|

|

|

报告导航:研究报告—

制造业—汽车

|

|

2014-2017年中国汽车胶管行业研究报告 |

|

字数:2.7万 |

页数:110 |

图表数:0 |

|

中文电子版:8000元 |

中文纸版:4000元 |

中文(电子+纸)版:8500元 |

|

英文电子版:2350美元 |

英文纸版:2500美元 |

英文(电子+纸)版:2650美元 |

|

编号:YSJ078

|

发布日期:2014-09 |

附件:下载 |

|

|

|

得益于庞大的汽车市场基础,中国汽车胶管需求巨大。2013年中国汽车胶管需求量总计4.6亿米,市场规模为174亿元。预计未来随着汽车产业的发展,汽车胶管将保持稳定增长的态势,2017年需求量有望达到6.4亿米,市场规模有望达到241亿元。

根据功能不同,汽车胶管可分为发动机胶管、燃油胶管、空调胶管、制动胶管、动力转向胶管等。从市场需求数量来看,发动机胶管规模最大,2013年为接近1.3亿米,占汽车胶管市场需求总量比重近28%,预计2017年将超过1.7亿米。从市场价值来看,燃油胶管规模最高,2013年超过50亿元,占汽车胶管市场总价值比重超过29%,2017年有望达到70亿元,高于其他类型胶管。

