|

|

|

报告导航:研究报告—

制造业—汽车

|

|

2014-2015年全球及中国汽车排气系统行业研究报告 |

|

字数:2.9万 |

页数:130 |

图表数:143 |

|

中文电子版:8000元 |

中文纸版:4000元 |

中文(电子+纸)版:8500元 |

|

英文电子版:2300美元 |

英文纸版:2450美元 |

英文(电子+纸)版:2600美元 |

|

编号:ZYW201

|

发布日期:2015-03 |

附件:下载 |

|

|

|

《2014-2015年全球及中国汽车排气系统行业研究报告》包含以下内容:

1、全球汽车市场与产业简介

2、中国汽车市场与产业分析

3、全球汽车排气系统市场与产业分析

4、中国汽车排气系统市场与产业分析

5、中国汽车排放规则分析

6、13家汽车排气系统厂家研究,3家载体厂家研究,7家催化剂厂家研究

2009年平均每辆汽油机汽车的排气系统价格为250美元左右,随着环保政策的日益苛刻,2014年增加到每辆车280美元。而柴油机汽车更加昂贵,2009年平均每辆柴油机汽车排气系统价格为350美元,2014年达到530美元。

2014年9月欧洲轻型车(LightVehicles)正式实施Euro 6B标准,加上中美汽车销量大增,带动全球汽车排气系统市场增长3.2%达到331亿美元,增速比2013年的2.3%有所加快。

2017年欧洲将开始实施Euro 6C标准,中国可能实施汽油车Euro 6A标准,预计2016年汽车排气系统市场将会大幅度增长7%。而2015年没有大规模的新标准实施,中国市场高增长不再,预计全球汽车排气系统市场规模增长2.1%。

中国柴油车排气系统市场可能持续令人失望。早在2005年5月,政府就宣布2011年1月1日开始施行国四标准,但推迟了5次,最终2015年1月1日起实施国四标准。但是2015年中国经济低迷,商用车销量下滑,商业车的竞争完全是价格竞争,国四标准根本无法真正执行,绝大部分还是国三车。

2014年中国货车销售318万辆,同比下降8.9%,其中轻型货车受国四排放标准带来的成本上升和厂家生产准备不足等因素影响最大,销量仅166万辆,比2013年的190万辆减少24万辆,全年降幅达12.9%。预计2015年的降幅会更大。

中国4吨以上车型使用高压共轨+SCR,4吨以下车型使用高压共轨+EGR。不过目前中国缺少专门加油站可以加尿素,未来也不大可能出现。货车的经营成本非常高,货车经营者利润非常微薄,不得不尽量压低成本,因此货车主添加尿素意愿很低。同时货车主为了环保而买国四标准货车的数量非常少。

汽车排气系统利润最丰厚的在上游,特别是载体(Substrate)和催化剂。载体部分,全球前三大的市场占有率超过96%,分别是日本的NGK、美国的Corning和日本的Ibiden。NGK和Corning都把中国市场看做最重要的市场,尤其康宁,因此2014年取得近20%的增长。Ibiden则将全部精力放在欧美市场,在中国市场毫无建树,导致其收入连续下滑。

