|

|

|

报告导航:研究报告—

制造业—工业机械

|

|

2013-2016年中国运动控制器行业研究报告 |

|

字数:2.3万 |

页数:79 |

图表数:98 |

|

中文电子版:7500元 |

中文纸版:3750元 |

中文(电子+纸)版:8000元 |

|

英文电子版:1800美元 |

英文纸版:1900美元 |

英文(电子+纸)版:2100美元 |

|

编号:LT-019

|

发布日期:2014-06 |

附件:下载 |

|

|

|

近年来中国机床、纺织、印刷、包装和电子等行业的快速发展有力带动了对运动控制器的需求。2006-2012年中国运动控制器需求量稳定增长,由2006年的25.36万套上升至2012年的75.45万套。2013年中国运动控制器市场需求依旧相对稳定,增速约为19%,需求量在90万套左右。

通用运动控制器作为伺服系统的控制装置,其市场规模受到伺服系统的直接影响。近几年,中国伺服系统市场的快速增长带动通用运动控制器的市场规模不断扩大,由2006 年的5.43 亿元增长到2012年的19.46亿元,年均复合增长率为23.7%。2013年中国通用运动控制器市场规模在23.4亿左右,同比增长约16.9%。

根据平台不同,通用运动控制器可以分为PLC 控制器、嵌入式控制器和PC-Based 控制卡三大类。2013年中国PLC控制器市场份额达55.68%,其次为嵌入式控制器。

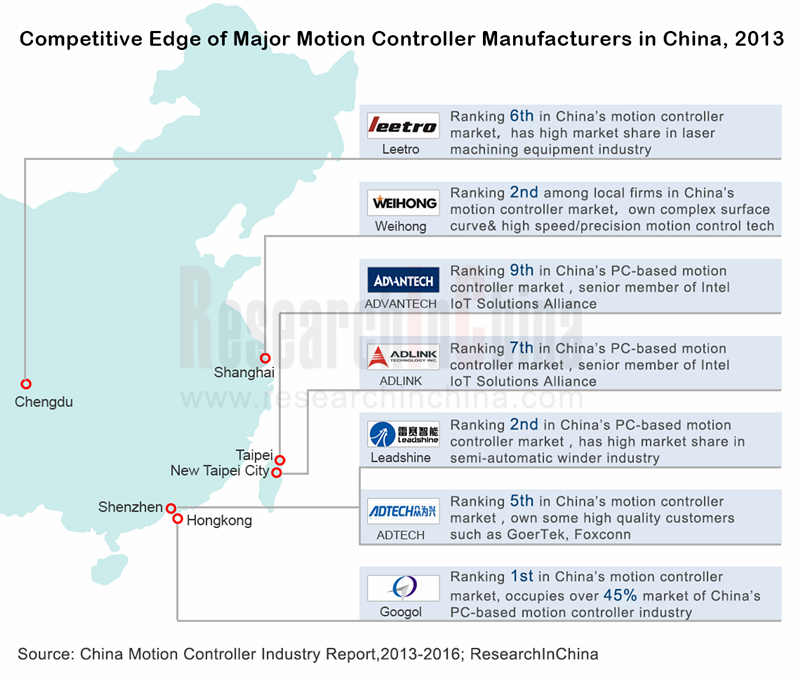

目前中国本土运动控制器企业如固高科技、上海维宏、雷塞等公司主要是针对中低端市场,欧美企业主要是针对高端市场,总体上来说,中国本土企业的市场份额超过50%。其中固高科技市场份额位居首位,2013年达14.2%。

Pc-based控制器近年来在中国发展迅速,主要原因是开放的系统、合理的性能和较低的价格,特别适合中国市场。在Pc-based控制器领域,本土厂商已逐渐崭露头角,领先厂商有固高科技、雷赛智能、众为兴、成都乐创、上海维宏等,这些厂商同时也为一些细分行业提供专用控制器。固高科技在该细分领域拥有统治性的优势,2013年市场份额高达45.32%。

未来几年,运动控制器的需求增长仍将集中于机床、印刷、包装,电子等行业,而烟草机械、医疗设备等行业对运动控制器的需求也将稳定增长,预计到2016年中国运动控制器需求量将接近190万套,而通用运动控制器市场规模有望达到40亿元左右。

水清木华研究中心《2013-2016年中国运动控制器行业研究报告》着重研究了以下内容:

