|

|

|

报告导航:研究报告—

制造业—汽车

|

|

2013-2017年全球及中国汽车电子产业链研究报告 |

|

字数:23.1万 |

页数:799 |

图表数:784 |

|

中文电子版:19000元 |

中文纸版:9500元 |

中文(电子+纸)版:19500元 |

|

英文电子版:5800美元 |

英文纸版:6400美元 |

英文(电子+纸)版:6100美元 |

|

编号:HJ003

|

发布日期:2014-11 |

附件:无 |

|

|

|

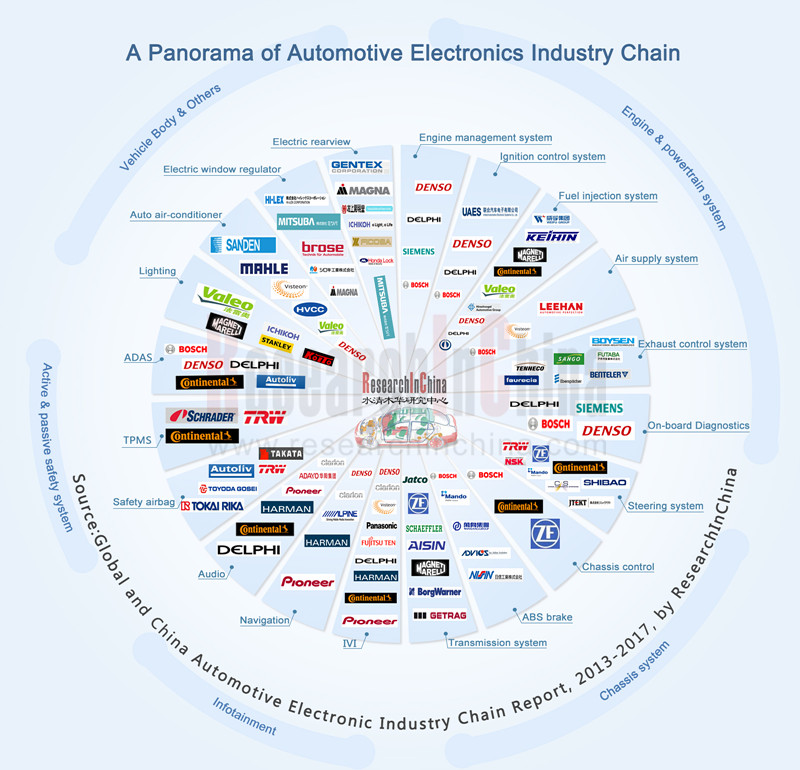

汽车电子产业是将电子信息技术应用到汽车上所形成的产业。从应用层面来看,汽车电子可以分为引擎/传动系统、底盘系统、车身系统、车载通讯与通信系统、安全系统等。

本报告主要研究范围涵盖了安全气囊、胎压监测、ADAS、IVI(导航和音响)、自动变速器、燃油喷射、汽车照明以及Telematics等八个领域,研究了产业现状、市场趋势、竞争格局、供应关系,以及主要国内外企业的财务数据、运营情况、发展策略等。

胎压监测:

TPMS最初是作为进口车型的豪华配置进入中国市场,随着中国消费者对汽车安全性能要求逐渐提高,中国整车制造商开始将TPMS作为标准配置,TPMS安装已逐渐从高档车向中型车渗透。

2014年5月,中国已标配 TPMS 的国产乘用车品牌共73个,涉及车型312种,涉及款式1567个。根据测算,2013年中国汽车用TPMS的OEM市场规模已达247万套,比2012年增长了32.8%。最近几年,TPMS在中国市场呈现高速增长,一方面由于市场规模小,对比基数小,另一方面则是许多厂商看好TPMS在中国的逐步普及趋势。

虽然中国TPMS标准已经获批,但还未出台强制安装政策。我们预测2015年前后中国将出台相关政策,市场将迎来快速发展。保守估计,2014-2017年中国TPMS的年均增长速度将保持在27.8%,2017年前装市场规模将达到661万套,后装市场规模也将迅速增长。

ADAS

辅助驾驶是汽车领域近年来发展最快的技术,目前辅助驾驶技术已经进入“高级辅助驾驶(ADAS)”的大量应用阶段。2013年中国ADAS市场的规模为6亿美元,到2019年预计将达到27亿美元。2013-2017年复合增长率预计将达到29%。

2014年中国在售车款数量为6079款,仅有约6%的车款装配了一个或一个以上的ADAS系统,而这些车款中有约1/2为进口车。另外约1/2的本土生产的车款中超过80%为合资车厂生产,国产品牌的汽车ADAS配置率远低于国际品牌。

2013年中国共销售汽车2199万辆,其中乘用车1793万辆,商用车406万辆,ADAS预装率在2.5%左右,整体装配率在3%左右。

燃油喷射

车用电喷系统分为汽油电喷和柴油电喷系统,汽油电喷技术有较高的普及率,主要汽车企业均掌握了该技术。而柴油电喷技术被美国德尔福、德国博世和日本电装等几家企业所垄断。

2013年中国重卡高压共轨系统使用比例在35%左右,随着国IV落实时间明确,2014年高压共轨装配比例开始快速提升。国三的直列泵装置因燃油压力及喷射控制问题无法满足国四及国五要求,未来需全部更换为电控高压共轨喷射系统。预计2015年中国重卡柴油高压共轨使用比例将提升至60%,2017年有望提升至80%。

根据测算,2014年中国柴油电控高压共轨市场规模有望达到68.46亿元,2017年有望达到107.51亿元,年均增长速度为16.23%。

水清木华研究中心《2013-2017年全球以及中国汽车电子产业链报告》主要内容包括:

中国汽车整车市场和零部件市场整体分析,包括乘用车及商用车产销量、乘用车及商用车市场格局、零部件市场竞争格局; 中国汽车整车市场和零部件市场整体分析,包括乘用车及商用车产销量、乘用车及商用车市场格局、零部件市场竞争格局;

全球及中国汽车电子市场整体分析,包括定义与分类、市场规模、发展历程、发展趋势。 全球及中国汽车电子市场整体分析,包括定义与分类、市场规模、发展历程、发展趋势。

智能驾驶、ADAS、Telematics、IVI、导航、音响、安全气囊、TPMS、自动变速器、燃油喷射、照明等主要汽车电子细分市场的定义与分类、发展历程、行业标准、政策法规、研发路线、市场规模、产销量、配套情况、市场需求、竞争格局、进出口情况、发展趋势。 智能驾驶、ADAS、Telematics、IVI、导航、音响、安全气囊、TPMS、自动变速器、燃油喷射、照明等主要汽车电子细分市场的定义与分类、发展历程、行业标准、政策法规、研发路线、市场规模、产销量、配套情况、市场需求、竞争格局、进出口情况、发展趋势。

大陆、电装、博世、德尔福、奥利托夫、天合、马瑞利、爱信、摩比斯、法雷奥、喜莱德、威伯科、哈曼国际、先锋、歌乐、采埃孚、京滨、海拉、小糸、航盛电子、 德赛、凯源科技、华阳集团、泰好电子、好帮手、吉利、奇瑞、中国重汽、威孚高科等全球及中国主要零部件厂商的企业简介、在华业务、财务状况、产销量、主要客户、主要产品、配套情况、生产基地、研发状况、技术路线以及汽车电子各细分领域业务开展情况。 大陆、电装、博世、德尔福、奥利托夫、天合、马瑞利、爱信、摩比斯、法雷奥、喜莱德、威伯科、哈曼国际、先锋、歌乐、采埃孚、京滨、海拉、小糸、航盛电子、 德赛、凯源科技、华阳集团、泰好电子、好帮手、吉利、奇瑞、中国重汽、威孚高科等全球及中国主要零部件厂商的企业简介、在华业务、财务状况、产销量、主要客户、主要产品、配套情况、生产基地、研发状况、技术路线以及汽车电子各细分领域业务开展情况。

英飞凌、飞思卡尔、瑞萨、德州仪器、Mobileye等主要汽车电子半导体厂家的企业简介、财务状况、主要客户、主要产品、应用领域、解决方案、研发状况、技术线。 英飞凌、飞思卡尔、瑞萨、德州仪器、Mobileye等主要汽车电子半导体厂家的企业简介、财务状况、主要客户、主要产品、应用领域、解决方案、研发状况、技术线。

Automotive electronic industry emerges after electronic information technology getsapplied to the cars. From the perspective of application, automotive electronics can be divided into engine/transmission system, chassis system, body system, communication system, safety system and so forth.

This report covers airbags, tire pressure monitoring, ADAS, IVI (navigation and audio), automatic transmission, fuel injection, lighting and telematics. Meanwhile, it studies status quo, market trends, competition patterns and supply relationship of the industry, as well as analyzes financial data, operation and development strategies of major Chinese and foreign companies.

Tire Pressure Monitoring:

TPMS entered the Chinese market as the luxurious configuration of imported vehicle models. As Chinese consumers gradually put forward higher requirements on automotive safety, Chinese automobile manufacturers have applied TPMS as standard configuration; TPMS has been installed not only in luxury cars, but also in midrange cars.

In May 2014, 73 Chinese local passenger car brands set TPMS as standard configuration for 312 models and 1,567 styles. China’s automotive TPMS OEM market size was estimated to reach 2.47 million sets in 2013, representing an increase of 32.8% over 2012. In recent years, Chinese TPMS market has been growing quickly owing to the small market size, a low comparison base and the optimistic attitudes of many TPMS vendors toward the popularity of TPMS in China.

Although China’s TPMS standards have been approved, mandatory installation policies have not been issued yet. We forecast that China will introduce relevant policies around 2015, and the market will see rapid development then. It is conservatively estimated that Chinese TPMS market will present a CAGR of 27.8% during 2014-2017, the OEM market size will reach 6.61 million sets by 2017, and the aftermarket size will swell swiftly as well.

ADAS

Aideddriving has been the fastest growing automotive technology over recent years, and it has entered the "Advanced Driver Assistance Systems (ADAS)" large-scale application stage. China’s ADAS market size hit USD600 million in 2013, and will amount to USD2.7 billion in 2019, with the estimated CAGR of 29% during 2013-2017.

In 2014, only about 6% of 6,079 vehicle models for sale in China are equipped with one or more sets of ADAS. Among these ADAS-contained models, imported cars account for 50%, and the ones made in China occupy the remaining 50%; however, over 80% of the ones made in China are produced by joint ventures, which means the ADAS configuration rate of domestic brands is much lower than that of international brands.

China sold 21.99 million automobiles in 2013, including 17.93 million passenger cars and 4.06 million commercial vehicles, with the ADAS preinstalled rate of about 2.5% and the overall assembly rate of 3% or so.

Fuel Injection

Automotive EFI System is divided into gasoline and diesel electronic injection system. Gasoline electronic injection system is more popular and major carmakers all have mastered the know-how of it. However, diesel electronic injection technology is monopolized by a few giants such as Delphi, Bosch and Denso.

The application proportion of Chinese heavy truck high-pressure common rail system was about 35% in 2013, and ascends quickly in 2014 as the enforcement time of National Emission Standards IV is definite. In-line pump devices complying with National Emission Standards III can not meet the requirements of National Emission Standards IV and V in terms of fuel pressure and injection control, so they need to be completely replaced by electric control high-pressure common rail injection system in the future. The application proportion of Chinese heavy truck diesel high-pressure common rail system will increase to 60% in 2015 and 80% in 2017.

According to estimates, Chinese diesel electric-control high-pressure common rail market size is expected to reach RMB6.846 billion in 2014 and RMB10.751 billion in 2017 with an AAGRof 16.23%.

The report coversthe following:

Chinese automobile and auto parts markets, including output, sales volume and market structure of passenger cars and commercial vehicles, and the competition pattern of auto parts market; Chinese automobile and auto parts markets, including output, sales volume and market structure of passenger cars and commercial vehicles, and the competition pattern of auto parts market;

Global and Chinese automotive electronic market, embracing definition, classification, market size, development course and development trends. Global and Chinese automotive electronic market, embracing definition, classification, market size, development course and development trends.

Definition, classification, development course, industrial standards, policies & regulations, R & D route, market size, output, sales volume, supporting, market demand, competition pattern, import & export and development trends of major automotive electronic market segments, such as intelligent driving, ADAS, Telematics, IVI, navigation, audio, airbags, TPMS, automatic transmission, fuel injection and lighting. Definition, classification, development course, industrial standards, policies & regulations, R & D route, market size, output, sales volume, supporting, market demand, competition pattern, import & export and development trends of major automotive electronic market segments, such as intelligent driving, ADAS, Telematics, IVI, navigation, audio, airbags, TPMS, automatic transmission, fuel injection and lighting.

Profile, business in China, financial situation, output, sales volume, major customers, main products, supporting, production bases, R & D, technology routes and segments of major global and Chinese auto parts companies, including Continental, Denso, Bosch, Delphi, Autoliv, TRW, Magneti Marelli, Aisin, Mobis, Valeo, Schrader, WABCO, Harman International, Pioneer, Clarion, ZF Friedrichshafen, Keihin, Hella, Koito, Hangsheng Electronics, Desay, Kysonix, Foryou, Topsystem Electronics, Coagent, Geely, Chery, China National Heavy Duty Truck and Weifu. Profile, business in China, financial situation, output, sales volume, major customers, main products, supporting, production bases, R & D, technology routes and segments of major global and Chinese auto parts companies, including Continental, Denso, Bosch, Delphi, Autoliv, TRW, Magneti Marelli, Aisin, Mobis, Valeo, Schrader, WABCO, Harman International, Pioneer, Clarion, ZF Friedrichshafen, Keihin, Hella, Koito, Hangsheng Electronics, Desay, Kysonix, Foryou, Topsystem Electronics, Coagent, Geely, Chery, China National Heavy Duty Truck and Weifu.

