|

|

|

报告导航:研究报告—

制造业—化工

|

|

2014-2017年全球及中国高阻隔材料(PVDC、EVOH、PEN)行业研究报告 |

|

字数:3.5万 |

页数:145 |

图表数:145 |

|

中文电子版:8500元 |

中文纸版:4250元 |

中文(电子+纸)版:9000元 |

|

英文电子版:2500美元 |

英文纸版:2700美元 |

英文(电子+纸)版:2800美元 |

|

编号:WLQ020

|

发布日期:2014-09 |

附件:下载 |

|

|

|

高阻隔材料是指具有很强的阻止小分子气体(如O2、CO2、N2、水蒸气),香味及其它有机溶剂蒸汽等透过的能力。阻隔性能较好的三大高阻隔材料为聚偏二氯乙烯(PVDC)、乙烯/乙烯醇共聚物(EVOH) 和聚萘二甲酸乙二醇酯(PEN),它们主要用于制成薄膜或容器,用于对阻隔性能要求较高食品、药品、军品、化妆品、农药、精密仪器及高档精细化学品等包装领域,同时三者均可用于制作真空绝热板材料。

由于PVDC、EVOH和PEN对原材料质量和工艺控制要求较高,目前世界上生产PVDC、EVOH和PEN原材料(树脂)企业不多,三大市场均被少数几家企业寡头垄断。

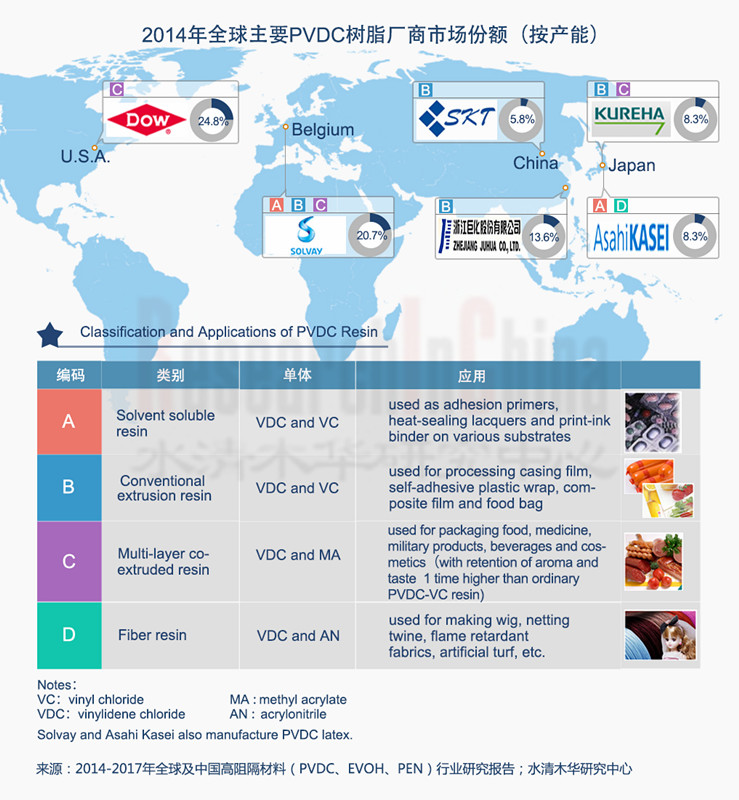

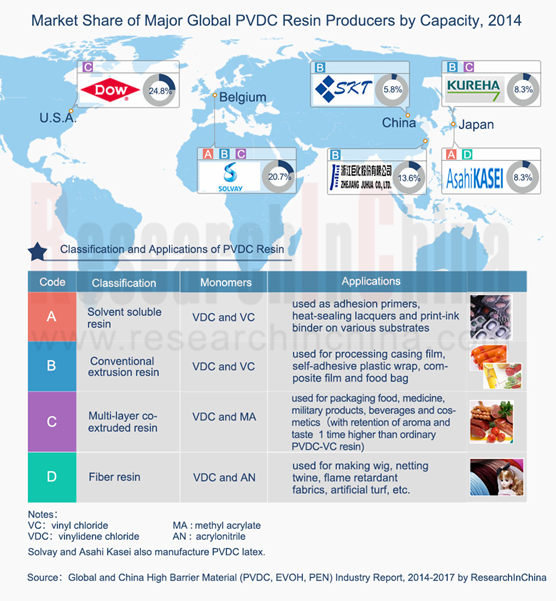

PVDC原料主要形式有PVDC树脂和乳胶。全球PVDC树脂生产企业主要有陶氏化学(美国)、苏威公司(比利时)、吴羽公司(日本)、旭化成(日本)等。2013年,全球PVDC树脂产能228Kt/a,2014年全球PVDC产能将增至242Kt/a,新增产能主要由中国PVDC生产企业带动(但产能未完全释放)。

截至2014年,中国PVDC树脂生产企业仅有两家,分别是浙江巨化股份和南通汇羽丰新材料有限公司。两家公司生产的PVDC树脂均主要用于肠衣膜生产。近年来,巨化股份加大了PVDC的投资开发力度,产能从2009年的3Kt/a增加到2013年的28Kt/a,2014年将进一步增加至33Kt/a。南通汇羽丰新材料有限公司生产的PVDC树脂主要供给河南双汇生产肠衣膜。2014年底,该公司将新增3.6Kt/a PVDC树脂产能,总产能将达13.6Kt/a。

