|

|

|

报告导航:研究报告—

生命科学—生物科技

|

|

2014-2019年全球及中国单克隆抗体行业研究报告 |

|

字数:4.2万 |

页数:135 |

图表数:119 |

|

中文电子版:8000元 |

中文纸版:4000元 |

中文(电子+纸)版:8500元 |

|

英文电子版:2600美元 |

英文纸版:2800美元 |

英文(电子+纸)版:2900美元 |

|

编号:ZYM058

|

发布日期:2014-10 |

附件:下载 |

|

|

|

尽管全球经济低迷、汇率变动较大,但由于市场需求较为强劲, 2013年全球单抗市场规模超过800亿美元,仍是近年来CAGR最快的生物技术药物之一。

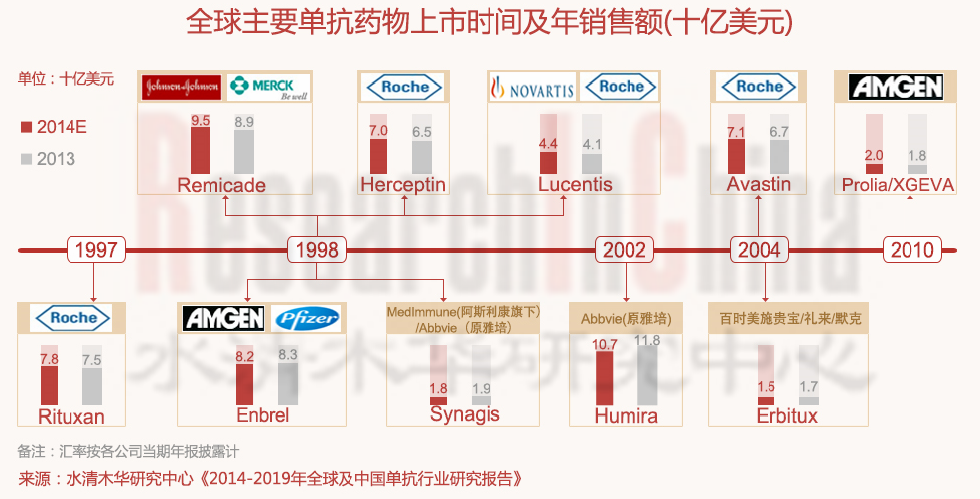

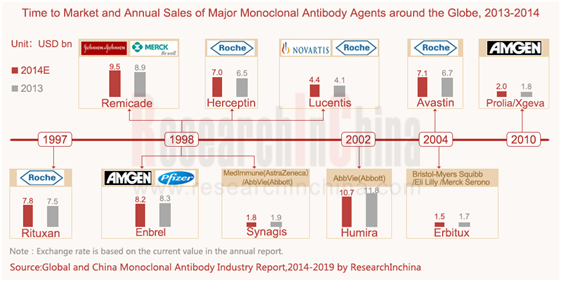

全球重磅单抗产品仍主要集中在罗氏(基因泰克)、安进、AbbVie(雅培)、强生、诺华等公司。2013年全球销售top10单抗产品(依次为Humira阿达木单抗、Remicade英利昔单抗、Enbrel依那西普、Rituxa利昔妥单抗、Avastin贝伐珠单抗、Herceptin曲妥珠单抗、Lucents兰尼单抗、Synagis帕利珠单抗、Prolia/Xgeva地诺单抗、Erbitux西妥昔单抗)基本来自以上这些企业,而这10种单抗药物的全球销售额(包括第三方销售)合计约达581亿美元,预计2014年可达641亿美元。

这些企业不仅构建了成熟的单抗研发平台,在靶位基因的筛选、基因的测序、抗体结构的构建以及工业化生产等一系列流程上有着不可比拟的技术优势;而且资金雄厚(近年这些生物制药巨头的研发费用一般可占到同期销售收入的15-20%),未来5-10年有望继续保持全球单抗市场的领先地位。

2014年9月,百时美施贵宝的单抗药物Opdivo (nivolumab)正式进入FDA和EMA的优先审批通道,该药适应症为不可切除的或转移性黑色素瘤;美国默沙东旗下Keytruda(pembrolizumab)成为FDA批准的首例PD-1单抗,该药物用于晚期黑色素瘤。

