|

|

|

报告导航:研究报告—

TMT产业—消费电子

|

|

2013-2014年全球及中国微型电声行业研究报告 |

|

字数:2.2万 |

页数:100 |

图表数:115 |

|

中文电子版:8000元 |

中文纸版:4000元 |

中文(电子+纸)版:8500元 |

|

|

|

|

|

编号:ZYW185

|

发布日期:2014-09 |

附件:下载 |

|

|

|

《2013-2014年全球及中国微型电声行业研究报告》包含以下内容:

1、微型电声系统简介

2、微型电声下游市场

3、微型电声产业分析

4、21家微型电声厂家研究

2013年下半年微型电声行业开始恶化,除耳机(Earphone和Headphone)产品外毛利率全面下滑,平均价格(ASP)也出现下滑。进入2014年,微型电声龙头大厂AAC罕见业绩下滑。原因有几方面,手机市场包括智能手机市场已经无法高速增长,而中国智能手机市场开始出现下滑。根据中国工业和信息化部电信研究院发布的数据,2014年1~8月,全国手机市场累积出货量为2.93亿部。而2013年1-8月份为3.96亿部。同比下滑24%,1-8月智能手机出货量为2.54亿部,同比下降11.3%。不仅手机,平板电脑市场也明显停止增长,苹果平板电脑出货量开始下滑,笔记本电脑市场略微好转。

另一方面,微型电声行业竞争加剧,电声行业从人工到自动化转移过程中创造了丰厚的利润空间,现在各大厂家都完成了自动化生产线的布局,成本下降的潜力已经几乎不存在了。再一方面,目前手机竞争的焦点包括厚度、CPU、屏幕、照相这4个领域,对声音性能关注度不高,提高声音性能靠外接耳机而不是靠手机本身,厂家更愿意采用廉价的电声元件。

MEMS麦克风领域,大型MEMS Foudry或IDM厂提供廉价的MEMS Die,让MEMS麦克风价格迅速下滑,价格战激烈,连龙头大厂Knowles也罕见地出现亏损,更不要说其他厂家了。

手机音频朝集成化方向发展,Speaker/Receiver集成为Speaker Modules,然后再集成Box,现在则是增加LDS天线功能。再有就是把Mic做在FPC上,让手机可以灵活地增加多个FPC,简化线路板设计,提高稳定性。也降低手机厚度。未来手机内所有音频元件可能都集成为一个模块。手机音频元件的价格会进一步降低。

各大微型电声厂家都加大力度开发非电声类产品来弥补业绩下滑的困境,不过初期投入巨大,拖累整体毛利率下滑。电声领域唯一的亮点是耳机,随着iPhone之类高价手机的流行,众多超过100美元的耳机也获得了广阔的市场,中国蓝牙耳机的普及率也因汽车销量大增而大增。耳机业务业绩爆发,美律、Cresyn、歌尔是最佳代表。

The report highlights the followings:

1. Introduction to Micro Electronic-Acoustics System

2. Downstream Market of Micro Electronic-Acoustics

3. Micro Electronic-Acoustics Industry

4. 21 Micro Electronic-Acoustics Enterprises

The micro electronic-acoustics industry began to deteriorate in the second half of 2013, reflecting a broad decline in gross margin and average selling price of products except earphone and headphone. The industry leader–AAC has accidentally suffered downdrafts entering 2014 for several reasons: it is impossible for the mobile phone market including the smartphone market to reproduce high growth, and China’s smartphone market shows signs of decline. According to data released by China Academy of Telecommunication Research of MIIT, the domestic mobile phone market accumulated shipments of 293 million units in January-August 2014, down 24% as opposed to 396 million units a year earlier, including 254 million smartphones (down 11.3% yr-on-yr). Besides, the tablet PC market apparently stopped growing e.g. a slowdown in iPad shipments, in contrast to the slightly improved laptop computer market.

