|

|

|

报告导航:研究报告—

TMT产业—电子半导体

|

|

2015年全球及中国IC载板行业研究报告 |

|

字数:1.7万 |

页数:130 |

图表数:160 |

|

中文电子版:8500元 |

中文纸版:4250元 |

中文(电子+纸)版:9000元 |

|

英文电子版:2200美元 |

英文纸版:2350美元 |

英文(电子+纸)版:2500美元 |

|

编号:ZYW200

|

发布日期:2015-03 |

附件:下载 |

|

|

|

《2015年全球及中国IC载板行业研究报告》包含以下内容:

1、半导体与IC封装行业概况

2、IC载板下游市场分析

3、IC载板发展趋势

4、IC载板产业分析

5、12家IC载板厂家研究

6、6家IC载板周边厂家研究

IC载板(基板,Substrate)行业在2015年可能面临困境,一方面是FOWLP的日渐成熟,另一方面则是平板电脑销量下滑,智能手机增长乏力。另外,2013年的繁荣刺激企业在2014年大规模扩产,导致产能利用率不足。

对于手机和平板电脑领域为核心市场的FC-CSP基板面临来自FOWLP的强力竞争,FOWLP具备压倒性的优势,包括低封装高度(Low Profile),更高速度,更多I/O,更高集成度(Higher Integration),更简单的工艺(less processing step),最重要是无需载板,大幅度降低成本,IC载板占IC总成本的比例超过50%。

尽管FOWLP目前还不成熟,成本优势并不明显,但这已经是大势所趋,传统FC-CSP基板将不得不降价来与FOWLP竞争。一旦FOWLP成熟,那么FC-CSP基板的需求量会骤减60%以上。所以2015年,FC-CSP基板厂家必须大幅度降价来提前获得市场优势。预计2015年IC载板市场规模缩小7%,为71.2亿美元。

下游市场方面,大屏幕手机严重挤压平板电脑生存空间,平板电脑下滑明显。并且平板电脑功能单一,通常只是做儿童玩具,更新换代需求很少。智能手机领域,中国作为全球最大的智能手机市场,在2014年已经出现下滑。

2015年IC载板市场最大亮点是SiP封装基板,也就是智能手表,高端智能手表的核心元件必须采用SiP封装。Apple Watch内建二颗重要核心处理器,均采用SiP封装技术。Apple Watch最重要的SiP基板生产难度最高,价格比一般ARM处理器采用的晶片尺寸覆晶基板(FCCSP)高出4~5倍,订单则由南电(Nanya)、景硕(Kinsus)等台湾厂商分食。日月光(ASE)承接Apple Watch的S1晶片SiP封测业务。

此外,2015年PC市场也有可能回暖,因为平板电脑下滑也就意味着笔记本电脑市场复苏,笔记本电脑市场连续3年下滑后在2014年第一次增长,预计2015年继续增长。且笔记本电脑内建独立显卡比例大幅度升高,意味着GPU出货量大增。

IC载板应用市场中,表现较好的还有Memory市场。

Global and China IC Substrate Industry Report, 2015 highlights the followings:

1. Status quo of semiconductor and IC packaging industry

2. Analysis on downstream market of IC substrate

3. Development trend of IC substrate

4. Analysis on IC substrate industry

5. Research on 12 IC substrate vendors

6. Research on 6 IC substrate peripheral companies

IC substrate industry may be in a predicament in 2015, rooted in two aspects: first, the maturing of FOWLP; second, the tablet sales decline and sluggish smartphone growth. In addition, the prosperity of IC substrate industry in 2013 stimulated large-scale expansion of enterprises in 2014, thus leading to an insufficient rate of capacity utilization.

For FC-CSP substrate with mobile phone and tablet PC as the core market facing strong competition from FOWLP that has overwhelming superiorities including low profile, higher speed, more I/O, higher integration, less processing step, especially needing no substrate which slashes cost as IC substrate accounts for more than half of the total cost of IC.

