|

|

|

报告导航:研究报告—

TMT产业—电子半导体

|

|

2013-2014年全球及中国IC载板行业研究报告 |

|

字数:1.1万 |

页数:100 |

图表数:126 |

|

中文电子版:8000元 |

中文纸版:4000元 |

中文(电子+纸)版:8500元 |

|

英文电子版:2200美元 |

英文纸版:2400美元 |

英文(电子+纸)版:2500美元 |

|

编号:ZYW185

|

发布日期:2014-07 |

附件:下载 |

|

|

|

《2013-2014年全球及中国IC载板行业研究报告》包含以下内容:

1、全球半导体产业现状

2、IC载板简介

3、IC载板市场分析

4、IC载板产业分析

5、11家IC载板厂家研究

6、全球前4大IC封装厂家研究

PCB行业可分硬板(Rigid PCB)、软板(FPCB)、载板(Substrate)三大类。IC载板行业在2012和2013年两年连续下滑,根源在两方面:一是因为PC出货量下降,而CPU用载板是IC载板的主要类型,是单价(ASP)最高的载板;二是韩国企业为压制日本和台湾IC载板厂家的发展,大幅度降价,尤其是三星旗下的三星电机(SEMCO)大幅度降价近30%。这导致2013年全球IC载板行业市场规模下跌10.3%,至75.68亿美元。不过苦尽甘来,预计2014和2015年IC载板行业将迎来增长。

2014年增长的动力有几方面。首先是联发科的8核芯片MT6592采用FC-CSP封装,该芯片在2013年10月推出,预计2014年出货量会大增。随着联发科进入28nm时代,联发科会全面采用FC-CSP封装,接下来中国大陆的展讯也会采用。其次是LTE 4G网络开始兴建,BASESTATION 芯片需要IC载板。

其三,是可穿戴设备(wearable devices)大量进入市场,这会刺激SiP模块封装,也需要IC载板。其四是手机追求超薄,就需要芯片具备良好的散热,FC-CSP封装在散热和厚度方面优势明显,未来手机的主要芯片都会是FC-CSP封装或SiP模块封装,包括电源管理和存储器。

其五,PC行业在2014年复苏。平板电脑在2014年高增长不再来,甚至会下滑,消费者意识到平板电脑只能做玩具,完全无法和PC比性能,PC行业将复苏。最后三星电机(SEMCO)不再杀价竞争,因为苹果下一代处理器A8确定会由台湾TSMC代工,而非三星电子代工。三星电机(SEMCO)即便杀价,也不可能让台湾TSMC给予其订单。

预计2014年全球IC载板行业市场规模增长9.8%,2015年会加速增长,增幅达11.6%。

IC载板行业可以分为日韩台三大阵营。日本企业是IC载板的开创者,技术实力最强,掌握利润最丰厚的CPU载板。韩国和台湾企业则依靠产业链配合,韩国拥有全球70%左右的内存产能,三星一直为苹果代工处理器,三星也能够生产部分手机芯片。

台湾企业则在产业链上更强大,台湾拥有全球65%的晶圆代工产能,80%的手机高级芯片由台湾TSMC或UMC代工,这些代工的利润率远高于传统电子产品的利润率,毛利率在50%以上。以联发科的MT6592为例,代工由TSMC或UMC完成,封装由ASE和SPIL完成,载板由景硕提供,测试由KYEC完成,这些厂家都在一个厂区内,效率极高。

大陆企业在产业链完全没有任何优势,缺乏晶圆代工厂家和封装厂家支持,落后台湾数年乃至十几年。即便有海思和展讯这样出货量不低的大陆企业,台湾厂家仍然占据供应链的话语权。

Global and China IC Substrate Industry Report, 2014-2015 contains the followings

1. Status quo of global semiconductor industry

2. Introduction of IC substrate

3. Analysis on IC substrate market

4. Analysis on IC substrate industry

5. Research on 11 IC substrate vendors

6. Research on the world’s top 4 IC substrate packaging companies.

PCB (printed circuit board) industry can be divided into three broad categories i.e. rigid PCB, flexible PCB (FPCB) and substrate. IC substrate industry suffered a continuous decline in 2012 and 2013, rooted in two aspects: first, the PC shipment declined, and CPU substrate as the main type of IC substrate enjoyed the highest average selling price (ASP); second, to suppress the development of Japanese and Taiwanese IC substrate vendors, Korean companies slashed price, Samsung Electro-Mechanics (SEMCO), in particular, implemented a nearly 30% price cut. This led to the global IC substrate industry market scale down 10.3% to USD7.568 billion in 2013. But after suffering comes happiness, IC substrate industry is expected to bloom in 2014 and 2015.