Profile, financial condition, major customers, main products, application fields, solutions, R & D and technology routes of major global and Chinese automotive electronic semiconductor companies, embracing Infineon, Freescale, Renesas, Texas Instruments and Mobileye. Profile, financial condition, major customers, main products, application fields, solutions, R & D and technology routes of major global and Chinese automotive electronic semiconductor companies, embracing Infineon, Freescale, Renesas, Texas Instruments and Mobileye.

第一章 总论

1.1 汽车整体市场

1.1.1 汽车市场

1.1.2 乘用车整体及细分市场

1.1.3 商用车整体及细分市场

1.2 汽车零部件市场

1.3 汽车电子市场规模

1.3.1 定义

1.3.2 全球汽车电子市场规模

1.3.3 中国汽车电子市场规模

1.4 汽车电子发展趋势

1.4.1 车联网将汽车电子产业链延伸

1.4.2 智能驾驶迅速发展,ADAS前景广阔

1.4.3 信息娱乐技术与其他技术融合

第二章 被动安全系统

2.1 概述

2.1.1 定义

2.1.2 安全气囊定义

2.1.3 安全气囊袋原料

2.1.4 气囊传感器

2.1.5 主动式安全带

2.2 汽车安全系统市场

2.2.1 全球汽车安全系统市场

2.2.2 中国汽车安全气囊市场

2.3 厂家研究

2.3.1 奥托立夫

2.3.2 高田

2.3.3 TRW(天合)

2.3.4 丰田合成

2.3.5 东海理化

2.3.6 Nihon Plast

2.3.7 锦恒汽车安全技术控股有限公司

2.3.8 东方久乐

2.3.9 KSS

2.3.10 摩比斯Mobis

2.3.11 ARC Vehicle

2.3.12 大赛璐

2.3.13 重庆光大产业

2.3.14 同致电子

2.3.15 天津市益中汽车安全带

2.3.16 FLIR System(Night Vision)

第三章 TPMS

3.1 TPMS产业概述

3.1.1 定义

3.1.2 分类

3.1.3 作用

3.1.4 系统构成

3.2 全球TPMS行业发展情况

3.2.1 全球整体概况

3.2.2 主要国家发展情况

3.3 中国TPMS行业发展情况

3.3.1 技术发展现状

3.3.2 行业标准及政策

3.3.3 市场概况

3.4 国外TPMS重点企业分析

3.4.1 喜莱德

3.4.2 大陆

3.4.3 天合

3.4.4 贝鲁

3.4.5 李尔

3.4.6 欧姆龙

3.4.7 太平洋工业

3.4.8 电装

3.4.9 博世

3.4.10 日立汽车系统

3.5 国内重点企业

3.5.1 江西凯源科技有限公司

3.5.2 上海保隆汽车科技股份有限公司

3.5.3 深圳市航盛电子股份有限公司

3.5.4 广东铁将军防盗设备有限公司

3.5.5 上海泰好电子科技有限公司

3.5.6 深圳市永奥图科技有限公司

3.5.7 苏州驶安特汽车电子有限公司

3.5.8 东莞市诺丽电子科技有限公司

3.5.9 南京泰晟科技实业有限公司

3.5.10 车王电子(宁波)有限公司

3.5.11 慈溪市福尔达实业有限公司

3.5.12 河南天海电器有限公司

3.5.13 惠州华阳通用电子有限公司

3.5.14 凯迪彤创(厦门)电子科技有限公司

3.5.15 扬州科安电子科技有限公司

3.5.16 伟盈汽车科技有限公司

3.5.17 伟力通电子技术有限公司

3.5.18 世纪鸿进(厦门)电子科技有限公司

3.5.19 江苏云意电气股份有限公司

3.5.20 东莞市腾派电子科技有限公司

3.6 传感器供应商

3.6.1 市场概述

3.6.2 GE

3.6.3 英飞凌

3.6.4 飞思卡尔

第四章 ADAS

4.1 ADAS系统概述

4.1.1 概述

4.1.2 主要ADAS系统功能和技术方案

4.1.3 消费者对ADAS的认知

4.2 全球及中国ADAS市场现状与竞争格局

4.2.1 全球ADAS市场

4.2.2 中国ADAS市场

4.3 整车厂商ADAS发展状况

4.3.1 大众集团(Volkswagen)

4.3.2 宝马公司(BMW)

4.3.3 戴姆勒公司(Daimler AG)

4.3.4 沃尔沃(Volvo)

4.3.5 通用汽车(GM)

4.3.6 福特汽车公司(Ford Motor)

4.3.7 丰田汽车公司(Toyota Motor)

4.3.8 本田汽车(Honda Motor)

4.3.9 日产汽车(Nissan Motor)

4.4 全球ADAS芯片/解决方案主要企业

4.4.1 Mobileye

4.4.2 德州仪器(TI)

4.4.3 瑞萨电子(Renesas)

4.4.4 飞思卡尔(Freescale)

4.5 全球ADAS系统集成主要企业

4.5.1 威伯科(WABCO)

4.5.2 奥托立夫(Autoliv)

4.5.3 大陆集团(Continental AG)

4.5.4 博世(Bosch)

4.5.5 德尔福(Delphi)

4.5.6 电装(Denso)

第五章 IVI(导航和音响)

5.1 IVI概述

5.1.1 IVI简介

5.1.2 GENIVI Alliance

5.1.3 CCC

5.1.4 MHL

5.1.5 典型IVI设计

5.2 IVI市场与产业

5.2.1 全球IVI市场规模

5.2.2 全球汽车连接服务、TSP市场规模

5.2.3 IVI产业

5.2.4 中国IVI市场

5.2.5 典型车型对应的Infotainment供应商

5.3 汽车导航市场分析

5.3.1 全球汽车导航市场

5.3.2 中国汽车导航市场

5.4 汽车音响市场与产业

5.4.1 汽车音响系统简介

5.4.2 汽车音响系统产业链

5.4.3 全球主要汽车厂家音响系统主要供应厂家供应比例

5.4.4 中国汽车音响产业与市场

5.5 全球IVI(导航与音响)厂家研究

5.5.1 哈曼国际(Harman)

5.5.2 大陆集团(Continetal)

5.5.3 先锋Pioneer

5.5.4 华阳集团

5.5.5 阿尔派Alpine

5.5.6 歌乐Clarion

5.5.7 德尔福Delphi

5.5.8 伟世通Visteon

5.5.9 航盛电子Hangsheng Electronic

5.5.10 松下汽车系统

5.5.11 富士通天Fujitsu Ten

5.5.12 爱信精机(AisinAW)