中国运动控制器行业发展环境(包括产业、政策环境)分析等; 中国运动控制器行业发展环境(包括产业、政策环境)分析等;

中国运动控制器市场规模及未来3年预测、竞争格局(TOP10厂商市场份额)、供需分析等; 中国运动控制器市场规模及未来3年预测、竞争格局(TOP10厂商市场份额)、供需分析等;

中国运动控制器下游行业应用(包括机床、纺织机械、塑料机械行业等)市场分析等; 中国运动控制器下游行业应用(包括机床、纺织机械、塑料机械行业等)市场分析等;

中国11家中低压变频器重点企业(包括雷赛智能、固高、众为兴、研华、乐创等)经营情况及运动控制器器业务分析等。 中国11家中低压变频器重点企业(包括雷赛智能、固高、众为兴、研华、乐创等)经营情况及运动控制器器业务分析等。

In recent years, China has seen rapid development in machine tool, textile, printing, packaging, electronics, and other industries, which has boosted the demand for motion controllers. In 2006-2012, the demand for motion controllers in China presented steady growth, from 253,600 sets in 2006 to 754,500 sets in 2012. In 2013, the market demand for motion controllers in China still showed a relatively stable growth, at roughly 19%, to about 900,000 sets.

The market size of universal motion controllers, which serve as the control devices of the servo system, is directly influenced by the system. In recent years, the rapid growth of the servo system in China has driven the market size of universal motion controllers to rise from RMB543 million in 2006 to RMB1.946 billion in 2012, with a CAGR of 23.7%. And in 2013, the market size of general motion controllers in China stood at RMB2.34 billion, an increase of some 16.9% on a year-on-year basis.

According to different platforms, general motion controllers can fall into three categories: PLC controller, embedded controller, and PC-based controller card. In 2013, the market share of PLC controllers in China reached 55.68%, followed by embedded controllers.

Currently, some Chinese motion controller manufacturers including Googol Technology, Shanghai Weihong and Leadshine Technology are targeted at medium and low-end market while European and American companies focus mainly on high-end market. Generally, the market share of the Chinese enterprises has exceeded 50%, and Googol Technology ranked first with a 14.2% market share in 2013.

In recent years, with the open system, reasonable performance and lower prices, Pc-based controllers have developed at a fast pace in China, hence a popularity in the Chinese market. As for Pc-based controllers, the Chinese manufacturers have gradually emerged as major players, including Googol Technology, Leadshine Technology, Adtech, Leetro, and Shanghai Weihong, etc. Meanwhile, these players also provide dedicated controllers to some industry segments. However, Googol Technology has dominated the Pc-based controller market, with the market share in 2013 hitting as high as 45.32%.

In the forthcoming years, the growth of demand for motion controllers will still come from such industries as machine tool, printing, packaging, and electronics while the industries like tobacco machinery and medical device will see a steadily growing demand for motion controllers. It is projected that by 2016 the demand for motion controllers in China will be close to 1.9 million sets, and that the market size of general motion controllers will be very likely to reach RMB4 billion or so.

China Motion Controller Industry Report, 2013-2016 released by ResearchInChina will mainly deal with the followings:

Development environment of motion controllers in China, including industry and policy environment, etc.; Development environment of motion controllers in China, including industry and policy environment, etc.;

Market size of motion controllers in China and the expectations in the following 3 years, competition pattern (the market share of Top 10 manufacturers) as well as supply and demand, etc.; Market size of motion controllers in China and the expectations in the following 3 years, competition pattern (the market share of Top 10 manufacturers) as well as supply and demand, etc.;

Application of motion controllers in downstream sectors (including machine tools, textile machinery, plastics machinery industry, etc.) in China and market analysis, etc.; Application of motion controllers in downstream sectors (including machine tools, textile machinery, plastics machinery industry, etc.) in China and market analysis, etc.;

Operation of 11 key medium and low-voltage inverter manufacturers in China (including Leadshine Technology, Googol Technology, Adtech, Advantech and Leetro, etc.) and analysis of motion controller business, etc. Operation of 11 key medium and low-voltage inverter manufacturers in China (including Leadshine Technology, Googol Technology, Adtech, Advantech and Leetro, etc.) and analysis of motion controller business, etc.