On the other hand, the micro electronic-acoustics industry amid intensified competition has created space for generous profits in the transfer process from manual to automatic, and players have now completed the layout of automatic production lines, leading to non-existence of potential for cost reduction. Nowadays, mobile phone competition focuses on thickness, CPU, screen and camera, less concerned about sound performance, whose improvements depend on earphone rather than the phone itself, thus vendors prefer to adopt cheap electro-acoustic components.

In the field of micro electromechanical system (MEMS) microphone, large MEMS foundries or IDMs provide cheap MEMS dies which causes a drastic drop in MEMS microphone prices. The fierce price war has brought a rare loss for Knowles, not to mention other companies.

Mobile phone audio frequency is developing towards integration, speaker/receiver is firstly integrated into speaker modules, then box, and now equipped with function of LDS antenna. Then there is microphone mounted on FPC which enables flexibility for addition of multiple FPCs to mobile phones, simplifies circuit board design, improves stability and reduces thickness. All audio frequency components in a mobile phone may be integrated into a module in the future to bring the price down.

Micro electro-acoustic vendors have intensified efforts to develop non-electro-acoustic products to compensate for the decline in performance, but the huge initial investment is a burden to the overall gross margin. As the only highlight in electro-acoustics, headphones even those priced above USD100 won the broad market following the popularity of expensive phones such as iPhone, so did China's bluetooth headphone in the wake of booming auto sales. Merry, Cresyn and GoerTek best represent companies prosperous in the headphone business.