中国PVDC树脂市场呈现2个特点。(1)PVDC树脂产品单一,产量不足,进口依存度很高(PVDC树脂加工设备依存度也很高)。2013年,中国PVDC树脂消表观消费量为53.6Kt/a,进口依存度为48.5%,2013年之前达到50%以上。(2)PVDC树脂应用领域将不断拓展,消费量将保持较快增长。2014年中国PVDC树脂消费领域主要集中在肠衣膜领域,随着中国保鲜膜PVDC树脂、多层挤出PVDC树脂产能释放以及PVDC薄膜加工设备的国产化率提高,未来PVDC消费领域将不断拓展,消费量将较保持较快增长。

EVOH阻隔性包装薄膜、汽油箱、复合瓶及共挤出塑料片材。2014年,全球EVOH树脂产能为142Kt,市场被可乐丽集团(日本)、合成化学工业集团(日本)和长春石油化学股份有限公司(台湾)垄断。由于市场需求高,两大龙头公司均不断增加产能。2014年1月,Kuraray在美国的公司(Kuraray America, Inc.)EVOH树脂新增产能12Kt/a,使Kuraray全球产能增至81Kt/a。2015年初,Nippon Gohsei在美国的公司(NOLTEX L.L.C.)EVOH树脂将新增产能15Kt/a,届时Nippon Gohsei在全球产能将达66Kt/a。

全球PEN树脂绝大部分用于生产PEN薄膜和注塑制品,还有10%左右用于生产PEN纤维。目前,PEN市场被帝人(日本)和杜邦(美国)的合资公司(杜邦帝人薄膜公司&帝人杜邦薄膜公司)以及SKC(韩国)占据。

水清木华研究中心《2014-2017年全球及中国高阻隔材料(PVDC、EVOH、PEN)行业研究报告》主要包括以下几个内容:

高阻隔材料概述(包括高阻隔材料的定义、分类、产业链、相关政策、发展前景 高阻隔材料概述(包括高阻隔材料的定义、分类、产业链、相关政策、发展前景

等);

全球及中国PVDC、EVOH、PEN的市场情况(包括定义、分类、生产工艺、加工工 全球及中国PVDC、EVOH、PEN的市场情况(包括定义、分类、生产工艺、加工工

艺、全球及中国的产能、产销量、进出口和下游应用及发展前景等);

全球及中国PVDC、EVOH、PEN的生产企业(包括美国陶氏、比利时苏威等PVDC 全球及中国PVDC、EVOH、PEN的生产企业(包括美国陶氏、比利时苏威等PVDC

生产企业,日本可乐丽、日本合成化学等EVOH的生产企业和日本帝人、美国杜邦等

PEN的生产企业等公司简介,营收情况,营收构成,研发投入,PVDC、EVOH及PEN

业务,在华业务等)。

High barrier materials can block the penetration of small molecular gas (such as O2, CO2, N2, water vapor), aroma and other organic solvent vapor prominently. By virtue of better barrier performance, polyvinylidene chloride (PVDC), ethylene / vinyl alcohol copolymer (EVOH) and polyethylene naphthalate (PEN) are mainly used to produce thin films and containers, and utilized in such fields with higher requirements on barrier properties as food, medicine, military products, cosmetics, pesticides, precision instruments and high-grade fine chemicals; additionally, they are also suitable for the production of vacuum insulation panel materials.

In the world, only a small number of companies are capable of producing PVDC, EVOH and PEN which require high-quality raw materials and strict process control, so that the current PVDC, EVOH and PEN markets are dominated by a few oligopolists.

PVDC raw materials exist in the forms of PVDC resins and latexes. Global PVDC resin producers embrace Dow Chemical (USA.), Solvay (Belgium), Kureha (Japan) and Asahi Kasei (Japan). The global PVDC resin capacity reached 228Kt/a in 2013, and will hit 242Kt/a in 2014. New capacity is mainly contributed by Chinese PVDC manufacturers (but the capacity is not fully released).

As of 2014, there has been only two PVDC resin production enterprises in China, namely Zhejiang Juhua and Nantong SKT. Both companies produce PVDC resins used in casing films. In recent years, Juhua has increased investment in PVDC, so that the capacity jumped from 3Kt/a in 2009 to 28Kt/a in 2013 and will further rise to 33Kt/a in 2014. Nantong SKT primarily supplies PVDC resins to Henan Shuanghui(i.e., Shineway Group) for the purpose of casing film production. By the end of 2014, Nantong SKT will add the capacity of 3.6Kt/a PVDC resins, so the total capacity will reach 13.6Kt/a.

Chinese PVDC resin market presents two characteristics.

(1) Limited varieties of PVDC resin products with insufficient output and high import dependence (the import dependence ratio of PVDC resin processing equipment is also high). In 2013, China's apparent consumption of PVDC resin amounted to 53.6Kt/a, and the ratio of import dependence was 48.5%, compared with the over 50% before 2013.