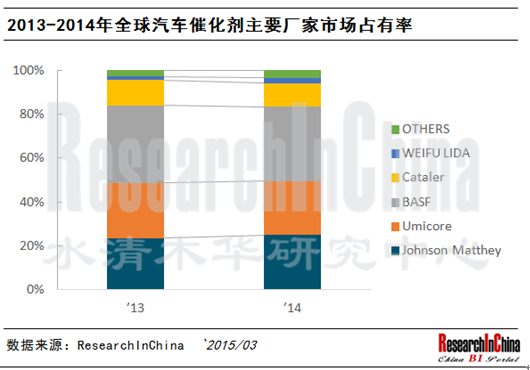

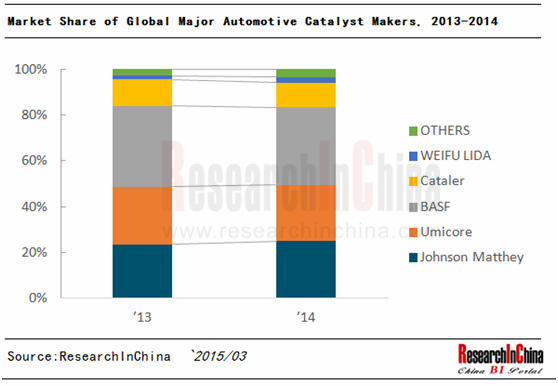

催化剂部分,2014年汽车催化剂市场规模高达117亿美元,比2013年增长8.0%。前三大厂家市场占有率超过80%。竞争的焦点仍然是中国地区,前三大厂家BASF、Johnson Matthey、Umicore都在中国大陆持续扩产,一度落后的Umicore在2014年产能扩大一倍,2015年有望取得不错的成绩。

Global and China Automotive Exhaust System Industry Report, 2014-2015 covers the following:

1. Overview of Global Automotive Market and Industry;

2. Analysis on China's Automotive Market and Industry;

3. Analysis on Global Automotive Exhaust System Market and Industry;

4. Analysis on China's Automotive Exhaust System Market and Industry;

5. Analysis on China's Automotive Emission Regulations;

6. Research on 13 automotive exhaust system manufacturers, 3 substrate manufacturers and 7 catalyst manufacturers.

In 2009, the average price for the exhaust system of each gasoline engine-powered vehicle reached approximately USD250. However, as the environmental protection policies became increasingly strict, this figure climbed to USD280 in 2014. Comparatively, the exhaust system of diesel engine-powered vehicles was much more expensive, with the price for each unit totaling USD350 in 2009 and USD530 in 2014.

In September 2014, the Euro 6B standard for light-duty vehicles officially came into force, which, combined with a sharp rise in vehicle sales volume in the United States and China, helped prompt the global auto exhaust system market to increase by 3.2% to USD33.1 billion, which was a little faster than 2.3% in 2013.

In 2017, Europe will begin to put Euro 6C standard into effect while China may implement Euro 6A standard for gasoline vehicles. It is expected, therefore, that by 2016 the automotive exhaust system market will expand significantly by 7%. However, it is very likely that only a small number of new standards would go into effect in 2015, and China's high-speed growth will become a past. Thus, we project that the market size of global automotive exhaust system will rise 2.1%.

China's diesel engine-driven vehicle exhaust system market may continue to be disappointing. As early as May 2005, the Chinese government announced the national IV standard would come into effect on January 1, 2011, which was delayed for 5 times. It was on January 1, 2015 that the standard was put into effect. But in 2015, with China's economic downturn and declined commercial vehicle sales volume, the competition from commercial vehicles boils down to price competition. The national IV standard will be not implemented at all and therefore most vehicles will still take national III standard.

In 2014, the sales volume of trucks in China totaled 3.18 million units in 2014, down 8.9% year on year. Among them, affected by the factors including the increased costs caused by the national IV standard and the automakers' inadequate production, only 1.66 million light-duty trucks were sold, decreasing by 240,000 units from 1.9 million units in 2013, a full-year 12.9% drop. We predict that this rate will rise in 2015.

In China, more than 4-ton vehicles use high pressure common rail + SCR while less than 4-ton models take high pressure common rail + EGR. However, China now lacks special gas stations that can fill urea and will not have. The operating costs of trucks are extremely high and truck owners can only get low profits, thus forcing them into bringing down costs. Hence, they are reluctant to fill urea. Meanwhile, out of a motive of environmental protection, very few trucker owners choose to buy the national IV standard vehicles.

The upstream sectors of automotive exhaust system, substrate and catalyst in particular, are the most profitable. In terms of substrate, the combined market share of the top 3 global enterprises—NGK, Corning, and Ibiden exceeded 96%. NGK and Corning viewed China as the most important market, especially Corning, which achieved a nearly 20% growth in 2014. Ibiden thoroughly focused on the European and American markets and scored poor performance in China, thereby leading its revenue to continuously decline.

With regard to catalyst, the market size of automotive catalyst reached as much as USD11.7 billion in 2014, up 8.0% from 2013. The total market share of the top three manufacturers exceeded 80%, with the competition mainly concentrated in China. The top three players—BASF, Johnson Matthey, and Umicore successively extended their presence into mainland China. Umicore, once lagged behind, doubled its capacity in 2014 and will very likely achieve good performance in 2015.