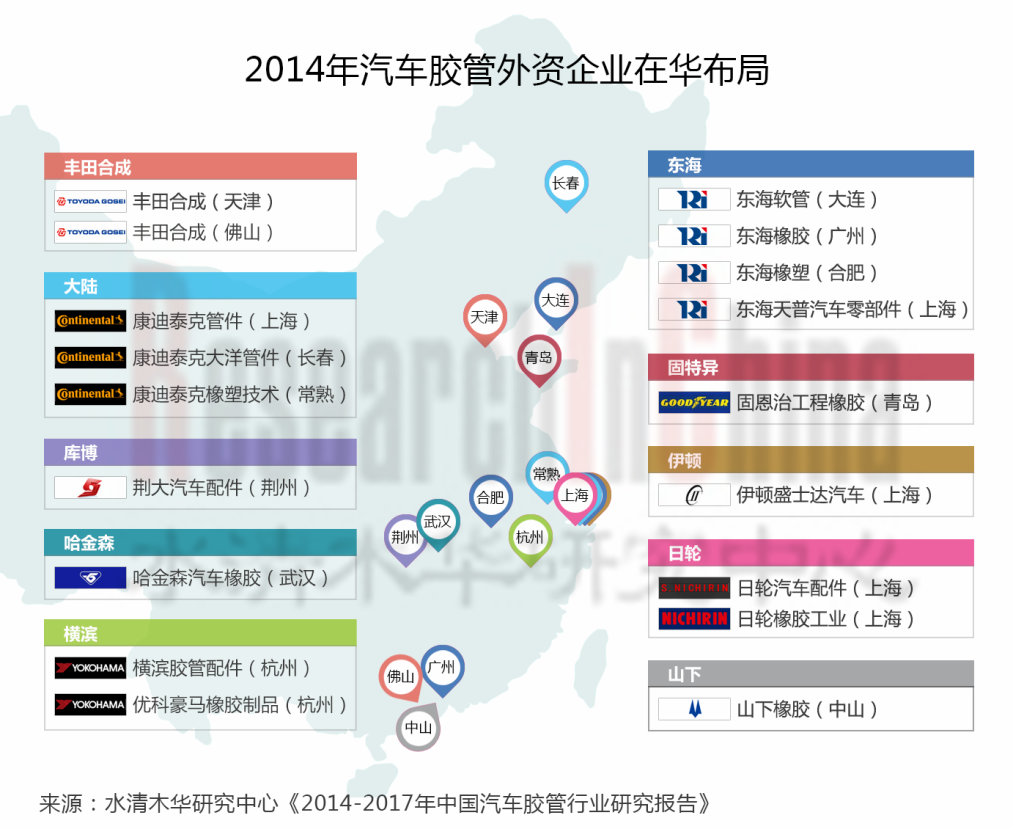

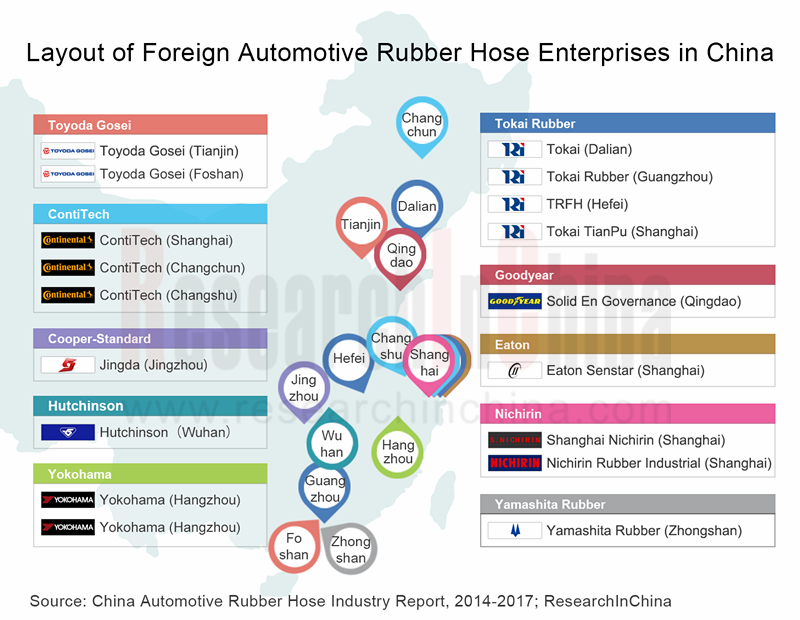

中国汽车胶管市场竞争者主要分为外资及本土两大阵营,其中外资企业主要为高档及豪华车型进行装配,本土企业以中低档车型为主。

哈金森是法国主要汽车胶管供应商之一,于1995年进入中国市场。目前哈金森在武汉、苏州分别设有1家子公司,其中武汉子公司主要从事汽车胶管业务,产品主要供应给神龙、长安福特、上海通用、沃尔沃、菲亚特、日产、北京奔驰、宝马、英瑞杰公司等。

鹏翎股份是中国本土汽车胶管主要生产商之一,主要生产发动机冷却系统管路和燃油胶管,其产品主要为一汽大众、上海大众、长城汽车等企业配套。2013年鹏翎股份市场占有率为5.66%,随着产能提升,2017年市场占有率有望超过8%。

水清木华研究中心《2014-2017年中国汽车胶管行业研究报告》主要包括以下内容:

中国汽车胶管整体市场及细分市场(包括发动机胶管、燃油胶管、空调胶管、制动胶管、动力转向胶管)规模及预测;  中国汽车胶管的配套模式、区域格局、主要生产企业和整车厂的供应关系;  中国汽车胶管的上游原材料价格变动影响分析,以及下游汽车行业的发展情况及预测;  主要外资汽车胶管生产商和本土生产商的发展现状、主要产品、产能、产销量、运营情况、配套关系以及发展预测等内容。

Thanks to its huge automobile market base, China’s demand for automotive rubber hose is enormous, totaling 460 million meters and equaling RMB 17.4 billion in market scale in 2013. As automobile industry develops further, the demand for automotive rubber hose will maintain a steady growth trend, with demand expected to reach 640 million meters and market size at RMB 24.1 billion.

According to function, automotive rubber hose can be divided into engine hose, fuel hose, air conditioner hose, brake hose, power steering hose, etc. Seen from market demand, engine hose is the most prominent in terms of scale, accounting for nearly 28% of total market demand for hose in 2013 and estimated to exceed 170 million meters in 2017. From the perspective of market value, fuel hose is the largest segment as concerns scale, topping RMB 5 billion in 2013, more than 29% of total market value of automotive rubber hose and expected to hit RMB 7 billion by 2017, higher than that of other types of hoses.

Competitors in the Chinese automotive rubber hose market consist mainly of two camps, namely, foreign companies and local ones, of which the former serves chiefly upscale and luxury car models, while local ones support low and medium-end car models.

Hutchinson, one of major French automotive rubber hose providers, entered Chinese market in 1995. The company now has one subsidiary in Wuhan and Suzhou respectively, with the former specializing in automotive rubber hose business and supplying its products to Dongfeng Peugeot Citroen, Ford, Shanghai GM, Volvo, Fiat, Nissan, Beijing Benz, BMW and Inergy.

