电池管理系统是电动汽车和混合动力汽车的一个关键组成部分。为保证电池安全可靠地运行,电池管理系统需要具有电池状态监测和评估,充放电控制、电池均衡等功能。

2013年以来电动汽车特别是纯电动汽车起火事故频发,导致消费者对电动汽车产生了安全疑虑。同HEV相比,PHEV和BEV的电池系统结构较为复杂,对电池续航力与安全性的要求更高,必须配套更加成熟可靠的BMS。因此,电池管理系统行业将随电动汽车市场的扩大而受益。

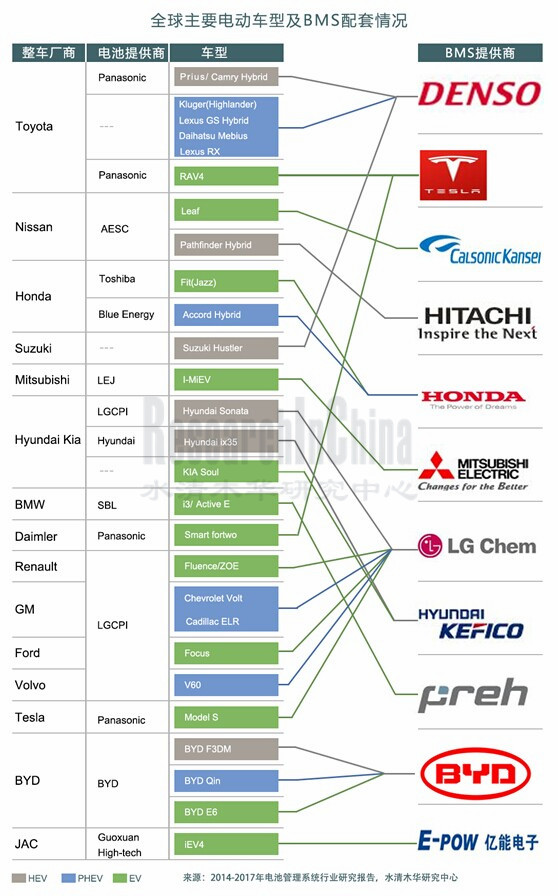

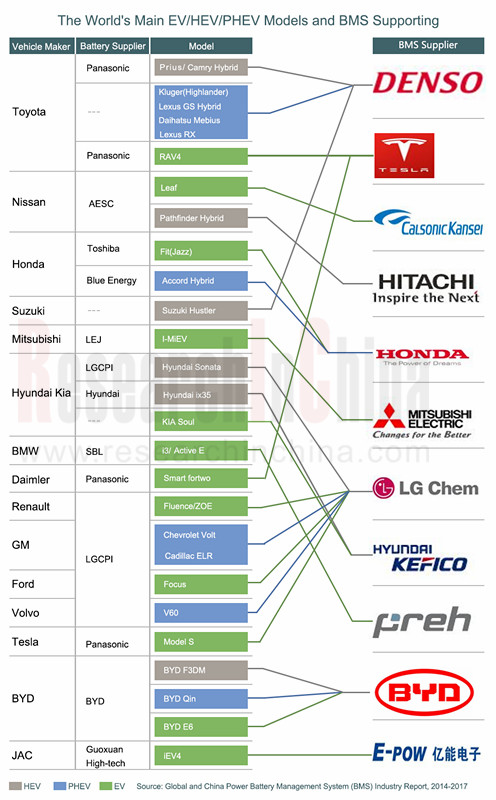

纵观全球BMS市场,以Denso、Preh为代表的传统汽车零部件厂商凭借在整车厂供应链中的重要地位,已经抢占了先机。前者作为丰田汽车最重要的零部件供应商,先后为Prius、Camry Hybrid等车型提供电池管理模块;后者主要为宝马I系纯电动车配套电池管理系统。

而电池厂商也不甘落后,LGC与通用、福特、沃尔沃等多家企业建立了合作关系,为其提供动力电池组并配套BMS。整车企业中,特斯拉先进的BMS技术正是其在市场上脱颖而出的重要因素。反观专业的BMS厂商受制于技术和资金,发展较为缓慢。

2014年上半年,中国新能源汽车产量和销量分别为20692辆和20477辆,均已超过2013年全年数量。预计2015年前后,中国新能源汽车市场产能将快速释放,特别是插电式混合动力汽车和微型纯电动车增长更为迅速,将带动中国BMS市场的高速发展。

