|

|

|

报告导航:研究报告—

制造业—能源矿产

|

|

2014-2017年中国电力储能行业研究报告 |

|

字数:2.8万 |

页数:88 |

图表数:84 |

|

中文电子版:7000元 |

中文纸版:3500元 |

中文(电子+纸)版:7500元 |

|

英文电子版:2100美元 |

英文纸版:2300美元 |

英文(电子+纸)版:2400美元 |

|

编号:ZL017

|

发布日期:2014-11 |

附件:下载 |

|

|

|

储能在电力系统中有广泛的应用,涉及发电、传输、分配以及终端用户的各个环节。电力储能技术种类众多,包括抽水蓄能、压缩空气、飞轮、化学电池、超级电容等,除了抽水蓄能较为成熟外,其他技术尚处于产业化初期或者研究开发阶段。但储能产业的重要性已为各国政府重视,储能的发展势在必行。

为了更加清洁、可持续的未来,中国政府正在持续加大在清洁能源技术领域上的政策倾斜力度。截至2013年底,中国发电总装机容量达到1250GW,其中风力发电91.4GW,占比7.3%,成为中国继火电、水电之后的第三大电源;光伏发电装机容量达到18.1GW,占比1.5%,超越美国成为全球第一大光伏市场。

随着发电装机量的快速增长,中国的储能需求日益扩大和迫切。2013年中国抽水蓄能总装机容量21.5GW,其他技术装机容量65MW。但同期电网调峰储能需求为95GW,2014年将达到110GW,发展空间巨大。另外,风电和光伏并网也将产生相当规模的储能需求,2014年将分别达5.6GW和3.8GW。