Tianjin Pengling Rubber Hose Co., Ltd., one of major local automotive rubber hose manufacturers, mainly produces engine cooling system pipeline and fuel hose, which are offered to FAW-Volkswagen, Shanghai Volkswagen, Great Wall Motors, etc. The company took up a 5.66% market share in 2013, which is expected to surpass 8% by 2017, as capacity continues to be ramped up.

China Automotive Rubber Hose Industry Report, 2014-2017 by ResearchInChina focuses on the following:

Chinese overall automotive rubber hose market and market segments (engine hose, fuel hose, air conditioner hose, brake hose, power steering hose) scale and forecast; Chinese overall automotive rubber hose market and market segments (engine hose, fuel hose, air conditioner hose, brake hose, power steering hose) scale and forecast;

Supporting models, regional landscape, major manufacturers of automotive rubber hose and supply relationship with complete vehicle makers in China; Supporting models, regional landscape, major manufacturers of automotive rubber hose and supply relationship with complete vehicle makers in China;

Effect of changes in upstream raw material prices on automotive rubber hose, development of and forecast for downstream automobile industry in China; Effect of changes in upstream raw material prices on automotive rubber hose, development of and forecast for downstream automobile industry in China;

Development, main products, output & sales volume, operation, supporting relationship of and development forecast for major foreign and local Chinese automotive rubber hose manufacturers. Development, main products, output & sales volume, operation, supporting relationship of and development forecast for major foreign and local Chinese automotive rubber hose manufacturers.