Although it is in its infancy without obvious cost advantage, FOWLP has been an irresistible trend, the traditional FC-CSP substrate will have to reduce the price to enter a competition, and the demand for the latter will be sharply reduced by more than 60% once FOWLP matures. So in 2015, FC-CSP substrate vendors have to substantially reduce the price to gain market advantage in advance. It is expected that in 2015 the IC substrate market will encounter a 7% scale-down to USD7.12 billion.

In the downstream market, large screen mobile phone squeezed the living space of tablet PC which declined significantly. And the single-functional tablet PC is mostly used as a toy for children with less demand for replacement. In the field of smartphone, China as the world’s largest smartphone market declined in 2014.

SiP packaging substrate will be the highlight for IC substrate market in 2015 as core components of high-end smart watches must adopt SiP packaging. Both the two core processors built in Apple Watch use SiP packaging technology. The most important SiP substrate of Apple Watch calls for the most difficult production, priced 4-5 times higher than FCCSP applied to general ARM processor. The orders are shared by Nanya, Kinsus and other Taiwanese vendors. ASE undertakes Apple Watch’s SI chip SiP packaging business.

The PC market is also likely to recover in 2015 for tablet PC slump means the recovery of laptop computer market. Laptop computer market saw the first growth in 2014 after three consecutive years of decline and is expected to continue the trend in 2015. And laptop discrete graphics card accounts for a zooming proportion, signifying GPU shipments boost.

Another excellent performer in IC substrate applications is the memory market.

第一章、全球半导体产业

1.1、全球半导体产业概况

1.2、IC封装概况

1.3、IC封测产业概况

第二章、IC载板下游市场

2.1、IC载板简介

2.2、FLIP CHIP IC 载板

2.3、全球手机市场

2.4、全球智能手机市场

2.5、中国手机市场

2.6、平板电脑市场

2.7、CPU与GPU市场

2.8、内存市场

第三章、IC载板市场与产业

3.1、IC载板市场

3.2、WIDE IO/HMC MEMORY

3.3、EMBEDDED COMPONENT SUBSTRATE

3.4、EMBEDDED TRACE SUBSTRATE

3.5、手持设备IC封装 IC PACKAGING FOR HANDSET

3.5.1、手持设备IC封装现状

3.5.2、PoP封装

3.5.3、FOWLP

3.6、SIP封装

3.7、2.5D封装(SI/GLASS/ORGANIC INTERPOSER)

3.7.1、2.5D封装简介

3.7.2、2.5D封装应用

3.7.3、2.5D Interposer市场规模

3.7.4、2.5D 封装供应商

3.8、TSV(3D)封装

3.8.1、TSV封装设备

3.9、FC-PoP封装

3.10、IC载板产业

第四章、IC载板厂家研究

4.1、欣兴

4.2、IBIDEN

4.3、大德电子

4.4、SIMMTECH

4.5、LG INNOTEK

4.6、SEMCO

4.7、南亚电路板

4.8、景硕KINSUS

4.9、SHINKO

4.10、KYOCERA SLC

4.11、AT&S

4.12、珠海越亚封装基板

4.13、EASTERN

第五章、IC载板封装厂家研究

5.1、日月光

5.2、AMKOR

5.3、矽品精密

5.4、星科金朋

5.5、三菱瓦斯化学

5.6、AJINOMOTO

1. Global Semiconductor Industry

1.1 Overview

1.2 IC Packaging

1.3 IC Packaging and Testing

2. Downstream Market of IC Substrate

2.1 Introduction to IC Substrate

2.2 Flip Chip IC Substrate

2.3 Global Mobile Phone Market

2.4 Global Smartphone Market

2.5 Chinese Mobile Phone Market

2.6 Laptop Computer Market

2.7 CPU and GPU Market

2.8 Memory Market

3. IC Substrate Market and Industry

3.1 IC Substrate Market

3.2 Wide IO/HMC Memory

3.3 Embedded Component Substrate

3.4 Embedded Trace Substrate

3.5 IC Packaging for Portable Devices

3.5.1 Status Quo

3.5.2 PoP Packaging

3.5.3 FOWLP

3.6 SIP Packaging

3.7 2.5D Packaging (SI/Glass/Organic Interposer)

