|

|

|

报告导航:研究报告—

金融与服务业—金融业

|

|

2014年中国互联网理财行业研究报告 |

|

字数:2.9万 |

页数:71 |

图表数:60 |

|

中文电子版:7000元 |

中文纸版:3500元 |

中文(电子+纸)版:7500元 |

|

英文电子版:1800美元 |

英文纸版:1900美元 |

英文(电子+纸)版:2100美元 |

|

编号:WLQ015

|

发布日期:2014-05 |

附件:下载 |

|

|

|

互联网理财是指相关公司与金融机构合作,通过互联网技术和平台为客户提供财富保值增值的服务模式。随着互联网技术的发展和网民数量的大幅度增长,2013下半年以来,中国互联网理财产品和理财平台不断出现。

中国主要电子商务企业(阿里巴巴、苏宁、京东)、互联网公司(腾讯、百度等)均已推出了互联网理财产品。例如阿里巴巴推出的余额宝、百度推出的百赚、腾讯推出的理财通等均成为中国主流的互联网理财产品。

中国现有大多数互联网理财产品本质上是货币基金,如余额宝对接的是天弘增利宝货币市场基金,百赚对接的是华夏现金增利E货币基。由于许多互联网理财产品实现了货币基金的T+0赎回,具有投资门槛低(许多1元起售),购买及赎回方便快捷,收益率较高(一般高于银行一年定期存款)等特点,因而吸引了大批用户。

在现有互联网理财产品中,规模最大的为余额宝。该产品于2013年6月13日推出,隶属于阿里巴巴公司。截至2014年3月31日,余额宝申购额总计5413亿元,在货币基金申购额中市场份额为37.13%。自成立日至2014年3月31日,余额宝为客户累计实现收益75亿元,其中2014年一季度收益额高达57亿元。自成立日至2013年末,余额宝平均年化收益率为4.9%;自成立日至2014年一季度,该产品平均年化收益率为5.2%。

从理财平台来看,各大互联网公司和第三方基金销售机构正在加紧布局这一领域,淘宝、和讯、百度、腾讯、网易、新浪、京东等公司的理财平台相继上线。中国现有互联网理财平台主要分为以下几类:

电商平台:淘宝和京东,主要为金融机构提供电子商务平台,金融机构在淘宝或京东开设店铺销售理财产品。 电商平台:淘宝和京东,主要为金融机构提供电子商务平台,金融机构在淘宝或京东开设店铺销售理财产品。

展示平台:百度财富、腾讯理财超市等,主要利用聚集的用户优势,将理财产品引入理财平台并分类列表展示,最后引导用户进入第三方理财网站购买理财产品。 展示平台:百度财富、腾讯理财超市等,主要利用聚集的用户优势,将理财产品引入理财平台并分类列表展示,最后引导用户进入第三方理财网站购买理财产品。

销售服务平台:腾讯理财汇、天天基金网等。例如腾讯利用旗下子公司财付通获得的第三方支付牌照和基金销售支付牌照,建立理财平台“理财汇”,为用户提供净值查询、基金筛选、基金诊断、股票资讯、大势行情、预约开户等一站式在线服务。 销售服务平台:腾讯理财汇、天天基金网等。例如腾讯利用旗下子公司财付通获得的第三方支付牌照和基金销售支付牌照,建立理财平台“理财汇”,为用户提供净值查询、基金筛选、基金诊断、股票资讯、大势行情、预约开户等一站式在线服务。

在互联网理财平台中,理财产品购买规模较大的有东方财富网旗下的天天基金网。2014年第一季度,天天基金网认购/申购交易多达1,955,738笔,基金销售额为385亿元,环比增长83.8%。2014年第一季度,东方财富网的基金销售业务收入已超过其他业务,成为公司的核心业务之一。

《2014年中国互联网理财行业研究报告》主要包括以下内容:

中国互联网金融概况(包括互联网用户,金融机构存款,社会融资规模,互联网金融商业模式、投资案例、市场现状、发展趋势等) 中国互联网金融概况(包括互联网用户,金融机构存款,社会融资规模,互联网金融商业模式、投资案例、市场现状、发展趋势等)

互联网理财产品市场(包括定义,分类,相关政策及机构,市场概况,竞争格局,互联网理财对银行影响等) 互联网理财产品市场(包括定义,分类,相关政策及机构,市场概况,竞争格局,互联网理财对银行影响等)