5.5.13 电装Denso

5.5.14 摩比斯

5.5.15 好帮手电子科技

5.5.16 深圳宝凌

5.5.17 JVC建伍

5.5.18 Blaupunkt

5.5.19 Garmin

5.5.20 德赛西威

第六章 自动变速器

6.1 变速器简介

6.1.1 汽车变速器简介

6.1.2 汽车变速器分类

6.1.3 政策环境

6.2 自动变速器市场

6.2.1 市场规模

6.2.2 市场格局

6.2.3 自动变速器研发情况

6.2.4 自动变速器研研发前景

6.2.5 自动变速器研发路线

6.3细分市场

6.3.1 乘用车自动变速器

6.3.2 商用车自动变速器

6.4全球主要变速器厂商

6.4.1 JATCO

6.4.2 爱信

6.4.3 博格华纳

6.4.4 采埃孚

6.4.5 格特拉克

6.4.6 舍弗勒

6.4.7 Magneti Marelli

6.4.8 Oerlikon Graziano

6.4.9 Delphi

6.4.10 Continental

6.5 中国自主汽车变速器厂商

6.5.1 重庆青山工业有限责任公司

6.5.2 陕西法士特汽车传动集团公司

6.5.3 浙江万里扬变速器股份有限公司

6.5.4 山东蒙沃变速器有限公司

6.5.5 安徽星瑞齿轮传动有限公司

6.5.6 浙江吉利控股集团

6.5.7 奇瑞汽车股份有限公司

6.5.8 中国重汽集团大同齿轮有限公司

6.5.9 湖南江麓容大车辆传动

6.5.10 綦江齿轮传动有限公司

6.6 中外合资汽车变速器厂商

6.6.1 大众汽车变速器

6.6.2 爱信

6.6.3 加特可广州自动变速箱有限公司

6.6.4 博格华纳双离合器传动系统有限公司

6.6.5 上海通用东岳动力总成有限公司

6.6.6 格特拉克(江西)传动系统有限公司

6.6.7 杭州依维柯汽车变速器有限公司

6.6.8 哈尔滨东安汽车发动机制造有限公司

6.6.9 湖南中德汽车自动变速器股份有限公司

6.6.10 丰田汽车(常熟)零部件有限公司

6.6.11上海汽车变速器有限公司

6.6.12 本田汽车零部件制造有限公司

6.6.13 采埃孚

6.6.14 北京摩比斯变速器有限公司

6.6.15 内蒙古欧意德发动机有限公司

6.6.16 南京邦奇自动变速箱有限公司

第七章 燃油喷射

7.1 定义及分类

7.1.1 定义

7.1.2 分类

7.1.3 政策环境

7.2 市场需求

7.2.1 市场需求量

7.2.2 进出口

7.2.3 主要企业

7.3 细分市场

7.3.1 汽油电控燃油喷射系统

7.3.2 柴油电控燃油喷射系统

7.4 主要企业研究

7.4.1 博世

7.4.2 德尔福

7.4.3 电装

7.4.4 法雷奥

7.4.5 大陆

7.4.6 京滨

7.4.7 马瑞利

7.4.8 德西福格

7.4.9 无锡威孚高科技集团股份有限公司

7.4.10 山西新天地发动机制造有限公司

7.4.11 南岳电控(衡阳)工业技术有限公司

7.4.12 北京亚新科天纬油泵油嘴股份有限公司

7.4.13 成都天兴仪表(集团)有限公司

7.4.14 中国重汽集团重庆燃油喷射系统有限公司

7.4.15 龙泵企业集团公司

7.4.16 山东鑫亚工业股份有限公司

7.4.17 成都威特电喷有限责任公司

第八章 汽车照明

8.1 汽车照明产业与市场

8.1.1 全球汽车照明市场和产业

8.1.2 全球汽车照明配套体系

8.1.3 中国汽车照明产业

8.1.4 中国汽车照明OEM配套情况

8.2 LED汽车照明产业

8.2.1 全球LED汽车照明市场

8.2.2 汽车内饰LED 照明

8.2.3 汽车外饰(Exterior)LED照明

8.2.4 LED产业链

8.2.5 LED产业地域分布

8.2.6 台湾LED产业

8.2.7 中国大陆LED产业

8.2.8 白光LED 专利

8.3 汽车照明厂家研究

8.3.1 海拉

8.3.2 小糸Koito

8.3.3 市光Ichikoh

8.3.4 斯坦雷Stanley

8.3.5 法雷奥Valeo

8.3.6 Automotive Lighting(马瑞利,Magneti Marelli)

8.3.7 丽清科技

8.3.8 其他照明厂家

第九章 乘用车Telematics

9.1 中国乘用车Telematics市场发展状况分析

9.1.1 市场概况

9.1.2 主要Telematics品牌业务分析

9.1.3 中国Telematics新增市场规模

9.2 中国合资主机厂Telematics业务研究

9.2.1 上海通用安吉星

9.2.2 丰田G-BOOK

9.2.3 本田HondaLink

9.2.4 沃尔沃SENSUS

9.2.5 长安福特SYNC

9.2.6 东风日产CARWINGS智行+

9.2.7 东风悦达起亚UVO

9.2.8 东风雪铁龙Citroën Connect

9.2.9 东风标致Blue-i

9.2.10 奔驰Mercedes-Benz CONNECT

9.2.11 北京现代Blue Link

9.2.12 华晨宝马 ConnectedDrive

9.3 中国本土主机厂Telematics业务研究

9.3.1 上海汽车inkaNet

9.3.2 长安汽车in Call

9.3.3 吉利汽车G-NetLink

9.3.4 奇瑞Cloudrive

9.4 中国乘用车市场的TSP研究

9.4.1 远特科技

9.4.2 博泰悦臻

9.4.3 钛马信息

9.4.4 四维图新

9.4.5 WirelessCar

9.4.6 休斯车联网

9.4.7 九五智驾

9.4.8 车网互联

1 Overview

1.1 Overall Automobile Market

1.1.1 Automobile Market

1.1.2 Passenger Car Market and Segments

1.1.3 Commercial Vehicle Market and Segments

1.2 Auto Parts Market

1.3 Automotive Electronic Market Size

1.3.1 Definition

1.3.2 Global

1.3.3 China

1.4 Development Trend of Automotive Electronics

1.4.1 IOV Extends Automotive Electronic Industry Chain

1.4.2 Intelligent Driving Develops Rapidly, and ADAS Is Promising

1.4.3 Infotainment Technology Integrates with Other Technologies

2 Passive Safety System

2.1 Overview

2.1.1 Definition

2.1.2 Definition of Airbags

2.1.3 Airbag Materials

2.1.4 Airbag Sensors

2.1.5 Active Seat Belts

2.2 Automotive Safety System Market

2.2.1 Global Market

2.2.2 China Airbag Market

2.3 Automotive Safety System Companies

2.3.1 Autoliv

2.3.2 Takata

2.3.3 TRW

2.3.4 Toyoda Gosei

2.3.5 Tokai Rika

2.3.6 Nihon Plast

2.3.7 Jinheng Automotive Safety Technology Holdings Ltd.

2.3.8 East Joy Long

2.3.9 KSS

2.3.10 Mobis

2.3.11 ARC Vehicle

2.3.12 Daicel

2.3.13 Chongqing Guangda Industrial Co., Ltd

2.3.14 Tung Thih Electronic

2.3.15 Tianjin Yizhong Vehicle Safety Belt Factory

2.3.16 FLIR System (Night Vision)

3 TPMS

3.1 Overview

3.1.1 Definition

3.1.2 Classification

3.1.3 Function

3.1.4 System Constitution

3.2 Development of Global TPMS Industry

3.2.1 Overview of Global TPMS Industry

3.2.2 Main Countries

3.3 Development of China TPMS Industry

3.3.1 Status Quo of Technology

3.3.2 Industrial Standard and Policy

3.3.3 Market Overview

3.4 Key Foreign TPMS Companies

3.4.1 Schrader

3.4.2 Continental

3.4.3 TRW

3.4.4 Beru

3.4.5 Lear

3.4.6 Omron

3.4.7 Pacific Industrial

3.4.8 Denso

3.4.9 Bosch

3.4.10 Hitachi Automotive Systems

3.5 Key Chinese TPMS Companies

3.5.1 Kysonix Inc.

3.5.2 Shanghai Baolong Automotive Corporation

3.5.3 Shenzhen Hangsheng Electronics Co., Ltd

3.5.4 Steelmate Co., Ltd.

3.5.5 Shanghai Topsystm Electronic Technology Co., Ltd.

3.5.6 Shenzhen Autotech Co., Ltd.

3.5.7 Sate Auto Electronic Co., Ltd

3.5.8 Dongguan Nannar Electronics Technology Co., Ltd.

3.5.9 Nanjing Top Sun Technology Co., Ltd

3.5.10 Mobiletron Electronics (Ningbo) Co., Ltd.

3.5.11 Cixi Fu'erda Industrial Co., Ltd.

3.5.12 China Auto Electronics Group Limited

3.5.13 Huizhou Foryou General Electronics Co., Ltd.

3.5.14 KaDyTons (Xiamen) Electronic Technology Co., Ltd.

3.5.15 Yangzhou Kooan Electronic Technology Co., Ltd.

3.5.16 Wellgain Auto Technology Co., Ltd.

3.5.17 VICTON Electronic Technology Co., Ltd.

3.5.18 Century Hongking Auto Technology Co., Ltd.

3.5.19 Jiangsu Yunyi Electric Co., Ltd

3.5.20 Dongguan Tipi Electronics Technology Co., Ltd.

3.6 Sensor Suppliers

3.6.1 Market Overview

3.6.2 GE

3.6.3 Infineon

3.6.4 Freescale

4 ADAS

4.1 Overview of Advanced Driver Assistance System (ADAS)

4.1.1 Overview

4.1.2 Functions and Technological Solutions of Main ADAS Systems

4.1.3 Consumers’ Recognition on ADAS

4.2 Global and China ADAS Application Status and Competitive Landscape

4.2.1 Global ADAS Market

4.2.2 China ADAS Market

4.3 ADAS Development of Automobile Manufacturers

4.3.1 Volkswagen

4.3.2 BMW

4.3.3 Daimler AG

4.3.4 Volvo

4.3.5 GM

4.3.6 Ford Motor

4.3.7 Toyota Motor

4.3.8 Honda Motor

4.3.9 Nissan Motor

4.4 Global Major ADAS Chip/Solutions Companies

4.4.1 Mobileye

4.4.2 TI

4.4.3 Renesas

4.4.4 Freescale

4.5 Global Major ADAS System Integrators

4.5.1 WABCO

4.5.2 Autoliv

4.5.3 Continental AG

4.5.4 Bosch

4.5.5 Delphi

4.5.6 Denso

5 IVI (Navigation and Audio)

5.1 IVI Overview

5.1.1 IVI Introduction

5.1.2 GENIVI Alliance

5.1.3 CCC

5.1.4 MHL

5.1.5 Typical IVI Design

5.2 IVI Market and Industry

5.2.1 Global IVI Market Size

5.2.2 Global Car Connection Service and TSP Market Size

5.2.3 IVI Industry

5.2.4 China IVI Market

5.2.5 Infotainment Suppliers of Typical Models

5.3 Automotive Navigation Market

5.3.1 Global Automotive Navigation Market

5.3.2 China Automotive Navigation Market

5.4 Automotive Audio Market and Industry

5.4.1 Introduction to Automotive Audio System

5.4.2 Automotive Audio System Industry Chain

5.4.3 Supply Ratio of Major Automotive Audio System Suppliers for Key Global Automakers

5.4.4 China Automotive Audio Industry and Market

5.5 Global IVI Companies

5.5.1 Harman

5.5.2 Continetal

5.5.3 Pioneer

5.5.4 Foryou Group

5.5.5 Alpine

5.5.6 Clarion

5.5.7 Delphi

5.5.8 Visteon

5.5.9 Hangsheng Electronic

5.5.10 Panasonic Automotive Systems

5.5.11 Fujitsu Ten

5.5.12 AisinAW

5.5.13 Denso

5.5.14 Mobis

5.5.15 Coagent Enterprise Limited Co., Ltd.

5.5.16 Shenzhen Baoling Electronic Co., Ltd.

5.5.17 JVC Kenwood

5.5.18 Blaupunkt

5.5.19 Garmin

5.5.20 Desay SV Automotive

6 Automatic Transmission

6.1 Introduction

6.1.1 Automotive Transmission Introduction

6.1.2 Automotive Transmission Classification

6.1.3 Policy Climate

6.2 Automatic Transmission Market

6.2.1 Market Size

6.2.2 Market Pattern

6.2.3 Automatic Transmission R & D Situation

6.2.4 Automatic Transmission R & D Prospect

6.2.5 Automatic Transmission R & D Course

6.3 Market Segments

6.3.1 Passenger Car Transmission

6.3.2 Commercial Vehicle Transmission

6.4 Global Major Transmission Companies

6.4.1 JATCO

6.4.2 Aisin

6.4.3 BorgWarner

6.4.4 ZF

6.4.5 GETRAG

6.4.6 Schaeffler

6.4.7 Magneti Marelli

6.4.8 Oerlikon Graziano

6.4.9 Delphi

6.4.10 Continental

6.5 Chinese Transmission Companies

6.5.1 Chongqing Tsingshan Industrial

6.5.2 Shaanxi Fast Group

6.5.3 Zhejiang Wanliyang Transmission Co., Ltd.

6.5.4 Shandong Menwo Transmission Co., Ltd.

6.5.5 Anhui Xingrui Gear-tansmission Co., Ltd.

6.5.6 Geely Group

6.5.7 Chery Automobile Co., Ltd.

6.5.8 Shanxi Datong Gear Group. Co. Ltd

6.5.9 Hunan Jianglu&Rongda Vehicle Transmission limited company

6.5.10 Qijiang Gear Transmission Co., Ltd.

6.6 Sino-foreign Joint Ventures

6.6.1 Volkswagen Transmission

6.6.2 Aisin

6.6.3 Guangzhou JATCO Automatic Transmission Co., Ltd.

6.6.4 BorgWarner DualTronic Transmission Systems Co., Ltd.

6.6.5 SGM Dongyue PT

6.6.6 GETRAG (Jiangxi) Transmission Co., Ltd.

6.6.7 Hangzhou HAVECO Automotive Transmission Co., Ltd.

6.6.8 Harbin DongAn Automotive Engine Manufacturing Co., Ltd.

6.6.9 Hunan Sino-German Automobile Automatic Transmission Co., Ltd

6.6.10 Toyota Motor (Changshu) Auto Parts Co., Ltd

6.6.11 Shanghai Automobile Gear Works

6.11.1 Shenyang Saic Brilliance Automobile Transmission Co., Ltd.

6.11.2 Shandong SAIC Automotive Transmission Co., Ltd.

6.11.3 Liuzhou SAIC Automotive Transmission Co., Ltd.

6.6.12 Honda Auto Parts Manufacturing Co., Ltd.

6.6.13 ZF

6.6.14 Beijing MOBIS Transmission Co., Ltd.

6.6.15 Inner Mongolia OED Engine Co., Ltd.

6.6.16 Punch Powertrain Nanjing Co., Ltd.

7 Electronic Fuel Injection System

7.1 Definition and Classification

7.1.1 Definition

7.1.2 Classification

7.1.3 Policy Environment

7.2 Market Demand

7.2.1 Demand

7.2.2 Import and Export

7.2.3Major Enterprises

7.3 Segmented Market

7.3.1 Gasoline EFI

7.3.2 Diesel EFI

7.4 Key EFI Companies

7.4.1 Bosch

7.4.2 Delphi

7.4.3 Denso

7.4.4 Valeo

7.4.5 Continental

7.4.6 Keihin

7.4.7 Magneti Marelli

7.4.8 Hirschvogel

7.4.9 Weifu High-technology Group Co., Ltd.

7.4.10 Shanxi Yuci XinTianDi Engine Manufacturing Co., Ltd.

7.4.11 Nanyue Fuel Injection Systems Co., Ltd.

7.4.12 ASIMCO Tianwei Fuel Injection Equipment Stock Co., Ltd.

7.4.13 Chengdu Tianxing Instrument And Meter Co., Ltd.

7.4.14 China Heavy Duty Truck Group Chongqing Fuel System Co., Ltd.

7.4.15 LONGBENG Enterprise Group

7.4.16 Shandong Xinya Industrial Co., Ltd.

7.4.17 Chengdu WIT Electronic Fuel System Co., Ltd.

8 Automotive Lighting

8.1 Automotive Lighting Industry and Market

8.1.1 Global Automotive Lighting Industry and Market

8.1.2 Global Automotive Lighting Supporting System

8.1.3 China Automotive Lighting Industry

8.1.4 China Automotive Lighting OEM System

8.2 LED Automotive Lighting Industry

8.2.1 Global LED Automotive Lighting Market

8.2.2 Automotive Interior LED Lighting

8.2.3 Automotive Exterior LED Lighting

8.2.4 LED Industry Chain

8.2.5 Geographical Distribution of LED Industry

8.2.6 Taiwan LED Industry

8.2.7 LED Industry in Mainland China

8.2.8 White LED Patent

8.3 Automotive Lighting Companies

8.3.1 Hella

8.3.2 Koito

8.3.3 Ichikoh

8.3.4 Stanley

8.3.5 Valeo

8.3.6 Automotive Lighting (Magneti Marelli)

8.3.7 Laster Tech

8.3.8 Others

9 Passenger Car Telematics

9.1 Market Development Status

9.1.1 Market Overview

9.1.2 Business of Main Telematics Brands

9.1.3 Newly-increased Market Size of Telematics in China

9.2 Telematics Business of Joint Ventures in China

9.2.1 Shanghai GM OnStar

9.2.2 Toyota G-BOOK

9.2.3 Honda HondaLink

9.2.4 Volvo SENSUS

9.2.5 Changan Ford SYNC

9.2.6 Dongfeng Nissan CARWINGS

9.2.7 Dongfeng Yueda Kia UVO

9.2.8 Dongfeng Citroen Citroen Connect

9.2.9 Dongfeng Peugeot Blue-i

9.2.10 Mercedes-Benz CONNECT

9.2.11 Beijing Hyundai Blue Link

9.2.12 BMW Brilliance ConnectedDrive

9.3 Telematics Business of Local Companies in China

9.3.1 SAIC inkaNet

9.3.2 Changan in Call

9.3.3 Geely G-NetLink

9.3.4 Chery Cloudrive

9.4 TSP of Chinese Passenger Car Market

9.4.1 Chinatsp

9.4.2 PATEO

9.4.3 TimaNetworks

9.4.4 NavInfo

9.4.5 WirelessCar

9.4.6 HUGHES Telematics

9.4.7 YesWay

9.4.8 Carsmart

图:2003-2014年中国汽车制造企业数量及同比增长

图:2003-2014年中国汽车制造行业收入及同比增长

图:2003-2014年中国汽车制造行业利润总额及同比增长

图:2003-2014年中国汽车制造行业毛利率

表:2009-2017年中国汽车产销量(分乘用车和商用车)

图:2007-2017年中国汽车保有量及同比增长

表:2005-2017年中国乘用车产量,同比增长及在汽车产量中占比

图:2008-2013年中国乘用车市场各车型销量份额

图:2008-2017年中国乘用车各车型销量份额

表:2008-2013年中国乘用车销量Top10生产商

表:2009-2017年中国客车产量(分车型)

表:2009-2017年中国客车销量(分车型)

表:2012-2013年中国客车产销量Top10生产商(分车型)

表:2009-2017年中国货车产量(分车型)

表:2009-2017年中国货车销量(分车型)

表:2012-2013年中国货车产销量Top10生产商(分车型)

图:本研究报告涉及范围

表:2003-2013年全球汽车电子市场规模

表:汽车电子细分市场生命周期表

表:2005-2013年中国汽车电子市场规模

图:车联网产业链

表:中国汽车市场主要Telematics品牌配套情况

表:主要Telematics品牌安全防护功能对比

图:Models for Basic ITS Elements

图:2014-2030智能汽车产业链市场规模

表:汽车智能化进程三阶段情况

图:智能驾驶的三种方案

图:高级驾驶辅助系统(ADAS)种类

图:典型气囊电子结构

表:2009-2013年全球主要汽车安全系统厂家收入排名

图:2008-2016年全球汽车安全系统市场规模

图:2013、2016年全球汽车安全系统市场细分(按产品)

