|

报告导航:研究报告—

制造业—材料

|

|

2014-2016年全球及中国石墨烯行业研究报告 |

|

字数:2.6万 |

页数:78 |

图表数:59 |

|

中文电子版:7000元 |

中文纸版:3500元 |

中文(电子+纸)版:7500元 |

|

英文电子版:1700美元 |

英文纸版:1800美元 |

英文(电子+纸)版:2000美元 |

|

编号:LT024

|

发布日期:2014-09 |

附件:下载 |

|

|

|

由于具有优异的力学、热学、电学和磁学性能,石墨烯在高性能电子器件、复合材料、传感器及能量储存等领域拥有广泛的应用前景。

目前已经被产品化的石墨烯主要应用在电池导电添加剂、散热材料、复合材料等领域,产品以氧化还原法制备的石墨烯粉体和浆料居多,成本已经下降到10 元/g内。2013年,半导体电子、能源(主要为电池)和复合材料行业对石墨烯需求最大,占比分别为26%,19%,14%。

2013年全球石墨烯市场规模在1250万美元左右,同比上升了50%;预计到2020年将达到1.2亿美元左右。目前石墨烯市场规模还很小,并且全球范围内产学结合进度不及预期,因此石墨烯的产业化成熟阶段应在2020年以后。

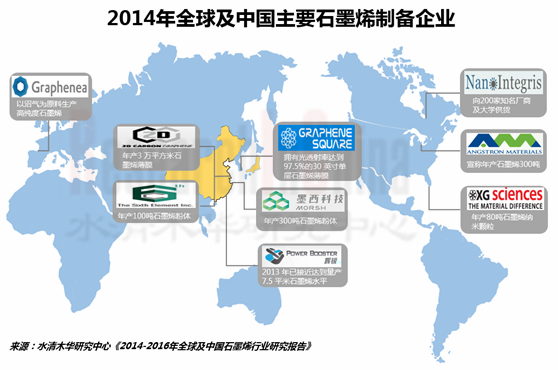

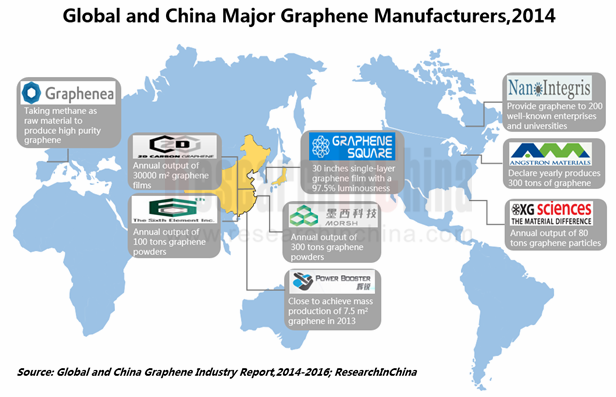

中国石墨烯良好的研究优势,为其产业化和拓展应用提供了有力支撑。截止目前,中国先后成立了几十家石墨烯相关企业,有一部分公司已经公告规模化生产线投产的消息,但均为石墨烯粉体或薄膜产品,并非真正意义上的石墨烯。

2013年常州第六元素建成中国首条大规模宏量制备、全自动控制的粉体石墨烯生产线,目前石墨烯粉体产能100吨/年。预计2016年可年产1000吨粉体石墨烯。

2013年5月,二维碳素年产3万平方米石墨烯透明导电薄膜生产线正式投产,形成年产500万片石墨烯触摸屏的生产规模。预计2015年二维碳素可年产300万平方米石墨烯透明导电薄膜。

墨西科技300吨石墨烯项目于2012年9月开工,该项目已于2013年底建成投产。但该项目所产产品并非真正意义上的石墨烯,而是多层石墨烯微片。

水清木华研究中心《2014-2016年全球及中国石墨烯行业研究报告》着重研究了以下内容:

● 石墨烯上下游产业(包括石墨、石墨烯器件加工等)发展概况分析等;

● 全球石墨烯行业发展概况(包括市场需求、市场规模)、产业化前景及下游细分市场(包括锂电池、超级电容、透明电极)分析等;

● 中国石墨烯行业发展概况及下游细分市场(包括锂电池、透明电极、单晶硅等)分析等;

● 全球18家石墨烯重点企业(包括Applied Graphene Materials、Haydale Graphene Industries、Graphene NanoChem Plc等)经营情况及石墨烯业务分析等;

● 中国10家石墨烯重点企业(包括方大炭素、金路集团、康得新等)经营情况及石墨烯业务分析等。

With excellent performance in mechanics, thermology, electricity and magnetics, graphene enjoys broad application prospects in high-performance electronic devices, composite materials, sensors, energy storage and the like.