互联网理财平台市场(包括中国及国外互联网理财平台概况,综合性理财平台,基金销售平台,手机理财APP等) 互联网理财平台市场(包括中国及国外互联网理财平台概况,综合性理财平台,基金销售平台,手机理财APP等)

主要互联网理财产品分析(包括阿里、百度、腾讯、苏宁、京东、天天基金网等公司的互联网理财产品简介、盈利模式、申购额、资金投向、收益等) 主要互联网理财产品分析(包括阿里、百度、腾讯、苏宁、京东、天天基金网等公司的互联网理财产品简介、盈利模式、申购额、资金投向、收益等)

主要互联网理财平台分析(包括阿里、百度、腾讯、京东旗下的理财平台,天天基金网、数米基金网、好买基金网、基金买卖网、爱基金网等基金销售平台) 主要互联网理财平台分析(包括阿里、百度、腾讯、京东旗下的理财平台,天天基金网、数米基金网、好买基金网、基金买卖网、爱基金网等基金销售平台)

Internet financing refers to the service pattern in which relevant companies carry out cooperation with financial institutions to provide customers with wealth preservation and appreciation through internet technology and platform. With the development of internet technology and significantly-growing number of netizens, internet financial products and platforms are constantly emerging in China since the second half of 2013.

Leading Chinese e-commerce companies (Alibaba, Suning, Jingdong) and internet companies (Tencent, Baidu, etc.) have launched internet financial products, e.g. Alibaba’s Yu’ebao, Baidu’s Baizhuan, Tencent’s Li Cai Tong have all become the mainstream internet financial products in China.

In China, most of the existing internet financial products are, in essence, monetary funds, like Yu’ebao docked with TianHong Income Box Money Market Fund, and Baizhuan docked with ChinaAMC Cash Income MMF E. Many internet financial products have realized T+0 monetary fund redemption, characterized by low investment threshold (starting at RMB1 in many cases), convenient and efficient purchase and redemption, and high rate of return (generally higher than the bank’s 1-year fixed term deposit), thus attracting a large number of users.

Introduced on June 13, 2013, Alibaba’s Yu’ebao is currently the biggest internet financial product. As of March 31, 2014, its subscription amount totaled RMB541.3 billion, accounting for 37.13% of monetary fund subscription. Since its inception to March 31, 2014, Yu’ebao has realized cumulative earnings of RMB7.5 billion for its customers, as high as RMb5.7 billion in the first quarter of 2014. Since its inception to the end of 2013, Yu’ebao’s average annualized rate of return had stayed at 4.9%, which climbed to 5.2% since its inception to the end of the first quarter of 2014.

With regard to financial platform, major internet companies and third-party fund sales institutions are stepping up the field layout: Taobao, Hexun, Baidu, Tencent, Netease, Sina and Jingdong have successively launched their financial platforms, mainly divided into the following categories:

E-commerce platform: Taobao and Jingdong mainly provide e-commerce platform for financial institutions, which set up shops at Taobao or Jingdong to sell financial products.

Display platform: Baidu Caifu (caifu.baidu.com), Tencent’s Financial Supermarket (finance.qq.com/market.htm), etc. which take advantage of gathered users to introduce financial products into financial platform for list gallery by category, and finally guide users to enter third-party financial websites to buy financial products.

Sales & service platform: Tencent’s Li Cai Hui (money.tenpay.com), fund.eastmoney.com, e.g. Tencent by using third-party payment license and fund sales payment license obtained by its subsidiary – Tenpay establishes the financial platform “Li Cai Hui” to provide users with one-stop online services involving net inquiry, fund screening, fund diagnosis, stock information, market trend, making appointment for account-opening, etc..

Among internet financial platforms, fund.eastmoney.com (under eastmoney.com) boasts large-scale purchase of financial products, with the number of subscription transactions hitting 1,955,738 in the first quarter of 2014, generating fund sales of RMB38.5 billion, a quarter-on-quarter increase of 83.8%. At the same time, fund sales of eastmoney.com by virtue of outstanding revenue has become one of the company’s core businesses.

China Internet Financing Industry Report, 2014 covers the followings:

Overview of internet finance in China (including internet users, deposits of financial institutions, scale of social financing, business model, investment case, market situation, trends, etc.) Overview of internet finance in China (including internet users, deposits of financial institutions, scale of social financing, business model, investment case, market situation, trends, etc.)