第一章、全球及中国汽车市场与产业

1.1、全球汽车市场

1.1.1、美国汽车市场

1.1.2、日本与巴西汽车市场

1.1.3、德国、英国、法国汽车市场

1.1.4、韩国与意大利汽车市场

1.2、全球汽车品牌表现

1.2.1、大众

1.2.2、奔驰与宝马

1.2.3、沃尔沃、PSA、菲亚特

1.2.4、通用、现代

1.2.5、丰田

1.2.6、雷诺日产

第二章、中国汽车市场与产业

2.1、中国汽车市场概况

2.2、中国汽车市场近况

2.3、中国汽车市场分析

2.4、中国典型汽车厂家销量

第三章、汽车排气系统概况

3.1、汽车排气系统简介

3.2、三元催化器

3.2.1、陶瓷载体

3.2.2、催化剂

3.2.3、衬垫

3.3、柴油机国IV标准排气系统

3.4、全球重载柴油车排放标准展望

3.5、全球排放标准时刻图

3.6、轻型车(LIGHTDUTY)排气系统发展趋势

3.7、重型车排气系统发展趋势

3.8、中国2020年汽车排放规则展望

第四章、汽车排气系统市场与产业

4.1、全球汽车排气系统市场

4.2、中国汽车排气系统市场

4.3、全球汽车排气系统产业

4.4、中国汽车排气系统产业

4.5、中国主要轿车三元催化剂 供应商一览

第五章、汽车排气系统厂家研究

5.1、佛吉亚

5.1.1、长春佛吉亚排气系统有限公司

5.1.2、武汉佛吉亚通达排气系统公司

5.1.3、佛吉亚排气控制技术(烟台)有限公司

5.2、天纳克

5.2.1、上海天纳克排气系统有限公司

5.2.2、天纳克同泰(大连)排气系统有限公司

5.2.3、天纳克-埃贝赫(大连)排气系统有限公司

5.3、埃贝赫

5.4、三五

5.4.1、Arvinsango

5.5、双叶工业

5.5.1、天津双协机械工业

5.5.2、天津双叶协展机械

5.6、本特勒

5.7、波森

5.8、YUTAKA

5.8.1、重庆金丰机械

5.8.2、武汉金丰汽配

5.8.3、佛山丰富汽配

5.8.4、佛山优佳达

5.9、世钟工业

5.9.1、北京世钟汽车配件

5.9.2、盐城世钟汽车配件

5.10、保定市屹马汽车配件制造有限公司

5.11、重庆海特环保

5.12、克康(上海)排气控制系统

5.13、BOSAL

第六章、陶瓷载体与DPF厂家研究

6.1、NGK

6.1.1、NGK(苏州)环保陶瓷有限公司

6.2、康宁

6.2.1、康宁(上海)有限公司

6.3、IBIDEN

第七章、催化剂厂家

7.1、汽车排气系统催化剂产业

7.2、庄信万丰

7.3、优美科

7.4、巴斯夫

7.5、CATALER

7.6、昆明贵研催化剂

7.7、无锡威孚力达催化净化器

1. Global and China Automotive Market and Industry

1.1 Global Automotive Market

1.1.1 US Automotive Market

1.1.2 Japanese and Brazilian Automotive Market

1.1.3 German, UK, and French Automotive Markets

1.1.4 South Korean and Italian Automotive Markets

1.2 Global Automotive Brands

1.2.1 Volkswagen

1.2.2 Mercedes-Benz and BMW

1.2.3 Volvo, PSA, and Fiat

1.2.4 General Motors and Hyundai

1.2.5 Toyota

1.2.6 Renault-Nissan

2. China Automotive Market and Industry

2.1 Overview

2.2 Latest Developments

2.3 Market Analysis

2.4 Sales Volume of Typical Automakers

3. Overview of Automotive Exhaust System

3.1 Overview

3.2 Three-way Catalyst

3.2.1 Ceramic Monolith

3.2.2 Catalyst

3.2.3 Liner

3.3 National IV Standard for Exhaust System of Diesel-driven Vehicles

3.4 Outlook of Global Emission Standards for Heavy Duty Diesel-Driven Vehicles

3.5 Timeline of Global Emission Standards

3.6 Development Trend in Exhaust System of Light-duty Vehicles

3.7 Development Trend in Exhaust System of Heavy-duty Vehicles

3.8 Vision for China's 2020 Automotive Emission Regulations

