|

|

|

报告导航:研究报告—

制造业—汽车

|

|

2014-2016年全球和中国动力锂电池行业研究报告 |

|

字数:3.4万 |

页数:195 |

图表数:198 |

|

中文电子版:9000元 |

中文纸版:4500元 |

中文(电子+纸)版:9500元 |

|

英文电子版:2600美元 |

英文纸版:2800美元 |

英文(电子+纸)版:2900美元 |

|

编号:YS002

|

发布日期:2014-09 |

附件:下载 |

|

|

|

2013年,全球电动汽车销量达到22.8万辆,其中插电式混动动力(PHEV)汽车销量9.5万辆,纯电动(EV)汽车销量13.3万辆,随着全球范围内电动汽车推广力度加大,预计到2016年,电动汽车销量将增长至70万辆。

2013年全球电动汽车动力电池需求达到5,662MWh,随着电动汽车销量的攀升,单车电池容量的不断提升,预计到2016年动力电池需求有望攀升至的31,100MWh。

目前全球动力电池主要有三个技术路线:

(1)锰系,主要采用LMO作为正极材料,但一般经过改性处理,并混合少量NCM或LNO提高电池能量密度,主要代表厂商是LGC、AESC、LEJ等,在中国主要是中信国安盟固利,目前已成为全球电动汽车领域的主流技术路线。

(2)三元系,主要采用NCA和NCM作为正极材料,NCM电池能量密度高,但成本高于LMO电池,主要代表厂商是SDI、SKI,在中国主要是力神、万向等;NCA 采用18650型电池,主要应用于特斯拉,能量密度在目前是最高的,但由于安全性能较差,需要先进的BMS以监控电池工作状态,并未被广泛采用。

(3)LFP,美国和加拿大最先开始研发的动力电池技术,主要专利主要拥有者包括,美国Valence、A123、德州大学、加拿大Phostech和魁北克水电公司;目前中国众多的动力电池厂商均采用LFP技术,代表厂商BYD、国轩高科等,但由于LFP电池存在诸多问题,并未被全球广泛采用。

目前全球占据主流地位的锰系动力电池,包括NCM和LMO,电池组成本普遍在600$/kWh以上;成本较低的NCA 18650电池由于安全性问题没有成为汽车厂商的普遍选择,同样成本较低的LFP电池则由于综合性能较差,仅在中国和美国推广使用,而美国汽车厂商也已经普遍开始放弃LFP电池,转而采购日韩厂商生产的锰系电池。

目前动力电池尚没有取得重大技术突破,预计动力电池价格下跌的主要驱动因素将来自于原材料成本下跌和规模效应,下跌空间相对有限。

2013年中国动力电池出货量为533MWh,同比增长61%,占全球比重不到10%,主要需求来自于电动城市公交客车。目前中国充换电设施不齐全,私人电动乘用车销量很少。

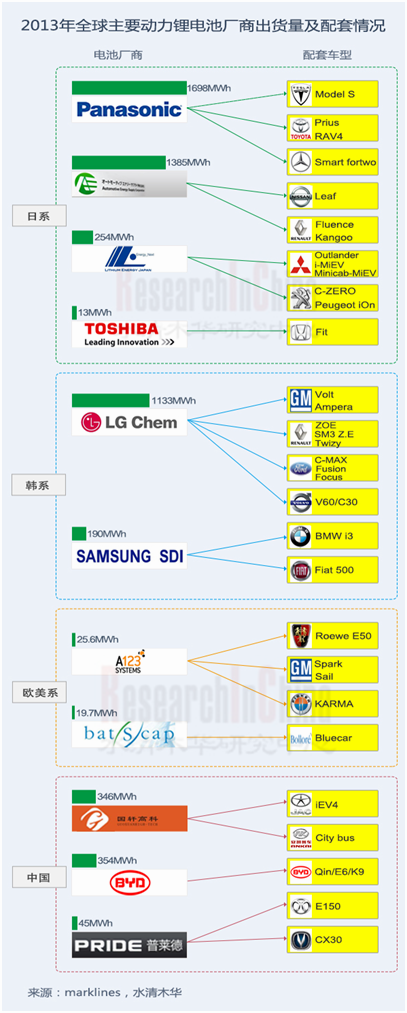

从动力电池厂商来看,比亚迪、国轩高科出货量远高于其他竞争对手,比亚迪电池为自产的电动乘用车和客车配套,国轩高科则为江淮汽车、安凯客车等配套。

从全球趋势来看,获得大型汽车制造商的支持对动力电池厂商尤为重要,中国而言,预计在未来一段时间内,电动客车仍然是中国动力电池市场发展的主要驱动力,如何进入电动客车供应链显得至关重要。

水清木华研究中心《2014-2016年全球和中国动力锂电池行业研究报告》着重研究了以下内容:

动力锂电池产业链分析,覆盖四大关键材料、电芯、Pack+BMS等领域; 动力锂电池产业链分析,覆盖四大关键材料、电芯、Pack+BMS等领域;

动力锂电池技术路线分析,包括成本、性能及发展方向等; 动力锂电池技术路线分析,包括成本、性能及发展方向等;

全球及中国电动汽车行业分析,包括行业整体、各国市场、具体车型产销及性能参数等; 全球及中国电动汽车行业分析,包括行业整体、各国市场、具体车型产销及性能参数等;

