|

|

|

报告导航:研究报告—

制造业—工业机械

|

|

2013-2016年中国中低压变频器行业研究报告 |

|

字数:4.5万 |

页数:98 |

图表数:100 |

|

中文电子版:8000元 |

中文纸版:4000元 |

中文(电子+纸)版:8500元 |

|

英文电子版:2200美元 |

英文纸版:2400美元 |

英文(电子+纸)版:2500美元 |

|

编号:LT-018

|

发布日期:2014-06 |

附件:下载 |

|

|

|

2013年中国工控行业的需求回暖,带动了中低压变频器市场的复苏。2013年中国中低压变频器市场规模达225.7亿元左右,同比增长5.2%。

从市场结构来看,低压变频器占主流,中压变频器由于应用范围较窄,市场占比远不及低压变频器。但中国中压变频器在整个中低压变频器市场占比已由2006年的8.7%上升到2013年的约15.8%,发展前景仍然可期。

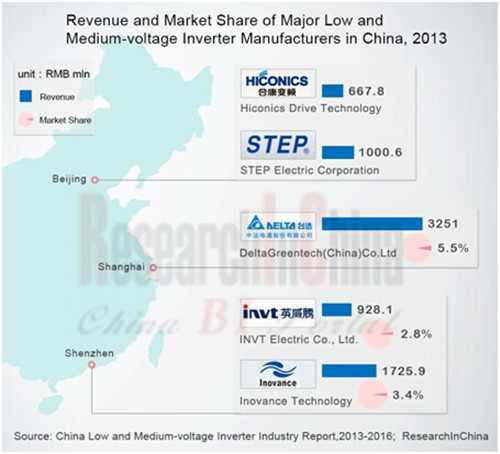

在中低压领域,中国本土企业主要生产V/F控制产品,对于性能优越、技术含量高的矢量变频器等产品,本土绝大多数企业还没有开发出成熟的产品。目前中国本土中低压变频器市场主要厂商有英威腾、汇川技术、新时达、合康变频及欧瑞传动等。2013年,汇川技术市场份额达到3.4%,是中国本土企业中市场份额最高的厂商。

目前,外资厂商在中国中低压变频器市场的占有率超过70%。2013年中国中低压变频器行业市场份额排名前五位的均为外资厂商,依次分别是ABB、西门子、安川、台达和施耐德;其中ABB、西门子市场份额分别达16.6%、 15.4%。

起重机械和电梯是中国中低压变频器应用较为广泛的两大行业。2013年,中国起重及电梯用中低压变频器市场规模分别达到32.4亿元和21.2亿元左右。中国电梯用中低压变频器市场集中度较高,2013年市场份额排名前三位的供应商是汇川、艾默生和安川;此外,富士和施耐德在电梯用变频器市场也占据一定的份额。

节能环保推广是推动中国中低压变频器行业发展的动力,变频技术也正处于从调速到节能的转变过程。未来中低压变频器将以自动化改造和进口替代为主线,本土企业将重点发展控制和驱动技术。预计2014-2016年中国中低压变频器市场将保持约9%左右的年均增速,到2016年中国中低压变频器市场规模有望达到300亿元左右。

水清木华研究中心《2013-2016年中国中低压变频器行业研究报告》着重研究了以下内容:

中国中低压变频器发展环境(包括产业、政策及技术环境)分析等; 中国中低压变频器发展环境(包括产业、政策及技术环境)分析等;

中国中低压变频器市场规模及未来3年预测、竞争格局、供需分析等; 中国中低压变频器市场规模及未来3年预测、竞争格局、供需分析等;

中国中低压变频器下游行业应用(包括起重、电梯、机床行业等)市场分析等; 中国中低压变频器下游行业应用(包括起重、电梯、机床行业等)市场分析等;

中国16家中低压变频器重点企业(包括ABB、西门子、施耐德、汇川、英威腾等)经营情况及中低压变频器业务分析等。 中国16家中低压变频器重点企业(包括ABB、西门子、施耐德、汇川、英威腾等)经营情况及中低压变频器业务分析等。

In 2013, the rising demand from China's industrial control industry helped drive the recovery of low and medium-voltage inverter market, with the market size of low and medium-voltage inverters in China for the year hitting about RMB22.57 billion, up 5.2% from a year earlier.