电力储能技术种类众多,中国以锂电池、铅酸电池和液流技术为主(不含抽水蓄能),2013年其所占比例分别为60%,20%和14%。

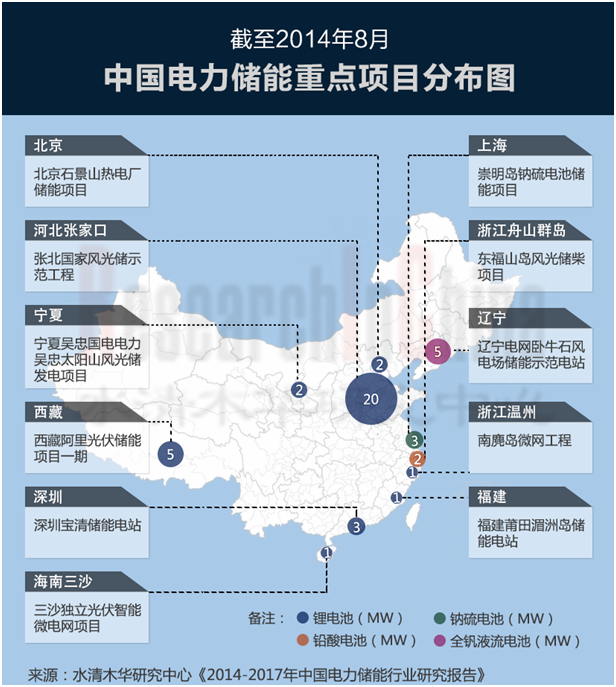

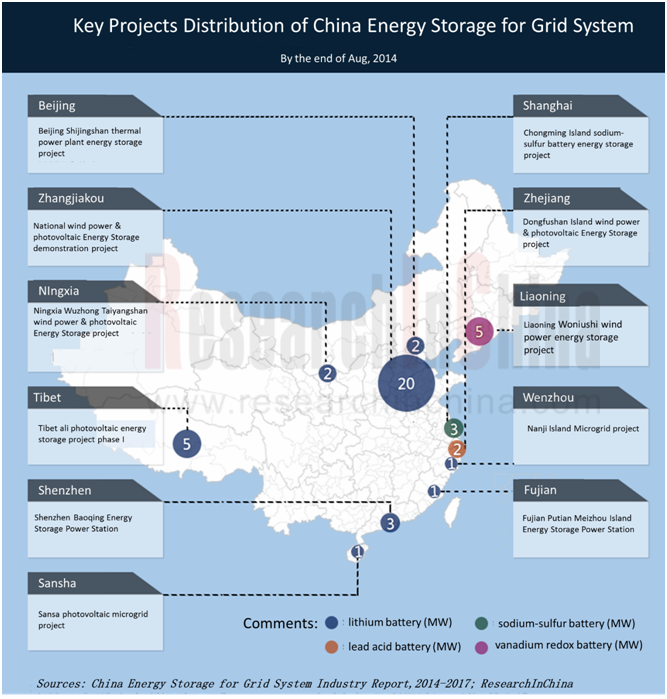

截止2014年8月底,中国参与储能产业的企业已有数十家。其中采用锂电池储能技术的有中航锂电、欣旺达等;采用铅酸电池的有南都电源、圣阳股份等;采用液流技术的有融科储能、普能科技等;上海电气及思源电气则采用钠硫储能技术。

水清木华研究中心《2014-2017年中国电力储能行业研究报告》主要包括以下内容:

中国电力储能的发展环境与趋势分析等; 中国电力储能的发展环境与趋势分析等;

中国电力储能的市场规模、竞争格局、应用领域的发展现状及预测等; 中国电力储能的市场规模、竞争格局、应用领域的发展现状及预测等;

全球及中国21家储能重点生产企业(Alstom、南都电源、上海电气、融科储能等)的经营情况及技术路线等。 全球及中国21家储能重点生产企业(Alstom、南都电源、上海电气、融科储能等)的经营情况及技术路线等。

Energy storage has a wide range of applications in electric power system, involving all aspects of power generation, transmission, distribution and end user. The energy storage technologies for grid system include pumped storage, compressed air, flywheel, chemical battery, super capacitor, etc. Except the relatively mature pumped storage, others are still at the early stage of industrialization or under research. However, all governments have been virtually aware of the importance of energy storage industry, hence a desperate need for development of energy storage.

To create a clean, sustainable future, the Chinese government is shifting its focus in policy to clean energy technology. As of the end of 2013, China's total installed capacity of power generation had reached 1,250GW, which contained 91.4GW of wind power (accounting for 7.3%), the third power source in China following thermal power and hydropower. Meanwhile, China had seen a photovoltaic (PV) power generation installed capacity of 18.1GW (representing 1.5%), overtaking the United States as the world’s largest photovoltaic market.

As the installed power generation capacity grows rapidly, the demand for energy storage in China is increasingly expanding. In 2013, the installed capacity of pumped storage in China totaled 21.5GW, in contrast to 65MW for other technologies; while the demand for energy storage for peak-load regulation of power grid was 95GW and expected to rise to 110GW in 2014, reflecting a great development potential. In addition, an integrated grid of wind power and PV power will generate a considerable demand for energy storage, at 5.6GW and 3.8GW, respectively, in 2014.

There are various kinds of energy storage technologies for grid system, with China, for example, primarily adopting lithium batteries, lead-acid batteries and flow technology (excluding pumped storage), which held respective proportions of 60%, 20% and 14% in 2013.

As of the end of August 2014, there had been scores of energy storage enterprises in China. Among them, China Aviation Lithium Battery Co., Ltd. and SUNWODA Electronics Co., Ltd. employ lithium battery energy storage technology; Narada Power Source Co., Ltd. and Shandong Sacred Sun Power Sources Co., ltd. adopt lead-acid battery technology; Dalian Rongke Power Co. Ltd and Prudent Energy Inc. depend on flow technology; Shanghai Electric Group Co., Ltd. and Sieyuan Electric Co., Ltd. resort to sodium-sulfur energy storage technology.

China Energy Storage for Grid System Industry Report, 2014-2017 compiled by ResearchInChina is mainly concerned with the followings:

Development environment, trends, etc. of energy storage for grid system in China; Development environment, trends, etc. of energy storage for grid system in China;

Current situation and prediction of energy storage for grid system in China by market size, competitive landscape, and applications; Current situation and prediction of energy storage for grid system in China by market size, competitive landscape, and applications;

Operation and technical route of 21 major energy storage manufacturers in China and worldwide, including Alstom, Narada, Shanghai Electric, and Rongke Power, etc. Operation and technical route of 21 major energy storage manufacturers in China and worldwide, including Alstom, Narada, Shanghai Electric, and Rongke Power, etc.

