|

|

|

报告导航:研究报告—

制造业—工业机械

|

|

2013-2016年中国液压支架行业研究报告 |

|

字数:2.1万 |

页数:70 |

图表数:84 |

|

中文电子版:6500元 |

中文纸版:3250元 |

中文(电子+纸)版:7000元 |

|

英文电子版:1700美元 |

英文纸版:1800美元 |

英文(电子+纸)版:2000美元 |

|

编号:LT010

|

发布日期:2013-12 |

附件:下载 |

|

|

|

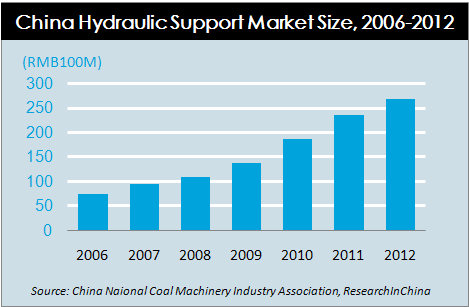

中国煤机行业从20 世纪60 年代末开始液压支架研发工作。70年代从英国、德国、波兰和前苏联引进数十套液压支架,经过试用,仿制和总结经验,到20 世纪80 年代液压支架的研制和应用获得了迅速的发展,相继研制和生产了TD 系列、ZY 系列和ZZ 系列等20 多种不同规格的液压支架。 在煤炭综采设备中,液压支架是数量最多、投资最大的产品。近年来,中国液压支架的生产量和销售量均快速增长。2012年液压支架市场规模达到267.8亿元,2006-2012 年年均复合增长率达23.7%。 目前中国生产液压支架的企业已达110 多家。由于综采液压支架为专业化产品,其中高端产品专业化程度高,虽然近两年有不少企业涉足液压支架市场,未对生产中高端产品为主的大型煤机企业造成威胁,行业竞争格局基本保持稳定。2012年郑煤机、北煤机和平煤机是中国液压支架市场前三大企业,合计市场份额达45.5%;尤其是郑煤机,在高端液压支架市场份额超过60%。 郑煤机是中国煤炭综采液压支架行业的龙头企业,是中国第一台液压支架诞生地,是世界第一台放顶煤液压支架诞生地。2012年郑煤机液压支架产量达21,786架,实现销售收入72.8亿元,2009-2012年公司液压支架产量和销售收入年均增速分别达25.2%和23.7%。 水清木华研究中心《2013-2016年中国液压支架行业研究报告》主要包括以下几个内容:● 中国液压支架行业发展环境,包括政策环境、煤机市场发展、煤机行业格局及需求分析等;

● 中国液压支架行业发展现状、市场供需、竞争格局及发展趋势分析等;

● 中国液压支架行业主要企业(包括郑煤机、山东矿机、林州重机、天地科技、三一国际、北煤机、平煤机、平阳重工等)运营情况及液压支架业务分析等;

● 2013-2016年中国液压支架行业市场规模、供需情况分析预测等;

Chinese coal mine machinery industry took to hydraulic support research

and development from the late 1960s, and introduced dozens of sets of

hydraulic supports from the United Kingdom, Germany, Poland and the

former Soviet Union in the 70s; after the trial use, imitation and

lessons learned, the development and application of hydraulic support

gained rapid development in the 1980s, accompanied by successive

development and production of over 20 different specifications of

hydraulic supports embracing TD series, ZY series and ZZ series. Among

fully-mechanized coal mining equipment, hydraulic support is the

product with the largest number and investment. In recent years, China’s

hydraulic support production and sales have been growing fast. In 2012

hydraulic support market size reached RMB26.78 billion, with compound

annual growth rate in 2006-2012 up to 23.7%.  For

now, there exist more than 110 manufacturers of hydraulic support in

China. As fully-mechanized coal mining hydraulic support pertains to

specialized product, including high-end products with a high degree of

specialization, although there have been many companies involved in

hydraulic support market over recent two years, it poses no threat to

large coal mine machinery firms mainly engaged in the production of mid

to high-end products, the industry competition structure basically

remains stable. In 2012 Zhengzhou Coal Mining Machinery Group Company

Limited, ChinaCoal Beijing Coal Mining Machinery Co., Ltd. and

Pingdingshan Coal Mine Machinery Co., Ltd. as the top three enterprises

in the Chinese hydraulic support market captured 45.5% market share;

