|

|

|

报告导航:研究报告—

生命科学—制药医疗

|

|

2014-2017年中国心血管介入器械行业研究报告 |

|

字数:4.1万 |

页数:112 |

图表数:112 |

|

中文电子版:8000元 |

中文纸版:4000元 |

中文(电子+纸)版:8500元 |

|

英文电子版:2200美元 |

英文纸版:2400美元 |

英文(电子+纸)版:2500美元 |

|

编号:ZLC-009

|

发布日期:2014-09 |

附件:下载 |

|

|

|

近年,受老龄化加剧、消费观念、饮食工作等生活方式变化的影响,中国心血管疾病患病率逐年增长,进而促进了中国冠脉介入手术市场的发展。2013年,中国接受PCI手术总例数达454,505例,同比增长16.9%;同期,中国心血管介入器械行业市场规模达201.2亿元。

目前,以微创医疗、乐普医疗、先健科技、垠艺为主导的内资企业占据着中国心血管介入器械行业的半壁江山。2013年,中国内资企业所占市场份额达53.4%;而以强生、美敦力、波士顿科学、雅培、贝朗、泰尔茂为首的外资企业所占份额为31.2%;港澳台投资企业为15.4%。

中国心血管介入器械包括心血管支架、导管、导丝、球囊、手术辅助装置等,其中以心血管支架为主。

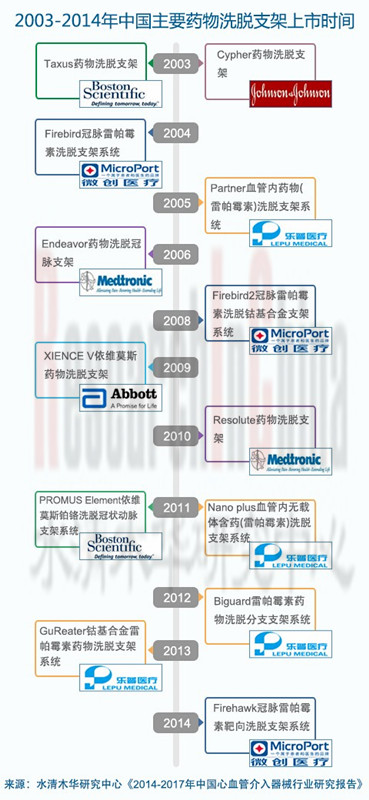

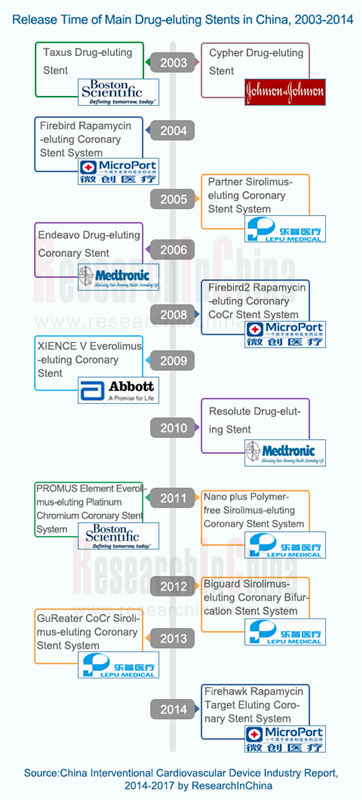

心血管支架:2013年中国心血管支架市场规模为112亿元,其中国产药物支架系统的市场占有率达78.8%。同年,中国心血管支架使用量为68.6万套,同比增长11.7%,其中药物洗脱支架使用比例高达99.5%,这说明DES已逐步成为心血管介入治疗的重要器械。

另外,雅培已研发出生物降解支架,并在欧洲销售;而乐普医疗也在加大生物降解支架的研发,预计2017年上市。由于生物降解支架自身性能优异,未来有望逐步代替DES,成为中国冠脉支架市场重要品种。

球囊导管:2013年中国冠脉球囊导管需求量为118.6万套,其中扩张用冠脉球囊导管50万套。随着以乐普医疗、微创医疗、吉威医疗为首的本土冠脉球囊导管生产企业的较快发展,国产冠脉球囊导管所占市场份额从2009年的20%增长到了2013年的40%。

