|

|

|

报告导航:研究报告—

制造业—汽车

|

|

2013年全球及中国汽车音响与Infotainment行业研究报告 |

|

字数:3.7万 |

页数:158 |

图表数:134 |

|

中文电子版:8500元 |

中文纸版:4250元 |

中文(电子+纸)版:9000元 |

|

英文电子版:2600美元 |

英文纸版:2700美元 |

英文(电子+纸)版:2900美元 |

|

编号:ZYW161

|

发布日期:2013-11 |

附件:下载 |

|

|

|

《2013年全球及中国汽车音响与Infotainment行业研究报告》主要包含: 1、全球汽车市场近况 2、中国汽车市场近况 3、汽车In-vehicle infotainment (IVI)简介 4、汽车音响市场与产业研究 5、汽车Infotainment市场研究 6、23家主要汽车音响与Infotainment厂家研究 2013年全球Infotainment市场规模大约为301亿美元,比2012年增长4.2%,增长放缓的原因包括欧洲汽车市场低迷,Infotainment售价降低。预计明年起该市场开始恢复增长,预计2014年市场规模达338亿美元,增长12.2%,2015年市场规模达401亿美元,2016年市场规模达456亿美元。 Infotainment市场增长的主要原因在于,其功能的增加和升级大大增加了售价。高端Infotainment的地图将升级为3D地图,显示屏将从6-8英寸升级为10-12英寸,后座娱乐系统(Rear Seat Entainment)也会更加普及,同时还会增加3G或4G网络连接功能,还有对应智能手机的APP大量出现。 Infotainment还将有一个质的飞跃,增加了先进驾驶辅助功能(ADAS);所以未来Infotainment必然会增加HUD系统,这将大幅度提高其成本,这也意味着仪表盘(Instrument Cluster)厂家需要和Infotainment厂家协作。日本厂家如AisinAW、DENSO,美国的Visteon、Delphi,德国的Continental和韩国的Mobis都拥有仪表盘(Instrument Cluster)业务,未来优势明显。 智能手机的大量普及使得汽车Infotainment正在经历一次革新,3G或4G网络连接将大大提高汽车Infotainment价格。目前对于汽车联网有两大阵营,一大阵营是以车厂为主导,以GENIVI为代表,GENIVI 创始成员包括:Volvo、BMW、FAW、GM、HONDA、HYUNDAI、JAGUAR、JOHNDEER、NISSAN、PSA、RENAULT、SAIC。GENIVI采用通用型平台,可能会是Linux,开放型的APP开发界面,成本高昂,安全性高,开发周期长,Infotainment内嵌3G或4G网络连接功能,服务费会很高。 另一大阵营是以智能手机厂家为主导的阵营,包括MirrorLink和MHL。MirrorLink由三家知名手机大厂诺基亚、三星、LG; 六家汽车大厂戴姆勒(Daimler)、通用汽车、本田、Hyundai、Toyota和Volkswagen, 及两家系统供应大厂阿尔派电子(Alpine Electronics)和松下共同成立。MirrorLink在手机和Infotainment中嵌入APP,然后以USB或WiFi连接,开发周期很短,成本低,并且已经有大量产品上市。还有更为简单的MHL联盟,由诺基亚、三星、索尼、东芝以及矽映(Silicon Image)等五家公司共同创建。其传输速率更高,价格更低。 目前两大阵营各有拥护者。在后装Infotainment市场,肯定是MirrorLink或MHL主导市场。前装市场由车厂主导,不过车厂开发周期太长,成本高昂,尤其是汽车连接3G或4G的服务费用惊人,使用成本也很高昂。预计未来高端市场由车厂主导,中低端市场由手机厂家主导。

产业方面,OEM市场逐渐扩大,售后市场(After Market)逐渐缩小,因为今天的高端车配置会成为明天的中低端车配置。尽管售后市场逐渐萎缩,但是市场门槛低,小厂家非常多,特别是中国市场上百家厂家云集,很多企业年收入不足2000万人民币。中国市场的产品同质化非常严重,价格竞争异常激烈,经常有大型厂家不堪利润过低而倒闭,如2013年八月份倒闭的中国惠州天缘电子。

