|

|

|

报告导航:研究报告—

制造业—汽车

|

|

2014-2016年全球和中国燃料电池产业链研究报告 |

|

字数:3.3万 |

页数:198 |

图表数:202 |

|

中文电子版:8500元 |

中文纸版:4250元 |

中文(电子+纸)版:9000元 |

|

英文电子版:2600美元 |

英文纸版:2800美元 |

英文(电子+纸)版:2900美元 |

|

编号:YS002

|

发布日期:2014-10 |

附件:下载 |

|

|

|

2013年全球燃料电池出货量为215.3MWh,其中大型固定式(Stationary)燃料电池电站出货量占比最大,约为187MW。大型的燃料电池电站应用主要集中在美国、韩国和日本,主要应用于发电、热电联产、IT数据中心等。

截止到2014年,燃料电池在汽车领域的应用规模虽较小,但却是最为重要的应用领域。经过二十多年的发展,目前燃料电池技术已经相对成熟,供应链体系逐步完善。早期困扰燃料电池汽车实用化的三大课题:耐久性、低温工作及低成本化中前两个课题已经解决,过去3-4 年每100kW燃料电池催化剂消耗Pt大幅降低至30g,系统成本已经下降50%以上至500-1000美元/KW,耐久性可以达到10年以上,并完成了零下30℃启动的测试。

2015年2025年将是燃料电池汽车从技术成熟到工艺成熟的阶段,2025年后有望进入普及阶段。

丰田和现代把燃料电池汽车2015年计划各推出1000辆燃料电池汽车,售价在5-10 万美元,较几年前削减了降低了90%的成本,已直逼纯电动汽车Tesla Model S的水平,2015年有望成为燃料电池汽车商业化元年。

对中国而言,经过最近十年的发展,中国初步形成了燃料电池发动机、动力电池、DC/DC变换器、驱动电机、供氢系统等关键零部件的配套研发体系,实现了百辆级动力系统与整车的生产能力。但与发达国家相比:

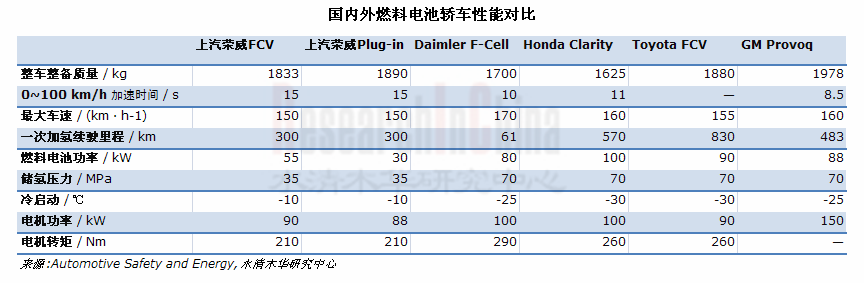

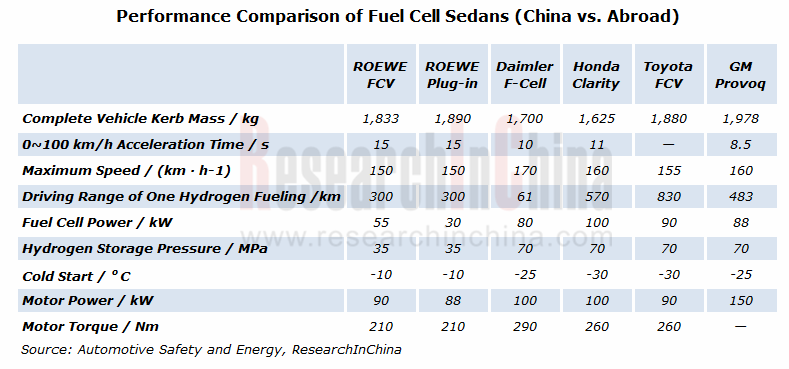

(1)国内燃料电池发动机输出功率在55kW,远低于国外的80~100kW水平;

(2)国内轿车燃料电池发动机使用寿命仅为2000小时,远低于国外5000小时的水平;

(3)在冷启动方面,我国初步实现了燃料电池系统低温(-10℃)启动,并正在研发-20℃启动,这与外国目前-30℃的低温启动指标存在很大的差距;

(4)系统成本高昂,主要由于质子交换膜、炭纸、铂金属催化剂、高纯度石墨粉等关键原材料大量依靠进口;

(5)其他系统部件无成熟产品,在空气压缩机、加湿器、氢循环装置等系统部件领域,中国企业几无涉及;

(6)系统集成能力弱,系统优化提升电堆性能与寿命能力不足,丰田燃料电池组已做到3kW/L功率密度,并通过系统集成去掉了加湿模块。

在燃料电池系统产业化方面,我国仅有少量企业涉足,且营收规模非常小,代表企业是大连新源动力和上海神力科技。在燃料电池汽车商用化方面,国内仅有上汽集团在持续投入研发燃料电池汽车。截止到2014年,上汽专门研发氢燃料电池汽车的团队超过100人,并计划于2015年实现小批量生产。但从整体性能参数来看,上汽燃料电池汽车尚处于国际上一代(3-5年)的技术水平。

水清木华研究中心《2014-2016年全球和中国燃料电池行业研究报告》着重研究了以下内容:

