludao with the collective output hitting 90 million sq

meters so far. And it has stretched its commercial arm towards Northeast

China and North China from East China to develop its gypsum board

business. Beijing New Building Material (Group) is still

accelerating the capacity layout in around China. In 2012, the gypsum

board capacity of the company recorded 1.65 billion sq meters, of which,

“Dragon” brand’s contributed 450 million sq meters while “Taishan” 1.2

billion sq meters. Thus far, the company has had seven production lines

under construction with the collective capacity expecting 260 million sq

meters. The estimates show its expectation of 2 billion sq meters of

gypsum board capacity by 2015 will be realized in advance.

第一章 石膏产品概述

1.1 石膏矿简介及应用

1.1.1 矿物简介

1.1.2 矿物分级及应用

1.2 石膏制品分类

第二章 全球石膏板行业发展情况

2.1 全球石膏板供给情况

2.2 全球石膏板需求情况

第三章 中国石膏板行业发展情况

3.1 石膏储量及分布

3.2供给情况

3.3 市场格局

3.3.1 区域格局

3.3.2 企业竞争格局

3.4 需求情况

3.4.1 下游房地产市场情况

3.4.2 需求结构

3.4.3 需求规模

第四章 主要国外石膏板企业

4.1 圣戈班

4.1.1 公司简介

4.1.2 经营情况

4.1.3 石膏板业务

4.1.4 石膏板业务在中国

4.2 可耐福

4.2.1 公司简介

4.2.2 石膏板业务在中国

4.3 博罗

4.3.1 公司简介

4.3.2 经营情况

4.3.3 石膏板业务在中国

4.4 拉法基

4.4.1 公司简介

4.4.2 经营情况

4.4.3 石膏板业务在中国

4.5 埃特(Etex)

4.5.1 公司简介

4.5.2 经营情况

4.5.3 石膏产品业务

4.6 USG

4.6.1 公司简介

4.6.2 经营情况

4.6.3 石膏产品业务

4.7 National Gypsum(NGC)

第五章 主要国内石膏板生产企业

5.1 北新建材

5.1.1 公司简介

5.1.2 经营情况

5.1.3 收入结构

5.1.4 毛利率

5.1.5 石膏板产能及规划

5.2 中兴石膏板

5.3 杰森石膏板

5.4 拜尔集团

5.5 兔宝宝

5.5.1 公司简介

5.5.2 经营情况

5.6 大王椰

5.7 雪丰建材

1. Gypsum Products

1.1 Gypsum Ore and Application

1.1.1 Breif Introduction

1.1.2 Grading & Application

1.2 Classification of Gypsum Products

2. Development of Global Gypsum Board Industry

2.1 Supply

2.2 Demand

3. Development of China Gypsum Board Industry

3.1 Reserves and Distribution of Gypsum Resources

3.2 Supply

3.3 Market Structure

3.3.1 Regional Pattern

3.3.2 Enterprise Competition

3.4 Demand

3.4.1 Real Estate Market

3.4.2 Demand Structure

3.4.3 Demand Scale

4.Key Foreign Companies

4.1 Saint-Gobain

4.1.1 Profile

4.1.2 Operation

4.1.3 Gypsum Board Business

4.1.4 Gypsum Board Business in China

4.2 Knauf

4.2.1 Profile

4.2.2 Gypsum Board Business in China

4.3 Boral

4.3.1 Profile

4.3.2 Operation

4.3.3 Gypsum Board Business in China

4.4 LAFARGE

4.4.1 Profile

4.4.2 Operation

4.4.3 Gypsum Board Business in China

4.5 Etex

4.5.1 Profile

4.5.2 Operation

4.5.3 Gypsum Board Business

4.6 USG

4.6.1 Profile

4.6.2 Operation

4.6.3 Gypsum Board Business

4.7 National Gypsum (NGC)

5. Leading Chinese Companies

5.1 Beijing New Building Material (Group)

5.1.1 Profile

5.1.2 Operation

5.1.3 Revenue Structure

5.1.4 Gross Margin

5.1.5 Capacity and Planning of Gypsum Board

5.2 Zhongxing Gypsum Board

5.3 Jason Plasteboard Group

5.4 Baier Group

5.5 Dehua TB New Decoration Material Co., Ltd.

5.5.1 Profile

5.5.2 Operation

5.6 Hangzhou King Coconut Holding Group Co., Ltd.

5.7 Xuefeng Building Material

表:石膏的分级及用途

表:石膏制品分类

表:2011-2012年全球石膏产量(分地区)

表:2008-2012年美国石膏供应量

图:2008-2012年美国石膏板销量

表:美国主要石膏板生产企业

表:欧洲主要石膏板生产企业

表:2011年全球石膏板人均消费量对比

图:2011年美国石膏板消费需求结构

图:2006-2011年中国石膏矿石探明储量

图:2006-2013年中国石膏板产量(

表:2012年中国石膏板产量(分地区)

图:2011年中国石膏板市场结构(分企业)

表:2012年国内主要石膏板企业市场布局

表:2012年国内三大外资石膏板企业产能(

图:2011年中国石膏板市场结构(分产品档次)

图:2006-2013年中国房地产开发投资及增速

图:2006-2013年中国房屋竣工面积及增速

图:2006-2013年中国房屋开工面积及增速

图:2006-2013年中国住宅竣工面积及增速

图:2006-2013年中国住宅开工面积及增速

图:2006-2013年中国商用房竣工面积及增速

图:2006-2013年中国商用房开工面积及增速

图:2006-2013年中国办公楼竣工面积及增速

图:2006-2013年中国办公楼开工面积及增速

图:2011年中国石膏板消费需求结构

图:2010-2015年中国石膏板市场需求及预测

图:2007-2012年Saint-Gobain净销售额及净利润

图:2012年Saint-Gobain净销售额及营业利润结构(分业务)