3.7.1 Introduction to 2.5D Packaging

3.7.2 Application of 2.5D Packaging

3.7.3 Market Size of 2.5D Interposer

3.7.4 Suppliers of 2.5D Packaging

3.8 TSV (3D) Packaging

3.8.1 TSV Packaging Equipment

3.9 FC-PoP Packaging

3.10 IC Substrate Industry

4. IC Substrate Vendors

4.1 Unimicron

4.2 IBIDEN

4.3 Daeduck Electronics

4.4 SIMMTECH

4.5 LG INNOTEK

4.6 SEMCO

4.7 Nan Ya PCB

4.8 KINSUS

4.9 SHINKO

4.10 KYOCERA SLC

4.11 AT&S

4.12 ACCESS

4.13 EASTERN

5. IC Substrate Packaging Companies

5.1 ASE

5.2 AMKOR

5.3 SPIL

5.4 STATS ChipPAC

5.5 Mitsubishi Gas Chemical Company

5.6 AJINOMOTO

1994-2019年全球半导体市场规模

2015年全球半导体市场增速

1998-2019年全球半导体市场下游分布

2009-2019年全球半导体市场地域分布

2000-2019年全球半导体企业Capital

2012-2016全球半导体设备市场地域分布

2010-2019年Wafer Process Equipment Sales by Product

2014年全球半导体产业收入Top30

主要电子产品使用IC的封装类型

2012-2017年全球IC Packaging and Testing市场规模

2012-2017年全球Outsourcing IC Packaging and Testing市场规模

2012-2017年全球IC Packaging 市场规模

2012-2017年全球IC Testing市场规模

2009-2013年台湾封测产业收入

2013年全球前10大封装企业收入

2007-2015年全球手机出货量

2011-2014年全球3G/4G手机出货量地域分布

Worldwide Mobile Phone Sales to End Users by Vendor in 2013 (Thousands of Units)

2014年3季度全球十大手机厂家出货量

Worldwide Smartphone Sales to End Users by Vendor in 2013 (Thousands of Units)

Worldwide Smartphone Sales to End Users by Operating System in 2013 (Thousands of Units)

2013-2015年全球Top 13智能手机厂家出货量

2014年3季度主要智能手机厂家出货量

2013年1月-2014年12月中国手机市场月度出货量

2014年中国智能手机市场主要厂家市场占有率

2014年中国4G手机市场主要厂家市场占有率

2011-2016年全球平板电脑出货量

Top Five Tablet Vendors, Shipments Fourth Quarter 2014

Top Five Tablet Vendors, Shipments, Market Share, and Growth, Calendar Year 2014

2008-2015年CPU与GPU出货量

2008-2015年笔记本电脑出货量

2010-2014年全球主要笔记本电脑ODM厂家出货量

2012-2016年内存市场规模

2009-2016年IC载板市场规模

2009-2016年IC载板分技术市场规模

IC载板具体应用产品

Mobile DRAM Trend

WIDE IO的优点

SK Hynix WIDE IO2 Roadmap

HMC Architecture

HMC BENEFITS

内嵌被动与主动元件主板的优点

Embedded Component Substrate Process

Comparison of Embedded Active & Passive Components

Roadmap of Embedded Passive Substrate

Structure Roadmap of Embedded Active Substrate

FOWLP and PLP Process Comparison

WHY EMBEDDED TRACE?

EMBEDDED TRACE Package Features

EMBEDDED TRACE Package Sweet Spot (for Wire Bonding)

EMBEDDED TRACE Package Sweet Spot (for FLIP CHIP)