燃料电池分类、应用领域和发展趋势; 燃料电池分类、应用领域和发展趋势;

全球燃料电池行业市场概况、专利分析、出货量和市场规模等;

全球日、韩、欧、美、中等国家或地区燃料电池发展现状,以及中国与国际水平的差

距;

全球燃料电池汽车全产业链,包括燃料电池系统,电堆,部件,氢燃料等,涵盖主流

供应商,技术发展水平,成本等要素;

全球7家燃料电池系统厂商经营、技术、发展规划及产销动态;

中国4家燃料电池系统厂商以及7家产业配套厂商经营、技术、发展规划及产销动态。

In 2013, fuel cell shipment worldwide reached 215.3MWh, in which the biggest percentage (about 187MW) was contributed by large stationary fuel cell power station. The application of large fuel cell power station was mainly concentrated in America, S. Korea and Japan, widely for power generation, combined heat and power generation (also called cogeneration), IT data center, etc.

As of 2014, the application of fuel cell in automotive industry, despite of small scale, was the most important among other fields. After two decades or more of development, the current fuel cell technology is relatively mature, and the fuel cell supply chain is gradually improving. Amid the three issues (durability, low-temperature working and cost minimization) that hinder the practicalities of fuel cell in the early stage, the former two have been addressed. In the past 3-4 years, Pt consumed by per 100kw fuel cell catalyst reduced to 30g, system cost dropped by more than 50% to USD500-1000/KW, durability was able to reach as long as over 10 years, and fuel cell start-up test at minus 30oC was completed.

The period of 2015-2025 will witness fuel cell vehicle developing from mature technology to mature technical process, and after 2025, there will be a stage of popularization, as it is projected.

Toyota and Hyundai each plan to launch 1,000 fuel cell vehicles in 2015 priced at USD50,000-100,000, close to the price of pure electric vehicle Tesla Model S, with 90% cost cuts as opposed to the figure a few year ago. 2015 is expected to be the first commercialization year for fuel cell vehicles.

After nearly a decade of development, a supporting R&D system has been initially formed in China covering fuel cell engine, power battery, DC/DC converter, drive motor, hydrogen-donating system and other key components and parts, and hundreds of power systems and complete vehicles can be annually produced in China. However, compared with the developed countries:

1) Domestic fuel cell engine output power (55kW) is way behind the counterpart (80~100kW) overseas;

2) Domestic sedan fuel cell engine service life (2,000 hours) is quite lower than that (5,000 hours) abroad;

3) With respect to cold start, China has basically achieved low-temperature (-10oC) start-up and is now developing -20oC start-up technology, which is still far behind the current -30oC start-up indicator in foreign countries;

4) Domestic system is high in cost in China, which is attributed to the fact that the critical materials including proton exchange membrane, carbon paper, platinum metal catalyst, high purity graphite powder, etc. mostly rely on import;

5) No mature products of system units are developed in China, and almost no Chinese companies are engaged in areas of system units such as air compressor, humidifier, hydrogen circulating device, etc.;

6) System integration capability in China is still weak and electric pile performance and service life are inadequately optimized, while fuel cell stack of Toyota has reached a power density of 3kW/L and the humidification module has been removed via system integration.

Only a small number of Chinese companies set foot in fuel cell system industrialization, achieving small revenue, represented by Sunrise Power Co., Ltd. and Shanghai Shen-li High Tech Co., Ltd. In terms of fuel cell vehicle commercialization, only SAIC MOTOR continuously invests in fuel cell vehicle R&D. As of 2014, a team of over 100 professionals in SAIC MOTOR have been exclusively involved in R&D of hydrogen fuel cell vehicle and small-batch production is expected to be attained in 2015 as planned. Unfortunately, from the perspective of overall performance parameter, SAIC MOTOR fuel cell vehicle still remains at a level of the last generation (3-5 years before) overseas.

Global and China Fuel Cell Industry Chain Report, 2014-2016 of ResearchInChina highlights the followings:

Classification, application area and development trend of fuel cell; Classification, application area and development trend of fuel cell;

Market overview, patent, shipment, market size, etc. of fuel cell industry worldwide; Market overview, patent, shipment, market size, etc. of fuel cell industry worldwide;

Fuel cell development in Japan, S. Korea, Europe, America, China and other countries/regions, and the gap between China and the world (in terms of fuel cell development); Fuel cell development in Japan, S. Korea, Europe, America, China and other countries/regions, and the gap between China and the world (in terms of fuel cell development);

Global fuel cell vehicle industry chain embracing fuel cell system, electric pile, unit, hydrogen fuel, etc. covering such elements as major suppliers, technology development, cost, etc. Global fuel cell vehicle industry chain embracing fuel cell system, electric pile, unit, hydrogen fuel, etc. covering such elements as major suppliers, technology development, cost, etc.

Operation, technology, development planning and output & sales dynamics of 7 fuel cell system manufacturers worldwide; Operation, technology, development planning and output & sales dynamics of 7 fuel cell system manufacturers worldwide;

Operation, technology, development planning and output & sales dynamics of 4 fuel cell system manufacturers and 7 associated industrial players in China. Operation, technology, development planning and output & sales dynamics of 4 fuel cell system manufacturers and 7 associated industrial players in China.

