|

|

|

报告导航:研究报告—

制造业—化工

|

|

2014-2016年中国农药行业研究报告 |

|

字数:6.3万 |

页数:159 |

图表数:193 |

|

中文电子版:8500元 |

中文纸版:4250元 |

中文(电子+纸)版:9000元 |

|

英文电子版:2500美元 |

英文纸版:2700美元 |

英文(电子+纸)版:2800美元 |

|

编号:ALZ-004

|

发布日期:2014-05 |

附件:下载 |

|

|

|

农药作为当前世界农业发展最重要的增产方法之一,近年市场增长相对稳定。2006-2012年中国化学农药原药产量年均复合增长率达18.3%。2013年,受农药行业环保趋严逐步淘汰落后产能影响,当期中国农药原料药产量同比下滑10%左右。但产品价格上涨抵消了产量下降对行业效益影响,2013年中国农药行业营业收入达2813亿元,同比增长19.3%;同期利润总额229.3亿元,较上年增长30.9%。

中国不仅是农药生产与消费大国,也是农药出口大国。2013年,中国农药出口量109.5万吨,同比增长22.1%。并且中国农药出口结构正发生重大转变。2013年,中国农药制剂出口数量约占出口总量60%左右,成为农药出口主要类型;2013年,中国除草剂、杀菌剂、杀虫剂出口量占比分别达68%、23%、8%。

全球农药公司可分为研发型和过期专利型两类,前者主要包括先正达、陶氏、巴斯夫、拜耳、孟山都等大型跨国企业;而中国农药生产商整体规模小、技术差,因此中国农药企业主要在做原料药和仿制药。

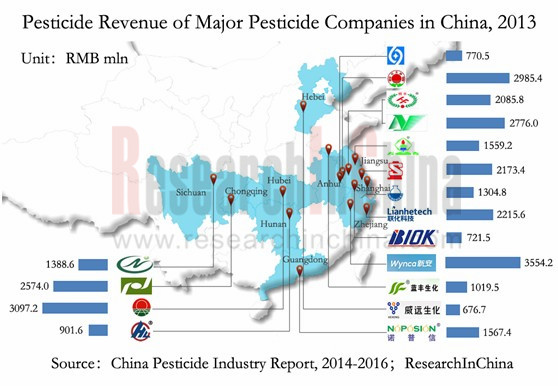

由于原料药和仿制药行业进入门槛较低,中国农药生产企业很多,约2000多家,企业集中度极低。中国农药行业主要企业有新安股份、沙隆达、红太阳等17家企业,2013年这17家企业农药业务营业收入共计313.7亿元,市场占有率之和仅为11.1%。

近年,随着农药价格的走强,中国农药行业毛利率逐渐增长,已从2010年的14.7%提高到2013年的17.3%。新安股份是中国最大的草甘膦生产企业;2013年其农药业务营业收入为35.5亿元,农药业务毛利率为27.8%,同比大涨15.8个百分点。诺普信是中国最大的农药制剂企业之一;2013年其农药业务营业收入为15.7亿元,农药业务毛利率为40.9%,微跌0.7个百分点,不过仍保持在较高水平。

《2014-2016年中国农药行业研究报告》主要包括以下几个方面:

中国农药市场供给、产能状况、销售情况、竞争格局、进出口、发展预测等; 中国农药市场供给、产能状况、销售情况、竞争格局、进出口、发展预测等;

中国农药行业政策、行业标准、上下游行业等; 中国农药行业政策、行业标准、上下游行业等;

全球及中国17家农药生产企业的运营状况、农药业务分析及发展情况等。 全球及中国17家农药生产企业的运营状况、农药业务分析及发展情况等。

As one of the most important methods to increase production in current global agricultural development, pesticide market presents stable growth in recent years. In 2006-2012, chemical pesticide API (converting into active ingredient) output of China attained CAGR of 18.3%, but declined by 10% in 2013 greatly influenced by backward capacity elimination under stringent environmental protection requirement of pesticide industry. However, the price increase offset the unfavorable impact brought by output dropping, operating revenue of Chinese pesticide industry surged by 19.3% year-on-year to RMB281.3 billion, and total profit reached RMB22.93 billion, presenting a 30.9% YoY rise in 2013.

China is not only the big pesticide producer and consumer, but also the large exporter. In 2013, the pesticide export volume soared up by 22.1% yr-on-yr to 1,095kt, and the export structure experienced significant change. Also in the same year, pesticide preparation exported shared about 60% of total export, being the major variety of pesticide export. In addition, the export volume of herbicide, bactericide and insecticide occupied 68%, 23% and 8% of the total, respectively.

Global pesticide players could be divided into two types, namely, R&D oriented and overdue patent oriented. The former mainly covers Syngenta, DOW, Bayer and Monsanto. Chinese pesticide companies, featured with small scale and weak technology, are mostly engaged in APIs and generic drugs.

Due to relatively low entry barrier of APIs and generic drugs, there are large quantities of pesticide manufacturers in China, approximating 2000 ones, indicating extremely low concentration. The major players cover 17 ones including Zhejiang Xinan Chemical Industrial Group, NANJING RED SUN and HUBEI SANONDA, revenue of which attained RMB31.37 billion, and market share being merely 11.1% in 2013.

Along with the soaring up of pesticide price in recent years, the gross margin of pesticide industry in China rose gradually, already up from 14.7% of 2010 to 17.3% of 2013. Zhejiang Xinan Chemical Industrial Group, as the largest glyphosate manufacturer in China, realized pesticide revenue of RMB3.55 billion, and gross margin 27.8% (surging by 15.8 percentage points yr-on-yr) in 2013. Noposion Agrochemicals, one of the the largest pesticide preparation manufacturers in China, got revenue of RMB40.9% from pesticide business, but its gross margin declined slightly by 0.7 percentage points to 40.9%, still being the high level.

