|

|

|

报告导航:研究报告—

制造业—工业机械

|

|

2014-2016年中国锂电池专用设备行业研究报告 |

|

字数:2.0万 |

页数:73 |

图表数:71 |

|

中文电子版:6500元 |

中文纸版:3250元 |

中文(电子+纸)版:7000元 |

|

英文电子版:1750美元 |

英文纸版:1850美元 |

英文(电子+纸)版:2050美元 |

|

编号:LT-020

|

发布日期:2014-07 |

附件:下载 |

|

|

|

中国锂电设备制造业起步较晚,虽然陆续出现了一批专业锂电池设备制造企业,但目前为止国产设备的技术水平还相对较弱,自动化程度不高,部分大型电池厂商仍需要进口国外设备。

日韩等国家基础机械加工能力较为突出,其锂电设备制造厂商专业分工较细,积累了较好的技术优势,在中国锂电池专用设备市场拥有较高份额。2013年平野、皆藤分别占中国锂电池专用设备市场12.1%、10.6%的份额,位居第一、二位。

中国从事锂电池相关设备制造的本土企业较多,但大多规模较小,主要从事生产线上的工装夹具及某一工序半自动化设备的制造。2013年中国本土锂电池专用设备企业中,雅康精密市场份额最高,达到8.4%,其次为赢合科技。

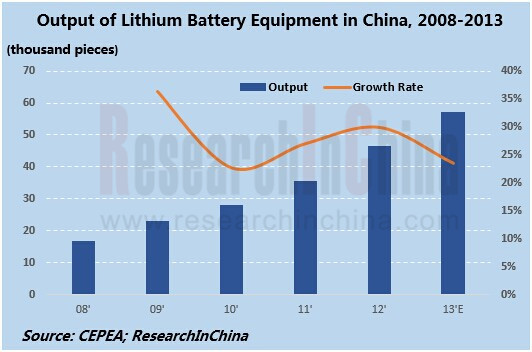

2008-2013年中国锂电池专用设备产量年均复合增长率约27.8%。2013年中国锂电池专用设备产量在5.73万台左右,其中卷绕机产量2.3万台左右,涂布机产量4000台左右。并且,涂布机是增长较快产品之一,近五年产量年均增速约达30%。其主要原因是近年来下游电池厂商对隔膜涂覆趋之若鹜,设备厂商纷纷跟进,对涂布产品线进行补充调整。

从下游市场来看,目前传统消费电子领域仍是锂电设备需求最大的市场,其需求量占中国锂电池需求总量的60%左右。不过由于传统消费电子市场相对稳定,未来中国电网储能及动力电池将成为锂电池专用设备增长的主要动因。预计到2016年,中国电网储能及动力电池将的锂电池专用设备需求规模将分别达到31亿元和60亿元。

水清木华研究中心《2013-2016年中国锂电池专用设备行业研究报告》着重研究了以下内容:

中国锂电池专用设备行业发展环境(包括产业、政策环境及国外标杆企业)分析等; 中国锂电池专用设备行业发展环境(包括产业、政策环境及国外标杆企业)分析等;

中国锂电子专用设备市场供需(产量及未来3年预测、供需结构)、竞争格局(TOP10厂商市场份额)分析等; 中国锂电子专用设备市场供需(产量及未来3年预测、供需结构)、竞争格局(TOP10厂商市场份额)分析等;

中国锂电池专用设备下游行业应用(包括消费电子、电网储能及动力电池行业等)市场需求分析等; 中国锂电池专用设备下游行业应用(包括消费电子、电网储能及动力电池行业等)市场需求分析等;

中国11家锂电池专用设备重点企业(包括赢合科技、七星电子、吉阳、浩能科技等)经营情况及锂电池专用设备业务分析等。 中国11家锂电池专用设备重点企业(包括赢合科技、七星电子、吉阳、浩能科技等)经营情况及锂电池专用设备业务分析等。

Lithium battery equipment manufacturing started late in China, although a batch of professional manufacturers have sprung up in succession, the technology of homemade equipment is still less advanced and automated, and some large battery manufacturers have to import equipment from abroad. By contrast, in countries such as Japan and South Korea with excellent basic mechanical processing capacity, lithium battery equipment manufacturers have clear-cut division of labor and accumulation of technological advantages, thus gaining higher share in the Chinese lithium battery equipment market. In 2013, Hirano Tecseed and Kaido MFG accounted for 12.1% and 10.6% of China’s lithium battery equipment market, ranking first and second, separately.