2014年4月,强生旗下杨森研发单元(Janssen)宣布,FDA已批准单抗药物Sylvant(siltuximab)用于HIV阴性和人类疱疹病毒-8(HHV-8)阴性的多中心型巨大淋巴结增生症患者的治疗;礼来的单抗药物Cyramza(ramucirumab)获FDA批准用于不能手术切除(不可切除性)或经化疗后扩散(转移)的晚期胃癌和胃食管交界部腺癌患者的治疗。

中国单抗市场近年发展也较快,2010-2013年其市场规模年均复合增长率达38.9%,国产上市单抗产品达9种如中信国健的泰欣生(尼托珠单抗)、百泰生物的健尼哌(重组抗CD25人源化单克隆抗体)。但市场主要被利妥昔单抗、曲妥珠单抗、英夫利昔单抗、贝伐珠单抗等进口产品占据,占比达七成以上。

不过,2014年8月,海正药业的注射用重组人Ⅱ型肿瘤坏死因子受体-抗体融合蛋白(商品名安佰诺)收到SFDA可申请生产现场检查通知,预计14年底前可上市。届时有望进一步增强国产单抗药物供应能力。

随着单抗技术的进步、部分单抗重磅药物专利期的即将到来以及对单抗前景的看好,丽珠集团、沃森生物、华兰生物、复星医药等众多企业纷纷重资进入单抗市场,并且已有多个产品进入临床前或临床研究。

2014年9月,华兰生物的3种单抗仿制药即曲妥珠单抗、贝伐珠单抗、利妥昔单抗均已提交临床申请;2014年8月,沃森生物的重组抗肿瘤坏死因子-α全人源单克隆抗体注射液获得了韩国食品药品安全部颁发的临床试验批件;2014年4月,复星医药正式收到SFDA核发的重组人鼠嵌合抗CD20单克隆抗体注射液药物(利妥昔单抗仿制药)临床试验批件。

Despite world-wide economic downturn and great changes in exchange rate, benefiting from robust market demand, global monoclonal antibody market size exceeded USD 80 billion in 2013, still one of biotech drugs with the fastest CAGR in recent years.

Global blockbuster monoclonal antibody agents are still concentrated in Roche (Genentech), Amgen, AbbVie (Abbott), Johnson & Johnson, Novartis, etc. In 2013, the top 10 best-selling monoclonal antibody agents (Humira, Remicade, Enbrel, Rituxa, Avastin, Herceptin, Lucents, Synagis, Prolia/Xgeva and Erbitux, in order) mostly came from these companies mentioned above. Global sales of these ten monoclonal antibody agents totaled about USD 58.1 billion in 2013, and are predicted to amount to USD 64.1 billion in 2014.

These companies construct mature monoclonal antibody R&D platform, have unparalleled technical advantages in a series of processes including the selection of target gene, genetic sequencing, construction of monoclonal antibody structure and industrialized production, and are well-capitalized (R&D costs of these companies accounted for 15%-20% of revenue during the same period.). It is expected that they will keep a leading position in global monoclonal antibody market over the next five to ten years.

In Sept. 2014, Opdivo (nivolumab) of Bristol-Myers Squibb was accepted for priority review by FDA and EMA. The indication of the drug is unresectable or metastatic melanoma. In the same month, KEYTRUDA (pembrolizumab) under Merck became the first FDA-approved Anti-PD-1 therapy, which can be used for advanced melanoma.

In Apr. 2014, Janssen under Johnson & Johnson announced the FDA had approved SYLVANT (siltuximab) for the treatment of patients with multicentric Castleman's disease (MCD) who are human immunodeficiency virus (HIV) negative and human herpesvirus-8 (HHV-8) negative. Lilly's CYRAMZA (ramucirumab) became first FDA-approved treatment for with advanced gastric cancer or gastroesophageal junction (GEJ) adenocarcinoma with disease progression on or after prior chemotherapy.

The Chinese monoclonal antibody market developed rapidly in recent years, with market size recording a CAGR of 38.9% during 2010-2013. There are nine domestic monoclonal antibody agents introduced to the market, such as Shanghai CP Guojian Pharmaceutical’s Nimotuzuma and Biotech Pharm’s recombinant humanized anti-CD25 monoclonal antibody. However, the market is dominated by imported agents like Rituximab, Trastuzumab, Infliximab and Bevacizumab, which account for more than 70%.