The report dwells on following aspects:

Market supply, capacity, sales, competition pattern, export & import, development forecast, etc in China pesticide industry; Market supply, capacity, sales, competition pattern, export & import, development forecast, etc in China pesticide industry;

Industry policy, standard and upstream & downstream industries ; Industry policy, standard and upstream & downstream industries ;

17 Global and Chinese pesticide players, including their operation, pesticide business analysis and development. 17 Global and Chinese pesticide players, including their operation, pesticide business analysis and development.

第一章 农药行业概述

1.1 定义

1.2 分类

1.3 产业链

第二章 中国农药行业发展现状

2.1 生产情况

2.1.1 农药原药产量

2.1.2 农药制剂产量

2.1.3 分省市产量

2.2 销售情况

2.3 进出口情况

2.3.1 进口情况

2.3.2 出口情况

2.3.3 进出口价格

2.4 经营情况

2.4.1 企业数量

2.4.2 营业收入

2.4.3 利润水平

2.5 竞争格局

2.5.1 国际市场

2.5.2 中国市场

2.6 进入壁垒

2.6.1 严格的行政许可

2.6.2 较高的资本壁垒

2.6.3 环保方面的障碍

2.6.4 先进技术引进的障碍

2.6.5 市场进入障碍

第三章 中国农药行业发展环境

3.1 政策环境

3.1.1 监管政策

3.1.2 行业政策

3.1.3 行业标准

3.2 上下游行业

3.2.1 上游行业

3.2.2 下游行业

第四章 中国农药行业发展预测分析

4.1 农药原药产能向中国转移

4.1.1 中国企业主要做“仿制药”