At present, the productized graphene is mainly used in such fields as battery conductive additives, heat dissipating materials and composite materials, with products dominated by graphene powder and suspension prepared by oxidation-reduction method. Also, its costs have been reduced to within RMB10/g. In 2013, the industries including semiconductor electronics, energy (primarily battery) and composite materials showed the highest demand for graphene, which occupied 26%, 19% and 14%, respectively, of the total.

In 2013, the size of global graphene market stood at around USD12.5 million, up 50% year on year, and this figure is expected to climb to USD120 million by 2020. Currently, there is a small market size of graphene, and the integration progress of production and teaching is worse than expected. Consequently, the graphene industrialization will tend to be mature after 2020.

China’s strong strength in graphene research provides a strong support for graphene industrialization and application extension. Up until now, China has successively set up dozens of graphene related enterprises, some of which has announced that the mass production lines went into operation. But these lines produce graphene powder or film products, rather than the graphene in its true sense.

In 2013, The Sixth Element (Changzhou) Materials Technology Co., Ltd. built the first large-scale macro preparation, full-automatic graphene powder production line in China, with existing capacity of 100 t/a, which is estimated to rise to 1,000 t/a by 2016.

In May 2013, 2D Carbon Graphene Material Co., Ltd. put its 30,000m2/a transparent graphene conductive film production line into operation, thus bringing into being a production scale of 5 million pcs/a graphene touch screen. It is predicted that by 2015 the company will produce 3,000,000 square meters of transparent grapheme conductive film per year.

Ningbo Morsh Technology’s 300 t/a graphene project, which started its construction in September 2012, was completed and put into operation at the end of 2013. However, the products made by the project were not the real graphene but multilayer graphene nanoplatelets.

Global and China Graphene Industry Report, 2014-2016 released by ResearchInChina mainly deals with the followings:

Developments of graphene upstream and downstream sectors, including graphite, graphene device processing, etc.; Developments of graphene upstream and downstream sectors, including graphite, graphene device processing, etc.;

Developments of global graphene industry (including market demand and market size), industrialization prospects and downstream market segments such as lithium battery, supercapacitor and transparent electrode; Developments of global graphene industry (including market demand and market size), industrialization prospects and downstream market segments such as lithium battery, supercapacitor and transparent electrode;

Developments of China’s graphene industry and analysis of downstream market segments e.g. lithium battery, transparent electrode and monocrystalline silicon; Developments of China’s graphene industry and analysis of downstream market segments e.g. lithium battery, transparent electrode and monocrystalline silicon;

Operation and graphene business of 18 major global graphene enterprises, including Applied Graphene Materials, Haydale Graphene Industries, Graphene NanoChem Plc, etc.; Operation and graphene business of 18 major global graphene enterprises, including Applied Graphene Materials, Haydale Graphene Industries, Graphene NanoChem Plc, etc.;

Operation and graphene business of 10 major Chinese grapheme enterprises including Fangda Carbon New Material, Sichuan Jinlu Group and Beijing Kangde Xin Composite Material. Operation and graphene business of 10 major Chinese grapheme enterprises including Fangda Carbon New Material, Sichuan Jinlu Group and Beijing Kangde Xin Composite Material.

