|

报告导航:研究报告—

生命科学—制药医疗

|

|

2013-2016年中国养老产业研究报告 |

|

字数:4.9万 |

页数:104 |

图表数:75 |

|

中文电子版:8500元 |

中文纸版:4250元 |

中文(电子+纸)版:9000元 |

|

英文电子版:2400美元 |

英文纸版:2500美元 |

英文(电子+纸)版:2700美元 |

|

编号:PQ006

|

发布日期:2014-03 |

附件:下载 |

|

|

|

目前中国老龄化已进入加速期。2013年中国65岁及以上老年人口达1.3161亿,占总人口的比重达9.7%;预计2016年中国65岁及以上老年人口比重将达到10.7%。同时,中国老年人口抚养比(指每100名劳动年龄人口要负担多少名老年人)的不断走高以及高龄老年人、无子女老年人、失能老人、慢性病老年人数量的持续增多均加剧了中国人口老龄化的严峻性。

2013年,中国60岁以上、65岁以上老年人口抚养比分别达21.4%、13.1%;中国高龄老年人口(80岁以上)上升到0.23亿人,且年均增长100万人的态势将持续到2025年;失能老年人口增长到3750万人;慢性病老年人突破1亿人。

为了应对中国不断加剧的老龄化问题,中国政府在2011年将老龄事业纳入“十二五”规划,自2012年起加速出台扶持养老产业的政策,明确鼓励和引导民间资本进入养老产业,并不断降低外资进入壁垒等。

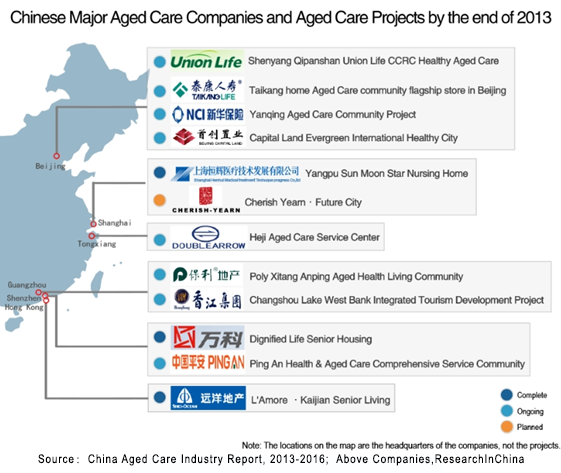

在养老产业巨大潜力和诸多项利好政策等驱动下,房地产开发商、保险公司、多元化企业和外资企业纷纷涉足中国养老住宅、医疗护理和养老金融等养老领域。

房地产商中,保利地产通过现有项目改造、开发养老公寓、嫁接旅游地产和养老机构及社区医疗中心等形式进军养老产业;世纪爱晚和世联地产则分别通过构建“全国连锁大规模综合性养老社区”和打造“投资商+开发商+服务商+运营商”全链条开发的模式进入。

保险企业主要是通过开发养老社区的模式进军养老产业。保守估计,截至2013年底,中国保险系企业在养老地产领域的投资已达500-600亿元。目前泰康人寿在北京昌平、上海松江、广州萝岗和海南三亚均有养老项目布局。2013年11月,合众人寿在武汉率先建成业内第一家养老社区,有别于泰康人寿等保险公司养老社区定位于高端市场,该社区定位在中端,目标客户群覆盖范围更大。

此外,多元化企业如中水电地产、联想控股、今典集团和金陵饭店,外资企业如城堡投资、Emeritus等也纷纷进军中国养老产业。

《2013-2016年中国养老产业研究报告》主要包括以下几个方面:

. 中国养老产业概况,包括养老模式、产业链及基本特点等;

. 中国养老体系分析,包括中国养老产业政策环境、养老保障体系、医疗保障体系、金融保障体系等;

. 中国养老市场分析,包括养老市场需求情况、养老市场供给(包括居家养老和机构养老)、养老市场发展趋势等;