There are several factors for the growth in 2014.

First, MediaTek’s 8-core MT6592 adopts FC-CSP packaging. Released in October 2013, the chip will see shipment boost-up in 2014. Entering the age of 28nm, MediaTek will ensure uniform adoption of FC-CSP packaging; Spreadtrum from Mainland China will follow in its footsteps. First, MediaTek’s 8-core MT6592 adopts FC-CSP packaging. Released in October 2013, the chip will see shipment boost-up in 2014. Entering the age of 28nm, MediaTek will ensure uniform adoption of FC-CSP packaging; Spreadtrum from Mainland China will follow in its footsteps.

Second, LTE 4G networks are under construction, thereof IC substrate is needed by BASESTATION chip. Second, LTE 4G networks are under construction, thereof IC substrate is needed by BASESTATION chip.

Third, wearable devices are invading the market, which will stimulate SiP module packaging, also needs IC substrate. Third, wearable devices are invading the market, which will stimulate SiP module packaging, also needs IC substrate.

Fourth, the pursuit of ultra-thin mobile phone requires chip with good heat dissipation, FC-CSP packaging boasts obvious advantages in terms of heat dissipation and thickness. Main chip for mobile phone of the future will be the FC-CSP packaging or SiP module packaging, involving power management and memory. Fourth, the pursuit of ultra-thin mobile phone requires chip with good heat dissipation, FC-CSP packaging boasts obvious advantages in terms of heat dissipation and thickness. Main chip for mobile phone of the future will be the FC-CSP packaging or SiP module packaging, involving power management and memory.

Fifth, PC industry will revive in 2014. Tablet PC will not see high growth, even fall in 2014, since consumers have been aware of its function only as a toy but completely unable to compare with PC in performance, PC industry will usher in recovery. At last, SEMCO will not fall back on price-cutting competition, because it is Taiwan’s TSMC not Samsung Electronics that on track to produce Apple’s next-generation processor A8. Even slashing price, it is impossible for TSMC to turn over the order. Fifth, PC industry will revive in 2014. Tablet PC will not see high growth, even fall in 2014, since consumers have been aware of its function only as a toy but completely unable to compare with PC in performance, PC industry will usher in recovery. At last, SEMCO will not fall back on price-cutting competition, because it is Taiwan’s TSMC not Samsung Electronics that on track to produce Apple’s next-generation processor A8. Even slashing price, it is impossible for TSMC to turn over the order.

The global IC substrate industry market scale is expected to grow at a rate of 9.8% in 2014, and then speed up to 11.6% in 2015.

IC substrate industry falls into three camps i.e. Japan, Korea and Taiwan. Japanese companies as the IC substrate pioneer have the strongest technical strength, mastering the most profitable CPU substrate. Korean and Taiwanese companies rely on the industrial chain cooperation, the former hold about 70% of the world's memory capacity, the Apple’s processor foundry provider Samsung also can produce part of mobile phone chips.

Taiwanese companies are more powerful in the industrial chain by possessing 65% of global foundry production capacity and 80% of senior mobile phone chip foundry (by TSMC or UMC), whose margin is much higher than that of traditional electronic products, (gross margin) exceeding 50%. MediaTek’s MT6592, for instance, the foundry is charged by TSMC or UMC, the packaging is completed by ASE and SPIL, the substrate is offered by Kinsus and testing by KYEC; sharing the same factory, these vendors are pretty high-efficient.

The utterly disadvantaged Mainland Chinese companies in the industrial chain lack support from foundries and packaging companies, lagging behind Taiwanese counterparts several even a dozen years. Even Hisilicon and Spreadtrum have impressive shipments, Taiwanese companies still hold the discourse right of the supply chain.