4.1.2 低成本优势承接产业转移

4.2 需求旺盛促使农药景气度较高

4.3 中国农药行业市场供给分析

4.3.1 行业整合加剧 供给能力增强

4.3.2 原药和制剂结构调整仍将继续

4.4 中国农药行业政策变化趋势

4.4.1 未来政策面将继续保持紧缩

4.4.2 环保管理逐步走向正规化与国际化

第五章 中国主要农药企业

5.1 红太阳

5.1.1 企业简介

5.1.2 经营情况

5.1.3 营收构成

5.1.4 毛利率

5.1.5 客户

5.1.6 农药业务

5.1.7 研发和投资

5.1.8 预测与展望

5.2 江山股份

5.2.1 企业简介

5.2.2 经营情况

5.2.3 营收构成

5.2.4 毛利率

5.2.5 客户

5.2.6 农药业务

5.2.7 研发和投资

5.2.8 预测与展望

5.3 利尔化学

5.3.1 企业简介

5.3.2 经营情况

5.3.3 营收构成

5.3.4 毛利率

5.3.5 客户

5.3.6 农药业务

5.3.7 研发和投资

5.3.8 预测与展望

5.4 扬农化工

5.4.1 企业简介

5.4.2 经营情况

5.4.3 营收构成

5.4.4 毛利率

5.4.5 客户

5.4.6 农药业务

5.4.7 研发和投资

5.4.8 预测与展望

5.5 长青股份

5.5.1 企业简介

5.5.2 经营情况

5.5.3 营收构成

5.5.4 毛利率

5.5.5 客户

5.5.6 农药业务

5.5.7 研发和投资

5.5.8 预测与展望

5.6 新安股份

5.6.1 企业简介

5.6.2 经营情况

5.6.3 营收构成

5.6.4 毛利率

5.6.5 客户

5.6.6 农药业务

5.6.7 研发和投资

5.6.8 预测与展望

5.7 升华拜克

5.7.1 企业简介

5.7.2 经营情况

5.7.3 营收构成

5.7.4 毛利率

5.7.5 客户

5.7.6 农药业务

5.7.7 研发和投资

5.7.8 预测与展望

5.8 沙隆达

5.8.1 企业简介

5.8.2 经营情况

5.8.3 营收构成

5.8.4 毛利率

5.8.5 客户

5.8.6 农药业务

5.8.7 研发和投资

5.8.8 预测与展望

5.9 辉丰股份

5.9.1 企业简介

5.9.2 经营情况

5.9.3 营收构成

5.9.4 毛利率

5.9.5 客户

5.9.6 农药业务

5.9.7 研发和投资

5.9.8 预测与展望

5.10 湖南海利

5.10.1 企业简介

5.10.2 经营情况

5.10.3 营收构成

5.10.4 毛利率

5.10.5 客户

5.10.6 农药业务

5.10.7 研发和投资

5.10.8 预测与展望

5.11 华邦颖泰

5.11.1 企业简介

5.11.2 经营情况

5.11.3 农药业务

5.11.4 预测与展望

5.12 联化科技

5.12.1 企业简介

5.12.2 经营情况

5.12.3 营收构成

5.12.4 毛利率

5.12.5 客户

5.12.6 农药业务

5.12.7 研发和投资

5.12.8 预测与展望

5.13 蓝丰生化

5.13.1 企业简介

5.13.2 经营情况

5.13.3 营收构成

5.13.4 毛利率

5.13.5 客户

5.13.6 农药业务

5.13.7 研发和投资

5.13.8 预测与展望

5.14 诺普信

5.14.1 企业简介

5.14.2 经营情况

5.14.3 营收构成

5.14.4 毛利率

5.14.5 客户

5.14.6 农药业务

5.14.7 研发和投资

5.14.8 预测与展望

5.15 威远生化

5.15.1 企业简介

5.15.2 经营情况

5.15.3 营收构成

5.15.4 毛利率

5.15.5 客户

5.15.6 农药业务

5.15.7 研发和投资

5.15.8 预测与展望

5.16 国光农化

5.16.1 企业简介

5.16.2 经营情况

5.16.3 营收构成

5.16.4 毛利率

5.16.5 客户

5.16.6 农药业务

5.16.7 研发和投资

5.16.8 预测与展望

5.17 利民化工

5.17.1 企业简介

5.17.2 经营情况

5.17.3 营收构成

5.17.4 毛利率

5.17.5 客户

5.17.6 农药业务

5.17.7 研发和投资

5.17.8 预测与展望

第六章 总结与预测

6.1 技术

6.2 进出口

6.3 产量

6.4企业

1. Overview of Pesticide Industry

1.1 Definition

1.2 Classification

1.3 Industry Chain

2. Status Quo of China Pesticide Industry

2.1 Production

2.1.1 Pesticide API Output

2.1.2 Pesticide Preparation Output

2.1.3 Output by Province/City

2.2 Sales

2.3 Import & Export

2.3.1 Import

2.3.2 Export

2.3.3 Import/Export Prices

2.4 Operation

2.4.1 Number of Industrial Players

2.4.2 Revenue

2.4.3 Profit

2.5 Competition Pattern

2.5.1 International Market

2.5.2 Chinese Market

2.6 Entry Barriers

2.6.1 Strict Administrative Licensing

2.6.2 Higher Capital Barrier

2.6.3 Environmental Protection-related Barriers

2.6.4 Obstacles in Introducing Advanced Technologies

2.6.5 Market Entry Barriers

3. Development Environment of China Pesticide Industry

3.1 Policy Environment

3.1.1 Regulatory Policy

3.1.2 Industrial Policy

3.1.3 Industrial Standard

3.2 Upstream/Downstream Sectors

3.2.1 Upstream

3.2.2 Downstream

4. Development Outlook of China Pesticide Industry

4.1 Pesticide API Capacity Transferring to China

4.1.1 Chinese Players Specializing in “Generic Drugs”

4.1.2 Low-cost Edge Backing Industry Transferring

4.2 Robust Demand Fueling Boom of Pesticide Industry

4.3 Supply in China Pesticide Market

4.3.1 Accelerating Industrial Integration, Improving Supply Capabilities

4.3.2 Structural Adjustment in API and Preparations Will Continue

4.4 Policy Tendency in China Pesticide Industry

4.4.1 Further Tight Policies are Expected

4.4.2 Environmental Protection Management will Gradually Become Normalized and Internationalized

5. Major Chinese Pesticide Players

5.1 NANJING RED SUN

5.1.1 Profile

5.1.2 Operation

5.1.3 Revenue Structure

5.1.4 Gross Margin

5.1.5 Customers

5.1.6 Pesticide Business

5.1.7 R&D and Investment

5.1.8 Estimates and Outlook

5.2 Nantong Jiangshan Agrochemical & Chemicals

5.2.1 Profile

5.2.2 Operation

5.2.3 Revenue Structure

5.2.4 Gross Margin

5.2.5 Customers

5.2.6 Pesticide Business

5.2.7 R&D and Investment

5.2.8 Estimates and Outlook

5.3 Lier Chemical

5.3.1 Profile

5.3.2 Operation

5.3.3 Revenue Structure

5.3.4 Gross Margin

5.3.5 Customers

5.3.6 Pesticide Business

5.3.7 R&D and Investment

5.3.8 Estimates and Outlook

5.4 Jiangsu Yangnong Chemical

5.4.1 Profile

5.4.2 Operation

5.4.3 Revenue Structure

5.4.4 Gross Margin

5.4.5 Customers

5.4.6 Pesticide Business

5.4.7 R&D and Investment

5.4.8 Estimates and Outlook

5.5 Jiangsu Changqing Agrichemical

5.5.1 Profile

5.5.2 Operation

5.5.3 Revenue Structure

5.5.4 Gross Margin

5.5.5 Customers

5.5.6 Pesticide Business