中国BMS市场主要进入三类企业:一类是第三方BMS厂商,如亿能电子、冠拓电源、力高新能源等。其中亿能电子是中国BMS厂商中产品应用最为广泛的企业,其BMS产品配套了长安、东风、北汽、福田、江淮、众泰等多款型号的电动汽车。其次是电池系统封装企业,如国轩高科、温斯顿电池等。其中国轩高科为江淮汽车、安凯客车等厂商提供整套的电池系统,包括电池模块和BMS。第三类是整车厂商,主要包括比亚迪和北汽新能源。其中比亚迪集电池、BMS、电动汽车研发于一身,在成本和效率方面拥有优势。

整体来看,中国BMS行业无论是技术规范还是业务模式,同国外相比还较为落后。为了缩小差距,部分企业采取参股并购等方式,以期望实现“弯道超车”。如北汽新能源通过与SK、Atieva等企业的合作,提升电池系统性能并增加技术实力;众泰汽车则通过控股杰能动力来满足自身对BMS的需求;而德赛电池参股亿能电子,是希望实现从消费电子BMS到电动汽车BMS的技术升级。

水清木华研究中心《2014-2017年全球及中国汽车电池管理系统(BMS)行业研究报告》主要内容包括:

全球及中国电动汽车市场发展概况(包括概况、市场规模、整车产量、销量等)

全球及中国电动汽车市场发展概况(包括概况、市场规模、整车产量、销量等)

全球及中国BMS行业发展概况(包括发展现状及预测、市场规模、BMS配套情况等)

全球及中国BMS行业发展概况(包括发展现状及预测、市场规模、BMS配套情况等)

全球BMS行业主要生产企业(包括公司及子公司营业收入、营收构成、净利润、研发情况、产品概况、整车厂配套、最新动态、在华业务等)

全球BMS行业主要生产企业(包括公司及子公司营业收入、营收构成、净利润、研发情况、产品概况、整车厂配套、最新动态、在华业务等)

中国BMS行业主要生产企业(包括公司及子公司营业收入、营收构成、净利润、研发情况、产品概况、整车厂配套、最新项目等)

中国BMS行业主要生产企业(包括公司及子公司营业收入、营收构成、净利润、研发情况、产品概况、整车厂配套、最新项目等)

BMS芯片行业主要生产企业(包括公司营业收入、营收构成、净利润、BMS芯片解决方案等)

BMS芯片行业主要生产企业(包括公司营业收入、营收构成、净利润、BMS芯片解决方案等)

BMS is a key component of electric vehicles and hybrid vehicles. To ensure safe and reliable operation of batteries, BMS needs to have various functions such as battery status monitoring and assessment, charging and discharging control, balancing and so forth.

The fire accidents of electric vehicles (particularly pure electric vehicles) since 2013 result in consumers’ concerns about the safety of electric vehicles. Compared with HEV, PHEV and BEV have more complex battery system structure, which requires more excellent battery endurance and safety; therefore, PHEV and BEV need more mature and reliable BMS. The BMS industry will benefit from the expansion of the electric vehicle market.

Throughout the global BMS market, traditional auto parts makers represented by Denso and Preh have seized opportunities by virtue of their important positions in the vehicle supply chain. As Toyota’s most important parts supplier, Denso has provided battery management modules for Prius, Camry Hybrid and other models. Preh mainly offers BMS for BMW I series pure electric vehicles.

Meanwhile, the battery vendor LGC has established cooperative relationship with GM, Ford, Volvo and many other enterprises by providing power battery packs and related BMS to them. As for automobile companies, Tesla performs remarkably with advanced BMS technology. In contrast, professional BMS firms develop relatively slower due to technical and financial factors.

In the first half of 2014, China produced 20,692 new energy vehicles and sold 20,477 ones, higher than the figures in 2013. In 2015, Chinese new energy vehicle market capacity will be quickly released, especially plug-in hybrid electric vehicles and mini pure electric vehicles will witness faster growth, which will drive the rapid development of the Chinese BMS market.

In the Chinese BMS market, there are three types of enterprises:

First, third-party BMS vendors, such as Epower Electronics, GuanTuo Power and LIGOO New Energy Technology. Among them, the products of Epower Electronics are used most widely and adopted by Changan, Dongfeng, BAIC, Foton, JAC, Zotye and so on.

Second, battery system packaging companies represented by Guoxuan High-tech and Winston Battery. Guoxuan High-tech serves JAC and Ankai Automobile with battery modules and BMS.

Third, vehicle manufacturers, including BYD and BAIC BJEV. BYD integrates batteries and BMS with electric vehicle R & D, and shows advantages in terms of cost and efficiency.

Overall, China BMS industry still lags behind foreign countries in technical specifications and business models. To narrow the gap, some companies hope to make progress by mergers and acquisitions. For example, BAIC BJEV enhances battery system performance and technological strength via the cooperation with SK, Atieva and other enterprises; Zotye meets its demand for BMS by holding Jieneng; Desai masters some share of Epower Electronics in order to upgrade its technology from consumer electronics to electric vehicle BMS.

