|

|

|

报告导航:研究报告—

制造业—材料

|

|

2012-2015年全球及中国针状焦行业研究报告 |

|

字数:2.8万 |

页数:70 |

图表数:64 |

|

中文电子版:6500元 |

中文纸版:3250元 |

中文(电子+纸)版:7000元 |

|

|

|

|

|

编号:ZL005

|

发布日期:2013-07 |

附件:下载 |

|

|

|

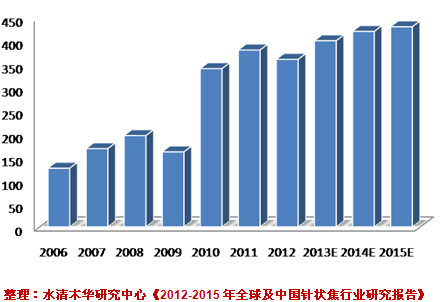

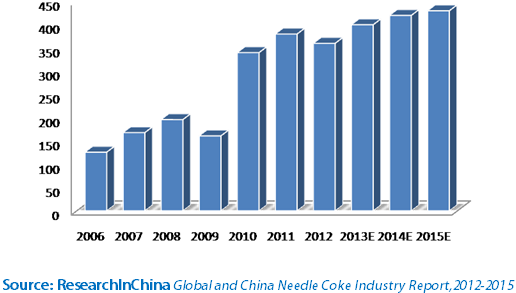

针状焦主要应用于电炉炼钢用石墨电极、锂电池、核电、航天等领域。2009年之后,随着针状焦各下游行业逐步复苏,全球针状焦需求量迅速回升。同期,全球针状焦行业巨头为操控价格而均未大幅扩张产能,从而使得全球针状焦市场供应持续紧张。2012年,全球针状焦供给缺口达10万吨。而在全球最主要的针状焦消费国中,中国针状焦市场供应紧张情况最为显著,需求缺口达到12万吨。 作为全球最大的钢铁生产国,中国一直保持巨量的针状焦需求,且近年来随着国内石墨电极行业产品结构持续优化,超高功率石墨电极比重不断增加,针状焦需求量增速明显加快。同期,由于中国针状焦生产企业数量少,技术基础薄弱,普遍存在稳定生产及产品质量控制方面的技术障碍,中国针状焦产能增长缓慢,针状焦产品供应缺口不断拉大。2009-2012年,中国针状焦需求量从16.1万吨增长到36万吨,年复合增长率达30.8%。同期,中国针状焦年产能仅从13.0万吨增长到24万吨,年复合增长率22.7%。由于绝大部分新涉足针状焦业务企业存在诸多技术障碍,且行业内企业产能增长有限,预计未来2年中国针状焦市场供应紧张局面将会延续。 图:2006-2015E年中国针状焦需求量(单位:千吨)

由于中国是富煤少油的国家,煤系针状焦原料供应充足,且相关技术较为成熟,故国内现有针状焦产能以及拟在建针状焦项目绝大部分属于煤系针状焦,油系针状焦项目占比偏小。同时,从需求方面看,大规格超高功率石墨电极产品目前已成为石墨电极行业发展重点,而油系针状焦因自身成分特征更适合制备该产品,因此,中国针状焦市场又呈现出结构性供需失衡的特点。 国际上,油系针状焦生产技术被美国、英国、日本垄断,煤系针状焦生产技术被日本垄断。ConocoPhillips是全球最大的油系针状焦生产商,针状焦产能为37万吨/年,近年来公司产能基本保持稳定。公司是全球油系针状焦价格的主导者之一。 Seadrift 是全球第二大油系针状焦生产企业,针状焦产能达15万吨/年。2010年,该公司被美国最大的石墨电极生产企业GTI收购,成为其子公司。根据GTI的规划,公司远期产能将达24-25万吨/年。 C-Chem是新日铁集团旗下一家专业生产碳素制品的公司,是全球最大的煤系针状焦生产商。近年来,公司通过产能扩建有力地提升了针状焦产能,2012年公司针状焦产能达17万吨/年。 宏特化工是中国首家实现工业化生产煤系针状焦的企业,为满足国内需求公司于2008年开始兴建10万吨煤系针状焦项目,该项目于2012年投入运行。公司针状焦产能已达15万吨/年。 2011年6月,中钢鞍钢针状焦二期工程开始招标,根据市场需求现状,公司将二期项目产能调整至12万吨/年。2012年二期项目的可行性研究和环评工作已经完成,预计到2014年投产。 《2012-2015全球及中国针状焦行业研究报告》共分6章,以详实的数据深入分析全球以及中国针状焦行业的发展背景与市场格局,具体分析了16家中外针状焦大型企业(Seadrift、C-Chem及山西宏特等)的经营状况,并预测了针状焦行业的发展趋势。