In China, more local enterprises are engaged in the manufacturing of lithium battery-related equipment, but mostly small in scale and occupied in the manufacturing of jigs and fixtures on the production line and semi-automatic equipment for a process. Of all the Chinese lithium battery equipment manufacturers, Areconn Precision Machinery Co., Ltd. enjoyed the highest market share in 2013, reaching 8.4%, followed by Yinghe Technology Co.Ltd..

The output of lithium battery equipment in China grew at a CAGR of some 27.8% in 2008-2013, to approximately 57,300 units in 2013, including about 23,000 coilers and 4,000 coaters. And coater as one of the fast-growing products registered an output AAGR of around 30% over the last five years, mainly because downstream battery makers have scrambled for diaphragm coating in recent years, followed by equipment manufacturers with adjustment and supplement of coating product lines.

Judging from the downstream market, the traditional consumer electronics field is still the largest demander for lithium battery equipment, holding roughly 60% of the total lithium battery demand in China. However, due to the fact that the traditional consumer electronics market is relatively stable, China's grid energy storage and power battery will give major impetus to the growth of lithium battery equipment. It is estimated that by 2016 the demand for lithium battery equipment from grid energy storage and power battery will hit RMB3.1 billion and RMB6 billion, respectively.

China Lithium Battery Equipment Industry Report, 2014-2016 by ResearchInChina, mainly deals with the followings:

Development environment (including industry and policy environment as well as international benchmarking enterprises), etc. of China lithium battery equipment industry; Development environment (including industry and policy environment as well as international benchmarking enterprises), etc. of China lithium battery equipment industry;

Supply and demand (output and a forecast for the next 3 years, supply-demand structure), competitive landscape (market share of top 10 manufacturers), etc. of China lithium battery equipment market; Supply and demand (output and a forecast for the next 3 years, supply-demand structure), competitive landscape (market share of top 10 manufacturers), etc. of China lithium battery equipment market;

Market demand for Chinese lithium battery equipment from downstream applications (e.g. consumer electronics, grid energy storage, power battery); Market demand for Chinese lithium battery equipment from downstream applications (e.g. consumer electronics, grid energy storage, power battery);

Operation, lithium battery equipment business, etc. of 11 key companies in China, involving Yinghe Technology, Sevenstar Electronics, Geesun and Haoneng Technology. Operation, lithium battery equipment business, etc. of 11 key companies in China, involving Yinghe Technology, Sevenstar Electronics, Geesun and Haoneng Technology.