especially Zhengzhou Coal Mining Machinery Group Company Limited

occupied more than 60% in the high-end market. Zhengzhou Coal

Mining Machinery Group Company Limited is the leading enterprise in

China’s fully-mechanized coal mining hydraulic support, but also the

birthplace of China’s first hydraulic support and the World’s first

caving hydraulic support. In 2012 it produced 21,786 hydraulic supports,

achieving sales of RMB7.28 billion. In 2009-2012 hydraulic support

production and sales grew at average annual growth rates of 25.2% and

23.7%, respectively. China Hydraulic Support Industry Report, 2013-2016 of ResearchInChina mainly covers the following content:

Development environment for China hydraulic support industry, including

policy environment, coal mine machinery market development, coal mine

machinery industry pattern and demand, etc.;  Development status, market supply and demand, competition pattern and development tendency of China hydraulic support industry;

Operation, hydraulic support business, etc. of key companies (such as

Zhengzhou Coal Mining Machinery Group Company Limited, Shandong Mining

Machinery Group Co., Ltd, Linzhou Heavy Machinery Group Co., Ltd, Tiandi

Science & Technology Co., Ltd, Sany Heavy Equipment International

Holdings Co., Ltd., ChinaCoal Beijing Coal Mining Machinery Co., Ltd.,

Pingdingshan Coal Mine Machinery Co., Ltd., Shanxi Pingyang Industry

Machinery Co., Ltd.);  Market size, supply-demand analysis and forecasting, etc. of China hydraulic support industry in 2013-2016.