In terms of market structure, the market was dominated by low-voltage inverters, while medium-voltage inverters, due to limited application, occupied a far smaller market share than low-voltage inverters. However, China witnessed a rise in the proportion of medium-voltage inverters in the low and medium-voltage inverter market, from 8.7% in 2006 to roughly 15.8% in 2013, hence with broad development prospects.

In the field of low and medium-voltage products, the Chinese enterprises mainly produce V/F control products. As for the products such as vector inverter with superior performance and high technical content, the overwhelming majority of Chinese enterprises still not have developed mature products. Currently, the major local players in Chinese low and medium-voltage inverter market are comprised of INVT, Inovance Technology, STEP Electric, Hiconics Drive Technology and EURA DRIVES, etc. In 2013, Inovance Technology occupied a 3.4% market share, making it the manufacturer with the biggest market share in China.

At present, the market share of foreign manufacturers in the Chinese low and medium-voltage inverter market exceeds 70%. In 2013, the top 5 low and medium-voltage inverter manufacturers by market share were all foreign companies, namely ABB, Siemens, Yaskawa, Delta Electronics and Schneider Electric, of which the market share of ABB and Siemens were 16.6% and 15.4%, respectively.

Hoisting machinery and elevators are the major two industries in which the Chinese low and medium-voltage inverters are widely used. And in 2013, the market size of the low and medium-voltage inverters for hoisting machinery and elevators in China reached approximately RMB3.24 billion and RMB2.12 billion, respectively. Market concentration rate of low and medium-voltage inverters for elevators was relatively higher in China, and the top 3 suppliers in terms of market share in 2013 were Inovance Technology, Emerson and Yaskawa. In addition, Fuji Electric and Schneider Electric also held a certain market share.

Energy conservation and environmental protection are the driving force to promote the development of China's low and medium-voltage inverter industry. Frequency conversion technology is in the process of transforming from speed governing to energy conservation. In future, most low and medium-voltage inverters will be replaced by those that have conducted automated transformation or the imported ones, and Chinese enterprises will focus on the development of control and drive technologies. It is predicted that during 2014-2016 the Chinese low and medium-voltage inverter market will keep an AAGR of around 9%, and the market size is expected to reach approximately RMB30 billion by 2016.

China Low and Medium-voltage Inverter Industry Report, 2013-2016, released by ResearchInChina, mainly focuses on the followings:

Development environment of low and medium-voltage inverters in China (including industry, policy and technology environment), etc.; Development environment of low and medium-voltage inverters in China (including industry, policy and technology environment), etc.;

The market size of low and medium-voltage inverters in China as well as prediction, competition pattern and supply and demand analysis in the coming 3 years; The market size of low and medium-voltage inverters in China as well as prediction, competition pattern and supply and demand analysis in the coming 3 years;

The application and market analysis of China’s low and medium-voltage inverters in the downstream sectors, including hoisting machinery, elevator, machine tool industries; The application and market analysis of China’s low and medium-voltage inverters in the downstream sectors, including hoisting machinery, elevator, machine tool industries;

Operation of 16 key low and medium-voltage inverter manufacturers in China (including ABB, Siemens, Schneider Electric, INVT as well as Inovance Technology) and analysis on their low and medium-voltage inverter business. Operation of 16 key low and medium-voltage inverter manufacturers in China (including ABB, Siemens, Schneider Electric, INVT as well as Inovance Technology) and analysis on their low and medium-voltage inverter business.