第一章 锂电池专用设备简介

1.1 定义与分类

1.2 行业进入壁垒

1.3 上下游产业链

第二章 中国锂电池专用设备行业发展环境

2.1 产业环境

2.2 政策环境

2.3 国际标杆企业分析

2.3.1 CKD

2.3.2 平野 HIRANO

2.3.3 皆藤 Kaido MFG

2.3.4 东丽工程 Toray Engineering

第三章 中国锂电池专用设备市场分析

3.1 发展概况

3.2 市场供需

3.3竞争格局

第四章 中国锂电池专用设备应用行业分析

4.1 应用行业概述

4.2 消费电子

4.3 储能

4.3.1 中国风/光储能发展

4.3.2 中国分布式储能发展

4.3.3 储能锂电池设备需求

4.4 动力电池

第五章 中国锂电池专用设备行业重点企业分析

5.1 赢合科技

5.1.1 企业简介

5.1.2 经营情况

5.1.3 营收构成

5.1.4 毛利率

5.1.5 客户与供应商

5.1.6 研发

5.1.7 锂电池专用设备业务

5.1.8 发展前景

5.2 七星电子

5.2.1 企业简介

5.2.2 经营情况

5.2.3 营收构成

5.2.4 毛利率

5.2.5 客户与供应商

5.2.6 锂电池专用设备业务

5.2.8 发展前景

5.3 雅康

5.3.1 企业简介

5.3.2 锂电池专用设备业务

5.4 吉阳

5.4.1 企业简介

5.4.2 锂电池专用设备业务

5.5 兰格

5.5.1 企业简介

5.5.2 锂电池专用设备业务

5.6 骏泰

5.6.1 企业简介

5.6.2 经营情况

5.6.3 研发

5.6.4 锂电池专用设备业务

5.7 浩能科技

5.7.1 公司简介

5.7.2 锂电池专用设备业务

5.8 科锐

5.8.1 公司简介

5.8.2 锂电池专用设备业务

5.9 恒翼能

5.9.1 公司简介

5.9.2 锂电池专用设备业务

5.10 信宇人

5.10.1 公司简介

5.10.2 锂电池专用设备业务

5.11 新嘉拓

5.11.1 公司简介

5.11.2 锂电池专用设备业务

第六章 总结与预测

6.1 总结

6.2预测

1. Overview of Lithium Battery Equipment

1.1 Definition and Classification

1.2 Industry Access Barrier

1.3 Upstream and Downstream Industry Chain

2. Development Environment of China Lithium Battery Equipment Industry

2.1 Industry Environment

2.2 Policy Environment

2.3 International Benchmarking Enterprises

2.3.1 CKD

2.3.2 Hirano Tecseed

2.3.3 Kaido MFG

2.3.4 Toray Engineering

3. China Lithium Battery Equipment Market

3.1 Development

3.2 Supply & Demand

3.3 Competitive Landscape

4. China Lithium Battery Equipment Application Industry

4.1 Overview

4.2 Consumer Electronics

4.3 Energy storage

4.3.1 Development of Wind/Photovoltaic Energy Storage

4.3.2 Development of Distributed Energy Storage

4.3.3 Demand for Energy Storage Lithium Battery Equipment

4.4 Power Battery

5. Key Players in China

5.1 Yinghe Technology Co.Ltd.

5.1.1 Profile

5.1.2 Operation

5.1.3 Revenue Structure

5.1.4 Gross Margin

5.1.5 Clients & Suppliers

5.1.6 R&D

5.1.7 Lithium Battery Equipment Business

5.1.8 Prospects

5.2 Beijing Sevenstar Electronics Co.,Ltd.

5.2.1 Profile

5.2.2 Operation

5.2.3 Revenue Structure

5.2.4 Gross Margin

5.2.5 Clients & Suppliers

5.2.6 Lithium Battery Equipment Business

5.2.7 Prospects

5.3 Areconn Precision Machinery Co., Ltd.

5.3.1 Profile

5.3.2 Lithium Battery Equipment Business

5.4 Shenzhen Geesun Automation Technology Co., Ltd.

5.4.1 Profile

5.4.2 Lithium Battery Equipment Business

5.5 Guangzhou CLG Electric Equipment Co., Ltd.

5.5.1 Profile

5.5.2 Lithium Battery Equipment Business

5.6 Dongguan Jigtech Precision Machinery Co.,Ltd

5.6.1 Profile

5.6.2 Operation

5.6.3 R&D

5.6.4 Lithium Battery Equipment Business

5.7 Shenzhen Haoneng Technology Co., Ltd.

5.7.1 Profile

5.7.2 Lithium Battery Equipment Business

5.8 Dongguan Career Motor Equipment Co., Ltd.

5.8.1 Profile

5.8.2 Lithium Battery Equipment Business