第一章 液压支架行业概述

1.1 定义及分类

1.2 产业链分析

第二章 中国液压支架行业运行环境分析

2.1政策环境

2.2 中国煤机行业市场环境

2.2.1 中国煤机行业现状

2.2.2 行业格局

2.2.3 需求

第三章 中国液压支架行业发展分析

3.1 发展现状

3.2 市场供需

3.3 竞争格局

3.4 发展趋势

3.3.1 成套化

3.3.2 安全化

第四章 中国液压支架行业主要企业

4.1 郑煤机

4.1.1 企业简介

4.1.2 经营情况

4.1.3 营收构成

4.1.4 液压支架业务

4.1.5 毛利率

4.1.6 客户与供应商

4.1.7 预测与展望

4.2 山东矿机

4.2.1 企业简介

4.2.2 经营情况

4.2.3 营收构成

4.2.4 液压支架业务

4.2.5 毛利率

4.2.6 客户与供应商

4.2.7 预测与展望

4.3 林州重机

4.3.1 企业简介

4.3.2 经营情况

4.3.3 营收构成

4.3.4 液压支架业务

4.3.5 毛利率

4.3.6 客户与供应商

4.3.7 预测与展望

4.4 天地科技

4.4.1 企业简介

4.4.2 运营情况

4.4.3 营收构成

4.4.4 液压支架业务

4.4.5 毛利率

4.4.6 客户与供应商

4.4.7 预测与展望

4.5 三一国际

4.5.1 公司简介

4.5.2 运营情况

4.5.3 营收构成

4.5.4 液压支架业务

4.5.5 毛利率

4.5.6 客户与供应商

4.5.7 预测与展望

4.6北煤机

4.6.1 公司简介

4.6.2 运营情况

4.6.3 液压支架业务

4.7 平阳重工

4.7.1 企业简介

4.7.2 经营情况

4.7.3 液压支架业务

4.8 平煤机

4.8.1 企业简介

4.8.2 经营情况

4.8.3 液压支架业务

4.9 神坤装备

4.9.1 企业简介

4.9.2 经营情况

4.9.3 液压支架业务

4.10 邯郸煤机

4.10.1 企业简介

4.10.2 经营情况

4.10.3 液压支架业务

4.10 邯郸煤机

4.10.1 企业简介

4.10.2 经营情况

4.10.3 液压支架业务

4.11 淄博泰力

4.11.1 企业简介

4.11.2 经营情况

4.11.3 液压支架业务

4.12 天安矿机

4.12.1 企业简介

4.12.2 经营情况

4.12.3 液压支架业务

4.13 华阳煤矿支护设备

4.13.1 企业简介

4.13.2 经营情况

4.13.3 液压支架业务

第五章 总结与预测

1. Overview of Hydraulic Support Industry

1.1 Definition and Classification

1.2 Industry Chain

2. Operating Environment for China Hydraulic Support Industry

2.1 Policy Environment

2.2 Market Environment for China Coal Mine Machinery Industry

2.2.1 Status Quo

2.2.2 Industry Structure

2.2.3 Demand

3. Development of China Hydraulic Support Industry

3.1 Development Status

3.2 Market Supply and Demand

3.3 Competition Pattern

3.4 Development Tendency

3.4.1 Complete Sets

3.4.2 Safety-oriented

4. Key Companies

4.1 Zhengzhou Coal Mining Machinery Group Company Limited

4.1.1 Profile

4.1.2 Operation

4.1.3 Revenue Structure

4.1.4 Hydraulic Support Business

4.1.5 Gross Margin

4.1.6 Clients and Suppliers

4.1.7 Forecast & Outlook

4.2 Shandong Mining Machinery Group Co., Ltd.

4.2.1 Profile

4.2.2 Operation

4.2.3 Revenue Structure

4.2.4 Hydraulic Support Business

4.2.5 Gross Margin

4.2.6 Clients and Suppliers

4.2.7 Forecast & Outlook

4.3 Linzhou Heavy Machinery Group Co., Ltd.

4.3.1 Profile

4.3.2 Operation

4.3.3 Revenue Structure

4.3.4 Hydraulic Support Business

4.3.5 Gross Margin

4.3.6 Clients and Suppliers

4.3.7 Forecast & Outlook

4.4 Tiandi Science & Technology Co., Ltd.

4.4.1 Profile

4.4.2 Operation

4.4.3 Revenue Structure

4.4.4 Hydraulic Support Business

4.4.5 Gross Margin

4.4.6 Clients and Suppliers

4.4.7 Forecast & Outlook

4.5 Sany Heavy Equipment International Holdings Co., Ltd.

4.5.1 Profile

4.5.2 Operation

4.5.3 Revenue Structure

4.5.4 Hydraulic Support Business

4.5.5 Gross Margin

4.5.6 Clients and Suppliers

4.5.7 Forecast & Outlook

4.6 ChinaCoal Beijing Coal Mining Machinery Co., Ltd.

4.6.1 Profile

4.6.2 Operation

