|

|

|

报告导航:研究报告—

制造业—汽车

|

|

2013年全球及中国汽车照明行业研究报告 |

|

字数:3.8万 |

页数:159 |

图表数:147 |

|

中文电子版:8500元 |

中文纸版:4250元 |

中文(电子+纸)版:9000元 |

|

英文电子版:2500美元 |

英文纸版:2600美元 |

英文(电子+纸)版:2800美元 |

|

编号:ZYW153

|

发布日期:2013-09 |

附件:下载 |

|

|

|

2012-2013年全球及中国汽车照明行业研究报告包括以下内容: - 1、全球汽车产业与市场

- 2、中国汽车产业与市场

- 3、汽车照明简介

- 4、LED产业简介

- 5、汽车照明产业分析

- 6、17家汽车照明厂家研究

- 7、4家汽车照明LED颗粒厂家研究

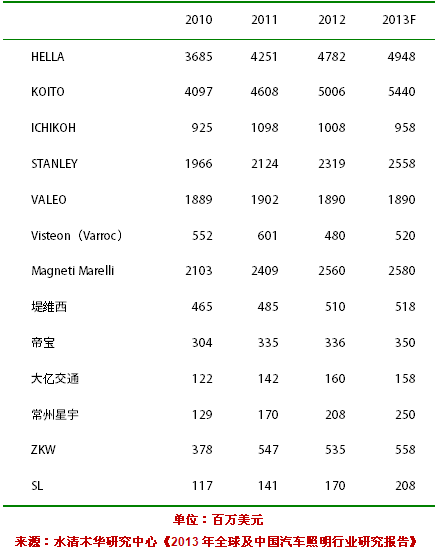

虽然中国经济增速放缓,但是中国汽车市场却依然火热,尤其是SUV和豪华车。1-7月中国汽车产销分别完成12335千辆和12230千辆,同比分别增长12.5%和12.0%。2013年1-7月,中国轿车累计销量6268935辆,同比增14%,7月销量同比增加10.8%。 MPV 1-7月累计销量647585辆,同比增32%, 7月销量同比增加12%。SUV 1-7月累计销量1479665,同比大增49.3%。微客(Crossover Passenger Car)则非常惨淡, 1-7月累计销量为973996辆, 同比下滑8.3%。 汽车照明市场变化不大,虽然过去1年高亮度(HB)LED颗粒(Die)价格大幅度下滑,但是LED颗粒成本所占LED头灯(Head Lamp)成本比例很低,LED的模组、散热和光引擎等成本相加还是远高于氙灯和卤素灯成本。加上汽车领域对可靠性的测试时间最少在3年以上,因此LED头灯进展缓慢。氙灯发展比较迅速,从原来的高级车迅速向中级车蔓延,未来在近光灯领域,氙灯可能取代卤素灯的霸主地位。 日本厂家进一步扩大市场范围,蚕食欧洲厂家的地盘,尤其是小糸,高踞中国市场第一名,几乎垄断了上海大众、上海通用、上海汽车的车灯市场。印度厂家Varroc买下Visteon的汽车照明业务后,第一年出现了20%的下滑,显然收购双方还需要时间来磨合。 Valeo的汽车照明业务属于该公司Visibility事业部,该事业部将更多精力放在了毛利率更高且市场处于成长期的Park4U停车辅助模块。Hella虽然受欧洲市场拖累,但是在日本、美洲和中国的售后市场占据霸主地位,其业绩相当稳定。台湾厂家只关注维修市场,日本厂家则只关注OEM市场,这也让Hella在售后市场非常强大。 2010-2013年全球主要汽车照明厂家收入

Global and China Automotive Lighting Industry Report, 2013 covers the followings: 1. Global Automotive Industry and Market 2. China Automotive Industry and Market 3. An Introduction to Automotive Lighting 4. An Introduction to LED Industry 5. An Analysis of Automotive Lighting Industry 6. An insight into 17 Automotive Lighting Companies 7. A Study of four Automotive Lighting LED Die Companies Although