However, in Aug. 2014, Hisun Pharm received notice from SFDA on applying for production field inspection for Recombinant Human Tumor Necrosis Factor Receptor Type II - Antibody Fusion Protein, which is expected to be introduced to the market by the end of 2014. Then supply capacity of domestic monoclonal antibody agents will be further enhanced.

With advancement of monoclonal antibody technology, incoming expiry date for patents of some blockbuster monoclonal antibody agents and bright future for monoclonal antibody, Livzon Pharmaceutical Group, Walvax Biotechnology, Hualan Biological Engineering, Shanghai Fosun Pharmaceutical and other companies invested heavily to enter monoclonal antibody market, and multiple products have entered stage of pre-preclinical or clinical research.

In Sept. 2014, Hualan Biological Engineering submitted clinical applications for its three monoclonal antibody generic drugs, namely, trastuzumab, bevacizumab and rituximab; In Aug. 2014, Walvax Biotechnology’s recombinant anti-tumor necrosis factor-α fully human monoclonal antibody injection obtained clinical trial permission issued by Korean Food and Drug Administration (KFDA); In Apr. 2014, Shanghai Fosun Pharmaceutical formally received clinical trial permission approved and issued by CFDA for recombinant human-mouse chimeric anti-CD20 monoclonal antibody injection (rituximab monoclonal antibody genetic drug).

第一章 单克隆抗体行业概述

1.1定义

1.2分类

1.3技术发展

第二章 全球单克隆抗体行业发展概况

2.1. 发展现状

2.2 市场规模

2.3 竞争格局

2.4 发展前景及预测

2.4.1 市场规模预测

2.4.2 竞争格局预测

2.4.3 研发趋势预测

第三章 中国单克隆抗体行业市场分析

3.1 发展现状

3.2 市场规模

3.3细分市场

3.3.1利妥昔单抗/美罗华 (Rituxan)

3.3.2曲妥珠单抗/赫赛汀(Herceptin)

3.3.3西妥昔单抗/爱必妥(Erbitux)

3.3.4 尼妥珠单抗/泰欣生(Nimotuzumab)

3.3.5 贝伐珠单抗

3.3.6 重组人Ⅱ型肿瘤坏死因子受体-抗体融合蛋白

3.4竞争格局

3.5发展前景

第四章 国外单克隆抗体药物重点企业分析

4.1罗氏制药有限公司

4.1.1公司介绍

4.1.2 经营状况

4.1.3 营收构成

4.1.4 研发与投资

4.1.5 单抗业务(基因泰克)