4. Automotive Exhaust System Market and Industry

4.1 Global Automotive Exhaust System Market

4.2 China Automotive Exhaust System Market

4.3 Global Automotive Exhaust System Industry

4.4 China Automotive Exhaust System Industry

4.5 Major Sedan-dedicated Three-way Catalyst Suppliers in China

5. Automotive Exhaust System Manufacturers

5.1 FAURECIA

5.1.1 Faurecia (Changchun) Exhaust System

5.1.2 Wuhan Faurecia Tongda Exhaust System

5.1.3 Faurecia Emission Control Technologies Yantai

5.2 Tenneco

5.2.1 Shanghai Tenneco Exhaust System

5.2.2 Tenneco Tongtai (Dalian) Exhaust System

5.2.3 Tenneco-Eberspaecher (Dalian) Exhaust System

5.3 Eberspaecher

5.4 Sango

5.4.1 Arvin sango

5.5 Futaba Industrial

5.5.1 Tianjin Shuang Shye Mechanical Industrial

5.5.2 Tianjin Futaba Shye Chan Mechanical Industrial

5.6 Benteler

5.7 Boysen

5.8. YUTAKA

5.8.1 Chongqing Jin Feng Mechanical

5.8.2 Wuhan Jin Feng Mechanical

5.8.3 Foshan Fengfu Auto Parts

5.8.4 Foshan Yutaka Auto Parts

5.9 Sejong Industrial

5.9.1 Beijing Sejong Automobile Fittings

5.9.2 Yancheng Sejong Automobile Fittings

5.10 Baoding Yima Motor Vehicle Fitting

5.11 Chongqing HITER Environmental Protection Group

5.12 Katcon (Shanghai) Emission Control System

5.13 BOSAL

6. Ceramic Monolith and DPF Manufacturers

6.1 NGK

6.1.1 NGK Ceramics Suzhou

6.2 Corning

6.2.1 Corning Shanghai

6.3 IBIDEN

7. Catalyst Manufacturers

7.1 Automotive Exhaust System Catalyst Industry

7.2 Johnson Matthey

7.2 Umicore

7.4 BASF

7.5 Cataler

7.6 Kunming Sino-Platinum Metals Catalyst

7.7 Wuxi Weifu Lida Catalytic Converter

2010-2015年全球汽车销量

2003-2015年全球LightVehicles 产量地域分布

2005-2015年中国汽车销量

2008-2015年中国各类型汽车年产量同比增幅

2011-2014年中国乘用车月度销量

2011-2014年中国商用车月度销量

2006-2014年中国乘用车销量

2006-2014年中国商用车销量

2011-2014年比亚迪月度销量

2011-2014年长城月度销量

2011-2014年吉利汽车月度销量

2011-2014年GAC乘用车月度销量

2011-2014年DFG乘用车月度销量

2012-2014年CNHTC月度销量

2011-2014年华晨宝马月度销量

柴油机排气系统

宝马M3 排气系统

汽油机排气系统结构

三元催化器结构

Tennco 的EGR系统

Bosch的SCR系统

Tennco的SCR系统

HDD排放技术趋势

2008-2016年全球汽车排气系统市场规模

2025年汽车排气系统市场类型分布

2009、2014年汽油机与柴油机排气系统平均价格

2009、2014年乘用车排气系统市场规模

2009、2014年商用车排气系统市场规模

2009-2015年中国汽车排气系统市场规模

2009-2015年中国汽车排气系统ASP

2010-2015年中国柴油机尾气处理系统市场规模

2013-2014年全球主要汽车排气系统厂家收入排名

2014年FORD 排气系统供应商供应比例

2014年GM排气系统供应商供应比例

2014年VW排气系统供应商供应比例