受《高值医用耗材集中采购工作规范》实施的影响,心血管介入器械产品的采购价将持续下降,相关企业的利润空间将会进一步压缩。但是由于价格的大幅下降,更多患者有能力接受心血管手术,行业有望继续保持较快的增长。预计到2017年,中国心血管介入器械行业市场规模将达412亿元。

《2014-2017年中国心血管介入器械行业研究报告》主要包括以下内容:

中国心血管介入器械行业现状,包括总体概况、市场需求、进出口情况、竞争格局以及进入壁垒等; 中国心血管介入器械行业现状,包括总体概况、市场需求、进出口情况、竞争格局以及进入壁垒等;

中国心血管介入器械行业发展环境,包括宏观环境、政策环境以及上下游行业等; 中国心血管介入器械行业发展环境,包括宏观环境、政策环境以及上下游行业等;

中国心血管介入器械行业各细分市场(包括冠脉支架、球囊导管、导管、导丝、鞘组和辅助装置)现状、竞争格局等; 中国心血管介入器械行业各细分市场(包括冠脉支架、球囊导管、导管、导丝、鞘组和辅助装置)现状、竞争格局等;

国外6家、中国12家心血管介入器械企业的经营状况和心血管介入器械业务分析等。 国外6家、中国12家心血管介入器械企业的经营状况和心血管介入器械业务分析等。

The prevalence of cardiovascular disease in China impacted by accelerated aging of population and changes in consumption concept, dietary habit, way of working and other lifestyles has been growing year after year, thereby promoting the development of domestic percutaneous coronary intervention (PCI) market. PCI cases in China totaled 454,505 in 2013, up 16.9% from a year earlier; meanwhile the interventional cardiovascular device industry there was worth RMB20.12 billion.

At present, half of the Chinese interventional cardiovascular device industry is dominated by domestic companies led by MicroPort, Lepu Medical, Lifetech Scientific, and Dalian Yinyi. In 2013, 53.4% of the Chinese market was controlled by domestic companies, 31.2% by foreign counterparts represented by Johnson & Johnson, Medtronic, Boston Scientific, Abbott, B. Braun and Terumo, and 15.4% by those invested by Hong Kong, Macao and Taiwan.

Interventional cardiovascular devices in China include cardiovascular stent, catheter, guidewire, balloon, surgical auxiliary devices, etc., among which cardiovascular stent is predominant.

Cardiovascular stent: In 2013, the Chinese cardiovascular stent market equaled RMB11.2 billion, 78.8% of which was occupied by domestic drug-eluting stents. That same year, 686,000 units of cardiovascular stent were consumed in China, up 11.7% year on year, and drug-eluting stents accounted for 99.5%, indicating that the drug-eluting stent is gradually becoming an important device for interventional cardiovascular therapy.

In addition, Abbott has developed biodegradable stents, which are sold in Europe; Lepu Medical is endeavoring to develop biodegradable stents, which are expected to be available on the market in 2017. Thanks to its excellent performance, biodegradable stents are likely to replace drug-eluting stents gradually in the future, thus becoming the main variety in domestic coronary stent market.

Balloon catheter: In 2013, China’s demand for PTCA balloon catheter amounted to 1.186 million units, 500,000 of which were PTCA balloon catheters for dilatation. With rapid development of local PTCA balloon catheter producers represented by Lepu Medical, MicroPort and JW Medical, domestic PTCA balloon catheters increased its market share from 20% in 2009 to 40% in 2013.

Affected by the implementation of “Regulations on the Centralized Procurement of High-value Medical Consumables”, purchase price of interventional cardiovascular devices will continue to decline, further squeezing profit margins of relevant companies. However, the substantial decline in prices will enable more patients to receive PCI, thus helping the industry maintain a fairly rapid growth rate. It is expected that the Chinese interventional cardiovascular device market will worth RMB41.2 billion by 2017.