4.1.6在华业务

4.2强生公司

4.2.1 公司介绍

4.2.2 经营状况

4.2.3 营收构成

4.2.4 研发与投入

4.2.5 单抗业务

4.2.6 在华业务

4.3默克公司

4.3.1 公司介绍

4.3.2 经营状况

4.3.3 营收构成

4.3.4 研发与投资

4.3.5 单抗业务

4.3.6 在华业务

4.4 诺华公司

4.4.1 公司介绍

4.4.2 经营状况

4.4.3 营收构成

4.4.4 研发与投资

4.4.5 单抗业务

4.4.6 在华业务

4.5 AbbVie

4.5.1 公司介绍

4.5.2 营收构成

4.5.3 研发与投入

4.5.4 单抗业务

4.5.5 在华业务

4.6 安进公司

4.6.1 公司简介

4.6.2 经营状况

4.6.3 营收构成

4.6.4 研发与投资

4.6.5 单抗业务

4.6.6 在华业务

第五章 国内单克隆抗体药物重点企业

5.1上海兰生国健药业有限公司

5.1.1公司介绍

5.1.2上海中信国健药业股份有限公司

5.1.3 上海张江生物技术有限公司

5.1.4 中信国健生物技术研究院

5.1.5上海国盛药业有限公司

5.2北京百泰生物药业公司

5.2.1公司介绍

5.2.2 竞争优势

5.2.3发展前景

5.3成都华神集团股份有限公司

5.3.1 公司介绍

5.3.2成都华神生物技术有限责任公司

5.4上海美恩生物技术有限公司

5.4.1 公司介绍

5.4.2 单抗业务

5.5浙江海正药业股份有限公司

5.5.1 公司介绍

5.5.2 单抗业务

5.6 云南沃森生物技术股份有限公司

5.6.1 公司简介

5.6.2 单抗业务

5.7上海复星医药(集团)股份有限公司

5.7.1 公司介绍

5.7.2 单抗业务

5.8 北京双鹭药业股份有限公司

5.8.1公司简介

5.8.2 单抗业务

5.9 深圳万乐药业有限公司

5.9.1 公司简介

5.9.2 单抗业务

5.10 华海药业股份有限公司

5.10.1 公司简介

5.10.2 单抗业务

5.11 丽珠集团股份有限公司

5.11.1 公司简介

5.11.2 单抗业务

5.12 华兰生物工程股份有限公司

5.12.1 公司简介

5.12.2 单抗业务

第六章 总结与预测

6.1 国内外公司对比

6.2 市场预测

1. Overview of Monoclonal Antibody Industry

1.1 Definition

1.2 Classification

1.3 Technological Development

2. Overview of Global Monoclonal Antibody Industry

2.1 Status Quo

2.2 Market Size

2.3 Competitive Landscape

2.4 Development Prospect and Prediction

2.4.1 Market Size

2.4.2 Competitive Landscape

2.4.3 R&D Trend

3 Chinese Monoclonal Antibody Market

3.1 Status Quo

3.2 Market Size

3.3 Market Segments

3.3.1 Rituximab/Rituxan

3.3.2 Trastuzumab/Herceptin

3.3.3 Cetuximab/Erbitux

3.3.4 Nimotuzumab/Infilixma

3.3.5 Bevacizumab

3.3.6 Recombinant Human Tumor Necrosis Factor Receptor Type II - Antibody Fusion Protein

3.4 Competitive Landscape

3.5 Development Prospect

4 Key Foreign Monoclonal Antibody Agent Enterprises

4.1 Roche Pharmaceuticals

4.1.1 Profile

4.1.2 Operation

4.1.3 Revenue Structure

4.1.4 R&D and Investment

4.1.5 Monoclonal Antibody Business (Genentech)

4.1.6 Business in China

4.2 Johnson & Johnson

4.2.1 Profile

4.2.2 Operation

4.2.3 Revenue Structure

4.2.4 R&D and Investment

4.2.5 Monoclonal Antibody Business

4.2.6 Business in China

4.3 Merck

4.3.1 Profile

4.3.2 Operation

4.3.3 Revenue Structure

4.3.4 R&D and Investment

4.3.5 Monoclonal Antibody Business

4.3.6 Business in China

4.4 Novartis

4.4.1 Profile

4.4.2 Operation

4.4.3 Revenue Structure

4.4.4 R&D and Investment

4.4.5 Monoclonal Antibody Business

4.4.6 Business in China

4.5 AbbVie

4.5.1 Profile

4.5.2 Revenue Structure

4.5.3 R&D and Investment

4.5.4 Monoclonal Antibody Business

4.5.5 Business in China

4.6 Amgen

4.6.1 Profile

4.6.2 Operation

4.6.3 Revenue Structure

4.6.4 R&D and Investment

4.6.5 Monoclonal Antibody Business

4.6.6 Business in China

5 Key Chinese Monoclonal Antibody Agent Enterprises

5.1 Shanghai Lansheng States Kin Pharmaceutical Co., Ltd.

5.1.1 Profile