Needle coke mainly finds application in graphite electrode for electric

steelmaking and in areas of lithium battery, nuclear power, aerospace,

etc. Since 2009, the global demand for needle coke has shoot up in the

wake of the gradual recovery in the industrial downstream. During the

same period, the world’s industrial magnates have taken no actions to

expand their capacities in a massive scale, out of consideration for

holding precedence in prices, leading to lingeringly strained supply all

over the world with the supply-demand gap in 2012 hitting 100,000 tons.

In particular, China was the most distinctive with the short supply

gapping 120,000 tons among the world’s leading needle coke consumers. As

the largest steel producer in the world, China has been maintaining

huge demand for needle cokes. Moreover, ultra-high power graphite

electrode is occupying increasing proportion as a result of continuously

optimizing product structure in the graphite electrode industry, which,

in turn, further fuels the demand for needle cokes. At the same time,

China has smaller amount of needle coke enterprises which feature weak

technological base and are huddled by the uncertainty of stable

production and product quality. Thus, the needle coke capacity in China

has seen slow growth with the supply gap increasingly widening. In

2009-2012, China’s demand for needle coke soared from 161,000 tons to

360,000 tons with the CAGR of 30.8% while the annual capacity surged

from 130,000 tons to 240,000 tons with the CAGR of 22.7%. Given that

most new industrial players encounter technical huddles and that

industrial veterans witness limited capacity growth, the supply shortage

is projected to go on in the upcoming two years. Needle Coke Demand in China, 2006-2015E (kt)

As

China is rich in coal and poor in oil, the supply of coal-based needle

coke raw materials is abundant and China is technologically advanced in

this regard. Nationwide, the existing needle coke capacity and most of

planned and ongoing needle coke capacities are coal based needle cokes

rather than oil-based needle cokes. Presently, large-sized ultra-high

power graphite electrode products have become the mainstream in the

graphite electrode industry. Because of its unique properties, oil-based

needle cokes are ideal to make large-sized ultra-high power graphite

electrode products. Hence, China needle coke market is witnessing

structural imbalance between supply and demand. Internationally,

oil-based needle coke production technology is dominated by the US,

Britain and Japan while the coal-based needle coke production technology

is monopolized by Japan. ConocoPhillips, the world’s biggest producer

of oil-based needle coke, realizes the needle coke capacity of 370,000

tons/a and the figure keeps stable in recent years. And the tycoon

serves as one of benchmark makers when it comes to the oil-based needle

coke prices globally. Seadrift is the world’s second largest

oil-based needle coke maker with the capacity recording 150,000 tons/a.

In 2012, it was taken over by GTI, America’s largest graphite electrode

manufacturer. According to GTI planning, the long-term capacity of the

company will reach 240,000-25,000 tons/a. C-Chem is a

professional carbon product maker under Nippon Steel, and the world’s

largest coal-based needle coke producer. In recent years, its needle

coke capacity has greatly boosted through capacity expansion with the

figure in 2012 soaring to 170,000 tons/a. Shanxi Hongte Coal

Chemical Industry is a coal-based needle coke enterprise in China, the

first realized commercial production. In response to domestically robust

demand, the company began its 100,000-ton coal-based needle coke

project in 2008 which was put into operation in 2012 with the current

capacity of 150, 000tons/a. In Jun., 2011, the bidding of SINO

Steel Anshan Research Institute of Thermal Energy’s second phase of

needle coke project drew the curtain. According to real market demand,

the company adjusted the capacity of the second phase to 120,000 tons/a.