第一章、移动电声器件简介

1.1、手机受话器

1.2、手机扬声器

1.3、微型麦克风

1.4、MEMS麦克风简介

1.5、MEMS麦克风市场与产业

1.6、微型扬声器

1.7、手机电声发展趋势

第二章、微型电声产品下游市场

2.1、全球手机市场

2.2、全球智能手机市场

2.3、中国手机市场

2.4、平板电脑市场

2.5、笔记本电脑市场

2.6、台式机市场

第三章、微型电声产业

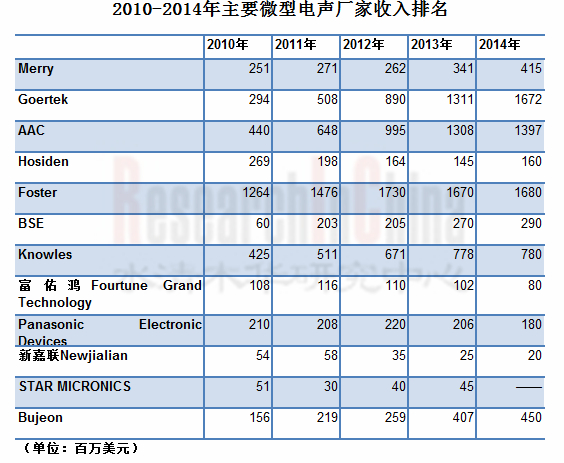

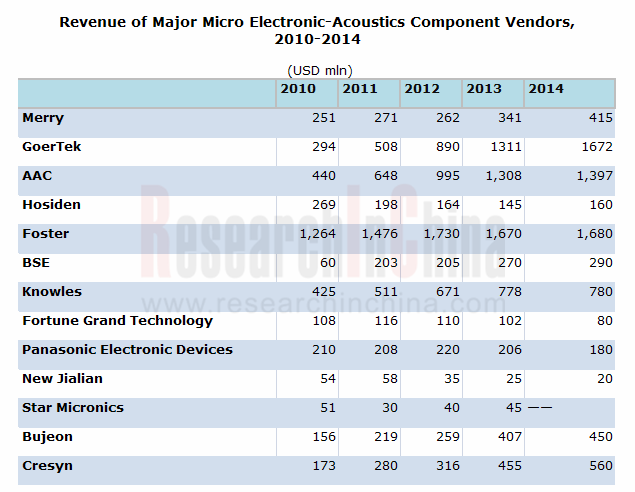

3.1、微型电声行业排名

3.2、电声各项产品市场占有率

3.3、耳机市场

3.4、MEMS麦克风市场

3.5、MEMS麦克风市场产业

3.6、手机电声器件厂家与手机厂家配套关系比例

3.7、笔记本电脑扬声器

3.8、中国耳机产业

第四章、微型电声厂家研究

4.1、KNOWLES

4.2、美律MERRY

4.3、歌尔声学GOERTEK

4.4、瑞声AAC

4.5、HOSIDEN

4.6、FOSTER

4.7、BSE

4.8、BUJEON

4.9、CRESYN

4.10、富佑鸿FOURTUNE GRAND TECHNOLOGY

4.11、振耀科技NETRONIX

4.12、松下电子部品PANASONIC ELECTRONIC DEVICES

4.13、声扬SONION

4.14、新嘉联NEWJIALIAN

4.15、STAR MICRONICS

4.16、江苏裕成YUCHENG ELECTRONIC

4.17、共达SHANDONG GETTOP ACOUSTIC

4.18、联声电子HANGZHOU UNIS ELECTRONIC

4.19、莱特电子RIGHTTECHNOLOGY

4.20、三富电子BLUECOM

4.21、缤特力PLANTRONICS

1. Introduction to Mobile Electro-Acoustic Components

1.1 Mobile Phone Receiver

1.2 Mobile Phone Speaker

1.3 Micro Microphone

1.4 Introduction to MEMS Microphone

1.5 Market and Industry of MEMS Microphone

1.6 Micro Loudspeaker

1.7 Trends of Mobile Phone Electro-Acoustic Components

2. Downstream Market of Micro Electro-Acoustic Products

2.1 Global Mobile Phone Market

2.2 Global Smartphone Market

2.3 China Mobile Phone Market

2.4 Tablet PC Market

2.5 Laptop Computer Market

2.6 Desktop PC Market

3. Micro Electronic-Acoustics Industry

3.1 Industry Ranking

3.2 Market Share by Products

3.3 Headphone Market

3.4 MEMS Microphone Market

3.5 MEMS Microphone Industry

3.6 Relationship between Electronic-Acoustic Component Vendors and Mobile Phone Vendors

3.7 Laptop Speaker

3.8 China Earphone Industry

4. Micro Electronic-Acoustic Component Vendors

4.1 Knowles

4.2 Merry

4.3 GoerTek

4.4 AAC

4.5 Hosiden

4.6 Foster

4.7 BSE

4.8 Bujeon

4.9 Cresyn

4.10 Fortune Grand Technology

4.11 Netronix

4.12 Panasonic Electronic Devices

4.13 Sonion

4.14 New Jialian

4.15 Star Micronics

4.16 Jiangsu Yucheng Electronic

4.17 Shandong Gettop Acoustic

4.18 Hangzhou Unis Electronic

4.19 Right Technology

4.20 Bluecom

4.21 Plantronics

智能手机音频系统

2007-2015年全球ECM麦克风市场规模

2008-2010年全球主要ECM麦克风厂家产量

2010-2011年全球MEMS麦克风采购商采购数量

2007-2015年全球微型扬声器/受话器市场规模

2008-2010年全球主要微型扬声器/受话器厂家产量

2007-2015年全球手机出货量

Worldwide Mobile Phone Sales to End Users by Vendor in 2013 (Thousands of Units)

Worldwide Smartphone Sales to End Users by Vendor in 2013 (Thousands of Units)

Worldwide Smartphone Sales to End Users by Operating System in 2013 (Thousands of Units)

2013-2015年全球Top 13智能手机厂家出货量

2014年1-8月中国手机月度出货量

2011-2016年全球平板电脑出货量

2013年平板电脑主要品牌市场占有率

2012、2013年全球平板电脑制造厂家产量

2008-2015年笔记本电脑出货量

2010-2013年全球主要笔记本电脑ODM厂家出货量

2008-2015年Desktop PC出货量

Top 5 Vendors, Worldwide PC Shipments, Fourth Quarter 2013

Top 5 Vendors, Worldwide PC Shipments 2013

微型电声行业排名The Rank of Micro Electronic-Acoustics Component Industry

主要微型电声厂家2010-2014年营业利润率

2014年全球耳机市场主要厂家市场占有率(出货量)