5.1.2 Shanghai CP Guojian Pharmaceutical Co., Ltd.

5.1.3 Shanghai Zhangjiang Biotech Co., Ltd.

5.1.4 Shanghai CP GuoJian Biotech Academy

5.1.5 Shanghai Guosheng Pharmaceutical Co., Ltd.

5.2 Beijing Biotech Pharmaceutical Co., Ltd.

5.2.1 Profile

5.2.2 Competitive Advantages

5.2.3 Development Prospect

5.3 Chengdu Huasun Group Co., Ltd.

5.3.1 Profile

5.3.2 Chengdu Huasun Biotech Co., Ltd.

5.4 Shanghai Medipharm Biotech Co., Ltd.

5.4.1 Profile

5.4.2 Monoclonal Antibody Business

5.5 Zhejiang Hisun Pharmaceutical Co., Ltd.

5.5.1 Profile

5.5.2 Monoclonal Antibody Business

5.6 Yunnan Walvax Biotechnology Co., Ltd.

5.6.1 Profile

5.6.2 Monoclonal Antibody Business

5.7 Shanghai Fosun Pharmaceutical (Group) Co., Ltd.

5.7.1 Profile

5.7.2 Monoclonal Antibody Business

5.8 Beijing SL Pharmaceutical Co., Ltd.

5.8.1 Profile

5.8.2 Monoclonal Antibody Business

5.9 Shenzhen Main Luck Pharmaceuticals Inc.

5.9.1 Profile

5.9.2 Monoclonal Antibody Business

5.10 Huahai Pharmaceutical Co., Ltd.

5.10.1 Profile

5.10.2 Monoclonal Antibody Business

5.11 Livzon Pharmaceutical Group Inc.

5.11.1 Profile

5.11.2 Monoclonal Antibody Business

5.12 Hualan Biological Engineering Co., Ltd.

5.12.1 Profile

5.12.2 Monoclonal Antibody Business

6 Summary and Forecast

6.1 Comparison between Domestic and Foreign Companies

6.2 Market Forecast

图:2013年全球单抗药物种类(按类型)构成

表:欧美发达国家的单抗药物技术水平

表:截止2014年9月FDA批准上市的部分单抗药物靶点

图:2004和2013年全球治疗性抗体研发领域

图:2009-2014年全球单克隆抗体药物销售额

表:截至2014年9月全球与单抗有关的并购事件

表:2011-2014年全球主要单抗药物的上市时间及年销售额

表:2009-2014年全球主要生物制药公司研发投入

表:全球主要单抗药物专利到期时间

表:ENBREL在美国和加拿大市场竞争分析

表:2013-2014年全球部分单抗新品或新适应症研究

表:2012-2014全球单抗类企业部分合作项目

表:截至2014年9月中国批准上市的单抗产品

表: 2014年中国部分单抗药物研究进度

表:国内外单抗药物技术水平对比

图:2010-2014年中国抗体药物销售额

表:2009-2013年中国22座城市典型医院的主要单抗药物购药金额

图:2008-2013年利妥昔单抗在中国样本医院购药金额及同比增长

图:2009-2013年利妥昔单抗在中国三大城市典型医院购药金额

图:2009-2013年曲妥珠单抗在中国样本医院购药金额

表:2009-2013年曲妥珠单抗在中国三大城市典型医院购药金额

图:2009-2013年西妥昔单抗在中国样本医院购药金额

表:2009-2013年西妥昔单抗/爱必妥在华三大城市典型医院购药金额

表:2010-2013年尼妥珠单抗/泰欣生在中国三大城市医院购药金额

表:2011-2013年贝伐珠单抗/安维汀在华典型医院购药金额

图:2009-2013年重组人II型肿瘤坏死因子受体-抗体融合蛋白在中国样本医院购药金额及同比增长

表:2010-2013年重组人II型肿瘤坏死因子受体-抗体融合蛋白在中国三大城市医院购药金额

表:2014年上半年益赛普、强克、恩利价格对比

图:2012年中国农村居民主要疾病死因构成

图:2012年中国城市居民主要疾病死因构成

表:2014年进入中国地方医保的单抗产品

表:截止2014年9月中国处于临床的部分单抗产品

表:2010-2014年中国投资于单抗产业的部分上市公司及项目

表:1990-2014年罗氏主要并购案例

图:2008-2014年罗氏营业收入及净利润

图:2010-2014年罗氏(分业务)营业收入

表:2012-2013年罗氏制药和诊断试剂(分应用领域)营业收入

表:2014上半年罗氏制药和诊断试剂(分应用领域)营业收入

表:2012-2013年罗氏(分地区)销售收入及其收入占比

图:2013年罗氏制药和诊断试剂(分地区)营业收入

表:2014上半年罗氏制药和诊断试剂(分地区)营业收入

表:2011-2014年罗氏(分业务)研发投入

表:截至2013年底罗氏部分产品获批上市情况

表:2010-2013年罗氏(基因泰克)主要单抗产品全球销售额

表:2011-2014年罗氏各种单抗产品(分地区)销售收入

表:截至2014年7月24日罗氏部分在研产品

图:2010-2014年罗氏制药业务在华销售额及同比增长

图:2010-2014年罗氏诊断业务在华销售额及同比增长

表:罗氏在华主要子公司

表:2009-2013年罗氏美罗华/利妥昔单抗在华销售情况

表:2009-2013年罗氏赫赛汀/曲妥珠单抗在华销售情况

表:2011-2013年贝伐珠单抗/安维汀在华销售情况

图:2009-2014年强生公司总收入及净利润

图:2009-2014年强生公司总收入(分产品)