5.5.7 R&D and Investment

5.5.8 Estimates and Outlook

5.6 Zhejiang Xinan Chemical Indusyrial Group

5.6.1 Profile

5.6.2 Operation

5.6.3 Revenue Structure

5.6.4 Gross Margin

5.6.5 Customers

5.6.6 Pesticide Business

5.6.7 R&D and Investment

5.6.8 Estimates and Outlook

5.7 Zhejiang Shenghua Biok Biology

5.7.1 Profile

5.7.2 Operation

5.7.3 Revenue Structure

5.7.4 Gross Margin

5.7.5 Customers

5.7.6 Pesticide Business

5.7.7 R&D and Investment

5.7.8 Estimates and Outlook

5.8 HUBEI SANONDA

5.8.1 Profile

5.8.2 Operation

5.8.3 Revenue Structure

5.8.4 Gross Margin

5.8.5 Customers

5.8.6 Pesticide Business

5.8.7 R&D and Investment

5.8.8 Estimates and Outlook

5.9 Jiangsu Huifeng Agrochemical

5.9.1 Profile

5.9.2 Operation

5.9.3 Revenue Structure

5.9.4 Gross Margin

5.9.5 Customers

5.9.6 Pesticide Business

5.9.7 R&D and Investment

5.9.8 Estimates and Outlook

5.10 Hunan Haili Chemical

5.10.1 Profile

5.10.2 Operation

5.10.3 Revenue Structure

5.10.4 Gross Margin

5.10.5 Customers

5.10.6 Pesticide Business

5.10.7 R&D and Investment

5.10.8 Estimates and Outlook

5.11 Huapont-Nutrichem

5.11.1 Profile

5.11.2 Operation

5.11.3 Pesticide Business

5.11.4 Estimates and Outlook

5.12 Lianhe Chemical Technology

5.12.1 Profile

5.12.2 Operation

5.12.3 Revenue Structure

5.12.4 Gross Margin

5.12.5 Customers

5.12.6 Pesticide Business

5.12.7 R&D and Investment

5.12.8 Estimates and Outlook

5.13 Lanfeng Biochemical

5.13.1 Profile

5.13.2 Operation

5.13.3 Revenue Structure

5.13.4 Gross Margin

5.13.5 Customers

5.13.6 Pesticide Business

5.13.7 R&D and Investment

5.13.8 Estimates and Outlook

5.14 Noposion Agrochemicals

5.14.1 Profile

5.14.2 Operation

5.14.3 Revenue Structure

5.14.4 Gross Margin

5.14.5 Customers

5.14.6 Pesticide Business

5.14.7 R&D and Investment

5.14.8 Estimates and Outlook

5.15 Hebei Veyong Bio-Chemical

5.15.1 Profile

5.15.2 Operation

5.15.3 Revenue Structure

5.15.4 Gross Margin

5.15.5 Customers

5.15.6 Pesticide Business

5.15.7 R&D and Investment

5.15.8 Estimates and Outlook

5.16 Sichuan Guoguang Agrochemical

5.16.1 Profile

5.16.2 Operation

5.16.3 Revenue Structure

5.16.4 Gross Margin

5.16.5 Customers

5.16.6 Pesticide Business

5.16.7 R&D and Investment

5.16.8 Estimates and Outlook

5.17 Limin Chemical

5.17.1 Profile

5.17.2 Operation

5.17.3 Revenue Structure

5.17.4 Gross Margin

5.17.5 Customers

5.17.6 Pesticide Business

5.17.7 R&D and Investment

5.17.8 Estimates and Outlook

6. Summary and Forecast

6.1 Technology

6.2 Import & Export

6.3 Output

6.4 Enterprises

表:农药分类和主要品种

图:农药产业链

图:2006-2014年中国化学农药原药(折有效成分100%)产量

图:2006-2014年中国农药制剂主要产品产量

图:2013年中国化学农药原药(折有效成分100%)产量结构(按省市)

图:2013年中国杀虫剂产量结构(按省市)

图:2013年中国除草剂产量结构(按省市)

图:2013年中国杀菌剂产量结构(按省市)

图:2005-2013年中国化学农药原药(折有效成分100%)产销率

图:2008-2013年中国农药进口量及增长率

图:2008-2013年中国农药进口金额及增长率

图:2008-2013年中国农药出口量及增长率

图:2008-2013年中国农药出口金额及增长率

图:2008-2013年中国农药进出口平均价格

图:2006-2013年中国农药行业企业数量

图:2006-2013年中国农药行业亏损企业占比

图:2006-2013年中国农药行业主营业务收入

图:2006-2013年中国农药行业利润总额

图:2006-2013年中国农药行业毛利率

图:2008-2013年中国农药行业主要企业农药业务毛利率

表:2011-2013年全球吡啶碱产能及分布

表:2013年11月起对各印度、日本公司征收的反倾销税税率

图:2012-2013年中国农药行业主要企业农药业务营业收入

图:2013年中国农药行业主要企业市场份额

表:中国农药行业监管政策及主要内容

表:2005-2014年中国农药行业主要政策

表:2013-2017年中国到期的农药专利产品

图:2013年中国农药加工制造成本欧美国家比例

图:2013年中国人力成本指数与欧美国家对比

图:2008-2016E年中国化学农药原药产量

表:2008-2013年中国农药行业重要兼并重组事件

表:新版《农药管理条例》(征求意见稿)与旧版比较

表:农药行业“十二五”规划

表:全球农药行业相关的国际条约

表:中国农药相关环保政策

图:2008-2014年红太阳营业收入和净利润

表:2008-2013年红太阳(分产品)营业收入

表:2008-2013年红太阳(分地区)营业收入

表:2008-2013年红太阳毛利率(分产品)

图:2008-2013年红太阳前五名客户贡献收入及占比

表:2013年红太阳前五名客户收入贡献及占比

表:2013年红太阳主要子公司、参股公司营业收入及净利润

表:2013年红太阳主要产品产能及基地分布

表:2012-2016E年红太阳营业收入和净利润

图:2008-2014年江山股份营业收入及净利润

表:2008-2013年江山股份(分产品)营业收入

图:2008-2013年江山股份(分地区)营业收入

图:2008-2013年江山股份(分地区)营业收入占比

表:2008-2013年江山股份毛利率(分产品)

图:2008-2013年江山股份前五名客户销售金额及占比

表:2013年江山股份前五名客户贡献收入及收入占比

表:截止2013年底江山股份非募集资金项目及进展

表:2011-2013年江山股份研发支出及占营业收入比例

表:2012-2016E年江山股份营业收入和净利润

图:2008-2014年利尔化学营业收入及净利润

图:2009-2013年利尔化学(分产品)营业收入

图:2008-2013年利尔化学(分地区)营业收入

图:2008-2013年利尔化学(分地区)营业收入占比

表:2008-2013年利尔化学毛利率(分产品)

图:2008-2013年利尔化学前五名客户销售金额及占比

表:2013年利尔化学前五名客户贡献收入及收入占比

图:2008-2013年利尔化学研发支出及占营业收入比例

表:2012-2016E年利尔化学营业收入和净利润

图:2008-2014年扬农化工营业收入及净利润

图:2008-2013年扬农化工(分产品)营业收入

表:2008-2013年扬农化工(分地区)营业收入

图:2008-2013年扬农化工(分地区)营业收入占比

表:2008-2013年扬农化工毛利率(分产品)

图:2008-2013年扬农化工前五名客户销售金额及占比

表:2013年杨农化工前五名客户贡献收入及收入占比

表:2013年扬农化工主要产品产能

表:2011-2013年扬农化工研发支出及占营业收入比例

表:2012-2016E年扬农化工营业收入和净利润

图:2008-2014年长青股份营业收入及净利润

表:2008-2013年长青股份(分产品)营业收入

表:2008-2013年长青股份(分地区)营业收入

表:2008-2013年长青股份毛利率(分产品)