第一章 汽车胶管概述

1.1 产品简介

1.2 产品结构

1.3 产品分类

第二章 中国汽车胶管市场情况

2.1 汽车行业现状及前景

2.2 汽车胶管整体市场

2.3 配套模式

2.4 市场格局

2.4.1 区域格局

2.4.2 竞争格局

2.4.3 供应关系

2.5 细分市场

2.5.1 散热器胶管

2.5.2 燃油胶管

2.5.3 空调胶管

2.5.4 制动胶管

2.5.5 动力转向胶管

第三章 汽车胶管原材料市场

3.1 橡胶市场

3.2 炭黑市场

3.3 编织线市场

3.4 化工助剂市场

第四章 主要外资企业

4.1 哈金森

4.1.1 公司简介

4.1.2 运营情况

4.1.3 汽车胶管配套

4.1.4 在华情况

4.2 丰田合成

4.2.1 公司简介

4.2.2 运营情况

4.2.3 营收结构

4.2.4 投资情况

4.2.5 研发情况

4.2.6 主要客户

4.2.7 汽车胶管配套

4.2.8 在华情况

4.3 康迪泰克

4.3.1 公司简介

4.3.2 运营情况

4.3.3 汽车胶管配套

4.3.4 在华情况

4.4 东海橡胶

4.4.1 公司简介

4.4.2 运营情况

4.4.3 汽车胶管配套

4.4.4 在华情况

4.5 山下橡胶

4.5.1 公司简介

4.5.2 运营情况

4.5.3 汽车胶管产品

4.5.4 山下橡胶(中山)有限公司

4.6 伊顿

4.6.1 公司简介

4.6.2 运营情况

4.6.3 在华情况

4.6.4 伊顿盛士达汽车流体连接器(上海)有限公司

4.7 库博标准

4.7.1 公司简介

4.7.2 运营情况

4.7.3 主要客户

4.7.4 生产基地

4.7.5 汽车胶管配套

4.7.6 在华情况

4.7.7 荆大(荆州)汽车配件有限公司

4.8 横滨橡胶

4.8.1 公司简介

4.8.2 运营情况

4.8.3 汽车胶管配套

4.8.4 在华情况

4.8.5 横滨胶管配件(杭州)有限公司

4.8.6 山东横滨橡胶工业制品有限公司

4.8.7 杭州优科豪马橡胶制品有限公司

4.9 日轮

4.9.1 公司简介

4.9.2 运营情况

4.9.3 汽车胶管配套

4.9.4 在华情况

4.10 固特异

4.10.1 公司简介

4.10.2 运营情况

4.10.3 汽车胶管业务

4.10.4 固恩治(青岛)工程橡胶有限公司

第五章 中国本土生产企业

5.1 美晨科技

5.1.1 公司简介

5.1.2 营业收入及毛利率

5.1.3 胶管业务

5.1.4 主要客户

5.1.5 经营业绩预测

5.2 鹏翎股份

5.2.1 公司简介

5.2.2 营业收入及毛利率

5.2.3 胶管业务

5.2.4 主要客户

5.2.5 子公司

5.2.6 经营业绩预测

5.3 凌云股份

5.3.1 公司简介

5.3.2 运营情况

5.3.3 子公司

5.3.4 阔丹-凌云汽车胶管有限公司

5.3.5 长春亚大汽车零件制造有限公司

5.4 川环科技

5.5 丰茂远东橡胶

5.6 南京七四二五橡塑

5.7 天元奥特

5.8 大港胶管

5.9 新上橡

5.10 上海三达

5.11 上海威乐

第六章 总结及预测

6.1 市场规模将保持8.5%的平均增速

6.2 发动机胶管需求量最大,燃油胶管市场价值最高

6.3 2017年鹏翎股份市场份额将达到8%

1. Overview of Automotive Rubber Hose

1.1 Profile

1.2 Structure

1.3 Classification

2. Chinese Automotive Rubber Hose Market

2.1 Status Quo and Prospect of Automobile Industry

2.2 Overall Automotive Rubber Hose Market

2.3 Supporting Model

2.4 Market Landscape

2.4.1 Regional Landscape

2.4.2 Competitive Landscape

2.4.3 Supply Relationship

2.5 Market Segments

2.5.1 Radiator Hose

2.5.2 Fuel Hose

2.5.3 Air Conditioner Hose

2.5.4 Brake Hose

2.5.5 Power Steering Hose

3. Automotive Rubber Hose Raw Material Market

3.1 Rubber

3.2 Carbon Black

3.3 Braided Wire

3.4 Auxiliary Chemicals

4. Major Foreign Companies

4.1 Hutchinson

4.1.1 Profile

4.1.2 Operation

4.1.3 Supply Relationship

4.1.4 Business in China

4.2 Toyoda Gosei

4.2.1 Profile

4.2.2 Operation

4.2.3 Revenue Structure

4.2.4 Investment

4.2.5 R&D

4.2.6 Major Customers

4.2.7 Supply Relationship

4.2.8 Business in China

4.3 ContiTech

4.3.1 Profile

4.3.2 Operation

4.3.3 Supply Relationship

4.3.4 Business in China

4.4 Tokai Rubber

4.4.1 Profile

4.4.2 Operation

4.4.3 Supply Relationship

4.4.4 Business in China

4.5 Yamashita Rubber

4.5.1 Profile

4.5.2 Operation

4.5.3 Automotive Rubber Hose Products

4.5.4 Yamashita Rubber (Zhongshan) Co., Ltd.

4.6 Eaton

4.6.1 Profile

4.6.2 Operation

4.6.3 Business in China

4.6.4 Shanghai Eaton-Senstar Automotive Fluid Connector Co., Ltd

4.7 Cooper-Standard

4.7.1 Profile