China Interventional Cardiovascular Device Industry Report, 2014-2017 focuses on the following:

Status quo of China interventional cardiovascular device industry, including overview, market demand, import & export, competitive landscape and entry barriers; Status quo of China interventional cardiovascular device industry, including overview, market demand, import & export, competitive landscape and entry barriers;

Development environment of China interventional cardiovascular device industry, embracing macro environment, policy climate and upstream & downstream sectors; Development environment of China interventional cardiovascular device industry, embracing macro environment, policy climate and upstream & downstream sectors;

Status quo, competitive landscape, etc. of China interventional cardiovascular device market segments, covering coronary stent, balloon catheter, catheter, guidewire, sheath group and auxiliary devices; Status quo, competitive landscape, etc. of China interventional cardiovascular device market segments, covering coronary stent, balloon catheter, catheter, guidewire, sheath group and auxiliary devices;

Operation, interventional cardiovascular device business, etc. of 6 foreign and 12 Chinese interventional cardiovascular device companies. Operation, interventional cardiovascular device business, etc. of 6 foreign and 12 Chinese interventional cardiovascular device companies.

第一章 心血管介入器械行业概述

1.1 定义

1.2 产品分类及应用

1.3 产业链

第二章 中国心血管介入器械行业现状

2.1 总体概况

2.2 市场需求

2.3 进出口情况

2.4 竞争格局

2.5 进入壁垒

2.5.1 技术和工艺壁垒

2.5.2 人才壁垒

2.5.3 专利壁垒

2.5.4 政策壁垒

2.5.5 市场渠道壁垒

第三章 中国心血管介入器械行业发展环境

3.1 宏观环境

3.2 政策环境

3.2.1 监管政策

3.2.2 行业政策

3.3 上下游行业

3.3.1 上游行业

3.3.2 下游行业

第四章 中国心血管介入器械行业细分市场

4.1冠脉支架

4.1.1 市场概况

4.1.2 药物洗脱支架

4.1.3 生物可吸收支架

4.2 球囊导管

4.2.1 市场概况

4.2.2 供需情况

4.3 导管

4.4 导丝

4.5 鞘组和辅助装置

第五章 在华国外企业

5.1 强生(Johnson & Johnson)

5.1.1 公司简介

5.1.2 经营情况

5.1.3 营收构成

5.1.4 毛利率

5.1.5 心血管介入器械业务

5.1.6 在华发展

5.2 美敦力(Medtronic)

5.2.1 公司简介

5.2.2 经营情况

5.2.3 心血管介入器械业务

5.2.4 在华发展

5.3 波士顿科学(Boston Scientific)

5.3.1 公司简介

5.3.2 经营情况

5.3.3 心血管介入器械业务

5.3.4 在华发展

5.4 雅培(Abbott Laboratories)

5.4.1 公司简介

5.4.2 经营情况

5.4.3 心血管介入器械业务

5.4.4 在华发展

5.5 贝朗(B.Braun)