. 中国养老地产分析,包括国外先进模式借鉴、行业发展现状、行业竞争情况、行业盈利模式、在建项目、行业投资风险等;

. 中国养老产业主要企业(包括4家房地产企业、4家保险企业和7家其他企业)经营情况,养老产业项目运营情况,未来发展规划等。

Currently, China has entered the accelerated aging period. China’s population aged 65 and above reached 131.61 million in 2013, accounting for 9.7% of total population; and the proportion will rise to 10.7% in 2016. Meanwhile, the rising old-age dependency ratio (shown as the proportion of aged dependents per 100 working-age population) as well as the growing number of elderly people, childless elderly, disabled elderly and elderly with chronic disease have exacerbated the seriousness of population aging in China.

In 2013, China’s dependency ratios of populations aged over 60 and above 65 were up to 21.4% and 13.1%, respectively; Chinese elderly population (80 years and older) rose to 23 million, and the annual growth of one million people would continue to 2025; disabled elderly population increased to 37.5 million; the elderly with chronic disease outnumbered 100 million.

To cope with the continuously compounded aging problem in China, the Chinese Government included the cause of aging in China's Twelfth Five Year Plan (2011-2015) in 2011, and accelerated the introduction of policies to support the aged care industry from 2012 on, explicitly encouraged and guided private capital into the aged care industry as well as continued to lower barriers to foreign investment, etc..

Real estate developers, insurance companies, diversified enterprises and foreign enterprises driven by the huge potential of aged care industry and many favorable policies have successively set foot in China’s senior housing, medical care, pension finance and other aged care fields.

Among real estate developers, Poly Real Estate tapped into the aged care industry through transformation of existing projects, development of senior apartment, grafting of tourism real estate, pension institutions and community health center as well as other forms; followed by AIWAN Investment Corporation and Shenzhen World Union Properties Consultancy Co., Ltd. via building “large-scale comprehensive national chain of retirement community” and creating “investors + developer + service provider + operator” whole-chain development mode, respectively.

Insurance companies mainly turn to the development of retirement community to enter the industry. Based on a conservative estimate, Chinese insurance companies had invested RMB50-60 billion in the field of aged care real estate by the end of 2013. So far, Taikang Life has laid out pension projects in Changping (Beijing), Songjiang (Shanghai), Luogang (Guangzhou) and Sanya (Hainan). In November 2013, Union Life became the first to build retirement community in the industry in Wuhan, which, unlike retirement communities of Taikang Life and other insurance companies positioned in the high-end market, was middle-positioned, with target customers covering a wider range.

Moreover, diversified enterprises e.g. Sinohydro Real Estate, Legend Holdings, Antaeus Group and Jinling Hotel, foreign companies e.g. Fortress Investment and Emeritus have also entered China’s aged care industry.

China Aged Care Industry Report, 2013-2016 mainly covers the followings:  Overview of aged care industry in China, involving aged care model, industrial chain and basic features, etc.;  Analysis on aged care system in China, including industrial policy environment, old-age security system, medical security system, financial security system, etc.;  Analysis on aged care market in China, covering demand, supply (including home-based and institutional care for the aged), development tendency, etc.;  Analysis on aged care real estate in China, including lessons drawn from advanced foreign models, industry development status, industry competition, industry profit models, projects under construction, industry investment risk, etc.;  Operation, aged care business, future development planning, etc. of major aged care companies in China (containing four real estate companies, four insurance companies and seven other companies).