4.7.2 Operation

4.7.3 Major Customers

4.7.4 Production Base

4.7.5 Supply Relationship

4.7.6 Business in China

4.7.7 Jingda (Jingzhou) Automotive Co. Ltd.

4.8 Yokohama Rubber

4.8.1 Profile

4.8.2 Operation

4.8.3 Supply Relationship

4.8.4 Business in China

4.8.5 Yokohama Hoses & Coupling (Hangzhou) Co., Ltd.

4.8.6 Shandong Yokohama Rubber Industrial Products Co., Ltd.

4.8.7 Yokohama Industrial Products-Hangzhou Co., Ltd.

4.9 Nichirin

4.9.1 Profile

4.9.2 Operation

4.9.3 Supply Relationship

4.9.4 Business in China

4.10 Goodyear

4.10.1 Profile

4.10.2 Operation

4.10.3 Automotive Rubber Hose Business

4.10.4 Veyance (Qingdao) Engineered Elastomers Co., Ltd.

5. Local Chinese Manufacturers

5.1 Shandong Meichen Science & Technology Co., Ltd.

5.1.1 Profile

5.1.2 Revenue and Gross Margin

5.1.3 Rubber Hose Business

5.1.4 Major Customers

5.1.5 Performance Forecast

5.2 Tianjin Pengling Rubber Hose Co., Ltd.

5.2.1 Profile

5.2.2 Revenue and Gross Margin

5.2.3 Rubber Hose Business

5.2.4 Major Customers

5.2.5 Subsidiaries

5.2.6 Performance Forecast

5.3 Lingyun Industrial Corporation Limited

5.3.1 Profile

5.3.2 Operation

5.3.3 Subsidiaries

5.3.4 Codan-Lingyun Automotive Rubber Hose Co., Ltd.

5.3.5 Changchun Chinaust Automobile Parts Co., Ltd.

5.4 Sichuan Ring Technology Co., Ltd.

5.5 Ningbo Fengmao Far-East Rubber Co., Ltd.

5.6 Chonche Group Nanjing No. 7425 Factory

5.7 Beijing Tian Yuan Ao Te Rubber and Plastic Co., Ltd.

5.8 Tianjin Dagang Rubber Hose Co., Ltd.

5.9 Shanghai Xinshangxiang Automobile Hose Co., Ltd.

5.10 Shanghai Sanda Automobile Parts Co., Ltd.

5.11 Shanghai Velle Auto Air Conditioning Co., Ltd.

6. Summary and Forecast

6.1 Average Growth Rate of 8.5% in Market Scale

6.2 Enormous Demand for Engine Hose; Highest Market Value for Fuel Hose

6.3 An 8% Market Share for Tianjin Pengling Rubber Hose by 2017

图:汽车胶管分类

表:2009-2017年中国汽车产量

表:每辆车各类胶管平均使用量

表:2012-2017年中国汽车胶管市场规模

图:中国汽车零部件配套模式

表:中国外资汽车胶管主要生产商及产品类型

表:中国大陆汽车胶管主要生产商及产品类型

表:中国外资汽车胶管主要生产商配套客户

表:中国大陆汽车胶管主要生产商配套客户

表:2012-2017年中国汽车发动机胶管市场规模

表:中国汽车散热器胶管主要供应商及配套客户

表:2012-2017年中国汽车燃油胶管市场规模

表:中国汽车燃油胶管主要供应商及配套客户

表:2012-2017年中国汽车空调胶管市场规模

表:中国汽车空调胶管主要供应商及配套客户

表:2012-2017年中国汽车制动系统胶管市场规模

表:中国汽车制动胶管主要供应商及配套客户

表:2012-2017年中国汽车动力转向系统胶管市场规模

表:中国汽车动力转向胶管主要供应商及配套客户

表:各类汽车胶管橡胶平均使用量

图:2010-2014年上海天然橡胶市场价格(含17%税)

表:各类汽车胶管炭黑平均使用量

表:2009-2014年中国炭黑进口数量及金额

表:2009-2014年中国炭黑出口数量及金额

表:各类汽车胶管编织线平均使用量

图:2010-2014年中国芳纶线1100-DP平均价格

表:2009-2014年胶管用主要化工助剂平均价格

图:2013财年Hutchinson营业额构成(分产品)

图:2013财年Hutchinson营业额构成(分地区)

表:Hutchinson各类汽车胶管主要配套厂商及车型

表:哈金森在华生产基地

图:2009-2013财年丰田合成营业收入及同比增长

图:2009-2013财年丰田合成净利润及同比增长

图:2009-2013财年丰田合成净利率

图:2009-2013财年丰田合成营收构成(分产品)

图:2009-2013财年丰田合成营收构成(分区域)

图:2009-2013财年丰田合成投资额构成(分业务)

图:2009-2013财年丰田合成研发支出及其占营业收入比例

图:2009-2013财年丰田合成研发支出构成(分业务)

表:FY2012-FY2014丰田合成主要客户占比

表:TOYODA GOSEI各类汽车胶管主要配套厂商及车型

表:丰田合成在华汽车胶管生产基地

表:2012-2013年康迪泰克运营销售额、EBIT及员工数量

图:2013年康迪泰克销售额构成(分部门)