全球及中国动力锂电池行业分析,包括出货量、价格、市场规模、电池配套关系等; 全球及中国动力锂电池行业分析,包括出货量、价格、市场规模、电池配套关系等;

美、日、韩等国9家锂电池厂商经营、技术、发展规划及产销动态; 美、日、韩等国9家锂电池厂商经营、技术、发展规划及产销动态;

中国10家动力锂电池厂商经营、技术、发展规划及产销动态。 中国10家动力锂电池厂商经营、技术、发展规划及产销动态。

In 2013, the sales volume of global electric vehicles reached 228,000 vehicles, including 95,000 PHEVs and 133,000 BEVs. With the further promotion of electric vehicles globally, the sales volume will rise to 700,000 vehicles by 2016.

The global demand for electric vehicle power batteries came to 5,662MWh in 2013; however, following the rising electric vehicle sales and battery capacity per vehicle, the figure is expected to climb to 31,100MWh by 2016.

Currently, the global power batteries develop mainly in the following three technology roadmaps:

(1) Manganese-based. This type of batteries uses LMO as cathode materials. Typically, however, after modification treatment, they are mixed with a small amount of NCM or LNO to increase their energy density. This is mainly represented by the foreign companies—including LGC, AESC, and LEJ, as well as the Chinese company CITIC GUOAN MGL. Now, this has become the mainstream technology roadmap in the field of global electric vehicles.

(2) Ternary materials-based. This mainly takes NCA and NCM as cathode materials. NCM-based batteries have high energy density, but with higher costs than that of LMO batteries. The typical companies consist of SDI and SKI from abroad and the Chinese Lishen and Wangxiang Group, etc. NCA adopts 18650-type battery, which is mainly used in Tesla, with the highest energy density for now. But because of poor safety performance, the advanced BMS is needed to monitor the operating condition of the battery. Thus, the battery has not been widely used.

(3) LFP-based. Canada and the United States were the first to develop power battery technology, with main patent owners including the U.S. Valence, A123 and University of Texas, and the Canadian Phostech and Hydro-Quebec. On the other hand, there are numerous power battery companies in China such as BYD and Hefei Guoxuan High-Tech Power Energy Co.,Ltd that adopt the LFP technology, but the LFP battery has many problems and was not made available around the world.

At present, manganese-series power battery consisting of NCM and LMO occupies the mainstream status on a global scale, with the cost of battery pack generally higher than USD600/kWh; the lower-cost NCA 18650 batteries fail to be popular with automakers due to safety issues; the similarly lower-cost LFP batteries, because of the poor comprehensive performance, are only popularized and used in China and the United States, while the U.S. automakers have gradually abandoned LFP batteries and turned on purchasing Mn-series batteries from Japanese and S. Korean companies.

There is no major technological breakthrough yet in power battery. The main driving factors for power battery price collapses are expected to come from the material cost reduction and scale effect, with relatively limited downslide potential.

China’s power battery shipments reached 533MWh in 2013, which increased by 61% year on year and accounted for less than 10% of the world’s total. At present the main demand comes from electric city bus. As the charging facilities are not perfect in China, the private electric passenger cars are rarely sold.

In terms of power battery companies, BYD and Guoxuan High-Tech have the shipments that have far exceeded those of their rivals. And BYD batteries are mainly used to support its own electric passenger cars and buses while Guoxuan High-Tech supplies batteries to JAC, Ankai Bus and other auto makers.

For power battery companies, winning the support of big carmakers is of the utmost importance from a global perspective. It is projected that electric buses will still be the main driving forces behind the development of China's power battery market for some time to come. How to penetrate the electric bus supply chain seems crucial.

Global and China Li-ion Power Battery Industry Report , 2014-2016 by ResearchInChina mainly covers the followings:

Analysis of industry chain, including the key materials, Cells, Pack & BMS, etc.; Analysis of industry chain, including the key materials, Cells, Pack & BMS, etc.;

Analysis of technology roadmap, including battery cost, performance, and development directions, etc.; Analysis of technology roadmap, including battery cost, performance, and development directions, etc.;

Market size, sales volume ,supply relationship, etc. of global and Chinese  electrical vehicle industry; electrical vehicle industry;

Shipment, market size, price, supply relationship, etc. of global and Chinese Li-ion Power Battery industry. Shipment, market size, price, supply relationship, etc. of global and Chinese Li-ion Power Battery industry.

Operation, technology, development plan, production & marketing of nine lithium battery separator companies in the world, mainly of Korea, Japan and USA; Operation, technology, development plan, production & marketing of nine lithium battery separator companies in the world, mainly of Korea, Japan and USA;

Operation, technology, development plan, production & marketing of ten lithium battery separator companies in China. Operation, technology, development plan, production & marketing of ten lithium battery separator companies in China.