图:2012-2017汽车前\Chest\Head气囊在中国\印度\南美的渗透率

图:2013、2016年全球汽车安全系统市场地域分布

图:2008-2015年中国乘用车气囊市场规模

图:2008-2015年中国乘用车气囊配置趋势

图:Autoliv In Numbers

图:Autoliv Milestone

图:Autoliv汽车安全系统产品

图:2010-2014年Autoliv营业收入&营业利润

图:2010-2014H1 Autoliv毛利率

图:2010-2014奥托立夫收入与净利润率

图:Autoliv全球工厂分布

图:2011-2014年Autoliv(分产品)营收占比

图:2009-2013年奥托立夫各项产品产量

图:2012年1季度-2014年2季度奥托立夫各项产品产量

图:2009-2013年Autoliv(分地区)营收占比

图:Autoliv成本结构及变化

图:2011-2013年Autoliv销售占比超过10%的客户

图:2013年Autoliv主要客户及销售占比

图:2013 Autoliv 在汽车安全各子市场的份额

图:2013年奥托立夫Contributing Models

图:2014年奥托立夫Contributing Models

图:Autoliv在中国的组织架构

图:2000-2014年Autoliv 在中国的员工人数

图:2000-2013年Autoliv中国销售额

图:Autoliv 在中国的发展里程碑

图:Autoliv在中国的业务布局

图:奥托立夫在中国的客户分布

图:FY2006-FY2015 高田收入与营业利润率

图:FY2006-FY2014高田收入产品分布

图:FY2009-FY2014高田收入地域分布

图:FY2009-FY2014高田营业利润地域分布

表:FY2008-FY2014高田的客户分布

图:FY2011-FY2014高田收入分布(分国家)

图:FY2007-FY2015 高田研发经费投入

图:2004-2014年天合收入与营业利润率

图:2013年天合(分产品)收入结构

图:2013年天合客户分布

图:2013年TRW欧洲区客户分布

图:2013年天合(分地区)收入结构

图:2009-2014年天合富奥汽车安全系统(长春)有限公司收入与营业利润

图:2006-2015财年丰田合成收入与营业利润率

图:2006-2014财年丰田合成(分产品)收入结构

图:2006-2014财年丰田合成(分地区)收入结构

图:2006-2014财年丰田合成亚太地区收入与营业利润率

图:2009-2015财年丰田合成研发经费所占比率

图:FY2005-FY2014东海理化收入与营业利润率

图:FY2008-FY2014 东海理化(分产品)收入结构

图:FY2009-FY2013东海理化(分地区)收入结构

图:FY2009-FY2014东海理化(主要客户)收入结构

图:FY2011-FY2014东海理化(除丰田外客户)收入结构

图:FY2006-FY2015 Nihon Plast富拉司特收入与营业利润率

图:FY2005-FY2014富拉司特(按产品)收入结构

图:FY2005-FY2014富拉司特(按地区)收入结构

图:FY2010-FY2014富拉司特(按地区)营业利润构成

图:FY2008-FY2014富拉司特客户结构

图:2006-2014年锦恒汽车安全营收与毛利(单位:亿港元)

图:2011-2014Q2锦恒汽车安全(按产品)收入结构(单位:港元)

图:2005-2014年现代摩比斯收入与营业利润率

图:2005-2014财年大赛璐收入与营业利润率

图:2008-2015财年大赛璐收入部门分布

图:2009-2015财年大赛璐利润部门分布

图:2007-2014年TTE收入与运营利润率

图:2012年7月-2014年7月TTE月度收入与增幅

表:天津市益中汽车安全带厂主要客户

图:FLIR System概况

图:2003-2013年FLIR System收入

图:2013年FLIR System(分部门)收入构成

表:轮胎气压与油耗关系

表:全球主要国家强制安装TPMS的法规

图:全球TPMS发展历程

图:2008-2017年全球TPMS OEM市场规模及装配率

图:2014、2017年全球TPMS OEM需求分布

图:2013年全球主要TPMS企业市场占有率

表:全球主要TPMS生产商与汽车制造商配套关系

图:2008-2017年美国TPMS OEM市场规模

图:2008-2017年欧盟TPMS OEM市场规模

图:2008-2017年日本TPMS OEM市场规模

图:2008-2017年韩国TPMS OEM市场规模

表:中国TPMS工作温度标准

表:中国TPMS压力测量误差标准

表:2014年中国TPMS覆盖率

表:中国已标配TPMS的部分车型

图:2014年中国标配TPMS的乘用车车型比例

表:2014年中国各类型乘用车TPMS覆盖率

图:2014年中国标配TPMS的乘用车系别比例

表:2014年中国各系别乘用车TPMS覆盖率

图:2014年中国在售自主品牌乘用车TPMS覆盖率(分品牌)

图:2008-2017年中国TPMS OEM市场规模

图:2008-2017年中国TPMS装配率

表:Schrader TPMS产品配套厂商及车型

图:2009-2013年大陆集团员工人数

图:2009-2014年Continental营业收入&EBIT

图:2008-2013年大陆集团分部门营收占比

图:2008-2013年大陆集团分地区营收占比

表:Continental TPMS产品配套厂商及车型

表:TRW TPMS产品配套厂商及车型

表:2013年TRW在华销售额

表:Beru TPMS主要配置参数

表:Beru TPMS产品配套厂商及车型

图:2010-2013年李尔集团经营指标

表:2010-2014财年Omron财务指标

图:2013财年Omron销售额分布(分部门)

表:Omron TPMS产品配套厂商及车型

图:FY2010-2014 Omron在华销售额

图:FY2009-2013 Pacific Industrial销售额及利润

图:FY2013 Pacific Industrial销售额分布(分业务)

图:FY2013 Pacific Industrial销售额分布(分区域)

表:Pacific Industrial TPMS产品配套厂商及车型

表:Pacific Industrial在华据点

图:2009-2013财年电装员工人数

图:FY2013-2015电装销售额及利润

图:FY2011-FY2015年Denso营业利润&净利润

图:FY2011-FY2015Q1Denso分部门营收占比

表:FY2011-FY2015Q1Denso分部门销售收入

图:FY2013-2015电装各地区销售额及运营利润

图:FY2010-FY2014年Denso(分客户)销售收入

图:FY2013-2014电装客户结构

表:Denso TPMS产品配套厂商及车型

表:电装在华企业分布

图:2009-2013年罗伯特博世员工人数

图:2009-2013年Bosch营业收入&EBIT

图:2012-2013年Bosch分部门营收占比

图:2012-2013年Bosch汽车部门销售收入&EBIT

图:2012-2013年Bosch分地区营收占比

表:Bosch TPMS产品配套厂商及车型

表:2012-2013年博世在主要国家销售额

表:FY2011-2015日立汽车系统营业收入

表:Hitachi Automotive Systems TPMS产品配套厂商及车型

表:日立汽车系统在华分布

图:凯源科技技术来源

表:胎安特TPMS产品性能

表:保隆科技产品销售网络

表:保隆科技主要客户

表:铁将军经销网络

表:上海泰好TPMS系列产品

表:上海泰好TPMS主要配置

图:奥图科技TPMS产品系列

表:奥图科技TPMS产品指标

表:驶安特主要客户

表:驶安特销售网络

图:诺丽电子TPMS产品

表:2011-2014年车王电子经营指标

图:2012-2013年车王电子营业收入结构(分产品)

图:福尔达员工分布

图:福尔达产品分布

图:天海集团主要业务及生产基地分布

图:惠州华阳业务

表:科安电子TPMS主要配置

表:2013年全球十大汽车MEMS供应商排名

图:2009-2013年GE营业收入及利润

图:2009-2013年GE工业部门各类产品营业收入及利润

图:2013年英飞凌三大业务全球排名

表:FY2012-2013年英飞凌(分部门)收入

表:FY2012-2013英飞凌(分地区)收入

图:2010-2014H1 Freescale营业收入及净利润

图:2010-2014H1 Freescale毛利率

图:2011-2014年 Freescale分产品营收占比

图:2013年 Freescale分地区营收占比

表:各地区主动安全相关法规&机构标准

图:欧洲NCAP各领域权重系数

图:高级驾驶辅助系统(ADAS)种类

表:主要ADAS系统的功能

表:主要ADAS系统技术方案

图:摄像头对道路标记线的识别

图:车道偏离时报警示意图

图:2012年获得欧洲NCAP “Advanced”奖的车道保持辅助系统

图:全景泊车系统的显示

图:智能泊车工作过程

图:有无刹车辅助系统的制动效果对比

图:2012年获得欧洲NCAP “Advanced”奖的自动紧急制动系统

图:主动防碰撞系统工作过程

图:ACC系统的工作过程

图:夜视系统夜间视野范围对比

图:开启夜视系统时的中控显示屏

图:夜视系统侦测到行人时的投影

图:基于面部特征的疲劳监测

图:基于车辆实时轨迹的疲劳监测

图:中日德美驾驶员中曾发生过交通事故的比例

图:车主调查:增加的交通量加重驾驶压力

图:车主调查:ADAS系统的接受度

图:2011-2017年全球ADAS市场规模

图:2010-2016E全球主要ADAS系统渗透率

图:2013年全球(分地区)ADAS装配率

图:2010-2019E全球ADAS用传感器需求量

图:2010-2019E全球ADAS用半导体器件市场规模

表:主要整车厂车道偏离预警/辅助系统配置情况

表:主要整车厂泊车辅助/智能泊车系统配置情况

表:主要整车厂预防碰撞系统(带主动制动)配置情况

表:主要整车厂自适应巡航系统配置情况

表:主要整车厂夜视系统配置情况

表:配置超过3个系统的车型(LDW、泊车辅助、主动制动、ACC、夜视)

图:全球基于传感器的ADAS主要系统集成商

图:欧洲地区ADAS集成商前三名及市场份额

图:北美地区ADAS集成商前三名及市场份额

图:亚太地区ADAS集成商前三名及市场份额

图:全球ADAS集成商前五名及市场份额

图:2012-2017China ADAS Market Revenue Growth Rate

表:2014年中国标配并线辅助系统(LCA)比例最高的前五名OEM

表:2014年中国可配并线辅助系统(LCA)比例最高的前五名OEM

表:2014年中国标配泊车辅助系统比例最高的前五名OEM

表:2014年中国可配泊车辅助系统比例最高的前五名OEM

表:2014年中国标配车道偏离预警系统(LDWS)比例最高的前五名OEM

表:2014年中国可配车道偏离预警系统(LDWS)比例最高的前五名OEM

表:2014年中国标配主动制动系统(Active Braking)比例最高的前五名OEM

表:2014年中国可配主动制动系统(Active Braking)比例最高的前五名OEM

表:2014年中国标配自适应巡航系统(ACC)比例最高的前五名OEM

表:2014年中国可配自适应巡航系统(ACC)比例最高的前五名OEM

表:2014年中国配置ADAS的车款数量及进口车款占比

表:2014年中国在售车款中配置各ADAS的比例

图:大众Front Assist系统

图:大众Parking Assist系统

图:大众Lane Assist系统

表:大众各车型ADAS配置情况

图:Audi Pre Sense Front system

图:Audi Adaptive cruise control – sensor anf their detection ranges

图:Audi Park Assist - parking procedure

图:Audi Lane Assist系统

图:Audi Night Vision Assistant

表:Audi各车型ADAS配置情况

表:Porsche各车型ADAS配置情况

表:SEAT& Skoda各车型ADAS配置情况

图:BMW Park Assistant

图:BMW Night Vision

表:BMW各车型ADAS配置情况

表:BMW驾驶辅助主要先进配置

图:Mercedes-Benz Attention Assist illustration

图:Mercedes-Benz Brake Assist Plus and Pre-Safe Brake illustration

图:Mercedes-Benz DISTRONIC PLUS with Steering Assist

表:Mercedes-Benz驾驶辅助主要先进配置

表:Mercedes-Benz各车型ADAS配置情况

表:Volvo驾驶辅助主要先进配置

表:Volvo各车型ADAS配置情况

图:GM车道偏离预警和碰撞预警系统

表:GM各品牌各车型ADAS配置情况

表:GM驾驶辅助主要先进配置

图:Ford Active park assist

表:Ford各车型ADAS配置情况

表:Lincoln各车型ADAS配置情况

表:Ford Motor Company驾驶辅助主要先进配置

图:丰田预防碰撞系统(2012年开发新型)