表:2010-2013年康迪泰克流体技术部门销售额及员工数量

表:ContiTech各类汽车胶管主要配套厂商及车型

表:康迪泰克在华胶管生产基地

图:2009-2013财年东海橡胶销售额及利润

图:2013年东海橡胶销售额地区分布

表:2011-2012财年东海橡胶各部门业绩

表:Tokai Rubber各类汽车胶管主要配套厂商及车型

表:2011-2012财年东海橡胶在华收入

表:东海橡胶在华据点分布

图:FY2009-2013 Yamashita Rubber 销售额及利润

表:山下橡胶(中山)有限公司各类汽车胶管主要配套厂商及车型

图:2009-2013年伊顿员工人数

图:2009-2013年伊顿营业收入,净利润和毛利率

表:2009-2013年伊顿(分部门)营业收入

表:2009-2013年伊顿(分地区)营业收入

表:2012-2013年库博标准主要财务指标

表:2011-2013年库博标准收入结构(分地区)

表:2012-2013年库博标准主要客户销售额占比

表:2013年库博标准全球生产基地分布

表:Cooper-Standard各类汽车胶管主要配套厂商及车型

表:2013年库博标准在华生产基地

图:2010-2013财年横滨橡胶员工人数

图:2010-2013年横滨橡胶销售额及运营利润

图:2010-2013年横滨橡胶净利润

图:2010-2013年横滨橡胶研发支出

图:2013年横滨橡胶销售额及运营利润结构(分业务)

图:2013年横滨橡胶工业部门销售额结构(分产品)

图:2013年横滨橡胶工业部门销售额及运营利润

表:Yokohama各类汽车胶管主要配套厂商及车型

表:横滨橡胶在华公司分布

图:2011-2013年Nichirin销售额

图:2011-2013年Nichirin利润额

图:2011-2013年Nichirin研发支出

表:Nichirin各类汽车胶管主要配套厂商及车型

图:2009-2013年固特异员工人数

图:2009-2013年固特异营业收入,净利润和毛利率

表:2009-2013年固特异(分地区)营业收入

图:2009-2013年美晨科技员工人数

图:2009-2013年美晨科技营业收入、净利润和毛利率

表:2014上半年美晨科技营业收入、净利润和毛利率

表:2009-2014年美晨科技(分产品)营业收入

表:2009-2014年美晨科技(分产品)毛利率

表:2009-2013年美晨科技(分地区)营业收入

图:2009-2014年美晨科技空气系统胶管营业收入及毛利率

图:2009-2014年美晨科技输水系统胶管营业收入及毛利率

图:2009-2014年美晨科技其他胶管营业收入及毛利率

表:2012-2014年美晨科技前五名客户及收入贡献率

表:2014-2017年美晨科技营业收入、净利润及毛利率

图:2010-2013年鹏翎股份员工人数

图:2010-2013年鹏翎股份营业收入,净利润和毛利率

表:2014上半年鹏翎股份营业收入,净利润和毛利率

表:2010-2014年鹏翎股份(分地区)营业收入

表:2010-2014年鹏翎股份(分产品)营业收入

表:2010-2014年鹏翎股份(分产品)毛利率

表:2012-2013年鹏翎股份前五名客户及收入贡献率

表:2013年鹏翎股份子公司经营情况

表:鹏翎股份募集资金主要建设项目

表:2014-2017年鹏翎胶管营业收入、净利润及毛利率

表:2010-2014年凌云股份营业收入、净利润及毛利率

表:2012-2014年凌云股份营业收入、营业成本及毛利率

表:2012-2014年凌云股份各地区营业收入

表:阔丹-凌云汽车胶管有限公司各类汽车胶管主要配套厂商及车型

表:长春亚大汽车零件制造有限公司各类汽车胶管主要配套厂商及车型

图:川环科技组织结构

图:宁波丰茂远东橡胶有限公司主要客户

图:7425工厂组织结构

图:天元奥特主要客户

图:大港胶管主要客户

表:上海三达汽车配件有限公司各类汽车胶管主要配套厂商及车型

表:上海威乐汽车空调器有限公司各类汽车胶管主要配套厂商及车型

表:2013-2017年中国汽车胶管市场规模增速

图:中国汽车胶管市场结构

表:2012-2017年鹏翎股份及美晨科技市场份额

Classification of Automotive Rubber Hose

China’s Automobile Output, 2009-2017E

Average Consumption of Various Hoses by Each Vehicle

Chinese Automotive Rubber Hose Market Scale, 2012-2017E

Auto Parts Supporting Model in China

Major Foreign Automotive Rubber Hose Manufacturers and Their Products in China

Major Mainland Chinese Automotive Rubber Hose Manufacturers and Their Products

Customers of Major Foreign Automotive Rubber Hose Manufacturers in China

Customers of Major Mainland Chinese Automotive Rubber Hose Manufacturers

Chinese Automotive Engine Rubber Hose Market Scale, 2012-2017E

Major Suppliers of Automotive Radiator Rubber Hose and Customers Supported in China