Internet financial product market (involving definition, classification, policies and institutions, market overview, competition pattern, impact of internet financing on banks) Internet financial product market (involving definition, classification, policies and institutions, market overview, competition pattern, impact of internet financing on banks)

Internet financial platform market (embracing overview of Chinese and foreign internet financial platforms, comprehensive financial platforms, fund trading platforms and mobile finance APPs) Internet financial platform market (embracing overview of Chinese and foreign internet financial platforms, comprehensive financial platforms, fund trading platforms and mobile finance APPs)

Analysis of main internet financial products (including introduction, profit model, subscription amount, fund flow and earnings of internet financial products introduced by Alibaba, Baidu, Tencent, Suning, Jingdong and fund.eastmoney.com) Analysis of main internet financial products (including introduction, profit model, subscription amount, fund flow and earnings of internet financial products introduced by Alibaba, Baidu, Tencent, Suning, Jingdong and fund.eastmoney.com)

Analysis of main internet financial platforms (including financial platforms of Alibaba, Baidu, Tencent, Jingdong and fund sales platforms like fund.eastmoney.com, fund123.cn, howbuy.com, jjmmw.com, 5ifund.com. Analysis of main internet financial platforms (including financial platforms of Alibaba, Baidu, Tencent, Jingdong and fund sales platforms like fund.eastmoney.com, fund123.cn, howbuy.com, jjmmw.com, 5ifund.com.