表:Toyota Motor Corporation驾驶辅助主要先进配置

表:Toyota各车型ADAS配置情况

表:Lexus各车型ADAS配置情况

表:Advanced features of CMBS

图:Honda ADAS Diagram

表:Honda驾驶辅助主要先进配置

表:Honda各车型ADAS配置情况

图:Nissan Forward Emergency Braking System

图:Nissan Distance Control Assist System Configuration

图:Nissan Lane Departure Prevention System Configuration

表:Nissan驾驶辅助主要先进配置

表:Nissan各车型ADAS配置情况

表:Infiniti各车型ADAS配置情况

图:2007-2016E Mobileye ADAS系统装配车型数量

图:2011-2014H1 Mobileye营业收入及净利润

图:2011-2014H1 Mobileye毛利率

表:Mobileye提供的ADAS产品

图:2011-2014H1 Mobileye分部门营业收入

图:2011-2014Q1 Mobileye分部门营业利润

表:Mobileye EyeQ® 组成结构

图:Mobileye前装市场合作厂商及流程

表:2011-2013年Mobileye来自OEM收入中占比超10%的客户

图:2010-2014H1 TI营业收入及净利润

图:2010-2014H1 TI毛利率

图:2010-2014H1 TI分部门营收占比

表:2010-2014H1 TI分部门营业利润

图:2010-2013年 TI分地区营收占比

表:TI产品在汽车领域的应用

图:TI模拟和嵌入式处理器件在ADAS中的应用

图:TI AFE5401

图:Block diagram for TDA2x SoC

图:TDA2x Evaluation Module

图:Renesas三大类产品和应用领域

图:FY2011-FY2015Q1 Renesas营业收入及营业利润

图:FY2011-FY2015Q1 Renesas净利润

图:Renesas的产品和组织改革进程

图:FY2011-FY2015Q1 Renesas半导体部分占总营收比例

图:FY2012-FY2014 Renesas分产品营收占比(半导体部分)

图:FY2012-FY2014 Renesas MCU业务各应用领域销售额

图:FY2012-FY2014 Renesas analog and Power Devices业务各应用领域销售额

图:FY2012-FY2014 Renesas Soc业务各应用领域销售额

图:FY2015Renesas销售数据的统计项变化

图:FY2015Q1 Renesas半导体业务各应用领域销售占比

图:FY2015Q1 Renesas汽车领域各应用销售占比

图:Renesas R-Car V2H SoC

图:Renesas Sensor Fusion框图

表:Renesas ADAS方案推荐产品

图:Renesas ADAS产品路线图

图:freescale ADAS Applications

表:Freescale ADAS MCU的4代产品

图:Freescale 77GHz Radar系统

表:Freescale Radar系统解决方案和目标应用

图:Freescale基于Power Architecture®技术的Qorivva 32位MCU系列

表:Freescale 视觉系统解决方案

图:WABCO产品的两大目标

图:2010-2014H1 WABCO营业收入及营业利润

图:2010-2014H1 WABCO毛利率

图:WABCO全球工厂布局

图:2011年WABCO各细分产品营收占比

图:WABCO分市场类型(by End-Markets)营收占比

图:WABCO分地区营收占比

表:WABCO各类市场的主要客户

表:WABCO ADAS功能的产品

图:WABCO ADAS产品路线图

图:WABCO OptiPace™

图:Autoliv Active Safety发展路径和战略

图:2009-2013年Autoliv Active Safety产品出货量与装配车型数量

表:Autoliv Active Safety主要客户

图:2009-2013年Autoliv Active Safety产品销售额

图:Autolive主动安全系统支持功能

表:Autolive主动安全系统产品系列和应用

图:Autoliv夜视系统Dynamic Spot Light功能

图:2011-2013年Continental底盘与安全事业部销售收入

图:2013-2018年Continental细分行业销售复合增长率

图:2011-2014年Continental ADAS产品销售量与增长率

表:Continental ADAS全球生产基地&研发中心

表:大陆集团自动驾驶路线图

图:ContiGuard集成主、被动安全系统功能

图:Continental集成安全算法

表:Bosch汽车底盘控制系统部门产品

图:Bosch紧急制动系统(2个类型)

表:Bosch驾驶员疲劳监测系统

表:Bosch ACC系统(2个类型)

表:Bosch传感器系统&ADAS应用

图:2011-2013年德尔福员工人数

图:2004-2014年德尔福收入与毛利率

图:2007-2014年德尔福收入与运营利润率

图:2007-2013年德尔福收入与EBITDA率

图:2012-2014年Delphi分部门营收占比

表:2010-2013年德尔福(分部门)毛利率

图:2013-2016年Delphi各部门主要增长领域

表:2010-2013年德尔福(分地区)营业收入

图:Delphi主要客户及区域分布

图:2012-2013年德尔福前五名客户及收入贡献率

图:Delphi安全和主动安全产品5年CAGR预测

图:截至2013年Delphi主动安全产品的客户

表:Delphi传感器系统&ADAS应用

图:Delphi集成安全和联网技术的方案

图:Delphi实现智能驾驶的路线

图:Denso驾驶安全技术路线

图:Denso驾驶员状态监测系统

图:Denso车道辅助系统

图:Denso Pre-Crash Safety System

表:Delphi传感器系统&ADAS应用

图:各驾驶状态Denso提供的安全功能和产品

图:Denso三个等级(入门、标准、高级)的ADAS产品包

图:IVI典型框架图

图:IVI典型指标

图:2011-2018年全球IVI市场规模

图:2011-2018年全球IVI出货量

图:2011-2018年全球IVI普及率

图:2009-2018年全球汽车连接服务、TSP、Telecom、硬件市场规模

图:2009-2018年全球汽车连接服务设备出货量

图:2013、2018全球具备Connectivity功能汽车出货量地域分布

表:2012-2013年全球主要IVI厂家收入排名

图:2011-2016年中国IVI出货量

图:2013年中国IVI OEM市场主要厂家市场占有率

图:2007-2015年全球嵌入式汽车导航市场规模

图:2007-2015年全球嵌入式汽车导航系统出货量

图:2013年丰田汽车导航主要供应厂家供应比例

图:2013年本田汽车导航主要供应厂家供应比例

图:2013年日产汽车导航主要供应厂家供应比例

图:2013年通用汽车导航主要供应厂家供应比例

图:2013年福特汽车导航主要供应厂家供应比例

图:2013年大众汽车导航主要供应厂家供应比例

图:2013年宝马汽车导航主要供应厂家供应比例

图:2013年奔驰汽车导航主要供应厂家供应比例

图:2013年现代汽车导航主要供应厂家供应比例

图:2014年1-8月中国汽车市场GPS导航系统预装量

图:2014年1-8月中国汽车市场GPS导航系统渗透率

图:汽车音响系统产业链

表:汽车音响系统产业链厂家介绍

图:2013年丰田汽车音响系统主要供应厂家供应比例

图:2013年本田汽车音响系统主要供应厂家供应比例

图:2013年日产汽车音响系统主要供应厂家供应比例

图:2013年通用汽车音响系统主要供应厂家供应比例

图:2013年福特汽车音响系统主要供应厂家供应比例

图:2013年大众汽车音响系统主要供应厂家供应比例

图:2013年宝马汽车音响系统主要供应厂家供应比例

图:2012年奔驰汽车音响系统主要供应厂家供应比例

图:2013年现代汽车音响系统主要供应厂家供应比例

图:2013年PSA汽车音响系统主要供应厂家供应比例

表:中国汽车音响厂家与整车厂家配套状况

图:2013年中国前装(OE)汽车音响主要厂家市场占有率

图:2004-2014财年哈曼国际收入与营业利润率

图:2012财年1季度-2014财年3季度销售额与EBITDA Margin

图:2010-2016财年Harman收入业务分布

图:2010-2014财年哈曼国际各部门毛利率

图:2006-2013财年哈曼国际地域收入分布

图:2008-2014财年哈曼国际客户结构比例

图:2009-2013财年HARMAN Infotainment 与Car Audio收入情况

图:2009-2014财年Harman中国区收入

图:Harman的CAR ADUIO主要客户

图:HARMAN全球制造基地一览

图:大陆汽车Interior全球分布

图:2007-2014年Continental Automotive Interior 收入与营业利润率

图:2006-2014财年先锋收入与营业利润率

图:2007-2015财年先锋收入部门分布

图:2007-2015财年先锋汽车电子部门收入与营业利润率

图:2012-2015财年Pioneer收入地域分布

图:先锋汽车电子在新兴市场销售计划

图:先锋全球车载音响生产基地产能统计

图:先锋汽车音响在中国的组织结构

图:2006-2014财年阿尔派收入与营业利润率

图:2012-2014财年Alpine收入业务分布

图:2006-2014财年阿尔派汽车音响部门收入与营业利润率

图:2005-2014财年阿尔派Information &Communication 收入与营业利润率

图:2005-2013财年阿尔派地域收入分布

图:2014财年Alpine收入地域分布

图:2006-2014财年歌乐收入与营业利润率

图:2009-2014财年歌乐收入地域分布

图:Clarion生产基地分布

图:歌乐中国组织结构

图:2013年Visteon汽车电子业务收入产品分布

图:2013年Visteon汽车电子业务收入地域分布

图:2013年Visteon汽车电子业务收入客户分布

图:合并前后的组织结构

图:合并前后收入地域分布

图:YFV 组织结构

图:延锋伟世通电子的组织结构

图:延峰伟士通中国分布

图:YFV电子事业部生产基地分布

图:YFV电子事业部Key Event

图:航盛Vehicle Infotainment产品

图:PAS主要客户

图:2005-2014财年富士通天收入与营业利润率统计

图:2005-2013财年FujitsuTen收入部门分布

图:2007-2014财年Aisin收入与营业利润率

图:FY2013-2014爱信主要客户

图:2007-2015财年Aisin AW收入与营业利润

表:2008-2014财年爱信精机导航仪产量

图:好帮手电子有限公司组织结构

图:2009-2014财年JVC建伍收入与营业利润

图:2008-2013财年JVC建伍收入部门分布

图:2008-2015财年JVC建伍汽车电子收入

图:2007-2014年Garmin销售额与营业利润率

图:2009-2014年H1 Garmin销售额业务分布

图:2009-2013年Garmin营业利润业务分布

图:2009-2013年 Garmin销售额地域分布

图:手动变速器的挡位

表:手动变速器和自动变速器的优缺点

表:四种自动变速器主要生产厂商和技术对比

表:中国汽车变速器行业主要政策

图:2007-2016年中国自动变速器市场规模

表:全球主要汽车品牌的自动变速器搭载情况

表:中国主要中高级乘用车的自动变速器搭载情况

表:主要自主品牌中高级乘用车的自动变速器搭载情况

表:2012年中国大陆厂商自动变速器的研发类型统计

图:2012年中国自动变速器自主研发类型分布

表:自动变速器自主研发的前景分析

表:各种类型自动变速器的国产途径

图:2007-2016年中国乘用车变速器市场规模

图:2006-2015年中国乘用车自动及手动变速器市场比例

图:2007-2016年中国乘用车自动变速器市场规模

图:2015年中国乘用车自动变速器各种自动变速器产能占比

表:2013年中国乘用车各类自动变速器已有及在建产能

表:中国外资自动变速器企业在华主要配套企业及车型

图:中外乘用车自动变速器配套比例

图:2007-2016年中国商用车变速器市场规模

图:2007-2016年中国重卡变速器市场规模

表:中国主要重卡企业变速器内部供应情况

图:2007-2016年中国中卡变速器市场规模

表:中国主要中卡生产企业变速器来源情况

图:2007-2016年中国轻卡变速器市场规模

表:中国主要商用车变速器生产企业

表:主要商用车变速器配套企业

表:2012年中国商用车自动变速器主要在建产能

表:FY2010-2012 加特可营业收入、运营利润及净利润

表:加特可生产基地

表:加特可海外工厂

图:FY2011-2014爱信变速器产量

图:FY2010-2014 Aisin AI销售额及运营利润

图:2004-2014年博格华纳销售额

表:2010-2012年博格华纳两大部门销售额

图:2013年博格华纳主要客户

表:2010-2012年采埃孚各地区及各部门销售额

表:2012年采埃孚各项产品销售额

图:2010-2012年格特拉克销量

图:2010-2012年格特拉克销售额

图:2010-2012年格特拉克员工数量

表:2008-2013年舍弗勒销售额及EBIT

图:2012-2013年舍弗勒销售额结构

图:舍弗勒汽车行业主要客户

图:Magneti Marelli全球分布

图:2006-2013年Magneti Marelli收入与Trading Profit率

图:2013年Magneti Marelli收入产品分布

表:2011-2012年Oerlikon Graziano经营业绩

图:2011-2012年Oerlikon Graziano营业收入结构(分地区)