(2) PVDC resin application will continue to extend, and the consumption will maintain rapid growth. In 2014, China’s PVDC resin consumption fields are mainly reflected in casing films. As China releases the capacity of plastic wrap PVDC resins and multilayer extrusion PVDC resins as well as enhances the localization rate of PVDC film processing equipment, the future PVDC consumption fields will be enlarged, and the consumption will climb rapidly.

EVOH is suitable for the production of packaging films, gasoline tank, composite bottles and co-extruded plastic sheets. In 2014, the global EVOH resin capacity is recorded at 142Kt, and the market is monopolized by Kuraray (Japan), Nippon Gohsei (Japan) and ChangChun PetroChemical (Taiwan). Due to robust market demand, the former two giants keep expanding capacity. In January 2014, Kuraray’s subsidiary in the United States (Kuraray America, Inc.) raised the EVOH resin capacity by 12Kt/a, so that Kuraray’s global capacity ascended to 81Kt/a. In early 2015, the subsidiary of Nippon Gohsei in the United States (NOLTEX L.L.C.) will obtain the new EVOH resin capacity of 15Kt/a, then the global capacity of Nippon Gohsei is to hit 66Kt/a.

On a global basis, the overwhelming majority of PEN resins gets used to produce PEN films and injection molding products; besides, about 10% of PEN resins are adopted for the production of PEN fibers. Currently, the PEN market is occupied by the joint ventures set up by Teijin (Japan) and DuPont (USA), and SKC (South Korea).

The report highlights the following:

Overview of high barrier materials (including definition, classification, industry chain, related policies, prospects, etc.); Overview of high barrier materials (including definition, classification, industry chain, related policies, prospects, etc.);

Global and Chinese PVDC, EVOH, PEN market (embracing definition, classification, production technology, processing technology, capacity, output, sales volume, import, export, applications and development prospects, etc.); Global and Chinese PVDC, EVOH, PEN market (embracing definition, classification, production technology, processing technology, capacity, output, sales volume, import, export, applications and development prospects, etc.);

Profile, revenue, revenue structure, R & D investment, PVDC, EVOH and PEN business, and business in China of global and Chinese PVDC, EVOH and PEN producers (comprising PVDC companies such as USA Dow and Belgium Solvay, EVOH enterprises such as Japan Kuraray and Nippon Gohsei, as well as PEN manufacturers such as Japan Teijin and USA DuPont). Profile, revenue, revenue structure, R & D investment, PVDC, EVOH and PEN business, and business in China of global and Chinese PVDC, EVOH and PEN producers (comprising PVDC companies such as USA Dow and Belgium Solvay, EVOH enterprises such as Japan Kuraray and Nippon Gohsei, as well as PEN manufacturers such as Japan Teijin and USA DuPont).

第一章 高阻隔材料概述

1.1 定义

1.2 分类

1.3 产业链

1.4 相关政策

1.5 发展前景

第二章 聚偏二氯乙烯(PVDC )

2.1 定义和分类

2.1.1 定义

2.1.2 分类

2.2 生产工艺

2.3 全球供需分析及预测

2.3.1 全球产能

2.3.2 全球供需分析

2.4 中国供需分析及预测

2.4.1 中国产能

2.4.2 中国供需分析

2.5 进出口分析

2.5.1 出口分析

2.5.2 进口分析

2.6下游应用及发展前景

2.6.1 PVDC肠衣膜

2.6.2 PVDC涂布膜

2.6.3 PVDC保鲜膜

2.6.4 PVDC收缩膜

2.6.5 PVDC共挤拉伸膜

第三章 全球及中国PVDC主要生产企业

3.1美国陶氏化学公司

3.1.1 企业简介

3.1.2 经营情况

3.1.3 营收构成

3.1.4 功能塑料部门

3.1.5 研发支出

3.1.6 PVDC生产基地及产能

3.1.7 PVDC树脂(SARAN)

3.1.8 PVDC 薄膜( SARANEX)

3.1.9 发展战略

3.2 索尔维

3.2.1 简介

3.2.2 经营情况

3.2.3 营收构成

3.2.4 毛利率

3.2.5 研发支出

3.2.6 专用聚合物

3.2.7 PVDC生产基地及产能

3.2.8 PVDC产品

3.2.8.1 Diofan® 乳胶

3.2.8.2 Ixan® 挤出树脂

3.2.8.3 Ixan® 可溶性树脂

3.2.9 在华业务

3.3吴羽株式会社

3.3.1 企业简介

3.3.2 经营情况

3.3.3 营收构成

3.3.4研发支出

3.3.5 PVDC生产基地及产能

3.3.6 PVDC产品

3.3.6.1 PVDC树脂

3.3.6.2新克瑞哈龙

3.3.6.3克瑞哈龙薄膜

3.3.6.4克瑞哈龙多层薄膜

3.3.7 在华业务

3.4旭化成株式会社

3.4.1 企业简介

3.4.2 经营情况

3.4.3 营收构成

3.4.4 研发支出

3.4.5 PVDC生产基地及产能

3.4.6 PVDC产品

3.4.6.1 PVDC 乳胶

3.4.6.2 PVDC树脂

3.4.6.3 PVDC 阻隔膜(Barrialon)

3.4.6.4 PVDC 纤维Saran)

3.5中国浙江巨化股份有限公司

3.5.1 企业简介

3.5.2 经营情况

3.5.3营收构成

3.5.4 毛利率

3.5.5 研发支出

3.5.6 营业成本

3.5.7 PVDC业务

3.5.8 发展战略

3.6 中国河南双汇投资发展股份有限公司

3.6.1 企业简介

3.6.2 经营情况

3.6.3 PVDC业务

3.6.3.1 PVDC树脂

3.6.3.2 PVDC 薄膜

第四章 乙烯/乙烯醇共聚物(EVOH)