图:2010-2013年长青股份前五名客户销售金额及占比

表:2013年长青股份前五名客户贡献收入及收入占比

表:2013年长青股份主要产品及产能

图:2008-2013年长青股份研发支出及占营业收入比例

表:2012-2016E年长青股份营业收入和净利润

表:截止2013年底新安股份投资项目进展

图:2008-2014年新安股份营业收入及净利润

图:2008-2013年新安股份(分产品)营业收入

图:2008-2013年新安股份(分地区)营业收入

表:2008-2013年新安股份毛利率(分产品)

图:2008-2013年新安股份前五名客户销售金额及占比

表:2013年新安股份前五名客户贡献收入及收入占比

图:2008-2013年新安股份农药产品营业收入及占比

表:2008-2013年新安股份农药产品毛利率

表:2011-2013年新安股份研发支出及占营业收入比例

表:2012-2016E年新安股份营业收入和净利润

图:2008-2014年升华拜克营业收入及净利润

表:2008-2013年升华拜克(分产品)营业收入

图:2008-2013年升华拜克(分地区)营业收入

图:2008-2013年升华拜克(分地区)营业收入占比

表:2008-2013年升华拜克毛利率(分产品)

图:2008-2013年升华拜克前五名客户销售金额及占比

表:2013年升华拜克前五名客户名称、贡献收入及收入占比

表:2011-2013年升华拜克研发支出及占营业收入比例

表:2012-2016E年升华拜克营业收入和净利润

表:2013年沙隆达主要产品体系

表:2013年沙隆达主要产品产能

图:2008-2014年沙隆达营业收入及净利润

表:2008-2013年沙隆达(分产品)营业收入

表:2008-2013年沙隆达(分地区)营业收入

表:2008-2013年沙隆达毛利率(分产品)

图:2008-2013年沙隆达前五名客户销售金额及占比

表:2013年沙隆达前五名贡献收入及收入占比

表:2011-2013年沙隆达研发支出及占营业收入比例

表:2012-2016E年沙隆达营业收入和净利润

图:2008-2014年辉丰股份营业收入及净利润

表:2008-2013年辉丰股份(分产品)营业收入

图:2008-2013年辉丰股份(分地区)营业收入

图:2008-2013年辉丰股份(分地区)营业收入占比

表:2008-2013年辉丰股份毛利率(分产品)

图:2010-2013年辉丰股份前五名客户销售金额及占比

表:2013年辉丰股份前五名贡献收入及收入占比

表:2013年辉丰股份主要产品及产能

表:2013年全球咪鲜胺主要生产区域及企业

表:氟环唑原药中国企业登记情况

图:2008-2013年辉丰股份研发支出及占营业收入比例

表:2012-2016E年辉丰股份营业收入和净利润

图:2008-2014年湖南海利营业收入及净利润

表:2008-2013年湖南海利(分产品)营业收入

表:2008-2013年湖南海利(分地区)营业收入

表:2008-2013年湖南海利毛利率(分产品)

图:2008-2013年湖南海利前五名客户销售金额及占比

表:2013年湖南海利前五名贡献收入及收入占比

表:截止2013年底湖南海利非募集资金项目进度

表:2011-2013年湖南海利研发支出及占营业收入比例

表:2012-2016E年湖南海利营业收入和净利润

图:2008-2014年华邦颖泰营业收入及净利润

表:2013年华邦颖泰农药各业务模块

表:2013年华邦颖泰农药业务生产子公司营业收入

表:截止2013年底华邦颖泰农药业务在建工程项目

表:2013年华邦颖泰公司现有及储备农药原药产品

表:2012-2016E年华邦颖泰营业收入和净利润

图:2008-2014年联化科技营业收入及净利润

表:2008-2013年联化科技(分产品)营业收入

表:2008-2013年联化科技(分地区)营业收入

表:2008-2013年联化科技毛利率(分产品)

图:2008-2013年联化科技前五名客户销售金额及占比

表:2013年联化科技前五名贡献收入及收入占比

图:2008-2013年联化科技研发支出及占营业收入比例

表:2012-2016E年联化科技营业收入和净利润

图:2008-2014年蓝丰生化营业收入及净利润

表:2008-2013年蓝丰生化(分产品)营业收入

图:2008-2013年蓝丰生化(分地区)营业收入

图:2008-2013年蓝丰生化(分地区)营业收入占比

表:2008-2013年蓝丰生化毛利率(分产品)

图:2009-2013年蓝丰生化前五名客户销售金额及占比

表:2013年蓝丰生化前五名贡献收入及收入占比

图:2008-2013年蓝丰生化研发支出及占营业收入比例

表:2012-2016E年蓝丰生化营业收入和净利润

图:2008-2014年诺普信营业收入及净利润

图:2008-2013年诺普信(分产品)营业收入

图:2008-2013年诺普信(分产品)营业收入占比

表:2008-2013年诺普信(分地区)营业收入

表:2008-2013年诺普信毛利率(分产品)

图:2008-2013年诺普信前五名客户销售金额及占比

表:2013年诺普信前五名贡献收入及收入占比

图:2008-2013年诺普信研发支出及占营业收入比例

表:2012-2016E年诺普信营业收入和净利润

表:2013年威远生化主要子公司及主要业务

图:2008-2014年威远生化营业收入及净利润

表:2008-2013年威远生化(分产品)营业收入

图:2008-2013年威远生化(分地区)营业收入

表:2008-2013年威远生化毛利率(分产品)

图:2008-2013年威远生化前五名客户销售金额及占比

表:2013年威远生化前五名贡献收入及收入占比

表:截止2013年底威远生化非募集资金项目及进展

表:2011-2013年威远生化研发支出及占营业收入比例

表:2012-2016E年威远生化营业收入和净利润

表:2013年公司主要产品

图:2011-2013年国光农化营业收入及净利润

表:2011-2013年国光农化(分产品)营业收入

表:2011-2013年国光农化(分地区)营业收入

表:2011-2013年国光农化毛利率(分产品)