第一章 电力储能概述

1.1 定义及分类

1.2 应用领域

1.3 产业链

1.4 存在的问题

第二章 中国电力储能行业发展现状

2.1 政策环境

2.2 技术环境

2.3 储能规模

2.4 竞争格局

2.4.1 企业竞争格局

2.4.2 抽水蓄能

2.4.3 锂电池

2.4.4 飞轮储能

2.4.5 液流电池储能

2.4.6 压缩空气储能

2.4.7 钠硫电池

2.4.8 超导磁储能

第三章 中国电力储能应用领域发展现状

3.1 风力发电

3.2 光伏发电

3.3 分布式发电及微网

3.4 电网调峰

第四章 全球主要储能企业

4.1 Alstom power

4.1.1 公司简介

4.1.2 经营情况

4.1.3 储能业务

4.2 Axion Power

4.2.1 公司简介

4.2.2 经营情况

4.2.3 储能业务

4.3 Beacon power

4.3.1 公司简介

4.3.2 储能业务

4.4 GE Energy

4.4.1 公司简介

4.4.2 经营情况

4.4.3 储能业务

4.5 Maxwell Technologies

4.5.1 公司简介

4.5.2 经营情况

4.5.3 储能业务

4.6 Altair Nanotechnologies

4.6.1 公司简介

4.6.2 储能业务

4.7 小结

第五章 中国主要储能企业

5.1 南都电源

5.1.1 公司简介

5.1.2 经营情况

5.1.3 营收构成

5.1.4 毛利率

5.1.5 储能业务

5.1.6 前景及预测

5.2 圣阳股份

5.2.1 公司简介

5.2.2 经营情况

5.2.3 营收构成

5.2.4 毛利率

5.2.5 储能业务

5.2.6 前景及预测

5.3 汇川技术

5.3.1 公司简介

5.3.2 经营情况

5.3.3 营收构成

5.3.4 毛利率

5.3.5 储能业务

5.3.6 前景及预测

5.4 中天科技

5.4.1 公司简介

5.4.2 经营情况

5.4.3 营收构成

5.4.4 毛利率

5.4.5 储能业务

5.4.6 前景及预测

5.5 风帆股份

5.5.1 公司简介

5.5.2 经营情况

5.5.3 营收构成

5.5.4 毛利率

5.5.5 储能业务

5.5.6 前景及预测

5.6 比亚迪

5.6.1 公司简介

5.6.2 经营情况

6.6.3 营收构成

5.6.4 毛利率

5.6.5 储能业务

6.6.6 前景及预测

5.7 阳光电源

5.7.1 公司简介

5.7.2 经营情况

5.7.3 营收构成

5.7.4 毛利率

5.7.5 储能业务

5.7.6 前景及预测

5.8 上海电气

5.8.1 公司简介

5.8.2 营收情况

5.8.3 营收构成

5.8.4 毛利率

5.8.5 储能业务

5.8.6 前景及预测

5.9 欣旺达

5.9.1 公司简介

5.9.2 营收情况

5.9.3 营收构成

6.9.4 毛利率

5.9.5 储能业务

5.9.6 前景及预测

5.10 科陆电子

5.10.1 公司简介

5.10.2 经营情况

5.10.3 营收构成

5.10.4 毛利率

5.10.5 储能业务

5.10.6 前景及预测

5.11 普能科技

5.11.1 公司简介

5.11.2 储能业务

5.12 睿能科技

5.12.1 公司简介

5.12.2 储能业务

5.13 融科储能

5.13.1 公司简介

5.13.2 储能业务

5.14 润峰新能源

5.14.1 公司简介

5.14.2 储能业务

5.15 中航锂电

5.15.1 公司简介

5.15.2 储能业务

5.16 小结

第六章 总结与预测

6.1 总结

6.2 预测

1 Overview of Energy Storage for Grid System

1.1 Definition and Classification

1.2 Application

1.3 Industry Chain

1.4 Problems

2 Status Quo of Energy Storage for Grid System in China

2.1 Policy Environment

2.2 Technical Environment

2.3 Scale of Energy Storage

2.4 Competitive Landscape

2.4.1 Enterprise

2.4.2 Pumped Storage

2.4.3 Lithium Battery

2.4.4 Flywheel Energy Storage

2.4.5 Flow Battery Energy Storage

2.4.6 Compressed Air Energy Storage

2.4.7 Sodium–sulfur Battery

2.4.8 Superconducting Magnetic Energy Storage (SMES)

3 Applications of Energy Storage for Grid System in China

3.1 Wind Power Generation

3.2 PV Power Generation

3.3 Distributed Generation and Micro-grid

3.4 Peak-load Regulation of Power Grid

4 Major Energy Storage Enterprises in the World

4.1 Alstom Power

4.1.1 Profile

4.1.2 Operation

4.1.3 Energy Storage Business

4.2 Axion Power

4.2.1 Profile

4.2.2 Operation