第一章 中低压变频器简介

1.1 定义与分类

1.2 产品特性

1.3 上下游产业链

第二章 中国中低压变频器发展环境

2.1 产业环境

2.2 政策环境

2.3 技术环境

第三章 中国中低压变频器市场分析

3.1 市场规模

3.2 市场供应

3.2.1 原材料供应

3.2.2 企业供应

3.3 市场需求

第四章 中国中低压变频器竞争格局分析

4.1 品牌竞争

4.2 渠道竞争

第五章 中国中低压变频器应用行业分析

5.1 应用行业概述

5.2 起重机械用变频器

5.3 电梯用变频器

5.4 机床用变频器

5.5 轨道交通用变频器

5.6 家电用变频器

5.6.1 变频空调

5.6.2 变频洗衣机

5.6.3 变频冰箱

第六章 中国中低压变频器重点企业分析

6.1 英威腾

6.1.1 企业简介

6.1.2 经营情况

6.1.3 营收构成

6.1.4 毛利率

6.1.5 客户与供应商

6.1.6 研发与投资

6.1.7 中低压变频器业务

6.1.8 发展前景

6.2 汇川技术

6.2.1 企业简介

6.2.2 经营情况

6.2.3 营收构成

6.2.4 毛利率

6.2.5 客户与供应商

6.2.6 研发

6.2.7 低压变频器业务

6.2.8 发展前景

6.3 新时达

6.3.1 企业简介

6.3.2 经营情况

6.3.3 营收构成

6.3.4 毛利率

6.3.5 客户与供应商

6.3.6 投资

6.3.7 电梯变频器业务

6.3.8 发展前景

6.4 合康变频

6.4.1 企业简介

6.4.2 经营情况

6.4.3 营收构成

6.4.4 毛利率

6.4.5 客户与供应商

6.4.6 研发与投资

6.4.7 中低压变频器业务

6.4.8 发展前景

6.5 欧瑞传动

6.5.1 企业简介

6.5.2 经营情况

6.6 希望森兰

6.6.1 企业简介

6.6.2 经营情况

6.7 西门子中国

6.7.1 企业简介

6.7.2 变频器业务

6.7.3 西门子电气传动有限公司(SEDL)

6.7.4 西门子(上海)电气传动设备有限公司(SEDS)

