|

|

|

报告导航:研究报告—

制造业—工业机械

|

|

2014-2017年全球及中国液压行业研究报告 |

|

字数:3.5万 |

页数:92 |

图表数:76 |

|

中文电子版:8000元 |

中文纸版:4000元 |

中文(电子+纸)版:8500元 |

|

英文电子版:1900美元 |

英文纸版:2000美元 |

英文(电子+纸)版:2200美元 |

|

编号:BXM075

|

发布日期:2014-10 |

附件:下载 |

|

|

|

液压件是现代装备制造业的重要基础件,广泛应用于工程机械、冶金机械、塑料机械、航空航天、机床、农业机械等多个领域。2013年全球液压产业销售额近340亿美元,其中中国占到30%以上的份额,位列世界第二位。

尽管中国液压产业已经形成一定规模,但是大而不强,高端液压产品,如大中型挖掘机液压件等严重依赖进口。2011年中国液压件进口额为34.2亿美元,接近当年液压行业产值的50%,其中工程机械液压件占到进口额的70%左右。近年,受下游需求疲软影响,中国液压件进口需求下滑,2013年约为25亿美元,但是高端液压件占比依然居高不下。

为了促进液压件等关键核心部件的开发与研制,中国一方面在政策和资金上给予鼓励,另一方面积极搭建主机与配套方之间的平台。

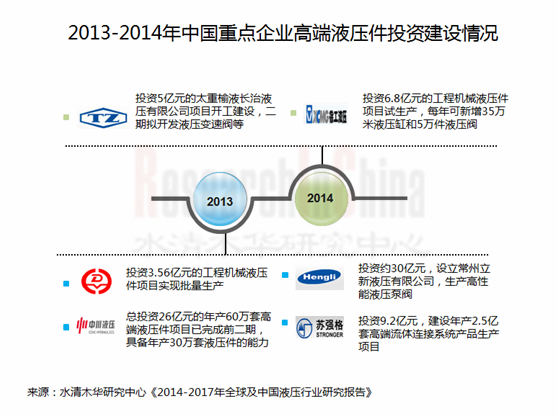

在此拉动下,近年中国专业液压生产商和工程机械主机企业等积极投入到高端液压件的研制中。其中,江苏恒立、中川液压、力源液压、太重渝液等企业已逐渐进入高端液压产品行列。

江苏恒立:少数突破挖掘机用高压及超高压油缸研制的本土企业。2013年投资约30亿元,成立了江苏恒立液压有限公司,主要生产高性能液压泵阀。该项目一期投产后,将新增年产2万件挖掘机用高压柱塞泵、2万件多路阀、199万件通用高性能液压控制阀和1万件电液比例伺服阀的能力。

中川液压:常林集团子公司,成立于2010年,现已具备年产30万套高端液压主件的能力。在扩大产能的同时,公司积极加快自主研发。2012年8月,公司“AP4V0112TVN液压轴向柱塞泵、AP4V0112TE液压轴向柱塞泵、MA170W回转马达、VM28PF主阀”四款高端液压产品通过国家级鉴定。

此外,川崎、KYB等外企也在加快在华进程。

川崎精机:中国最大的液压挖掘机零部件供货商。2005年在华成立川崎精密机械(苏州)有限公司,主要生产工程机械挖掘机用液压泵和液压马达;2009年又成立川崎春晖精密机械(浙江)有限公司,首期生产1.2万台液压泵,随着规模的扩大,还将增加液压马达和控制阀的生产。

KYB:2013财年实现销售额3527.1亿日元,其中在华收入占到7.3%。根据公司发展规划,未来三年将加强在华迷你及小型挖掘机液压件市场的发展,同时积极拓展中国铁路、农业机械用液压件市场。

水清木华研究中心《2014-2017年全球及中国液压行业研究报告》重点分析了以下内容:

全球液压行业规模、区域格局及企业格局等; 全球液压行业规模、区域格局及企业格局等;

中国液压行业相关政策、行业现状及存在的问题等; 中国液压行业相关政策、行业现状及存在的问题等;

中国液压件生产、销售、进出口以及工程机械液压件市场现状等; 中国液压件生产、销售、进出口以及工程机械液压件市场现状等;

全球7家重点企业经营情况及在华业务等; 全球7家重点企业经营情况及在华业务等;

中国16家重点企业经营情况、营收结构及发展战略等。 中国16家重点企业经营情况、营收结构及发展战略等。

Hydraulic parts are the crucial basic components to modern equipment manufacturing and widely used in the fields such as construction machinery, metallurgical machinery, plastic machinery, aerospace, machine tool and agricultural machinery. In 2013, the world’s hydraulic industry sales approached USD34 billion, of which China swept over 30% shares and ranked second worldwide.