第一章 燃料电池介绍

1.1 燃料电池工作原理

1.2 燃料电池分类

1.3 燃料电池应用领域

1.3.1 Large Stationary

1.3.2 Small Stationary

1.3.3 Portable Power

1.3.4 Materials Handling

1.3.5 Transportation

1.4 燃料电池发展趋势

第二章 全球燃料电池行业分析

2.1 全球市场总览

2.2 全球燃料电池专利情况

2.3 燃料电池出货量

2.4 燃料电池市场规模

2.5 燃料电池系统厂商

第三章 全球各国燃料电池行业分析

3.1日本

3.1.1 Micro-CHP

3.1.2 FCV

3.2 韩国

3.3 美国

3.3.1 支持政策

3.3.2 Forklift

3.3.3 Stationary

3.4 欧洲

3.4.1 支持政策

3.4.2 FCV

3.5 中国

3.5.1 支持政策

3.5.2 燃料电池系统

3.5.3 关键材料

3.5.4 燃料电池附件

3.5.5 基础设施

第四章 燃料电池汽车产业链

4.1 全球FCV市场

4.1.1 FCV优势

4.1.2 研发和导入阶段(1993-2015)

4.1.3 推广阶段(2015-2025)

4.1.4 普及阶段(2025年以后)

4.2 燃料电池系统

4.3 燃料电池堆(Stack)

4.3.1 技术路线

4.3.2 电极(催化剂)