6.7.5 发展前景

6.8 ABB中国

6.8.1 企业简介

6.8.2 变频器业务

6.8.3 北京ABB电气传动系统有限公司

6.9 安川电机中国

6.9.1 企业简介

6.9.2 中低压变频器业务

6.9.3 发展前景

6.10 富士电机中国

6.10.1 企业简介

6.10.2 变频器业务

6.10.3 投资

6.11 施耐德中国

6.11.1 企业简介

6.11.2 变频器业务

6.11.3 施耐德(苏州)变频器有限公司

6.12 台达电子

6.12.1 企业简介

6.12.2 变频器业务

6.12.3 中达电通股份有限公司

6.13 三菱电机中国

6.13.1 企业简介

6.13.2 变频器业务

6.13.3 三菱电机大连

6.14 艾默生中国

6.14.1 企业简介

6.14.2 艾默生网络能源(中国)有限公司

6.15 丹弗斯中国

6.15.1 企业简介

6.15.2 浙江海利普电子科技有限公司

6.16 罗克韦尔中国

6.16.1 企业简介

6.16.2 变频器业务

第七章 总结与预测

7.1 总结

7.2预测

1. Profile of Low and Medium-voltage Inverters

1.1 Definition & Classification

1.2 Product Features

1.3 Upstream and Downstream Industry Chain

2. Development Environment of Low and Medium-voltage Inverters in China

2.1 Industry Environment

2.2 Policy Environment

2.3 Technological Environment

3. Low and Medium-voltage Inverter Market in China

3.1 Market Size

3.2 Market Supply

3.2.1 Supply of Raw Materials

3.2.2 Supply by Enterprise

3.2 Market Demand

4. Competition Pattern of Low and Medium-voltage Inverters in China

4.1 Brand Competition

4.2 Channel Competition

5. Application of Low and Medium-voltage Inverters in China

5.1 Overview of Application Industry

5.2 Inverters for Hoisting Machinery

5.3 Inverters for Elevators

5.4 Inverters for Machine Tools

5.5 Inverters for Rail Transit

5.6 Inverters for Household Appliances

5.6.1 Inverter Air Conditioners

5.6.2 Inverter Washing Machines

5.6.3 Inverter Refrigerators

6. Key Manufacturers of Low and Medium-voltage Inverter in China

6.1 INVT

6.1.1 Profile

6.1.2 Operation

6.1.3 Revenue Structure

6.1.4 Gross Margin

6.1.5 Customers and Suppliers

6.1.6 R&D and Investment

6.1.7 Low and Medium-voltage Inverter Business

6.1.8 Development Prospects

6.2 Inovance Technology

6.2.1 Profile

6.2.2 Operation

6.2.3 Revenue Structure

6.2.4 Gross Margin

6.2.5 Customers and Suppliers

6.2.6 R&D

6.2.7 Low-voltage Inverter Business

6.2.8 Development Prospects

6.3 STEP Electric Corporation

6.3.1 Profile

6.3.2 Operation

6.3.3 Revenue Structure

6.3.4 Gross Margin

6.3.5 Customers and Suppliers

6.3.6 Investment

6.3.7 Elevator Inverter Business

6.3.8 Development Prospects

6.4 Hiconics Drive Technology

6.4.1 Profile

6.4.2 Operation

6.4.3 Revenue Structure

6.4.4 Gross Margin

6.4.5 Customers and Suppliers

6.4.6 R&D and Investment

6.4.7 Low and Medium-voltage Inverter Business

6.4.8 Development Prospects

6.5 EURA DRIVES

6.5.1 Profile

6.5.2 Operation

6.6 Slanvert

6.6.1 Profile

6.6.2 Operation

6.7 Siemens China

6.7.1 Profile

6.7.2 Inverter Business

6.7.3 Siemens Electrical Drives Ltd. (SEDL)

6.7.4 Siemens Electrical Drives (Shanghai) Ltd. (SEDS)

6.7.5 Development Prospects

6.8 ABB China Ltd.

6.8.1 Profile

6.8.2 Inverter Business

6.8.3 ABB Beijing Drive Systems Co, Ltd.

6.9 Yaskawa Electric (China) Co., Ltd.

6.9.1 Profile

6.9.2 Low and Medium-voltage Inverter Business

6.9.3 Development Prospects

6.10 Fuji Electric (China) Co., Ltd.

6.10.1 Profile

6.10.2 Inverter Business

6.10.3 Investment

6.11 Schneider Electric (China) Co., Ltd.

6.11.1 Profile

6.11.2 Inverter Business

6.11.3 Schneider (Suzhou) Drives. Co., Ltd.

6.12 Delta Electronics

6.12.1 Profile

6.12.2 Inverter Business

6.12.3 Delta Greentech (China) Co., Ltd.