Global and China Automotive Audio and Infotainment Industry Report, 2013 mainly covers the followings: 1. Recent Developments of Global Automotive Market 2. Recent Developments of China Automotive Market 3. Introduction to In-vehicle Infotainment (IVI) 4. Automotive Audio Market and Industry Research 5. Automotive Infotainment Market Research 6. 23 Major Automotive Audio and Infotainment Vendors In 2013, global infotainment market size approximated US$30.1 billion, an increase of 4.2% from a year earlier; and the decelerated growth was due to the sluggish European automotive market and lower infotainment prices. The market is expected to restore growth from the next year, with the size up 12.2% to US$33.8 billion in 2014, US$40.1 billion in 2015 and US$45.6 billion in 2016. Infotainment market growth is largely because its increased and upgraded functions have greatly raised price. High-end infotainment map will be upgraded to 3D map, with display up from 6-8 inches to 10-12 inches, and rear-seat entertainment system will be more popular, also accompanied by the adding of 3G or 4G network connection as well as the mushrooming of corresponding smart phone APPs. Infotainment will also see qualitative leap i.e. added by advanced driver assistance systems (ADAS); thus HUD system is bound to be added in the future, which will significantly improve the cost, but also means instrument cluster companies need to collaborate with infotainment vendors. Japan’s Aisin AW and DENSO, U.S. Visteon and Delphi, Germany’s Continental and South Korea’s Mobis all have instrument cluster business, showing obvious future edges. The massive prevalence of smart phones enables automotive infotainment to undergo a reform, 3G or 4G network connection will greatly improve automotive infotainment prices. At present, there are two camps for automotive networking, one of them is led by vehicle manufacturers, represented by GENIVI, whose founding members include Volvo, BMW, FAW, GM, HONDA, HYUNDAI, JAGUAR, JOHNDEER, NISSAN, PSA, RENAULT and SAIC. GENIVI uses general purpose platform, may be Linux with open-type application programming interface, high cost, high safety, long development cycle, infotainment embedded with 3G or 4G network connectivity, and the service charge will be high. Another camp is led by smart phone vendors like MirrorLink and MHL. MirrorLink, jointly launched by three well-known mobile phone vendors – Nokia, Samsung and LG, six automakers – Daimler, General Motors, Honda, Hyundai, Toyota and Volkswagen, as well as two system suppliers - Alpine Electronics and Panasonic, embeds APP in phone and infotainment, connected by USB or WiFi, with very short development cycle, low cost, and a large number of products have been rolled out into the market. There is simpler MHL League, co-founded by Nokia, Samsung, Sony, Toshiba and Silicon Image, with higher transmission rate and lower prices. Both camps have advocators. In the AM infotainment market, MirrorLink or MHL is definitely the leader. The OEM market is dominated by the vehicle manufacturer, whose development cycle is too long and costly, especially the 3G or 4G auto connectivity service fees are amazing, and so is the CTU (cost to use). In the future, the high-end market is expected to be dominated by the vehicle manufacturer, while the low- and medium-end market by mobile phone vendors.

In the industry, OEM market is by degrees expanding, while after market is just the opposite, because today’s high-end automotive configuration will become tomorrow’s low- and mid-end automotive configuration. Despite a shrinking trend, the aftermarket still attracts quite some small vendors due to the low threshold, especially the Chinese market gathers hundreds, many of them see annual revenue of less than RMB20 million. There is serious product homogeneity in the Chinese market, accompanied by fierce price competition. Large vendors, always, can’t bear the meager profit to declare bankruptcy, e.g. Huizhou Freeway Electronics Co., Ltd. which was closed down in August 2013.