4.6.3 Hydraulic Support Business

4.7 Shanxi Pingyang Industry Machinery Co., Ltd.

4.7.1 Profile

4.7.2 Operation

4.7.3 Hydraulic Support Business

4.8 Pingdingshan Coal Mine Machinery Co., Ltd.

4.8.1 Profile

4.8.2 Operation

4.8.3 Hydraulic Support Business

4.9 Sunkun Equipment Co., Ltd.

4.9.1 Profile

4.9.2 Operation

4.9.3 Hydraulic Support Business

4.10 China Coal Handan Coal Mining Machinery Company Limited

4.10.1 Profile

4.10.2 Operation

4.10.3 Hydraulic Support Business

4.11 Zibo Taili Machinery Manufacturing Co., Ltd.

4.11.1 Profile

4.11.2 Operation

4.11.3 Hydraulic Support Business

4.12 Shenyang Tian An Mining Machinery Technology Co., Ltd.

4.12.1 Profile

4.12.2 Operation

4.12.3 Hydraulic Support Business

4.13 Tai'an Huayang Coal Mine Supporting Equipment Co., Ltd.

4.13.1 Profile

4.13.2 Operation

4.13.3 Hydraulic Support Business

5. Summary & Forecast

图:液压支架分类

图:三机一架示意图

图:煤机行业产业链

表:2012-2013年主要煤矿安全事件

表:2005-2012年煤机行业相关重要法规条例

图:中国煤机行业主要发展阶段

图:2003-2012年中国煤机行业市场规模

图:2012年中国主要煤机厂商市场占有率

图:2003-2012年中国综采设备产值

图:2012-2015年煤机行业市场规模

图:十一五及十二五期间新建煤矿投资及对煤机的新增需求预测

图:2006-2012年中国液压支架市场规模

图:各类煤矿对液压支架需求

图:2006-2012年中国液压支架产量

图:2012年中国液压支架市场结构

图:2012年中国液压支架产地分布

图:中国主要煤机厂商成套化发展情况

图:2005-2012年主要煤炭安全相关政策法规

图:2008-2013年郑煤机营业收入及净利润

图:2008-2013年郑煤机(分产品)营收占比

图:2008-2013年郑煤机(分地区)营收占比

图:2009-2012年郑煤机液压支架销售收入及毛利率

图:2009-2012年郑煤机液压支架产量

图:2008-2013年郑煤机毛利率

图:2008-2013年郑煤机(分产品)毛利率

图:2009-2012年华测检测前五名客户营收贡献及占比

图:2009-2012年华测检测前五名供应商采购金额及占比

图:2012-2015年郑煤机营业收入及净利润

图:2008-2013年山东矿机营业收入及净利润

图:2008-2013年山东矿机(分产品)营收占比

图:2009-2013年山东矿机(分地区)营收占比

图:2009-2012年山东矿机支护设备营业收入及占比

表:山东矿机主要支护产品

图:2008-2013年山东矿机毛利率

表:2008-2013年山东矿机(分产品)毛利率

图:2009-2012年山东矿机前五名客户营收贡献及占比

图:2009-2012山东矿机前五名供应商采购金额及占比

图:2012-2015年山东矿机营业收入及净利润

图:2008-2013年林州重机营业收入及净利润

图:2008-2013年林州重机(分产品)营收占比

表:2008-2013年林州重机(分地区)营收占比

图:2009-2012年林州重机液压支架营业收入及毛利率

图:2011-2012年林州重机液压支架产销及库存量

图:2008-2013年林州重机毛利率

图:2008-2013年林州重机(分产品)毛利率

图:2009-2012年林州重机前五名客户营收贡献及占比

图:2009-2012林州重机前五名供应商采购金额及占比

图:2012-2015年林州重机营业收入及净利润

图:2008-2013年天地科技营业收入及净利润

表:2009-2013年天地科技(分产品)营收占比

图:2008-2013年天地科技(分地区)营收占比

图:2011-2012年天地科技液压支架销售收入及占比

图:2011-2012年天地科技液压支架产销及库存量

图:2008-2013年天地科技毛利率

图:2008-2013年天地科技(分产品)毛利率

图:2009-2012年天地科技前五名客户营收贡献及占比

图:2009-2012天地科技前五名供应商采购金额及占比

图:2012-2015年天地科技营业收入及净利润

图:2008-2013年三一国际营业收入及净利润

图:2008-2012年三一国际(分产品)营收占比

图:2008-2013年三一国际毛利率

图:2009-2012年三一国际前五名客户营收贡献及占比

图:2009-2012三一国际前五名供应商采购额占比

图:2012-2015年三一国际营业收入及净利润

图:2007-2010年北煤机营业收入

图:2007-2009年北煤机液压支架产量

图:2007-2009年平阳重工销售收入及销售利润率

图:2007-2009年平阳重工液压支架产量

图:2007-2009年平煤机械销售收入及销售利润率

图:2007-2009年平煤机液压支架产量

图:2007-2009年神坤装备械销售收入及销售利润率

图:2007-2009年神坤装备液压支架产量

图:2007-2009年邯郸煤机械销售收入及销售利润率

图:2007-2009年邯郸煤机液压支架产量

图:2007-2009年邯郸煤机械销售收入及销售利润率

图:2007-2009年邯郸煤机液压支架产量

图:2007-2009年淄博泰力械销售收入及销售利润率

图:2007-2009年淄博泰力液压支架产量

图:2007-2009年天安矿机械销售收入及销售利润率