第一章 互联网金融概况

1.1 互联网用户

1.1.1 网民

1.1.2 手机网民

1.1.3 网上支付用户

1.2 金融机构存款及社会融资

1.2.1 金融机构存款

1.2.2 社会融资

1.3 互联网金融概况

1.3.1 定义

1.3.2 商业模式

1.3.3 支付模式

1.3.4 投资案例

1.4 市场现状及发展趋势

1.4.1 市场现状

1.4.2 发展趋势

第二章 互联网理财产品市场

2.1 定义及分类

2.1.1 定义

2.1.2 分类

2.2 相关政策及机构

2.2.1 相关政策

2.2.2 基金销售机构

2.2.3 基金销售支付机构

2.3 市场概况及竞争格局

2.3.1 市场概况

2.3.2 竞争格局

2.4 互联网理财对银行影响

2.4.1 互联网理财产品与银行理财产品对比

2.4.2 互联网理财对银行理财业务影响

2.4.3 银行对互联网金融(理财)的反击

第三章 互联网理财平台市场

3.1 概况

3.1.1 中国互联网理财平台

3.1.2 国外互联网理财平台

3.2 综合性理财平台

3.3 基金销售平台

3.3.1 基金发展情况

3.3.2 基金销售模式

3.3.3 平台盈利模式

3.3.4 基金销售收入

3.4手机理财APP

3.4.1 概况

3.4.2 挖财

3.4.3 铜板街

3.5 发展趋势

第四章 主要互联网理财产品

4.1 阿里余额宝

4.1.1 简介

4.1.2 盈利模式

4.1.3 申购额

4.1.4 资金投向

4.1.5 收益

4.2 腾讯理财通

4.2.1 简介

4.2.2 申购额

4.2.3 资金投向

4.2.4 收益

4.3 百度理财产品

4.3.1 简介

4.3.2 申购额

4.3.3 资金投向

4.3.4 收益

4.4 苏宁零钱宝

4.4.1 简介

4.4.2 申购额

4.4.3 资金投向

4.4.4 收益

4.5 京东小金库和京东8.8

4.5.1 京东小金库

4.5.2 京东8.8

4.6 天天基金网旗下理财产品

4.6.1 活期宝

4.6.2 定期宝

4.6.3 财富债添利

4.6.4 2013年末理财产品

4.7 其他互联网理财产品

4.7.1 阿里娱乐宝

4.7.2 苏宁对公理财产品及定期理财产品

第五章 主要互联网理财平台

5.1 阿里旗下理财平台

5.1.1 淘宝理财

5.1.2 淘宝基金网店

5.1.3 招财宝

5.2 百度理财平台

5.2.1 百度理财

5.2.2 百度财富

5.3 腾讯理财平台

5.3.1 理财汇

5.3.2 理财超市

5.4 和讯理财客

5.5 京东金融

5.6 新浪微财富

5.7天天基金网

5.7.1 简介

5.7.2 理财产品

5.7.3 销售模式

5.7.4 盈利模式

5.7.5 经营业绩

5.8 数米基金网

5.9 好买基金网

5.10 基金买卖网

5.11 爱基金网

1. Overview of Internet Finance

1.1 Internet User

1.1.1 Netizen

1.1.2 Mobile Netizen

1.1.3 Online Payment User

1.2 Financial Institution's Deposit and Social Financing

1.2.1 Financial Institution's Deposit

1.2.2 Social Financing

1.3 Overview of Internet Finance

1.3.1 Definition

1.3.2 Business Model

1.3.3 Payment Model

1.3.4 Investment Case

1.4 Market Situation and Trends

1.4.1 Market Situation

1.4.2 Trends

2. Internet Financial Product Market

2.1 Definition and Classification

2.1.1 Definition

2.1.2 Classification

2.2 Policies and Institutions

2.2.1 Policies

2.2.2 Fund Sales Institutions

2.2.3 Fund Sales & Payment Institutions

2.3 Market Overview and Competition Pattern

2.3.1 Market Overview

2.3.2 Competition Pattern

2.4 Impact of Internet Financing on Banks

2.4.1 Comparison between Internet Financial Products and Bank Financial Products

2.4.2 Impact of Internet Financing on Bank Financial Services

2.4.3 Bank’s Counterattack against Internet Finance (Financing)

3. Internet Financial Platform Market

3.1 Overview

3.1.1 China Internet Financial Platform

3.1.2 Foreign Internet Financial Platform

3.2 Comprehensive Financial Platform

3.3 Fund Trading Platforms

3.3.1 Fund Development

3.3.2 Fund Sales Model

3.3.3 Platform Profit Model

3.3.4 Fund Sales

3.4 Mobile Finance APP

3.4.1 Overview

3.4.2 Wa Cai

3.4.3 Tong Ban Jie

3.5 Trends

4. Main Internet Financial Product

4.1 Alibaba’s Yu’ebao

4.1.1 Profile

4.1.2 Profit Model

4.1.3 Subscription Amount

4.1.4 Fund Flow

4.1.5 Earnings

4.2 Tencent’s Li Cai Tong

4.2.1 Profile

4.2.2 Subscription Amount

4.2.3 Fund Flow

4.2.4 Earnings

4.3 Baidu's Financial Products

4.3.1 Profile

4.3.2 Subscription Amount

4.3.3 Fund Flow

4.3.4 Earnings

4.4 Suning’s Ling Qian Bao

4.4.1 Profile

4.4.2 Subscription Amount

4.4.3 Fund Flow

4.4.4 Earnings

4.5 JD Xiaojinku and JD 8.8

4.5.1 JD Xiaojinku

4.5.2 JD 8.8

4.6 Financial Products of fund.eastmoney.com

4.6.1 Huo Qi Bao

4.6.2 Ding Qi Bao

4.6.3 Zhai Tian Li

4.6.4 Year-End 2013 Financial Products

4.7 Others

4.7.1 Alibaba’s Yu Le Bao

4.7.2 Suning’s Corporate Financial Products and Regular Financial Products

5. Main Internet Financial Platforms

5.1 Alibaba’s Financial Platforms

5.1.1 Taobao Licai (licai.taobao.com)

5.1.2 Taobao Fund Online Store

5.1.3 Zhaocaibao (zhaocaibao.alipay.com)

5.2 Baidu’s Financial Platforms

5.2.1 Baidu Licai (8.baidu.com)

5.2.2 Baidu Caifu (caifu.baidu.com)

5.3 Tencent’s Financial Platforms

5.3.1 Li Cai Hui (money.tenpay.com)

5.3.2 Financial Supermarket (finance.qq.com/market.htm)

5.4 Hexun’s Licaike (licaike.hexun.com)

5.5 JD Finance (jr.jd.com)

5.6 Sina’s Weicaifu (weicaifu.com)

5.7 fund.eastmoney.com

5.7.1 Profile

5.7.2 Financial Products

5.7.3 Sales Model

5.7.4 Profit Model

5.7.5 Operating Performance

5.8 fund123.cn

5.9 howbuy.com

5.10 jjmmw.com

5.11 5ifund.com

图:2007-2013年中国网民数量及互联网渗透率

图:2007-2013年中国手机网民数量及其在网民中占比

图:2007-2013年中国网上支付用户数量及其在网民中占比

图:2007-2013年中国金融机构存款余额及同比增长

表:2011-2013年中国金融机构中单位存款及个人存款余额

表:2007-2013年中国社会融资规模及融资构成

表:中国互联网金融商业模式、盈利来源及代表企业

图:中国互联网企业进入金融领域发展模式

表:2011-2013年中国互联网金融投资案例数及投资总额(分细分行业)