表:2011-2012年大陆集团Powertrain部门销售额、EBIT及员工数量

表:2006-2013年重庆青山手动变速箱总成产销量及配套车型

表:2006-2013年法士特手动变速箱总成产销量及配套车型

图:2007-2016年万里扬营业收入及毛利率

表:2012-2013年万里扬主要产品营业收入及毛利率

表:万里扬主要变速器子公司及2012年销售收入、净利润

表:2011-2013年山东蒙沃总资产、净资产及净利润

图:2008-2016年山东蒙沃销售收入

表:2006-2012年山东临工手动变速箱总成产销量及配套车型

表:2006-2012年安徽星瑞齿轮传动有限公司手动变速箱总成产销量及配套车型

图:2008-2016年吉利集团营业额及毛利率

图:2009-2016年吉利集团变速箱业务营业额

表:吉利集团下属变速器厂商

表:吉利集团搭载自动变速箱的车型

表:奇瑞汽车搭载CVT的车型

表:2006-2012年大同齿轮手动变速箱总成产销量

表:2006-2011年綦江齿轮传动有限公司手动变速箱总成产销量及配套车型

表:2008-2012年大众汽车变速器(上海)资产、负债及营业收入

表:2006-2012年大众汽车变速器(上海)手动变速箱总成产销量及配套车型

图:2006-2013年唐山爱信齿轮有限公司变速器销量

图:2006-2013年唐山爱信齿轮有限公司销售收入

图:加特可(广州)发展历程

表:2011-2012年上海通用东岳动力总成有限公司变速箱产销量

表:2007-2012年格特拉克(江西)手动变速箱总成产销量及配套车型

表:2008年格特拉克赣州工厂营业指标

表:2008年格特拉克于都工厂营业指标

表:杭州依维柯汽车变速器有限公司主要客户

表:杭州依维柯汽车变速器有限公司主要变速器产品

表:2011-2012年杭州依维柯手动变速箱总成产销量及配套车型

表:2006-2009年东安三菱手动变速箱总成产销量及配套车型

表:东安三菱主要产品及其理论产能

表:2008-2012年上海汽车变速器有限公司手动变速箱总成产销量及配套车型

表:2008-2010年沈阳上汽金杯汽车变速器有限公司手动变速箱总成产销量及配套车型

表:2009-2012年山东上汽汽车变速器有限公司手动变速箱总成产销量及配套车型

表:2010-2012年柳州上汽手动变速箱总成产销量及配套车型

表:2009-2010年上海采埃孚营业指标

表:2008-2009年采埃孚传动技术(杭州)有限公司经营指标

表:2008-2009年采埃孚传动技术(苏州)有限公司经营指标

图:采埃孚传动技术(苏州)有限公司主要客户

图:电控燃油喷射系统构成

表:2011-2017年中国车用电喷系统需求量

表:2010-2014年中国电控燃油喷射装置进口数量及金额

表:2013年中国电控燃油喷射装置主要进口来源国

表:2014年1-5月中国电控燃油喷射装置主要进口来源国

表:2010-2014年中国电控燃油喷射装置出口数量及金额

表:2013年中国电控燃油喷射装置主要出口目的地

表:2014年1-5月中国电控燃油喷射装置主要出口目的地

表:中国汽车电控燃油喷射系统主要供应商及配套客户

图:2008-2017年中国汽油电喷OEM市场规模

表:2012-2017年中国汽油喷射市场结构

表:2012-2017年中国GDi OEM市场规模

表:中国汽油电子喷射主要厂商配套关系

表:2011-2017年中国柴油高压共轨市场规模

表:2011-2017年中国柴油非高压共轨市场规模

表:2011-2017年中国中重型及轻型柴油电控高压共轨市场比重

图:中国主要企业柴油电喷市场份额

表:中国主要企业燃油喷射系统配套关系

表:博世燃油喷射系统主要产品

表:博世在中国及东盟地区燃油喷射系统主要配套车型

表:博世在欧美地区燃油喷射系统主要配套车型

表:博世在日本地区燃油喷射系统主要配套车型

表:2012-2013年博世在主要国家销售额

表:博世汽柴股权比例

表:2009-2013年博世汽柴资产、营业收入及净利润

表:2007-2013年博世汽柴高压共轨销量

表:2009-2013年联合汽车电子有限公司资产、负债及营业收入

表:德尔福燃油喷射系统主要配套车型

表:2011-2013年福尔福在华销售额

表:德尔福在华燃油系统生产基地

表:电装在东盟地区燃油喷射系统主要配套车型

表:电装在欧美地区燃油喷射系统主要配套车型

表:电装在日本地区燃油喷射系统主要配套车型

表:电装在华企业分布

图:2008-2013年法雷奥员工人数

图:2005-2014年法雷奥收入与毛利率

图:2009-2014年H1法雷奥(分部门)营业收入

图:2012-2014年H1法雷奥 (分部门) EBITDA

表:2009-2013年法雷奥(分市场)主营收入

图:2007-2014H1 法雷奥(按地区)客户分布情况

表:法雷奥燃油喷射系统主要配套车型

表:大陆集团燃油喷射系统主要产品

表:大陆集团燃油喷射系统主要配套车型

表:大陆集团在华业务分布

图:2010-2014财年京滨营业收入,净利润和毛利率

表:2010-2014财年京滨(分部门)营业收入

表:2010-2014财年京滨(分产品)营业收入

表:2011-2013财年京滨(分地区)营业收入

表:2009-2014财年京滨主要产品销量

表:京滨燃油喷射系统主要配套车型

表:京滨在华分布

表:马瑞利燃油喷射系统主要配套车型

表:马瑞利在华公司分布

表:Hirschvogel燃油喷射系统主要配套车型

图:2009-2013年威孚高科员工人数

表:2014年威孚高科收入、利润及毛利率

图:2009-2013年威孚高科营业收入,净利润和毛利率

表:2009-2013年威孚高科(分地区)营业收入

表:2010-2013年威孚高科(分业务)营业收入

表:2012-2013年威孚高科各项产品产销量

图:2010-2013年威孚高科燃油喷射系统营业收入及毛利率

表:2013年威孚高科从事燃油喷射业务的子公司

表:2014-2017年威孚高科各项业务营业收入及毛利率

表:2010-2012年亚新科天纬各类产品产量

表:2010-2012年亚新科天纬营业收入

图:2010-2016年全球汽车照明市场规模

图:2013年丰田汽车照明系统主要供应商供应比例

图:2013年本田汽车照明系统主要供应商供应比例

图:2013年日产雷诺汽车照明系统主要供应商供应比例

图:2013年通用汽车照明系统主要供应商供应比例

图:2013年福特汽车照明系统主要供应商供应比例

图:2013年大众汽车照明系统主要供应商供应比例

图:2013年现代汽车照明系统主要供应商供应比例

图:2013年中国轿车照明主要厂家市场占有率

表:2013年中国车灯前20强收入(单位:亿元)

图:2014年小糸制造所客户分布

表:中国车灯厂家主要客户

图:2010-2016年全球LED汽车照明市场规模(单位:百万美元)

表:2012-2014年全球前30大LED厂家收入排名

图:2013、2014年全球LED 产值地域分布

图:台湾LED企业关系图

表:台湾LED 厂家2012-2014年营业利润率

图:1899-2014 Hella Milestone

图:2007-2014财年HELLA收入与EBIT

图:HELLA组织结构

图:FY2010-FY2014 HELLA收入部门分布

图:2007-2012财年HELLA收入地域分布

图:2013-2014财年HELLA收入地域分布

图:Hella员工数量全球分布

图:HELLA Regional market coverage by end customers FY 2013-2014

图:FY2006-FY2015小糸收入与运营利润率

图:2008-2013财年小糸收入地域分布

图:小糸车灯有限公司主要配套车型

图:上海小糸车灯有限公司2004-2013年收入与运营利润率

图:FY2006-FY2014年Ichikoh收入与运营利润率

图:2007-2012财年市光收入地域分布

图:市光工业全球机构分布

图:市光工业日本机构分布

图:市光主要配套车型

图:斯坦雷主要产品

图:FY2006-FY2015斯坦雷收入与运营利润率

表:FY2010-FY2014 Stanley资产与负债

图:FY2006-FY2014斯坦雷汽车照明事业部收入与运营利润率

图:FY2008-FY2014斯坦雷(Stanley)收入地域分布

图:2004-2013年广州斯坦雷收入与运营利润率

图:使用Automotive Lighting车灯的车

图:丽清公司结构

图:2008-2014年丽清科技收入与毛利率

图:2012年8月-2014年8月丽清科技月度收入

图:2011-2013年丽清科技收入业务分布

图:丽清产品实例

图:2012年1季度-2014年2季度OSRAM季度收入与EBITA Margin

图:2012-2014年OSRAM收入部门分布

图:2012-2014年OSRAM EBITA部门分布

图:2012-2014年OSRAM收入地域分布

图:OS部门主要产品

表:2012年2季度-2014年2季度Osram SP事业部收入与EBIT

表:2012年2季度-2014年2季度Osram OS事业部收入与EBIT

图:2008-2014年三立收入与运营利润率

图:2010-2014年三立收入产品分布

图:2013财年Varroc收入产品分布

图:伟世通汽车照明部门技术中心全球分布

图:伟世通汽车照明部门生产基地全球分布

图:FY2011-FY2014 Fiem Revenue and Profit

图:FY2014 Revenue Product Mix

图:Fiem Manufacturing Unit

图:Fiem Major Clients

图:Fiem主要产品

图:ZKW组织结构

图:2014年ZKW员工地域分布

图:2005-2014年堤维西收入与运营利润率

图:2012年8月-2014年8月堤维西月度收入与增幅

表:2013年堤维西大陆子公司财务状况

图:2006-2014年帝宝收入与运营利润率

图:2012年8月-2014年8月帝宝工业月度收入

图:2009-2012帝宝收入地域分布

图:2003-2014年大亿交通收入与运营利润率

图:2012年8月-2014年8月大亿交通月度收入与增幅

图:大亿集团企业分布

表:大亿交通客户

图:常州星宇股权结构

表:常州星宇2012-2013年产量

图:2007-2014年常州星宇收入与运营利润率

图:常州星宇产品配套情况

图:2007-2012年常州星宇客户结构

图:2012年常州星宇员工岗位分布

图:江苏彤明车灯主要客户

表:中国汽车市场主要Telematics品牌配套情况

表:主要Telematics品牌安全防护功能对比

表:主要Telematics品牌导航功能对比

表:主要Telematics品牌互联娱乐功能对比

表:主要Telematics品牌资费对比

图:2014年1-8月中国乘用车市场主要Telematics品牌预装量(单位:套)

表:安吉星的配套车型及销量

表:安吉星服务介绍

图:安吉星套餐资费情况

图:2014年1-8月中国乘用车市场安吉星新增用户数

表:OnStar发展历程

图:安吉星通信技术路线

表:MyLink 2.0主要功能与参数

表:MyLink智能车载互联系统的配套车型及销量

表:IntelliLink智能车载交互系统的配套车型及销量

表:G-BOOK的配套车型及销量

表:手机连接G-BOOK与DCM连接G-BOOK服务对比

图:2014年1-8月中国市场G-BOOK新增用户数(单位:户)

表:HondaLink的配套车型及销量

表:HondaLink主要功能与服务

图:2014年1-8月中国市场HondaLink新增用户数(单位:户)

表:SENSUS系统的配套车型及销量

表:Sensus Connect功能与服务

表:Volvo On Call功能与服务

表:SYNC的配套车型及销量

表:SYNC功能与服务

图:2014年1-8月中国市场SYNC新增用户数(单位:户)

图:中国市场AppLink2.0平台9款首发应用

表:CARWINGS智行+的配套车型及销量

表:CARWINGS智行+服务与功能

图:2014年1-8月中国市场CARWINGS智行+新增用户数(单位:户)

表:Nismo Watch功能与参数

表:UVO的配套车型及销量

图:UVO系统服务

表:UVO资费情况

图:2014年1-8月中国市场UVO新增用户数(单位:户)

表:Citroën Connect车型配置情况

表:Citroën Connect系统功能与服务

图:2014年1-8月中国市场Citroën Connect新增用户数(单位:户)

表:Blue-i的配套车型及销量

表:Blue-i系统功能与服务

图:2014年1-8月中国市场Blue-i新增用户数(单位:户)

表:Mercedes-Benz CONNECT的配套车型及销量

表:Mercedes-Benz CONNECT服务与功能

图:2014年1-8月中国市场Benz CONNECT新增用户数(单位:户)

表:Blue Link的配套车型及销量

表:BlueLink资费情况

表:Blue Link系统服务

图:2014年1-8月中国市场Blue Link新增用户数(单位:户)

表:ConnectedDrive的配套车型及销量

表:ConnectedDrive功能与服务

图:2014年1-8月中国市场ConnectedDrive新增用户数(单位:户)

表:inkaNet的配套车型及销量

表:inkaNet功能与服务

表:上汽inkaNet套餐资费情况

图:2014年1-8月中国市场inkaNet新增用户数(单位:户)

表:In Call的配套车型及销量

表:In call系统车型配套及资费

表:G-NetLink的配套车型及销量

表:G-netlink功能与服务

表:Cloudrive的配套车型及销量

表:Cloudrive功能与服务

图:2014年1-8月中国市场Cloudrive新增用户数(单位:户)

图:远特科技产品结构

图:远特科技产品应用

图:一汽D_Partner系统

图:博泰悦臻产品平台体系

图:博泰悦臻产品HMI特点

表:博泰Telematics业务发展概况

图:钛马信息公司结构

表:钛马星云功能与服务

图:2013年中国车载前装导航市场图商份额

图:2013年四维图新分产品收入占比

表:四维图新趣驾(FunDrive)主要功能

图:WirelessCar全球分布

图:WirelessCar中国市场发展历程

图:WirelessCar主要客户

图:休斯车联网发展历程

图:九五智驾客户

图:九五智驾车联网平台架构

表:九五互联服务与配套车型

图:九五智驾手机应用

图:九五智驾合作伙伴

图:2011-2013年九五智驾营业收入、净利润与毛利率

图:2011-2013年九五智驾研发投入及占营收比例

图:乐乘盒子

图:2012-2014H1车网互联营业收入和净利润

Number of Chinese Automobile Manufacturers and YoY Growth, 2003-2014

Revenue and YoY Growth of China Automobile Manufacturing Industry, 2003-2014

Total Profit and YoY Growth of China Automobile Manufacturing Industry, 2003-2014

Gross Margin of China Automobile Manufacturing Industry, 2003-2014

China's Automobile Output and Sales Volume (by Passenger Car and Commercial Vehicle), 2009-2017E

China's Automobile Ownership and YoY Growth, 2007-2017E

China's Passenger Car Output, YoY Growth and % in Total Automobile Output, 2005-2017E

China's Passenger Car Sales Structure by Model, 2008-2013

China's Passenger Car Sales Structure by Model, 2008-2017E

Top 10 Passenger Car Manufacturers in China by Sales Volume, 2008-2013

China's Bus Output (by Model), 2009-2017E

China's Bus Sales Volume (by Model), 2009-2017E

Top 10 Bus Manufacturers in China by Output and Sales Volume (by Model), 2012-2013