图:2007-2009年天安矿机液压支架产量

图:2007-2009年华阳煤矿支护设备销售收入及销售利润率

图:2007-2009年华阳煤矿支护设备液压支架产量

图:2013-2016年中国液压支架市场规模

图:2013-2016年中国液压支架需求量

Classification of Hydraulic Support

Schematic Diagram of Coal Cutter, Scrapper, Boring Machine and Hydraulic Support

Coal Mine Machinery Industry Chain

Major Coal Mine Safety Events, 2012-2013

Important Laws and Regulations Related to Coal Mine Machinery Industry, 2005-2012

Main Development Stages of China Coal Mine Machinery Industry

Market Size of China Coal Mine Machinery Industry, 2003-2012

Market Share of China’s Leading Coal Mine Machinery Manufacturers, 2012

Output Value of Chinese Fully-mechanized Coal Mining Equipment, 2003-2012

Market Size of Coal Mine Machinery Industry, 2012-2015E

Forecasting for Investment in New Coal Mines and New Demand for Coal Mine Machinery during the Period of the 11th Five-Year Plan and the 12th Five-Year Plan

China Hydraulic Support Market Size, 2006-2012

Demand for Hydraulic Support from Coal Mines

China Hydraulic Support Production, 2006-2012

China Hydraulic Support Market Structure, 2012

Distribution of Hydraulic Support Origins in China, 2012

Complete Sets Development of Major Coal Mine Machinery Manufacturers in China

Main Policies and Regulations Related to Coal Safety, 2005-2012

Revenue and Net Income of Zhengzhou Coal Mining Machinery Group, 2008-2013

Revenue Structure of Zhengzhou Coal Mining Machinery Group by Product, 2008-2013

Revenue Structure of Zhengzhou Coal Mining Machinery Group by Region, 2008-2013

Hydraulic Support Sales and Gross Margin of Zhengzhou Coal Mining Machinery Group, 2009-2012

Hydraulic Support Production of Zhengzhou Coal Mining Machinery Group, 2009-2012

Gross Margin of Zhengzhou Coal Mining Machinery Group, 2008-2013

Gross Margin of Zhengzhou Coal Mining Machinery Group by Product, 2008-2013

Zhengzhou Coal Mining Machinery Group’s Revenue from Top 5 Clients and % of Total Revenue, 2009-2012

Zhengzhou Coal Mining Machinery Group’s Procurement from Top 5 Suppliers and % of Total Procurement, 2009-2012

Revenue and Net Income of Zhengzhou Coal Mining Machinery Group, 2012-2015E

Revenue and Net Income of Shandong Mining Machinery Group, 2008-2013

Revenue Structure of Shandong Mining Machinery Group by Product, 2008-2013

Revenue Structure of Shandong Mining Machinery Group by Region, 2009-2013

Shandong Mining Machinery Group’s Revenue from Support Equipment and % of Total Revenue, 2009-2012

Main Support Products of Shandong Mining Machinery Group

Gross Margin of Shandong Mining Machinery Group, 2008-2013

Gross Margin of Shandong Mining Machinery Group by Product, 2008-2013

Shandong Mining Machinery Group’s Revenue from Top 5 Clients and % of Total Revenue, 2009-2012

Shandong Mining Machinery Group’s Procurement from Top 5 Suppliers and % of Total Procurement, 2009-2012