Although with a certain scale, China hydraulic industry may be well bigger but not stronger, with heavy reliance on importing high-end hydraulic products like medium and large excavator hydraulic parts. In 2011, China’s import value of hydraulic parts was up to USD3.42 billion, being close to 50% of output value of hydraulic industry in the same year; wherein, about 70% of import value came from construction machinery hydraulic parts. Affected by the weak downstream demand over recent years, China’s import of hydraulic parts has fallen, with the import value just reaching about USD2.5 billion in 2013 but still with heavy reliance on high-end imports.

To promote the R&D and production of crucial components like hydraulic parts, China gives policy and capital incentives on the one hand and actively builds a platform between main engine and supporting side on the other hand.

Spurred by this, professional Chinese hydraulic producers, construction machinery (main engine) enterprises, etc have been aggressively involved in the research and manufacturing of top-grade hydraulic parts over the recent years. In particular, the companies such as Hengli Highpressure Oil Cylinder, Shandong Zhongchuan Hydraulic, AVIC Liyuan Hydraulic, and Taiyuan Heavy Machinery Group Yuci Hydraulics have been the producers of high-end hydraulic products.

Hengli Highpressure Oil Cylinder: as one of a few local producers of high pressure and ultra high pressure oil cyclinders used for excavators, the company invested approximately RMB3 billion to set up Jiangsu Hengli Hydraulic Co., Ltd which mainly produces high-performance hydraulic pump valves. Once the project’s first-stage puts into production, the company will annually increase 20,000 high pressure plunger pumps used for excavators, 20,000 multiway valves, 1.99 million universal high-performance hydraulic control valves, and 10,000 electrohydraulic proportional servo valves.

Shandong Zhongchuan Hydraulic: founded in 2010 and as the subsidiary of Shandong Changlin Group, Shandong Zhongchuan Hydraulic now has been capable of annually producing 300,000 sets of top-grade main hydraulic components. Whilst expanding production capacity, the company is actively speeding up independent research and development. In August, 2012, the company’s four models of top-grade hydraulic products including AP4V0112TVN hydraulic axial piston pump, AP4V0112TE hydraulic axial piston pump, MA170W rotary motor, and VM28PF master valve passed the state-level appraisal.

Besides, Kawasaki Precision Machinery, KYB and other foreign players are also accelerating their business growth in China.

Kawasaki Precision Machinery: it is the largest supplier of hydraulic excavator parts in China. In 2005, it established Kawasaki Precision Machinery (Suzhou) Co., Ltd which mainly produces the hydraulic pumps and hydraulic motors used for excavator; then in 2009 it set up Kawasaki Chunhui Precision Machinery (Zhejiang) Co., Ltd with the first-stage production of 12,000 hydraulic pumps and with the hydraulic motor and control valve production to be raised along with scale expansion.

KYB: Its sales hit JPY352.71 billion in FY2013, of which sales in China accounted for 7.3%. According to its development planning, KYB will speed up the development of mini and small excavator hydraulic parts market in China in the next three years and at the same time actively explore the Chinese market of hydraulic parts for railways and agricultural machinery.

Global and China Hydraulic Industry Report, 2014-2017 by ResearchInChina highlights the following:

Global hydraulic industry scale, regional pattern, corporate pattern, etc.; Global hydraulic industry scale, regional pattern, corporate pattern, etc.;

Policies on Chinese hydraulic industry, status quo of the industry, existing problems in the industry, etc.; Policies on Chinese hydraulic industry, status quo of the industry, existing problems in the industry, etc.;

Production, sales, import and export of hydraulic parts in China, status quo of construction machinery hydraulic parts, etc.; Production, sales, import and export of hydraulic parts in China, status quo of construction machinery hydraulic parts, etc.;

Operation, business in China, etc of world’s seven leading companies; Operation, business in China, etc of world’s seven leading companies;

Operation, revenue structure, development strategies, etc of sixteen Chinese companies. Operation, revenue structure, development strategies, etc of sixteen Chinese companies.