第一章 养老产业概述

1.1 定义

1.2 产业链

1.3 模式

1.3.1 家庭养老

1.3.2 机构养老

1.3.3 社区居家养老

1.4 基本特点

1.4.1 综合性

1.4.2 福利性

1.4.3 公益性

1.4.4 营利性

第二章 中国养老保障体系分析

2.1 养老政策环境

2.1.1 “十二五”规划

2.1.2 其他政策法规

2.2 养老保障

2.2.1 养老保险

2.2.2 社会救助

2.2.2.1 城乡最低生活保障制度

2.2.2.2 农村五保供养制度

2.2.3 高龄老年人生活补贴

2.3 医疗保障

2.3.1 城镇基本医疗保险

2.3.2 新型农村合作医疗

2.3.3 老年卫生服务

2.4 金融保障

2.4.1 养老金融

2.4.2 商业养老保险

2.4.3 护理保险

2.4.4 养老机构综合责任保险

第三章 中国养老市场分析

3.1 养老市场需求

3.1.1 中国老龄化进入加速期

3.1.2 老年人口抚养比逐年上升

3.1.3 劳动年龄人口占比呈下行趋势

3.1.4平均家庭户规模缩小

3.2 养老市场供给

3.2.1 养老格局

3.2.2 居家养老

3.2.2.1 居家养老政策

3.2.2.2 居家养老供给

3.2.2.3 居家养老需求

3.2.2.4 居家养老存在的问题

3.2.3 机构养老

3.2.3.1 养老机构分类

3.2.3.2 供需

3.3 养老市场趋势

3.3.1 养老护理人员供需严重失衡

3.3.2 民办养老机构政策驱动

3.3.3 高端养老服务需求强劲

第四章 中国养老地产市场分析

4.1 行业发展概况

4.1.1 简介

4.1.2 国外经验借鉴

4.2 行业竞争现状

4.2.1 总体情况

4.2.2 房地产企业

4.2.3 保险公司

4.2.4 多元化企业

4.2.5 外资企业

4.3 行业盈利模式

4.3.1 持有经营

4.3.2 出售+出租

4.3.3 出售

4.4 养老地产在建项目

4.5 行业投资风险

4.5.1 销售方式

4.5.2 盈利模式

4.5.3 配套支持政策

4.5.4 养老地产选址

4.5.5 盈利水平

第五章 中国养老产业主要企业

5.1 万科股份

5.1.1 公司简介

5.1.2 经营情况

5.1.3 营收构成

5.1.4 毛利率

5.1.5 养老地产业务

5.1.6发展预测

5.2 保利地产

5.2.1 公司简介

5.2.2 经营情况

5.2.3 营收构成

5.2.4 毛利率

5.2.5 养老地产业务

5.2.6发展预测

5.3 首创置业

5.3.1 公司简介

5.3.2经营情况

5.3.3营收构成

5.3.4毛利率

5.3.5养老地产业务

5.3.6发展预测

5.4远洋地产

5.4.1公司简介

5.4.2经营情况

5.4.3营收构成

5.4.4毛利率

5.4.5养老地产业务

5.4.6发展预测

5.5 泰康人寿

5.5.1 公司简介

5.5.2 经营情况

5.5.3 营收构成

5.5.4 养老业务

5.6 新华保险

5.6.1 公司简介

5.6.2 经营情况

5.6.3 营收构成

5.6.4 养老业务

5.6.4.1发展战略

5.6.4.2健康管理中心项目

5.6.4.3 养老社区项目

5.6.5发展预测

5.7 中国平安

5.7.1 公司简介

5.7.2 经营情况

5.7.3 营收构成

5.7.4 养老业务

5.7.5发展预测

5.8 合众人寿

5.8.1 公司简介

5.8.2 经营情况

5.8.3 营收构成

5.8.4 养老业务

5.9 上海亲和源

5.9.1 公司简介

5.9.2 经营情况

5.9.3 养老地产业务

5.9.4 发展战略

5.10 汇晨老年公寓

5.10.1 项目简介

5.10.2 经营情况

5.10.3 发展战略

5.11 天津鹤童老年福利协会

5.11.1 项目简介

5.11.2 经营情况

5.11.3 发展动态

5.12 夕阳红连锁老人公寓

5.12.1 背景介绍

5.12.2 运营方式

5.12.3 江苏江阴夕阳红老年康乐中心

5.13 恒晖医疗

5.13.1 公司简介

5.13.2 经营情况

5.14 双箭股份

5.14.1 公司简介

5.14.2养老业务

5.14.3发展战略

5.15 河北廊坊燕达国际健康城

5.15.1 项目简介

5.15.2 重点项目分析

5.15.3 经营方式

1 Overview of Aged Care Industry

1.1 Definition

1.2 Industry Chain

1.3 Modes

1.3.1 Home-based Care

1.3.2 Institution-based Care

1.3.3 Community-based Care

1.4 Features

1.4.1 Comprehensiveness

1.4.2 Welfare

1.4.3 Public Benefit

1.4.4 Profitability

2 China's Aged Care Security System

2.1 Aged Care Policies

2.1.1 Twelfth Five-Year Plan

2.1.2 Other Policies and Regulations