Revenue and Net Income of Shandong Mining Machinery Group, 2012-2015E

Revenue and Net Income of Linzhou Heavy Machinery Group, 2008-2013

Revenue Structure of Linzhou Heavy Machinery Group by Product, 2008-2013

Revenue Structure of Linzhou Heavy Machinery Group by Region, 2008-2013

Hydraulic Support Revenue and Gross Margin of Linzhou Heavy Machinery Group, 2009-2012

Hydraulic Support Production, Sales and Inventory of Linzhou Heavy Machinery Group, 2011-2012

Gross Margin of Linzhou Heavy Machinery Group, 2008-2013

Gross Margin of Linzhou Heavy Machinery Group by Product, 2008-2013

Linzhou Heavy Machinery Group’s Revenue from Top 5 Clients and % of Total Revenue, 2009-2012

Linzhou Heavy Machinery Group’s Procurement from Top 5 Suppliers and % of Total Procurement, 2009-2012

Revenue and Net Income of Linzhou Heavy Machinery Group, 2012-2015E

Revenue and Net Income of Tiandi Science & Technology, 2008-2013

Revenue Structure of Tiandi Science & Technology by Product, 2009-2013

Revenue Structure of Tiandi Science & Technology by Region, 2008-2013

Tiandi Science & Technology’s Sales from Hydraulic Support and % of Total Revenue, 2011-2012

Hydraulic Support Production, Sales and Inventory of Tiandi Science & Technology, 2011-2012

Gross Margin of Tiandi Science & Technology, 2008-2013

Gross Margin of Tiandi Science & Technology by Product, 2008-2013

Tiandi Science & Technology’s Revenue from Top 5 Clients and % of Total Revenue, 2009-2012

Tiandi Science & Technology’s Procurement from Top 5 Suppliers and % of Total Procurement, 2009-2012

Revenue and Net Income of Tiandi Science & Technology, 2012-2015E

Revenue and Net Income of Sany Heavy Equipment International Holdings, 2008-2013

Revenue Structure of Sany Heavy Equipment International Holdings by Product, 2008-2012

Gross Margin of Sany Heavy Equipment International Holdings, 2008-2013

Sany Heavy Equipment International Holdings’ Revenue from Top 5 Clients and % of Total Revenue, 2009-2012

Sany Heavy Equipment International Holdings’ Procurement from Top 5 Suppliers and % of Total Procurement, 2009-2012

Revenue and Net Income of Sany Heavy Equipment International Holdings, 2012-2015E

Revenue of ChinaCoal Beijing Coal Mining Machinery, 2007-2010

Hydraulic Support Production of ChinaCoal Beijing Coal Mining Machinery, 2007-2009

Sales and Sales Margin of Shanxi Pingyang Industry Machinery, 2007-2009

Hydraulic Support Production of Shanxi Pingyang Industry Machinery, 2007-2009

Sales and Sales Margin of Pingdingshan Coal Mine Machinery, 2007-2009

Hydraulic Support Production of Pingdingshan Coal Mine Machinery, 2007-2009

Sales and Sales Margin of Sunkun Equipment, 2007-2009

Hydraulic Support Production of Sunkun Equipment, 2007-2009

Sales and Sales Margin of China Coal Handan Coal Mining Machinery, 2007-2009

Hydraulic Support Production of China Coal Handan Coal Mining Machinery, 2007-2009

Sales and Sales Margin of Zibo Taili Machinery Manufacturing, 2007-2009

Hydraulic Support Production of Zibo Taili Machinery Manufacturing, 2007-2009

Sales and Sales Margin of Shenyang Tian An Mining Machinery Technology, 2007-2009

Hydraulic Support Production of Shenyang Tian An Mining Machinery Technology, 2007-2009

Support Equipment Sales and Sales Margin of Tai'an Huayang Coal Mine Supporting Equipment, 2007-2009

Support Equipment (Hydraulic Support) Production of Tai'an Huayang Coal Mine Supporting Equipment, 2007-2009

China Hydraulic Support Market Size, 2013-2016E

Chinese Demand for Hydraulic Support, 2013-2016E

如果这份报告不能满足您的要求,我们还可以为您定制报告,请 留言说明您的详细需求。

|