4.1 定义及其性能

4.2 生产工艺

4.3 全球供需分析

4.3.1 全球产能

4.3.2 全球供需

4.4中国供需分析

4.4.1 中国发展现状

4.4.2 中国EVOH供需分析

4.5 下游应用及发展前景

4.5.1 EVOH阻隔性包装薄膜和共挤出塑料片材

4.5.2 EVOH多层汽油箱

4.5.3 EVOH多层复合瓶

4.5.4 纺织材料

4.5.5 医用材料

4.5.6 真空绝缘板

第五章 全球及中国EVOH主要生产企业

5.1可乐丽株式会社

5.1.1 企业简介

5.1.2 经营情况

5.1.3营收构成

5.1.4 研发支出

5.1.5可乐丽国外子公司

5.1.6 EVOH生产基地及产能

5.1.7 EVOH产品

5.1.7.1 EVOH树脂

5.1.7.2 EVOH 薄膜

5.1.8 在华业务

5.2 日本合成化学工业公司

5.2.1 企业简介

5.2.2经营情况

5.2.3营收构成

5.2.4 EVOH生产基地及产能

5.2.5 EVOH产品

5.2.5.1 EVOH 树脂(SoarnoL)

5.2.5.2 Soarlite

5.2.6在华业务

5.3台湾长春石油化学股份有限公司

第六章 聚萘二甲酸乙二醇酯(PEN)