2.2 Old-age Security

2.2.1 Pension Insurance

2.2.2 Social Assistance

2.2.2.1 Urban and Rural Minimum Living Standard Guarantee System

2.3 Medical Security

2.3.1 Urban Basic Medical Insurance

2.3.2 New Rural Cooperative Medical

2.3.3 Elderly Health Care Services

2.4 Financial Security

2.4.1 Pension Finance

2.4.2 Commercial Pension Insurance

2.4.3 Nursing Insurance

2.4.4 Comprehensive Liability Insurance of Aged Care Institutions

3 Chinese Aged Care Market

3.1 Demand

3.1.1 China's Population Aging Enters the Accelerated Phase

3.1.2 Dependency Ratio of Elderly Population Increases Year by Year

3.1.3 Population Changes Exacerbate the Aging Problem

3.1.4 Average Household Size Shrinks

3.2 Supply

3.2.1 Aged Care Pattern

3.2.2 Home-based Care

3.2.3 Institution-based Care

3.3 Trends

3.3.1 Imbalance between Supply and Demand

3.3.2 Private Aged Care Institutions Develop Quickly

3.3.3 Robust Demand for High-end Aged Care Services

4 Chinese Aged Care Real Estate Market

4.1 Overview

4.1.1 Brief Introduction

4.1.2 Foreign Experience

4.2 Competition

4.2.1 Overview

4.2.2 Real Estate Enterprises

4.2.3 Insurance Companies

4.2.4 Diversified Enterprises

4.2.5 Foreign-funded Enterprises

4.3 Profit Modes

4.3.1 Self-operation

4.3.2 Sale + Lease

4.3.3 Sale

4.4 Proposed and Ongoing Aged Care Real Estate Projects

4.5 Investment Risks

4.5.1 Sales Modes

4.5.2 Profit Modes

4.5.3 Supporting Policies

4.5.4 Site Selection

4.5.5 Profitability

5 Key Enterprises in China Aged Care Industry

5.1 Vanke

5.1.1 Profile

5.1.2 Operation

5.1.3 Revenue Structure

5.1.4 Gross Margin

5.1.5 Aged Care Real Estate

5.1.6 Development Prospect

5.2 Poly Real Estate

5.2.1 Profile

5.2.2 Operation

5.2.3 Revenue Structure

5.2.4 Gross Margin

5.2.5 Aged Care Real Estate

5.2.6 Development Prospect

5.3 Beijing Capital Land Ltd

5.3.1 Profile

5.3.2 Operation

5.3.3 Revenue Structure

5.3.4 Gross Margin

5.3.5 Aged Care Real Estate

5.3.6 Development Prospect

5.4 Sino-Ocean Land Holdings Ltd.

5.4.1 Profile

5.4.2 Operation

5.4.3 Revenue Structure

5.4.4 Gross Margin

5.4.5 Aged Care Real Estate

5.4.6 Development Prospect

5.5 Taikang Life

5.5.1 Profile

5.5.2 Operation

5.5.3 Revenue Structure

5.5.4 Aged Care Business

5.6 New China Life Insurance

5.6.1 Profile

5.6.2 Operation

5.6.3 Revenue Structure