第一章 运动控制器简介

1.1 定义与分类

1.2 行业进入壁垒

1.3 上下游产业链

第二章 中国运动控制器行业发展环境

2.1 产业环境

2.2 政策环境

第三章 中国运动控制器市场分析

3.1 发展概况

3.2 市场供需

3.3竞争格局

第四章 中国运动控制器应用行业分析

4.1 应用行业概述

4.2 数控机床

4.3 纺织机械

4.4 医疗设备

4.5 电子设备

4.6 塑料机械

4.7 印刷机械

第五章 中国运动控制器行业重点企业分析

5.1 雷赛智能

5.1.1 企业简介

5.1.2 经营情况

5.1.3 营收构成

5.1.4 毛利率

5.1.5 客户与供应商

5.1.6 研发

5.1.7 运动控制器业务

5.1.8 发展前景

5.2 众为兴

5.2.1 企业简介

5.2.2 经营情况

5.2.3 营收构成

5.2.4 毛利率

5.2.5 客户与供应商

5.2.6 运动控制器业务

5.2.8 发展前景

5.3 乐创

5.3.1 企业简介

5.3.2 经营情况

5.3.3 营收构成

5.3.4 毛利率

5.3.5 客户

5.3.6 研发

5.3.7 运动控制器业务

5.3.8 发展前景

5.4 固高科技

5.4.1 企业简介

5.4.2 经营情况

5.4.3 运动控制器业务

5.4.4 投资

5.5 凌华

5.5.1 企业简介

5.5.2 经营情况

5.5.3 营收构成

5.5.4 运动控制卡业务

5.5.6 发展前景

5.6 研华

5.6.1 企业简介

5.6.2 经营情况

5.6.3 营收构成

5.6.4 毛利率

5.6.5 研发与投资

5.6.6 运动控制卡业务

5.6.7 发展前景

5.7 科远股份

5.7.1 企业简介

5.7.2 经营情况

5.7.3 营收构成

5.7.4 毛利率

5.6.5 研发与投资

5.7.6 运动控制器业务

5.7.7 发展前景

5.8 维宏电子

5.8.1 公司简介

5.8.2 经营情况

5.1.3 营收构成

5.1.4 毛利率

5.1.5 客户与供应商

5.1.6 研发与投资

5.1.7 运动控制器业务

5.1.8 发展前景

5.9 多普康

5.9.1 企业简介

5.9.2 运动控制器业务

5.10 太控科技

5.10.1 企业简介

5.10.2 运动控制器业务

5.11 海川数控

5.11.1 企业简介

5.11.2 运动控制器业务

第六章 总结与预测

6.1 总结

6.2预测

1. Profile of Motion Controller

1.1 Definition and Classification

1.2 Industry Access Barrier

1.3 Upstream and Downstream Industry Chain

2 Development Environment of Motion Controller Industry in China

2.1 Industry Environment

2.2 Policy Environment

3 Motion Controller Market in China

3.1 Development

3.2 Supply & Demand

3.3 Competition Pattern

4 Motion Controller Application Industry in China

4.1 Overview of Application Industry

4.2 Numerically Controlled Machine Tools

4.3 Textile Machinery

4.4 Medical Equipment

4.5 Electronic Equipment

4.6 Plastic Machinery

4.7 Printing Machinery

5 Major Motion Controller Manufacturers in China

5.1 Leadshine Technology

5.1.1 Profile

5.1.2 Operation

5.1.3 Revenue Structure

5.1.4 Gross Margin

5.1.5 Clients and Suppliers

5.1.6 R&D

5.1.7 Motion Controller Business

5.1.8 Development Prospects

5.2 ADTECH

5.2.1 Profile

5.2.2 Operation

5.2.3 Revenue Structure

5.2.4 Gross Margin

5.2.5 Clients and Suppliers

5.2.6 Motion Controller Business

5.2.8 Development Prospects