China’s economic growth slows down, the market of automobile,

especially SUV and luxury car, is still prosperous. In the first seven

months of 2013, China’s output and sales volume of automobile reached

12.335 million and 12.230 million respectively, up 12.5% and 12.0% year

on year separately. The sales volume of sedan in the first seven months

was 6,268,935, an yr-on-yr increase of 14%, and the sales volume in July

jumped by 10.8% year on year. The cumulative sales volume of

MPV in the first seven months was 647,585, up 32% year on year, and the

sales volume in July increased by 12% year on year. The cumulative sales

volume of SUV in the first seven months was 1,479,665, a surge of 49.3%

year on year. The cumulative sales volume of crossover passenger car

was only 973,996, down 8.3% year on year. The automotive lighting

market has changed little. Although the price of high-brightness (HB)

LED die has declined sharply in the past year, LED die only occupies a

very small share in the cost of LED head lamp, the costs of LED module,

heat dissipation and optical engine are still much higher than the costs

of xenon and halogen lamps. In addition, the test on reliability lasts

at least three years in the automotive field, so the development of LED

head lamp has been slow. Xenon lamp has developed fast, extending from

high-end cars to mid-end cars, and may replace halogen lamp to become

the dominator in the field of dipped headlight. Japanese

companies have further expanded their market strongholds, and grabbed

over market share from European companies. Koito occupies the largest

share in the Chinese market, and almost monopolizes the market of

automotive lamps for Shanghai VW, Shanghai GM and SAIC. Indian Varroc

witnessed a decline of 20% in the first year after the acquisition of

Visteon’s automotive lighting business, indicating the need for

adjustment. Valeo's automotive lighting business is subject to

the company’s Visibility division, and the division focuses more on the

Park4U parking assistance module which has a higher gross margin and is

in the stage of market growth. Hella is dragged down by the European

market, but it occupies a dominant position in the aftermarket of Japan,

America and China, with quite a stable performance, since Taiwanese

companies are merely concerned about the maintenance market and Japanese

enterprises only focus on the OEM market. Revenue of Global Major Automotive Lighting Companies, 2010-2013 (Unit: USD mln)

第一章、全球及中国汽车市场与产业

1.1、全球汽车市场

1.2、全球汽车产业

第二章、中国汽车市场与产业

2.1、中国汽车市场概览

2.2、中国汽车市场近况

2.3、中国乘用车市场品牌竞争格局

2.4、中国汽车出口近况

2.5、2006-2013年6月中国汽车市场数据

2.6、中国汽车产业

第三章:汽车照明

3.1、汽车照明简介

3.2、汽车照明光源简介

3.3、LED光源优点

3.4、车用LED照明近况

3.5、LED车前灯配光

3.5.1、反射式

3.5.2、投射式

3.5.3、透镜成像、全反射透镜、DOE透镜

3.6、LED车灯散热

3.7、LED车灯市场

3.8、HID氙气灯

3.8.1、HID氙气灯简介

3.8.2、HID氙气灯市场

第四章、LED产业

4.1、LED产业链

4.2、2010-2013年全球前27大LED厂家收入排名

4.3、台湾LED产业

4.3.1、台湾LED产业格局

4.3.2、2010年台湾LEDEPITAXY(磊晶)厂排名

4.3.3、台湾LED封装厂排名

4.4、中国大陆LED产业

第五章:汽车照明产业与市场

5.1、前装(OEM)汽车照明市场规模

5.2、全球汽车照明产业

5.3、全球汽车照明配套体系

5.4、中国汽车照明产业

5.5、中国汽车照明OEM配套情况

第六章、汽车照明厂家研究

6.1、海拉

6.2、小纟KOITO

6.2.1、上海小纟车灯有限公司

6.2.2、广州小纟车灯有限公司

6.3、市光ICHIKOH

6.4、斯坦雷STANLEY

6.4.1、广州斯坦雷

6.4.2、天津斯坦雷电气有限公司

6.5、法雷奥VALEO

6.6、伟世通VISTEON

6.6.1、延锋伟世通(YFV)

6.6.2、常州大茂伟世通

6.7、AUTOMOTIVE LIGHTING(马瑞利,MAGNETI MARELLI)