第一章 动力锂电池介绍

1.1 动力电池分类

1.2 动力电芯结构

第二章 动力锂电池产业链分析

2.1 产业概述

2.2 关键材料

2.2.1 正极材料

2.2.2 负极材料

2.2.3 隔膜

2.2.4 电解液

2.3 电芯(Cell)

2.3.1电芯成本

2.3.2电芯容量

2.3.3电芯结构

2.3.4供应关系

2.4 PACK+BMS

2.4.1电池成本

2.4.2 BMS

2.5 技术路线

2.5.1成本分析

2.5.2技术路线选择

2.5.3技术趋势

第三章 全球电动汽车市场分析

3.1电动汽车分类

3.1.1 Micro Hybrid (u-HEV)

3.1.2 Hybrid (HEV)

3.1.3 Plug-in Hybrid (PHEV)

3.1.4 Electric Vehicle (EV)

3.2全球电动汽车市场

3.2.1 整体市场

3.2.2 美国

3.2.3 欧洲

3.2.4 日本

3.3中国电动汽车市场

3.3.1 整体市场

3.3.2 客车市场

3.4电动汽车车型

第四章 全球动力锂电池行业分析

4.1全球动力锂电池行业

4.1.1动力锂电池需求

4.1.2动力锂电池价格

4.1.3动力锂电池市场规模

4.2中国动力锂电池行业

4.2.1动力锂电池需求

4.2.2动力锂电池价格

4.2.3锂电池市场规模

4.3动力锂电池厂商

4.3.1市场份额

4.3.2配套关系

第五章 韩国主要动力锂电池厂商

5.1 LG Chemical

5.1.1公司简介

5.1.2电池技术

5.1.3业务发展及展望

5.1.4客户分析

5.1.5在华布局

5.1.6产能产量

5.2 SDI

5.2.1公司简介

5.2.2电池技术

5.2.3业务发展及展望

5.2.4客户分析

5.2.5在华布局

5.2.6产能产量

5.3 SK Innovation

5.3.1公司简介

5.3.2电池技术

5.3.3业务发展及展望

5.3.4在华布局

5.3.5产能产量

第六章 日本主要动力锂电池厂商

6.1 Panasonic

6.1.1公司简介

6.1.2电池技术

6.1.3业务发展及展望

6.1.4在华布局

6.1.5客户分析

6.1.6产量产能

6.2 AESC

6.2.1公司简介

6.2.2电池技术

6.2.3业务发展及展望

6.2.4在华布局

6.2.5产能产量

6.3 LEJ

6.3.1公司简介

6.3.2电池技术

6.3.3业务发展及展望

6.3.4客户分析

6.3.5产能产量

第七章 欧美主要动力锂电池厂商

7.1 Li-Tec&Accumotive

7.1.1公司简介

7.1.2电池技术

7.1.3业务发展及展望

7.1.4客户分析

7.2 A123

7.2.1 公司简介

7.2.2业务发展及展望

7.2.3 在华布局

7.3 Valence

7.3.1公司简介

7.3.2业务发展及展望

7.3.3 技术成果

7.3.4 在华布局

第八章 中国主要动力电池厂商

8.1国轩高科

8.1.1公司简介

8.1.2电池技术

8.1.3业务发展及展望

8.1.4客户分析

8.1.5产能产量

8.2比亚迪

8.2.1 公司简介

8.2.2电池技术

8.2.3 应用领域

8.2.4 客户分析

8.2.5 产能产量

8.3北京普莱德

8.3.1 公司简介

8.3.2技术工艺

8.3.3业务发展及展望

8.3.4客户分析

8.3.5产能产量

8.4天津力神

8.4.1 公司简介

8.4.2 电池技术

8.4.3 业务发展和展望

8.4.4客户分析

8.4.5产能产量

8.5比克电池

8.5.1 公司简介

8.5.2 电池技术

8.5.3 业务发展和展望

8.5.4 客户分析

8.5.5 产能产量

8.6万向电动

8.6.1公司简介

8.6.2电池技术

8.6.3业务发展与展望

8.6.4客户分析

8.7中聚电池

8.7.1公司简介

8.7.2电池技术

8.7.3业务发展及展望

8.7.4客户分析

8.7.5产量产能

8.8中信国安盟固利

8.8.1公司简介

8.8.2电池技术

8.8.3业务发展及展望

8.8.4产能产量

8.9中航锂电

8.9.1公司简介

8.9.2电池技术

8.9.3R&D

8.9.4业务发展及展望

8.9.5客户分析

8.9.6产量产能

8.10东莞新能源

8.10.1公司简介

8.10.2电池技术

8.10.3业务发展及展望

1. Introduction to Power Lithium Battery

1.1 Power Battery Classification

1.2 Power Cell Structure

2. Power Lithium Battery Industry Chain Analysis

2.1 Industry Overview

2.2 Critical Materials

2.2.1 Cathode Materials

2.2.2 Anode Materials

2.2.3 Separator

2.2.4 Electrolyte

2.3 Cell

2.3.1 Cell Cost

2.3.2 Cell Capacity

2.3.3 Cell Structure

2.3.4 Supply Relationship

2.4 PACK+BMS

2.4.1 Battery Costs

2.4.2 BMS

2.5 Technology Roadmap

2.5.1 Cost Analysis

2.5.2 Selection of Technology Roadmap

2.5.3 Technology Trends

3. Global Electric Vehicle Market

3.1 Classification

3.1.1 Micro Hybrid (u-HEV)

3.1.2 Hybrid (HEV)

3.1.3 Plug-in Hybrid (PHEV)

3.1.4 Electric Vehicle (EV)

3.2 Global EV Market

3.2.1 Overview

3.2.2 USA

3.2.3 Europe

3.2.4 Japan

3.3 EV Market in China

3.3.1 Overview

3.3.2 Bus Market

3.4 Electric Vehicle Models

4. Global Power Lithium Battery Industry

4.1 Global Power Lithium Battery Industry

4.1.1 Demand

4.1.2 Price

4.1.3 Market Size

4.2 China Power Lithium Battery Industry

4.2.1 Demand

4.2.2 Price

4.2.3 Market Size

4.3 Power Lithium Battery Companies

4.3.1 Market Share

4.3.2 Supporting Relationship

5. Major Power Lithium Battery Manufacturers in Korea

5.1 LG Chemical

5.1.1 Profile

5.1.2 Battery Technology

5.1.3 Business Development and Outlook

5.1.4 Customer Analysis