图:2009-2014年强生公司总收入构成(分产品)

表:2011-2013年强生公司制药业务(分产品)收入

表:2009-2014年强生研发投入及占营业收入比重

表:强生单抗产品

图:2009-2014年强生单抗全球销售额

表:强生公司在华企业及主要产品

图:2010-2013年中国进口英夫利昔金额

图:2009-2014年默克销售收入与净利润

表:2011-2013年默克集团(分产品)营业收入

图:2009-2014年Merck研发投入及占营业收入比重

表:截至2014年7月Merck在研项目进度

图:2011-2014年Merck的英夫利昔单抗/类克销售收入

图:2009-2014年诺华销售收入与营业利润

表:2010-2014年Novartis(分业务)营业收入

图:2011-2014年Novartis(分地区)营业收入

图:2009-2014年诺华研发投入及占营业收入比重

表:2011 -2014诺华单抗产品及销售收入

表:诺华在华子公司

图:2010-2013年巴利昔单抗在华22典型医院进口药品购药金额

表: 2012-2013年雷珠单抗在华销售情况

表:HUMIRA主要销售地区及其适应症

表:2011-2013年AbbVie(分产品or分地区)营业收入

图:2013-2014年AbbVie研发投入及占营业收入比重(按季度)

图:2009-2014年Abbvie研发投入

表:2012-2014年AbbVie公司单抗产品及销售收入

图:2007-2014年阿达木单抗全球销售收入

图:2012-2014年Abbvie的Synagis全球销售收入

图:2010-2013年阿达木单抗在华22典型医院进口药品购药金额

图:2009-2014年Amgen营业收入与净利润

表:2009-2014年Amgen(分产品)营业收入

图:2009-2014年Amgen(分地区)营业收入

图:2008-2014年Amgen研发投入及占总营业收入比重

表:截止2014年6月Amgen部分在研产品

表:截止2014年6月Amgen市场化单抗产品

图:2009-2014年Amgen在售单抗产品营业收入

图:2009-2014年Amgen ENBREL(分地区)营业收入

表:ENBEL的专利期情况

表: ENBEL同类竞争产品

图:2009-2014年Panitumumab(分地区)营业收入

表:Panitumumab专利期情况

表: Panitumumab同类竞争产品

图:2010-2014年Amgen 的Denosumab(分地区)营业收入

表:Denosumab专利期情况

表: Denosumab同类竞争产品

图:2008-2010年中信国健营业收入及净利润

表:截止2014年10月中信国健在研部分单抗产品系列

表:张江生物部分在研单抗产品

表:百泰生物在研单抗项目

图:2009-2014年华神集团营业收入和营业利润

图:2007-2013年华神生物营业收入与净利润

图:2009-2014年海正药业营业收入和营业利润

图:沃森生产产业布局

表:2009-2014年沃森生物营业收入与营业利润

表:上海丰茂单抗技术指标

表:截止2014年9月上海丰茂5类单抗仿制药研发进度

表:嘉和生物在研单抗产品及进展

图:2008-2013年复星医药营业收入和营业利润

图:2009-2014年双鹭药业营业收入和营业利润

图:2009-2014年华海药业营业收入与营业利润

图:2009-2014年丽珠集团营业收入与营业利润

图:2009-2014年华兰生物营业收入和营业利润

表:近年国内外部分企业单抗领域投资事件及金额

图:2013-2019年全球单抗市场规模及同比增长

表:全球前六大单抗药物销售额及专利到期时间表

图:2013-2019年中国单抗市场规模及占全球市场比重

Composition of Monoclonal Antibody Agents Worldwide by Type, 2013

Technological Level of Monoclonal Antibody Agents in Developed Countries of Europe and America

Targets of Some Monoclonal Antibody Agents Approved for Marketing by FDA by Sept. 2014

R&D Fields of Therapeutic Antibody around the Globe, 2004 & 2013

Sales of Monoclonal Antibody Agents Worldwide, 2009-2014

M&A Events Related to Monoclonal Antibody Worldwide by Sept. 2014

Time to Market and Annual Sales of Major Monoclonal Antibody Agents around the Globe, 2011-2014