Apple iPad 4 LTE A1459 IC Package Type List

PoP封装发展趋势

2.5D Interposer Manffacturing Revenue

2010-2017 Breakdown by interposer bulk material

TSV下游应用

TSV设备供应商

2012-2017年TSV封装设备分布

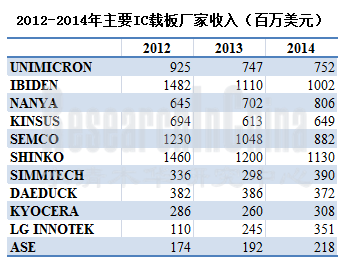

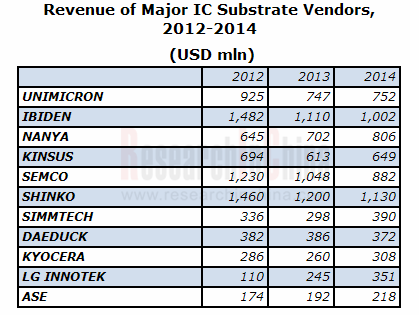

2010-2014年主要IC载板厂家收入

欣兴组织结构

2003-2014年欣兴收入与毛利率

2009-2014年欣兴收入与营业利润率

2012年1季度-2014年4季度欣兴季度收入与毛利率

2010-2014年欣兴销售额技术分布Sales Breakdown by Technology

2010-2014年欣兴收入下游应用分布Sales Breakdown by Application

2010-2014欣兴产能Capacity

2004-2013年欣兴CAPEX

欣兴历年合并

2006-2015财年IBIDEN收入与运营利润率

2006-2015财年IBIDEN收入业务分布

2012年2季度-2014年2季度IBIDEN季度收入业务分布

2012年2季度-2014年2季度IBIDEN季度营业利润业务分布

2010-2015财年ibiden电子事业部收入产品分布

2010-2015财年ibiden CAPEX与depreciation

2005-2014年大德电子收入与运营利润率

2009-2014年大德电子收入by bunesiss

2005-2014年大德GDS收入与运营利润率

2010-2014年大德GDS收入业务分布

SIMM TECH组织结构

2004-2014年SIMMTECH收入与运营利润率

2009-2014年SIMMTECH收入、毛利率与净利率

2009-2013年SIMMTECH资产负债表

2013-2015年SIMMTECH 收入产品分布

2013年1季度-2014年4季度SIMMTECH季度毛利率与运营利润率

2013年1季度-2014年4季度SIMMTECH季度出货量

2012-2015年SIMMTECH出货量

2013年1季度-2014年4季度SIMMTECH季度产能利用率

2012-2015年SIMMTECH产能利用率

2008-2014年SIMMTECH收入by application

2012-2014年SIMMTECH Substrate收入by application

SIMMTECH厂区

2006-2015年LG INNOTEK收入与运营利润率

2012年1季度-2014年4季度LG INNOTEK收入与运营利润率

2011-2015年LG INNOTEK 收入业务分布

2011-2015年LG INNOTEK 运营利润业务分布

2009-2014年SEMCO收入与营业利润率

2010-2014年SEMCO收入部门分布

2013年1季度-2014年4季度SEMCO ACI事业部收入与运营利润率

2014年1季度-2014年4季度SEMCO HDI 与PKG收入

南亚电路板组织结构

2006-2014年南亚电路板收入与毛利率

2009-2015年南亚电路板收入与营业利润率

2013年1月-2015年1月南亚电路板每月收入与增幅

南亚电路板产能与全球分布

2004-2014年景硕收入与毛利率

2009-2015年景硕收入与营业利润率

2013年1月-2015年1月景硕每月收入与增幅

2011-2014年景硕收入产品分布

2011年景硕收入下游应用分布

Q1/2014景硕收入BY Applications

Q4/2014景硕收入BY Applications

2013\2014 KINSUS客户分布

FY207-FY2015 Shinko收入与净利润

2010-2015财年Shinko收入业务分布

FY2005-FY2015 AT&S与EBITDA率

AT&S重庆substrate厂ramp

FY2014 AT&S收入业务与地域分布

FY2015 AT&S收入业务与地域分布

Q2/13-Q4/14 AT&S Mobile Devices & Substrates业务季度收入

AT&S Mobile Devices & Substrates业务主要客户

Q2/13-Q4/14 AT&S Industrial & Automotive 业务季度收入

AT&S Industrial & Automotive 业务主要客户

2010-2015 AT&S员工数量

2010-2015 AT&S CAPEX

日月光组织结构

2005-2015年日月光收入与毛利率

2009-2015年日月光收入与营业利润率

2013年1月-2015年1月日月光月度收入

2010-2014年ASE收入业务分布

2013年1季度-2014年4季度ASE封装部门收入与毛利率

2013年1季度-2014年4季度ASE封装部门收入类型分布

2013年1季度-2014年4季度ASE材料部门收入与毛利率

2013年1季度-2014年4季度ASE IC业务收入下游分布

2013年1季度-2014年4季度ASE EMS收入与毛利率

2013年1季度-2014年4季度ASE EMS收入breakdown

2005-2014年Amkor收入与毛利率、运营利润率

2007-2014年Amkor收入封装类型分布

2012-2014 Amkor Packaged units

2012-2014年Amkor收入下游分布

矽品精密工业组织结构

2003-2014年矽品收入、毛利率、运营利润率

2013年1月-2015年1月SPIL月度收入

2012年4季度-2014年4季度SPIL季度收入、毛利率与营业利润率

2005-2014年矽品收入地域分布

2005-2014年矽品收入下游应用分布

2005-2014年矽品收入业务分布

矽品2006-2014年产能统计

2004-2014年星科金朋收入与毛利率

2014年星科金朋资产负债表

2006-2013年星科金朋收入封装类型分布

2006-2013年星科金朋收入下游应用分布