第一章 石墨烯行业概述

1.1 定义

1.2 制备方法

1.3 应用领域

1.3.1 集成电路

1.3.2 传感器

1.3.3 晶体管

1.3.4 透明电极

1.3.5 海水淡化

1.3.6 超级电容器

第二章 上下游行业概况

2.1 石墨

2.2 石墨烯器件加工

第三章 全球石墨烯行业发展分析

3.1 总体概况

3.2 产业化前景

3.3 细分市场

3.3.1 锂电池行业

3.3.2 超级电容器行业

3.3.3 透明电极行业

第四章 中国石墨烯行业发展分析

4.1 总体概况

4.2 细分市场

3.2.1 锂电池行业

3.2.2 超级电容器行业

3.2.3 透明电极行业

3.2.4 单晶硅行业

第五章 全球石墨烯行业主要企业

5.1 Northern Graphite

5.1.1 公司简介

5.1.2 运营情况

5.1.3 石墨烯业务

5.2 CVD

5.2.1 公司简介

5.2.2 运营情况

5.2.3 石墨烯业务

5.3 Focus Graphite

5.3.1 公司简介

5.3.2 运营情况

5.3.3 石墨烯业务

5.4 Lomiko Metals

5.4.1 公司简介

5.4.2 运营情况

5.4.3 石墨烯业务

5.5 Applied Graphene Materials

5.5.1 公司简介

5.5.2 运营情况

5.5.3 石墨烯业务

5.6 Graphene NanoChem Plc

5.6.1 公司简介

5.6.2 运营情况

5.6.2 石墨烯业务

5.7 Haydale Graphene Industries

5.7.1 公司简介

5.7.2 运营情况

5.7.3 石墨烯业务

5.8 Cientifica Plc

5.8.1 公司简介

5.8.2 运营情况

5.8.3 石墨烯业务

5.9 其他企业

5.9.1 Graphene Laboratories

5.9.2 Graphenea

5.9.3 Graphene Square

5.9.4 Grafoid

5.9.5 XG Sciences Inc

5.9.6 Bluestone Global Tech

5.9.7 Angstron Materials

5.9.8 Graphenano

5.9.10 Vorbeck Materials

第六章 中国石墨烯行业主要企业

6.1 方大炭素

6.1.1 企业简介

6.1.2 经营情况

6.1.3 营收构成

6.1.4 石墨烯业务

6.1.5 毛利率

6.1.6 预测与展望

6.2 金路集团

6.2.1 企业简介

6.2.2 经营情况

6.2.3 营收构成

6.2.4 石墨烯业务

6.2.5 毛利率

6.3 康得新

6.3.1 公司简介

6.3.2 经营情况

6.3.3 营收构成

6.3.4 石墨烯业务

6.3.5 毛利率

6.3.6 预测与展望

6.4 厦门凯纳

6.3.1 企业简介

6.3.2 运营情况

6.3.3 石墨烯业务

6.5 先丰纳米

6.5.1 公司简介

6.5.2 石墨烯业务

6.6 第六元素

6.6.1 公司简介

6.6.2 运营情况

6.6.3 石墨烯业务

6.7二维炭素

6.7.1 企业简介

6.7.2 石墨烯业务

6.8 吉仓纳米

6.8.1 公司简介

6.8.2 石墨烯业务

6.9 普兰纳米

6.9.1 公司简介

6.9.2 石墨烯业务

6.10 墨西科技

6.10.1 公司简介

6.10.2 石墨烯业务

第七章 总结与预测

7.1 总结

7.2 预测

1. Overview of Graphene Industry

1.1 Definition

1.2 Preparation Method

1.3 Applications

1.3.1 Integrated Circuit

1.3.2 Sensor

1.3.3 Transistor

1.3.4 Transparent Electrode

1.3.5 Sea Water Desalinization

1.3.6 Supercapacitor

2. Overview of Upstream and Downstream Sectors

2.1 Graphite

2.2 Graphene Device Processing

3. Development of Global Graphene Industry

3.1 Overview

3.2 Industrialization Prospects

3.3 Market Segments

3.3.1 Lithium Battery

3.3.2 Supercapacitor

3.3.3 Transparent Electrode

4. Development of China Graphene Industry

4.1 Overview

4.2 Market Segments

4.2.1 Lithium Battery

4.2.2 Supercapacitor

4.2.3 Transparent Electrode

4.2.4 Monocrystalline Silicon

5. Major Global Graphene Enterprises

5.1 Northern Graphite

5.1.1 Profile

5.1.2 Operation

5.1.3 Graphene Business

5.2 CVD

5.2.1 Profile

5.2.2 Operation

5.2.3 Graphene Business

5.3 Focus Graphite

5.3.1 Profile

5.3.2 Operation

5.3.3 Graphene Business

5.4 Lomiko Metals

5.4.1 Profile

5.4.2 Operation

5.4.3 Graphene Business

5.5 Applied Graphene Materials

5.5.1 Profile

5.5.2 Operation

5.5.3 Graphene Business

5.6 Graphene NanoChem Plc

5.6.1 Profile

5.6.2 Operation

5.6.2 Graphene Business

5.7 Haydale Graphene Industries

5.7.1 Profile

5.7.2 Operation

5.7.3 Graphene Business

5.8 Cientifica Plc

5.8.1 Profile

5.8.2 Operation

5.8.3 Graphene Business

5.9 Other Enterprises

5.9.1 Graphene Laboratories

5.9.2 Graphenea

5.9.3 Graphene Square

5.9.4 Grafoid

5.9.5 XG Sciences Inc.

5.9.6 Bluestone Global Tech