Meanwhile, the feasibility study and environmental assessment of the

second phase had been done in 2012. And it is estimated to be put into

production in 2014. The 6-chapter report conducts an in-depth

analysis on the development background and market pattern of global and

China needle coke industry, highlights the business performance of 16

large industrial players at home and abroad, and predicts the

development trend of the industry.

第一章针状焦概述

1.1产品介绍

1.2分类及应用

1.3 产业链

第二章全球针状焦行业发展现状

2.1 发展概述

2.2 供应情况

2.3 需求情况

2.4 技术现状

2.5市场竞争格局

2.6美国

2.7日本

2.8英国

本章小结

第三章中国针状焦行业发展现状

3.1发展环境

3.1.1政策环境

3.1.2技术环境

3.1.3贸易环境

3.2供应情况

3.3需求情况

3.4市场竞争格局

3.5进出口情况

3.6重点拟在建项目

3.7价格走势

本章小结

第四章中国石墨电极行业发展情况

4.1发展环境

4.2生产情况

4.3需求情况

4.4市场格局

本章小结

第五章全球针状焦重点生产企业

5.1 CONOCOPHILLIPS

5.1.1公司介绍

5.1.2经营情况

5.1.3针状焦业务

5.2 SEADRIFT

5.2.1公司介绍

5.2.2针状焦业务

5.3 JX HOLDINGS INC

5.3.1公司介绍

5.3.2经营情况

5.3.3针状焦业务

5.4 C-CHEM

5.4.1公司介绍

5.4.2针状焦业务

5.5 MITSUBISHI CHEMICAL(MC)

5.5.1公司介绍

5.5.2经营情况

5.5.3针状焦业务

5.6 PETROCOKES JAPAN LIMITED

5.6.1公司介绍

5.6.2针状焦业务

5.7 INDIAN OIL COMPANY LIMITED

5.7.1公司介绍

5.7.2经营情况

5.7.3针状焦业务

本章小结

第六章中国针状焦重点生产企业

6.1方大炭素(FANGDA CARBON NEW MATERIAL CO., LTD)

6.1.1公司介绍

6.1.2经营情况

6.1.3针状焦项目

6.2 宏特化工(SHANXI HONGTE COAL CHEMICAL INDUSTRY CO., LTD.)

6.2.1 公司介绍

6.2.2 经营情况

6.2.3重点项目

6.2.4针状焦业务

6.3锦州石化(JINZHOU PETROCHEMICAL CO.,LTD)

6.3.1公司介绍

6.3.2经营情况

6.3.3针状焦业务

6.4中钢热能(SINO STEEL ANSHAN RESEARCH INSTITUTE OF THERMAL ENERGY CO.,LTD )

6.4.1公司介绍

6.4.2针状焦业务

6.5宝钢化工(BAOSTEEL CHEMICAL)

6.5.1公司介绍

6.5.2经营情况

6.5.3针状焦业务

6.6海化集团(SHANDONG HAIHUA GROUP CO.,LTD)

6.6.1公司介绍

6.6.2针状焦业务

6.7兖矿科蓝(JINING YANKUANG KELAN COKE CO., LTD)

6.7.1公司介绍

6.7.2 针状焦业务

6.8宝泰隆(QITAIHE BAOTAILONG COAL&COAL CHEMICALS PUBLIC CO.,LTD)

6.8.1公司介绍

6.8.2经营情况

6.8.3针状焦业务

6.9三元碳素(SY CARBON)

6.9.1公司介绍

6.9.2针状焦业务

6.10其他企业

6.10.1金州集团(Jinzhou Coal and Coke Group)