5.9 HYNN Technologies Co., Ltd.

5.9.1 Profile

5.9.2 Lithium Battery Equipment Business

5.10 Shenzhen Xinyuren Technology Co., Ltd.

5.10.1 Profile

5.10.2 Lithium Battery Equipment Business

5.11 Shenzhen New Katop Automation Technology Co.,Ltd

5.11.1 Profile

5.11.2 Lithium Battery Equipment Business

6. Summary and Forecast

6.1 Summary

6.2 Forecast

表:锂电池主要生产工艺及相关专用设备

图:锂电池专用设备行业产业链

图:2009-2013年中国锂电池市场规模

图:2009-2013年中国动力锂电池市场规模

图:2009-2020年全球电动汽车产量

图:2009-2014年中国锂电池电芯产能

表:2009-2013年锂电池专用设备相关政策

图:2010-2013财年CKD净销售额及净利润

图:2010-2014财年CKD(分部门)营业收入

图:喜开理(上海)机器有限公司销售网络

图:2010-2013财年平野营业收入

图:2010-2013财年平野净利润及每股净利润

图:2010-2013年平野(分产品)营收构成

图:2010-2013财年平野涂布相关设备销售额

图:2010-2013年平野涂布相关设备订单额及订单存货

表:平野主要锂电池专用涂布设备

图:皆藤小型锂电池卷绕设备及应用

图:皆藤大型锂电池卷绕设备及应用

图:皆藤中型锂电池卷绕设备及应用

图:2009-2013财年东丽工程销售额

表:东丽工程主要锂电池专用设备

图:2007-2009年上海华丽销售额

图:2013年中国锂电专用设备(分产品)市场份额

图:2008-2013年中国锂电池专用设备产量

图:2008-2013年中国锂电池专用叠片机产量

图:2008-2013年中国锂电池专用涂布机产量

图:2008-2013年中国锂电池专用卷绕机产量

图:2013年中国主要锂电池专用设备厂商市场份额

图:2013年中国锂电池涂布机主要厂商市场份额

图:2012年中国锂电池专用设备(分行业)市场份额占比

图:2006-2016年中国消费电子类锂电池产量

图:2008-2016年中国消费类锂电池设备需求规模

表:国家电网张北风光储能项目情况

表:南方电网宝清储能电站情况

图:2012-2020年中国风光储能市场规模

表:中国户用及工商业储能市场规模

图:2009-2016年中国风/光储能锂电池设备需求规模

图:2004-2015年中国动力电池专用设备市场规模

图:2011-2013年赢合科技营业收入与净利润

图:2011-2013年赢合科技(分产品)营业收入占比

图:2011-2013年赢合科技(分地区)营业收入占比

图:2011-2013年赢合科技(分产品)毛利率

图:2011-2013年赢合科技前十名供应商合计采购金额及占比

表:2013年赢合科技前十名供应商采购金额及占比

图:2011-2013年赢合科技前十名客户合计营业收入及占比

表:2013年赢合科技前十名客户营业收入及占比

图:2011-2013年赢合科技研发支出及占营业收入比例

表:截至2014年一季度赢合科技主要锂电池专用设备研发项目

图:2011-2013年赢合科技锂电池专用设备(分产品)营业收入

图:2011-2013年赢合科技运动控制器(分产品)平均售价

图:2013年赢合科技锂电池专用设备(分产品)产销量

图:2013-2016年赢合科技营业收入及净利润

图:2008-2014年七星电子营业收入与净利润

图:2008-2013年七星电子(分产品)营收占比

图:2008-2013年七星电子(分产品)毛利率

图:2010-2013年七星电子前五名客户营业收入及占比

图:2010-2013年七星电子前五名供应商采购金额及占比

表:七星电子自动化设备分公司主要锂电池专用设备

图:2013-2016年七星电子营业收入与净利润

表:雅康精密主要锂电专用设备

表:吉阳主要锂电池专用设备

表:广州兰格主要锂电池专用设备

图:2006-2012年东莞骏泰销售额及员工人数

图:骏泰精密研发人员构成

表:东莞骏泰主要锂电池专用设备

表:浩能科技主要锂电池专用设备

表:科锐机电主要锂电池专用设备

表:恒翼能主要锂电池专用检测设备

表:信宇人主要锂电池专用设备

表:新嘉拓主要锂电池专用设备

图:2008-2016年中国锂电池专用设备产量

Main Production Technology of Lithium Battery and Relevant Equipment

Lithium Battery Equipment Industry Chain

China Lithium Battery Market Size, 2009-2013

China Power Lithium Battery Market Size, 2009-2013

Global Electric Car Production, 2009-2020E

Capacity of Lithium Battery Cells in China, 2009-2014

Policies on Lithium Battery Equipment, 2009-2013

Net Sales and Net Income of CKD, FY2010-FY2013

Revenue of CKD by Segment, FY2010-FY2014

Sales Network of CKD (China) Corporation

Revenue of Hirano Tecseed, FY2010-FY2013

Net Income and Earnings per Share (EPS) of Hirano Tecseed, FY 2010-FY2013

Revenue Structure of Hirano Tecseed by Product, 2010-2013

Hirano Tecseed’s Revenue from Coating Related Equipment, FY2010-FY2013

Order Value and Inventory of Coating Related Equipment of Hirano Tecseed, 2010-2013