5.5.1 公司简介

5.5.2 经营情况

5.5.3 心血管介入器械业务

5.5.4 在华发展

5.6 泰尔茂

5.6.1 公司简介

5.6.2 经营状况

5.6.3 心血管介入器械业务

5.6.4 在华发展

第六章 国内主要企业

6.1 微创医疗

6.1.1 公司简介

6.1.2 经营情况

6.1.3 营收构成

6.1.4 心血管介入器械业务

6.1.5 研发与投资

6.1.6 预测与展望

6.2 乐普医疗

6.2.1 公司简介

6.2.2 经营情况

6.2.3 营收构成

6.2.4 毛利率

6.2.5 心血管介入器械业务

6.2.6 研发与投资

6.2.7 预测与展望

6.3 先健科技

6.3.1 公司简介

6.3.2 经营情况

6.3.3 营收构成

6.3.4 心血管介入器械业务

6.3.5 研发与投资

6.3.6 预测与展望

6.4 吉威医疗

6.4.1 公司简介

6.4.2 心血管介入器械业务

6.5 垠艺

6.5.1 公司简介

6.5.2 心血管介入器械业务

6.6 深圳业聚

6.6.1 公司简介

6.6.2 心血管介入器械业务

6.7 益心达

6.7.1 公司简介

6.7.2 心血管介入器械业务

6.8 北京迪玛克

6.8.1 公司简介

6.8.2 心血管介入器械业务

6.9 华医圣杰

6.9.1 公司简介

6.9.2 心血管介入器械业务

6.10 心宜医疗

6.10.1 公司简介

6.10.2 心血管介入器械业务

6.11 赛诺医疗

6.11.1 公司简介

6.11.2 心血管介入器械业务

6.12 美中双和

6.12.1 公司简介

6.12.2 心血管介入器械业务

第七章 预测与展望

7.1 行业总体预测

7.2 细分市场预测

7.2.1 冠脉支架

7.2.2 球囊导管

1. Overview of Interventional Cardiovascular Device Industry

1.1 Definition

1.2 Classification and Application of Products

1.3 Industry Chain

2. Status Quo of China Interventional Cardiovascular Device Industry

2.1 Overview

2.2 Market Demand

2.3 Import & Export

2.4 Competitive Landscape

2.5 Entry Barriers

2.5.1 Technology

2.5.2 Talent

2.5.3 Patent

2.5.4 Policy

2.5.5 Market Channel

3. Development Environment of China Interventional Cardiovascular Device Industry

3.1 Macro Environment

3.2 Policy Climate

3.2.1 Regulatory Policies

3.2.2 Industrial Policies

3.3 Upstream & Downstream Sectors

3.3.1 Upstream

3.3.2 Downstream

4. Market Segments of China Interventional Cardiovascular Device Industry

4.1 Coronary Stent

4.1.1 Market Profile

4.1.2 Drug-Eluting Stent

4.1.3 Bioabsorbable Stent

4.2 Balloon Catheter

4.2.1 Market Profile

4.2.2 Supply & Demand

4.3 Catheter

4.4 Guidewire

4.5 Sheath Group and Auxiliary Devices

5. Foreign Companies in China

5.1 Johnson & Johnson

5.1.1 Profile

5.1.2 Operation

5.1.3 Revenue Structure

5.1.4 Gross Margin

5.1.5 Interventional Cardiovascular Device Business

5.1.6 Development in China

5.2 Medtronic

5.2.1 Profile

5.2.2 Operation

5.2.3 Interventional Cardiovascular Device Business

5.2.4 Development in China

5.3 Boston Scientific

5.3.1 Profile

5.3.2 Operation

5.3.3 Interventional Cardiovascular Device Business

5.3.4 Development in China

5.4 Abbott Laboratories

5.4.1 Profile

5.4.2 Operation

5.4.3 Interventional Cardiovascular Device Business

5.4.4 Development in China

5.5 B. Braun

5.5.1 Profile

5.5.2 Operation

5.5.3 Interventional Cardiovascular Device Business

5.5.4 Development in China

5.6 Terumo

5.6.1 Profile

5.6.2 Operation

5.6.3 Interventional Cardiovascular Device Business

5.6.4 Development in China

6. Major Domestic Companies

6.1 MicroPort

6.1.1 Profile

6.1.2 Operation

6.1.3 Revenue Structure

6.1.4 Interventional Cardiovascular Device Business

6.1.5 R&D and Investment

6.1.6 Forecast and Outlook

6.2 Lepu Medical

6.2.1 Profile

6.2.2 Operation