6.10.2济宁碳素集团(JN Carbon)

6.10.3首山焦化(Shoushan Coking)

本章小结

1. Overview of Needle Coke

1.1 Profile

1.2 Classification and Application

1.3 Industrial Chain

2. Development of Global Needle Coke Industry

2.1 Development Overview

2.2 Supply

2.3 Demand

2.4 Technology Status

2.5 Competition Pattern

2.6 USA

2.7 Japan

2.8 UK

Summary

3. Development of China Needle Coke Industry

3.1 Development Environment

3.1.1 Policy Environment

3.1.2 Technology Environment

3.1.3 Trade Environment

3.2 Supply

3.3 Demand

3.4 Competition Pattern

3.5 Import & Export

3.6 Major Projects Planned and under Construction

3.7 Price Trend

Summary

4. Development of China Graphite Electrode Industry

4.1 Development Environment

4.2 Production

4.3 Demand

4.4 Competition Pattern

Summary

5. Key Companies Worldwide

5.1 ConocoPhillips

5.1.1 Profile

5.1.2 Operation

5.1.3 Needle Coke Business

5.2 Seadrift

5.2.1 Profile

5.2.2 Needle Coke Business

5.3 JX Holdings Inc

5.3.1 Profile

5.3.2 Operation

5.3.3 Needle Coke Business

5.4 C-Chem

5.4.1 Profile

5.4.2 Needle Coke Business

5.5 Mitsubishi Chemical (MC)

5.5.1 Profile

5.5.2 Operation

5.5.3 Needle Coke Business

5.6 Petrocokes Japan Limited

5.6.1 Profile

5.6.2 Needle Coke Business

5.7 Indian Oil Company Limited

5.7.1 Profile

5.7.2 Operation

5.7.3 Needle Coke Business

Summary

6. Key Companies in China

6.1 Fangda Carbon

6.1.1 Profile

6.1.2 Operation

6.1.3 Needle Coke Project

6.2 Shanxi Hongte Coal Chemical Industry Co., Ltd

6.2.1 Profile

6.2.2 Operation

6.2.3 Key Projects

6.2.4 Needle Coke Business

6.3 Jinzhou Petrochemical Co., Ltd

6.3.1 Profile

6.3.2 Operation

6.3.3 Needle Coke Business

6.4 Sinosteel Anshan Research Institute of Thermo-Energy Co., Ltd. (RDTE)

6.4.1 Profile

6.4.2 Needle Coke Business

6.5 Baosteel Chemical

6.5.1 Profile

6.5.2 Operation

6.5.3 Needle Coke Business

6.6 Shandong Haihua Group Co., Ltd

6.6.1 Profile

6.6.2 Needle Coke Business

6.7 Jining Yankuang Kelan Coke Co., Ltd

6.7.1 Profile

6.7.2 Needle Coke Business

6.8 Qitaihe Baotailong Coal&Coal Chemicals Public Co., Ltd

6.8.1 Profile

6.8.2 Operation

6.8.3 Needle Coke Business

6.9 SY Carbon

6.9.1 Profile

6.9.2 Needle Coke Business

6.10 Others

6.10.1 Jinzhou Coal and Coke Group

6.10.2 JN Carbon

6.10.3 Shoushan Coking

Summary

图:针状焦实物

图:针状焦产业链

图:2006-2015年全球针状焦产能(单位:万吨/年)

图:2006-2013年全球针状焦产能结构(分产品)(单位:万吨/年)

表:2007-2013年全球及中国电炉钢产量及石墨电极需求量

图:2006-2012年全球针状焦需求量(单位:万吨)

表:全球煤系针状焦生产工艺及其特点

图:不同原料生产针状焦的工艺流程

表:2012年全球(不含中国)主要针状焦生产企业产能及产品

表:2012年美国针状焦生产企业产能及生产基地

表:2012年日本主要针状焦生产企业产能及产品类型

表:2012年英国针状焦生产企业产能及生产基地

表:2007-2013年全球针状焦产能及需求量

图:2006-2015E年中国针状焦产能(单位:千吨/年)