第一章概述

1.1 定义

1.2 构成

第二章全球液压行业发展现状

2.1 市场规模

2.2 地区结构

2.3 重点企业

第三章中国液压行业发展现状

3.1 相关政策

3.2 行业规模

3.3 主要问题

第四章中国液压件市场分析

4.1 市场供需

4.1.1 生产情况

4.1.2 销售情况

4.1.3 进出口

4.2 工程机械液压件市场

4.3 企业格局

第五章国外重点企业

5.1 BOSCH-REXROTH

5.1.1 企业简介

5.1.2 经营状况

5.1.3 营收构成

5.1.4 研发

5.1.5 在华发展

5.1.6 博世力士乐(常州)有限公司

5.2 EATON

5.2.1 企业简介

5.2.2 经营情况

5.2.3 营收构成

5.2.4 企业收购

5.2.5 液压业务

5.2.6 中国液压业务

5.3 PARKER HANNIFIN

5.3.1 企业简介

5.3.2 经营情况

5.3.3 营收构成

5.3.4 在华发展

5.4 Kawasaki Precision Machinery

5.4.1 企业简介

5.4.2 经营情况

5.4.3 液压元件业务

5.4.4 川崎精密机械(苏州)有限公司

5.5 KYB

5.5.1 企业简介

5.5.2 企业经营

5.5.3 营收构成

5.5.4 液压元件业务

5.5.5 在华发展

5.6 YUKEN

5.6.1 企业简介

5.6.2 经营情况

5.6.3 在华发展

5.7 NABTESCO

5.7.1 企业简介

5.7.2 经营情况

5.7.3 营收构成

5.7.4 航空与液压机械业务

5.7.5 在华发展

5.7.6 上海博特斯克液压有限公司

5.7.7 江苏纳博特斯克液压有限公司

第六章中国重点企业

6.1 恒立油缸(601100)