4.3.3 电解质膜

4.3.4 双极板

4.4 燃料电池成本与展望

4.4.1 燃料电池系统成本

4.4.2 燃料电池材料成本

4.5 氢燃料

4.5.1 氢气制取

4.5.2 氢气仓储、运输

4.5.3 氢气制氢、储运综合成本

4.5.4 车载储氢罐及其安全性

4.5.5 加氢站

第五章 全球燃料电池系统厂商

5.1 Plug Power

5.1.1 公司简介

5.1.2 经营分析

5.1.3产品分析

5.1.4 客户分析

5.1.5 研究开发

5.1.6发展及展望

5.2 Ballard Power

5.2.1公司简介

5.2.2 经营分析

5.2.3 产品分析

5.2.4 客户分析

5.2.5 研究开发

5.2.6 发展及展望

5.2.7 在华布局

5.3 Fuel Cell

5.3.1 公司简介

5.3.2 经营分析

5.3.3 产品分析

5.3.4 客户分析

5.3.5 研究开发

5.3.6 发展及展望

5.4 HYGS

5.4.1 公司简介

5.4.2 经营分析

5.4.3 产品分析

5.4.4 研究开发

5.5 SFC Power

5.5.1 公司简介

5.5.2 经营分析

5.5.3 产品分析

5.5.4 研究开发

5.6 Ceramic

5.6.1 公司简介

5.6.2 经营分析

5.6.3 产品分析

5.6.4 研究开发

5.7 Bloom Energy

5.7.1 公司简介

5.7.2 产品分析

5.7.3 客户分析

第六章 中国燃料电池系统厂商

6.1上海神力

6.1.1 公司简介

6.1.2 经营分析

6.1.3 产品分析

6.1.4 研究开发

6.2 新源动力

6.2.1 公司简介

6.2.2 经营分析

6.2.3 产品分析

6.2.4 发展及展望

6.2.5 技术分析

6.3 武汉理工新能源

6.3.1 公司简介

6.3.2 产品分析

6.3.3 客户分析

6.3.4 发展及展望

6.4 碧空新能源

6.4.1 公司简介

6.4.2 产品分析

6.4.3 研究开发

6.4.4 客户分析

6.4.5 合作项目

6.4.6 发展及展望

第七章 中国燃料电池供应链厂商

7.1 华昌化工

7.1.1 公司简介

7.1.2 经营分析

7.1.3 燃料电池业务

7.2 三爱富

7.2.1 公司简介

7.2.2 经营分析

7.2.3 燃料电池业务

7.3 东岳集团

7.3.1 公司简介

7.3.2 经营分析

7.3.3 燃料电池业务

7.4 贵研铂业

7.4.1 公司简介

7.4.2 经营分析

7.4.3 燃料电池业务

7.5 氢阳能源

7.5.1 公司简介

7.5.2 研究开发

7.5.3 发展及展望

7.6 上海中科同力

7.6.1 公司简介

7.6.2 经营分析

7.7 北京金能

1. Introduction to Fuel Cell

1.1 Working Principle

1.2 Classification

1.3 Application Field

1.3.1 Large Stationary

1.3.2 Small Stationary

1.3.3 Portable Power

1.3.4 Materials Handling

1.3.5 Transportation

1.4 Development Trend

2 Fuel Cell Industry Worldwide

2.1 Market Overview

2.2 Patents

2.3 Shipment

2.4 Market Size

2.5 Fuel Cell System Companies

3 Fuel Cell Industry by Country

3.1 Japan

3.1.1 Micro-CHP

3.1.2 FCV

3.2 S. Korea

3.3 USA

3.3.1 Supporting Policies

3.3.2 Forklift

3.3.3 Stationary

3.4 Europe

3.4.1 Supporting Policies

3.4.2 FCV

3.5 China

3.5.1 Supporting Policies

3.5.2 Fuel Cell System

3.5.3 Key Materials

3.5.4 Fuel Cell Accessories

3.5.5 Infrastructure

4 Fuel Cell Vehicle Industry Chain

4.1 Global FCV Market

4.1.1 FCV Superiority

4.1.2 R&D and Introduction Stage (1993-2015)

4.1.3 Promotion (2015-2025)

4.1.4 Popularization (after 2025)

4.2 Fuel Cell System

4.3 Fuel Cell Stack

4.3.1 Technology Roadmap

4.3.2 Electrode (Catalyst)

4.3.3 Electrolyte Membrane

4.3.4 Bipolar Plate

4.4 Fuel Cell Cost and Outlook

4.4.1 Fuel Cell System Cost

4.4.2 Fuel Cell Material Cost

4.5 Hydrogen Fuel

4.5.1 Hydrogen Preparation

4.5.2 Hydrogen Storage and Transportation

4.5.3 Comprehensive Cost of Preparation, Storage and Transportation

4.5.4 In-vehicle Hydrogen Tank and its Safety

4.5.5 Hydrogen Refueling Station

5 Fuel Cell System Manufacturers Worldwide

5.1 Plug Power

5.1.1 Profile

5.1.2 Operation

5.1.3 Products

5.1.4 Customers

5.1.5 R&D

5.1.6 Development and Outlook

5.2 Ballard Power

5.2.1 Profile

5.2.2 Operation

5.2.3 Products

5.2.4 Customers

5.2.5 R&D

5.2.6 Development and Outlook

5.2.7 Layout in China

5.3 Fuel Cell

5.3.1 Profile

5.3.2 Operation

5.3.3 Products

5.3.4 Customers

5.3.5 R&D

5.3.6 Development and Outlook

5.4 HYGS

5.4.1 Profile

5.4.2 Operation

5.4.3 Products

5.4.4 R&D

5.5 SFC Power

5.5.1 Profile

5.5.2 Operation

5.5.3 Products

5.5.4 R&D

5.6 Ceramic

5.6.1 Profile

5.6.2 Operation

5.6.3 Products

5.6.4 R&D

5.7 Bloom Energy

5.7.1 Profile

5.7.2 Products

5.7.3 Customers

6 Fuel Cell System Manufacturers in China

6.1 Shanghai Shen-li High Tech Co., Ltd.

6.1.1 Profile

6.1.2 Operation

6.1.3 Products

6.1.4 R&D

6.2 Sunrise Power Co., Ltd.

6.2.1 Profile

6.2.2 Operation

6.2.3 Products

6.2.4 Development and Outlook

6.2.5 Technology

6.3 Wuhan WUT New Energy Co., Ltd. (WUT)

6.3.1 Profile

6.3.2 Products

6.3.3 Customers

6.3.4 Development and Outlook

6.4 Beijing Azure Hydrogen Energy Science & Technology Co., Ltd.

6.4.1 Profile

6.4.2 Products

6.4.3 R&D

6.4.4 Customers

6.4.5 Cooperation

6.4.5 Development and Outlook

7 Fuel Cell Industry Chain Enterprises in China

7.1 Jiangsu Huachang Chemical Co., Ltd.

7.1.1 Profile

7.1.2 Operation

7.1.3 Fuel Cell Business

7.2 Shanghai 3F New Material Co., Ltd.

7.2.1 Profile

7.2.2 Operation

7.2.3 Fuel Cell Business

7.3 Dongyue Group

7.3.1 Profile

7.3.2 Operation

7.3.3 Fuel Cell Business

7.4 Sino-Platinum Co., Ltd.

7.4.1 Profile

7.4.2 Operation

7.4.3 Fuel Cell Business

7.5 Jiangsu Qingyang Energy

7.5.1 Profile

7.5.2 R&D

7.5.3 Development and Outlook

7.6 Shanghai TL Chemical Co., Ltd.

7.6.1 Profile

7.6.2 Operation

7.7 Golden Energy Fuel Cell Co., Ltd. (GEFC)

图:质子交换膜燃料电池结构与工作原理

表:燃料电池分类

图:不同种类燃料电池工作原理

图:固定式燃料电池的典型应用

图:2012年美国前五大燃料电池通信电源客户(Top Five Fuel Cell Telecommunications Customers in 2012)

图:Intelligent Energy推出的氢燃料电池移动电源

图:2012年美国前十大燃料电池叉车客户(Top Ten Fuel Cell Material Handling Customers in 2012)

图:氢燃料电池与新旧能源体系并行发展

图:2012年全球燃料电池产品Top5客户

图:1971-2013年全球燃料电池专利技术申请量

表:全球燃料电池专利技术申请(分国家/地区)

表:全球燃料电池专利技术申请(Top 10企业)

图:2009-2013年燃料电池出货量(按数量)(Shipments by Application)

图:2009-2013年燃料电池出货量(按功率)(Megawatts by Application)

图:2009-2013年燃料电池不同类型出货量(按数量)(Shipments by fuel cell type)

图:2009-2013年燃料电池不同类型出货量(按功率)(Megawatts by fuel cell type)

图:2009-2013年燃料电池不同地区出货量(按数量)(Shipments by region)

图:2009-2013年燃料电池不同地区出货量(按功率)(Megawatts by region)