The report includes:

Overview of global and Chinese electric vehicle market (including overview, market size, output, sales volume, etc.)

Overview of global and Chinese electric vehicle market (including overview, market size, output, sales volume, etc.)

Overview of global and China BMS industry (embracing status quo, forecast, market size, BMS supporting, etc.)

Overview of global and China BMS industry (embracing status quo, forecast, market size, BMS supporting, etc.)

Major vendors in global BMS industry (involving revenue, revenue of subsidiaries, revenue structure, net income, R & D, products, supporting for vehicle plants, latest developments, business in China, etc.)

Major vendors in global BMS industry (involving revenue, revenue of subsidiaries, revenue structure, net income, R & D, products, supporting for vehicle plants, latest developments, business in China, etc.)

Major vendors in China BMS industry (comprising revenue, revenue of subsidiaries, revenue structure, net income, R & D, products, supporting for vehicle plants, new projects, etc.)

Major vendors in China BMS industry (comprising revenue, revenue of subsidiaries, revenue structure, net income, R & D, products, supporting for vehicle plants, new projects, etc.)

Main enterprises in BMS chip industry (including revenue, revenue structure, net income, BMS chip solutions, etc.)

Main enterprises in BMS chip industry (including revenue, revenue structure, net income, BMS chip solutions, etc.)

第一章 电池管理系统概述

1.1 蓄电池系统定义

1.2 电池管理系统定义

1.2.1 定义

1.2.2 分类

第二章 全球BMS市场发展概况

2.1 全球电动车市场概况

2.2 全球BMS市场现状和发展趋势

第三章 中国BMS市场发展概况

3.1 中国电动汽车市场产销分析

3.2 中国BMS市场规模

3.3 中国BMS市场现状和发展趋势

第四章 全球BMS厂商研究

4.1 Denso

4.1.1 企业简介

4.1.2 BMS业务

4.2 Preh

4.2.1 企业简介

4.2.2 BMS业务

4.3 Calsonic Kansei

4.3.1 企业简介

4.3.2 BMS业务

4.4 Hitachi Automotive Systems

4.4.1 企业简介

4.4.2 BMS业务

4.5 Mitsubishi Electric

4.5.1 企业简介

4.5.2 BMS业务

4.6 Hyundai Kefico

4.6.1 企业简介

4.6.2 BMS业务

4.7 LG Chem

4.7.1 企业简介

4.7.2 BMS业务

4.8 Tesla Motors

4.8.1 企业简介

4.8.2 BMS业务

4.9 Lithium Balance

4.9.1 企业简介

4.9.2 产品介绍

4.9.3 产品应用

4.9.4 在华布局

4.10 Vecture

4.10.1 企业简介

4.10.2 产品介绍

4.10.3 产品应用

4.10.4 产业布局

4.11 Rimac Automobili

4.11.1 企业简介

4.11.2 产品介绍

4.11.3 产品应用

4.12 创扬科技股份有限公司

4.12.1 企业简介

4.12.2 产品介绍及应用

4.13 Clayton Power

4.13.1 企业简介

4.13.2 产品介绍

第五章 中国大陆BMS厂商研究

5.1 惠州市亿能电子有限公司(Huizhou Epower electronics co.,ltd)

5.1.1 企业简介

5.1.2 BMS业务

5.2 哈尔滨冠拓电源设备有限公司(Harbin GuanTuo power co., Ltd.)

5.2.1 企业简介

5.2.2 BMS产品

5.3 安徽力高新能源技术有限公司(Anhui LIGOO New Energy Technology Co., Ltd.)

5.3.1 企业简介

5.3.2 BMS业务

5.4 比亚迪(BYD)

5.4.1 企业简介

5.4.2 BMS业务

5.5 北京新能源汽车股份有限公司

5.6 温斯顿电池制造有限公司

5.6.1 企业简介

5.6.2 BMS产品

5.7 合肥国轩高科动力能源有限公司(Hefei Guoxuan High-tech power energy Co., Ltd)

5.7.1 企业简介

5.7.2 BMS业务

5.8 杭州杰能动力有限公司

5.8.1 企业简介

5.8.2 BMS业务

5.9 宁波拜特测控技术有限公司(Ningbo bate Technology Co., Ltd.)

5.9.1 企业简介

5.9.2 BMS业务

5.10 宁波远道电子有限公司

5.10.1 企业简介

5.10.2 BMS产品

5.11 深圳市安泰佳科技有限公司(Shenzhen Antega Technology Co.,Ltd)

5.11.1 企业简介

5.11.2 BMS产品

5.12 芜湖天元汽车电子有限公司

5.12.1 企业简介

5.12.2 BMS产品

5.13 深圳市派司德科技有限公司(Shenzhen Battsister Tech. Co., Ltd.)