6.1.1 企业简介

6.1.2 经营情况

6.1.3 营收构成

6.1.4 毛利率

6.1.5 产能与产销量

6.1.6 研发与在建项目

6.1.7 客户

6.1.8 发展前景

6.2 泰丰液压

6.2.1 企业简介

6.2.2 经营情况

6.2.3 毛利率

6.2.4 竞争优势

6.3 榆次液压集团有限公司

6.3.1榆次液压有限公司

6.3.2 长治液压有限公司

6.4 太重集团榆次液压工业有限公司

6.4.1 企业简介

6.4.2 经营情况

6.5 中航力源液压股份有限公司

6.5.1 企业简介

6.5.2 经营情况

6.5.3 投资

6.6 圣邦液压

6.7 浙江苏强格液压股份有限公司

6.7.1 企业简介

6.7.2 子公司

6.8 山东中川液压有限公司

6.8.1 企业简介

6.8.2 经营情况

6.9 北京华德液压工业集团有限责任公司

6.9.1 企业简介

6.9.2 经营情况

6.10 海门市液压件厂有限责任公司

6.11 四川长江液压件有限责任公司

6.12 徐州徐工液压件有限公司

6.12.1 企业简介

6.12.2 经营情况

6.13 宁波广天赛克思液压有限公司

6.14 山东隆源液压科技有限公司

6.15 江苏国瑞液压机械有限公司

6.16 浙江海宏液压科技股份有限公司

第七章总结与预测

7.1 市场

7.2 企业

7.2.1 国外企业

7.2.2 国内企业

1 Overview of Hydraulic Industry

1.1 Definition

1.2 Structure

2 Development of Global Hydraulic Industry

2.1 Market Size

2.2 Regional Structure

2.3 Key Players

3 Development of China Hydraulic Industry

3.1 Related Policies

3.2 Industry Scale

3.3 Main Problems

4 Analysis on China Hydraulic Parts Market

4.1 Supply and Demand

4.1.1 Production

4.1.2 Sales

4.1.3 Import and Export

4.2 Construction Machinery Hydraulic Parts Market

4.3 Corporate Pattern

5 Major Foreign Companies

5.1 Bosch-Rexroth

5.1.1 Profile

5.1.2 Operation

5.1.3 Revenue Structure

5.1.4 R&D

5.1.5 Development in China

5.1.6 Bosch Rexroth (Changzhou) Co., Ltd

5.2 Eaton

5.2.1 Profile

5.2.2 Operation

5.2.3 Revenue Structure

5.2.4 Corporate Acquisition

5.2.5 Hydraulic Business

5.2.6 Hydraulic Business in China

5.3 Parker Hannifin

5.3.1 Profile

5.3.2 Operation

5.3.3 Revenue Structure

5.3.4 Development in China

5.4 Kawasaki Precision Machinery

5.4.1 Profile

5.4.2 Operation

5.4.3 Hydraulic Components Business

5.4.4 Kawasaki Precision Machinery (Suzhou) Co., Ltd.

5.5 KYB

5.5.1 Profile

5.5.2 Operation

5.5.3 Revenue Structure

5.5.4 Hydraulic Components Business

5.5.5 Development in China

5.6 YUKEN

5.6.1 Profile

5.6.2 Operation

5.6.3 Development in China

5.7 Nabtesco

5.7.1 Profile

5.7.2 Operation

5.7.3 Revenue Structure

5.7.4 Aviation and Hydraulic Machinery Business

5.7.5 Development in China

5.7.6 Shanghai Nabtesco Hydraulic Co., Ltd.

5.7.7 Jiangsu Nabtesco Hydraulic Co., Ltd

6 Key Chinese Companies

6.1 Hengli Highpressure Oil Cylinder (601100)

6.1.1 Profile

6.1.2 Operation

6.1.3 Revenue Structure

6.1.4 Gross Margin

6.1.5 Capacity, Output and Sales Volume

6.1.6 R&D and Projects under Construction

6.1.7 Customers

6.1.8 Prospects

6.2 Shandong Taifeng Hydraulic Co., Ltd.

6.2.1 Profile

6.2.2 Operation

6.2.3 Gross Margin

6.2.4 Competitive Edge

6.3 Yuci Hydraulics Group Corporation

6.3.1Yuci Hydraulics Co., Ltd.