4.2.3 Energy Storage Business

4.3 Beacon power

4.3.1 Profile

4.3.2 Energy Storage Business

4.4 GE Energy

4.4.1 Profile

4.4.2 Operation

4.4.3 Energy Storage Business

4.5 Maxwell Technologies

4.5.1 Profile

4.5.2 Operation

4.5.3 Energy Storage Business

4.6 Altair Nanotechnologies

4.6.1 Profile

4.6.2 Energy Storage Business

4.7 Summary

5 Major Energy Storage Enterprises in China

5.1 Narada

5.1.1 Profile

5.1.2 Operation

5.1.3 Revenue Structure

5.1.4 Gross Margin

5.1.5 Energy Storage Business

5.1.6 Outlook and Forecast

5.2 Sacred Sun

5.2.1 Profile

5.2.2 Operation

5.2.3 Revenue Structure

5.2.4 Gross Margin

5.2.5 Energy Storage Business

5.2.6 Outlook and Forecast

5.3 Inovance

5.3.1 Profile

5.3.2 Operation

5.3.3 Revenue Structure

5.3.4 Gross Margin

5.3.5 Energy Storage Business

5.3.6 Outlook and Forecast

5.4 ZTT

5.4.1 Profile

5.4.2 Operation

5.4.3 Revenue Structure

5.4.4 Gross Margin

5.4.5 Energy Storage Business

5.4.6 Outlook and Forecast

5.5 Fengfan

5.5.1 Profile

5.5.2 Operation

5.5.3 Revenue Structure

5.5.4 Gross Margin

5.5.5 Energy Storage Business

5.5.6 Outlook and Forecast

5.6 BYD

5.6.1 Profile

5.6.2 Operation

5.6.3 Revenue Structure

5.6.4 Gross Margin

5.6.5 Energy Storage Business

5.6.6 Outlook and Forecast

5.7 Sungrow

5.7.1 Profile

5.7.2 Operation

5.7.3 Revenue Structure

5.7.4 Gross Margin

5.7.5 Energy Storage Business

5.7.6 Outlook and Forecast

5.8 Shanghai Electric

5.8.1 Profile

5.8.2 Revenue

5.8.3 Revenue Structure

5.8.4 Gross Margin

5.8.5 Energy Storage Business

5.8.6 Outlook and Forecast

5.9 Sunwoda

5.9.1 Profile

5.9.2 Revenue

5.9.3 Revenue Structure

5.9.4 Gross Margin

5.9.5 Energy Storage Business

5.9.6 Outlook and Forecast

5.10 Clou Electronics

5.10.1 Profile

5.10.2 Operation

5.10.3 Revenue Structure

5.10.4 Gross Margin

5.10.5 Energy Storage Business

5.10.6 Outlook and Forecast

5.11 Prudent Energy

5.11.1 Profile

5.11.2 Energy Storage Business

5.12 Raynen

5.12.1 Profile

5.12.2 Energy Storage Business

5.13 Rongke Power

5.13.1 Profile

5.13.2 Energy Storage Business

5.14 Shandong RealForce Enterprises

5.14.1 Profile

5.14.2 Energy Storage Business

5.15 China Aviation Lithium Battery

5.15.1 Profile

5.15.2 Energy Storage Business

5.16 Summary

6 Summary and Forecast

6.1 Summary

6.2 Forecast

表:储能技术分类

图:电力系统储能技术应用方向

表:储能应用领域

表:储能在智能电网中的应用

图:储能在电力系统中的应用

图:储能产业链

表:中国储能行业相关政策

图:储能技术发展阶段

表:2013-2014年部分储能技术成本评价

图:2008-2013年全球储能累计装机规模

图:2013年全球储能系统各技术份额

图:2009-2014年中国发电装机容量及储能需求

图:2013年中国储能项目应用分布情况

表:中国主要储能企业及其技术路线

图:2010-2020年中国抽水蓄能装机容量

图:2010-2014年中国风光电配套锂电池消费量