表:中国互联网理财产品分类

表:截至2014年一季度末中国获得基金销售牌照的机构

表:截至2014年一季度末中国获得基金销售牌照的独立基金销售机构

表:截至2014年一季度末中国获得基金销售支付牌照的公司

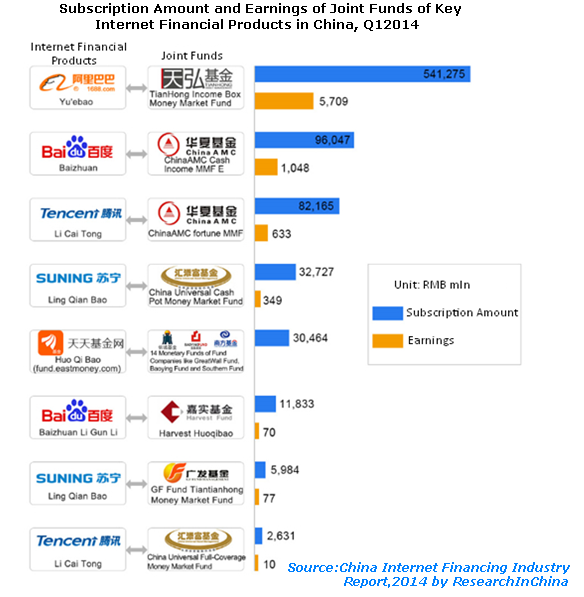

表:截至2014年一季度末中国主要互联网理财产品(对接基金)申购额及收益对比

表:2014年中国主要互联网理财产品收益率对比

表:中国互联网理财产品和银行理财产品对比

表:国外主要互联网理财平台经营模式

表:中国主要综合性互联网理财平台及其支付工具

图:2007-2013年中国公募基金发行数量及构成

图:2012-2013年中国开放式基金发行量构成(分基金类型)

图:2007-2013年中国货币基金数量及资产净值

表:2009-2013年中国货币基金与其他基金收益对比

图:中国基金互联网销售渠道

表:中国基金销售互联网渠道与其他销售渠道模式对比

图:2007-2012年中国基金销售渠道占比

图:2009-2012年中国基金销售机构基金销售收入及同比增长

图:2012年中国基金销售收入构成(分销售机构)

表:2012年中国独立基金销售机构基金销售收入

表:挖财产品介绍、融资情况及盈利模式

表:铜板街产品介绍、融资情况及盈利模式

图:2013-2014年余额宝用户数及申购额

图:2013-2014年余额宝用户平均存入金额

表:2013-2014年余额宝(对接基金)资金投向构成

图:2013-2014年余额宝(对接基金)收益率

图:2013-2014年余额宝对接的基金收益及环比增长(分季度)

表:2013年余额宝对接基金管理费、托管费及销售服务费收入

表:截至2014年第一季度末理财通对接基金申购额

表:截至2014年第一季度末理财通对接基金资金投向构成

图:2014年理财通(对接基金)收益率

表:2014年第一季度理财通对接基金收益

表:2013-2014年百度推出的理财产品及特点

图:2013-2014年百赚(对接基金)申购额及环比增长

表:2013-2014年百赚(对接基金)投资投向构成

图:2013-2014年百赚(对接基金)分季度收益及环比增长

图:2013-2014年百赚(对接基金)收益率

图:2014年百度百赚利滚利版(对接基金)收益率

表:截至2014年第一季度末苏宁零钱宝对接基金资金投向结构

图:2014年零钱宝(对接基金)收益率

图:2014年小金库(对接基金)收益率

表:2014年活期宝对接基金及收益率

表:2013-2014年活期宝(对接基金)申购笔数及申购金额

表:定期宝对接基金及收益率

表:招财宝与余额宝对比

图:天天基金网盈利模式

图:2008-2013年东方财富网营业收入及同比增长

图:2008-2013年东方财富网净利润及同比增长

图:2013-2014年天天基金网分季度基金交易笔数及环比增长

图:2013-2014年天天基金网分季度基金销售额及环比增长

图:数米基金网盈利模式

图:好买基金网盈利模式

Internet Population and Penetration in China, 2007-2013

Number of Mobile Netizens and % of Netizens in China, 2007-2013

Number of Online Payment Users and % of Netizens in China, 2007-2013

Deposit Balance of China's Financial Institutions and YoY Growth, 2007-2013

Corporate and Individual Deposit Balance of Financial Institutions in China, 2011-2013