6.3.2 Changzhi Hydraulics Co., Ltd.

6.4 Taiyuan Heavy Machinery Group Yuci Hydraulics Co., Ltd.

6.4.1 Profile

6.4.2 Operation

6.5 AVIC Liyuan Hydraulic Co., Ltd.

6.5.1 Profile

6.5.2 Operation

6.5.3 Investment

6.6 Sunbun Hydraulic Co., Ltd

6.7 Zhejiang Stronger Hydraulic Co., Ltd.

6.7.1 Profile

6.7.2 Subsidiaries

6.8 Shandong Zhongchuan Hydraulic Co., Ltd.

6.8.1 Profile

6.8.2 Operation

6.9 Beijing Huade Hydraulic Industrial Group Co., Ltd.

6.9.1 Profile

6.9.2 Operation

6.10 Haimen Hydraulic Component Plant Co., Ltd.

6.11 Sichuan Changjiang Hydraulic Parts Co., Ltd.

6.12 Xuzhou XuGong Hydraulic Component Co., Ltd

6.12.1 Profile

6.12.2 Operation

6.13 Ningbo Wide Sky SKS Hydraulic Co., Ltd.

6.14 Shandong Longyuan Hydraulic Technology Co., Ltd.

6.15 Jiangsu Guori Hydraulic Machinery Co., Ltd.

6.16 Haihong Hydraulic Technology Stock Co., Ltd.

7 Summary and Prediction

7.1 Market

7.2 Enterprises

7.2.1 Overseas Companies

7.2.2 Chinese Companies

表:液压系统构成

图:2008-2017E年全球液压行业销售额

表:2008-2011年世界液压行业国内市场(分国家/地区)销售额

表:全球主要液压件供应商

表:中国液压行业相关政策

图:2006-2017年中国液压行业产值及同比增长

表:2014年中国高端液压件研制情况

表:2014年中国液压产业基地建设情况

图:2007-2014年中国液压件产量及同比增长

图:2013-2014年中国液压元件产量(分地区)构成

图:2009-2017年中国液压件销售额

图:中国液压件下游应用行业结构

图:中国液压系统产品市场销售结构

图:2005-2013年中国液压件进出口额

图:2006-2017年中国工程机械行业销售额及同比增长

表:2014年6月底中国主要工程机械主机企业液压元件基地

图:2004-2013年博世力士乐营业收入及同比增长

表:2011-2013年博世力士乐(分地区)营业收入及构成

图:2005-2013年博世力士乐研发投入及占比

图:2007-2014年伊顿公司净收入与净利润

图:2011-2014年伊顿(分业务)净收入及构成

图:2009-2013年伊顿(分地区)净收入及构成

表:2013年以前伊顿主要收购业务

图:2009-2014年伊顿液压业务净收入与营业利润

表:派克汉尼汾(分地区/分业务)工厂分布

图:2007-2014财年Parker公司净收入及净利润

表:FY2010-FY2014年派克汉尼汾(分业务)营业收入

图:2009-2013财年川崎精机销售收入及营业利润

图:川崎精机全球生产基地

图:KYB全球业务分布

表:2006-2013财年KYB净收入与净利润

图:KYB 2014年中期(FY2014-FY2016)计划

表:2012-2013财年KYB(分业务)销售收入

图:2013财年KYB(分业务)销售收入构成

表:2012-2013财年KYB(分地区)销售收入

表:2014年KYB液压元件主要产品

图:2009-2013财年KYB液压元件业务营业收入与营业利润

图:FY2013年KYB液压元件业务(分用途)外部销售净收入占比

图:2010-2011财年KYB工业用液压元件(分产品)净收入及占比

图:2014-2016财年KYB 液压业务规划

表:2014年KYB在中国的全资子公司

图:2010-2013财年KYB 在华收入

图:2010-2014财年油研销售额与净利润

表:2012-2013财年油研公司(分地区)销售额

表:2012-2013财年油研公司(分业务)销售额

表:2012-2013财年油研公司主要液压元件销售额

图:日本油研液压在华子公司

图:2008-2014财年纳博特斯克营业收入与净利润

表:2008-2014财年纳博特斯克(分产品)净收入及营业利润

表:FY2008-FY2014纳博特斯克(分地区)净收入及占比

图:FY2014年纳博特斯克航空与液压机械业务主要产品与主要客户

图:FY2011-FY2013年纳博特斯克航空与液压机械业务(分产品)净收入

图:2014财年纳博特斯克公司的挖液压产品市场份额

图:FY2010-FY2014财年纳博特斯克在中国净收入及占比

图:上海纳博特斯克液压有限公司股东结构

图:2008-2014年恒立油缸营业收入及净利润

图:2009-2014年恒立油缸(分产品)主营业务收入

图:2009-2014年恒立油缸(分地区)主营业务收入

图:2009-2014年恒立油缸(分产品)毛利率

表:2008-2014恒立油缸(分产品)产能

表:2008-2014年恒立油缸(分产品)产销量及产销率

图:2008-2014年恒立油缸研发支出及占比

表:2011-2014年恒立油缸前五名及第一名营业收入贡献及占比

表:2013-2017年恒立油缸营业收入与净利润

图:2009-2011年山东泰丰营业收入与净利润

图:2009-2011年山东泰丰(分产品)营业收入

图:2009-2011年山东泰丰插装阀产品销量及平均单价

表:2009-2011年山东泰丰分产品毛利率

表:榆次液压集团有限公司成员企业

表:力源液压产业结构和生产基地

图:2009-2014年力源液压营业收入与净利润

表:圣邦液压发展历程

图:2010-2013年北京华德液压主营业收入与净利润

图:2009-2013年华德液压液压件产量

图:2007-2014年徐工液压营业收入与净利润

图:2010-2016年全球6吨及以上液压挖机需求量

Structure of Hydraulic System

Global Hydraulic Industry Sales, 2008-2017E

Domestic Market Sales of World’s Hydraulic Industry (by Country/Region), 2008-2011

World’s Major Suppliers of Hydraulic Parts

Policies on China Hydraulic Industry

Output Value and YoY Growth of China Hydraulic Industry, 2006-2017E

Research and Production of High-end Hydraulic Parts in China, 2014

Construction of Hydraulic Industry Bases in China, 2014

China’s Output and YoY Growth of Hydraulic Parts, 2007-2014

Structure of China’s Hydraulic Parts Output (by Region), 2013-2014

China’s Hydraulic Parts Sales, 2009-2017E

Application Structure of Hydraulic Parts in China

Sales Structure of China Hydraulic System Product Market

Import and Export Value of Hydraulic Parts in China, 2005-2013

Sales and YoY Growth of China Construction Machinery Industry, 2006-2017E

Hydraulic Parts Bases of Leading Construction Machinery Main-engine Enterprises in China, end-June, 2014