第一章、全球半导体产业

1.1、全球半导体产业概况

1.2、IC封装概况

1.3、IC封测产业概况

第二章、IC载板简介

2.1、IC载板简介

2.2、FLIP CHIP IC 载板

2.3、IC载板趋势

第三章、IC载板市场与产业

3.1、IC载板市场

3.2、手机市场

3.3、WLCSP市场

3.4、PC市场

3.5、平板电脑市场

3.6、FPGA与CPLD市场

3.7、IC载板产业

3.8、晶圆代工FOUNDRY市场规模

3.9、晶圆代工行业竞争分析

第四章、IC载板厂家研究

4.1、欣兴

4.2、IBIDEN

4.3、大德电子

4.4、SIMMTECH

4.5、LG INNOTEK

4.6、SEMCO

4.7、南亚电路板

4.8、景硕KINSUS

4.9、SHINKO

4.10、KYOCERA SLC

4.11、AT&S

第五章、IC载板封装厂家研究

5.1、日月光

5.2、AMKOR

5.3、矽品精密

5.4、星科金朋

5.5、三菱瓦斯化学

1. Global Semiconductor Industry

1.1 Overview

1.2 IC Packaging

1.3 IC Packaging and Testing

2. IC Substrate

2.1 Introduction

2.2 Flip Chip IC Substrate

2.3 Trends

3. IC Substrate Market and Industry

3.1 IC Substrate Market

3.2 Mobile Phone Market

3.3 WLCSP Market

3.4 PC Market

3.5 Tablet PC Market

3.6 FPGA and CPLD Market

3.7 IC Substrate Industry

3.8 Wafer Foundry Market Size

3.9 Wafer Foundry Industry Competition

4. IC Substrate Vendors

4.1 Unimicron

4.2 IBIDEN

4.3 Daeduck Electronics

4.4 SIMMTECH

4.5 LG INNOTEK

4.6 SEMCO

4.7 Nan Ya PCB

4.8 Kinsus

4.9 Shinko

4.10 Kyocera SLC

4.11 AT&S

5. IC Substrate Packaging Companies

5.1 ASE

5.2 Amkor

5.3 Siliconware Precision

5.4 STATS ChipPAC

5.5 MITSUBISHI GAS CHEMICAL COMPANY

2009-2014年全球半导体产业季度收入

2008-2017年全球半导体产业年度收入

2012-2017年全球半导体市场产品分布

2012-2017年各种半导体产品市场规模增幅

主要电子产品使用IC的封装类型

2012-2017年全球IC Packaging and Test市场规模

2012-2017年全球Outsourcing IC Packaging and Test市场规模

2012-2017年全球IC Packaging 市场规模

2012-2017年全球IC Test市场规模

2009-2013年台湾封测产业收入

2013年全球前10大封装企业收入

2009-2016年IC载板市场规模

IC载板具体应用产品

2011-2016 IC载板 by node

2007-2015年全球手机出货量

Worldwide Smartphone Sales to End Users by Vendor in 2013 (Thousands of Units)

Worldwide Smartphone Sales to End Users by Operating System in 2013 (Thousands of Units)

Worldwide Mobile Phone Sales to End Users by Vendor in 2013 (Thousands of Units)