图:2011-2025年全球燃料电池市场规模

图:2010-2015年全球燃料电池基础原材料市场规模

表:世界主要燃料电池系统厂商

图:燃料电池热电联产项目能实现90%的能量效率

图:日本ENE-FARM项目设备图

图:日本燃料电池热电联产(CHP)项目发展路线图(2012版)

图:日本ENE-FARM销量、价格及补贴政策(2012版)

图:日本ENE-FARM价格及增长预期(2012版)

图:日本远景目标是燃料电池提供42%的家庭能源

图:日本燃料电池汽车和加氢站2015年商业化路线图

图:丰田汽车燃料电池系统

表:日本汽车公司主导的燃料电池汽车联盟

图:日本FCV和HRS发展路线图

表:韩国不同领域燃料电池拟达到的性能指标

图:韩国燃料电池汽车价格和保有量

图:2004-2015年美国燃料电池相关补贴金额逐年下降

图:2006-2013年EERE燃料电池补贴方向

表:Ballard对铅酸和燃料电池成本测算参数

图:Ballard测算的燃料电池叉车NPV

表:Bloom Energy SOFC 系统经济性

表:2012年美国主要IT公司数据中心清洁能源比例

图:德国HRS推广规划

图:英国FCV和HRS发展路线图

图:英国HRS推广规划

表:中国燃料电池汽车技术规范(2012版)

表:2013-2015年中央财政燃料电池汽车补贴标准

表:中国燃料电池科研机构

图:中国燃料电池国际专利数(2012年)

表:中国燃料电池专利技术分布(2012年)

表:国内外燃料电池轿车性能对比

表:国内外燃料电池系统耐久性对比

表:国内外燃料电池客车性能对比

图:上汽集团(SAIC)燃料电池系统

表:燃料电池关键材料国内外对标

表:燃料电池附件系统国内外对比

表:中国示范性加氢站基础设施

图:各种技术汽车碳排放对比

图:各种技术汽车综合性能对比

图:燃料电池和锂电池车续航里程对比

表:丰田 FCV-R 基本参数及其与纯电动 Leaf 对比

表:中国国产燃料电池客车技术参数

图:2005-2014年北美地区运行中的燃料电池公交数量

图:北美燃料电池公交每月运行里程数(英里)

表:全球主要汽车厂商燃料电池车型及推广计划

表:全球燃料电池汽车企业开发和部署状态

图:全球主要汽车厂商燃料电池汽车发展路线图

表:车用燃料电池发展阶段的时间预期

图:2005-2050年FCV、汽油车、纯电/混动汽车市场占有率

图:FCV Bus关键部件成本构成

图:燃料电池动力系统结构

表:燃料电池关键材料国内外供应商

表:质子交换膜燃料电池技术特点

表:质子交换膜燃料电池典型应用

图:丰田通过将铂金材料镀层技术减少铂用量

图:全球 Pt 供给及消费 Vs 燃电汽车消费假设

图:燃料电池催化剂Pt减量技术路线图

图:Pt减量驱动下的燃料电池系统成本控制预期

图:目前三种主要双极板

表:燃料电池汽车工业化过程中面临的主要问题

图:燃料电池成本下降路径

图:充分摊薄后的电堆成本构成

图:DOE测算的燃料电池成本趋势(量产50万套前期下)

图:不同生产规模下的电池成本及拆分

表:燃料电池系统成本估算中的细节参数

图:氢燃料的来源分布

图:分布式制氢技术分解

图:国内不同工艺下制氢成本

图:美国不同工艺下的制氢成本

图:美国制氢成本控制目标

图:燃料电池氢气供应配套设施结构及技术路线

图:美国未来车载储氢成本下降路径

图:美国氢气运输成本测算及降低路径

表:两种商用化储氢罐的其本情况

图:欧洲氢燃料成本及其下降通道规划

图:氢气和其他气体的存储压力比较

图:液态氢气储罐结构图

表:联合国氢燃料电池安全性标准

图:加氢站的运行成本构成

图:欧洲加氢站投资需求及计划

图:全球加氢站分布图(2013年)

表:各国加氢站规划对比

表:美国加州加氢站建设计划

表:PLUG前二十大股东(截至2014.6.30)

图:2004-2014Q2 PLUG经营业绩

图:2013年PLUG营业收入构成

图:PLUG燃料电池产品

图:2007-2014Q2 Gendrive产品出货量及订单

图:2007-2014Q2 Gendrive产品售价

图:PLUG供应链

图:2012年Gendrive产品主要客户构成

图:2004-2014Q2 PLUG研发支出

图:1997-2012年PLUG专利申请数量

表:PLUG被引用次数最高的专利

图:Ballard前二十大股东(截止2014.6.30)

图:2009-2014Q2 Ballard经营业绩

图:2012-2014Q2 Ballard营业收入构成

图:2013年Ballard营收(分地区)

图:Ballard燃料电池产品

表:Ballard燃料电池产品性能参数

图:2009-2013年Ballard 燃料电池堆(fuel cell stack)出货量

图:2009-2013年Ballard燃料电池系统(fuel cell system)出货量

图:Ballard燃料电池产品主要市场

图:2009-2014Q2 Ballard研发支出

图:1990-2008年Ballard专利申请数量

表:Ballard被引用次数最高的专利

表:2014年Ballard发展展望

图:FuelCell前二十大股东(截止2014.6.30)