6.8、堤维西TYC

6.9、帝宝工业DEPO

6.10、大亿交通TAYIH-IND

6.11、常州星宇

6.12、江苏彤明

6.13、ZWK

6.14、燎旺车灯

6.15、三立

6.16、浙江天翀

6.17、丽清科技

第七章、汽车照明LED厂家研究

7.1、日亚化工

7.2、丰田合成

7.3、飞利浦

7.4、OSRAM

1. Global Automotive Market and Industry

1.1 Global Automotive Market

1.2 Global Automotive Industry

2. China Automotive Market and Industry

2.1 Overview of China Automotive Market

2.2 China Automotive Market Update

2.3 China Passenger Car Market Brand Competition

2.4 China Automotive Export Update

2.5 China Automotive Market Statistics in 2006- H12013

2.6 China Automotive Industry

3. Automotive Lighting

3.1 Introduction to Automotive Lighting

3.2 Introduction to Automotive Lighting Source

3.3 Advantages of LED Lighting Source

3.4 Automotive LED Lighting

3.5 Light Distribution of LED Head Lamp

3.5.1 Reflective

3.5.2 Projective

3.5.3 Lens Imaging, Total Reflection Lens, DOE Lens

3.6 Heat Dissipation of LED Automotive Lamp

3.7 LED Automotive Lamp Market

3.8 HID Xenon Lamp

3.8.1 Profile

3.8.2 Market

4. LED Industry

4.1 LED Industry Chain

4.2 Revenue Ranking of Global Top 27 LED Companies in 2010-2013

4.3 Taiwan LED Industry

4.3.1 Industry Pattern

4.3.2 Ranking of LED Epitaxy Companies in 2010

4.3.3 Ranking of LED Packaging Plants

4.4 Mainland China LED Industry

5. Automotive Lighting Industry and Market

5.1 OEM Automotive Lighting Market Size

5.2 Global Automotive Lighting Industry

5.3 Global Automotive Lighting OEM System

5.4 China Automotive Lighting Industry

5.5 China Automotive Lighting OEM System

6. Automotive Lighting Companies

6.1 Hella

6.2 Koito

6.2.1 Shanghai Koito Automotive Lamp Co., Ltd.

6.2.2 Guangzhou Koito Automotive Lamp Co., Ltd.

6.3 Ichikoh

6.4 Stanley

6.4.1 Guangzhou Stanley

6.4.2 Tianjin Stanley Electric Co., Ltd.

6.5 Valeo

6.6 Visteon

6.6.1 Yanfeng Visteon (YFV)

6.6.2 Changzhou Damao Visteon

6.7 Automotive Lighting (Magneti Marelli)

6.8 TYC

6.9 DEPO

6.10 Ta Yih Industrial

6.11 Changzhou Xingyu

6.12 Jiangsu Tongming

6.13 ZWK

6.14 Liaowang Automotive Lamp

6.15 SL

6.16 Zhejiang Tianchong

6.17 Laster Tech

7. Automotive Lighting LED Companies

7.1 Nichia Chemical

7.2 Toyoda Gosei

7.3 Philips

7.4 OSRAM

2011-2014 年轻型车辆产量

2011-2014年重型车辆产量

2010-2012年全球主要汽车品牌销量

2001-2012年中国汽车销量

2006-2013年6月中国汽车月度销量

2006-2013年6月中国轿车月度销量

2006-2013年6月中国SUV月度销量

2006-2013年6月中国MPV月度销量

2006-2013年6月中国交叉型乘用车月度销量

2006-2013年6月中国商用车月度销量

2006-2013年6月中国客车月度销量

2006-2013年6月中国重型卡车月度销量

小系LED投射式设计

LED透镜光学成像系统

全反射透镜成像

DOE透镜

2007-2014年五种汽车光源成本与光照度发展趋势

2008-2015年LED汽车照明市场规模

2009-2014年全球轿车前照灯照明光源分布

2009-2014年中国轿车前照灯照明光源分布

2010-2013全球主要LED厂家收入排名