6.2.3 Revenue Structure

6.2.4 Gross Margin

6.2.5 Interventional Cardiovascular Device Business

6.2.6 R&D and Investment

6.2.7 Forecast and Outlook

6.3 Lifetech Scientific

6.3.1 Profile

6.3.2 Operation

6.3.3 Revenue Structure

6.3.4 Interventional Cardiovascular Device Business

6.3.5 R&D and Investment

6.3.6 Forecast and Outlook

6.4 JW Medical

6.4.1 Profile

6.4.2 Interventional Cardiovascular Device Business

6.5 Dalian Yinyi

6.5.1 Profile

6.5.2 Interventional Cardiovascular Device Business

6.6 Neich Medical (Shenzhen)

6.6.1 Profile

6.6.2 Interventional Cardiovascular Device Business

6.7 SCW Medicath

6.7.1 Profile

6.7.2 Interventional Cardiovascular Device Business

6.8 Demax Medical

6.8.1 Profile

6.8.2 Interventional Cardiovascular Device Business

6.9 Starway Medical

6.9.1 Profile

6.9.2 Interventional Cardiovascular Device Business

6.10 Synexmed

6.10.1 Profile

6.10.2 Interventional Cardiovascular Device Business

6.11 Sino Medical

6.11.1 Profile

6.11.2 Interventional Cardiovascular Device Business

6.12 AmsinoMed Medical Device

6.12.1 Profile

6.12.2 Interventional Cardiovascular Device Business

7 Forecast and Outlook

7.1 Industry

7.2 Market Segments

7.2.1 Coronary Stent

7.2.2 Balloon Catheter

表:心血管介入器械种类及功能

表:心血管支架种类及特点

图:中国心血管介入器械行业产业链

图:2005-2013中国医疗器械行业工业总产值及同比增长

图:2005-2013中国医疗器械行业销售额及同比增长

图:2009-2013年中国心血管介入器械行业市场规模及同比增长

表:2013年中国心血管疾病患病人数

图:2012年中国农村居民主要疾病死因构成

图:2012年中国城市居民主要疾病死因构成

图:2002-2011年中国城乡居民冠心病死亡率变化趋势

图:2011-2013年中国冠脉介入术PCI病例数及增长率

图:2011-2013年中国冠脉支架植入量及DES使用比例

表:2008年中国主要介入医疗器械进口比例及进口价格

表:2013年中国血管支架进出口前十的国家及金额

图:2013年中国心血管介入器械行业市场构成

表:2012-2013年中国先天性心脏病介入治疗例数

图:中国心血管介入器械行业经营模式

图:1985-2013年中国GDP及同比增长率

表:2006-2013年中国心血管介入器械主要政策

表:2012-2013年中国医疗机构数量及床位数

图:2010-2014年6月中国医院数量(按等级)

表:2012-2013年中国卫生机构医疗服务量

表:2012-2013年中国卫生机构病床使用情况

图:1980-2013年中国卫生费用及所占GDP比重

图:2006-2013E年中国人均卫生费用及同比增长率

图:2004-2013年中国65岁及以上老年人数量及所占总人口比例

图:1980-2013年中国城镇和农村家庭人均收入及收入比

表:中国医保覆盖人群及支出水平

表:2011年中国京沪穗三市介入手术医保支付比例

图:2009-2013年中国国产冠脉药物支架系统市场占有率

图:2013年中国冠脉支架系统主要品牌及其市场份额(按使用量)

图:2011-2013年中国冠脉支架植入量

图:2012-2017E中国冠脉支架市场规模及同比增长

表:2011-2013年中国冠脉介入治疗相关数据对比

表:2013年中国国产主要药物洗脱支架产品列表

图:2013年进口和国产冠脉球囊导管产品市场份额对比

图:2012-2017E中国心血管介入球囊导管市场规模

表:2011-2013年中国冠脉球囊导管需求量

图:2012-2017E中国心血管介入导管市场规模

图:2012-2017E中国心血管介入导丝市场规模

图:2012-2017E中国心血管介入鞘组和辅助装置市场规模

图:2009-2014年强生公司总收入及净利润

图:2009-2014年强生公司总收入(分产品)

图:2009-2014年强生公司总收入构成(分产品)

图:2009-2014年强生公司毛利率

图:2009-2013年强生心血管业务销售额及同比增长

表:强生公司在华企业及主要产品

图:2009-2013财年美敦力营业收入及净利润

图:2009-2013财年美敦力营业收入(分产品)

图:2009-2013财年美敦力营业收入构成(分产品)

图:2009-2013财年美敦力冠状动脉产品营业收入及占总营业收入比

图:2009-2013年波士顿科学营业收入、净利润及毛利率

表:2009-2013年波士顿科学营业收入(分部门)

表:2009-2013年波士顿科学营业收入(分地区)

图:2009-2013年波士顿科学心血管部门营业收入及同比增长

图:2009-2013年雅培营业收入、净利润及毛利率

图:2009-2013年雅培营业收入(分产品)

图:2009-2013年雅培营业收入构成(分产品)

图:2009-2013年雅培心血管产品营业收入及占总营业收入比

图:2009-2013年贝朗营业收入、净利润及毛利率

表:2009-2013年贝朗营业收入(分部门)

表:2009-2013年贝朗营业收入(分地区)