第一章、全球及中国汽车市场与产业

1.1、全球汽车市场

1.2、全球汽车产业

第二章、中国汽车市场与产业

2.1、中国汽车市场概况

2.2、中国汽车市场近况

2.2.1、乘用车市场近况

2.2.2、商用车市场

2.3、中国汽车产业

第三章、汽车联网现状与未来

3.1、INFOTAINMENT简介

3.2、IVI、TSP、TELECOM、硬件市场规模

3.3、GENIVI联盟

3.4、MIRRORLINK

3.5、MHL

3.6、典型IVI设计

3.7、中国车联网

第四章、汽车音响市场与产业

4.1、汽车音响系统简介

4.2、汽车音响系统产业链

4.3、全球汽车音响系统厂家市场占有率

4.3.1、全球前装(OE)汽车音响系统厂家市场占有率

4.3.2、全球主要汽车厂家音响系统主要供应厂家供应比例

4.4、中国汽车音响产业与市场

4.4.1、中国汽车音响厂家与整车厂家配套状况

4.4.2、中国汽车音响市场

第五章、汽车INFOTAINMNET市场与产业

5.1、汽车INFOTAINMNET市场规模

5.2、汽车INFOTAINMENT产业

5.3、中国汽车INFOTAINMENT市场

5.4、中国汽车联网现状

5.5、全球汽车导航厂家与汽车厂家间供货比例

第六章、汽车音响与INFOTAINMENT厂家研究

6.1、哈曼国际

6.2、大陆集团

6.3、先锋

6.4、华阳集团

6.4.1、信华精机

6.4.2、惠州华阳多媒体

6.4.3、惠州华阳通用电子

6.5、阿尔派

6.6、歌乐

6.7、德尔福

6.8、伟世通

6.8.1、延锋伟世通

6.9、航盛电子

6.10、松下汽车系统

6.11、富士通天

6.12、爱信精机

6.13、电装

6.14、番禺巨大汽车音响

6.15、摩比斯

6.15.1、天津摩比斯

6.16、上声电子

6.17、好帮手电子科技

6.18、深圳宝凌

6.19、JVC建伍

6.20、BLAUPUNKT

6.21、BOSE

6.22、GARMIN

6.23、德赛西威

1. Global Automotive Market and Industry

1.1 Global Automotive Market

1.2 Global Automotive Industry

2. China Automotive Market and Industry

2.1 Market Profile

2.2 Recent Developments

2.2.1 Passenger Car

2.2.2 Commercial Vehicle

2.3 China Automotive Industry

3. Status Quo and Future of Automotive Networking

3.1 Introduction to Infotainment

3.2 IVI, TSP, TELECOM, Hardware Market Size

3.3 GENIVI Alliance

3.4 MIRRORLINK

3.5 MHL

3.6 Typical IVI Design

3.7 Telematics@China

4. Automotive Audio Market and Industry

4.1 Introduction to Automotive Audio System

4.2 Automotive Audio System Industry Chain

4.3 Market Share of Global Automotive Audio System Vendors

4.3.1 Market Share of Global OE Automotive Audio System Vendors

4.3.2 Supply Ratio of Automotive Audio System Suppliers for World’s Major Automakers

4.4 China Automotive Audio Industry and Market

4.4.1 Supporting Conditions between Chinese Automotive Audio Vendors and Automakers

4.4.2 China Automotive Audio Market

5. Automotive Infotainment Market and Industry

5.1 Market Size

5.2 Automotive Infotainment Industry

5.3 China Automotive Infotainment Market

5.4 Status Quo of China Automotive Networking

5.5 Supply Ratio between Global Automotive Navigation Vendors and Auto Makers

6. Automotive Audio and Infotainment Vendors

6.1 HARMAN

6.2 Continental

6.3 Pioneer