图:2008-2014Q3 FuelCell经营业绩

图:2009-2014Q3 FuelCell营收(分segment)

图:2009-2014Q3 FuelCell毛利率(分业务)

图:FuelCell燃料电池产品

表:FuelCell燃料电池产品性能参数

图:Fuel Cell供应链

图:2009-2014Q2年FuelCell研发支出

表:FuelCell发展历程

图:2008-2014Q2 HYGS经营业绩

图:2008-2013年HYGS营收(分segment)

图:2008-2013年HYGS净利润(分segment)

图:2008-2013年HYGS毛利率(分业务)

图:2013年HYGS营收(分地区)

表:HYGS HySTAT® electrolyzers产品结构图

表:2009-2014Q3HYGS在手未完成订单(backlog)

图:2009-2014Q2年HYGS研发支出

图:SFC Power股东结构(截止2013.12.31)

图:2008-2014Q2 SFC Power经营业绩

图:2012-2014Q2 SFC Power营收(分segment)

图:2012-2014Q2 SFC Power营收(分地区)

图:2012-2014Q2 SFC Power毛利率(分segment)

表:SFC 能源解决方案(energy system solution)

图:2008-2014Q2年SFC Power研发支出

图:Ceramic主要股东(截止2014.6.30)

图:2009-2014 Ceramic经营业绩

图:2011-2014 Ceramic营收(分地区)

图:2009-2014 Ceramic营收(分segment)

图:2009-2014 Ceramic研发支出

表:Bloom Energy ES-5700 Energy Server

图:2013年Shen-li股权结构图

图:Shen-li公司基本信息

图:2010-2012Q1 Shen-li经营业绩

表:High Temperature PEMFC Household Heat System

表:Low Temperature PEMFC Power System for City Bus

表:Low Temperature PEMFC Power System for Passenger Car

表:Low Temperature PEMFC Power System for Forklift

图:2013年Sunrise股权结构图

表:Sunrise公司基本信息

表:Sunrise公司车用燃料电池产品技术参数

图:Sunrise公司发展历程

图:Sunrise业务结构

表:WUT公司股权结构图

表:WUT公司基本信息

表:WUT公司PEMFC复合膜(Composite PEM)性能参数

表:WUT公司PEMFC膜电极(MEA)性能参数

表:碧空新能源公司基本信息

PFMFC Backup Power System

50KW Stationary Backup Power(EPS)

Multi-MW Distributed Generator System

Fuel Cell BUS

Fuel Cell Forklift

表:碧空新能源2014-15年国内业务发展计划

表:Huachang Chemical股权结构图

图:2008-2014Q2 Huachang Chemical经营业绩

图:2009-2013年Huachang Chemical毛利率(分产品)

图:2009-2013年Huachang Chemical营入构成(分产品)

图:2008-2014Q2 Huachang Chemical研发支出

表:3F New Material股权结构图

图:2008-2014Q2 3F New Material经营业绩

图:2009-2013年3F New Material毛利率(分产品)

图:2008-2014Q2 3F New Material研发支出

图:2009-2013年3F New Material营入构成(分产品)

表:Dongyue股权结构图

图:2009-2014Q2 Dongyue经营业绩

图:2008-2014Q2 Dongyue研发支出

图:2009-2013年Dongyue营入构成(分产品)

图:2009-2013年Dongyue营收构成(分地区)

表:Sino-platinum股权结构图

图:2008-2014Q2 Sino-platinum经营业绩

图:2008-2014Q2 Sino-platinum研发支出

图:2009-2013年Sino-platinum营入构成(分产品)

图:2009-2013年Sino-platinum毛利率(分产品)

表:江苏氢阳能源公司基本信息

图:2013年TL Chemical股权结构图

表:TL Chemical公司基本信息

图:2009-2013 TL Chemical经营业绩

表:Golden Energy公司基本信息

Structure and Working Principle of Proton Exchange Membrane Fuel Cell

Fuel Cell Classification

Working Principle of Fuel Cells of Various Types

Typical Application of Stationary Fuel Cell

Top 5 Fuel Cell Telecommunications Customers in the US, 2012)

Hydrogen Fuel Cell Portable Power Source Released by Intelligent Energy

Top 10 Fuel Cell Material Handling Customers in the US, 2012

Parallel Development of Hydrogen Fuel Cell and Traditional Energy System

Top 5 Global Fuel Cell Customers, 2012

Global Fuel Cell Patented Technologies Applied, 1971-2013

Global Fuel Cell Patented Technologies Applied by Country/Region

Top 10 Global Enterprises by Fuel Cell Patented Technologies Applied

Fuel Cell Shipments(Quantity) by Application, 2009-2013

Fuel Cell Shipments(Megawatts) by Application, 2009-2013

Fuel Cell Shipments (Quantity) by Fuel Cell Type, 2009-2013

Fuel Cell Shipments (Megawatts) by Fuel Cell Type, 2009-2013

Fuel Cell Shipments by Region, 2009-2013

Fuel Cell Shipments(Megawatts) by Region, 2009-2013

Market Size of Global Fuel Cell, 2011-2025E

Market Size of Global Fuel Cell Basic Raw Materials, 2010-2015EE

Major Fuel Cell System Manufacturers Worldwide

Fuel Cell CHP Project Achieving 90% Energy Efficiency

Equipment Drawing for Japan’s ENE-FARM Project

Roadmap for Japan’s Fuel Cell CHP Project (Version 2012)