图:2009-2013年贝朗Aesculap销售额及同比增长

图:2010-2013财年泰尔茂营业收入及净利润

图:2010-2013财年泰尔茂营业收入(分业务)

图:2010-2013财年泰尔茂营业收入(分地区)

图:2010-2013财年泰尔茂研发投入及占营业收入比

图:2010-2013财年泰尔茂心血管业务营业收入及占总营业收入比

图:2009-2013财年泰尔茂PTCA球囊扩张导管产量及同比增长

图:2009-2013财年泰尔茂造影导丝产量及同比增长

图:2009-2013财年泰尔茂PTCA导丝产量及同比增长

表:泰尔茂中国分公司及其主要业务

图:泰尔茂中国布局

图:2009-2013年微创医疗营业收入、净利润及毛利率

表:2011-2013年微创医疗营业收入(分产品)

图:2011-2013年微创医疗营业收入构成(分产品)

表:2009-2013年微创医疗营业收入(分地区)

图:2009-2013年微创医疗营业收入构成(分地区)

图:2011-2013年微创医疗心血管介入产品营业收入及占营业收入比

表:微创医疗心脏药物支架领域竞争优势

图:2009-2013年微创医疗研发支出及占总营业收入比

图:2012-2017E微创医疗营业收入及净利润预测

图:乐普医疗子公司分布

图:2009-2013年乐普医疗营业收入、净利润和毛利率

图:2009-2013年乐普医疗营业收入(分产品)

表:2009-2013年乐普医疗营业收入(分地区)

表:2009-2013年乐普医疗毛利率(分产品)

图:2010-2013年乐普医疗研发支出及占营业收入比

表:乐普医疗募投项目及完成情况

图:2012-2017E乐普医疗营业收入及净利润预测

图:2009-2013年先健科技营业收入、净利润及毛利率

图:2009-2013年先健科技营业收入(按业务)

图:2009-2013年先健科技营业收入构成(按业务)

图:2009-2013年先健科技先天性心脏病业务营业收入、同比增长及占总营业收入比

图:2009-2013年先健科技外周血管病业务营业收入、同比增长及占总营业收入比

图:2010-2013年先健科技研发投入、同比增长及占总营业收入比

图:2012-2017E先健科技营业收入及净利润

表:山东吉威爱克塞尔药物洗脱支架输送系统球囊顺应性

表:垠艺球囊扩张导管特点

表:COMBO双疗法支架技术参数

图:益心达PTCA球囊扩张导管

表:益心达PTCA球囊扩张导管特点及优点

表:益心达PTCA球囊扩张导管技术参数

表:北京迪玛克Gusta® PTCA球囊扩张导管技术参数

表:北京迪玛克Gusta®NC 非顺应性球囊扩张导管技术参数

表:心宜医疗Advancer™ PTCA球囊导管主要技术参数

表:心宜医疗Advancer Plus™ PTCA/CTO球囊导管主要技术参数

表:心宜医疗Advancer Hp™ 高压球囊导管主要技术参数

表:心宜医疗RUNNER™冠状动脉支架技术参数

表:心宜医疗CHALLENGER™冠状动脉支架技术参数

表:心宜医疗RAPA™雷帕霉素药物涂层冠脉支架技术参数

表:赛诺医疗BuMA™药物洗脱支架技术参数

表:赛诺医疗SUN冠脉支架技术参数

图:赛诺医疗Sleek PTCA快速交换扩张球囊导管球囊通过外径示意图

图:2012-2017E中国心血管介入器械行业市场规模及同比增长

Types and Functions of Interventional Cardiovascular Device

Types and Features of Cardiovascular Stent

Interventional Cardiovascular Device Industry Chain in China

Total Industrial Output Value and YoY Growth of China Medical Device Industry, 2005-2013

Revenue and YoY Growth of China Medical Device Industry, 2005-2013

Market Size and YoY Growth of China Interventional Cardiovascular Device Industry, 2009-2013

Number of Patients with Cardiovascular Disease in China, 2013

Death Rate Percentage of Major Diseases in Rural Area, 2012

Death Rate Percentage of Major Diseases in Urban Area, 2012

Changes in Mortality Rate of Coronary Heart Disease in Urban and Rural Areas of China, 2002-2011