6.4 Foryou Group

6.4.1 Shinwa (China) Industries

6.4.2 Foryou Multimedia Electronics

6.4.3 Foryou General Electronics

6.5 Alpine

6.6 Clarion

6.7 Delphi

6.8 Visteon

6.8.1 Yanfeng Visteon (YFV)

6.9 Hangsheng Electronics

6.10 Panasonic Automotive System (PAS)

6.11 FUJITSU TEN

6.12 AISIN AW

6.13 Denso

6.14 Panyu Vterk Automotive Audio

6.15 Mobis

6.15.1 Tianjin Mobis

6.16 Sonavox

6.17 Guangdong Coagent Electronics S&T

6.18 Shenzhen Baoling

6.19 JVCKENWOOD

6.20 BLAUPUNKT

6.21 Bose

6.22 Garmin

6.23 Desay SV Automotive

2011-2014 全球轻型汽车产量

2011-2014 全球重型汽车产量

2010-2012年全球主要汽车品牌销量

2001-2013年中国汽车产量

2008-2013年前10月中国各类型汽车年产量同比增幅

2012年1月-2013年10月中国乘用车月度销量与增幅

2011年1月-2013年10月中国乘用车销量车型分布

2011年1月-2013年10月奥迪、宝马、奔驰中国销量

2009-2013年10月中国乘用车销量国别分布

2011年1月-2013年10月中国中型与重型卡车月度销量

2011年1月-2013年10月中国轻型卡车月度销量

2011年1月-2013年10月中国微型卡车月度销量

2011年1月-2013年10月中国大型客车月度销量

2011年1月-2013年10月中国中型客车月度销量

2011年1月-2013年10月中国小型客车月度销量

Infotainment典型框架图

Infotainment典型指标

2009-2018年全球汽车连接服务、TSP、Telecom、硬件市场规模

2009-2018年全球汽车连接服务设备出货量

2013、2018全球具备Connectivity功能汽车出货量地域分布

汽车音响系统产业链

汽车音响系统产业链介绍

2011年全球OE汽车音响系统主要厂家市场占有率

2008-2011年欧盟汽车音响系统主要厂家市场占有率

2008-2011年北美汽车音响系统主要厂家市场占有率

2008-2011年亚太汽车音响系统主要厂家市场占有率

2013年丰田汽车音响系统主要供应厂家供应比例

2013年本田汽车音响系统主要供应厂家供应比例

2013年日产汽车音响系统主要供应厂家供应比例

2013年通用汽车音响系统主要供应厂家供应比例

2013年福特汽车音响系统主要供应厂家供应比例

2013年大众汽车音响系统主要供应厂家供应比例

2013年宝马汽车音响系统主要供应厂家供应比例

2012年奔驰汽车音响系统主要供应厂家供应比例

2013年现代汽车音响系统主要供应厂家供应比例

2013年PSA汽车音响系统主要供应厂家供应比例

2013年中国前装(OE)汽车音响主要厂家市场占有率

2011-2018年全球汽车Infotainment市场规模

2011-2018年全球汽车Infotainment出货量

2011-2018年全球汽车Infotainment普及率

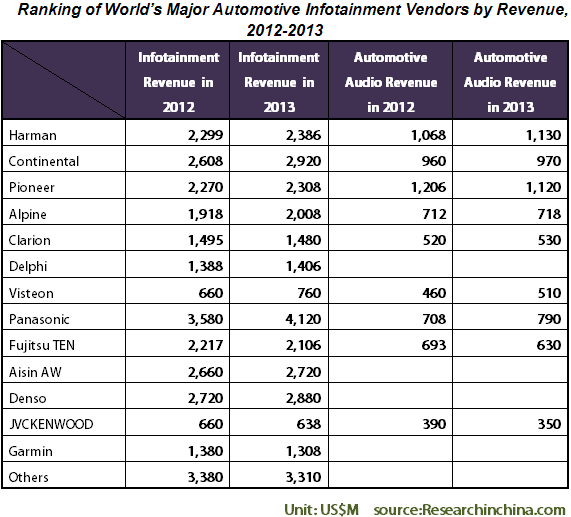

2012-2013年全球主要汽车Infotainment厂家收入排名

2011-2016年中国汽车Infotainment出货量

2013年中国汽车Infotainment OEM市场主要厂家市场占有率

2012汽车售后(AM)Infotainment销量前十厂家排行

2012汽车售后(AM)Infotainment销售额前十厂家排行

2013年丰田汽车 包括导航主要供应厂家供应比例

2013年本田汽车包括导航主要供应厂家供应比例

2013年日产汽车包括导航主要供应厂家供应比例

2013年通用汽车导航主要供应厂家供应比例

2013年福特汽车导航主要供应厂家供应比例

2013年大众汽车 导航 主要供应厂家供应比例

2013年宝马汽车导航主要供应厂家供应比例

2013年奔驰汽车导航主要供应厂家供应比例

2013年现代汽车导航主要供应厂家供应比例

2004-2014财年哈曼国际收入与营业利润率

2012财年1季度-2014财年1季度销售额与EBITDA Margin

2010-2016财年Harman收入业务分布

2010-2013财年哈曼国际各部门毛利率

2006-2013财年哈曼国际地域收入分布

2008-2011财年哈曼国际客户结构比例

2009-2013财年HARMAN Infotainment 与Lifestyle Backlog

2009-2014财年Harman中国区收入

Harman的CAR ADUIO主要客户