台湾LED企业关系图

2009-2014年台湾LED产业规模

2009-2014年台湾磊晶行业收入与增幅

2010年4季度-2012年2季度台湾磊晶行业季度收入与增幅

2009-2014年台湾LED封装与模组行业收入与增幅

2010年4季度-2012年2季度台湾LED封装与模组行业收入与增幅

2007-2014年全球OE汽车照明市场规模

2010-2013年全球主要汽车照明厂家收入

2012年丰田汽车照明系统主要供应商供应比例

2012年本田汽车照明系统主要供应商供应比例

2012年日产雷诺汽车照明系统主要供应商供应比例

2012年通用汽车照明系统主要供应商供应比例

2012年福特汽车照明系统主要供应商供应比例

2012年大众汽车照明系统主要供应商供应比例

2012年现代汽车照明系统主要供应商供应比例

2008-2012年中国轿车照明主要厂家市场占有率

2009-2012年国内车灯销售前10位

中国车灯厂家主要客户

2007-2013财年HELLA收入与EBIT

HELLA组织结构

2004-2013财年HELLA收入与员工数

2010-2012财年HELLA收入部门分布

2007-2012财年HELLA收入地域分布

Hella员工数量全球分布

2006-2014财年小纟收入与运营利润率

2003-2013财年小纟收入部门分布

2008-2013财年小纟收入地域分布

小纟车灯有限公司主要配套车型

上海小纟车灯有限公司2004-2012年收入与运营利润率

2004-2014财年市光收入与运营利润率

2007-2012财年市光收入地域分布

市光工业全球机构分布

市光工业日本机构分布

市光主要配套车型

斯坦雷主要产品

2006-2014财年斯坦雷收入与运营利润率

2005-2013财年斯坦雷汽车照明事业部收入与运营利润率

2008-2012财年斯坦雷收入地域分布

2004-2012年广州斯坦雷收入与运营利润率

2005-2013年法雷奥收入与毛利率

2009-2013年H1法雷奥收入部门分布

2007-2013H1 法雷奥客户地域分布

2013年H1 Valeo亚洲区收入国别分布

2013财年Varroc收入产品分布

伟世通汽车照明部门技术中心全球分布

伟世通汽车照明部门生产基地全球分布

伟世通汽车照明部门主要应用车型

延峰伟士通中国分布

2006-2012年Magneti Marelli收入与Trading Profit率

2005-2013年堤维西收入与运营利润率

2011年6月-2013年6月堤维西月度收入与增幅

2012年堤维西大陆子公司财务状况

2004-2013年帝宝收入与运营利润率

2011年6月-2013年6月帝宝工业月度收入

2009-2012帝宝收入地域分布

帝宝大陆子公司2012年财务数据

2003-2013年大亿交通收入与运营利润率

2011年6月-2013年6月大亿交通月度收入与增幅

大亿集团企业分布

大亿交通工业产品

大亿交通客户

常州星宇股权结构

2007-2013年常州星宇收入与运营利润率

2011-2012 常州星宇销量产品分布

2007-2012年常州星宇客户结构

2012年常州星宇员工岗位分布

江苏彤明车灯主要客户

2006-2013年三立收入与运营利润率

2008-2012年三立收入产品分布

丽清公司结构

2008-2014年丽清科技收入与毛利率

2011-2013年丽清科技收入业务分布

丽清产品实例

2003-2013年日亚化学收入与运营利润率

2004-2012年日亚化学LED部门收入与运营利润率

2008-2013财年丰田合成 收入与运营利润率

2008-2013财年丰田合成LED业务收入与运营利润率

2012年飞利浦照明业务收入业务分布与地域分布

2000-2013年飞利浦照明业务收入下游应用分布

2000-2013年飞利浦照明业务收入客户分布

2011年2季度-2013年2季度飞利浦照明业务季度销售额与EBITDA率

飞利浦照明业务市场地位

2013年飞利浦照明LED产品销售额

Lumileds产品分布

飞利浦中国分布

飞利浦照明中国市场地位

OSRAM股权结构

OSRAM子公司分布

2010-2014财年OSRAM收入与EBITDA

2011-2013财年OSRAM收入地域分布

2012财年1季度-2013财年3季度OSRAM季度收入与EBITA

2012财年1季度-2013财年3季度OSRAM Specialty Lighting业务季度收入与EBITA

2012财年1季度-2013财年3季度OSRAM Opto Semiconductors业务季度收入与EBITA

2012财年1季度-2013财年3季度OSRAM Lamps & Components 业务季度收入与EBITA

2012财年1季度-2013财年3季度OSRAM Luminaires & Solutions业务季度收入与EBITA

2012财年OSRAM收入渠道分布

Output of Light-Duty Vehicles, 2011-2014E

Output of Heavy-Duty Vehicles, 2011-2014E

Sales Volume of Major Automobile Brands in the World, 2010-2012

China’s Sales Volume of Automobile, 2001-2012

China’s Monthly Sales Volume of Automobile, 2006-Jun. 2013

China’s Monthly Sales Volume of Sedan, 2006-Jun. 2013

China’s Monthly Sales Volume of SUV, 2006-Jun. 2013

China’s Monthly Sales Volume of MPV, 2006-Jun. 2013