China’s Social Financing Scale and Financing Structure, 2007-2013

Business Model, Profit Source and Representative Firms of China Internet Finance

Development Model of Chinese Internet Companies in Financial Sector

Investment Cases and Total Investment in China Internet Finance by Segment, 2011-2013

Classification of Internet Financial Products in China

Chinese Institutions with Fund Sales License by the end of Q1 2014

Independent Chinese Fund Sales Institutions with Fund Sales License by the end of Q1 2014

Chinese Companies with Fund Sales Payment License by the end of Q1 2014

Comparison by Subscription Amount and Earnings of China’s Major Internet Financial Products (Joint Funds) by the end of Q1 2014

Comparison by Rate of Return of China’s Major Internet Financial Products, 2014

Comparison between Internet Financial Products and Bank Financial Products in China

Business Model of Major Foreign Internet Financial Platforms

Payment Instruments of Major Comprehensive Financial Platforms in China

Number and Composition of Publicly Offered Funds Issued in China, 2007-2013

Number of Open-ended Funds Issued in China (by Fund Type), 2012-2013

Quantity of Money Fund and Net Asset Value in China, 2007-2013

Earnings Comparison between Monetary Fund and Other Funds in China, 2009-2013

Online Fund Distribution Channels in China

Model Comparison between Online Fund Distribution Channel and Other Distribution Channels in China

Fund Distribution Channel Structure in China, 2007-2012

Fund Sales and YoY Growth of Fund Sales Institutions in China, 2009-2012

China’s Fund Sales Structure by Institution, 2012

Fund Sales of Independent Fund Sales Institutions in China, 2012

Introduction, Financing and Profit Model of Wa Cai

Introduction, Financing and Profit Model of Tong Ban Jie

Subscriber Number and Subscription Amount of Yu’ebao, 2013-2014

Average Deposit Amount of Yu’ebao Users, 2013-2014

Fund Flow Structure of Yu’ebao (Joint Funds), 2013-2014

Rate of Return of Yu’ebao (Joint Funds), 2013-2014

Quarterly Earnings and QoQ Growth of Yu’ebao Joint Funds, 2013-2014

Management Fee, Trustee Fee and Sales Service Fee of Yu’ebao Joint Funds, 2013

Subscription Amount of Joint Funds of Li Cai Tong by the end of Q1 2014

Fund Flow Structure of Joint Funds of Li Cai Tong by the end of Q1 2014

Rate of Return of Li Cai Tong (Joint Funds), 2014

Earnings of Joint Funds of Li Cai Tong, Q1 2014

Characteristics of Financial Products Launched by Baidu, 2013-2014

Subscription Amount and QoQ Growth of Baizhuan (Joint Founds), 2013-2014

Investment Flow Structure of Baizhuan (Joint Funds), 2013-2014

Quarterly Earnings and QoQ Growth of Baizhuan (Joint Funds), 2013-2014

Rate of Return of Baizhuan (Joint Funds), 2013-2014

Rate of Return of Baizhuan Li Gun Li (Joint Funds), 2014

Fund Flow Structure of Joint Funds of Suning’s Ling Qian Bao by the end of Q1 2014

Rate of Return of Ling Qian Bao (Joint Funds), 2014

Rate of Return of Xiaojinku (Joint Funds), 2014

Rate of Return of Joint Funds of Huo Qi Bao, 2014

Subscription Number and Amount of Huo Qi Bao (Joint Funds), 2013-2014

Rate of Return of Joint Funds of Ding Qi Bao

Comparison between Zhaocaibao and Yu’ebao

Profit Model of fund.eastmoney.com

Revenue and YoY Growth of eastmoney.com, 2008-2013

Net Income and YoY Growth Rate of eastmoney.com, 2008-2013

Number of Quarterly Fund Transactions and QoQ Growth of fund.eastmoney.com, 2013-2014

Quarterly Fund Sales and QoQ Growth of fund.eastmoney.com, 2013-2014

Profit Model of fund123.cn

Profit Model of howbuy.com

如果这份报告不能满足您的要求,我们还可以为您定制报告,请 留言说明您的详细需求。

|