2014年全球耳机市场主要厂家市场占有率(金额)

2014年OCC用耳机主要厂家市场占有率(金额)

2014年Mobile用蓝牙耳机主要厂家市场占有率(金额)

2012-2018年MEMS麦克风市场规模

2010-2019 ASP of MEMS microphones

2012年全球MEMS麦克风厂家收入排名

Global MEMS Microphone Market Share in Value ($M) 2013

Global MEMS Microphone Die Market Share in Value (Volume) 2013

Top MEMS Suppliers in the Mobile Phone and Tablet Market - 2013 Revenue ($M) - Breakdown by Product Type

2014 六大手机厂家微型扬声器配套供应商供应比例

2014 六大手机厂家免提听筒配套供应商供应比例

2014 六大手机厂家麦克风配套供应商供应比例

Knowles主要客户

2013年Knowles收入产品分布

2008-2014 Knowles收入与EBITDA

2008-2014 Knowles收入与营业利润率

2009-2013 Knowles净利润与资产

2011-2013 Knowles收入业务分布

2011-2013 Knowles营业利润业务分布

2013年Knowles客户分布

2011-2013年Knowles收入地域分布

2012年1季度-2014年2季度Knowles季度收入与营业利润

Merry Electronics Organization Chart

2012年8月-2014年8月美律每月收入与增幅

2005-2014年美律收入产品分布

2010-2013年美律各项产品产量

2014年Merry收入客户分布

2012年美律大陆子公司简要财务数据

2006-2014年歌尔声学收入与营业利润率

2012年歌尔声学前五大客户

2013年歌尔声学前五大客户

2009年1季度-2014年2季度Goertek季度收入

2009年1季度-2014年2季度Goertek毛利率和净利率

2009年1季度-2014年2季度Goertek库存周转天数

瑞声组织结构

2007-2014年瑞声收入与毛利率

2003-2014年瑞声收入与EBIT率

2012 -2016 AAC Technologies Consolidated balancesheet

AAC Technologies主要客户

2006-2014年瑞声收入产品分布

2008-2013年瑞声营业利润分布

2006-2013年瑞声收入地域分布

2006-2014财年HOSIDEN收入与营业利润率

2006-2015财年Foster收入与营业利润率

2009-2012财年Foster收入地域分布

2009-2011年3季度BSE收入客户分布

2009-2011年3季度BSE出货量客户分布

2011年3季度BSE收入产品分布

2013年CRESYN主要子公司财务数据

东莞大朗辉鸿电子厂2008年简要财务数据

苏州富鸿顺电子有限公司2008年简要财务数据

2012年8月-2014年8月振耀科技每月收入与增幅

2009-2013年Sonion收入与毛利率

新嘉联组织结构

2004-2014年新嘉联收入与营业利润率

2008-2013财年 STAR MICRONICS电声产品出货量下游分布

2008-2013财年 STAR MICRONICS电声产品收入下游分布

2008-2014年山东共达电声收入与营业利润

共达电声2008-2010年麦克风产量销量

共达电声2008-2010年微型扬声器/受话器产量销量

2012-2014年上半年Bluecom成本结构

天津三富各种产品产能

2008-2010年3季度天津三富收入与利润

2006-2015财年缤特力收入与营业利润率

2013年2季度-2014年2季度 Plantronics毛利率

2012财年-2014财年缤特力收入地域分布

受话器制造工艺流程

ECM与MEMS对比

2011-2014年全球3G/4G手机出货量地域分布

2014年全球手机微型扬声器厂家市场占有率(按金额)