2006-2013年星科金朋收入 地域分布

星科金朋全球分布

2014年星科金朋收入地域与业务分布

三菱瓦斯化学Organization Chart

2009-2015财年MGC收入与营业利润

2009-2015财年MGC收入by segment

2009-2015财年MGC operation income by segment

2009-2015财年MGC information and advanced material 部门Capex and Depreciation

ABF应用

ABF制造流程

ABF Construction

Outline of manufacturing substrate using ABF

Next build-up material in demand

Global Semiconductor Market Size, 1994-2019E

Global Semiconductor Market Growth Rate, 2015

Downstream Application of Global Semiconductor Market, 1998-2019E

Geographical Distribution of Global Semiconductor Market, 2009-2019E

Capital of Global Semiconductor Enterprises, 2000-2019E

Geographical Distribution of Global Semiconductor Equipment Market, 2012-2016E

Wafer Process Equipment Sales by Product, 2010-2019E

Top 30 of Global Semiconductor Industry by Revenue, 2014

IC Packaging Types Used by Major Electronic Products

Global IC Packaging and Testing Market Size, 2012-2017E

Global Outsourcing IC Packaging and Testing Market Size, 2012-2017E

Global IC Packaging Market Size, 2012-2017E

Global IC Testing Market Size, 2012-2017E

Revenue of Taiwan Packaging and Testing Industry, 2009-2013

Revenue of Top 10 Global Packaging Enterprises, 2013

Global Mobile Phone Shipments, 2007-2015E

Geographical Distribution of Global 3G/4G Mobile Phone Shipments, 2011-2014

Worldwide Mobile Phone Sales to End Users by Vendor in 2013

Shipments of Top 10 Global Mobile Phone Vendors, Q3 2014

Worldwide Smartphone Sales to End Users by Vendor in 2013

Worldwide Smartphone Sales to End Users by Operating System in 2013

Shipments of Top 13 Global Smartphone Vendors, 2013-2015E

Shipments of Major Smartphone Vendors, Q3 2014

Monthly Shipments of China Mobile Phone Market, 2013-2014

Market Share of Major Vendors in China Smartphone Market, 2014

Market Share of Major Vendors in China 4G Mobile Phone Market, 2014

Global Tablet PC Shipments, 2011-2016E

Top Five Tablet Vendors, Shipments Fourth Quarter 2014

Top Five Tablet Vendors, Shipments, Market Share, and Growth, Calendar Year 2014

CPU and GPU Shipments, 2008-2015E

Laptop Computer Shipments, 2008-2015E

Shipments of Major Global Laptop ODM Vendors, 2010-2014

Memory Market Size, 2012-2016E

IC Substrate Market Size, 2009-2016E

IC Substrate Market Size by Technology, 2009-2016E

Specific Application Products of IC Substrate

Mobile DRAM Trend

Advantages of WIDE IO

SK Hynix WIDE IO2 Roadmap

HMC Architecture

HMC BENEFITS

Advantages of Embedded Passive and Active Component Motherboard

Embedded Component Substrate Process

Comparison of Embedded Active & Passive Components

Roadmap of Embedded Passive Substrate

Structure Roadmap of Embedded Active Substrate

FOWLP and PLP Process Comparison

WHY EMBEDDED TRACE?