HARMAN全球制造基地一览

1998-2012年大陆集团销售额与EBIT利润

2008-2012年大陆集团销售额地域分布

2008-2012年大陆集团销售额部门分布

2008-2012年大陆集团员工数量地域分布

2008-2012年大陆集团员工数量部门分布

2007-2013年大陆汽车内饰部门收入与营业利润率

2009-2012年大陆汽车Interior部门收入地域分布

2006-2014财年先锋收入与营业利润率

2007-2013财年先锋收入部门分布

2007-2014财年先锋汽车电子部门收入与营业利润率

2012-2014财年Pioneer收入地域分布

Pioneer Car Electronics Sales Plan in Emerging Markets

先锋全球车载音响生产基地产能统计

先锋汽车音响在中国的组织结构

信华精机客户分布

2006-2014财年阿尔派收入与营业利润率

2012-2014财年Alpine收入业务分布

2006-2013财年阿尔派汽车音响部门收入与营业利润率

2005-2013财年阿尔派Information &Communication 收入与营业利润率

2005-2013财年阿尔派地域收入分布

阿尔派中国企业简介

2006-2014财年歌乐收入与营业利润率

2009-2013财年歌乐收入地域分布

歌乐中国组织结构

2004-2013年德尔福收入与毛利率

2007-2013年德尔福收入与运营利润率

2007-2013年德尔福收入与EBITDA 率

2009-2013年前3季度德尔福收入产品分布

2010-2013年3季度德尔福各部门EBITDA

2010-2013年德尔福客户分布

2010-2013年德尔福收入地域分布

合并前后的组织结构

合并前后收入地域分布

YFV Organization

YFV 结构

Yanfeng Visteon Electronics Organization

2012年YFV收入客户分布

2012年YFV收入产品分布

延峰伟士通中国分布

2002-2012年延峰伟世通收入

YFV电子事业部组织结构

YFV电子事业部生产基地分布

YFV电子事业部Key Event

2010年延峰伟世通收入客户分布

2011年延峰伟世通收入客户分布

2010年延峰伟世通收入产品分布

航盛Vehicle Infotainment产品

PAS主要客户

2012财年PAS收入地域分布

2012财年松下汽车领域收入产品分布

大连松下汽车电子组织结构

2005-2013财年富士通天收入与营业利润率统计

2005-2013财年FujitsuTen收入部门分布

2007-2013财年Aisin收入与营业利润率

2014财年2季度 Aisin非丰田客户结构比例

2009-2011财年Aisin非丰田客户结构比例

2012-2013财年Aisin非丰田客户结构比例

2007-2014财年Aisin AW收入与营业利润

2008-2014财年爱信精机导航仪产量

2006-2014财年电装收入与营业利润率

电装2008-2013财年客户分布比例

2013/2014财年2季度Denso收入客户分布

2012-2014财年DENSO收入产品分布

天津摩比斯有限公司组织结构

好帮手电子有限公司组织结构

2007-2014财年JVC-KENWOOD收入与营业利润

2008-2013财年JVC-KENWOOD收入部门分布

使用BOSE音响的车型

2007-2013年Garmin销售额与营业利润率

2009-2013年Garmin销售额业务分布

2009-2013年Garmin营业利润业务分布

2009-2012年 Garmin销售额地域分布

Global Light Duty Vehicle Production, 2011-2014E

Global Heavy Duty Vehicle Production, 2011-2014E

Global Automotive Sales Volume by Major Brands, 2010-2012

China’s Automotive Production, 2001-2013

China’s Annual Automotive Production and YoY Growth by Type, 2008-Oct. 2013

China’s Monthly Sales Volume of Passenger Cars and Growth Rate, Jan. 2012-Oct. 2013

China’s Passenger Car Sales Volume by Model, Jan. 2011-Oct. 2013

Sales Volume of Audi, BMW, Mercedes-Benz in China, Jan. 2011-Oct. 2013

China’s Passenger Car Sales Volume by Country, 2009-Oct.2013

Monthly Sales Volume of Medium and Heavy Duty Trucks in China, Jan. 2011-Oct. 2013