6.13 Mitsubishi Electric (China) Co., Ltd.

6.13.1 Profile

6.13.2 Inverter Business

6.13.3 Mitsubishi Electric Dalian Industrial Products Co., Ltd.

6.14 Emerson in China

6.14.1 Profile

6.14.2 Emerson Network Power China

6.15 Danfoss China

6.15.1 Profile

6.15.2 Zhejiang Holip Electronic Technology Co., Ltd.

6.16 Rockwell Automation (China)

6.16.1 Profile

6.16.2 Inverter Business

7. Summary and Forecast

7.1 Summary

7.2 Forecast

表:三种电机节能方式比较

图:2005-2013年中国电力装机容量及新增装机容量

图:2006-2012年中国新增电机变频化率

表:2004-2013年中国变频器相关政策

表:变频器三种控制方式特性比较

图:2006-2013年中国中低压变频器市场规模

图:2013年中国中低压变频器成本构成

图:2006-2013年中国中低压变频器用IGBT市场规模

表:中国中低压变频器厂商优势领域对比

图:2013年中国中低压变频器区域分布

图:2012年中国中低压变频器(分负载)需求量占比

图:2013年中国中低压变频器主要厂商市场份额

图:中国中低压变频器内资企业分类

图:2010-2012年中国主要内资企业中低压变频器营业收入

图:2009-2013年中国中低压变频器销售渠道及占比

图:2013年中国中低压变频器(分功率段)产品渠道分布

图:2013年中国中低压变频器(分行业)市场份额占比

图:2009-2016年中国起重机械变频器市场规模

图:2006-2015年中国电梯专用变频器需求量及市场规模

图:2013年中国电梯用变频器(分功率段)市场占比

表:中国电梯用变频器主要生产企业

图:2013年中国电梯用变频器主要厂商市场份额

表:2009-2015年中国机床用变频器市场规模

图:2013年中国机床用变频器(分功率段)市场占比

图:2013年中国机床用变频器主要厂商市场份额

图:2009-2015年中国轨道交通用变频器市场需求量及市场规模

图:2011年中国轨道交通用变频器(分企业)市场份额占比

图:2008-2012年中国零售市场变频空调(按零售量)比重

图:2008-2015年中国变频空调出货量

图:2009-2015年中国空调变频器出货量

图:2013年中国主要变频空调厂商(按销售量)占比

表:空调用变频器三种供货途径及代表企业

图:2007-2012年中国变频洗衣机零售(按零售额)市场份额

图:2011-2012年中国城市变频冰箱市场销量占比

图:2006-2014年英威腾营业收入与净利润

图:2006-2013年英威腾(分产品)营业收入占比

图:2007-2012年英威腾(分地区)营业收入占比

表:2006-2012年英威腾(分产品)毛利率

表:2011-2013年英威腾前五名供应商合计采购金额及占比、前五客户合计营业收入贡献及占比

表:2008-2012年英威腾研发投入及占比

表:截至2013年底英威腾投资项目

表:2013年英威腾变频器生产子公司营业收入及净利润

表:2006-2012年英威腾(分产品)变频器产能

图:2013-2016年英威腾变频器及伺服产品营业收入

图:2007-2014年汇川技术营业收入与净利润

图:2007-2013年汇川技术(分产品)营业收入

表:2007-2013年汇川技术(分地区)营收占比

图:2007-2013年汇川技术(分产品)毛利率

表:2011-2013年汇川技术前五名供应商合计采购金额及占比、第一名供应商采购金额及占比

表:2011-2013年汇川技术前五名客户合计营业收入贡献及占比与第一名客户营业收入贡献及占比

表:2008-2013年汇川技术研发支出及占比

图:2007-2015年汇川技术低压变频器营业收入及同比增长

图:2007-2015年汇川技术低压变频器毛利率

表:2010-2016年汇川技术营业收入与净利润及同比增长

图:2007-2014年新时达营业收入与净利润

图:2007-2012年新时达(分产品)营业收入

图:2013年新时达(分产品)营收构成

图:2007-2013年新时达(分地区)营业收入

表:2007-2013年新时达(分产品)毛利率

表:2010-2011年新时达前五名供应商合计采购金额及占比与第一名供应商采购金额及占比

表:2011-2012年新时达前五名客户合计营业收入贡献及占比与第一名客户营业收入贡献及占比

表:截止2013年12月新时达投资建设项目

图:2009-2013年新时达电梯变频器系列产品营业收入及毛利率

表:2011-2016年新时达营业收入与净利润及同比增长

图:2006-2014年合康变频营业收入与净利润

图:2006-2013年合康变频(分产品)营收占比

图:2006-2013年合康变频(分地区)营收占比

图:2009-2013年合康变频(分产品)毛利率

表:2011-2012年合康变频前五名供应商合计采购金额及占比

表:2011-2012年合康变频前五名客户合计营业收入贡献及占比与第一名客户营业收入及占比

表:2008-2013年合康变频研发支出及占比

表:截止2013年底合康变频投资建设项目

表:2013年合康变频中低压变频器主要产品类别及特点

表:2010-2016年合康变频营业收入与净利润及同比增长

图:2004-2012年欧瑞传动营业收入及增速

图:2004-2010年欧瑞传动营业利润及增速

表:2013年希望森兰中低压变频器产品及应用范围

图:2004-2009年希望森兰营业收入及利润总额

表:2013年西门子中低压变频器产品系列

表:2004-2008年SEDL主要经济指标

表:2004-2009年SEDS主要经济指标

表:ABB中低压变频器种类及特性

图:2004-2009年北京ABB电气传动系统有限公司营业收入及利润总额

表:安川电机中低压变频器产品

表:2013年富士电机在华变频器业务生产、销售企业

表:富士电机(中国)有限公司中低压变频器系列产品

表:施耐德电气变频器产品及应用领域

图:2004-2009年施耐德(苏州)变频器有限公司营业收入和利润总额

表:台达电子变频器及应用领域

图:2004-2013年中达电通营业收入

图:2004-2009年中达电通利润总额

表:三菱电机中低压变频器产品类别及功率范围

表:三菱电机在华变频器企业

图:2004-2010年三菱电机大连营业收入

表:爱默生中低压变频器产品系列

图: 2007-2012财年艾默生网络能源(中国)有限公司销售收入及同比增长

表:海利普中低压变频器产品系列

表:罗克韦尔中低压变频器产品系列

图:2009-2013年中国主要本土中低压变频器厂商毛利率

图:2006-2016年中国中低压变频器市场规模

Comparison: Three Ways of Energy Conservation for Electric Motors

Electric Power Installed Capacity and Newly Added Installed Capacity in China, 2005-2013