2014年全球Handfree厂家市场占有率

2012年笔记本电脑用扬声器主要厂家市场占有率

MERRY Organization and Operation

2004-2014年美律收入与营业利润率

2007-2014年美律收入与毛利率

2006-2013年美律客户分布

2007-2013年瑞声客户分布

2006-2014财年 HOSIDEN收入产品分布

FY2010-FY2014财年Foster收入业务分布

2007-2014年BSE收入与营业利润

2010年Q2-Q3 BSE收入产品分布

2005-2014年振耀科技收入与营业利润率

振耀科技组织结构

2010-2013年振耀科技收入产品分布

STAR MICRONICS 2007-2012财年收入与营业利润率

2007-2012财年 STAR MICRONICS收入产品分布

杭州联声电子组织结构

莱特电子组织结构

Bluecom组织结构

2007-2014年Bluecom收入营业利润率

2006-2014年Bluecom收入产品分布

2006-2012年Bluecom收入客户分布

2011财年-2014财年缤特力收入业务分布

Smart Phone Audio Frequency System

Global ECM Microphone Market Size, 2007-2015E

Output of Major Global ECM Microphone Companies, 2008-2010

Purchase Quantity of Global MEMS Microphone Buyers, 2010-2011

Global Micro Speaker / Receiver Market Size, 2007-2015E

Output of Major Global Micro Speaker / Receiver Companies, 2008-2010

Global Mobile Phone Shipment, 2007-2015E

Worldwide Mobile Phone Sales to End Users by Vendor in 2013 (Thousands of Units)

Worldwide Smartphone Sales to End Users by Vendor in 2013 (Thousands of Units)

Worldwide Smartphone Sales to End Users by Operating System in 2013 (Thousands of Units)

Shipment of Top 13 Global Smartphone Vendors, 2013-2015E

China’s Monthly Mobile Phone Shipment, Jan.-Aug. 2014

Global Tablet PC Shipment, 2011-2016E

Market Share of Main Tablet PC Brands, 2013

Output of Global Tablet PC Vendors, 2012-2013

Laptop Computer Shipment, 2008-2015E

Shipment of Major Global Laptop ODMs, 2010-2013

Desktop PC Shipment, 2008-2015E

PC Shipment of Top 5 Vendors Worldwide, Q4 2013

PC Shipment of Top 5 Vendor Worldwide, 2013

Ranking of Micro Electronic-Acoustics Component Industry

Operating Margin of Major Electronic-Acoustics Component Vendors, 2010-2014

Market Share of Major Global Headphone Companies (by Shipment), 2014

Market Share of Major Global Headphone Companies (by Value), 2014

Market Share of Major OCC Headphone Companies (by Value), 2014

Market Share of Major Mobile Bluetooth Headphone Companies (by Value), 2014

MEMS Microphone Market Size, 2012-2018E

ASP of MEMS Microphone, 2010-2019E

Ranking of Global MEMS Microphone Companies by Revenue, 2012

Global MEMS Microphone Market Share in Value, 2013

Global MEMS Microphone Die Market Share in Value (Volume), 2013

Top MEMS Suppliers in the Mobile Phone and Tablet Market, 2013 (Revenue Breakdown by Product Type)

Supply Breakdown of Micro Speaker Suppliers of Six Major Mobile Phone Vendors, 2014