Monthly Sales Volume of Light Duty Trucks in China, Jan. 2011-Oct. 2013

Monthly Sales Volume of Mini Trucks in China, Jan. 2011-Oct. 2013

Monthly Sales Volume of Large Buses in China, Jan. 2011-Oct. 2013

Monthly Sales Volume of Medium Buses in China, Jan. 2011-Oct. 2013

Monthly Sales Volume of Mini Buses in China, Jan. 2011-Oct. 2013

Typical Diagram of Infotainment

Typical Indicators of Infotainment

Global Auto Connection Services IVI, TSP, Telecom, Hardware Market Size, 2009-2018E

Global Auto Connection Service Equipment Shipments, 2009-2018E

Global Connectivity Equipped Car Shipments by Region, 2013&2018E

Automotive Audio System Industry Chain

Introduction to Automotive Audio System Industry Chain

Market Share of Major OE Car Audio System Vendors in the World, 2011

Market Share of Major Automotive Audio System Vendors in European Union, 2008-2011

Market Share of Major Automotive Audio System Vendors in North America, 2008-2011

Market Share of Major Automotive Audio System Vendors in Asia-Pacific, 2008-2011

Supply Ratio of Major Automotive Audio System Vendors for Toyota, 2013

Supply Ratio of Major Automotive Audio System Vendors for Honda, 2013

Supply Ratio of Major Automotive Audio System Vendors for Nissan, 2013

Supply Ratio of Major Automotive Audio System Vendors for General Motors, 2013

Supply Ratio of Major Automotive Audio System Vendors for Ford, 2013

Supply Ratio of Major Automotive Audio System Vendors for Volkswagen, 2013

Supply Ratio of Major Automotive Audio System Vendors for BMW, 2013

Supply Ratio of Major Automotive Audio System Vendors for Benz, 2013

Supply Ratio of Major Automotive Audio System Vendors for Hyundai, 2013

Supply Ratio of Major Automotive Audio System Vendors for PSA, 2013

Market Share of Major OE Automotive Audio Vendors in China, 2013

Global Automotive Infotainment Market Size, 2011-2018E

Global Automotive Infotainment Shipments, 2011-2018E

Global Automotive Infotainment Penetration, 2011-2018E

Ranking of World’s Major Automotive Infotainment Vendors by Revenue, 2012-2013

China’s Automotive Infotainment Shipments, 2011-2016E

Market Share of Major Automotive OEM Infotainment Vendors in China, 2013

Ranking of Top 10 Automotive AM Infotainment Vendors by Sales Volume, 2012

Ranking of Top 10 Automotive AM Infotainment Vendors by Sales, 2012

Supply Ratio of Major Automotive Navigation Vendors for Toyota, 2013

Supply Ratio of Major Automotive Navigation Vendors for Honda, 2013

Supply Ratio of Major Automotive Navigation Vendors for Nissan, 2013

Supply Ratio of Major Automotive Navigation Vendors for General Motors 2013

Supply Ratio of Major Automotive Navigation Vendors for Ford, 2013

Supply Ratio of Major Automotive Navigation Vendors for Volkswagen, 2013

Supply Ratio of Major Automotive Navigation Vendors for BMW, 2013

Supply Ratio of Major Automotive Navigation Vendors for Toyota, 2013

Supply Ratio of Major Automotive Navigation Vendors for Hyundai, 2013

Revenue and Operating Margin of Harman, FY2004-FY2014

Sales and EBITDA Margin, Q1 FY2012-Q1 FY2014

Revenue Breakdown of Harman by Business, FY2010-FY2016

Gross Margin of Harman by Sector, FY2010-FY2013

Revenue Breakdown of Harman by Region, FY2006-FY2013

Client Structure of Harman, FY2008-FY2011

Harman Infotainment and Lifestyle Backlog, FY2009-FY2013

Revenue of Harman in China, FY2009-FY2014

Major Clients for Harman’s Automotive Audio

Harman’s Manufacturing Bases Worldwide

Sales and EBIT of Continental, 1998-2012

Sales Breakdown of Continental by Region, 2008-2012

Sales Breakdown of Continental by Sector, 2008-2012

Number of Continental’s Employees by Region, 2008-2012

Number of Continental’s Employees by Sector, 2008-2012

Revenue and Operating Margin of Continental Automotive - Interior Division, 2007-2013