5.13.1 企业简介

5.13.2 BMS业务

第六章 BMS芯片主要厂商研究

6.1 Analog Devices

6.1.1 企业简介

6.1.2 经营情况

6.1.3 营收构成分析

6.1.4 毛利率分析

6.1.5 BMS解决方案

6.2 Texas Instruments

6.2.1 企业简介

6.2.2 经营情况

6.2.3 营收构成分析

6.2.4 毛利率分析

6.2.5 BMS芯片业务现状及展望

6.3 Infineon

6.3.1 企业简介

6.3.2 经营情况

6.3.3 营收构成分析

6.3.4 毛利率分析

6.3.5 BMS芯片业务现状及展望

1 Overview of BMS

1.1 Definition of Battery System

1.2 Definition of BMS

1.2.1 Definition

1.2.2 Classification

2 Overview of Global BMS Market

2.1 Overview of Global Electric Vehicle Market

2.2 Status Quo and Development Trend of Global BMS Market

3 Overview of Chinese BMS Market

3.1 Production and Sales Volume of Chinese Electric Vehicle Market

3.2 Chinese BMS Market Size

3.3 Status Quo and Development Trend of Chinese BMS Market

4 Global BMS Vendors

4.1 Denso

4.1.1 Profile

4.1.2 BMS Business

4.2 Preh

4.2.1 Profile

4.2.2 BMS Business

4.3 Calsonic Kansei

4.3.1 Profile

4.3.2 BMS Business

4.4 Hitachi Automotive Systems

4.4.1 Profile

4.4.2 BMS Business

4.5 Mitsubishi Electric

4.5.1 Profile

4.5.2 BMS Business

4.6 Hyundai Kefico

4.6.1 Profile

4.6.2 BMS Business

4.7 LG Chem

4.7.1 Profile

4.7.2 BMS Business

4.8 Tesla Motors

4.8.1 Profile

4.8.2 BMS Business

4.9 Lithium Balance

4.9.1 Profile

4.9.2 Product Description

4.9.3 Product Application

4.9.4 Layout in China

4.10 Vecture

4.10.1 Profile

4.10.2 Product Description

4.10.3 Product Application

4.10.4 Industrial Layout

4.11 Rimac Automobili

4.11.1 Profile

4.11.2 Product Description

4.11.3 Product Application

4.12 JustPower

4.12.1 Profile

4.12.2 Product Description and Application

4.13 Clayton Power

4.13.1 Profile

4.13.2 Product Description

5 Chinese Mainland BMS Vendors

5.1 Huizhou Epower Electronics Co., Ltd

5.1.1 Profile

5.1.2 BMS Business

5.2 Harbin GuanTuo Power Co., Ltd.

5.2.1 Profile

5.2.2 BMS Products

5.3 Anhui LIGOO New Energy Technology Co., Ltd.

5.3.1 Profile

5.3.2 BMS Business

5.4 BYD

5.4.1 Profile

5.4.2 BMS Business

5.5 BAIC BJEV

5.6 Winston Battery

5.6.1 Profile

5.6.2 BMS Products

5.7 Hefei Guoxuan High-tech Power Energy Co., Ltd

5.7.1 Profile

5.7.2 BMS Business

5.8 Hangzhou Jieneng Power Co., Ltd.

5.8.1 Profile

5.8.2 BMS Business

5.9 Ningbo Bate Technology Co., Ltd.

5.9.1 Profile

5.9.2 BMS Business

5.10 Ningbo Longway Electrical Co., Ltd.

5.10.1 Profile

5.10.2 BMS Products

5.11 Shenzhen Antega Technology Co., Ltd

5.11.1 Profile

5.11.2 BMS Products

5.12 Wuhu Tianyuan Automobile Electric Co., Ltd.

5.12.1 Profile

5.12.2 BMS Products

5.13 Shenzhen Battsister Tech. Co., Ltd.

5.13.1 Profile

5.13.2 BMS Business

6 Major BMS Chip Vendors

6.1 Analog Devices

6.1.1 Profile

6.1.2 Operation

6.1.3 Revenue Structure

6.1.4 Gross Margin

6.1.5 BMS Solutions

6.2 Texas Instruments

6.2.1 Profile

6.2.2 Operation

6.2.3 Revenue Structure

6.2.4 Gross Margin

6.2.5 Current Situation and Prospect of BMS Chip Business

6.3 Infineon

6.3.1 Profile

6.3.2 Operation

6.3.3 Revenue Structure

6.3.4 Gross Margin

6.3.5 Current Situation and Prospect of BMS Chip Business