图:2011-2013年国光农化前五名客户销售金额及占比

表:2013年国光农化前五名客户名称、贡献收入及收入占比

表:2014年国光农化发行新股募集资金项目(单位:百万元)

表:2011-2013年国光农化研发支出及占营业收入比例

表:2012-2016E年国光农化营业收入和净利润

图:2011-2013年利民化工营业收入及净利润

表:2011-2013年利民化工(分产品)营业收入

表:2011-2013年利民化工(分地区)营业收入

表:2011-2013年利民化工毛利率(分产品)

图:2011-2013年利民化工前五名客户销售金额及占比

表:2013年利民化工前五名客户名称、贡献收入及收入占比

表:2011-2013年利民化工研发支出及占营业收入比例

表:2012-2016E年利民化工营业收入和净利润

图:2006-2014年中国化学农药原药(折有效成分100%)产量

图:2012-2013年中国农药行业主要企业农药业务营业收入

图:2013年中国农药行业主要企业市场份额

Classification and Main Varieties of Pesticides

Pesticide Industry Chain

Output of Chemical Pesticide APIs (equivalent to 100% Active Ingredient) in China, 2006-2014

Output of Major Pesticide Products in China, 2006-2014

Output Structure of Chemical Pesticide APIs (equivalent to 100% Active Ingredient) in China (by Province/City), 2013

China’s Insecticide Output Structure (by Province/City), 2013

China’s Herbicide Output Structure (by Province/City), 2013

China’s Bactericide Output Structure (by Province/City), 2013

Sales-output Ratio of Chemical Pesticide APIs (equivalent to 100% Active Ingredient) in China, 2005-2013

Pesticide Import Volume and Growth Rate in China, 2008-2013

Pesticide Import Value and Growth Rate in China, 2008-2013

Pesticide Export Volume and Growth Rate in China, 2008-2013

Pesticide Export Value and Growth Rate in China, 2008-2013

Average Import and Export Prices of Pesticides in China, 2008-2013

Number of Enterprises in China Pesticide Industry, 2006-2013

Enterprises in the Red of China Pesticide Industry, 2006-2013

Operating Revenue of China Pesticide Industry, 2006-2013

Total Profit of China Pesticide Industry, 2006-2013

Gross Margin of China Pesticide Industry, 2006-2013

Gross Margin of Pesticide Business of Major Companies in China Pesticide Industry, 2008-2013

Global Pyridine Base Capacity and Distribution, 2011-2013

Anti-dumping Duty Rates Levied on Indian and Japanese Companies since Nov 2013

Revenue of Pesticide Business of Major Companies in China Pesticide Industry, 2012-2013

Market Share of Major Companies in China Pesticide Industry, 2013

Regulatory Policies and Main Content in China Pesticide Industry

Major Policies on China Pesticide Industry, 2005-2014

Pesticide Patented Products Expired in China, 2013-2017

Pesticide Manufacturing Cost Comparison between China and European & American Countries, 2013

Labor Cost Comparison between China and European & American Countries, 2013

Output of Chemical Pesticide APIs in China, 2008-2016E

Key Merger and Reorganization Events in China Pesticide Industry, 2008-2013

Comparison between New Version Pesticide Management Regulations (Draft) and Old Version

"Twelfth Five-Year Plan" of Pesticide Industry

International Treaties in Global Pesticide Industry

Chinese Pesticide-related Environmental Policies

Revenue and Net Income of NANJING RED SUN, 2008-2014

Revenue of NANJING RED SUN (by Product), 2008-2013

Revenue of NANJING RED SUN (by Region), 2008-2013

Gross Margin of NANJING RED SUN (by Product), 2008-2013

NANJING RED SUN’s Revenue from Top 5 Clients and % of Total Revenue, 2008-2013

Revenue Contribution and % of Total Revenue of NANJING RED SUN’s Top 5 Clients, 2013

Revenue and Net Income of Main Subsidiaries and Shareholding Companies of NANJING RED SUN, 2013

Main Products, Capacity and Base Distribution of NANJING RED SUN, 2013

Revenue and Net Income of NANJING RED SUN, 2012-2016E

Revenue and Net Income of Nantong Jiangshan Agrochemical & Chemicals, 2008-2014

Revenue of Nantong Jiangshan Agrochemical & Chemicals (by Product), 2008-2013

Revenue of Nantong Jiangshan Agrochemical & Chemicals (by Region), 2008-2013

Revenue Structure of Nantong Jiangshan Agrochemical & Chemicals (by Region), 2008-2013

Gross Margin of Nantong Jiangshan Agrochemical & Chemicals (by Product), 2008-2013

Nantong Jiangshan Agrochemical & Chemicals’ Revenue from Top 5 Clients and % of Total Revenue, 2008-2013

Revenue Contribution and % of Total Revenue of Nantong Jiangshan Agrochemical & Chemicals’ Top 5 Clients, 2013

Non-fundraising Projects and Progress of Nantong Jiangshan Agrochemical & Chemicals, up to the End of 2013

R&D Costs and % of Total Revenue of Nantong Jiangshan Agrochemical & Chemicals, 2011-2013

Revenue and Net Income of Nantong Jiangshan Agrochemical & Chemicals, 2012-2016E

Revenue and Net Income of Lier Chemical, 2008-2014

Revenue of Lier Chemical (by Product), 2009-2013

Revenue of Lier Chemical (by Region), 2008-2013

Revenue Structure of Lier Chemical (by Region), 2008-2013

Gross Margin of Lier Chemical (by Product), 2008-2013

Revenue of Top 5 Clients and % of Total Revenue of Lier Chemical, 2008-2013

Revenue from Top 5 Clients and % of Total Revenue of Lier Chemical, 2013

R&D Costs and % of Total Revenue of Lier Chemical, 2008-2013

Revenue and Net Income of Lier Chemical, 2012-2016E

Revenue and Net Income of Jiangsu Yangnong Chemical, 2008-2013

Revenue of Jiangsu Yangnong Chemical (by Product), 2008-2013

Revenue of Jiangsu Yangnong Chemical (by Region), 2008-2013

Revenue Structure of Jiangsu Yangnong Chemical (by Region), 2008-2013

Gross Margin of Jiangsu Yangnong Chemical (by Product), 2008-2013

Jiangsu Yangnong Chemical’s Revenue from Top 5 Clients and % of Total Revenue, 2008-2013