5.1.5 Business Layout in China

5.1.6 Capacity and Output

5.2 SDI

5.2.1 Profile

5.2.2 Battery Technology

5.2.3 Business Development and Outlook

5.2.4 Customer Analysis

5.2.5 Business Layout in China

5.2.6 Capacity and Output

5.3 SK Innovation

5.3.1 Profile

5.3.2 Battery Technology

5.3.3 Development and Prospect

5.3.4 Business in China

5.3.5 Capacity and Output

6. Lithium-ion Power Battery Companies in Japan

6.1 Panasonic

6.1.1 Profile

6.1.2 Battery Technology

6.1.3 Business Development and Prospect

6.1.4 Business Layout in China

6.1.5 Customer Analysis

6.1.6 Capacity and Output

6.2 AESC

6.2.1 Profile

6.2.2 Battery Technology

6.2.3 Business Development and Outlook

6.2.4 Layout in China

6.2.5 Capacity and Output

6.3 LEJ

6.3.1 Profile

6.3.2 Battery Technology

6.3.3 Business Development and Outlook

6.3.4 Customer Analysis

6.3.5 Capacity and Output

7. Major Power Lithium Battery Manufacturers in Europe and America

7.1 Li-Tec&Accumotive

7.1.1 Profile

7.1.2 Battery Technology

7.1.3 Business Development and Outlook

7.1.4 Customer Analysis

7.2 A123

7.2.1 Profile

7.2.2 Operation

7.2.3 Subsidiaries in China

7.3 Valence

7.3.1 Profile

7.3.2 Operation

7.3.3 Latest Products

7.3.4 Subsidiaries in China

8. Major Chinese Power Battery Companies

8.1 Hefei Guoxuan High-tech Power Energy Co., Ltd

8.1.1 Profile

8.1.2 Battery Technology

8.1.3 Business Development and Prospects

8.1.4 Customers

8.1.5 Capacity and Output

8.2 BYD Company Co., LTD

8.2.1 Profile

8.2.2 Battery Technology

8.2.3 Application Fields

8.2.4 Customer Analysis

8.2.5 Capacity and Output

8.3 Beijing Pride Power System Technology

8.3.1 Profile

8.3.2 Technology

8.3.3 Business Development and Outlook

8.3.4 Customers

8.3.5 Capacity and Output

8.4 Tianjin Lishen Battery Joint-Stock Co., Ltd.

8.4.1 Profile

8.4.2 Battery Technology

8.4.3 Business Development and Outlook

8.4.4 Customers

8.4.5 Capacity and Output

8.5 China BAK Battery, Inc.

8.5.1 Profile

8.5.2 Battery Technology

8.5.3 Business Development and Outlook

8.5.4 Customers

8.5.5 Capacity and Output

8.6 Wanxiang EV

8.6.1 Profile

8.6.2 Battery Technology

8.6.3 Business Development and Outlook

8.6.4 Customers

8.7 Sinopoly Battery

8.7.1 Profile

8.7.2 Battery Technology

8.7.3 Business Development and Prospect

8.7.4 Customers

8.7.5 Capacity and Output

8.8 CITIC GUOAN Mengguli

8.8.1 Profile

8.8.2 Battery Technology

8.8.3 Business Development and Outlook

8.8.4 Capacity and Output

8.9 China Aviation Lithium Battery

8.9.1 Profile

8.9.2 Battery Technology

8.9.3 R&D

8.9.4 Business Development and Outlook

8.9.5 Customers

8.9.6 Capacity and Output

8.10 Amperex Technology

8.10.1 Profile

8.10.2 Battery Technology

8.10.3 Business Development and Outlook

图:功率型和容量型动力锂电池分类方法

图:方形电池(Prismatic Cell)结构

图:圆柱形电池(Cylindrical Cell)结构

图:软包(Pouch Cell)电池结构

图:动力锂电池价值链

图:动力锂电池生产工序

图:锂电池工作原理

图:锂电池成本结构

图:2006-2014年全球正极材料(分产品)出货量

图:2010-2014年中国正极材料价格

图:2013年全球正极材料厂商市场份额

图:2013年全球负极材料产量构成

图:2013年全球负极材料厂商市场份额

表:几种负极材料技术特性对比

表:普通电子和汽车对锂电池隔膜需求量

图:2008-2016年全球普通和高性能锂电池隔膜出货量

图:2008-2016年全球锂电池隔膜价格

图:2013年全球锂电池隔膜企业市场份额

表:2013年全球动力电池配套隔膜

表:2011-2016年全球锂电池电解液出货量

表:锂电池电解液成本构成

图:2013年全球LiPF6厂商市场份额

图:2009-2016年全球LiPF6价格

图:2013年全球电解液厂商市场份额

图:中国锂电池电芯成本结构

图:中国锂电池动力电芯成本下降趋势

表:2013年全球主要电动汽车搭载动力电芯情况

图:2013年全球主流电动汽车单体电池容量分布(Ah)