表:2008-2012年圣戈班Construction Products Sector主要财务指标

表:2008-2012年圣戈班Construction Products Sector销售收入及营业利润集团占比

表:圣戈班石膏建材业务基本情况

图:2002-2012年圣戈班在华营业收入

表:2007-2009年圣戈班石膏建材(中国)子公司营业收入及利润总额

表:2007-2009年可耐福中国石膏板主要子公司营业收入及利润总额

图:2007-2013财年博罗集团营业收入及净利润

图:2012财年博罗集团营业收入结构(分产品)

图:2010-2012年博罗集团Building Products业务收入及EBIT

图:2012年博罗集团Building Products业务收入结构(分产品

图:2010-2012年拉法基营业收入结构(分业务)

图:2007-2013年拉法基营业收入及净利润

图:2007-2012年Etex营业收入及净利润

图:2012年Etex营业收入结构(分产品)

表:2011年Etex收购的石膏建材子公司

图:2007-2013年USG营业收入及净利润

图:2010-2013年USG营业收入结构(分业务)

图:2007-2013年USG石膏板发货量及价格

表:North American Gypsum主要子公司

表:2010-2013年North American Gypsum营业收入及营业利润(亏损)

图:NGC在美国石膏矿及石膏板厂分布

图:2007-2013年北新建材营业收入及净利润

表:2010-2012年 北新建材营业收入(分产品)

表:2010-2012年北新建材营业收入(分地区)

表:2009-2012年北新建材毛利率(分产品)

图:2008-2015年北新建材石膏板产能情况

表:2013年北新建材在建石膏板投资项目

表:2007-2009年拜尔建材营业收入及利润总额

图:2008-2013年兔宝宝营业收入及净利润

Grading and Application of Gypsum

Classification of Gypsum Products

Global Gypsum Output by Region, 2011-2012

Gypsum Supply of America, 2008-2012

Plasterboard Sales in America, 2008-2012

Main Plasterboard Manufacturers in America

Main Plasterboard Manufacturers in Europe

Per Capita Plasterboard Consumption Worldwide, 2011

Plasterboard Consumption Demand Structure in the US, 2011

Proved Reserves of Gypsum Ore, 2006-2011

Plasterboard Output in China, 2006-2013

China Plasterboard Output by Region, 2012

China Plasterboard Market Structure by Enterprise, 2011

Market Layout of Main Plasterboard Companies in China, 2012

Capacities of Three Major Foreign Plasterboard Companies in China, 2012

China Plasterboard Market Structure by Product Grade, 2011

Investment in Real Estate in China and Growth Rate, 2006-2013

Floor Space of Building Completed and Growth Rate in China, 2006-2013

Floor Space of Building under Construction and Growth Rate in China, 2006-2013

Floor Space of Residence Completed and Growth Rate in China, 2006-2013

Floor Space of Residence under Construction and Growth Rate in China, 2006-2013

Floor Space of Commercial Properties Completed and Growth Rate in China, 2006-2013

Floor Space of Commercial Properties under Construction and Growth Rate in China, 2006-2013

Floor Space of Office Buildings Completed and Growth Rate in China, 2006-2013

Floor Space of Office Buildings under Construction and Growth Rate in China, 2006-2013

China Plasterboard Consumption Demand Structure, 2011

Demand in China Plasterboard Market, 2010-2015E

Net Sales and Net Income of Saint-Gobain, 2007-2012

Net Sales and Operating Income of Saint-Gobain by Business, 2012

Financial Indices of Construction Products Sector of Saint-Gobain, 2008-2012

Sales and Operating Income from Construction Products Sector of Saint-Gobain, 2008-2012

Gypsum Building Material Business of Saint-Gobain

Revenue of Saint-Gobain in China, 2002-2012

Revenue and Total Profit of Subsidiaries under Saint-Gobain Gypsum Building Material (China), 2007-2009

Revenue and Total Profit of Main Subsidiaries under Knauf China, 2007-2009

Revenue and Net Income of Boral, FY2007-FY2013

Revenue of Boral by Product, FY2012

Revenue and EBIT from Building Products Business of Boral, 2010-2012

Revenue from Building Products Business of Boral by Product, 2012

Revenue of LAFARGE by Business, 2010-2012

Revenue and Net Income of LAFARGE, 2007-2013

Revenue and Net Income of Etex, 2007-2012

Revenue of Etex by Product, 2012

Gypsum Building Material Subsidiaries Purchased by Etex, 2011

Revenue and Net Income of USG, 2007-2013

Revenue of USG by Business, 2010-2013

Plasterboard Shipment and Price of USG, 2007-2013

Main Subsidiaries under North American Gypsum

Revenue and Operating Profit (Negative Value) of North American Gypsum, 2010-2013

Gypsum Mines & Gypsum Board Plants of NGC in the US.

Revenue and Net Income of Beijing New Building Material (Group), 2007-2013

Revenue of Beijing New Building Material (Group) by Product, 2010-2012

Revenue of Beijing New Building Material (Group) by Region, 2010-2012

Gross Margin of Beijing New Building Material (Group) by Product, 2009-2012

Plasterboard Capacity of Beijing New Building Material (Group), 2008-2015E

Ongoing Plasterboard Investment Projects of Beijing New Building Material (Group), 2013

Revenue and Total Profit of Baier Building Materials, 2007-2009

Revenue and Net Income of Dehua TB New Decoration Material Co., Ltd., 2008-2013

如果这份报告不能满足您的要求,我们还可以为您定制报告,请 留言说明您的详细需求。

|