2010-2016年WLCSP封装市场规模

2010-2016年WLCSP出货量下游应用分布

2008-2015年全球PC用CPU与Discrete GPU 出货量

2011-2016年全球平板电脑出货量

2013年平板电脑主要品牌市场占有率

2012、2013年全球平板电脑制造厂家产量

2011年FPGA、CPLD市场下游分布与地域分布

1999-2013年主要FPGA厂家市场占有率

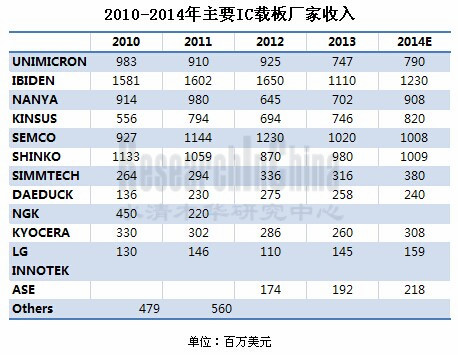

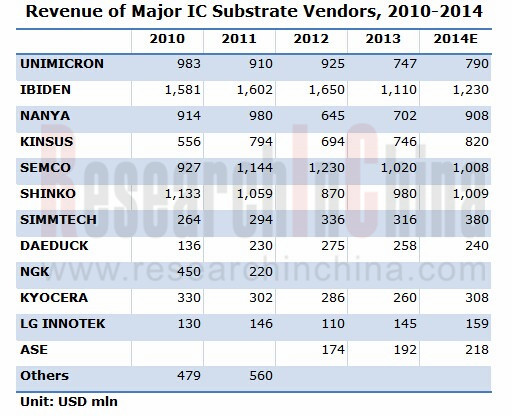

2010-2014年主要IC载板厂家收入

2008-2017年全球Foundry市场规模

2012-2017 Foundry Revenue of Advanced Nodes

2012-2018 Global Foundry capacity by node

2012-2018 Global Foundry revenue by node

Global ranking by foundry

2003-2014年欣兴收入与毛利率

2009-2014年欣兴收入与营业利润率

2012年1季度-2014年1季度欣兴季度收入与毛利率

2010-2014年欣兴销售额技术分布

2010-2014年欣兴收下游应用分布

2010-2014欣兴产能Capacity

2004-2013年欣兴CAPEX

欣兴历年合并

2012年2季度-2014年1季度IBIDEN季度收入业务分布

2012年2季度-2014年1季度IBIDEN季度营业利润业务分布

2010-2015财年ibiden电子事业部收入产品分布

2010-2015财年ibiden CAPEX与depreciation

SIMM TECH组织结构

2009-2013年SIMMTECH资产负债表

2013年1季度-2014年4季度SIMMTECH季度收入产品分布

2012-2015年SIMMTECH收入产品分布

2013年1季度-2014年4季度SIMMTECH季度毛利率与运营利润率

2013年1季度-2014年4季度SIMMTECH季度出货量

2012-2015年SIMMTECH出货量

2013年1季度-2014年4季度SIMMTECH季度产能利用率

2012-2015年SIMMTECH产能利用率

2008-2014年SIMMTECH收入by application

2012-2014年SIMMTECH Substrate收入by application

2006-2014年LG INNOTEK收入与运营利润率

2013-2015年SEMCO IC Substrate sales by technology

2013-2015年SEMCO IC Substrate operatio profit by technology

南亚电路板组织结构

2006-2014年南亚电路板收入与毛利率

2009-2014年南亚电路板收入与营业利润率

2012年5月-2014年5月南亚电路板每月收入与增幅

2004-2014年景硕收入与毛利率

2009-2014年景硕收入与营业利润率

2012年5月-2014年5月景硕每月收入与增幅

2011-2014年景硕收入产品分布

2011年景硕收入下游应用分布

Q1/2014景硕收入BY Applications

2013\2014 KINSUS客户分布

2007-2015财年Shinko收入与净利润

2010-2014财年Shinko收入业务分布

2005-2014财年 AT&S与EBITDA率

AT&S重庆substrate厂ramp

FY2014 AT&S收入地域分布

FY2014 AT&S资产负债表

20092-2014年日月光收入与营业利润率

2012年5月-2014年5月日月光月度收入

2010-2013年ASE收入业务分布

2013年1季度-2014年1季度ASE封装部门收入与毛利率

2013年1季度-2014年1季度ASE封装部门收入类型分布

2013年1季度-2014年1季度ASE材料部门收入与毛利率

2013年1季度-2014年1季度ASE EMS收入与毛利率

2013年1季度-2014年1季度ASE EMS收入breakdown

2014年1季度ASE收入下游应用

2007-2012年Amkor收入封装类型分布

矽品精密工业组织结构

2012年5月-2014年5月SPIL月度收入

2012年1季度-2014年1季度SPIL季度收入、毛利率与营业利润率

2005-2014年矽品收入地域分布

2005-2014年矽品收入下游应用分布

2005-2014年矽品收入业务分布

矽品2006-2014年产能统计

三菱瓦斯化学Organization Chart

2009-2015财年MGC收入与营业利润

2009-2015财年MGC收入by segment

2009-2015财年MGC operation income by segment

2011-2014年全球3G/4G手机出货量地域分布