Sales and YoY Growth of Bosch-Rexroth, 2004-2013

Sales and Percentage of Bosch-Rexroth by Region, 2011-2013

R&D Costs and % of Total Sales of Bosch-Rexroth, 2005-2013

Net Revenue and Net Income of Eaton, 2007-2014

Net Revenue and Percentage of Eaton by Business, 2011-2014

Net Revenue and Percentage of Eaton by Region, 2009-2013

Major Acquired Businesses of Eaton before 2013

Net Revenue and Operating Income of Eaton’s Hydraulic Business, 2009-2014

Distribution of Parker Hannifin’s Plants by Region/by Business

Net Revenue and Net Income of Parker Hannifin, FY2007-FY2014

Revenue of Parker Hannifin by Business, FY2010-FY2014

Sales and Operating Income of Kawasaki Precision Machinery, FY2009-FY2013

Worldwide Production Bases of Kawasaki Precision Machinery

Worldwide Business Distribution of KYB

Net Sales and Net Income of KYB, FY2006-FY2013

KYB’s Planning for Mid-2014(FY2014-FY2016)

KYB’s Sales by Business, FY2012-FY2013

KYB’s Sales Structure by Business, FY2013

KYB’s Sales by Region, FY2012-FY2013

KYB’s Key Hydraulic Parts, 2014

Revenue and Operation Income of KYB’s Hydraulic Parts Business, FY2009-FY2013

Percentage of External Net Sales of KYB’s Hydraulic Parts Business (by Application), FY2013

KYB’s Net Sales from Industrial Hydraulic Parts (by Product), FY2010-FY2011

KYB’s Hydraulic Business Planning, FY2014-FY2016

KYB’s Wholly-funded Subsidiaries in China, 2014

KYB’s Revenue in China, FY2010-FY2013

YUKEN’s Sales and Net Income, FY2010-FY2014

YUKEN’s Sales by Region, FY2012-FY2013

YUKEN’s Sales by Business, FY2012-FY2013

YUKEN’s Sales from Major Hydraulic Parts, FY2012-FY2013

YUKEN’s Subsidiaries in China

Sales and Net Income of Nabtesco, FY2008-FY2014

Net Sales and Operating Income of Nabtesco, FY2008-FY2014

Net Sales and Percentage of Nabtesco by Region, FY2008-FY2014

Key Products and Major Customers of Aviation and Hydraulic Machinery Business of Nabtesco, FY2014

Net Sales from Aviation and Hydraulic Machinery Business ((by Product) of Nabtesco, FY2011-FY2013

Market Share of Nabtesco’s Excavator Hydraulic Products, FY2014

Nabtesco’s Net Sales and Structure (%) in China, FY2010-FY2014

Equity Structure of Shanghai Nabtesco Hydraulic Co., Ltd.

Revenue and Net Income of Hengli Highpressure Oil Cylinder, 2008-2014

Operating Revenue of Hengli Highpressure Oil Cylinder by Product, 2009-2014

Operating Revenue of Hengli Highpressure Oil Cylinder by Region, 2009-2014

Gross Margin of Hengli Highpressure Oil Cylinder by Product, 2009-2014

Production Capacity of Hengli Highpressure Oil Cylinder by Product, 2008-2014

Output, Sales Volume and Sales-output Ratio of Hengli Highpressure Oil Cylinder, 2008-2014

R&D Costs and % of Total Revenue of Hengli Highpressure Oil Cylinder, 2008-2014

Revenue Contribution and Structure (%) of Hengli Highpressure Oil Cylinder’s Top 5 Customers and No.1 Customer, 2011-2014

Revenue and Net Income of Hengli Highpressure Oil Cylinder, 2013-2017E

Revenue and Net Income of Shandong Taifeng Hydraulic, 2009-2011

Revenue of Shandong Taifeng Hydraulic by Product, 2009-2011

Sales Volume and Average Unit Price of Catridge Valves of Shandong Taifeng Hydraulic, 2009-2011

Gross Margin of Shandong Taifeng Hydraulic by Product, 2009-2011

Member Companies of Yuci Hydraulics Group Corporation

Industry Structure and Production Bases of AVIC Liyuan Hydraulic Co., Ltd.

Revenue and Net Income of AVIC Liyuan Hydraulic, 2009-2014

Development Course of Sunbun Hydraulic

Operating Revenue and Net Income of Beijing Huade Hydraulic Industrial Group, 2010-2013

Hydraulic Parts Output of Beijing Huade Hydraulic Industrial Group, 2009-2013

Revenue and Net Income of Xuzhou XuGong Hydraulic Component, 2007-2014

World’s Demand for 6-ton and above Hydraulic Excavator, 2010-2016E

如果这份报告不能满足您的要求,我们还可以为您定制报告,请 留言说明您的详细需求。

|