5.6.4 Aged Care Business

5.6.4.1 Development Strategy

5.6.4.2 Health Management Center

5.6.4.3 Aged Care Communities

5.6.5 Development Prospect

5.7 Ping An Insurance (Group) Company of China, Ltd.

5.7.1 Profile

5.7.2 Operation

5.7.3 Revenue Structure

5.7.4 Aged Care Business

5.7.5 Development Prospect

5.8 Union Life Insurance Co., Ltd.

5.8.1 Profile

5.8.2 Operation

5.8.3 Revenue Structure

5.8.4 Aged Care Business

5.9 Shanghai Qinheyuan

5.9.1 Profile

5.9.2 Operation

5.9.3 Aged Care Real Estate

5.9.4 Development Strategy

5.10 Huichen Life

5.10.1 Project

5.10.2 Operation

5.10.3 Development Strategy

5.11 Tianjin Hetong Senior Citizen’s Welfare Association

5.11.1 Project

5.11.2 Operation

5.11.3 Development

5.12 Sunset Glow Chain Seniors’ Apartment

5.12.1 Background

5.12.2 Operation Modes

5.12.3 Jiangyin Sunset Glow Seniors’ Recreation Center

5.13 Shanghai Henghui Medical Treatment Technique Progress

5.13.1 Profile

5.13.2 Operation

5.14 Zhejiang Doubel Arrow Rubber Co.,Ltd

5.14.1 Profile

5.14.2 Aged Care Business

5.14.3 Development Strategy

5.15 Yanda International Health City

5.15.1 Introduction to the Project

5.15.2 Analysis of Key Projects

5.15.3 Operation Mode

图:养老产业相关产业链

表:“十二五”期间中国老龄事业发展重点任务

表:2001-2014年中国养老服务行业主要政策

图:2005-2012年中国城镇职工基本养老保险(分类型)人数

图:2007-2012年中国城镇职工基本养老保险基金收入及支出

图:2007-2012年中国城镇职工基本养老保险基金累计结存

图:2004-2013年中国城乡低保人数

图:2004-2013年中国农村五保供养人数

图:2007-2012年中国农村每人每年五保供养标准

图:2007-2011年中国享受高龄补贴老年人数量

图:2005-2013年中国城镇基本医疗保险(分类型)人数

图:2005-2012年中国城镇职工基本医疗保险(分类型)人数

图:2005-2013年中国城镇基本医疗保险基金收入及基金支出

图:2005-2012年中国城镇基本医疗保险基金累计结余

图:2007-2013年中国新农合参合人数及参合率

表:2012-2013年中国医疗卫生累计机构数及床位数

图:2006-2013年中国医疗卫生累计机构数

图:2005-2013年中国医院累计数量

图:2009-2013年中国医院(按经济类型)数量

图:2005-2013年中国医疗卫生机构床位数

图:2006-2013年中国卫生技术人员数量

图:2007-2013年中国企业年金概况

图:2000-2016年中国65岁及以上人口数及占总人口数比重

图:1990-2016年中国65岁及以上老年人口抚养比

图:1990-2016年中国15-64岁人口占比

图:1953-2013年中国平均家庭户规模

图:2007-2013年中国社区服务设施累计数量

图:2008-2016年中国各类养老机构数

图:2008-2016年中国各类养老机构床位数及收养老人数

图:2008-2016年中国各类养老机构每千名老年人拥有养老床位数

表:国外几种养老模式(社区)的比较

表:2010-2014年中国房地产企业开发的养老地产项目及模式

表:2010-2014年中国保险公司开发的养老地产项目

表:2010-2014年中国多元化企业开发的养老地产项目

表:2010-2014年外资企业在华养老地产进展

表:中国持有经营式养老地产项目案例及经营特点

表:中国出租+出售式养老地产项目案例及经营特点

表:中国出售式养老地产项目案例及经营特点

表:2011-2014年中国养老地产主要在建项目

图:2008-2013年万科股份营业收入和净利润

表:2008-2013年万科股份(分产品)营业收入

表:2008-2013年万科股份(分地区)营业收入

表:2008-2013年万科股份毛利率(分业务)