6.1 定义及其性能

6.2 生产工艺

6.2.1 PEN 树脂

6.2.2 PEN薄膜

6.3全球及中国PEN树脂生产现状

6.3.1 全球市场

6.3.2 中国市场

6.4 下游应用及发展前景

6.4.1 PEN薄膜

6.4.2 包装容器

6.4.3 PEN纤维

6.4.4 PEN/PET共混物和共聚物

第七章 全球及中国PEN主要生产企业

7.1 日本帝人株式会社

7.1.1 企业简介

7.1.2经营情况

7.1.3营收构成

7.1.4研发支出

7.1.5 PEN生产基地及产能

7.1.5.1杜邦帝人薄膜公司

7.1.5.2 帝人杜邦薄膜

7.1.6 PEN产品

7.1.6.1 PEN 树脂(Teonex®)

7.1.6.2 PEN 薄膜

7.1.6.3 PEN纤维

7.1.7在华业务

7.2 美国杜邦公司

7.2.1 企业简介

7.2.2经营情况

7.2.3营收构成

7.2.4 研发支出

7.2.5 PEN 业务

7.3 SKC

7.3.1 企业简介

7.3.2经营情况

7.3.3 营收构成

7.3.4 PEN业务

1 Overview of High Barrier Materials

1.1 Definition

1.2 Classification

1.3 Industry Chain

1.4 Policy

1.5 Prospect

2 Polyvinylidene Chloride (PVDC)

2.1 Definition and Classification

2.1.1 Definition

2.1.2 Classification

2.2 Production Process

2.3 Global Supply & Demand Analysis and Forecast

2.3.1 Global Capacity

2.3.2 Global Supply & Demand Analysis

2.4 China’s Supply & Demand Analysis and Forecast

2.4.1 China’s Capacity

2.4.2 China’s Supply and Demand Analysis

2.5 Import & Export Analysis

2.5.1 Export Analysis

2.5.2 Import Analysis

2.6 Application and Prospect

2.6.1 PVDC Casing Film

2.6.2 PVDC Coating Film

2.6.3 PVDC Plastic Wrap

2.6.4 PVDC Shrink Film

2.6.5 PVDC Coextruded Stretch Film

3 Major Global and Chinese PVDC Manufacturers

3.1 Dow Chemical

3.1.1 Profile

3.1.2 Operation

3.1.3 Revenue Structure

3.1.4 The Performance Plastics Segment

3.1.5 R&D Costs

3.1.6 Production Bases and Capacity of PVDC

3.1.7 PVDC Resins (SARAN)

3.1.8 PVDC Films (SARANEX)

3.2 Solvay

3.2.1 Profile

3.2.2 Operation

3.2.3 Revenue Structure

3.2.4 Gross Margin

3.2.5 R&D Costs

3.2.6 Specialty Polymers

3.2.7 Production Bases and Capacity of PVDC

3.2.8 PVDC Products

3.3 Kureha

3.3.1 Profile

3.3.2 Operation

3.3.3 Revenue Structure

3.3.4 R & D Costs

3.3.5 Production Bases and Capacity of PVDC

3.3.6 PVDC Products

3.3.7 Business in China

3.4 Asahi Kasei

3.4.1 Profile

3.4.2 Operation

3.4.3 Revenue Structure

3.4.4 R & D Costs

3.4.5 Production Bases and Capacity of PVDC

3.4.6 PVDC Products

3.5 Zhejiang Juhua

3.5.1 Profile

3.5.2 Operation

3.5.3 Revenue Structure

3.5.4 Gross Margin

3.5.5 R&D Costs

3.5.6 Operating Costs

3.5.7 PVDC Business

3.5.8 Development Strategy

3.6 Henan Shuanghui Investment & Development Co., Ltd.

3.6.1 Profile

3.6.2 Operation

3.6.3 PVDC Business

4 Ethylene Vinyl Alcohol Copolymer (EVOH)

4.1 Definition and Properties

4.2 Production Process

4.3 Global Supply and Demand Analysis

4.3.1 Global Capacity

4.3.2 Global Supply and Demand

4.4 China's Supply and Demand Analysis

4.4.1 Status Quo

4.4.2 EVOH Supply and Demand in China

4.5 Application and Prospect

4.5.1 EVOH Barrier Packaging Films and Co-extruded Plastic Sheets

4.5.2 EVOH Multilayer Fuel Tanks

4.5.3 EVOH Multilayer Composite Bottles

4.5.4 Textile Materials

4.5.5 Medical Materials

4.5.6 Vacuum Insulation Panels

5 Major Global and Chinese EVOH Producers

5.1 Kuraray

5.1.1 Profile

5.1.2 Operation

5.1.3 Revenue Structure

5.1.4 R & D Costs

5.1.5 Major Overseas Subsidiaries of Kuraray

5.1.6 Production Bases and Capacity of EVOH

5.1.7 EVOH Products

5.1.8 Business in China

5.2 Nippon Gohsei

5.2.1 Profile

5.2.2 Operation

5.2.3 Revenue Structure

5.2.4 Production Bases and Capacity of EVOH

5.2.5 EVOH Products

5.2.6 Business in China

5.3 Taiwan ChangChun PetroChemical

6 Polyethylene Naphthalate (PEN)

6.1 Definition and Properties

6.2 Production Process

6.2.1 PEN Resin

6.2.2 PEN Film

6.3 Status Quo of Global and Chinese PEN Resin Production

6.3.1 Global Market

6.3.2 China Market

6.4 Application and Prospect

6.4.1 PEN Film

6.4.2 Packaging Containers

6.4.3 PEN Fiber

6.4.4 PEN/PET Blends and Copolymers

7 Major Global and Chinese PEN Producers

7.1 Teijin

7.1.1 Profile

7.1.2 Operation

7.1.3 Revenue Structure

7.1.4 R & D Costs

7.1.5 Production Bases and Capacity of PEN

7.1.6 PEN Products

7.1.7 Business in China

7.2 DuPont

7.2.1 Profile

7.2.2 Operation

7.2.3 Revenue Structure

7.2.4 R & D Costs

7.2.5 PEN Business

7.3 SKC

7.3.1 Profile

7.3.2 Operation

7.3.3 Revenue Structure

7.3.4 PEN Business

图:中、高阻隔材料透气率比较

图:中高阻隔材料氧气透过率随相对湿度变化情况

图:高阻隔材料产业链

图:PVDC分子结构及及其相关特性

表:PVDC主要性能指标

表:PVDC分类及用途

表:2012-2014年全球PVDC树脂主要厂家及其产能

图:2010-2017年全球PVDC树脂消费量

图:2013年全球PVDC树脂消费量(分区域)

图:2009-2017年中国PVDC树脂产能

表:2013-2014年中国PVDC树脂及乳胶主要厂家及其产能

图:2009-2017年中国PVDC树脂产量及同比增长

图:2009-2017年中国PVDC树脂表观消费量及同比增长

图:2009-2017年中国PVDC树脂进口依存度

图:2010-2014年中国PVDC出口量及出口额

表:2013-2014年中国PVDC出口量及出口额(分来源省市)

表:2013-2014年中国PVDC出口量及出口额(分目的国家)

图:2009-2014年中国PVDC进口量及进口额

表:2013-2014年中国PVDC进口量及进口额(分来源国家/地区)

表:2013-2014年中国PVDC进口量及进口额(分目的省市)

表:2014年中国主要肠衣膜生产企业及其产能

表:2014年中国PVDC涂布膜主要生产企业及其产能

图:2009-2014年陶氏化学营业收入及同比增长

图:2009-2014年陶氏化学净利润及同比增长

图:2009-2014年陶氏化学净利率

图:2011-2014年陶氏化学营收构成(分部门)

图:2012-2014年陶氏化学销售利润率(分部门)

图:2009-2014陶氏化学营收构成(分区域)

表:陶氏化学功能塑料部门主要产品及其应用/市场

图:2011-2013年陶氏化学功能塑料部门营收构成

图:2013年陶氏化学功能塑料部门营收构成(分区域)

图:2009-2014年陶氏化学研发支出,同比增长及其占营业收入比例

图:陶氏化学PVDC树脂(SARAN)生产工艺

表:陶氏化学共挤阻隔膜主要产品

图:2014-2017年陶氏化学战略措施

图:2013年索尔维员工人数(分区域)