Number of PCI Cases and Growth Rate in China, 2011-2013

Coronary Stent Implantation and Usage Percentage of Drug-eluting Stent in China, 2011-2013

Import Share and Import Prices of Main Interventional Medical Devices in China, 2008

China’s Intravascular Stent Imports and Exports by Top 10 Countries, 2013

Market Structure of China Interventional Cardiovascular Device Industry, 2013

Number of Congenital Heart Disease Patients Receiving Interventional Therapy in China, 2012-2013

Business Models of China Interventional Cardiovascular Device Industry

China’s GDP and YoY Growth, 1985-2013

Main Policies Concerning Interventional Cardiovascular Device in China, 2006-2013

Number of Medical Institutions and Sickbeds in China, 2012-2013

Number of Hospitals in China (by Grade), 2010-Jun. 2014

Medical Service Quantity of Health Care Facilities in China, 2012-2013

Usage of Sickbeds in China’s Medical Institutions, 2012-2013

Health Costs and % of GDP in China, 1980-2013

Per Capita Health Costs and YoY Growth Rate in China, 2006-2013

Number of People 65 and Over and % of Total Population in China, 2004-2013

Ratio between Per Capita Income of Urban and Rural Households in China, 1980-2013

Medical Insurance Coverage and Expenditure in China

Proportion of Medical Insurance-covered Payment for Interventional Operation in Beijing, Shanghai and Guangzhou, 2011

Market Share of China-made Coronary Drug-eluting Stent System, 2009-2013

Market Share of Main Coronary Stent System Brands in China (by Consumption), 2013

Implantation of Coronary Stent in China, 2011-2013

China’s Coronary Stent Market Size and YoY Growth, 2012-2017E

Comparison of Relevant Data about PCI in China, 2011-2013

List of Main Domestic Drug-eluting Stent Products, 2013

Market Share of Imported and Domestic PTCA Balloon Catheter Products, 2013

China's Interventional Cardiovascular Balloon Catheter Market Size, 2012-2017E

China’s Demand for PTCA Balloon Catheter, 2011-2013

China's Interventional Cardiovascular Catheter Market Size, 2012-2017E

China's Interventional Cardiovascular Guide Wire Market Size, 2012-2017E

China's Interventional Cardiovascular Sheath Group and Auxiliary Device Market Size, 2012-2017E

Total Revenue and Net Income of Johnson & Johnson, 2009-2014

Total Revenue Breakdown of Johnson & Johnson (by Product), 2009-2014

Total Revenue Structure of Johnson & Johnson (by Product), 2009-2014

Gross Margin of Johnson & Johnson, 2009-2014

Johnson & Johnson’s Revenue from Cardiovascular Business and YoY Growth, 2009-2013

Johnson & Johnson’s Companies in China and Their Main Products

Revenue and Net Income of Medtronic, FY2009-FY2013

Revenue Breakdown of Medtronic (by Product), FY2009-FY2013

Revenue Structure of Medtronic (by Product), FY2009-FY2013

Medtronic’s Revenue from Coronary Artery Products and % of Total Revenue, FY2009-FY2013

Revenue, Net Income and Gross Margin of Boston Scientific, 2009-2013

Revenue Breakdown of Boston Scientific (by Division), 2009-2013

Revenue Breakdown of Boston Scientific (by Region), 2009-2013

Boston Scientific’s Revenue from Cardiovascular Division and YoY Growth, 2009-2013