5.3 Leetro Automation Co., Ltd.

5.3.1 Profile

5.3.2 Operation

5.3.3 Revenue Structure

5.3.4 Gross Margin

5.3.5 Clients

5.3.6 R&D

5.3.7 Motion Controller Business

5.3.8 Development Prospects

5.4 Googol Technology (HK) Limited

5.4.1 Profile

5.4.2 Operation

5.4.3 Motion Controller Business

5.4.4 Investment

5.5 ADLINK

5.5.1 Profile

5.5.2 Operation

5.5.3 Revenue Structure

5.5.4 Motion Control Card Business

5.5.6 Development Prospects

5.6 Advantech

5.6.1 Profile

5.6.2 Operation

5.6.3 Revenue Structure

5.6.4 Gross Margin

5.6.5 R&D and Investment

5.6.6 Motion Control Card Business

5.6.7 Development Prospects

5.7 Sciyon

5.7.1 Profile

5.7.2 Operation

5.7.3 Revenue Structure

5.7.4 Gross Margin

5.6.5 R&D and Investment

5.7.6 Motion Controller Business

5.7.7 Development Prospects

5.8 Shanghai Weihong Electronic Technology Co., Ltd.

5.8.1 Profile

5.8.2 Operation

5.1.3 Revenue Structure

5.1.4 Gross Margin

5.1.5 Clients and Suppliers

5.1.6 R&D and Investment

5.1.7 Motion Controller Business

5.1.8 Development Prospects

5.9 TOPCNC Automation Technology Co., Ltd.

5.9.1 Profile

5.9.2 Motion Controller Business

5.10 Tankon

5.10.1 Profile

5.10.2 Motion Controller Business

5.11 Haichuan Numerical Control Technology Co., Ltd.

5.11.1 Profile

5.11.2 Motion Controller Business

6 Summary and Forecast

6.1 Summary

6.2 Forecast

表:运动控制器分类

图:运动控制器行业产业链

图:2006-2015年中国伺服系统产品市场规模

图:2013年中国伺服系统(分行业)市场份额

表:2004-2013年中国运动控制器相关政策

图:中国运动控制器行业发展趋势

图:2006-2013年中国运动控制产品市场规模

图:2013年中国通用控制器(分类型)市场份额

2006-2013年中国通用运动控制器市场规模

图:2006-2013年中国运动控制器产量

图:2006-2013年中国运动控制器控制轴产量

图:2006-2013年中国运动控制器行业需求量

图:2013年中国运动控制器主要厂商市场份额

图:2013年中国PC-based控制器主要厂商市场份额

图:2013年中国运动控制器(分行业)市场份额占比

图:2006-2013年中国机床工具市场规模

图:2008-2015年中国数控机床行业运动控制市场规模

图:2008-2015年中国雕刻雕铣行业运动控制市场规模

图:2008-2015年中国雕刻雕铣行业运动控制市场规模

图:2006-2015年中国纺织机械行业市场规模

图:截止2013年中国运动控制产品在纺织机械行业的运用情况

图:2004-2013年中国医疗设备行业市场规模

图:2009-2015年中国电子设备制造行业市场规模

图:2004-2013年中国塑料加工机械行业市场规模

图:2004-2013年中国印刷机械行业市场规模

图:2011-2013年雷赛智能营业收入与净利润

图:2011-2013年雷赛智能(分产品)营业收入占比

图:2011-2013年雷赛智能(分地区)营业收入占比

图:2011-2013年雷赛智能(分销售模式)营业收入占比

表:2011-2013年雷赛智能经销商营业收入及占比(RMB thousand)