图:2013年索尔维业务部门主要业务

图:2013年索尔维区域业务介绍

图:2009-2014年索尔维营业收入及同比增长

图:2009-2014年索尔维净利润及同比增长

图:2009-2014年索尔维净利率

表:2012-2014年索尔维净销售额构成(分部门)

图:2013年索尔维高级材料部门净销售额构成(分业务和区域)

表:2009-2013年索尔维营收构成(分区域和国家)

图:2009-2013年索尔维毛利率(分部门)

图:2009-2013年索尔维研发支出,同比增长及其占营业收入比例

图:2009-2013年索尔维专用聚合物营业收入及同比增长

图:索尔维专用聚合物业务主要产品及其应用/市场

图:索尔维Diofan® 乳胶涂层对氧气和水蒸气的阻隔性能

表:索尔维 Diofan® 乳胶产品系列及应用

表:索尔维Ixan® 挤出树脂产品系列及应用

表:Ixan® 可溶性树脂产品系列及应用

表:吴羽事业部及主要产品

表:吴羽子公司及主要业务(分区域)

图:2009-2013财年吴羽营业收入及同比增长

图:2009-2013财年吴羽净利润及同比增长

图:2009-2013财年吴羽净利率

图:2010-2013财年吴羽营收构成(分部门)

图:2009-2013财年吴羽特殊塑料部门销售额及营业利润

图:2009-2013财年吴羽营收构成(分区域)

图:2009-2013财年吴羽净研发支出,同比增长及其占营业收入比例

图:2009-2013财年吴羽研发支出(分部门)

表:吴羽在PVDC中国子公司

图:2009-2013财年旭化成营业收入及同比增长

图:2009-2013财年旭化成净利润及同比增长

图:2009-2013财年旭化成净利率

图:2009-2013财年旭化成营收构成(分部门)

图:2009-2013财年旭化成营收构成(分区域)

图:2009-2013财年旭化成研发支出,同比增长及占营业收入比例

图:2012-2013财年旭化成研发支出(分部门)

图:2009-2014年巨化股份收入及同比增长

图:2009-2014年巨化股份净利润及同比增长

图:2009-2014年巨化股份净利率

图:2009-2014年巨化股份营收构成(分产品)

图:2009-2014年巨化股份营收构成(分区域)

图:2009-2014年巨化股份毛利率(分产品)

图:2009-2014年巨化股份毛利率(分地区)

图:2009-2014年巨化股份研发支出, 同比增长及其占营业收入比例

图:2012-2013年巨化股份食品包装材料营业成本

图:2009-2014年巨化股份PVDC产能,产量,销量及平均价格

图:2009-2014年河南双汇收入及同比增长

图:2009-2014年河南双汇净利润及同比增长

图:2009-2014年河南双汇净利率

图:2012-2013年河南双汇PVDC肠衣膜子公司收入及净利润

表:EVOH树脂的性能

图:2009-2017年全球EVOH树脂产能及同比增长

表:2014年全球EVOH树脂的生产企业及其产能

图:2014年全球EVOH树脂产能(分国家)

图:2009-2017年全球EVOH树脂产量及同比增长

图:2009-2017年全球EVOH树脂消费量及同比增长

表:2011及2013年全球EVOH树脂消费量(分区域和应用领域)

图:2009-2017年中国EVOH树脂消费量及同比增长

表:2011年及2013年中国EVOH树脂消费量(分领域)

图:EVOH多层共挤薄膜典型结构

表:几种汽油箱的优缺点

表:典型EVOH多层汽油箱的结构

图:2009-2013财年可乐丽营业收入及同比增长

图:2009-2013财年可乐丽净利润及同比增长

图:2009-2013财年可乐丽净利率

图:2012-2013财年可乐丽营收构成(分部门)

图:2009-2013财年可乐丽营收构成(分地区)

图:2009-2013财年可乐丽研发支出,同比增长及其占营业收入比例

图:可乐丽国外子公司分布

表:2014年可乐丽EVOH产品产能及生产基地

图:可乐丽EVOH树脂生产工艺

图:可乐丽EVOH树脂等级

图:可乐丽EVOH 薄膜生产工艺

表:可乐丽EVOH薄膜产品主要类型及应用

表:可乐丽中国分支机构

图:日本合成化学工业公司产品列表及分部门简介

图:2009-2013财年日本合成化学工业公司营业收入及同比增长

图:2009-2013财年日本合成化学工业公司净利润及同比增长

图:2009-2013财年日本合成化学工业公司净利率

图:2009-2013财年日本合成化学工业公司销售收入及营业利润(分部门)

表:2014年日本合成化学工业公司EVOH树脂生产基地及产能

表:日本合成化学工业公司EVOH树脂标准等级

表:日本合成化学工业公司EVOH树脂特殊等级

表:日本合成化学工业公司EVOH树脂(SoarnoL)应用

图:日本合成化学工业公司海外子公司

表:PEN的性能

图:PEN树脂生产工艺

图:PEN 薄膜生产工艺

图:帝人株式会社业务范围及增长动力

图:2009-2013财年帝人株式会社营业收入及同比增长

图:2009-2013财年帝人株式会社净利润及同比增长

图:2009-2013财年帝人株式会社净利率

图:2009-2013财年帝人株式会社营收构成(分部门)