Inverter Rate of Newly Added Electric Motors in China, 2006-2012

Policies on Inverters in China, 2004-2013

Comparison: Features for the Three Control Modes of Inverters

Market Size of Low and Medium-voltage Inverters in China, 2006-2013

Cost Structure of Low and Medium-voltage Inverters in China, 2013

Market Size of IGBT for Low and Medium-voltage Inverters in China, 2006-2013

Comparison: Strengths of Manufacturers of Low and Medium-voltage Inverters in China

Regional Distribution of Low and Medium-voltage Inverters in China, 2013

Proportion of Demand for Low and Medium-voltage Inverters by Load in China, 2012

Market Share of Major Manufacturers of Low and Medium-voltage Inverters in China, 2013

Classification of Domestic Manufacturers of Low and Medium-voltage Inverters in China

Revenue of Major Chinese Enterprises from Low and Medium-voltage Inverters, 2010-2012

Distribution Channels and Proportions of Low and Medium-voltage Inverters in China, 2009-2013

Product Channel Distribution of Low and Medium-voltage Inverters in China by Power Band, 2013

Market Share of Low and Medium-voltage Inverters in China by Sector, 2013

Market Size of Inverters for Hoisting Machinery in China, 2009-2016E

Demand and Market Size of Inverters for Elevators in China, 2006-2015E

Market Share of Inverters for Elevators in China by Power Band, 2013

Major Manufacturers of Inverters for Elevators in China

Market Share of Major Manufacturers of Inverters for Elevators in China, 2013

Market Size of Inverters for Machine Tools in China, 2009-2015E

Market Share of Inverters for Machine Tools in China by Power Band, 2013

Market Share of Major Manufacturers of Inverters for Machine Tools in China, 2013

Market Demand and Size of Inverters for Rail Transit in China, 2009-2015E

Market Share of Inverters for Rail Transit in China by Enterprise, 2011

Market Share of Inverter Air Conditioners in Chinese Retail Market by Retail Sales, 2008-2012

Shipment of Inverter Air Conditioners in China, 2008-2015E

Shipment of Inverters for Air Conditioners in China, 2009-2015E

Proportion of Major Inverter Air Conditioners Manufacturers in China by Sales Volume, 2013

Three Channels for Supplying Inverters for Air Conditioners and the Representative Enterprises

Market Share of Retailed Inverter Washing Machines in China by Retail Sales 2007-2012

Market Share of Inverter Refrigerators Sold in the Chinese Cities, 2011-2012

Revenue and Net Income of INVT, 2006-2014

Revenue Structure of INVT by Product, 2006-2013

Revenue Structure of INVT by Region, 2007-2012

Gross Margin of INVT by Product, 2006-2012

INVT’s Total Procurement from Top 5 Suppliers and Shares and Its Procurement from the Ranking No.1 Supplier and Shares, 2011-2013

R&D Costs and % in Revenue of INVT, 2008-2012

Investment Projects of INVT by the End of 2013

Revenue and Net Income of INVT’s Subsidiaries Producing Inverters, 2013

Capacity of Inverters of INVT by Product, 2006-2012

Revenue of INVT from Inverters and Servo Products, 2013-2016E

Revenue and Net Income of Inovance Technology, 2007-2014

Revenue of Inovance Technology by Product, 2007-2013

Revenue Structure of Inovance Technology by Region, 2007-2013

Gross Margin of Inovance Technology by Product, 2007-2013

Inovance Technology’s Total Procurement from Top 5 Suppliers and Shares and Its Procurement from the Ranking No.1 Supplier and Shares, 2011-2013