R&D Investment of Major Biopharmaceutical Companies Worldwide, 2009-2014

Expiration Date of Major Monoclonal Antibody Patents Worldwide

Competitive Analysis of Enbrel on American and Canadian Markets

Research on New Indications of Some Monoclonal Antibody Products in the World, 2013-2014

Several Cooperative Projects of Monoclonal Antibody Enterprises around the Globe, 2012-2014

Monoclonal Antibody Agents Approved for Marketing in China by Sept. 2014

Progress of Research on Some Monoclonal Antibody Agents in China, 2014

Technological Level Comparison of Monoclonal Antibody Agents at Home and Abroad

Sales of Monoclonal Antibody Agents in China, 2010-2014

Purchase Amount of Major Monoclonal Antibody Agents in Typical Hospitals of 22 Cities in China, 2009-2013

Purchase Amount of Rituximab in Sample Hospitals of China and YoY Growth, 2008-2013

Purchase Amount of Rituximab in Typical Hospitals of Three Major Cities in China, 2009-2013

Purchase Amount of Trastuzumab in Sample Hospitals of China, 2009-2013

Purchase Amount of Trastuzumab in Typical Hospitals of Three Major Cities in China, 2009-2013

Purchase Amount of Cetuximab in Sample Hospitals of China, 2009-2013

Purchase Amount of Cetuximab/Erbitux in Typical Hospitals of Three Major Cities in China, 2009-2013

Purchase Amount of Nimotuzumab in Hospitals of Three Major Cities in China, 2010-2013

Purchase Amount of Bevacizumab/Avastin in Typical Hospitals in China, 2011-2013

Purchase Amount of Recombinant Human Tumor Necrosis Factor Receptor Type II - Antibody Fusion Protein in Sample Hospitals of China and YoY Growth, 2009-2013

Purchase Amount of Recombinant Human Tumor Necrosis Factor Receptor Type II - Antibody Fusion Protein in Hospitals of Three Major Cities in China, 2010-2013

Price Comparison of Yisaipu, Qiangke and Enbrel in 2014H1

Death Causes Composition of Rural Residents in China, 2012

Death Causes Composition of Urban Residents in China, 2012

Monoclonal Antibody Products Covered by Local Medical Insurance in China, 2014

Some Clinical Monoclonal Antibody Products in China by Sept. 2014

Some Listed Companies and Projects Investing in Monoclonal Antibody Industry in China, 2010-2014

Major M&A Cases of Roche, 1990-2014

Revenue and Net Income of Roche, 2008-2014

Revenue Breakdown of Roche (by Business), 2010-2014

Pharmaceutical and Diagnostic Revenue Breakdown of Roche (by Application), 2012-2013

Pharmaceutical and Diagnostic Revenue Breakdown of Roche (by Application), 2014H1

Roche’s Revenue Breakdown and Percentage (by Region), 2012-2013

Pharmaceutical and Diagnostic Revenue Breakdown Roche (by Region), 2013

Pharmaceutical and Diagnostic Revenue Breakdown Roche (by Region), 2014H1

R & D Costs of Roche (by Business), 2011-2014

Some Products Approved for Marketing of Roche by the End of 2013

Global Sales of Major Monoclonal Antibody Products of Roche (Genentech), 2010-2013