Major Lithium Battery Coating Devices of Hirano Tecseed

Small-sized Lithium Battery Winding Devices of Kaido MFG and Their Application

Large-sized Lithium Battery Winding Devices of Kaido MFG and Their Application

Medium-sized Lithium Battery Winding Devices of Kaido MFG and Their Application

Sales of Toray Engineering, FY2009-FY2013

Major Lithium Battery Equipment of Toray Engineering

Sales of Shanghai TEK, 2007-2009

China Lithium Battery Equipment Market Share (by Product), 2013

Output of Lithium Battery Equipment in China, 2008-2013

Output of Lithium Battery Lamination Machines in China, 2008-2013

Output of Lithium Battery Coating Machines in China, 2008-2013

Output of Lithium Battery Winding Machines in China, 2008-2013

Market Share of Major Lithium Battery Equipment Manufacturers in China, 2013

Market Share of Major Lithium Battery Coating Machine Manufacturers in China, 2013

Proportion of China Lithium Battery Equipment Market Share (by Segment), 2012

Output of Consumer Lithium Batteries in China, 2006-2016E

Demand for Consumer Lithium Battery Equipment in China, 2008-2016E

Wind/Photovoltaic Energy Storage Project of State Grid in Zhangbei County

Energy Storage Power Station of China Southern Power Grid in Baoqing

Market Size of Wind/Photovoltaic Energy Storage in China, 2012-2020E

Market Size of Household and Commercial Energy Storage in China

Demand for Lithium Battery Equipment for Wind/Photovoltaic Energy Storage in China, 2009-2016E

Market Size of Power Battery Equipment in China, 2004-2015E

Revenue and Net Income of Yinghe Technology, 2011-2013

Revenue Structure of Yinghe Technology (by Product), 2011-2013

Revenue Structure of Yinghe Technology (by Region), 2011-2013

Gross Margin of Yinghe Technology (by Product), 2011-2013

Yinghe Technology’s Procurement from Top 10 Suppliers and % of Total Procurement, 2011-2013

Yinghe Technology’s Procurement from Top 10 Suppliers and % of Total Procurement, 2013

Yinghe Technology’s Revenue from Top 10 Clients and % of Total Revenue, 2011-2013

Yinghe Technology’s Revenue from Top 10 Clients and % of Total Revenue, 2013

R&D Costs and % of Total Revenue of Yinghe Technology, 2011-2013

Major Lithium Battery Equipment R&D Projects of Yinghe Technology as of 2014Q1

Yinghe Technology’s Revenue from Lithium Battery Equipment (by Product), 2011-2013

Average Selling Price of Yinghe Technology’s Motion Controllers (by Product) 2011-2013

Output and Sales Volume of Lithium Battery Equipment of Yinghe Technology (by Product), 2013

Revenue and Net Income of Yinghe Technology, 2013-2016E

Revenue and Net Income of Sevenstar Electronics, 2008-2014

Revenue Structure of Sevenstar Electronics (by Product), 2008-2013

Gross Margin of Sevenstar Electronics (by Product), 2008-2013

Sevenstar Electronics’ Revenue from Top 5 Clients and % of Total Revenue, 2010-2013

Sevenstar Electronics’ Procurement from Top 5 Suppliers and % of Total Procurement, 2010-2013

Major Lithium Battery Equipment of Sevenstar Electronics’ Battery Equipment Division

Revenue and Net Income of Sevenstar Electronics, 2013-2016E

Major Lithium Battery Equipment of Areconn Precision Machinery

Major Lithium Battery Equipment of Geesun

Major Lithium Battery Equipment of CLG

Sales and Employees of Jigtech Precision Machinery, 2006-2012

R&D Staff Composition of Jigtech Precision Machinery

Major Lithium Battery Equipment of Jigtech Precision Machinery

Major Lithium Battery Equipment of Haoneng Technology

Major Lithium Battery Equipment of Career Motor Equipment

Major Lithium Battery Detectors of HYNN Technologies

Major Lithium Battery Equipment of Xinyuren Technology

Major Lithium Battery Equipment of New Katop

China Lithium Battery Equipment Output, 2008-2016E

如果这份报告不能满足您的要求,我们还可以为您定制报告,请 留言说明您的详细需求。

|