图:2011-2013年雷赛智能(分行业)营业收入占比

图:2011-2013年雷赛智能(分产品)毛利率

图:2011-2013年雷赛智能前五名供应商合计采购金额及占比

表:2013年雷赛智能前五名供应商采购金额及占比

图:2011-2013年雷赛智能前五名客户合计营业收入及占比

表:2013年雷赛智能前五名客户营业收入及占比

图:2011-2013年雷赛智能研发支出及占营业收入比例

表:截至2014年一季度雷赛智能通用运动控制器研发项目

图:2011-2013年雷赛智能运动控制器(分产品)营业收入

图:2011-2013年雷赛智能运动控制器(分产品)平均售价

图:2011-2013年雷赛智能运动控制器销量及毛利率

图:2013-2016年雷赛智能营业收入及净利润

图:2011-2013年众为兴营业收入与净利润

图:2013年众为兴(分产品)营收占比

图:2013年众为兴(分产品)毛利率

表:众为兴主要运动控制器产品

图:2013-2016年众为兴营业收入与净利润

图:2011-2013年乐创营业收入与净利润

图:2011-2013年乐创(分产品)营收构成

图:2011-2013年乐创(分地区)营收构成

图:2011-2013年乐创(分产品)毛利率

图:2011-2013年乐创前五名客户合计营业收入及占比

图:2011-2013年乐创研发支出及占营业收入比例

图:2011-2013年乐创运动控制器营业收入及毛利率

表:乐创主要运控控制器产品

表:2013-2016年乐创运动控制器营业收入及毛利率

图:2009-2010年固高科技营业收入与净利润

表:固高科技主要运动控制器产品

图:2009-2013年凌华科技营业收入及净利润

图:2010-2013年凌华科技(分产品)营收构成

图:2010-2013年凌华科技(分地区)营收构成

表:凌华科技主要运动控制卡产品

图:2013-2016年凌华科技营业收入及净利润

图:2008-2013年研华科技营业收入及利润总额

图:2010-2013年研华科技(分产品)营收构成

图:2010-2013年研华科技(分地区)营收构成

图:2010-2013年研华科技毛利率

图:2008-2013年研华科技研发支出及占营业收入比例

表:2013年研华科技收购公司列表

图:2013年研华收购公司营业收入及净利润

表:研华科技主要运动控制卡产品

图:2013-2016年研华科技营业收入及净利润

图:2008-2014年科远股份营业收入及净利润

图:2008-2013年科远股份(分产品)营收占比

图:2008-2013年科远股份(分地区)营收占比

图:2008-2013年科远股份(分产品)毛利率

图:2008-2013年科远股份研发支出及占营业收入比例

表:截止2013年底科远股份募投项目建设情况

表:科远股份运动控制器产品

图:2013-2016年科远股份营业收入及净利润

图:2011-2013年维宏电子营业收入与净利润

图:2011-2013年维宏电子(分产品)营业收入占比

图:2011-2013年维宏电子(分地区)营业收入占比

图:2011-2013年维宏电子(分产品)毛利率

图:2011-2013年维宏电子前五名供应商合计采购金额及占比

表:2013年维宏电子前五名供应商采购金额及占比

图:2011-2013年维宏电子前五名客户合计营业收入及占比

表:2013年维宏电子前五名客户营业收入及占比

图:2011-2013年维宏电子研发支出及占营业收入比例

表:2013年维宏电子上市募集资金投资项目

图:2011-2013年维宏电子运动控制卡销量及产销率

图:2013-2016年维宏电子营业收入及净利润

表:多普康主要运动控制器产品

表:太控科技主要运动控制器产品

表:海川数控主要运动控制器产品

图:2011-2013年中国主要本土运动控制器厂商毛利率

图:2013-2016年中国运动控制器需求量

图:2006-2016年中国通用运动控制器市场规模

Classification of Motion Controllers

Motion Controller Industry Chain

Market Size of Servo System Products in China, 2006-2015E

Market Share of Servo Systems in China by Sector, 2013

Policies on Motion Controllers in China, 2004-2013

Development Trend of Motion Controller Industry in China

Market Size of Motion Controllers in China, 2006-2013

Market Share of Motion Controllers in China by Type, 2013

Market Size of General Motion Controllers in China, 2006-2013

Output of Motion Controllers in China, 2006-2013

Output of Control Shafts of Motion Controllers in China, 2006-2013

Demand for Motion Controllers in China, 2006-2013

Market Share of Major Motion Controller Manufacturers in China, 2013

Market Share of Major PC-based Motion Controller Manufacturers in China, 2013

Market Share Breakdown of Motion Controllers in China by Sector, 2013

Market Size of Machine Tools in China, 2006-2013

Market Size of Motion Control Products in CNC Machine Tool Industry in China, 2008-2015E

Market Size of Motion Control Products in Engraving and Milling Industry in China, 2008-2015E

Market Size of Motion Control Products in Engraving and Milling Industry in China, 2008-2015E

Market Size of Textile Machinery Industry in China, 2006-2015E

Application of Motion Controllers in Textile Machinery Industry in China by 2013

Market Size of Medical Device Industry in China, 2004-2013

Market Size of Electronic Equipment Manufacturing Industry in China, 2009-2015E

Market Size of Plastic Processing Machinery Industry in China, 2004-2013

Market Size of Printing Machinery Industry in China, 2004-2013

Revenue and Net Income of Leadshine Technology, 2011-2013

Revenue Structure of Leadshine Technology by Product, 2011-2013

Revenue Structure of Leadshine Technology by Region, 2011-2013

Revenue Structure of Leadshine Technology by Sales Model, 2011-2013

Leadshine Technology’s Revenue from Distributors and % of Total Revenue, 2011-2013

Revenue Structure of Leadshine Technology by Sector, 2011-2013

Gross Margin of Leadshine Technology by Product, 2011-2013

Leadshine Technology’s Procurement from Top 5 Suppliers and % of Total Procurement, 2011-2013