Supply Breakdown of Handfree Suppliers of Six Major Mobile Phone Vendors, 2014

Supply Breakdown of Microphone Suppliers of Six Major Mobile Phone Vendors, 2014

Major Clients of Knowles

Revenue of Knowles by Product, 2013

Revenue and EBITDA of Knowles, 2008-2014

Revenue and Operating Margin of Knowles, 2008-2014

Net Income and Assets of Knowles, 2009-2013

Revenue of Knowles by Business, 2011-2013

Operating Income of Knowles by Business, 2011-2013

Client Distribution of Knowles, 2013

Revenue of Knowles by Region, 2011-2013

Quarterly Revenue and Operating Income of Knowles, Q1 2012-Q2 2014

Organization Chart of Merry

Monthly Revenue and Growth Rate of Merry, Aug. 2012-Aug. 2014

Revenue of Merry by Product, 2005-2014

Output of Merry by Product, 2010-2013

Revenue of Merry by Client, 2014

Selected Financial Data of Merry Subsidiaries in Mainland China, 2012

Revenue and Operating Margin of GoerTek, 2006-2014

Top 5 Clients of GoerTek, 2012

Top 5 Clients of GoerTek, 2013

Quarterly Revenue of GoerTek, Q1 2009-Q2 2014

Gross Margin and Net Profit Margin of GoerTek, Q1 2009-Q2 2014

Inventory Turnover Days of GoerTek, Q1 2009-Q2 2014

Organization Chart of AAC

Revenue and Gross Margin of AAC, 2007-2014

Revenue and EBIT Margin of AAC, 2003-2014

Consolidated Balance Sheet of AAC, 2012-2016E

Major Clients of AAC

Revenue of AAC by Product, 2006-2014

Operating Income Breakdown of AAC, 2008-2013

Revenue of AAC by Region, 2006-2013

Revenue and Operating Margin of Hosiden, FY2006-FY2014

Revenue and Operating Margin of Foster, FY2006-FY2015E

Revenue of Foster by Region, FY2009-FY2012

Revenue of BSE by Client, 2009-Q3 2011

Shipment of BSE by Client, 2009-Q3 2011

Revenue of BSE by Product, Q3 2011

Financial Data of Cresyn’s Key Subsidiaries, 2013

Selected Financial Data of Dongguan Dalang Huihong Electronics Factory, 2008

Selected Financial Data of Suzhou Fu Hong Shun Electronics Co., Ltd., 2008

Monthly Revenue and Growth Rate of Netronix, Aug. 2012-Aug. 2014

Revenue and Gross Margin of Sonion, 2009-2013

Organization Chart of New Jialian

Revenue and Operating Margin of New Jialian, 2004-2014

Electro-Acoustic Product Shipment of Star Micronics by Application, FY2008-FY2013

Electro-Acoustic Product Revenue of Star Micronics by Application, FY2008-FY2013

Revenue and Operating Income of Gettop, 2008-2014

Microphone Output and Sales Volume of Gettop, 2008-2010

Micro Speaker/Receiver Output and Sales Volume of Gettop, 2008-2010

Cost Structure of Bluecom, 2012-H1 2014

Capacity of Bluecom by Product

Revenue and Profit of Bluecom, 2008-Q3 2010

Revenue and Operating Margin of Plantronics, FY2006-FY2015E

Gross Margin of Plantronics, Q2 2013-Q2 2014

Revenue of Plantronics by Region, FY2012-FY2014

Receiver Manufacturing Process

Comparison between ECM and MEMS

Global 3G/4G Mobile Phone Shipment by Region, 2011-2014

Market Share of Global Mobile Phone Mini Speaker Companies (by Value), 2014

Market Share of Global Handfree Companies, 2014

Market Share of Major Laptop Speaker Companies, 2012

Organization and Operation of Merry

Revenue and Operating Margin of Merry, 2004-2014

Revenue and Gross Margin of Merry, 2007-2014

Client Distribution of Merry, 2006-2013

Client Distribution of AAC, 2007-2013

Revenue of Hosiden by Product, FY2006-FY2014

Revenue of Foster by Business, FY2010-FY2014

Revenue and Operating Income of BSE, 2007-2014

Revenue of BSE by Product, Q2-Q3 2010

Revenue and Operating Margin of Netronix, 2005-2014

Organization Structure of Netronix

Revenue of Netronix by Product, 2010-2013

Revenue and Operating Margin of Star Micronics, FY2007-FY2012

Revenue of Star Micronics by Product, FY2007-FY2012

Organization Structure of Hangzhou Unis Electronic

Organization Structure of Right Technology

Organization Structure of Bluecom

Revenue and Operating Margin of Bluecom, 2007-2014

Revenue of Bluecom by Product, 2006-2014

Revenue of Bluecom by Client, 2006-2012

Revenue of Plantronics by Business, FY2011-FY2014

如果这份报告不能满足您的要求,我们还可以为您定制报告,请 留言说明您的详细需求。

|