China’s Monthly Sales Volume of Crossover Passenger Vehicle, 2006-Jun. 2013

China’s Monthly Sales Volume of Commercial Vehicle, 2006-Jun. 2013

China’s Monthly Sales Volume of Bus, 2006-Jun. 2013

China’s Monthly Sales Volume of Heavy-duty Truck, 2006-Jun. 2013

Projective LED Design of Koito

Optical Imaging System of LED Lens

Total Reflection Lens Imaging

DOE Lens

Cost and Illumination Development Trends of Five Automotive Light Sources, 2007-2014E

LED Automotive Lighting Market Size, 2008-2015E

Global Sedan Headlamp Light Source Distribution, 2009-2014E

China Sedan Headlamp Light Source Distribution, 2009-2014E

Ranking of Global Major LED Companies by Revenue, 2010-2013

Taiwan LED Enterprise Relationship

Taiwan LED Industry Scale, 2009-2014E

Revenue and Growth Rate of Taiwan Epitaxy Industry, 2009-2014E

Quarterly Revenue and Growth Rate of Taiwan Epitaxy Industry, 2010Q4-2012Q2

Revenue and Growth Rate of Taiwan LED Packaging and Module Industry, 2009-2014E

Revenue and Growth Rate of Taiwan LED Packaging and Module Industry, 2010Q4-2012Q2

Global OE Automotive Lighting Market Scale, 2007-2014E

Revenue of Global Major Automotive Lighting Companies, 2010-2013

Automotive Lighting System Supply Structure of Toyota, 2012

Automotive Lighting System Supply Structure of Honda, 2012

Automotive Lighting System Supply Structure of Nissan Renault, 2012

Automotive Lighting System Supply Structure of GM, 2012

Automotive Lighting System Supply Structure of Ford, 2012

Automotive Lighting System Supply Structure of VW, 2012

Automotive Lighting System Supply Structure of Hyundai, 2012

Market Share of Major Sedan Lighting Companies in China, 2008-2012

Top 10 Automotive Light Companies in China by Sales, 2009-2012

Major Customers of China’s Automotive Lamp Companies

Revenue and EBIT of Hella, FY2007-FY2013

Organization of Hella

Revenue and Workforce of Hella, FY2004-FY2013

Revenue of Hella by Division, FY2010-FY2012

Revenue of Hella by Region, FY2007-FY2012

Global Workforce of Hella

Revenue and Operating Margin of Koito, FY2006-FY2014

Revenue of Koito by Division, FY2003-FY2013

Revenue of Koito by Region, FY2008-FY2013

Vehicle Models Supported by Koito

Revenue and Operating Margin of Shanghai Koito, 2004-2012

Revenue and Operating Margin of Ichikoh, FY2004-FY2014

Revenue of Ichikoh by Region, FY2007-FY2012

Global Presence of Ichikoh

Presence of Ichikoh in Japan

Vehicle Models Supported by Ichikoh

Main Products of Stanley

Revenue and Operating Margin of Stanley, FY2006-FY2014

Revenue and Operating Margin of Stanley’s Automotive Lighting Division, FY2005-FY2013