图:全球主流电动汽车电池结构

图:2013年全球动力电池厂商关键材料供应体系

图:2013年中国动力电池厂商关键材料供应体系

图:动力锂电池组(Module)成本分解

表:2013年全球电动汽车电池技术、供应商及成本

图:Tesla Model S 电池成本下降路径

图:全球主要电动汽车BMS供应商

图:不同技术路线正极材料金属含量

图:不同技术路线正极材料成本分析

图:不同技术路线动力锂电池组性能

图:正极材料产品生命周期

图:LFP和LMP正极材料对比

表:不同技术路线正极材料技术指标

图:新型正极材料发展方向

图:层状富锂锰基正极材料化学结构

图:2013年全球电动汽车销量(分国家)

图:2008-2016年全球电动汽车销量

图:2013年美国电动汽车销量(分车型)

图:2013年欧洲电动汽车销量(分车型)

图:2013年日本电动汽车销量(分车型)

图:2008-2016年中国电动汽车销量

图:2008-2016年中国电动汽车销量占全球比重

图:2014-2015年中国电动汽车推广计划

表:2009-2016年中国电动公交客车销量及占比

表:2012-2016年中国电动客车(分企业)销量

表:2009-2014年中国电动客车投资

表:2011-2013年全球40款电动乘用车销量

表:2013年全球40款电动汽车电池容量及续航能力

图:2008-2016年全球电动汽车单车电池容量

图:2008-2016年全球Automotive Batteries需求

图:2008-2016年全球锂电池(分需求)出货量

表:2013年全球主要电动汽车电池组成本

图:2008-2016年全球动力锂电池组价格

图:2008-2016年全球动力锂电池产业规模

图:2008-2016年全球锂电池产业规模

图:2011-2016年中国Automotive Batteries需求

图:2008-2016年中国动力锂电池组价格

图:2010-2016年中国动力锂电池产业规模

图:2008-2016年中国锂电池产业规模

图:2013年全球40款电动汽车配套电池厂商市场份额

表:2013年全球40款电动汽车配套电池出货量

图:2013年全球小型锂电池企业市场份额

表:欧美动力锂电池厂商及配套车型

表:韩国动力锂电池厂商及及配套车型

表:日本动力锂电池厂商及及配套车型

表:中国动力锂电池厂商及及配套车型

图:2013年LGC股权结构图

图:2007-2014Q2年LGC经营业绩

图:2013年LGC营业收入分区域

图:2012-2013年LGC营业收入构成

图:LGC PHEV Cell材料成本构成

图:LGC Road Map for HEV LIB Technology

图:LGC Road Map for PHEV LIB Technology

图:LGC Road Map for EV LIB Technology

图:LGC锂业务发展及展望发展历程

图:2010-2014年 LGCPI经营业绩

图:2010-2014年HL Green Power经营业绩

图:2013Q1-2014Q2年LGC电池业务经营业绩

表:LGC动力锂电池配套电动汽车

表:LGC中国管理机构

图:LGC中国生产、销售网络

图:2011-2014年LGC动力和储能电池出货量(MWh)

图:2013年SDI股权结构图

图:2008-2014Q2年SDI经营业绩

图:2013年SDI营业收入分区域

图:SDI Road Map for xEV LIB Technology

图:SDI动力锂电池电芯技术性能

图:2007-2014Q2年SDI电池业务发展及展望经营业绩

图:2007-2014年SDI电池出货量与平均售价

图:2013Q1-2014Q2 SDI动力电池营收

表:SDI动力锂电池配套电动汽车

图:2011-2014年SDI动力和储能电池出货量(MWh)

图:SKI旗下主要子公司

表:SKI动力锂电池配套电动汽车

图:SKI中国合资公司BESK股权结构图

图:SKI中国合资公司BESK公司基本信息

表:BESK动力锂电池技术参数

图:2009-2013年SKI电池材料(隔膜)产量、产能与产能利用率

图:2008/09-2013/14财年松下经营业绩

图:2008/09-2013/14财年松下研发支出

图:2008-2013年松下营收构成(分segment)

图:2008-2013年松下运营利润构成(分segment)

图:2013年松下营收构成(分地区)

表:松下用于Tesla的NCA 18650电芯技术参数

图:松下 PHEV Cell材料成本构成

图:2013-2019年松下Automotive Batteries发展规划

图:2013-2019年松下汽车部门发展规划

图:2013-2019年松下各业务部门发展规划

表:Panasonic动力锂电池配套电动汽车

图:2010-2016年特斯拉电动汽车交付量

图:2011-2014年松下动力和储能电池出货量(MWh)