China's Truck Output (by Model), 2009-2017E

China's Truck Sales Volume (by Model), 2009-2017E

Top 10 Truck Manufacturers in China by Output and Sales Volume (by Model), 2012-2013

Research Scope of This Report

Global Automotive Electronic Market Size, 2012-2013

Life Cycle of Automotive Electronic Market Segments

China's Automotive Electronic Market Size, 2005-2013

IOV Industry Chain

Supporting of Major Telematics Brands in Chinese Automobile Market

Comparison between Major Telematics Brands in Security and Protection Features

Models for Basic ITS Elements

Market Size of Intelligent Vehicle Industry Chains, 2014-2030E

Three Stages of Automotive Intelligence Process

Three Solutions to Intelligent Driving

Types of ADAS

Electronic Structure of Typical Airbag

Ranking of Major Global Automotive Safety System Companies by Revenue, 2009-2014

Global Automotive Safety System Market Size, 2008-2016E

Global Automotive Safety System Products Distribution, 2013/2016

China/India/South America Auto Frontal/Chest/Head Airbag Penetration, 2012/2015E/2017E

Global Automotive Safety System Market by Region, 2013/2016E

China’s Passenger Vehicle Airbag Market Size, 2008-2015E

China’s Passenger Vehicle Airbag Configuration Trend, 2008-2015E

Autoliv In Numbers

Autoliv Milestone

Automotive Safety System Products of Autoliv

Revenue and Operating Margin of Autoliv, 2010-2014

Gross Margin of Autoliv, 2010-2014H1

Revenue and Net Profit Margin of Autoliv, 2010-2014

Global Presence of Autoliv

Revenue Breakdown of Autoliv by Product, 2011-2014

Output of Autoliv by Product, 2009-2013

Output of Autoliv by Product, 2012Q1-2014Q2

Revenue Breakdown of Autoliv by Region, 2009-2013

Cost Structure of Autoliv

Clients of Autoliv with Revenue Share over 10%, 2011-2013

Autoliv’s Major Customers and Sales Share, 2013

Autoliv’s Share in Automotive Security Market Segments, 2013

Autoliv’s Contributing Models, 2013

Autoliv’s Contributing Models, 2014

Autoliv China Organization

Autoliv China Headcounts Development

Autoliv’s Sales in China, 2000-2013

Autoliv China Milestone

Distribution of Autoliv in China

Customer Distribution of Autoliv in China

Revenue and Operating Margin of Takata, FY2006-FY2015E

Revenue Breakdown of Takata by Product, FY2006-FY2014

Revenue Breakdown of Takata by Region, FY2009-FY2014

Operating Income of Takata by Region, FY2009-FY2014

Customer Distribution of Takata, FY2008-FY2014

Revenue Breakdown of Takata by Country, FY2011-FY2014

Capex of Takata, FY2007-FY2015E

Revenue and Operating Margin of TRW, 2004-2014

Revenue Breakdown of TRW by Product, 2013

Customer Distribution of TRW, 2013

Customer Distribution of TRW in Europe, 2013

Revenue Breakdown of TRW by Region, 2013

Revenue and Operating Income of TRW Fawer Automobile Safety Systems (Changchun), 2009-2014

Revenue and Operating Margin of Toyoda Gosei, FY2006-FY2015E

Revenue Breakdown of Toyoda Gosei by Product, FY2006-FY2014

Revenue Breakdown of Toyoda Gosei by Region, FY2006-FY2014

Revenue and Operating Margin of Toyoda Gosei in Asia-Pacific, FY2006-FY2014

R&D Costs Percentage of Toyoda Gosei, FY2009-FY2015E

Revenue and Operating Margin of Tokai Rika, FY2005-FY2014

Revenue Breakdown of Tokai Rika by Product, FY2008-FY2014

Revenue Breakdown of Tokai Rika by Region, FY2009-FY2013

Revenue Breakdown of Tokai Rika by Customer, FY2009-FY2014

Revenue Breakdown of Tokai Rika by Customer (Except Toyota), FY2011-FY2014

Revenue and Operating Margin of Nihon Plast, FY2006-FY2015E

Revenue Breakdown of Nihon Plast by Product, FY2005-FY2014

Revenue Breakdown of Nihon Plast by Region, FY2005-FY2014

Operating Income Breakdown of Nihon Plast by Region, FY2010-FY2014

Customer Distribution of Nihon Plast, FY2008-FY2014

Revenue and Gross Profit of Jinheng Automotive Safety Technology Holdings, 2006-2014

Revenue Breakdown of Jinheng Automotive Safety Technology Holdings by Product, 2011-2014Q2

Revenue and Operating Margin of MOBIS, 2005-2014

Revenue and Operating Margin of Daicel, FY2005-FY2014

Revenue Breakdown of Daicel by Department, FY2008-FY2015E

Profit Breakdown of Daicel by Department, FY2009-FY2015E

Revenue and Operating Margin of TTE, 2007-2014

Monthly Revenue and Growth Rate of TTE, Jul 2012- Jul 2014

Major Customers of Tianjin Yizhong Vehicle Safety Belt Factory

Overview of FLIR System

Revenue of FLIR System, 2003-2013

Revenue Structure of FLIR System (by Division), 2013

Relationship between Tire Pressure & Fuel Consumption

Laws and Regulations on the Enforced Installation of TPMS in Major Countries Worldwide

Development Course of TPMS in the World

Global OEM TPMS Market Size and Assembly Rate, 2008-2017E

Global OEM TPMS Demand Distribution, 2014 vs 2017E

Market Share of Major TPMS Enterprises in the World, 2013

Relationship between Major TPMS Producers and Automobile Manufacturers in the World

OEM TPMS Market Size of the United States, 2008-2017E

OEM TPMS Market Size of European Union, 2008-2017E

OEM TPMS Market Size of Japan, 2008-2017E

OEM TPMS Market Size of South Korea, 2008-2017E

TPMS Operating Temperature Standard in China

TPMS Pressure Measurement Error Standard in China

China’s TPMS Coverage Rate, 2014

Some Vehicle Models Installed with TPMS in China

Proportion of Passenger Car Models Installed with TPMS as Standard Configuration in China, 2014

TPMS Coverage Rate by Passenger Car Model in China, 2014

Proportion of Passenger Car Series Installed with TPMS as Standard Configuration in China, 2014

TPMS Coverage Rate of Passenger Cars by Series in China, 2014

TPMS Coverage Rate of Available Independent Brand Passenger Cars (by Brand) in China, 2014

OEM TPMS Market Size in China, 2005-2012

TPMS Assembly Rate in China, 2008-2017E

TPMS Clients and Vehicle Models Served by Schrader

Number of Employees in Continental, 2009-2013

Revenue &EBIT of Continental, 2009-2014

Revenue of Continental by Division, 2009-2013

Revenue of Continental by Region, 2009-2013

TPMS Clients and Vehicle Models Served by Continental

TRW’s Revenue in China, 2013

TPMS Clients and Vehicle Models Served by TRW

Major Configuration Parameters of Beru’s TPMS

TPMS Clients and Vehicle Models Served by Beru

Lear’s Operational Indicators, 2010-2013

TPMS Clients and Vehicle Models Served by Lear

Omron’s Financial Indicators, FY2010-FY2014

Omron’s Revenue (by Division), FY2013

Omron’s Revenue in China, FY2010-FY2014

TPMS Clients and Vehicle Models Served by Omron

Revenue and Profit of Pacific Industrial, FY2009-FY2013

Revenue of Pacific Industrial (by Business), FY2013

Revenue of Pacific Industrial (by Region), FY2013

Branches of Pacific Industrial in China

TPMS Clients and Vehicle Models Served by Pacific Industrial

Number of Employees in Denso, FY2009-FY2013

Denso’s Revenue and Profit, FY2013-FY2015

Denso’s Revenue (by Division), FY2013-FY2014

Denso’s Revenue and Operating Income (by Region), FY2013-FY2015Q1

Denso’s Client Structure, FY2013-FY2014

TPMS Clients and Vehicle Models Served by Denso

Distribution of Denso's Companies in China

Employees of Robert Bosch, 2009-2013

Revenue and EBIT of Bosch, 2009-2013

Revenue of Bosch by Division, 2012-2013

Revenue and EBIT of Bosch’s Automotive Division, 2012-2013

Revenue of Bosch by Region, 2012-2013

TPMS Clients and Vehicle Models Served by Bosch

Bosch’s Revenue in Major Countries, 2012-2013

Revenue of Hitachi Automotive Systems, FY2011-FY2015

TPMS Clients and Vehicle Models Served by Hitachi Automotive Systems

Presence of Hitachi Automotive Systems in China

Technology Source of Kysonix

TPMS Product Performance of SecuTire

Sales Network of Shanghai Baolong Automotive Corporation

Major Clients of Shanghai Baolong Automotive Corporation

Steelmate’s Distribution Network

TPMS Product Series of Shanghai Topsystm

Major Configuration of TPMS of Shanghai Topsystm

TPMS Product Series of Autotech

TPMS Product Indicators of Autotech

Major Clients of Sate Auto

Sales Network of Sate Auto

TPMS Products of Nannar Electronics

Operational Indicators of Mobiletron Electronics, 2011-2014

Revenue of Mobiletron Electronics (by Product), 2012-2013

Fu'erda’s Employee Distribution

Fu'erda’s Product Distribution

Main Business and Production Base Distribution of China Auto Electronics Group Limited

Business of Huizhou Foryou

Major Configuration of Kooan’s TPMS

Global Top Ten Automotive MEMS Suppliers, 2013

GE’s Revenue and Profit, 2008-2012

Revenue and Profit of GE’s Industrial Division by Product, 2009-2013

Infineon’s Global Ranking in Three Businesses, 2013

Infineon’s Revenue (by Division), FY2012-FY2013

Infineon’s Revenue (by Region), FY2012-FY2013

Revenue and Net Income of Freescale, 2010-2014H1

Gross Margin of Freescale, 2010-2014H1

Revenue of Freescale by Product, 2011-2014

Revenue of Freescale by Region, 2011-2014

Regional Active Safety-related Regulations and Standards

Weight Coefficients of Euro NCAP in Various Fields

Types of ADAS

Functions of Main ADAS Systems

Technological Solutions of Main ADAS Systems

Camera Recognition of Road Marking Lines

Schematic Diagram of Lane Deviation Warning

Lane Keeping Assist System awarded with Euro NCAP Advanced, 2012

Display of Panoramic Parking System

Working Process of Intelligent Parking

Comparison between Braking Effect with and without Brake Assist System

Automatic Emergency Braking System awarded with Euro NCAP Advanced, 2012

Working Process of Active Anti-collision System

Working Process of ACC System

Night Vision Scope Comparison of Night Vision System

Central Control Display When Night Vision System Starts Up

Projection of Night Vision System When Detecting Pedestrians

Fatigue Monitoring Based on Facial Features

Fatigue Monitoring Based on Real-time Vehicle Trajectory

Percentage of Drivers with Traffic Accidents in China, Japan, Germany and USA

Survey on Vehicle Owners: Increased Traffic Volume Adds Pressure to Driving

Survey on Vehicle Owners: Acceptability of ADAS

Global ADAS Market Size, 2011-2017E

Global Penetration Rate of Main ADAS Systems, 2010-2016E

Global ADAS Installation Rate by Region, 2013

Global ADAS Sensor Demand, 2010-2019E

Global ADAS Semiconductor Device Market Size, 2010-2019E

Lane Deviation Warning / Assist System Configuration of Major Complete Vehicle Companies

Parking Assistance / Intelligent Parking System Configuration of Major Complete Vehicle Companies

Collision Prevention System (with Active Braking) Configuration of Major Complete Vehicle Companies

Adaptive Cruise System Configuration of Major Complete Vehicle Companies

Night Vision System Configuration of Major Complete Vehicle Companies

Vehicle Models with over Three Systems (LDW, Parking Assistance, Active Braking, ACC, Night Vision)

Global Major Sensor-based ADAS System Integrators

Top 3 ADAS Integrators and Their Market Shares in Europe

Top 3 ADAS Integrators and Their Market Shares in North America

Top 3 ADAS Integrators and Their Market Shares in Asia Pacific

Global Top 5 ADAS Integrators and Their Market Shares

Revenue Growth Rate of Chinese ADAS Market, 2012-2017E

Number of Models Carrying ADAS and % of Imported Models in China, 2014

Installation Rate of ADASs on Models Being Sold in China, 2014

Top 5 OEMs of LCA with Highest Installation Rate as Standard Configuration in China, 2014

Top 5 OEMs of LCA with Highest Installation Rate as Optional Configuration in China, 2014

Top 5 OEMs of PAS with Highest Installation Rate as Standard Configuration in China, 2014

Top 5 OEMs of PAS with Highest Installation Rate as Optional Configuration in China, 2014

Top 5 OEMs of LDWS with Highest Installation Rate as Standard Configuration in China, 2014

Top 5 OEMs of LDWS with Highest Installation Rate as Optional Configuration in China, 2014

Top 5 OEMs of Active Braking with Highest Installation Rate as Standard Configuration in China, 2014

Top 5 OEMs of Active Braking with Highest Installation Rate as Optional Configuration in China, 2014

Top 5 OEMs of ACC with Highest Installation Rate as Standard Configuration in China, 2014

Top 5 OEMs of ACC with Highest Installation Rate as Optional Configuration in China, 2014