2014年TOYOTA排气系统供应商供应比例

2014年RENAULT-NISSAN排气系统供应商供应比例

2014年BMW排气系统供应商供应比例

2014年BENZ排气系统供应商供应比例

2014年Hyundai排气系统供应商供应比例

2010-2014年中国主要排气系统厂家销售额

2014年中国主要汽车排气系统厂家市场占有率

中国主要轿车厂家三元催化剂、载体、催化剂供应关系

FECT全球分布

2005-2013年佛吉亚收入与营业利润率

2010年佛吉亚收入客户分布

2011年佛吉亚收入客户分布

2012年Faurecia收入客户分布

2014年Faurecia收入客户分布

2009-2014年佛吉亚收入产品分布

2015年佛吉亚排气系统产品配套

2012-2014年佛吉亚收入地域分布

2014年佛吉亚中国区收入业务分布

2009年佛吉亚中国收入客户分布

2010-2014年佛吉亚中国FECT收入

2014年佛吉亚中国FECT产能

2013年佛吉亚中国FECT市场占有率

2014-2018佛吉亚中国FECT客户分布

2014-2018佛吉亚中国FECT工厂分布

2014-2018佛吉亚中国FECT Roadmap

2010-2013长春佛吉亚排气系统有限公司财务数据

2013年成都、佛山佛吉亚FECT财务数据

2005-2013年TENNECO收入与EBIT率

2000-2014 TENNECO Net debt

2009-2014年TENNECO收入业务分布

2009-2014年TENNECO收入渠道分布

2009-2014 TENNECO收入地域分布

2009-2014 TENNECO EBIT 地域分布

2011年TENNECO 前20大客户

2012年TENNECO 前20大客户

2014年TENNECO 前20大客户占比

2014年TENNECO 主要平台

TENNECO Commercial Truck and Off-Highway Diesel Aftertreatment Customers

2012-2019年Tenneco技术路线图

2015年天纳克排气系统产品配套

埃贝赫2006-2014年收入与净利润

2006-2013年埃贝赫R&D、员工数、员工成本

2010-2014年埃贝赫收入地域分布

2015年埃贝赫排气系统产品配套

2000-2015财年三五员工人数与收入

2011-2014财年Sango收入产品分布

1998-2010年Arvinsango收入

2007-2015财年双叶工业收入与营业利润率

2013年1季度-2014年4季度双叶工业季度收入与营业利润率

2010-2015财年双叶工业收入地域分布

2011-2015财年双叶工业运营利润地域分布

2011财年-2014财年双叶工业收入客户分布

2012-2014财年双叶工业收入业务分布

2012-2013年本特勒收入及营业利润

2010年本特勒收入地域分布

2015年本特勒催化转化器产品配套

2008-2014年波森收入

2009-2015财年Yutaka 收入与营业利润率

2010-2014财年Yutaka收入地域分布

2009-2014年世钟工业收入与营业利润率

2014年世钟工业客户分布

2014年世钟工业海外收入地域分布

世钟工业全球分布

2007-2015财年NGK收入与营业利润率

2007-2015财年NGK收入部门分布

2012-2015财年NGK 陶瓷事业部收入产品分布

2008-2015财年NGK 陶瓷部门收入与营业利润率

2006-2013年康宁收入与毛利率

2011-2014年康宁收入业务分布

2005-2014 康宁Environmental Technologies 部门收入与净利润

2006-2015财年IBIDEN收入与运营利润率

2006-2015财年IBIDEN收入业务分布

2012年2季度-2014年2季度IBIDEN季度收入业务分布

2012年2季度-2014年2季度IBIDEN季度营业利润业务分布

2010-2015财年ibiden CAPEX与depreciation

2010-2015财年Ibiden陶瓷事业部收入产品分布

2010-2015 DPF市场规模

Automotive Catalyst Overview

Automotive Catalyst Manufacturer Business Model

三元催化器成本结构

2013-2014年全球汽车催化剂主要厂家市场占有率

2009-2015财年 Johnson Matthey收入与营业利润

FY2014 Johnson Matthey收入部门分布

FY2014 Johnson Matthey Sales by destination

Johnson Matthey Structure

FY2009-FY2015 Johnson Matthey Environmental Technologies Segment收入与营业利润

FY2009-FY2015 Johnson Matthey Environmental Technologies Segment 收入(excluding precious metals)