Revenue Breakdown of Continental Automotive - Interior Division by Region, 2009-2012

Revenue and Operating Margin of Pioneer, FY2006-FY2014

Revenue Breakdown of Pioneer by Sector, FY2007-FY2013

Revenue and Operating Margin of Pioneer - Automotive Electronics Division, FY2007-FY2014

Revenue Breakdown of Pioneer by Region, FY2012-FY2014

Pioneer Car Electronics Sales Plan in Emerging Markets

Capacity Statistics of Pioneer Car Audio Manufacturing Bases Worldwide

Organizational Structure of Pioneer Car Audio in China

Client Distribution of Shinwa (China) Industries

Revenue and Operating Margin of Alpine, FY2006-FY2014

Revenue Breakdown of Alpine by Business, FY2012-FY2014

Revenue and Operating Margin of Alpine – Car Audio Division, FY2006-FY2013

Revenue and Operating Margin of Alpine - Information & Communication, FY2005-FY2013

Revenue Breakdown of Alpine by Region, FY2005-FY2013

Profile of Alpine Branches in China

Revenue and Operating Margin of Clarion, FY2006-FY2014

Revenue Breakdown of Clarion by Region, FY2009-FY2013

Organizational Structure of Clarion in China

Revenue and Gross Margin of Delphi, 2004-2013

Revenue and Operating Margin of Delphi, 2007-2013

Revenue and EBITDA Margin of Delphi, 2007-2013

Revenue Breakdown of Delphi by Product, 2009-Q3 2013

EBITDA of Delphi by Sector, 2010-Q3 2013

Client Distribution of Delphi, 2010-2013

Revenue Breakdown of Delphi by Region, 2010-2013

Organizational Structure of Delphi Before and After the Merger

Revenue Breakdown of Delphi Before and After the Merger by Region

Organization of YFV

Organization of Yanfeng Visteon Electronics

Revenue Breakdown of YFV by Client, 2012

Revenue Breakdown of YFV by Product, 2012

Distribution of YFV in China

Revenue of YFV, 2002-2012

Organizational Structure of YFV - Electronics

Production Bases of YFV – Electronics

Key Events of YFV – Electronics

Revenue Breakdown of YFV by Client, 2010

Revenue Breakdown of YFV by Client, 2011

Revenue Breakdown of YFV by Product, 2010

Vehicle Infotainment Products of Hangsheng Electronics

Major Clients of PAS

Revenue Breakdown of PAS by Region, FY2012

Revenue Breakdown of Panasonic Automotive Sector by Product, FY2012

Organizational Structure of Panasonic Automotive Systems Dalian

Revenue and Operating Margin of FUJITSU TEN, FY2005-FY2013

Revenue Breakdown of FUJITSU TEN by Sector, FY2005-FY2013

Revenue and Operating Margin of Aisin, FY2007-FY2013

Non-Toyota Client Structure of Aisin, Q2 FY2014

Non-Toyota Client Structure of Aisin, FY2009-FY2011

Non-Toyota Client Structure of Aisin, FY2012-FY2013

Revenue and Operating Income of Aisin AW, FY2007-FY2014

Navigator Production of Aisin AW, FY2008-FY2014

Revenue and Operating Margin of Denso, FY2006-FY2014

Client Structure of Denso, FY2008-FY2013

Revenue Breakdown of Denso by Client, Q2 FY2013/2014

Revenue Breakdown of Denso by Product, FY2012-FY2014

Organizational Structure of Tianjin Mobis

Organizational Structure of Guangdong Coagent Electronics S&T

Revenue and Operating Income of JVCKENWOOD, FY2007-FY2014

Revenue Breakdown of JVCKENWOOD by Sector, FY2008-FY2013

Models Using Bose Audio

Sales and Operating Margin of Garmin, 2007-2013

Sales Breakdown of Garmin by Business, 2009-2013

Operating Income of Garmin by Business, 2009-2013

Sales Breakdown of Garmin by Region, 2009-2012

如果这份报告不能满足您的要求,我们还可以为您定制报告,请 留言说明您的详细需求。

|