图:2013年AESC股权结构图

图:AESC BEV Cell材料成本构成

图:AESC动力锂电池电池模组结构

图:AESC高容量动力电池规格及串并联方式

图:AESC高容量动力电池性能参数

图:AESC高功率动力电池规格及串并联方式

图:AESC高功率动力电池性能参数

图:AESC动力电池系统解决方案

表:AESC动力锂电池配套电动汽车

图:2011-2014年AESC动力和储能电池出货量(MWh)

图:2013年LEJ股权结构图

表:LEJ动力锂电池规格

表:LEJ动力锂电池配套电动汽车

图:2011-2014年LEJ动力和储能电池出货量(MWh)

图:Li-Tec高容量动力电池规格

图:Li-Tec高容量动力电池性能参数

图:Li-tec 德国卡门茨县动力电池工厂

表:A123历史发展

图:2007-2012年A123经营业绩

表:A123动力锂电池配套电动汽车

表:Revenue of Subsidiaries of A123Systems in China

图:Project Investment of Changzhou Gaobo, 2005-2008

图:Revenue and Net Profit of Valence,FY2008-FY2012

表:Operation of Valence’s Subsidiaries in China

图:国轩高科股权结构图

图:2009-2013年国轩高科经营业绩

图:国轩高科磷酸铁锂正极材料技术参数

图:国轩高科磷酸铁锂动力电池规格参数

表:国轩高科动力电池配套车型技术参数

图:2009-2013年国轩高科动力及储能电池产量、产能与产能利用率

表:2009-2013年国轩高科产能和投资计划

图:2008-2013比亚迪经营业绩

图:2012-2013年比亚迪(分业务)营收构成

图:2009-2013年比亚迪(分业务)毛利率

图:比亚迪磷酸铁锂电池主要性能

表:比亚迪Automotive Batteries组容量、重量及成本

图:比亚迪电动叉车锂电池容量、重量

表:比亚迪储能系统(ESS)锂电池容量

表:比亚迪应急电源(EPS)锂电池容量

图:2013.1-2014.5比亚迪电动汽车(分车型)销量

图:2011-2017年比亚迪电动汽车销量

图:2011-2017年比亚迪电动汽车电池需求(MWh)

图:2011-2017年比亚迪动力及储能电池产量、产能与产能利用率

图:2013年北京普莱德股权结构图

图:2011-2013年北京普莱德经营业绩

表:北京普莱德动力电池组性能参数

图:天津力神股权结构图

图:2011-2013天津力神经营业绩

图:天津力神动力电芯(Cell)技术路线图

图:天津力神动力电池组(Module)技术路线图

表:天津力神卷绕式动力电芯(Cell)性能参数

表:天津力神叠片式动力电芯(Cell)性能参数

表:天津力神聚合物动力电芯(Cell)性能参数

表:天津力神动力电芯(Cell)技术参数

图:天津力神动力电池客户

表:天津力神动力电池组性能参数

图:2000-2013年天津力神锂电池产能

表:2012-2014年天津力神动力电池投资计划

图:2008-2014Q1比克电池经营业绩

图:2009-2013比克电池(分区域)营收构成

图:2010-2013年比克电池研发投入

表:比克电池动力电芯(Cell)技术参数

图:比克国际(天津)有限公司基本信息

图:大连比克动力电池有限公司基本信息

图:2009-2013年比克动力锂电池销售收入

表:2013-2014年比克电池动力电池投资计划

图:2011-2013年中聚电池营收和毛利率

图:2011-2013年中聚电池净利润

表:中聚电池动力电芯技术参数

图:2009-2013年中信国安盟固利经营业绩

表:中信国安盟固利正极材料技术参数

表:中信国安盟固利动力电池模组技术参数

图:2013年中航锂电股权结构图

图:2010-2013年中航锂电经营业绩

图:中航锂电纯电动汽车BMS

图:中航锂电电池产品认证

图:中航锂电全球销售网络

图:中航锂电主要客户

图:青海时代新能源科技有限公司基本信息

Power-type and Capacity-type Power Lithium Battery Classification

Prismatic Cell Structure

Cylindrical Cell Structure

Pouch Cell Structure

Power Lithium Battery Value Chain

Power Lithium Battery Production Process

Working Principle of Lithium Battery

Cost Structure of Lithium Battery

Shipment of Global Cathode Materials (by Product), 2006-2014

Chinese Cathode Material Price, 2010-2014

Market Share of Global Cathode Material Enterprises, 2013

Output Structure of Global Anode Materials, 2013

Market Share of Global Anode Material Enterprises, 2013

Technical Feature Comparison among Several Anode Materials

Common Electronics and Automobiles’ Consumption of Lithium Battery Separator

Global Shipment of Ordinary and High-performance Lithium Battery Separator, 2008-2016E

Global Separator Price, 2008-2016

Market Share of Global Lithium Battery Separator Enterprises, 2013

Global Power Battery Supporting Separator, 2013

Shipment of Global Lithium Battery Electrolyte, 2011-2016

Cost Structure of Lithium Battery Electrolyte

Market Share of Global LiPF6 Enterprises, 2013

Global LiPF6 Price, 2009-2016E

Market Share of Global Electrolyte Enterprises, 2013

Cost Structure of Lithium Battery Cells in China

Cost Reduction Trend of Lithium Battery Cells in China

Cells Used on Major Electrical Vehicle Models Worldwide, 2013

Single Cell Capacity Distribution of Mainstream Electric Vehicles Worldwide (Ah), 2013