Sales Volume, Prices, and Subsidy Policy of Japan’s ENE-FARM (Version 2012)

Prices and Growth Expectation of Japan’s ENE-FARM (Version 2012)

Japan’s Long-term Goal: Fuel Cell Provides a 42% Home Energy

Commercialized Roadmap for Fuel Cell Automobiles and Hydrogen Filling Stations in Japan, 2015

Fuel Cell System of Toyota Motors

Fuel Cell Automobile Alliance Led by Japan’s Auto Makers

Roadmap for Japan’s FCV and HRS

Proposed Performance Indexes for Fuel Cell by Applications in S. Korea

Prices and Ownership of Fuel Cell Automobiles in S. Korea

Subsidy Amount of US Fuel Cell, 2004-2015E

Subsidy Direction of EERE Fuel Cell, 2006-2013

Ballard’s Parameters for Cost Calculation of Lead-acid Battery and Fuel Cell Ballard’s Calculated NPV of Fuel Cell Forklifts

System Efficiency of Bloom Energy SOFC

Proportion of Clean Energy in Data Center at Major US IT Companies, 2012

Germany’s HRS Promotion Plan

Roadmap for Britain’s FCV and HRS

Britain’s HRS Promotion Plan

Technical Specifications for Fuel Cell Automobiles in China, (Version 2012)

Subsidy Standards of Fuel Cell Automobiles by the Central Government, 2013-2015E

Fuel Cell Research Institutions in China

Number of Fuel Cell International Patents in China, 2012

Distribution of Fuel Cell Patented Technology in China, 2012

Performance of Domestic and Foreign Fuel Cell Cars

Durability of Domestic and Foreign Fuel Cell Systems

Performance of Domestic and Foreign Fuel Cell Buses

Fuel Cell System of SAIC

Domestic and Foreign Fuel Cell Key Materials

Domestic and Foreign Fuel Cell Accessory Systems

Infrastructure of Demonstration Hydrogen Filling Stations in China

Carbon Emission of Vehicles by Technological Type

Comprehensive Performance of Vehicles by Technological Type

Driving Mileage Comparison: Fuel Cell Vehicles vs. Lithium Battery Vehicles

Basic Parameters Comparison: Toyota’s FCV-R vs. “Leaf” PEV

Technical Parameters for China-branded Fuel Cell Buses

Number of Fuel Cell Bus under Operation in North America, 2005-2014

Monthly Mileage of Fuel Cell Bus in North America

FCV Modes and Promotion Plan of Major Global Auto Makers

Development and Deployment of Fuel Cell Automakers Worldwide

Roadmap for Fuel Cell Vehicles of Major Global Auto Makers

Expected Development Stage of Automotive Fuel Cell

Market Share of FCVs, GVs, PEVs, and HEVs, 2005-2050E

Cost Structure of Key Components of FCV Bus

Structure of Fuel Cell Power System

Domestic and Foreign Fuel Cell Key Material Suppliers

Technical Features of PEMFC

Typical Application of PEMFC

Toyota’s Decreased Platinum Usage through Platinum Material Coating Technology

Global Pt Supply and Consumption VS Consumption Hypothesis of Fuel Cell Automobiles

Technology Roadmap for Decreasing Pt Usage of Fuel Cell Catalyst

Expected Cost Control of Fuel Cell System Driven by Pt Decrement

Three Major Bipolar Plates

Main Issues Faced by Fuel-cell Vehicles during the Process of Industrialization

Descent Path of Fuel Cell Costs

Composition of Fully Diluted Cell Stack Costs

Fuel Cell Costs Trend Calculated by DOE (Under Premise of Mass-produced 500,000 Sets)

Cell Costs and Breakdown under Different Production Scales

Specific Parameters Employed in Estimating Fuel Cell System Costs

Sources of Hydrogen Fuel

Decomposition of Distributed Hydrogen Production Technology

Hydrogen Production Costs under Different Processes in China

Hydrogen Production Costs under Different Processes in USA

America’s Control Target for Hydrogen Production Costs

Structure and Technological Route of Supporting Hydrogen Supply Facility for Fuel Cell

Descent Path of Future Vehicle Hydrogen Storage Costs in USA

Hydrogen Transportation Costs Estimates and Descent Path in USA

Basic Situations of Two Commercial Hydrogen Tanks

Hydrogen Fuel Costs and Descent Path Planning in Europe

Storage Pressure Comparison between Hydrogen and Other Gases

Structure of Liquid Hydrogen Tank

UN’s Standards on Safety of Hydrogen Fuel Cell

Operating Costs Composition of Hydrogen Filling Station

Investment Demand and Plans for Hydrogen Filling Station in Europe

Global Hydrogen Filling Stations Distribution (2013)

Comparison of Hydrogen Filling Station Planning in Various Countries

Construction Plan for Hydrogen Filling Station in CA, USA

Top 20 Shareholders of PLUG (as of Jun. 30, 2014)