图:2006-2015E年中国针状焦产能结构(分产品)(单位:千吨/年)

图:2006-2015年中国针状焦需求量(单位:千吨)

图:2006-2015年中国针状焦产品供给缺口(单位:千吨)

表:2012年中国针状焦生产企业产能

图:2012年中国针状焦生产企业市场份额

图:2006-2013年中国针状焦产品进口量(单位:吨)

图:2006-2013年中国针状焦进口量(分产品)(单位:吨)

表:2013年第一季度中国针状焦进口量、金额及均价(分国家)

表:2011-2013年中国重点针状焦拟在建项目

图:2009-2013年中国煤系及油系针状焦进口均价(单位:美元/吨)

表:2006-2015年中国针状焦产能及需求量

表:2006-2015年中国电炉钢产量及其粗钢中占比

图:2006-2015年中国石墨电极产量(单位:千吨)

表:2006-2012年中国石墨电极产量(分产品)(单位:千吨)

图:2006-2012年中国石墨电极产品结构变化趋势

图:2006-2012年中国石墨电极需求量(单位:千吨)

图:2006-2012年中国石墨电极需求结构(单位:千吨)

表:2012年中国前10名生产企业超高功率石墨电极产能

表:2012年中国前10名生产企业高功率石墨电极产能

表:2006-2012年中国石墨电极产量及需求量(分产品)(单位:千吨)

图:2008-2013年ConocoPhillips公司营业收入及净利润(单位:百万美元)

表:CONOCO INC英国Humber生产基地针状焦性能指标

表:2012年CONOCO INC针状焦生产基地产能

表:2012年JX Holdings Inc下属企业及主营业务

图:2010-2014财年JX Holdings Inc营业收入及净利润(单位:十亿日元)

表:2012年JX Holdings Inc针状焦产能及生产基地

图:2012年C-Chem针状焦产业链

表:C-Chem针状焦性能指标

表:2008-2012财年三菱化学营业收入及净利润(单位:十亿日元)

表:2008-2010年三菱化学针状焦相关原料产能扩张计划

图:2008-2014年三菱化学针状焦产能(单位:千吨/年)

表:2012年Petrocokes Japan Limited针状焦产能及生产基地

图:2008-2015财年印度石油营业收入及净利润(单位:千万卢比)

表:2012年全球主要针状焦生产企业产能

图:2008-2015年方大炭素营业收入及净利润(单位:百万元)

表:2011年方大炭素针状焦项目

图:2005-2011年宏特化工销售收入(单位:百万元)

表:2011-2013年宏特化工针状焦项目

图:2006-2012年宏特化工针状焦产能(单位:吨/年)

表:2013年宏特化工针状焦性能指标

图:2008-2012年锦州石化销售收入(单位:亿元)

图:2006-2012年锦州石化针状焦实际产能(单位:千吨/年)

图:2007-2012年宝钢化工销售收入(单位:百万元)

图:2008-2015年宝泰隆营业收入及净利润(单位:百万元)

表:2013年宝泰隆针状焦项目

表:2013年三元碳素主要产品产能

表:2012年金州集团针状焦项目

表:2013年济宁碳素集团主要产品产能

表:2013年首山焦化针状焦项目

表:2012年中国针状焦生产企业已投产、在建及规划产能

Needle Coke

Industrial Chain of Needle Coke

Production Capacity of Needle Coke Worldwide, 2006-2015E

Production Capacity Structure of Needle Coke Worldwide by Products, 2006-2013

Output of EAF Steel and Demand of Graphite Electrode Worldwide, 2007-2013

Demand of Needle Coke Worldwide, 2007-2013

Processes and Features of Coal-based Needle Coke Worldwide

Processes to Produce Needle Coke with Different Raw Materials

Production Capacity and Products of Major Manufacturers Worldwide (Except China), 2012