EMBEDDED TRACE Package Features

EMBEDDED TRACE Package Sweet Spot (for Wire Bonding)

EMBEDDED TRACE Package Sweet Spot (for FLIP CHIP)

Apple iPad 4 LTE A1459 IC Package Type List

Development Trend of PoP Packaging

2.5D Interposer Manffacturing Revenue

Breakdown by Interposer Bulk Material, 2010-2017

Downstream Application of TSV

TSV Equipment Suppliers

Distribution of TSV Packaging Equipment, 2012-2017E

Revenue of Major IC Substrate Vendors, 2010-2014

Unimicron’s Organizational Structure

Unimicron’s Revenue and Gross Margin, 2003-2014

Unimicron’s Revenue and Operating Margin, 2009-2014

Unimicron’s Revenue and Gross Margin, Q1 2012-Q4 2014

Unimicron’s Sales Breakdown by Technology, 2010-2014

Unimicron’s Sales Breakdown by Application, 2010-2014

Unimicron’s Capacity, 2010-2014

Unimicron’s CAPEX, 2004-2013

Unimicron’s M & A

IBIDEN’s Revenue and Operating Margin, FY2006-FY2015

IBIDEN’s Revenue Breakdown by Business, FY2006-FY2015

IBIDEN’s Revenue Breakdown by Business, Q2 2012-Q2 2014

IBIDEN’s Operating Income by Business, Q2 2012-Q2 2014

Ibiden Electronics’ Revenue Breakdown by Product, FY2010-FY2015

IBIDEN’s CAPEX and Depreciation, FY2010-FY2015

Daeduck Electronics’ Revenue and Operating Margin, 2005-2014

Daeduck Electronics’ Revenue by Business, 2009-2014

Daeduck GDS’ Revenue and Operating Margin, 2005-2014

Daeduck GDS’ Revenue Breakdown by Business, 2010-2014

SIMMTECH’s Organizational Structure

SIMMTECH’s Revenue and Operating Margin, 2004-2014

SIMMTECH’s Revenue, Gross Margin and Net Profit Margin, 2009-2014

SIMMTECH’s Balance Sheet, 2009-2013

SIMMTECH’s Revenue Breakdown by Product, 2013-2015

SIMMTECH’s Gross Margin and Operating Margin, Q1 2013-Q4 2014

SIMMTECH’s Shipments, Q1 2013-Q4 2014

SIMMTECH’s Shipments, 2012-2015E

SIMMTECH’s Capacity Utilization, Q1 2013-Q4 2014

SIMMTECH’s Capacity Utilization, 2012-2015E

SIMMTECH’s Revenue by Application, 2008-2014

SIMMTECH’s Substrate Revenue by Application, 2012-2014

SIMMTECH’s Plants

LG INNOTEK’s Revenue and Operating Margin, 2006-2015E

LG INNOTEK’s Revenue and Operating Margin, Q1 2012-Q4 2014

LG INNOTEK’s Revenue Breakdown by Business, 2011-2015E

LG INNOTEK’s Operating Income by Business, 2011-2015E

SEMCO’s Revenue and Operating Margin, 2009-2014

SEMCO’s Revenue Breakdown by Department, 2010-2014

Revenue and Operating Margin of SEMCO’s ACI Segment, Q1 2013-Q4 2014

SEMCO’s HDI and PKG Revenue, Q1-Q4 2014

Nan Ya PCB’s Organizational Structure

Nan Ya PCB’s Revenue and Gross Margin, 2006-2014

Nan Ya PCB’s Revenue and Operating Margin, 2009-2015E

Nan Ya PCB’s Revenue and Growth Rate, Jan 2013-Jan 2015

Nan Ya PCB’s Capacity and Global Distribution

KINSUS’ Revenue and Gross Margin, 2004-2014

KINSUS’ Revenue and Operating Margin, 2009-2015E

KINSUS’ Revenue and Growth Rate, Jan 2013-Jan 2015

KINSUS’ Revenue Breakdown by Product, 2011-2014