Business Performance of PLUG, 2004-2014Q2

Revenue Structure of PLUG, 2013

Fuel Cell Products of PLUG

Product Shipments and Orders of Gendrive, 2007-2014Q2

Prices of Gendrive’s Products, 2007-2014Q2

Supply Chain of PLUG

Major Customers Structure of Gendrive’s Products, 2012

R&D Costs of PLUG, 2004-2014Q2

Number of Patent Applications of PLUG, 1997-2012

Most Cited Patents of PLUG

Top 20 Shareholders of Ballard (as of Jun. 30, 2014)

Business Performance of Ballard, 2009-2014Q2

Revenue Structure of Ballard, 2012-2014Q2

Revenue Breakdown of Ballard by Region, 2013

Ballard’s Fuel Cell Products

Performance Parameters of Ballard’s Fuel Cell Products

Fuel Cell Stack Shipments of Ballard, 2009-2013

Fuel Cell System Shipments of Ballard, 2009-2013

Main Markets for Ballard’s Fuel Cell Products

R&D Costs of Ballard, 2009-2014Q2

Number of Patent Applications of Ballard, 1990-2008

Most Cited Patents of Ballard

Development Prospect of Ballard, 2014

Top 20 Shareholders of FuelCel (as of Jun. 30, 2014)

Business Performance of FuelCell, 2008-2014Q3

Revenue Breakdown of FuelCell by Segment, 2009-2014Q3

Gross Margin of FuelCell by Business, 2009-2014Q3

FuelCell’s Fuel Cell Products

Performance Parameters of FuelCell’s Fuel Cell Products

Supply Chain of FuelCell

R&D Costs of FuelCell, 2009-2014Q2

Development Course of FuelCell

Business Performance of HYGS, 2008-2014Q2

Revenue Breakdown of HYGS by Segment, 2008-2013

Net Income Breakdown of HYGS by Segment, 2008-2013

Gross Margin of HYGS by Business, 2008-2013

Revenue Breakdown of HYGS by Region, 2013

Structure of HYGS HySTAT? Electrolyzers

Outstanding Orders of HYGS, 2009-2014Q3

R&D Costs of HYGS, 2009-2014Q2

Shareholder Structure of SFC Power (as of Dec. 31, 2013)

Business Performance of SFC Power, 2008-2014Q2

Revenue Breakdown of SFC Power by Segment, 2012-2014Q2

Revenue Breakdown of SFC Power by Region, 2012-2014Q2

Gross Margin of SFC Power by Segment, 2012-2014Q2

SFC’s Energy System Solution

R&D Costs of SFC Power, 2008-2014Q2

Major Shareholders of Ceramic (as of Jun. 30, 2014)

Business Performance of Ceramic, 2009-2014

Revenue Breakdown of Ceramic by Region, 2011-2014

Revenue Breakdown of Ceramic by Segment, 2009-2014

R&D Costs of Ceramic, 2009-2014

Bloom Energy ES-5700 Energy Server

Shareholding Structure of Shen-li, 2013

Profile of Shen-li

Business Performance of Shen-li, 2010-2012Q1

High Temperature PEMFC Household Heat System

Low Temperature PEMFC Power System for City Bus

Low Temperature PEMFC Power System for Passenger Car

Low Temperature PEMFC Power System for Forklift

Shareholding Structure of Sunrise, 2013

Profile of Sunrise

Technical Parameters of Sunrise’s Vehicle Fuel Cell Products

Development Course of Sunrise

Business Structure of Sunrise

Shareholding Structure of WUT

Profile of WUT

Performance Parameters of WUT’s PEMFC Composite PEM

Performance Parameters of WUT’s PEMFC MEA

Profile of Azure Hydrogen

PFMFC Backup Power System

50KW Stationary Backup Power (EPS)

Multi-MW Distributed Generator System

Fuel Cell Bus

Fuel Cell Forklift

Azure Hydrogen’s Development Plan for Domestic Business during 2014-15

Shareholding Structure of Huachang Chemical

Business Performance of Huachang Chemical, 2008-2014Q2

Gross Margin of Huachang Chemical by Product, 2009-2013

Revenue Structure of Huachang Chemical by Product, 2009-2013

R&D Costs of Huachang Chemical, 2008-2014Q2

Shareholding Structure of 3F New Material

Business Performance of 3F New Material, 2008-2014Q2

Gross Margin of 3F New Material by Product, 2009-2013

R&D Costs of 3F New Material, 2008-2014Q2

Revenue Structure of 3F New Material by Product, 2009-2013

Shareholding Structure of Dongyue

Business Performance of Dongyue, 2009-2014Q2

R&D Costs of Dongyue, 2008-2014Q2

Revenue Structure of Dongyue by Product, 2009-2013

Revenue Structure of Dongyue by Region, 2009-2013

Shareholding Structure of Sino-platinum

Business Performance of Sino-platinum, 2008-2014Q2

R&D Costs of Sino-platinum, 2008-2014Q2

Revenue Structure of Sino-platinum by Product, 2009-2013

Gross Margin of Sino-platinum by Product, 2009-2013

Profile of Jiangsu Hydrogen Energy Co., Ltd

Shareholding Structure of TL Chemical, 2013

Profile of TL Chemical

Business Performance of TL Chemical, 2009-2013

Profile of Golden Energy

如果这份报告不能满足您的要求,我们还可以为您定制报告,请 留言说明您的详细需求。

|