Revenue Contribution and % of Total Revenue of Jiangsu Yangnong Chemical’s Top 5 Clients, 2013

Main Products and Capacity of Jiangsu Yangnong Chemical, 2013

R&D Costs and % of Total Revenue of Jiangsu Yangnong Chemical, 2011-2013

Revenue and Net Income of Jiangsu Yangnong Chemical, 2012-2016E

Revenue and Net Income and Jiangsu Changqing Agrichemical, 2008-2014

Revenue of Jiangsu Changqing Agrichemical (by Product), 2008-2013

Revenue of Jiangsu Changqing Agrichemical (by Region), 2008-2013

Gross Margin of Jiangsu Changqing Agrichemical (by Product), 2008-2013

Jiangsu Changqing Agrichemical’s Revenue from Top 5 Clients and % of Total Revenue, 2010-2013

Revenue Contribution and % of Total Revenue of Jiangsu Changqing Agrichemical’s Top 5 Clients, 2013

Main Products and Capacity of Jiangsu Changqing Agrichemical, 2013

R&D Costs and % of Total Revenue of Jiangsu Changqing Agrichemical, 2008-2013

Revenue and Net Income of Jiangsu Changqing Agrichemical, 2012-2016E

Progress of Investment Projects of Zhejiang Xinan Chemical Industrial Group, up to the End of 2013

Revenue and Net Income of Zhejiang Xinan Chemical Industrial Group, 2008-2014

Revenue of Zhejiang Xinan Chemical Industrial Group (by Product), 2008-2013

Revenue of Zhejiang Xinan Chemical Industrial Group (by Region), 2008-2013

Gross Margin of Zhejiang Xinan Chemical Industrial Group (by Product), 2008-2013

Zhejiang Xinan Chemical Industrial Group’s Revenue from Top 5 Clients and % of Total Revenue, 2008-2013

Revenue Contribution and % of Total Revenue of Zhejiang Xinan Chemical Industrial Group’s Top 5 Clients, 2013

Revenue and % of Pesticide Business of Xinan Chemical Industrial Group, 2008-2013

Gross Margin of Pesticide Business of Xinan Chemical Industrial Group, 2008-2013

R&D Costs and % of Total Revenue of Zhejiang Xinan Chemical Industrial Group, 2011-2013

Revenue and Net Income of Zhejiang Xinan Chemical Industrial Group, 2012-2016E

Revenue and Net Income of Zhejiang Shenghua Biok Biology, 2008-2014

Revenue of Zhejiang Shenghua Biok Biology (by Product), 2008-2013

Revenue of Zhejiang Shenghua Biok Biology (by Region), 2008-2013

Revenue Structure of Zhejiang Shenghua Biok Biology (by Region), 2008-2013

Gross Margin of Zhejiang Shenghua Biok Biology (by Product), 2008-2013

Zhejiang Shenghua Biok Biology’s Revenue from Top 5 Clients and % of Total Revenue, 2008-2013

Namelist and Revenue Contribution of Zhejiang Shenghua Biok Biology’s Top 5 Clients, 2013

R&D Costs and % of Total Revenue of Zhejiang Shenghua Biok Biology, 2011-2013

Revenue and Net Income of Zhejiang Shenghua Biok Biology, 2012-2016E

Main Product Systems of HUBEI SANONDA, 2013

Main Products and Capacity of HUBEI SANONDA, 2013

Revenue and Net Income of HUBEI SANONDA, 2008-2014

Revenue of HUBEI SANONDA (by Product), 2008-2013

Revenue of HUBEI SANONDA (by Region), 2008-2013

Gross Margin of HUBEI SANONDA (by Product), 2008-2013

HUBEI SANONDA’s Revenue from Top 5 Clients and % of Total Revenue, 2008-2013

Revenue Contribution and % of Total Revenue of HUBEI SANONDA’s Top 5 Clients, 2013

R&D Costs and % of Total Revenue of HUBEI SANONDA, 2011-2013

Revenue and Net Income of HUBEI SANONDA, 2012-2016E

Revenue and Net Income of Jiangsu Huifeng Agrochemical, 2008-2014

Revenue of Jiangsu Huifeng Agrochemical (by Product), 2008-2013

Revenue of Jiangsu Huifeng Agrochemical (by Region), 2008-2013

Revenue Structure of Jiangsu Huifeng Agrochemical (by Region), 2008-2013

Gross Margin of Jiangsu Huifeng Agrochemical (by Product), 2008-2013

Jiangsu Huifeng Agrochemical’s Revenue from Top 5 Clients and % of Total Revenue, 2010-2013

Revenue Contribution and % of Total Revenue of Jiangsu Huifeng Agrochemical’s Top 5 Clients, 2013

Main Products and Capacity of Jiangsu Huifeng Agrochemical, 2013

Major Prochloraz Production Areas and Companies Worldwide, 2012

Registration of Chinese Epoxiconazole Companies

R&D Costs and % of Total Revenue of Jiangsu Huifeng Agrochemical, 2008-2013

Revenue and Net Income of Jiangsu Huifeng Agrochemical, 2012-2016E

Revenue and Net Income of Hunan Haili Chemical, 2008-2014

Revenue of Hunan Haili Chemical (by Product), 2008-2013

Revenue of Hunan Haili Chemical (by Region), 2008-2013

Gross Margin of Hunan Haili Chemical (by Product), 2008-2013

Hunan Haili Chemical’s Revenue from Top 5 Clients and % of Total Revenue, 2008-2013