5.9.7 Angstron Materials

5.9.8 Graphenano

5.9.9 Vorbeck Materials

6. Major Chinese Graphene Enterprises

6.1 Fangda Carbon New Material

6.1.1 Profile

6.1.2 Operation

6.1.3 Revenue Structure

6.1.4 Graphene Business

6.1.5 Gross Margin

6.1.6 Forecast and Outlook

6.2 Sichuan Jinlu Group

6.2.1 Profile

6.2.2 Operation

6.2.3 Revenue Structure

6.2.4 Graphene Business

6.2.5 Gross Margin

6.3 Beijing Kangde Xin Composite Material

6.3.1 Profile

6.3.2 Operation

6.3.3 Revenue Structure

6.3.4 Graphene Business

6.3.5 Gross Margin

6.3.6 Forecast and Outlook

6.4 Xiamen Knano Graphene Technology

6.4.1 Profile

6.4.2 Operation

6.4.3 Graphene Business

6.5 Nanjing XFNANO Materials Tech

6.5.1 Profile

6.5.2 Graphene Business

6.6 The Sixth Element (Changzhou) Materials Technology

6.6.1 Profile

6.6.2 Operation

6.6.3 Graphene Business

6.7 2D Carbon Graphene Material

6.7.1 Profile

6.7.2 Graphene Business

6.8 Nanjing JCNANO Tech

6.8.1 Profile

6.8.2 Graphene Business

6.9 Tianjin Plannano Technology

6.9.1 Profile

6.9.2 Graphene Business

6.10 Ningbo Morsh Technology

6.10.1 Profile

6.10.2 Graphene Business

7. Summary and Forecast

7.1 Summary

7.2 Forecast

表:四种石墨烯制备方法对比

表:2012-2013年全球主要国家和地区石墨产量及储量

表:全球主要石墨烯器件加工厂商

图:2013年全球石墨烯(分行业)需求占比

图:2012-2020年全球石墨烯市场规模

表:海外国家开展石墨烯相关的研发项目与资助情况

图:截止2012年底全球石墨烯领域前10 大专利申请人

图:截止2012年底全球石墨烯不同应用方向专利数量

表:全球主要石墨烯制备企业

图:2012-2020年全球锂电池市场规模

图:2008-2014年全球负极材料需求量

表:石墨烯在超级电容器领域主要进展

图:2013-2018年全球超级电容器市场规模

表:石墨烯在触摸屏领域主要进展

图:2012-2016年全球触控面板出货量

图:2010-2014年全球LCD 出货量

表:中国本土已具备产能石墨烯相关企业

图:2009-2014年中国锂电池产量

图:2012-2016年中国超级电容器市场规模

图:2006-2013年中国超级电容器(分产品)市场规模

图:2010-2014年中国触控面板(分产品)出货量

图:2008-2014年中国LCD TV 出货量

图:2006-2014年中国集成电路市场规模

图:2011年7月-2013年9月中国单晶硅周均价

图:2008-2013年Northern Graphite 销售成本及净利润

图:2010-2013年CVD Equipment 营业收入及净利润

图:2008-2013年Focus Graphite 运营成本及净利润

图:2009-2013年Lomiko Metals 运营成本

图:2011-2013年Applied Graphene Materials营业收入及净利润

图:2011-2013年Graphene NanoChem Plc营业收入及净利润

图:2011-2013年Haydale Graphene Industries营业收入及净利润

图:2011-2013年Applied Graphene Materials营业收入及净利润

图:2008-2014年方大炭素营业收入及净利润

图:2008-2014年方大炭素(分产品)营收占比

图:2008-2014年方大炭素(分地区)营收占比

图:2008-2014年方大炭素毛利率

图:2008-2014年方大炭素(分产品)毛利率

图:2013-2016年方大炭素营业收入及净利润

图:2008-2013年金路集团营业收入及净利润

图:2009-2014年金路集团(分产品)营收占比

图:2009-2013年金路集团(分地区)营收占比

图:2008-2014年金路集团毛利率

图:2009-2014年康得新营业收入及净利润

图:2009-2014年康得新(分产品)营收占比

图:2009-2014年康得新(分地区)营收占比

图:2009-2014年康得新(分产品)毛利率

图:2013-2016年康得新营业收入及净利润

表:厦门凯纳主要产品及规格

图:2012-2013年厦门凯纳营业收入及净利润

图:2012-2013年厦门凯纳营业成本及毛利率

表:厦门凯纳石墨烯专利情况

图:先丰纳米石墨烯系列产品及规格

表:2012年第六元素主要经营指标

表:第六元素石墨烯产品及应用

图:2012-2015年二维炭素石墨烯透明薄膜产能及销售收入

表:吉仓纳米主要石墨烯产品

表:普兰纳米主要石墨烯产品

图:墨西科技主要石墨烯产品

图:2011-2020年全球石墨烯(分领域)需求规模

Four Preparation Methods of Graphene

Graphite Output and Reserves in Major Countries and Regions, 2012-2013

Major Global Graphene Device Processors

Structure of Global Graphene Demand by Industry, 2013

Global Graphene Market Size, 2012-2020E

Graphene-related R&D Projects and Sponsorship in Foreign Countries

The World’s Top 10 Graphene Patent Applicant as of end-2012

Number of Global Graphene Patents by Application as of end-2012