2012财年 Johnson Matthey 的Environmental Technologies部门收入业务分布

2013财年 Johnson Matthey 的Emission Control Technologies 部门收入业务分布

2014财年 Johnson Matthey 的Emission Control Technologies 部门收入业务分布

2014财年 Johnson Matthey 的Emission Control Technologies 部门收入地域分布

Johnson Matthey LDV用Catalyst全球市场地位

Umicore组织结构

2005-2014年Umicore收入与EBIT率

2013-2014 Umicore收入(excluding metal)业务分布

2013-2014 Umicore EBIT 业务分布

2008-2014 Umicore催化剂收入与EBITDA

Umicore汽车催化剂业务全球分布

Umicore中国区组织结构

Umicore中国分布

Umicore中国区收入产品分布

2009-2014年巴斯夫Transportation催化剂业务收入

2011年巴斯夫移动催化剂收入地域分布

巴斯夫汽车催化剂业务全球分布

巴斯夫汽车催化剂业务全球研发平台

2002财年-2014财年Cataler收入

2010-2014年无锡威孚力达资产与负债

2005-2014年无锡威孚力达催化净化器收入与净利润

Global Automobile Sales Volume, 2010-2015

Output of Global Light-duty Vehicles by Region, 2003-2015

China’s Automobile Sales Volume, 2005-2015

YoY Growth of China’s Annual Auto Production by Type, 2008-2015

Monthly Sales Volume of Passenger Vehicles in China, 2011-2014

Monthly Sales Volume of Commercial Vehicles in China, 2011-2014

Sales Volume of Passenger Vehicles in China, 2006-2014

Sales Volume of Commercial Vehicles in China, 2006-2014

BYD's Monthly Sales Volume, 2011-2014

Great Wall's Monthly Sales Volume, 2011-2014

Geely's Monthly Sales Volume, 2011-2014

GAC's Monthly Sales Volume of Passenger Vehicles, 2011-2014

DFG's Monthly Sales Volume of Passenger Vehicles, 2011-2014

CNHTC's Monthly Sales Volume, 2012-2014

BMW Brilliance's Monthly Sales Volume, 2011-2014

Exhaust System of Diesel Engine

Exhaust System of BMW M3

Exhaust System Structure of Gasoline Engine

Structure of Three-way Catalyst

Tenneco's EGR System

Bosch's SCR System

Tenneco's SCR System

HDD Emission Technological Trend

Global Automotive Exhaust System Market Size, 2008-2016E

Automotive Exhaust System Market by Type, 2025E

Average Price for Exhaust System of Gasoline Engine and Diesel Engine, 2009 vs. 2014

Exhaust System Market Size of Passenger Vehicles, 2009 vs. 2014

Exhaust System Market Size of Commercial Vehicles, 2009 vs. 2014

Automotive Exhaust System Market Size in China, 2009-2015

ASP of Automotive Exhaust System in China, 2009-2015

Diesel Engine Exhaust System Market Size in China, 2010-2015

Ranking of Major Global Automotive Exhaust System Manufacturers by Revenue, 2013-2014

Supply Proportion of FORD's Exhaust System Suppliers, 2014

Supply Proportion of GM's Exhaust System Suppliers, 2014

Supply Proportion of VW's Exhaust System Suppliers, 2014

Supply Proportion of TOYOTA's Exhaust System Suppliers, 2014

Supply Proportion of RENAULT-NISSAN's Exhaust System Suppliers, 2014

Supply Proportion of BMW's Exhaust System Suppliers, 2014

Supply Proportion of BENZ's Exhaust System Suppliers, 2014

Supply Proportion of Hyundai's Exhaust System Suppliers, 2014

Sales Value of Major Exhaust System Manufacturers in China, 2010-2014

Market Share of Major Automotive Exhaust System Manufacturers in China, 2014

Three-Way Catalyst, Substrate, Catalyst Supply Relationship of Major Chinese Sedan Manufacturers