表:2012-2016年万科股份营业收入及净利润

图:2008-2013年保利地产营业收入和净利润

图:2008-2013年保利地产(分产品)营业收入

图:2008-2013年保利地产(分业务)毛利率

表:2012-2016年保利地产营业收入及净利润

图:2008-2013年首创置业营业收入和净利润

图:2008-2013年首创置业(分产品)营业收入

图:2008-2013年首创置业毛利率

表:2012-2016年首创置业营业收入及净利润

图:2008-2013年远洋地产营业收入和净利润

图:2008-2013年远洋地产(分产品)营业收入

图:2008-2013年远洋地产毛利率

表:2012-2016年远洋地产营业收入及净利润

图:2010-2012年泰康人寿营业收入和净利润

图:2010-2012年泰康人寿(分产品)营业收入

图:2008-2013年新华保险营业收入和净利润

图:2008-2013年新华保险(分产品)营业收入

表:2012-2016年新华保险营业收入及净利润

图:2008-2013年中国平安营业收入和净利润

图:2008-2013年中国平安(分产品)营业收入

表:2012-2016年中国平安营业收入及净利润

图:2009-2012年合众人寿营业收入和净利润

图:2009-2012年合众人寿(分产品)营业收入

表:合众优年生活养老入住方式及入住条件

表:上海亲和源会员卡类别及其费用和权益

表:汇晨老年公寓经营方式相关内容

表:汇晨公寓床位供给情况

表:鹤童老人五级护理评定等级界定标准及护理费用(单位:元/人/天)

表:“夕阳工程”内容

表:2009年江阴市夕阳红爱心护理院收费标准(单位:元/月)

表:上海徐汇区日月星养老院收费标准(单位:元/月)

表:燕达国际健康城五大板块介绍

Aged Care-related Industry Chain

Key Tasks of Chinese Ageing Development in the 12th Five-Year Plan Period (2011-2015)

Key Policies on China Aged Care Industry, 2011-2014

Number of Urban Employees Involved in Basic Endowment Insurance in China, 2005-2012

Income and Expenses of Basic Endowment Insurance Fund in Urban Regions of China, 2007-2012

Accumulated Balances of Basic Endowment Insurance Fund in Urban Regions of China, 2007-2012

Number of People Enjoying Subsistence Allowances for the Urban and Rural Poor in China, 2004-2013

Number of People Enjoying the Five Guarantees in Rural Areas of China, 2004-2013

Average Standard for the Five Guarantees in Rural Areas of China, 2007-2012

Population of Elderly People Who Enjoy Advanced Age Subsidies in China, 2007-2011

Number of Urban Workers and Residents Who Enjoy Basic Medical Insurance (by Type) in China, 2005-2013

Number of Urban On-service and Retired Workers Who Enjoy Basic Medical Insurance (by Type) in China, 2005-2012

Income and Expenses of China’s Urban Basic Medical Insurance Fund, 2005-2013

Accumulated Balance of China’s Urban Basic Medical Insurance Fund, 2005-2012

Number of Participants and Participation Rate of New Rural Cooperative Medical System in China, 2007-2013

Number of Medical & Health Institutions and Number of Beds in China, 2012-2013

Accumulated Number of Medical & Health Institutions in China, 2006-2013

Accumulated Number of Hospitals in China, 2005-2013

Number of Hospitals (by Economic Type) in China, 2009-2013

Number of Beds of Medical and Health Institutions in China, 2005-2013

Number of Health Technicians in China, 2006-2013

Overview of Enterprise Annuity in China, 2007-2013

Population Aged 65 or Above and Its Proportion in the Total Population of China, 2000-2016