Revenue of Stanley by Region, FY2008-FY2012

Revenue and Operating Margin of Guangzhou Stanley, 2004-2012

Revenue and Gross Margin of Valeo, 2005-2013

Revenue of Valeo by Division, 2009-2013H1

Customer Distribution of Valeo by Region, 2007-2013H1

Asian Revenue of Valeo by Country, 2013H1

Revenue of Varroc by Product, FY2013

Global Distribution of Technology Centers of Visteon’s Automotive Lighting Division

Global Distribution of Production Bases of Visteon’s Automotive Lighting Division

Main Vehicle Models Supported by Visteon’s Automotive Lighting Division

Presence of Yanfeng Visteon

Revenue and Trading Profit Margin of Magneti Marelli, 2006-2012

Revenue and Operating Margin of TYC, 2005-2013

Monthly Revenue and Growth Rate of TYC, Jun. 2011-Jun. 2013

Financial Situation of TYC’s Subsidiaries in Mainland China, 2012

Revenue and Operating Margin of DEPO, 2004-2013

Monthly Revenue of DEPO, Jun. 2011-Jun. 2013

Revenue of DEPO by Region, 2009-2012

Financial Data of DEPO’s Subsidiaries in Mainland China, 2012

Revenue and Operating Margin of Ta Yih Industrial, 2003-2013

Monthly Revenue and Growth Rate of Ta Yih Industrial, Jun. 2011-Jun. 2013

Enterprise Distribution of Ta Yih Group

Industrial Products of Ta Yih Industrial

Customers of Ta Yih Industrial

Equity Structure of Changzhou Xingyu

Revenue and Operating Margin of Changzhou Xingyu, 2007-2013

Sales Volume of Changzhou Xingyu by Product, 2011-2012

Customer Structure of Changzhou Xingyu, 2007-2012

Employment of Changzhou Xingyu, 2012

Major Customers of Jiangsu Tongming Automotive Lamp

Revenue and Operating Margin of SL, 2006-2013

Revenue of SL by Product, 2008-2012

Corporate Structure of Laster Tech

Revenue and Gross Margin of Laster Tech, 2008-2014

Revenue of Laster Tech by Business, 2011-2013

Products of Laster Tech

Revenue and Operating Margin of Nichia, 2003-2013

Revenue and Operating Margin of Nichia’s LED Division, 2004-2012

Revenue and Operating Margin of Toyoda Gosei, FY2008-FY2013

LED Business Revenue and Operating Margin of Toyoda Gosei, FY2008-FY2013

Lighting Business Revenue of Philips by Business/Region, 2012

Lighting Business Revenue of Philips by Application, 2000-2013

Lighting Business Revenue of Philips by Customer, 2000-2013

Quarterly Sales and EBITDA Margin of Philips’ Lighting Business, 2011Q2-2013Q2

Market Position of Philips’ Lighting Business

Sales of Philips’ Lighting LED Products, 2013

Product Distribution of Lumileds

Presence of Philips in China

Market Position of Philips Lighting in China

Equity Structure of OSRAM

Subsidiaries of OSRAM

Revenue and EBITDA of OSRAM, FY2010-FY2014

Revenue of OSRAM by Region, FY2011-FY2013

Quarterly Revenue and EBITDA of OSRAM, FY2012Q1-FY2013Q3

Quarterly Revenue and EBITA of OSRAM’s Specialty Lighting Business, FY2012Q1-FY2013Q3

Quarterly Revenue and EBITA of OSRAM’s Opto Semiconductors Business, FY2012Q1-FY2013Q3

Quarterly Revenue and EBITA of OSRAM’s Lamps & Components Business, FY2012Q1-FY2013Q3

Quarterly Revenue and EBITA of OSRAM’s Luminaires & Solutions Business, FY2012Q1-FY2013Q3

Revenue of OSRAM by Channel, FY2012

如果这份报告不能满足您的要求,我们还可以为您定制报告,请 留言说明您的详细需求。

|