Chinese Automotive Fuel Rubber Hose Market Scale, 2012-2017E

Major Suppliers of Automotive Fuel Rubber Hose and Customers Supported in China

Chinese Automotive Air Conditioner Rubber Hose Market Scale, 2012-2017E

Major Suppliers of Automotive Air Conditioner Rubber Hose and Customers Supported in China

Chinese Automotive Brake System Rubber Hose Market Scale, 2012-2017E

Major Suppliers of Automotive Brake Rubber Hose and Customers Supported in China

Chinese Automotive Power Steering System Rubber Hose Market Scale, 2012-2017E

Major Suppliers of Automotive Power Steering Rubber Hose and Customers Supported in China

Average Consumption of Rubber by Various Automotive Rubber Hoses

Market Prices of Natural Rubber on the Shanghai Futures Exchange (including a 17% tariff), 2010-2014

Average Consumption of Carbon Black by Various Automotive Rubber Hoses

Volume and Value of Imported Carbon Black into China, 2009-2014

Volume and Value of Exported Carbon Black from China, 2009-2014

Average Consumption of Braided Wire by Various Automotive Rubber Hoses

Average Price of Kevlar Line 1100-DP in China, 2010-2014

Average Prices of Main Auxiliary Chemicals for Hose, 2009-2014

Revenue Structure of Hutchinson (by Product), FY2013

Revenue Structure of Hutchinson (by Region), FY2013

Car Makers and Models Supported by Automotive Rubber Hoses of Hutchinson

Production Bases of Hutchinson in China

Revenue and YoY Growth of Toyoda Gosei, FY2009-FY2013

Net Income and YoY Growth of Toyoda Gosei, FY2009-FY2013

Net Profit Margin of Toyoda Gosei, FY2009-FY2013

Revenue Structure of Toyoda Gosei (by Product), FY2009-FY2013

Revenue Structure of Toyoda Gosei (by Region), FY2009-FY2013

Investment Structure of Toyoda Gosei (by Business), FY2009-FY2013

R&D Costs and % of Total Revenue of Toyoda Gosei, FY2009-FY2013

R&D Costs Structure of Toyoda Gosei (by Business), FY2009-FY2013

Sales Ratio to Major Customers of Toyoda Gosei, FY2012-FY2014

Main Car Makers and Models Supported by Automotive Rubber Hoses of Toyoda Gosei

Automotive Rubber Hose Production Bases of Toyoda Gosei in China

Sales, EBIT and Employees of ContiTech, 2012-2013

Sales Structure of ContiTech (by Division), 2013

Sales and Employees of Fluid Technology Division of ContiTech, 2010-2013

Main Car Makers and Models Supported by ContiTech’s Automotive Rubber Hoses

Automotive Rubber Hose Production Bases of ContiTech in China

Sales and Profit of Tokai Rubber, FY2009-FY2013

Sales Breakdown of Tokai Rubber by Region, 2013

Performance of Tokai Rubber by Division, FY2011-FY2012

Main Car Makers and Models Supported by Automotive Rubber Hoses of Tokai Rubber

Revenue of Tokai Rubber in China, FY2011-FY2012

Strongholds of Tokai Rubber in China

Sales and Profit of Yamashita Rubber, FY2009- FY 2013

Main Car Makers and Models Supported by Automotive Rubber Hoses of Yamashita Rubber (Zhongshan)

Number of Employees in Eaton, 2009-2013

Revenue, Net Income and Gross Margin of Eaton, 2009-2013

Revenue Breakdown of Eaton (by Business), 2009-2013

Revenue Breakdown of Eaton (by Region), 2009-2013

Main Financial Indexes of Cooper-Standard, 2012-2013

Revenue Structure of Cooper-Standard (by Region), 2011-2013

Sales Ratio to Major Customers of Cooper-Standard, 2012-2013

Main Global Production Bases of Cooper-Standard, 2013

Main Car Makers and Models Supported by Automotive Rubber Hoses of Cooper-Standard