KINSUS’ Revenue Breakdown by Application, 2011

KINSUS’ Revenue by Application, Q1 2014

KINSUS’ Revenue by Application, Q4 2014

Customer Distribution of KINSUS, 2013\2014

SHINKO’s Revenue and Net Income, FY2007-FY2015

SHINKO’s Revenue Breakdown by Business, FY2010-FY2015

AT&S and EBITDA Margin, FY2005-FY2015

Chongqing Substrate Plant Ramp of AT&S

AT&S’ Revenue Breakdown by Business/Region, FY2014

AT&S’ Revenue Breakdown by Business/Region, FY2015

Revenue of AT&S’ Mobile Devices & Substrates Business, Q2/13-Q4/14

Main Customers of AT&S’ Mobile Devices & Substrates Business

Revenue of AT&S’ Industrial & Automotive Business, Q2/13-Q4/14

Main Customers of AT&S’ Industrial & Automotive Business

AT&S’ Employees, 2010-2015

AT&S’ CAPEX, 2010-2015E

Financial Data of ACCESS, 2012-2013

Major Clients of ACCESS, 2011-2013

Revenue of Packaging Substrate of ACCESS, 2011-2013

Major Equipment of ACCESS

ASE’s Organizational Structure

ASE’s Revenue and Gross Margin, 2005-2015E

ASE’s Revenue and Operating Margin, 2009-2015E

ASE’s Revenue, Jan 2013-Jan 2015

ASE’s Revenue Breakdown by Business, 2010-2014

Revenue and Gross Margin of ASE’s Packaging Division, Q1 2013-Q4 2014

Revenue Breakdown of ASE’s Packaging Division by Type, Q1 2013-Q4 2014

Revenue and Gross Margin of ASE’s Materials Division, Q1 2013-Q4 2014

Revenue Breakdown of ASE’s IC Business by Application, Q1 2013-Q4 2014

ASE’s EMS Revenue and Gross Margin, Q1 2013-Q4 2014

ASE’s EMS Revenue Breakdown, Q1 2013-Q4 2014

Amkor’s Revenue, Gross Margin and Operating Margin, 2005-2014

Amkor’s Revenue Breakdown by Packaging Type, 2007-2014

Amkor’s Packaged Units, 2012-2014

Amkor’s Revenue Breakdown by Application, 2012-2014

SPIL’s Organizational Structure

SPIL’s Revenue, Gross Margin and Operating Margin, 2003-2014

SPIL’s Revenue, Jan 2013-Jan 2015

SPIL’s Revenue, Gross Margin and Operating Margin, Q4 2012-Q4 2014

SPIL’s Revenue Breakdown by Region, 2005-2014

SPIL’s Revenue Breakdown by Application, 2005-2014

SPIL’s Revenue Breakdown by Business, 2005-2014

SPIL’s Capacity, 2006-2014

STATS ChipPAC’s Revenue and Gross Margin, 2004-2014

STATS ChipPAC’s Balance Sheet, 2014

STATS ChipPAC’s Revenue Breakdown by Packaging Type, 2006-2013

STATS ChipPAC’s Revenue Breakdown by Application, 2006-2013

STATS ChipPAC’s Revenue Breakdown by Region, 2006-2013

Global Distribution of STATS ChipPAC

STATS ChipPAC’s Revenue Breakdown by Region/Business, 2014

Mitsubishi Gas Chemical’s Organization Chart

MGC’s Revenue and Operating Income, FY2009-FY2015

MGC’s Revenue by Segment, FY2009-FY2015

MGC’s Operating Income by Segment, FY2009-FY2015

CAPEX and Depreciation of MGC’s Information and Advanced Material Division, FY2009-FY2015

ABF Application

ABF Manufacturing Process

ABF Construction

Outline of Manufacturing Substrate Using ABF

Next Build-up Material in Demand

如果这份报告不能满足您的要求,我们还可以为您定制报告,请 留言说明您的详细需求。

|