图:2009-2013财年帝人株式会社营收构成(分地区)

图:2009-2013财年帝人株式会社研发支出,同比增长及其占营业收入比例

表:杜邦帝人公司全球生产基地分布

图:帝人杜邦薄膜亚太生产基地分布

图:Teonex 与 PET 薄膜对比

图:2009-2014年杜邦营业收入及同比增长

图:2009-2014年杜邦净利润及同比增长

图:2009-2014年杜邦净利率

图:2009-2014年杜邦营收构成(分部门)

图:2013年杜邦功能性材料部门营收构成(分产品和区域)

表:2010-2013年杜邦收入构成(分国家和区域)

图:2009-2014年杜邦研发支出,同比增长及占其占营业收入

图:截至2013年SKC股权结构

表:截至2013年SKC业务部门及主要产品产能(分地区)

图:2010-2013年SKC营业收入及同比增长

图:2010-2013年SKC净利润及同比增长

图:2010-2013年SKC净利率

图:2003-2013年SKC营业收入及营业利润(分业务)

Permeability Comparison between Medium and High Barrier Materials

Oxygen Transmission Rate (OTR) of Medium and High Barrier Materials Versus Relative Humidity

High Barrier Material Industry Chain

Molecular Structure and Related Features of PVDC

Global Consumption of PVDC Resin, 2010-2017E

Global Consumption of PVDC Resin by Region, 2013

Capacity of PVDC Resin in China, 2009-2017E

Output of PVDC Resin in China, 2009-2017E

Apparent Consumption of PVDC Resin in China, 2009-2017E

Import Dependence Ratio of PVDC Resin in China, 2009-2017E

Export Volume and Value of PVDC in China, 2010-2014

Import Volume and Value of PVDC in China, 2009-2014

Revenue and YoY Growth of Dow, 2009-2014

Net Income and YoY Growth of Dow, 2009-2014

Net Profit Margin of Dow, 2009-2014

Revenue Structure of Dow by Segment , 2011-2014

Revenue Structure of Dow by Region, 2009-2014

Revenue Structure of Dow’s Performance Plastics Segment by Business, 2011-2013

Revenue Structure of Dow’s Performance Plastics Segment by Region, 2013

Dow’s R&D Costs, YoY Growth and % of Revenue,2009-2013

Production Process of Dow's PVDC Resin (SARAN)

Number of Employees in Solvay by Region, 2009-2013

Main Business of Solvay by Operating Segments,2013

Profile of Solvay by Region,2013

Revenue and YoY Growth of Solvay, 2009-2014

Net Income and YoY Growth of Solvay, 2009-2014

Net Profit Margin of Solvay, 2009-2014

Net Sales Structure of Solvay's Advanced Materials Segment by Business and Region,2013

Solvay's R&D Costs, YoY Growth and % of Revenue, 2009-2013

Revenue and YoY Growth of Solvay's Specialty Polymers Business, 2009-2013

Main Products of Solvay Specialty Polymers

Combination of Barrier Properties (Diofan® Aqueous High Barrier Polymer Dispersions)