Production Capacity and Production Bases of Needle Coke Enterprises in USA, 2012

Production Capacity and Product Types of Main Needle Coke Enterprises in Japan, 2012

Production Capacity and Production Bases of Needle Coke Enterprises in Britain, 2012

Production Capacity and Demand of Needle Coke Worldwide, 2007-2013

Production Capacity of Needle Coke in China, 2006-2015E

Production Capacity Structure of Needle Coke in China by Product, 2006-2015E

Demand of Needle Coke in China, 2006-2015E

Supply Gap of Needle Coke in China, 2006-2015E

Production Capacity of Needle Coke Manufacturers in China, 2012

Market Share of Needle Coke Manufacturers in China, 2012

Import Volume of Needle Coke in China, 2006-2013Q1

Import Volume of Needle Coke in China by Product, 2006-2013Q1

Import Volume, Import Value and Average Price of Needle Coke in China by Country, 2013H1

Major Needle Coke Projects Planned and Under Construction in China, 2011-2012

Average Prices of Imported Coal-based and Petroleum-based Needle Coke, 2009-2013

Production Capacity and Demand of Needle Coke in China, 2006-2015E

Output of EAF Steel and % of Crude Steel in China, 2006-2015E

Output of Graphite Electrode in China, 2006-2015E

Output of Graphite Electrode in China by Product, 2006-2013

Product Mix of Graphite Electrode in China, 2006-2012

Demand of Graphite Electrode in China, 2006-2012

Demand Structure of Graphite Electrode in China, 2006-2012

Production Capacity of Ultra High Power Graphite Electrode of TOP10 Manufacturers in China, 2012

Production Capacity of High Power Graphite Electrode of TOP10 Manufacturers in China, 2012

Output and Demand of Graphite Electrode in China by Products, 2006-2012

Revenue and Net Income of ConocoPhillips, 2008-2013

Performance Indicators of Needle Coke Produced in UK-based Humber Production Site of Conoco INC

Needle Coke Capacity of CONOCO INC’s Production Bases, 2012

Subordinate Enterprises and Main Businesses of JX Holdings Inc, 2012

Revenue and Net Income of JX Holdings Inc, FY2010-FY2014

Production Capacity and Bases of Needle Coke of JX Holdings Inc, 2012

Needle Coke Industry Chain of C-Chem, 2012

Performance Indicators of Needle Coke of C-Chem

Revenue and Net Income of MC, FY2008-FY2012

Capacity Expansion Plan of Needle Coke Raw Materials of MC, 2008-2012

Production Capacity of Needle Coke of MC, 2008-2014 E

Production Capacity and Bases of Petrocokes, 2012

Revenue and Net Income of India Oil, FY2008-FY2015

Production Capacity of Major Needle Coke Manufacturers Worldwide, 2012

Revenue and Net Income of Fangda Carbon, 2008-2015E

Needle Coke Projects of Fangda Carbon, 2013

Sales of Hongte, 2005-2011

Needle Coke Projects of Hongte, 2011-2012

Production Capacity of Needle Coke of Hongte, 2006-2012

Performance Indicators of Needle Coke of Hongte, 2012

Sales of Jinzhou Petrochemical, 2008-2012

Actual Capacity of Needle Coke of Jinzhou Petrochemical, 2006-2012

Sales of Baosteel Chemical, 2007-2012

Revenue and Net Income of Baotailong, 2008-2015 E

Needle Coke Projects of Baotailong, 2013

Production Capacity of Main Products of SY Carbon, 2013

Needle Coke Projects of Jinzhou Coal and Coke Group, 2012

Production Capacity of Main Products of JN Carbon, 2013

Needle Coke Projects of Shoushan Coking, 2013

Production in Operation, Planned and Under Construction of Needle Coke Manufacturers in China, 2012

如果这份报告不能满足您的要求,我们还可以为您定制报告,请 留言说明您的详细需求。

|