Leadshine Technology’s Procurement from Top 5 Suppliers and % of Total Procurement, 2013

Leadshine Technology’s Revenue Top 5 Clients and % of Total Revenue, 2011-2013

Leadshine Technology’s Revenue from Top 5 Clients and % of Total Revenue, 2013

R&D Costs of Leadshine Technology and % of Revenue, 2011-2013

General Motion Controller R&D Project of Leadshine Technology by 2014Q1

Leadshine Technology’s Revenue from Motion Controllers by Product, 2011-2013

Average Selling Price of Motion Controllers of Leadshine Technology, 2011-2013

Sales Volume and Gross Margin of Motion Controllers of Leadshine Technology, 2011-2013

Revenue and Net Income of Leadshine Technology, 2013-2016E

Revenue and Net Income of ADTECH, 2011-2013

Revenue Structure of ADTECH by Product, 2013

Gross Margin of ADTECH by Product, 2013

Main Motion Controllers of ADTECH

Revenue and Net Income of ADTECH, 2013-2016E

Revenue and Net Income of Leetro, 2011-2013

Revenue Structure of Leetro by Product, 2011-2013

Revenue Structure of Leetro by Region, 2011-2013

Gross Margin of Leetro by Product, 2011-2013

Leetro’s Revenue from Top 5 Clients and % of Total Revenue, 2011-2013

R&D Costs of Leetro and % of Revenue, 2011-2013

Leetro’s Revenue and Gross Margin from Motion Controllers, 2011-2013

Main Motion Controllers of Leetro

Leetro’s Revenue and Gross Margin from Motion Controllers, 2013-2016E

Revenue and Net Income of Googol Technology, 2009-2010

Main Motion Controllers of Googol Technology

Revenue and Net Income of ADLINK, 2009-2013

Revenue Structure of ADLINK by Product, 2010-2013

Revenue Structure of ADLINK by Region, 2010-2013

Motion Control Card Products of ADLINK

Revenue and Net Income of ADLINK, 2013-2016E

Revenue and Total Profit of Advantech, 2008-2013

Revenue Structure of Advantech by Product, 2010-2013

Revenue Structure of Advantech by Region, 2010-2013

Gross Margin of Advantech, 2010-2013

R&D Costs of Advantech and % of Revenue, 2008-2013

List of Companies Acquired by Advantech, 2013

Revenue and Net Income of Companies Acquired by Advantech, 2013

Motion Control Card Products of Advantech

Revenue and Net Income of Advantech, 2013-2016E

Revenue and Net Income of Sciyone, 2008-2014

Revenue Structure Sciyon by Product, 2008-2013

Revenue Structure of Sciyon by Region, 2008-2013

Gross Margin of Sciyon by Product, 2008-2013

R&D Costs of Sciyon and % of Revenue, 2008-2013

Progress of Sciyon’s Self-Raised Fund Investment Projects by the End of 2013

Motion Controllers of Sciyon

Revenue and Net Income of Sciyon, 2013-2016E

Revenue and Net Income of Weihong Electronic, 2011-2013

Revenue Structure of Weihong Electronic by Product, 2011-2013

Revenue Structure of Weihong Electronic by Region, 2011-2013

Gross Margin of Weihong Electronic by Product, 2011-2013

Weihong Electronic’s Procurement from Top 5 Suppliers and % of Total Procurement, 2011-2013

Weihong Electronic’s Procurement from Top 5 Suppliers and % of Total Procurement, 2013

Weihong Electronic’s Revenue from Top 5 Clients and % of Total Revenue, 2011-2013

Weihong Electronic’s Revenue from Top 5 Clients and % of Total Revenue, 2013

R&D Costs of Weihong Electronic and % of Revenue, 2011-2013

Raised Fund Investment Projects of Listed Weihong Electronic, 2013

Sales Volume and Sales-output Ratio of Motion Control Cards of Weihong Electronic, 2011-2013

Revenue and Net Income of Shanghai Weihong Electronic Technology, 2013-2016E

Main Motion Controllers of TOPCNC

Main Motion Controllers of Tankon

Main Motion Controllers of Haichuan Numerical Control

Gross Margin of Chinese Motion Controller Manufacturers, 2011-2013

Demand for Motion Controllers in China, 2013-2016E

Market Size of General Motion Controllers in China, 2006-2016E

如果这份报告不能满足您的要求,我们还可以为您定制报告,请 留言说明您的详细需求。

|