Major Products and Services of Kureha by Segment

Revenue and YoY Growth of Kureha, FY2009-FY2013

Net Income and YoY Growth of Kureha, FY2009-FY2013

Net Profit Margin of Kureha, FY2009-FY2013

Revenue Structure of Kureha by Segment, FY2010-FY2013

Net Sales and Operating Income of Kureha's Specialty Plastics, FY2009-FY2013

Revenue Structure of Kureha by Region, FY2009-FY2013

Kureha's R&D Costs, YoY Growth and % of Revenue, FY2009-FY2013

Kureha's R&D Costs by Segment, FY2009-FY2013

Revenue and YoY Growth of Asahi Kasei, FY2009-FY2013

Net Income and YoY Growth of Asahi Kasei, FY2009-FY2013

Net Profit Margin of Asahi Kasei, FY2009-FY2013

Revenue Structure of Asahi Kasei by Segment, FY2009-FY2013

Revenue Structure of Asahi Kasei by Region, FY2010-FY2013

Asahi Kasei's R&D Costs, YoY Growth and % of Revenue, FY2009-FY2013

R&D Costs of Asahi Kasei by Segment, FY2012-FY2013

Revenue and YoY Growth of Juhua, 2009-2014

Net Income and YoY Growth of Juhua, 2009-2014

Net Profit Margin of Juhua, 2009-2014

Revenue Structure of Juhua by Product, 2009-2014

Revenue Structure of Juhua by Region, 2009-2014

Juhua's R&D Costs, YoY Growth and % of Total Revenue, 2009-2014

Juhua's Operating Costs of Food Packaging Materials, 2012-2013

Revenue and YoY Growth of Shuanghui, 2009-2014

Net Income and YoY Growth of Shuanghui, 2009-2014

Net profit margin of Shuanghui, 2009-2014

Global Capacity of EVOH Resin and YoY Growth, 2009-2017E

Global Capacity of EVOH Resin by Country, as of 2014

Global Output of EVOH Resin and YoY Growth, 2009-2017E

Global Consumption of EVOH Resin and YoY Growth, 2009-2017E

Consumption of EVOH Resin and YoY Growth in China, 2009-2017E

Structure of Typical EVOH Co-extrusion Multilayer

Structure of Typical EVOH Multilayer Fuel Tank

Revenue and YoY Growth of Kuraray, FY2009-FY2013

Net Income and YoY Growth of Kuraray, FY2009-FY2013

Net Profit Margin of Kuraray, FY2009-FY2013

Revenue Structure of Kuraray by Segment, FY2012-FY2013

Revenue Structure of Kuraray by Region, FY2009-FY2013

Kuraray’s R & D Costs, YoY Growth and % of Revenue, FY2009-FY2013

Major Overseas Subsidiaries of Kuraray

Kuraray's EVOH Capacity by Product and Production Base, as of 2014

Kuraray’s Production Process of EVOH Resin

Range of Kuraray's EVOH Resin Grades

Kuraray’s Processing of EVOH Film

Products List and Segments of NIPPON GOHSEI

Revenue and YoY Growth of Nippon Gohsei, FY2009-FY2013

Net Income and YoY Growth of Nippon Gohsei, FY2009-FY2013

Net Profit Margin of Nippon Gohsei, FY2009-FY2013

Nippon Gohsei's Standard Grades of EVOH Resin

Nippon Gohsei's Special Grade of EVOH Resin

Applications for EVOH Resin (SoarnoL) of Nippon Gohsei

Overseas Subidiaries of Nippon Gohsei

Production Process of PEN Resin

Production Process of PEN Film

Business Domains and Growth Drivers of Teijin

Revenue and YoY Growth of Teijin, FY2009-FY2013

Net Income and YoY Growth of Teijin, FY2009-FY2013

Net Profit Margin of Teijin, FY2009-FY2013

Revenue Structure of Teijin by Region, FY2009-FY2013

Teijin's R & D Costs, YoY Growth and % of Revenue, FY2009-FY2013

Gobal Network of DuPont Teijin Films

Asia Pacific Network of Teijin DuPont Films

Comparison between Teonex and PET Film

Revenue and YoY Growth of DuPont, 2009-2014

Net Income and YoY Growth of DuPont, 2009-2014

Net Profit Margin of DuPont, 2009-2014

Revenue Structure of DuPont by Segment, 2009-2014

Revenue Structure of DuPont Performance Materials by Product Group/Industry/ Region,2013

DuPont's R & D Costs, YoY Growth and % of Revenue of DuPont, 2009-2014

Equity Structure of SKC, as of 2013

Revenue and YoY Growth of SKC, 2010-2013

Net Income and YoY Growth of SKC, 2010-2013

Net Profit Margin of SKC, 2010-2013

Revenue and Operating Income of SKC by Business, 2003-2013

Key Performance Indicators of PVDC

Classification and Applications of PVDC

Major Global PVDC Resin Producers and Their Capacity, 2012-2014

Major PVDC Resin and Latex Producers and Their Capacity in China, 2013-2014

Export Volume and Value of PVDC in China by Source Province and Municipality, 2013-2014

Export Volume and Value of PVDC in China by Destination Country, 2013-2014

Import Volume and Value of PVDC in China by Source Country, 2013-2014

Import Volume and Value of PVDC in China by Destination Province/Municipality, 2013-2014

Chinese Casing Film Production Enterprises and Their Capacity, 2014

Major Chinese PVDC Coating Film Production Enterprises and Their Capacity, 2014

Major Products and Applications/Market of Dow's Performance Plastics Segment

Dow's Range of SARANEX Coextruded Barrier Films Products

Net Sales Structure of Solvay by Segment, 2012-2014

Revenue Structure of Solvay by Region and Country,2009-2013

Gross Margin of Solvay by Segment, 2009-2013

Solvay's Range of DIOFAN High Barrier Polymer Products

Solvay's Range of Ixan Barrier Polymer Resin Products

Application of Ixan® Soluble Barrier Polymer Powders

Subsidiaries of Kureha in China

Gross Margin of Juhua by Product, 2009-2014

Gross Margin of Juhua by Region, 2009-2014

PVDC Capacity, Output, Sales Volume and Average Price of Juhua, 2009-2014

Revenue and Net Income of Shuanghui’s Subsidiaries Engaged in PVDC casing film, 2012-2013

Properties of EVOH Resin

Global EVOH Resin Producers and Their Capacity, as of 2014

Global Consumption of EVOH Resin by Region and Application Area, 2013 Vs. 2011

Consumption of EVOH Resin by Application Area in China, 2013 Vs. 2011

Advantages and Disadvantages of Several Types of Fuel Tanks

Kuraray’s Types and Applications of EVOH Films

Branches of Kuraray in China

Sales Revenue and Operating Income of Nippon Gohsei by Segment, FY2009-FY2013

Nippon Gohsei's Production Bases and Capacity of EVOH Resin, as of 2014

Properties of PEN

Revenue Structure of Teijin by Segment, FY2009-FY2013

Revenue Structure of DuPont by Region, 2010-2013

SKC Business Division and Capacity of Main Products by Region, as of 2013

如果这份报告不能满足您的要求,我们还可以为您定制报告,请 留言说明您的详细需求。

|