Dependency Ratio of the Population Aged 65 and Above in China, 1990-2016

Proportion of Population Aged 15-64 in China, 1990-2016

Average Household Size in China, 1953-2013

Number of Community Service Facilities in China, 2007-2013

Number of Various Elderly and Disabled Service Agencies in China, 2008-2016

Number of Bed and Adopted Elderly in China’s Aged Care Institutions, 2008-2016

Number of Bed for Every 1,000 Senior Citizens in China’s Aged Cared Institutions, 2008-2016

Comparison between Overseas Aged Care Modes (Communities)

Aged Care Real Estate Projects and Modes of Real Estate Companies in China, 2010-2014

Aged Care Real Estate Projects of Insurance Companies in China, 2010-2014

Aged Care Real Estate Projects of Diversified Enterprises in China, 2010-2014

Aged Care Real Estate Progress of Foreign-funded Enterprises in China, 2010-2014

Cases and Operational Characteristics of Self-operation Type Aged Care Real Estate in China

Cases and Operational Characteristics of Sale + Lease Type Aged Care Real Estate in China

Cases and Operational Characteristics of Sale Type Aged Care Real Estate in China

Proposed and Ongoing Aged Care Real Estate Projects in China, 2011-2014

Revenue and Net Income of Vanke, 2008-2013

Revenue of Vanke (by Product), 2008-2013

Revenue of Vanke (by Region), 2008-2013

Gross Margin of Vanke (by Business), 2008-2013

Revenue and Net Income of Vanke, 2012-2016E

Revenue and Net Income of Poly Real Estate, 2008-2013

Revenue of Poly Real Estate (by Product), 2008-2013

Gross Margin of Poly Real Estate (by Business), 2008-2013

Revenue and Net Income of Poly Real Estate, 2012-2016E

Revenue and Net Income of Beijing Capital Land, 2008-2013

Revenue Breakdown of Beijing Capital Land by Product, 2008-2013

Gross Margin of Beijing Capital Land, 2008-2013

Revenue and Net Income of Beijing Capital Land, 2012-2016E

Revenue and Net Income of Sino-Ocean Land, 2008-2013

Revenue Breakdown of Sino-Ocean Land by Product, 2008-2013

Gross Margin of Sino-Ocean Land, 2008-2013

Revenue and Net Income of Sino-Ocean Land, 2012-2016E

Revenue and Net Income of Taikang Life, 2010-2012

Revenue Breakdown of Taikang Life by Product, 2010-2012

Revenue and Net Income of New China Life Insurance, 2008-2013

Revenue Breakdown of New China Life Insurance by Product, 2008-2013

Revenue and Net Income of New China Life Insurance, 2012-2016E

Revenue and Net Income of Ping An Insurance, 2008-2013

Revenue Breakdown of Ping An Insurance by Product, 2008-2013

Revenue and Net Income of Ping An Insurance, 2012-2016E

Revenue and Net Income of Union Life Insurance, 2009-2012

Revenue Breakdown of Union Life Insurance by Product, 2009-2012

Union Life CCRC Aged Care Scheme

Categories of Membership Cards and Their Costs & Interests of Shanghai Qinheyuan

Operation Modes of Huichen Life

Bed Supply of Huichen Life

Nursing Assessment Standards and Care Costs of Tianjin Hetong Elderly Welfare Association

Sunset Glow Project

Charging Standard of Sunset Glow Love Nursing Home in Jiangyin, 2009

Rate Standard of Shanghai Sun Moon Star Nursing Home

Five Divisions of Yanda International Health City

如果这份报告不能满足您的要求,我们还可以为您定制报告,请 留言说明您的详细需求。

|