Sales of Roche’s Monoclonal Antibody Products (by Region), 2011-2014

Some Products being Developed of Roche by Jul. 24, 2014

Roche’s Pharmaceutical Sales and YoY Growth in China, 2010-2014

Roche’s Diagnostic Sales and YoY Growth in China, 2010-2014

Roche’s Main Subsidiaries in China

Sales of Roche’s Rituximab/Rituxan in China, 2009-2013

Sales of Roche’s Herceptin/Trastuzumab in China, 2009-2013

Sales of Bevacizumab/Avastin in China, 2011-2013

Total Revenue and Net Income of Johnson & Johnson, 2009-2014

Total Revenue Breakdown of Johnson & Johnson (by Product), 2009-2014

Total Revenue Structure of Johnson & Johnson (by Product), 2009-2014

Pharmaceutical Revenue Breakdown of Johnson & Johnson (by Product), 2011-2013

R&D Costs and % of Total Revenue of Johnson & Johnson, 2009-2014

Monoclonal Antibody Products of Johnson & Johnson

Global Monoclonal Antibody Sales of Johnson & Johnson, 2009-2014

Johnson & Johnson’s Enterprises in China and Main Products

China’s Import Value of Infliximab, 2010-2013

Revenue and Net Income of Merck, 2009-2014

Revenue Breakdown of Merck (by Product), 2011-2013

R&D Costs and % of Total Revenue of Merck, 2009-2014

Progress of Merck’s Research Projects by Jul. 2014

Sales of Infliximab/Remicade of Merck, 2011-2014

Revenue and Operating Income of Novartis, 2009-2014

Revenue Breakdown of Novartis (by Business), 2010-2014

Revenue Breakdown of Novartis (by Region), 2011-2014

R&D Costs and % of Total Revenue of Novartis, 2009-2014

Novartis’ Monoclonal Antibody Products and Their Sales, 2011-2014

Novartis’ Subsidiaries in China

Purchase Amount of Basiliximab in Typical Hospitals of 22 Cities in China, 2010-2013

Sales of Lucentis in China, 2012-2013

Main Sales Regions and Indications of HUMIRA

Revenue Breakdown of Abbvie (by Product or Region), 2011-2013

R&D Costs and % of Total Revenue of Abbvie (by Quarter), 2013-2014

R&D Costs of Abbvie, 2009-2014

Abbvie’s Monoclonal Antibody Products and Their Sales, 2012-2014

Global Adalimumab Sales, 2007-2014

Global Synagis Sales of Abbvie, 2012-2014

Purchase Amount of Adalimumab in Typical Hospitals of 22 Cities in China, 2010-2013

Revenue and Net Income of Amgen, 2009-2014

Revenue Breakdown of Amgen (by Product), 2009-2014

Revenue Breakdown of Amgen (by Region), 2009-2014

R&D Costs and % of Total Revenue of Amgen, 2008-2014

Amgen’s Products Being Developed by Jun. 2014

Amgen’s Market-oriented Monoclonal Antibody Products by Jun. 2014

Revenue of Amgen’s Monoclonal Antibody Products Sold, 2009-2014

Revenue Breakdown of Amgen ENBREL (by Region), 2009-2014

ENBEL’s Patent Term

Similar Competitive Products of ENBEL

Revenue Breakdown of Panitumumab (by Region), 2009-2014

Panitumumab’s Patent Term

Similar Competitive Products of Panitumumab

Revenue Breakdown of Amgen’s Denosumab (by Region), 2010-2014

Denosumab’s Patent Term

Similar Competitive Products of Denosumab

Revenue and Net Income of Shanghai CP Guojian, 2008-2010

Some Monoclonal Antibody Products Being Developed of Shanghai CP Guojian, by Oct. 2014

Some Monoclonal Antibody Products Being Developed of Shanghai Zhangjiang Biotech

Monoclonal Antibody Research Projects of Beijing Biotech Pharmaceutical

Revenue and Operating Income of Chengdu Huasun Group, 2009-2014

Revenue and Net Income of Chengdu Huasun Biotech, 2007-2013

Revenue and Operating Income of Zhejiang Hisun Pharmaceutical, 2009-2014

Industrial Layout of Yunnan Walvax Biotechnology

Revenue and Operating Income of Yunnan Walvax Biotechnology, 2009-2014

Monoclonal Antibody Technical Indicators of Shanghai Fengmao

R&D Progress of 5 Categories of Monoclonal Antibody Generic Drugs of Shanghai Fengmao by Sept. 2014

Monoclonal Antibody Products Being Developed and Progress of Genor Biopharma

Revenue and Operating Income of Shanghai Fosun Pharmaceutical, 2008-2013

Revenue and Operating Income of Beijing SL Pharmaceutical, 2009-2014

Revenue and Operating Income of Huahai Pharmaceutical, 2009-2014

Revenue and Operating Income of Livzon Pharmaceutical Group, 2009-2014

Revenue and Operating Income of Hualan Biological Engineering, 2009-2014

Investment of Some Domestic and Foreign Enterprises in Monoclonal Antibody Field in Recent Years

Global Monoclonal Antibody Market Size and YoY Growth, 2013-2019E

Sales and Patent Expiration of Global Top Six Monoclonal Antibody Agents

Chinese Monoclonal Antibody Market Size and Its Share in the Global Market, 2013-2019E

如果这份报告不能满足您的要求,我们还可以为您定制报告,请 留言说明您的详细需求。

|