表:中国钒电池企业及其业务范围

图:2009-2020年中国风电装机容量

图:2009-2020年风电储能需求

图:2009-2020年中国光伏装机容量

图:2009-2020年中国光伏发电储能需求

图:2010-2014年Alstom 营业收入及净利润

图:2011-2013年Alstom(分产品)营业收入

图:2011-2014年Axion 营业收入及净利润

图:2009-2014年GE营业收入及净利润

图:2009-2014年GE(分产品)营业收入

图:2011-2014年Maxwell营业收入及净利润

图:2011-2014年Maxwell (分产品)营业收入

表:全球主要储能企业

图:2008-2014年南都电源营业收入及净利润

图:2011-2014年南都电源(分行业)营业收入

图:2010-2014年南都电源(分区域)营业收入

图:2011-2014年南都电源(分行业)毛利率

图:2012-2017年南都电源营业收入及净利润

图:2008-2014年圣阳股份营业收入及净利润

图:2009-2014年圣阳股份(分产品)营业收入

图:2009-2014年圣阳股份(分地域)营业收入

图:2009-2014年圣阳股份(分产品)毛利率

表:2013-2014年圣阳股份重点储能项目

图:2012-2017年圣阳股份营业收入及净利润

图:2008-2014年汇川技术营业收入及净利润

图:2010-2014年汇川技术(分产品)营业收入

图:2014H1年汇川技术(分地区)营收份额

图:2010-2014年汇川技术(分产品)毛利率

图:2012-2017年汇川技术营业收入及净利润

图:2008-2014年中天科技营业收入及净利润

图:2009-2014年中天科技营业收入及净利润

图:2014H1中天科技(分地区)营业收入

图:2012-2017年中天科技营业收入及净利润

图:2008-2014年风帆股份营业收入及净利润

图:2008-2014年风帆股份(分产品)营业收入

图:2014H1风帆股份(分地区)营业收入

图:2008-2014年风帆股份(分产品)毛利率

图:2012-2017年风帆股份营业收入及净利润

图:2009-2014年比亚迪营业收入及净利润

图:2009-2014年比亚迪(分产品)营业收入

图:2009-2014年比亚迪(分地区)营业收入

图:2009-2014年比亚迪(分产品)毛利率

图:2012-2017年比亚迪营业收入及净利润

图:2009-2014年阳光电源营业收入及净利润

图:2009-2014年阳光电源(分产品)营业收入

图:2014H1阳光电源(分地区)营收占比

图:2009-2014年阳光电源(分产品)毛利率

图:2012-2017年阳光电源营业收入及净利润

图:2009-2014年上海电气营业收入及净利润

图:2010-2014年上海电气(分产品)营业收入

图:2010-2014年上海电气(分地区)营业收入

图:2010-2014年上海电气(分产品)毛利率

图:2012-2017年上海电气营业收入及净利润

图:2009-2014年欣旺达营业收入及净利润

图:2009-2014年欣旺达(分产品)营业收入及净利润

图:2014H1欣旺达(分地区)营业收入

图:2012-2017年欣旺达营业收入及净利润

图:2009-2014年科陆电子营业收入及净利润

图:2009-2014年科陆电子(分产品)营业收入

图:2011-2014年科陆电子(分地区)营业收入

图:2009-2014年科陆电子(分产品)毛利率

图:2012-2017年科陆电子营业收入及净利润

表:普能科技千瓦级全钒液流电池储能系统应用项目

表:普能科技兆瓦级全钒液流电池储能系统应用项目

表:融科储能主要储能项目

表:中国主要储能企业

表:2009-2014年中国电力及储能规模

表:2012-2017年中国电力及储能规模

Classification of Energy Storage Technology

Application of Energy Storage Technology for Electrical Power System

Energy Storage Applications

Energy Storage Applications in Smart Power Grids

Energy Storage Applications in Electrical Power System

Energy Storage Industry Chain

Policies on Energy Storage Industry in China

Stage of Energy Storage Technology Development

Cost Assessment of Some Energy Storage Technologies, 2013-2014

Total Installed Capacity of Global Energy Storage, 2008-2013

Shares of Energy Storage Technologies Worldwide, 2013

Demand for Power Generation and Energy Storage in China, 2009-2014

Distribution of Energy Storage Project Applications in China, 2013

Technical Route of Major Energy Storage Enterprises in China

Installed Capacity of Pumped Storage in China, 2010-2020E

Consumption of Lithium Batteries for Wind-Solar Hybrid Power Generation in China, 2010-2014