欣兴组织结构

2006-2015财年IBIDEN收入与运营利润率

2006-2015财年IBIDEN收入业务分布

2005-2014年大德电子收入与运营利润率

2009-2014年大德电子收入by bunesiss

2004-2014年SIMMTECH收入与运营利润率

2009-2014年SIMMTECH收入、毛利率与净利率

SIMMTECH厂区

2011年1季度-2014年1季度LG INNOTEK收入与运营利润率

2011-2014年LG INNOTEK 收入业务分布

2011-2013年LG INNOTEK 运营利润业务分布

2010-2014年SEMCO收入部门分布

2012-2014年SEMCO营业利润部门分布

2013年1季度-2014年4季度SEMCO ACI事业部收入与运营利润率

南亚电路板产能与全球分布

日月光组织结构

2001-2014年日月光收入与毛利率

2005-2014年Amkor收入与毛利率、运营利润率

2003-2014年矽品收入、毛利率、运营利润率

2004-2014年星科金朋收入与毛利率

2006-2013年星科金朋收入封装类型分布

2006-2013年星科金朋收入下游应用分布

2006-2013年星科金朋收入 地域分布

Quarterly Revenue of Global Semiconductor Industry, 2009-2014

Revenue of Global Semiconductor Industry, 2008-2017E

Revenue of Global Semiconductor Industry by Product, 2012-2017E

Market Size Growth of Global Semiconductor Industry by Product, 2012-2017E

Annual Capital Expenditure of Semiconductor Industry, 2008-2017E

Capital Expenditure of Global Semiconductor Industry by Downstream Application, 2008-2017E

IC Packaging Types Used by Major Electronic Products

Global IC Packaging and Testing Market Size, 2012-2017E

Global Outsourcing IC Packaging and Testing Market Size, 2012-2017E

Global IC Packaging Market Size, 2012-2017E

Global IC Testing Market Size, 2012-2017E

Revenue of Taiwan Semiconductor Packaging & Testing Service Revenue, 2009-2013

Revenue of Global Top Ten Packaging Vendors, 2013

Global IC Substrate Market Size, 2009-2016E

Application Products of IC Substrate

IC Substrate by Node, 2011-2016E

Global Mobile Phone Shipment, 2007-2015E

Global 3G/4G Mobile Phone Shipment by Region, 2011-2014

Worldwide Smartphone Sales to End Users by Vendor, 2013 (Thousands of Units)

Worldwide Smartphone Sales to End Users by Operating System, 2013 (Thousands of Units)

Worldwide Mobile Phone Sales to End Users by Vendor, 2013 (Thousands of Units)

WLCSP Packaging Market Size, 2010-2016

WLCSP’s Shipment by Application, 2010-2016

Global PC-use CPU and Discrete GPU Shipment, 2008-2015

Global Tablet PC Shipment, 20011-2016

Market Share of Major Tablet PC Brands,2013

Shipment of Major Global Tablet PC Vendors, 2012-2013

Application Distribution and Geographical Distribution of FPGA and CPLD Market, 2011