Revenue, Net Income and Gross Margin of Abbott, 2009-2013

Revenue Breakdown of Abbott (by Product), 2009-2013

Revenue Structure of Abbott (by Product), 2009-2013

Revenue from Cardiovascular Products and % of Total Revenue, 2009-2013

Revenue, Net Income and Gross Margin of B. Braun, 2009-2013

Revenue Breakdown of B. Braun (by Division), 2009-2013

Revenue Breakdown of B. Braun (by Region), 2009-2013

Revenue and YoY Growth of B. Braun's Aesculap Division, 2009-2013

Revenue and Net Income of Terumo, FY2010-FY2013

Revenue of Terumo by Business, FY2010-FY2013

Revenue of Terumo by Region, FY2010-FY2013

R&D Cost and Proportion in Revenue of Terumo, FY2010-FY2013

Revenue from Cardiovascular Business and Revenue Share of Terumo, FY2010-FY2013

PTCA Balloon Dilatation Catheter Output and YoY Growth of Terumo, FY2009-FY2013

Angiographic Guidewire Output and YoY Growth of Terumo, FY2009-FY2013

PTCA Guidewire Output and YoY Growth of Terumo, FY2009-FY2013

China Branches and Their Business of Terumo

Terumo’s Layout in China

Revenue, Net Income and Gross Margin of MicroPort, 2009-2013

Revenue Breakdown of MicroPort (by Product), 2011-2013

Revenue Structure of MicroPort (by Product), 2011-2013

Revenue Breakdown of MicroPort (by Region), 2009-2013

Revenue Structure of MicroPort (by Region), 2009-2013

MicroPort’s Revenue from Interventional Cardiovascular Products and % of Total Revenue, 2011-2013

MicroPort’s Advantages in Heart Drug-eluting Stent Field

R&D Costs and % of Total Revenue of MicroPort, 2009-2013

Revenue and Net Income of MicroPort, 2012-2017E

Distribution of Lepu Medical’s Subsidiaries

Revenue, Net Income and Gross Margin of Lepu Medical, 2009-2013

Revenue Breakdown of Lepu Medical (by Product), 2009-2013

Revenue Breakdown of Lepu Medical (by Region), 2009-2013

Gross Margin of Lepu Medical (by Product), 2009-2013

R&D Costs and % of Total Revenue of Lepu Medical, 2010-2013

Lepu Medical’s Projects with Raised Funds and Progress

Revenue and Net Income of Lepu Medical, 2012-2017E

Revenue, Net Income and Gross Margin of Lifetech Scientific, 2009-2013

Revenue Breakdown of Lifetech Scientific (by Business), 2009-2013

Revenue Structure of Lifetech Scientific (by Business), 2009-2013

Lifetech Scientific’s Revenue from Congenital Heart Disease Business, YoY Growth and % of Total Revenue, 2009-2013

Lifetech Scientific’s Revenue from Peripheral Vascular Disease Business, YoY Growth and % of Total Revenue, 2009-2013

R&D Costs, YoY Growth and % of Total Revenue of Lifetech Scientific, 2010-2013

Revenue and Net Income of Lifetech Scientific, 2012-2017E

Balloon Compliance of JW Medical’s EXCEL Drug-eluting Stent Delivery System

Features of Dalian Yinyi’s Balloon Dilatation Catheters

Technical Parameters of COMBO Dual Therapy Stent

SCW Medicath’s PTCA Balloon Dilatation Catheters

Features and Advantages of SCW Medicath’s PTCA Balloon Dilatation Catheters

Technical Parameters of SCW Medicath’s PTCA Balloon Dilatation Catheters

Technical Parameters of Demax Medical’s Gusta® PTCA Balloon Dilatation Catheters

Technical Parameters of Demax Medical’s Gusta® PTCA Non-compliance Balloon Dilatation Catheters

Main Technical Parameters of Synexmed’s Advancer™ PTCA Balloon Catheter

Main Technical Parameters of Synexmed’s Advancer Plus™ PTCA/CTO Balloon Catheter

Main Technical Parameters of Synexmed’s Advancer Hp™ High Pressure Balloon Catheter

Technical Parameters of Synexmed’s RUNNER™ Coronary Stent

Technical Parameters of Synexmed’s CHALLENGER™ Coronary Stent

Technical Parameters of Synexmed’s RAPA™ Rapamycin Drug-eluting Coronary Stent

Technical Parameters of Sino Medical’s BuMA™ Drug-eluting Stent

Technical Parameters of Sino Medical’s SUN Coronary Stent

Diagram for Balloon Passing External Diameter of Sino Medical’s Sleek PTCA Rapid Exchange Dilatation Balloon Catheter

Market Size and YoY Growth of China Interventional Cardiovascular Device Industry, 2012-2017E

如果这份报告不能满足您的要求,我们还可以为您定制报告,请 留言说明您的详细需求。

|