Battery Structure of Mainstream Electric Vehicles Worldwide

Supply Chain of Key Materials of Global Cell Manufacturers, 2013

Supply Chain of Key Materials of Global Cell Manufacturers, 2013

Cost Decomposition of Lithium Battery Pack

Global Electric Vehicle Battery Technologies, Suppliers and Costs, 2013

The Falling Trend of Battery Cost of Tesla Model S

Major BMS Suppliers for Electrical Vehicles Worldwide

Metal Content of Cathode Materials in Different Technology Roadmaps

Cost Analysis of Cathode Materials in Different Technology Roadmaps

Performance of Lithium-Ion Battery Packs in Different Technology Roadmaps

Life Cycle of Cathode Material Products

Specifications of Cathode Materials in Different Technology Roadmaps

Development Trend in New Cathode Materials

Chemical Structure of Laminar Lithium-Rich Manganese-based Cathode Materials

Sales Volume of Global EVs by Country, 2013

Sales Volume of Global EVs, 2008-2016E

Sales Volume of EVS in the US by Model, 2013

Sales Volume of EVS in Europe by Model, 2013

Sales Volume of EVs in Japan by Model, 2013

Sales Volume of EVs in China, 2008-2016E

Proportion of China’s EVs in Global Total by Sales Volume, 2008-2016E

Plan for Promotion of EVs in China, 2014-2015E

Sales Volume of Electric City Buses and % of City Buses in China, 2009-2016E

Sales Volume of Electric Buses in China by Enterprise, 2012-2016E

Investment of Electric Buses in China, 2009-2014

Sales Volume of 40 Global Electric Passenger Vehicle Models, 2011-2013

Battery Capacity and Battery Life for 40 Global Electric Vehicle Models, 2013

Global EV Battery Capacity per Car, 2008-2016E

Global Demand for Automotive Battery, 2008-2016E

Global Lithium Battery Shipments (by Demand), 2008-2016E

Battery Pack Cost of Global Major EVs, 2013

Global Power Lithium Battery Pack Price, 2008-2016E

Global Power Lithium Battery Industry Scale, 2008-2016E

Global Lithium Battery Industry Scale, 2008-2016E

China’s Demand for Automotive Battery, 2011-2016E

China Power Lithium Battery Pack Price, 2008-2016E

China Power Lithium Battery Industry Scale, 2010-2016E

China Lithium Battery Industry Scale, 2008-2016E

Market Share of Battery Companies Supporting Global 40 EV Models, 2013

Shipments of Batteries for Global 40 EV Models, 2013

Market Share of Global Small Lithium Battery Companies, 2013

EU and US Power Lithium Battery Companies and Their Supported Models

S. Korean Power Lithium Battery Companies and Their Supported Models

Japanese Power Lithium Battery Companies and Their Supported Models

Chinese Power Lithium Battery Companies and Their Supported Models

Equity Structure of LGC, 2013

Operating Performance of LGC, 2007-2014Q2

Revenue of LGC by Region, 2013

Revenue Structure of LGC, 2012-2013

Material Costs Structure of LGC's PHEV Cel

LGC Road Map for HEV LIB Technology

LGC Road Map for PHEV LIB Technology

LGC Road Map for EV LIB Technology

Business Development and Outlook of LGC's Lithium Business

Operating Performance of LGCPI, 2010-2014

Operating Performance of HL Green Power, 2010-2014

Operating Performance of LGC's Battery Business, 2013Q1-2014Q2

Electrical Vehicles Supported by LGC's Power Lithium Batteries

Managing Organizations of LGC in China

Production and Sales Network of LGC in China

Shipment of LGC's Power and Energy Storage Batteries, 2011-2014 (MWh)

Equity Structure of SDI, 2013

Operating Performance of SDI, 2008-2014Q2

Revenue of SDI by Region, 2013

SDI Road Map for xEV LIB Technology

Technical Performance of SDI's Power Lithium Batteries

Development and Operating Performance of SDI's Battery Business, 2007-2014Q2

SDI's Battery Shipments and Average Selling Price, 2007-2014

SDI's Revenue of Power Batteries, 2013Q1-2014Q2

Electric Vehicles Supported by SDI's Power Lithium Batteries

SDI's Shipment of Power and Energy Storage Batteries (MWh), 2011-2014

Major Subsidiaries of SKI

Supported EV Models of SKI’s Lithium Power Battery

Equity Structure of BESK

Profile of BESK

Specifications of BESK’s Lithium Power Battery

Output, Capacity, and Capacity Ulitilization Rate of SKI’s Battery Material (Separator), 2009-2013

Operation Performance of Panasonic, FY2008/09- FY2013/14

R & D Costs of Panasonic, FY2008/09-FY2013/14

Revenue Breakdown of Panasonic by Segment, FY2008-FY2013

Operating Profit Breakdown of Panasonic by Segment, FY2008-FY2013

Revenue Breakdown of Panasonic by Region, FY2013

Specifications of Panasonic’s NCA 18650 Cell Applied in Tesla

Cost Strucuture of Panasonic’s PHEV Cell

Developemnt Plan of Panasonic’s Automotive Batteries, FY2013-FY2019

Development Plan of Panasonic’s Automobile Segment, FY2013- FY2019

Developemnt Plan of Panasonic by Segment, FY2013-FY2019

Supported Electric Vehicles of Panasonic’s Lithium-ion Power Battery

Deliveries of Tesla’s Electric Vehicle, 2010-2016

Shipment of Panasonic’s Power Battery and Energy-storage Battery (MWh), 2011-2014