Business Scope of Vanadium Battery Companies in China

Installed Capacity of Wind Power in China, 2009-2020E

Demand for Wind Power Storage, 2009-2020E

PV Installed Capacity in China, 2009-2020E

Demand for PV Power Generation and Energy Storage in China, 2009-2020E

Revenue and Net Income of Alstom, 2010-2014

Revenue Breakdown of Alstom by Product, 2011-2013

Revenue and Net Income of Axion, 2011-2014

Revenue and Net Income of GE, 2009-2014

Revenue Breakdown of GE by Product, 2009-2014

Revenue and Net Income of Maxwell, 2011-2014

Revenue Breakdown of Maxwell by Product, 2011-2014

Major Energy Storage Enterprises in the World

Revenue and Net Income of Narada, 2008-2014

Revenue Breakdown of Narada by Sector, 2011-2014

Revenue Breakdown of Narada by Region, 2010-2014

Gross Margin of Narada by Sector, 2011-2014

Revenue and Net Income of Narada, 2012-2017E

Revenue and Net Income of Sacred Sun, 2008-2014

Revenue Breakdown of Sacred Sun by Product, 2009-2014

Revenue Breakdown of Sacred Sun by Region, 2009-2014

Gross Margin of Sacred Sun by Product, 2009-2014

Key Energy Storage Projects of Sacred Sun, 2013-2014

Revenue and Net Income of Sacred Sun, 2012-2017E

Revenue and Net Income of Inovance, 2008-2014

Revenue Breakdown of Inovance by Product, 2010-2014

Revenue Structure of Inovance by Region, 2014H1

Gross Margin of Inovance by Product, 2010-2014

Revenue and Net Income of Inovance, 2012-2017E

Revenue and Net Income of ZTT, 2008-2014

Revenue and Net Income of ZTT, 2009-2014

Revenue Breakdown of ZTT by Region, 2014H1

Revenue and Net Income of ZTT, 2012-2017E

Revenue and Net Income of Fengfan, 2008-2014

Revenue Breakdown of Fengfan by Product, 2008-2014

Revenue Breakdown of Fengfan by Region, 2014H1

Gross Margin of Fengfan by Product, 2008-2014

Revenue and Net Income of Fengfan, 2012-2017E

Revenue and Net Income of BYD, 2009-2014

Revenue Breakdown of BYD by Product, 2009-2014

Revenue Breakdown of BYD by Region, 2009-2014

Gross Margin of BYD by Product, 2009-2014

Revenue and Net Income of BYD, 2012-2017E

Revenue and Net Income of Sungrow 2009-2014

Revenue Breakdown of Sungrow by Product, 2009-2014

Revenue Structure of Sungrow by Region, 2014H1

Gross Margin of Sungrow by Product, 2009-2014

Revenue and Net Income of Sungrow, 2012-2017E

Revenue and Net Income of Shanghai Electric, 2009-2014

Revenue Breakdown of Shanghai Electric by Product, 2010-2014

Revenue Breakdown of Shanghai Electric by Region, 2010-2014

Gross Margin of Shanghai Electric by Product, 2010-2014

Revenue and Net Income of Shanghai Electric, 2012-2017E

Revenue and Net Income of Sunwoda, 2009-2014

Revenue and Net Income of Sunwoda by Product, 2009-2014

Revenue Breakdown of Sunwoda by Region, 2014H1

Revenue and Net Income of Sunwoda, 2012-2017E

Revenue and Net Income of Clou Electronics, 2009-2014

Revenue Breakdown of Clou Electronics by Product, 2009-2014

Revenue Breakdown of Clou Electronics by Region, 2011-2014

Gross Margin of Clou Electronics by Product, 2009-2014

Revenue and Net Income of Clou Electronics, 2012-2017E

KW Class VRB Energy Storage System Application Project of Prudent Energy

MW Class VRB Energy Storage System Application Project of Prudent Energy

Key Energy Storage Projects of Rongke Power

Major Energy Storage Enterprises in China

Power & Energy Storage Size in China, 2009-2014

Power & Energy Storage Size in China, 2012-2017E

如果这份报告不能满足您的要求,我们还可以为您定制报告,请 留言说明您的详细需求。

|