Market Share of Major FPGA Vendors, 1999-2013

Revenue of Major IC Substrate Vendors, 2010-2014

Global Foundry Market Size, 2008-2017

Foundry Revenue of Advanced Nodes, 2012-2017

Global Foundry Capacity by Node, 2012-2018

Global Foundry Revenue by Node, 2012-2018

Global Ranking by Foundry, 2013

Unimicron’s Organizational Structure

Unimicron’s Revenue and Gross Margin, 2003-2014

Unimicron’s Revenue and Operating Margin, 2009-2014

Unimicron’s Quarterly Revenue and Gross Margin, Q1 2012-Q1 2014

Unimicron’s Sales Breakdown by Technology, 2010-2014

Unimicron’s Sales Breakdown by Application, 2010-2014

Unimicron’s Capacity by Product, 2010-2014

Unimicron’s CAPEX, 2004-2013

Unimicron's M & A

IBIDEN Revenue and Operating Margin, FY2006-FY2015

Revenue of IBIDEN by Business, FY2006-FY2015

Revenue of IBIDEN by Business, Q2 FY2012-Q1 FY2014

Operating Income of IBIDEN by Business,Q2 FY2012-Q1 FY2014

Revenue of IBIDEN ‘s Electronics Business by Product, FY2010-FY2015

IBIDEN’s CAPEX and Depreciation, FY2010-FY2015

Major Projects of IBIDEN in 2014

Revenue and Operating Margin of Daeduck Electronics, 2005-2014

Revenue of Daeduck Electronics by Business, 2009-2014

SIMMTECH’s Organizational Structure

SIMMTECH’s Revenue and Operating Margin, 2004-2014

Revenue, Gross Margin and Net Margin of SIMMTECH, 2009-2014

SIMMTECH’s Balance Sheet, 2009-2013

Quarterly Revenue of SIMMTECH by Product, Q3 2013-Q4 2014

Revenue of SIMMTECH by Product, 2012- 2015

Quarterly Gross Margin and Operating Margin of SIMMTECH, Q1 2013-Q4 2014

Quarterly Shipment of SIMMTECH, Q1 2013-Q4 2014

SIMMTECH’s Shipment, 2012-2015

Quarterly Capacity Utilization of SIMMTECH, Q1 2013-Q4 2014

Capacity Utilization of SIMMTECH, 2012- 2015

SIMMTECH’s Revenue by Application, 2008-2014

Substrate Revenue of SIMMTECH by Application, 2012-2014

SIMMTECH’s Plants

Revenue and Operating Margin of LG INNOTEK, 2006-2014

Quarterly Revenue and Operating Margin of LG INNOTEK, Q1 2011-Q1 2014

Revenue of LG INNOTEK by Business, 2011-2014

Operating Income of LG INNOTEK by Business, 2011-2013

Revenue and Operating Margin of SEMCO, 2009-2014

Revenue of SEMCO by Segment, 2010-2014

Operating Income of SEMCO by Segment, 2012-2014

Quarterly Revenue and Operating Margin of SEMCO’s ACI Segment, Q1 2013- Q4 2014

SEMCO’s IC Substrate Sales by Technology, 2013-2015

Operating Income of SEMCO’s IC Substrate by Technology, 2013-2015

Organizational Structure of Nan Ya PCB

Revenue and Gross Margin of Nan Ya PCB, 2006-2014

Revenue and Operating Margin of Nan Ya PCB, 2009-2014

Monthly Revenue and Growth Rate of Nan Ya PCB, May 2012-May 2014

Production Allocation and Monthly Capacity of Nan Ya PCB

Revenue and Gross Margin of Kinsus, 2004-2014

Revenue and Operating Margin of Kinsus, 2009-2014

Monthly Revenue and Growth Rate of Kinsus, May 2012-May 2014

Revenue of Kinsus by Product, 2011-2014

Revenue of Kinsus by Downstream Application, 2011

Revenue of Kinsus by Applications, Q1 2014

Client Structure of KINSUS, 2013-2014

Shinko’s Revenue and Net Income, FY2007-FY2015

Shinko’s Revenue by Business, FY2011-FY2014

Revenue and EBITDA Margin of AT&S, FY2005-FY2014

Global Presence of AT&S

Substrate Plant Ramp of AT&S in Chongqing

Revenue of AT&S by Region, FY2014

Balance Sheet of AT&S, FY2014

ASE Group Organization Chart

ASE’s Revenue and Gross Margin, 2001-2014

ASE’s Revenue and Operating Margin, 2009-2014

Monthly Revenue of ASE, May 2012-May 2014

ASE’s Revenue by Business, 2010-2013

Revenue and Gross Margin of ASE’s Packaging Division, Q1 2013-Q1 2014

Revenue of ASE’s Packaging Division by Type, Q1 2013-Q1 2014

Revenue and Gross Margin of ASE’s Materials Division, Q1 2013-Q1 2014

Revenue and Gross Margin of ASE’s EMS, Q1 2013-Q1 2014

Revenue of ASE’s EMS by Application, Q1 2013-Q1 2014

ASE’s Revenue by Application, Q1 2014

Amkor’s Revenue and Gross Margin and Operating Margin, 2005-2014

Amkor’s Revenue by Packaging Type, 2007-2012

Amkor’s Revenue by Product, 2012-2014Q1

Organizational Structure of Siliconware Precision

Revenue, Gross Margin, Operating Margin of Siliconware Precision, 2003-2014

Monthly Revenue of SPIL, May 2012-May 2014

Quarterly Revenue, Gross Margin and Operating Margin of SPIL, Q1 2012-Q1 2014

Revenue of SPIL by Region, 2005-2014

Revenue of SPIL by Downstream Application, 2005-2014

Revenue of SPIL by Business, 2005-2014

Capacity of SPIL, 2006-2014

Revenue and Gross Margin of STATS ChipPAC, 2004-2014

Revenue of STATS ChipPAC by Packaging Type, 2006-2013

Revenue of STATS ChipPAC by Application, 2006-2013

Revenue of STATS ChipPAC by Region, 2006-2013

Organization Chart of Mitsubishi Gas Chemical

Revenue and Operating Income of Mitsubishi Gas Chemical, FY2009-FY2015

Revenue of Mitsubishi Gas Chemical by Segment, FY2009-FY2015

Operating Income of Mitsubishi Gas Chemical by Segment, FY2009-FY2015

如果这份报告不能满足您的要求,我们还可以为您定制报告,请 留言说明您的详细需求。

|