Production Bases of Cooper-Standard in China, 2013

Number of Employees in Yokohama Rubber, FY2010-FY2013

Sales and Operating Profit of Yokohama Rubber, 2010-2013

Net Income of Yokohama Rubber, 2010-2013

R&D Costs of Yokohama Rubber, 2010-2013

Sales/Operating Profit Structure of Yokohama Rubber (by Business), 2013

Sales Structure of Industrial Products Division of Yokohama Rubber (by Product), 2013

Sales and Operating Profit of Industrial Products Division of Yokohama Rubber, 2013

Main Car Makers and Models Supported by Automotive Rubber Hoses of Yokohama Rubber

Subsidiaries & Affiliates of Yokohama Rubber in China

Sales of Nichirin, 2011-2013

Profit of Nichirin, 2011-2013

R&D Costs of Nichirin, 2011-2013

Main Car Makers and Models Supported by Automotive Rubber Hoses of Nichirin

Number of Employees in Goodyear, 2009-2013

Revenue, Net Income and Gross Margin of Goodyear, 2009-2013

Revenue Breakdown of Goodyear (by Region), 2009-2013

Number of Employees in Meichen S&T, 2009-2013

Revenue, Net Income and Gross Margin of Meichen S&T, 2009-2013

Revenue, Net Income and Gross Margin of Meichen S&T, 2014 H1

Revenue Breakdown of Meichen S&T (by Product), 2009-2014

Gross Margin of Meichen S&T (by Product), 2009-2014

Revenue Breakdown of Meichen S&T (by Region), 2009-2013

Revenue from and Gross Margin of Air Hose of Meichen S&T, 2009-2014

Revenue from and Gross Margin of Water Hose of Meichen S&T, 2009-2014

Revenue from and Gross Margin of Other Hoses of Meichen S&T, 2009-2014

Meichen S&T’s Revenue from Top 5 Customers and % of Total Revenue, 2012-2014

Revenue, Net Income and Gross Margin of Meichen S&T, 2014-2017E

Number of Employees in Tianjin Pengling Rubber Hose, 2010-2013

Revenue, Net Income and Gross Margin of Tianjin Pengling Rubber Hose, 2010-2013

Revenue, Net Income and Gross Margin of Tianjin Pengling Rubber Hose, 2014 H1

Revenue Breakdown of Tianjin Pengling Rubber Hose (by Region), 2010-2014

Revenue Breakdown of Tianjin Pengling Rubber Hose (by Product), 2010-2014

Gross Margin of Tianjin Pengling Rubber Hose (by Product), 2010-2014

Tianjin Pengling Rubber Hose’s Revenue from Top 5 Customers and % of Total Revenue, 2012-2013

Operation of Tianjin Pengling Rubber Hose’s Subsidiaries, 2013

Key Construction Projects with Raised Funds of Tianjin Pengling Rubber Hose

Revenue, Net Income and Gross Margin of Tianjin Pengling Rubber Hose, 2014-2017E

Revenue, Net Income and Gross Margin of Lingyun Industrial, 2010-2014

Revenue, Operating Costs and Gross Margin of Lingyun Industrial, 2012-2014

Revenue Breakdown of Lingyun Industrial (by Region), 2012-2014

Main Car Makers and Models Supported by Automotive Rubber Hoses of Codan-Lingyun Automotive Rubber Hose

Main Car Makers and Models Supported by Automotive Rubber Hoses of Changchun Chinaust Automobile Parts

Organizational Structure of Sichuan Ring Technology

Major Customers of Ningbo Fengmao Far-East Rubber

Organizational Structure of Chonche Group Nanjing No. 7425 Factory

Major Customers of Beijing Tian Yuan Ao Te Rubber and Plastic

Major Customers of Tianjin Dagang Rubber Hose

Main Car Makers and Models Supported by Automotive Rubber Hoses of Shanghai Sanda Automobile Parts

Main Car Makers and Models Supported by Automotive Rubber Hoses of Shanghai Velle Auto Air Conditioning

Growth in Chinese Automotive Rubber Hose Market Scale, 2013-2017E

Structure of Chinese Automotive Rubber Hose Market

Market Shares of Tianjin Pengling Rubber Hose and Meichen S&T, 2012-2017E

如果这份报告不能满足您的要求,我们还可以为您定制报告,请 留言说明您的详细需求。

|