Volkswagen’s Front Assist System

Volkswagen’s Parking Assist System

Volkswagen’s Lane Assist System

Volkswagen’s ADAS Configuration by Model

Audi Pre Sense Front system

Audi Adaptive Cruise Control – Sensor and Their Detection Ranges

AudiPark Assist - Parking Procedure

Audi Lane Assist System

Audi Night Vision Assistant

Audi’s ADAS Configuration by Model

Porsche’s ADAS Configuration by Model

SEAT & Skoda’s ADAS Configuration by Model

BMWPark Assistant

BMW Night Vision

BMW’s ADAS Configuration by Model

Major Advanced Configuration of BMW’s Driving Assistance

Mercedes-Benz Attention Assist illustration

Mercedes-Benz Brake Assist Plus and Pre-Safe Brake illustration

Mercedes-Benz DISTRONIC PLUS with Steering Assist

Major Advanced Configuration of Mercedes-Benz's Driving Assistance

Mercedes-Benz’s ADAS Configuration by Model

Major Advanced Configuration of Volvo's Driving Assistance

Volvo’s ADAS Configuration by Model

GM’s Lane Deviation Warning and Collision Warning System

GM’s ADAS Configuration under All Brands by Model

Major Advanced Configuration of GM's Driving Assistance

FordActivePark Assist

Ford’s ADAS Configuration by Model

Lincoln’s ADAS Configuration by Model

Major Advanced Configuration of Ford's Driving Assistance

Toyota’s Collision Prevention System (Developed in 2012)

Major Advanced Configuration of Toyota's Driving Assistance

Toyota’s ADAS Configuration by Model

ADAS Configuration of Lexus by Model

Advanced Features of CMBS

Honda ADAS Diagram

Major Advanced Configuration of Honda’s Driving Assistance

Honda’s ADAS Configuration by Model

Nissan Forward Emergency Braking System

Nissan Distance Control Assist System Configuration

Nissan Lane Departure Prevention System Configuration

Major Advanced Configuration of Nissan’s Driving Assistance

Nissan’s ADAS Configuration by Model

Infiniti’s ADAS Configuration by Model

Number of Models Carrying Mobileye’s ADAS System, 2007-2016E

Revenue and Net Income of Mobileye, 2011-2014H1

Gross Margin of Mobileye, 2011-2014H1

ADAS Products Provided by Mobileye

Revenue Breakdown of Mobileye by Division, 2011-2014H1

Operating Profit Breakdown of Mobileye by Division, 2011-2014Q1

Composition of Mobileye EyeQ?

Cooperative Companies of Mobileye in OEM Market and Procedures

Customers Accounting for More Than 10% of Mobileye’s OEM Revenue, 2011-2013

Revenue and Net Income of TI, 2010-2014H1

Gross Margin of TI, 2010-2014H1

Revenue Structure of TI by Division, 2010-2014H1

Operating Profit Breakdown of TI by Division, 2010-2014H1

Revenue Structure of TI by Region, 2010-2013

Application of TI’s Products in Automotive Sector

Application of TI’s Analog and Embedded Processors in ADAS

TI AFE5401

Block Diagram for TDA2x SoC

TDA2x Evaluation Module

Three Categories of Products and Their Application Fields of Renesas

Revenue and Operating Profit of Renesas, FY2011-FY2015Q1

Net Income of Renesas, FY2011-FY2015Q1

Products and Organization Evolution of Renesas

Proportion of Semiconductor Revenue to Total Revenue of Renesas, FY2011-FY2015Q1

Semiconductor Revenue Structure of Renesas by Product, FY2012-FY2014

MCU Revenue Breakdown of Renesas by Application Field, FY2012-FY2014

Analog and Power Devices Revenue Breakdown of Renesas by Application Field, FY2012-FY2014

SoC Revenue Breakdown of Renesas by Application Field, FY2012-FY2014

Statistics Changes in Sales Data of Renesas, FY2015

Semiconductor Revenue Structure of Renesas by Application Field, FY2015Q1

Automotive Revenue Structure of Renesas by Application, FY2015Q1

General-Purpose Revenue Structure of Renesas by Application, FY2015Q1

R-Car V2H SoC of Renesas

Block Diagram for Renesas Sensor Fusion

Recommended Products of Renesas ADAS Solutions

Roadmap for Renesas ADAS Products

Applications of Freescale’s ADAS

Four Generation Products of Freescale ADAS MCU

77GHz Radar System of Freescale

Radar System Solutions and Target Application of Freescale

Power Architecture?-based Qorivva 32-bit MCUs of Freescale

Vision System Solutions of Freescale

Two Goals of WABCO’s Products

Revenue and Operating Profit of WABCO, 2010-2014H1

Gross Margin of WABCO, 2010-2014H1

Global Factories of WABCO

Revenue Structure of WABCO by Product Segments, 2011

Revenue Structure of WABCO by End Market

Revenue Structure of WABCO by Region

Major Customers of WABCO in Various Markets

WABCO’s ADAS Products

Roadmap for WABCO’s ADAS Products

WABCO’s OptiPace?

Autoliv in Numbers

Autoliv’s Active Safety Development Path and Strategy

Shipments of and Number of Models Carrying Autoliv’s Active Safety Products, 2009-2013

Major Customers of Autoliv’s Active Safety

Autoliv’s Revenue from Active Safety Products, 2009-2013

Functions of Autoliv’s Active Safety System

Autoliv’s Active Safety System Products and Their Applications

Dynamic Spot Light Function of Autoliv’s Night Vision System

Continental’s Revenue from Chassis & Safety Division, 2011-2013

Revenue CAGR in Sector Segments of Continental, 2013-2018E

ADAS Products Sales Volume and Growth Rate of Continental, 2011-2014

Global ADAS Production Bases and R&DCenters of Continental

Roadmap for Automated Driving of Continental

ContiGuard Integrating Active and Passive Safety Systems

Continental’s Integrated Safety Algorithm (ISA)

Products of Bosch’s Automotive Chassis Control System Division

Bosch’s Emergency Braking Systems (Two Types)

Bosch’s Driver Drowsiness Detection System

Bosch’s ACC Systems (Two Types)

Applications of Bosch’s Sensor System and ADAS

Employees of Delphi , 2011-2013

Revenue and Gross Margin of Delphi, 2004-2014

Revenue and Operating Margin of Delphi, 2007-2014

Revenue and EBITDA Margin of Delphi, 2007-2013

Revenue of Delphi by Division, 2012-2014

Gross Margin of Delphi by Division, 2010-2013

Major Client of Delphi by Region

Top Five Clients and Revenue Contribution of Delphi, 2012-2013

Delphi’s Safety and Active Safety Product CAGR Forecast over the Next Five Years

Customers of Delphi’s Active Safety Products as of 2013

Applications of Delphi’s Sensor System and ADAS

Delphi’s Integrated Safety and Networking Technology Solutions

Delphi’s Roadmap for Intelligent Driving

Denso’s Technology Roadmap for Safe Driving

Denso’s Driver Status Monitor System

Denso’s Lane Keeping Assist System

Denso’s Pre-Crash Safety System

Applications of Delphi’s Sensor System and ADAS

Safety Functions and Products Supplied by Denso under Various Driving Situations

Three Levels (Entry, Standard, Advanced) of ADAS Products Suites of Denso

Typical Diagram of IVI

Typical Indicators of IVI

Global IVI Market Size, 2011-2018E

Global IVI Shipment, 2011-2018E

Global IVI Penetration Rate, 2011-2018E

Global Connection Service, TSP, Telecom and Hardware Market Size, 2009-2018E

Global Auto Connection Service Equipment Shipments, 2009-2018E

Global Connectivity Equipped Car Shipments by Region, 2013&2018E

Ranking of Global Major IVI Companies by Revenue, 2012-2013

China’s IVI Shipment, 2011-2016E

Market Share of Major Chinese IVI OEMs, 2013

Global Embedded Automotive Navigation Market Size, 2007-2015E

Global Embedded Automotive Navigation System Shipment, 2007-2015E

Supply Ratio of Major Automotive Navigation Vendors for Toyota, 2013

Supply Ratio of Major Automotive Navigation Vendors for Honda, 2013

Supply Ratio of Major Automotive Navigation Vendors for Nissan, 2013

Supply Ratio of Major Automotive Navigation Vendors for General Motors, 2013

Supply Ratio of Major Automotive Navigation Vendors for Ford, 2013

Supply Ratio of Major Automotive Navigation Vendors for Volkswagen, 2013

Supply Ratio of Major Automotive Navigation Vendors for BMW, 2013

Supply Ratio of Major Automotive Navigation Vendors for Benz, 2013

Supply Ratio of Major Automotive Navigation Vendors for Hyundai, 2013

Preinstalled GPS Volume in Chinese Automobile Market, Jan-Aug 2014

Penetration Rate of GPS in Chinese Automobile Market, Jan-Aug 2014

Automotive Audio System Industry Chain

Introduction to Automotive Audio System Industry Chain Players

Supply Ratio of Major Automotive Audio System Vendors for Toyota, 2013

Supply Ratio of Major Automotive Audio System Vendors for Honda, 2013

Supply Ratio of Major Automotive Audio System Vendors for Nissan, 2013

Supply Ratio of Major Automotive Audio System Vendors for General Motors, 2013

Supply Ratio of Major Automotive Audio System Vendors for Ford, 2013

Supply Ratio of Major Automotive Audio System Vendors for Volkswagen, 2013

Supply Ratio of Major Automotive Audio System Vendors for BMW, 2013

Supply Ratio of Major Automotive Audio System Vendors for Benz, 2013

Supply Ratio of Major Automotive Audio System Vendors for Hyundai, 2013

Supply Ratio of Major Automotive Audio System Vendors for PSA, 2013

Market Share of Major OE Automotive Audio Vendors in China, 2013

Infotainment Suppliers for Typical Auto Models

Revenue and Operating Margin of Harman International, FY2004-FY2014

Sales and EBITDA Margin of Harman International, Q1 FY2012-Q3 FY2014

Revenue Breakdown of Harman International by Business, FY2010-FY2016E

Gross Margin of Harman International by Division, FY2010-FY2014

Revenue Breakdown of Harman International by Region, FY2006-FY2013

Customer Structure of Harman International, FY2008-FY2014

Revenue from Infotainment and Car Audio of Harman International, FY2009-FY2013

Revenue of Harman International in China, FY2009-FY2014

Major Customers for Harman International’s Car Audio

Harman International’s Manufacturing Bases Worldwide

Global Distribution of Continental Automotive - Interior Division

Revenue and Operating Margin of Continental Automotive - Interior Division, 2007-2014

Revenue Breakdown of Continental Automotive - Interior Division by Region, 2009-2013

Revenue and Operating Margin of Pioneer, FY2006-FY2014

Revenue Breakdown of Pioneer by Division, FY2007-FY2015E

Revenue and Operating Margin of Pioneer - Automotive Electronics Division, FY2007-FY2015E

Revenue Breakdown of Pioneer by Region, FY2012-FY2015E

Pioneer Auto Electronics Sales Plan in Emerging Markets

Capacity Statistics of Pioneer Car Audio Manufacturing Bases Worldwide

Organizational Structure of Pioneer Car Audio in China

Customer Distribution of Shinwa Industries (China)

Revenue and Operating Margin of Alpine, FY2006-FY2014

Revenue Breakdown of Alpine by Business, FY2012-FY2014

Revenue and Operating Margin of Alpine – Car Audio Division, FY2006-FY2014

Revenue and Operating Margin of Alpine - Information & Communication, FY2005-FY2014

Revenue Breakdown of Alpine by Region, FY2005-FY2013

Revenue Breakdown of Alpine by Region, FY2014

Revenue and Operating Margin of Clarion, FY2006-FY2014

Revenue Breakdown of Clarion by Region, FY2009-FY2014

Manufacturing Bases Distribution of Clarion

Organizational Structure of Clarion in China

Auto Electronics Business Revenue of Visteon by Product, 2013

Auto Electronics Business Revenue of Visteon by Region, 2013

Auto Electronics Business Revenue of Visteon by Customer, 2013

Organization of YFV

Structure of YFV

Organizational Structure of YFV-Electronics

Revenue Breakdown of YFV by Customer, 2012

Revenue Breakdown of YFV by Product, 2012

Distribution of YFV in China

Revenue of YFV, 2002-2012

Production Bases of YFV – Electronics

Key Events of YFV – Electronics

Vehicle Infotainment Products of Hangsheng Electronics

Major Customers of PAS

Revenue and Operating Margin of Fujitsu Ten, FY2005-FY2014

Revenue Breakdown of Fujitsu Ten by Division, FY2005-FY2013

Revenue and Operating Margin of Aisin Seiki, FY2007-FY2014

Non-Toyota Customer Structure of Aisin Seiki, FY2013-FY2014

Non-Toyota Customer Structure of Aisin Seiki, FY2009-FY2011

Revenue and Operating Income of Aisin AW, FY2007-FY2015E

Navigator Output of Aisin Seiki, FY2008-FY2014

Organizational Structure of Coagent Electronics

Revenue and Operating Income of JVC Kenwood, FY2009- FY2014

Revenue of JVC Kenwood by Division, FY2008-FY2013

Revenue of JVC Kenwood - Auto Electronics, FY2008-FY2015E

Sales and Operating Margin of Garmin, 2007-2014

Sales Breakdown of Garmin by Business, 2009-H1 2014

Operating Income of Garmin by Business, 2009-2013

Sales Breakdown of Garmin by Region, 2009-2013

Manual Transmission Gears