Revenue Contribution and % of Total Revenue of Hunan Haili Chemical’s Top 5 Clients, 2013

Non-fundraising Projects and Progress of Hunan Haili Chemical, up to the End of 2013

R&D Costs and % of Total Revenue of Hunan Haili Chemical, 2011-2013

Revenue and Net Income of Hunan Haili Chemical, 2012-2016E

Revenue and Net Income of Huapont-Nutrichem, 2008-2014

Pesticide Business Segments of Huapont-Nutrichem, 2013

Revenue of Pesticide Subsidiaries of Huapont-Nutrichem, 2013

Pesticide Business Projects under Construction of Huapont-Nutrichem, up to the End of 2013

Existing and Reserved Pesticide API Products of Huapont-Nutrichem, 2013

Revenue and Net Income of Huapont-Nutrichem, 2012-2016E

Lianhe Chemical Technology Revenue and Net Income, 2008-2014

Revenue of Lianhe Chemical Technology (by Product), 2008-2013

Revenue of Lianhe Chemical Technology (by Region), 2008-2013

Gross Margin of Lianhe Chemical Technology (by Product), 2008-2013

Lianhe Chemical Technology’s Revenue from Top 5 Clients and % of Total Revenue, 2008-2013

Revenue Contribution and % of Total Revenue of Lianhe Chemical Technology’s Top 5 Clients, 2013

R&D Costs and % of Total Revenue of Lianhe Chemical Technology, 2008-2013

Revenue and Net Income of Lianhe Chemical Technology, 2012-2016E

Revenue and Net Income of Lanfeng Biochemical, 2008-2014

Revenue of Lanfeng Biochemical (by Product), 2008-2013

Revenue of Lanfeng Biochemical (by Region), 2008-2013

Revenue Structure of Lanfeng Biochemical (by Region), 2008-2013

Gross Margin of Lanfeng Biochemical (by Product), 2008-2013

Lanfeng Biochemical’s Revenue from Top 5 Clients and % of Total Revenue, 2009-2013

Revenue Contribution and % of Total Revenue of Lanfeng Biochemical’s Top 5 Clients, 2013

R&D Costs and % of Total Revenue of Lanfeng Biochemical, 2008-2013

Revenue and Net Income of Lanfeng Biochemical, 2012-2016E

Revenue and Net Income of Noposion Agrochemicals, 2008-2014

Revenue of Noposion Agrochemicals (by Product), 2008-2013

Revenue Structure of Noposion Agrochemicals (by Product), 2008-2013

Revenue of Noposion Agrochemicals (by Region), 2008-2013

Gross Margin of Noposion Agrochemicals (by Product), 2008-2013

Noposion Agrochemicals’ Revenue from Top 5 Clients and % of Total Revenue, 2008-2013

Revenue Contribution and % of Total Revenue of Noposion Agrochemicals’ Top 5 Clients, 2013

R&D Costs and % of Total Revenue of Noposion Agrochemicals, 2008-2013

Revenue and Net Income of Noposion Agrochemicals, 2012-2016E

Main Subsidiaries and Businesses of Hebei Veyong Bio-Chemical, 2013

Revenue and Net Income of Hebei Veyong Bio-Chemical, 2008-2014

Revenue of Hebei Veyong Bio-Chemical (by Product), 2008-2013

Revenue of Hebei Veyong Bio-Chemical (by Region), 2008-2013

Gross Margin of Hebei Veyong Bio-Chemical (by Product), 2008-2013

Hebei Veyong Bio-Chemical’s Revenue from Top 5 Clients and % of Total Revenue, 2008-2013 Revenue Contribution and % of Total Revenue of Hebei Veyong Bio-Chemical’s Top 5 Clients, 2013

Non-fundraising Projects and Progress of Hebei Veyong Bio-Chemical, up to the End of 2013

R&D Costs and % of Total Revenue of Hebei Veyong Bio-Chemical, 2011-2013

Revenue and Net Income of Hebei Veyong Bio-Chemical, 2012-2016E

Main Products of Sichuan Guoguang Agrochemical, 2013

Revenue and Net Income of Sichuan Guoguang Agrochemical, 2011-2013

Revenue of Sichuan Guoguang Agrochemical (by Product), 2011-2013

Revenue of Sichuan Guoguang Agrochemical (by Region), 2011-2013

Gross Margin of Sichuan Guoguang Agrochemical (by Product), 2011-2013

Sichuan Guoguang Agrochemical’s Revenue from Top 5 Clients and % of Total Revenue, 2011-2013

Namelist and Revenue Contribution of Sichuan Guoguang Agrochemical’s Top 5 Clients, 2013

Sichuan Guoguang Agrochemical’s New Share-issued Fundraising Project, 2014

R&D Costs and % of Total Revenue of Sichuan Guoguang Agrochemical, 2011-2013

Revenue and Net Income of Sichuan Guoguang Agrochemical, 2012-2016E

Revenue and Net Income of Limin Chemical, 2011-2013

Revenue of Limin Chemical (by Product), 2011-2013

Revenue of Limin Chemical (by Region), 2011-2013

Gross Margin of Limin Chemical (by Product), 2011-2013

Limin Chemical’s Revenue from Top 5 Clients and % of Total Revenue, 2011-2013

Namelist and Revenue Contribution of Limin Chemical’s Top 5 Clients, 2013

R&D Costs and % of Total Revenue of Limin Chemical, 2011-2013

Revenue and Net Income of Limin Chemical, 2012-2016E

Output of Chemical Pesticide APIs (equivalent to 100% Active Ingredient) in China, 2006-2014

Revenue of Pesticide Business of Major Enterprises in China Pesticide Industry, 2012-2013

Market Share of Major Enterprises in China Pesticide Industry, 2013

如果这份报告不能满足您的要求,我们还可以为您定制报告,请 留言说明您的详细需求。

|