Inovance Technology’s Total Revenue from Top 5 Customers and Shares and Its Revenue from the Ranking No.1 Customer and Shares, 2011-2013

R&D Costs and % in Total Revenue of Inovance Technology, 2008-2013

Revenue and YoY Growth of Inovance Technology from Low-voltage Inverters, 2007-2015E

Gross Margin of Inovance Technology from Low-voltage Inverters, 2007-2015E

Revenue, Net Income and YoY Growth Rates of Inovance Technology, 2010-2016E

Revenue and Net Income of STEP Electric, 2007-2014

Revenue of STEP Electric by Product, 2007-2012

Revenue Structure of STEP Electric by Product, 2013

Revenue of STEP Electric by Region, 2007-2013

Gross Margin of STEP Electric by Product, 2007-2013

STEP Electric’s Total Procurement from Top 5 Suppliers and Shares and Its Procurment from the Ranking No.1 Supplier and Shares, 2010-2011

STEP Electric’s Total Revenue from Top 5 Customers and Shares and Its Revenue from the Ranking No.1 Customer and Shares, 2011-2012

Investment Construction Projects of STEP Electric, by Dec 2013

Revenue and Gross Margin of STEP Electric’s Elevator Inverter Series, 2009-2013

Revenue, Net Income and YoY Growth Rates of STEP Electric, 2011-2016E

Revenue and Net Income of Hiconics Drive Technology, 2006-2014

Revenue Structure of Hiconics Drive Technology by Product, 2006-2013

Revenue Structue of Hiconics Drive Technology by Region, 2006-2013

Gross Margin of Hiconics Drive Technology by Product, 2009-2013

Hiconics Drive Technology’s Total Procurement from Top 5 Suppliers and Shares, 2011-2012

Hiconics Drive Technology’s Total Revenue from Top 5 Customers and Shares and Its Revenue from the Ranking No.1 Customer and Shares, 2011-2012

R&D Costs and % in Revenue of Hiconics Drive Technology, 2008-2013

Investment Construction Projects of Hiconics Drive Technology, by the End of 2013

Key Types and Characteristics of Low and Medium-voltage Inverters of Hiconics Drive Technology, 2013

Revenue, Net Income and YoY Growth Rates, 2010-2016E

Revenue and Growth Rate of EURA DRIVES, 2004-2012

Operating Income and Growth Rate of EURA DRIVES, 2004-2010

Low and Medium-voltage Inverters and Application Scope of Slanvert, 2013

Revenue and Total Profit of Slanvert, 2004-2009

Low and Medium-voltage Inverter Product Series of Siemens, 2013

Key Economic Indicators of SEDL, 2004-2008

Key Economic Indicators of SEDS, 2004-2009

Types and Features of Low and Medium-voltage Inverter Products of ABB

Revenue and Total Profit of ABB Beijing Drive Systems Co., 2004-2009

Low and Medium-voltage Inverter Products of Yaskawa Electric

Inverters Producing and Selling Enterprises of Fuji Electric in China, 2013

Low and Medium-voltage Inverter Products of Fuji Electric (China)

Inverter Products of Schneider Electric and Their Application Fields

Revenue and Total Profit of Schneider (Suzhou) Drives Co., Ltd., 2004-2009

Inverter Products of Delta Electronics and Their Application Fields

Revenue of Delta Greentech (China), 2004-2013

Total Profit of Delta Greentech (China), 2004-2009

Product Category and Power Range of Low and Medium-voltage Inverters of Mitsubishi Electric

Inverter Manufacturers of Mitsubishi Electric in China

Revenue of Mitsubishi Electric Dalian Industrial Products Co., Ltd., 2004-2010

Low and Medium-voltage Inverter Product Series of Emerson

Revenue and YoY Growth of Emerson Network Power China, FY 2007-2012

Low and Medium-voltage Inverter Product Series of Holip Electronic

Low and Medium-voltage Inverter Product Series of Rockwell Automation

Gross Margin of Major Chinese Low and Medium-voltage Inverter Manufacturers, 2009-2013

Market Size of Low and Medium-voltage Inverters in China, 2006-2016E

如果这份报告不能满足您的要求,我们还可以为您定制报告,请 留言说明您的详细需求。

|