Major Global Graphene Preparation Enterprises

Global Lithium Battery Market Size, 2012-2020E

Global Demand for Anode Materials, 2008-2014

Major Progress of Graphenes in Supercapacitor

Global Supercapacitor Market Size, 2013-2018E

Major Progress of Graphene in Touch Screen

Global Touch Panel Shipments, 2012-2016E

Global LCD Shipments, 2010-2014

Graphene Related Production Companies in China

China’s Lithium Battery Output, 2009-2014

China’s Supercapacitor Market Size, 2012-2016E

China’s Supercapacitor Market Size by Product, 2006-2013

China’s Touch Panel Shipments by Product, 2010-2014

China’s LCD TV Shipments, 2008-2014

China’s IC Market Size, 2006-2014

Average Weekly Price of Monocrystalline Silicon in China, Jul. 2011-Sep. 2013

Selling Cost and Net Income of Northern Graphite, 2008-2013

Revenue and Net Income of CVD Equipment, 2010-2013

Operating Cost and Net Income of Focus Graphite, 2008-2013

Operating Cost of Lomiko Metals, 2009-2013

Revenue and Net Income of Applied Graphene Materials, 2011-2013

Revenue and Net Income of Graphene NanoChem Plc, 2011-2013

Revenue and Net Income of Haydale Graphene Industries, 2011-2013

Revenue and Net Income of Applied Graphene Materials, 2011-2013

Revenue and Net Income of Fangda Carbon New Material, 2008-2014

Revenue Structure of Fangda Carbon New Material by Product, 2008-2014

Revenue Structure of Fangda Carbon New Material by Region, 2008-2014

Gross Margin of Fangda Carbon New Material, 2008-2014

Gross Margin of Fangda Carbon New Material by Product, 2008-2014

Revenue and Net Income of Fangda Carbon New Material, 2013-2016E

Revenue and Net Income of Sichuan Jinlu Group, 2008-2013

Revenue Structure of Sichuan Jinlu Group by Product, 2009-2014

Revenue Structure of Sichuan Jinlu Group by Region, 2009-2013

Gross Margin of Sichuan Jinlu Group, 2008-2014

Revenue and Net Income of Beijing Kangde Xin Composite Material, 2009-2014

Revenue Structure of Beijing Kangde Xin Composite Material by Product, 2009-2014

Revenue Structure of Beijing Kangde Xin Composite Material by Region, 2009-2014

Gross Margin of Beijing Kangde Xin Composite Material by Product, 2009-2014

Revenue and Net Income of Beijing Kangde Xin Composite Material, 2013-2016E

Main Products and Specifications of Xiamen Knano Graphene Technology

Revenue and Net Income of Xiamen Knano Graphene Technology, 2012-2013

Operating Cost and Gross Margin of Xiamen Knano Graphene Technology, 2012-2013

Graphene Patents of Xiamen Knano Graphene Technology

Graphene Series Products and Specifications of Nanjing XFNANO Materials Tech

Main Business Indicators of The Sixth Element (Changzhou) Materials Technology, 2012

Graphene Products and Applications of The Sixth Element (Changzhou) Materials Technology

Capacity and Sales of Transparent Graphene Film of 2D Carbon Graphene Material, 2012-2015E

Main Graphene Products of Nanjing JCNANO Tech

Main Graphene Products of Tianjin Plannano Technology

Main Graphene Products of Ningbo Morsh Technology

Global Demand for Graphene by Application, 2011-2020E

如果这份报告不能满足您的要求,我们还可以为您定制报告,请 留言说明您的详细需求。

|