Equity Structure of AESC, 2013

Costs Structure of AESC BEV Cell Materials

AESC Power Lithium-ion Battery Module Structure

Specifcication and Connecton of AESC High-capacity Power Battery

Performance Parameter of AESC High-capacity Power Battery

Specifcication and Connection of AESC High Power Battery

Performance Parameter of AESC High Power Battery

AESC Power Battery System Solutions

Supporting Electric Vehicles of AESC Power Lithium-Ion Battery

Shipments of AESC Power and Energy Storage Battery (MWh), 2011-2014E

Equity Structure of LEJ, 2013

Specifications of LEJ Power Lithium Batteries

Electric Vehicles Supported by LEJ's Power Lithium Batteries

LEJ's Shipment of Power and Energy Storage Batteries (MWh), 2011-2014

Specifications of Li-Tec's High-Capacity Power Batteries

Performance Parameters of Li-Tec's High-Capacity Power Batteries

Li-Tec's Power Battery Plant in Kamenz, Germany

History of A123Systems

Revenue and Gross Profit of A123Systems, FY2007- FY2012

Electric Vehicles Supported by A123's Power Lithium Batteries

Revenue of Subsidiaries of A123Systems in China

Project Investment of Changzhou Gaobo, 2005-2008

Revenue and Net Profit of Valence, FY2008-FY2012

Operation of Valence’s Subsidiaries in China

Equity Structure of Guoxuan

Operating Performance of Guoxuan, 2009-2013

Technical Parameters for Guoxuan’s LFP Cathode Materials

Specification Parameters for Guoxuan’s LFP Power Cells

Technical Parameters for Models Supported by Guoxuan’s Power Batteries

Power/Energy Storage Battery Output, Capacity and Capacity Utilization of Guoxuan, 2009-2013

Capacity and Investment Plan of Guoxuan, 2009-2013

Operating Performance of BYD, 2008-2013

Revenue Structure of BYD (by Business), 2012-2013

Gross Margin of BYD (by Business), 2009-2013

Major Characteristics of BYD Lithium Iron Phosphate Battery

Capacity, Weight and Cost of BYD Automotive Battery Pack

Lithium Battery Capacity and Weight of BYD Electric Forklifts

Lithium Battery Capacity of BYD ESS

Lithium Battery Capacity of BYD EPS

Sales Volume of BYD Electric Vehicle (by Model), Jan. 2013-May 2014

Sales Volume of BYD Electric Vehicles, 2011-2017

Battery Demand of BYD Electric Vehicle (MWh), 2011-2017

Output, Capacity and Capacity Utilization of BYD Power and Storage Battery, 2011-2017

Equity Structure of Pride, 2013

Operating Performance of Pride, 2011-2013

Performance Parameters of Pride’s Power Battery Pack

Equity Structure of Lishen

Operating Performance of Lishen, 2011-2013

Technology Roadmap for Power Cell of Lishen

Technology Roadmap for Power Battery Pack of Lishen

Performance Parameters of Spiral Wound Power Cell of Lishen

Performance Parameters of Laminated Power Cell of Lishen

Performance Parameters of Polymer Power Cell of Lishen

Technical Parameters of Power Cell of Lishen

Customers of Lishen’s Power Battery

Performance Parameters of Power Battery Pack of Lishen

Lithium Battery Capacity of Lishen, 2000-2013

Investment Plan for Power Battery of Lishen, 2012-2014

Operating Performance of CHINA BAK BATTERY, 2008-Q1 2014

Revenue Structure of CHINA BAK BATTERY (by Regions), 2009-2013

R & D Costs and % of Total Revenue of China BAK Battery, 2010-2013

Technical Parameters of Power Cell of China BAK Battery

Basic Information of BAK International (Tianjin) Limited

Basic Information of BAK Power Battery (Dalian)

Sales of High-power Lithium Battery Cells of China BAK Battery, 2009-2013

Investment Plan of High-power Lithium Battery Cells of China BAK Battery, 2013-2014

Revenue and Gross Margin of Sinopoly Battery, 2011-2013

Net Income of Sinopoly Battery, 2011-2013

Specifications of Sinopoly’s Power Cell

Operating Results of CITIC GUOAN Mengguli, 2009-2013

Technical Parameters of Cathode Materials of CITIC GUOAN Mengguli

Technical Parameters of Power Battery Modules of CITIC GUOAN Mengguli

Equity Structure of China Aviation Lithium Battery, 2013

Operating Results of China Aviation Lithium Battery, 2010-2013

Pure Electric Vehicle BMS of China Aviation Lithium Battery

Battery Certification of China Aviation Lithium Battery

Global Marketing Network of China Aviation Lithium Battery

Major Customers of China Aviation Lithium Battery

Basic Information of Amperex Technology Limited

如果这份报告不能满足您的要求,我们还可以为您定制报告,请 留言说明您的详细需求。

|