Global FECT Distribution

Faurecia's Revenue and Operating Margin, 2005-2013

Faurecia's Revenue by Client, 2010

Faurecia's Revenue by Client, 2011

Faurecia's Revenue by Client, 2012

Faurecia's Revenue by Client, 2014

Faurecia's Revenue by Product, 2009-2014

Supported Products of Faurecia's Exhaust System, 2015

Faurecia's Revenue by Region, 2012-2014

Faurecia's Revenue in China by Business, 2014

Faurecia's Revenue in China by Client, 2009

Faurecia's FECT Revenue in China, 2010-2014

Faurecia's FECT Capacity in China, 2014

Faurecia's FECT Market share in China, 2013

Faurecia's FECT in China by Client, 2014-2018E

Faurecia's FECT in China by Factory, 2014-2018E

Faurecia's FECT Roadmap in China, 2014-2018E

Financial Data of Faurecia (Changchun) Exhaust System, 2010-2013

Faurecia's Financial Data on FECT in Chengdu and Foshan Plants, 2013

Tenneco's Revenue and EBIT Margin, 2005-2013

Tenneco's Net Debt, 2000-2014

Tenneco's Revenue by Business, 2009-2014

Tenneco's Revenue by Channel, 2009-2014

Tenneco's Revenue by Region, 2009-2014

Tenneco's EBIT by Region, 2009-2014

Tenneco's Top 20 Clients, 2011

Tenneco's Top 20 Clients, 2012

Proportion of Tenneco's Top 20 Clients, 2014

Tenneco's Main Platform, 2014

Tenneco's Commercial Truck and Off-Highway Diesel Aftertreatment Customers

Tenneco's Technology Roadmap, 2012-2019

Supported Products of Tenneco's Exhaust System, 2015

Eberspaecher's Revenue and Net Income, 2006-2014

Eberspaecher's R&D, Number of Employees, and Labor Costs, 2006-2013

Eberspaecher's Revenue by Region, 2010-2014

Supported Products of Eberspaecher's Exhaust System, 2015

Sango's Number of Employees and Revenue, FY2000-FY2015

Sango's Revenue by Product, FY2011-FY2014

Arvinsango's Revenue, 1998-2010

Futaba Industrial's Revenue and Operating Margin, FY2007-FY2015

Futaba Industrial's Quarterly Revenue and Operating Margin, 2013Q1-2014Q4

Futaba Industrial's Revenue by Region, FY2010-FY2015

Futaba Industrial's Operating Income by Region, FY2011-FY2015

Futaba Industrial's Revenue by Client, FY2011-FY2014

Futaba Industrial's Revenue by Business, FY2012-FY2014

Benteler's Revenue and Operating Income, 2012-2013

Benteler's Revenue by Region, 2010

Supported Products of Benteler's Catalytic Converters, 2015

Boysen's Revenue, 2008-2014

Yutaka's Revenue and Operating Margin, FY2009-FY2015

Yutaka's Revenue by Region, FY2010-FY2014

Sejong Industrial's Revenue and Operating Margin, 2009-2014

Sejong Industrial's Client Distribution, 2014

Sejong Industrial's Overseas Revenue by Region, 2014

Global Presence of Sejong Industrial

NGK's Revenue and Operating Margin, FY2007-FY2015

NGK's Revenue by Segment, FY2007-FY2015

Revenue of NGK's Ceramics Segment by Product, FY2012-FY2015

Revenue and Operating Margin of NGK's Ceramics Segment, FY2008-FY2015

Corning's Revenue and Gross Margin, 2006-2013

Corning's Revenue by Business, 2011-2014

Revenue and Net Income of Corning's Environmental Technologies Segment, 2005-2014

Ibiden's Revenue and Operating Margin, FY2006-FY2015

Ibiden's Revenue by Business, FY2006-FY2015

Ibiden's Quarterly Revenue by Business, 2012Q2-2014Q2

Ibiden's Quarterly Operating Income by Business, 2012Q2-2014Q2

Ibiden's CAPEX and Depreciation, FY2010-FY2015

Revenue of Ibiden's Ceramic Segment by Product, FY2010-FY2015

DPF's Market Size, 2010-2015

Overview of Automotive Catalyst

Business Model of Automotive Catalyst Manufacturer

Cost Structure of Three-way Catalyst

Market Shares of Major Global Automotive Catalyst Manufacturers, 2013-2014

Johnson Matthey's Revenue and Operating Income, FY2009-FY2015

Johnson Matthey's Revenue by Segment, FY2014

Johnson Matthey's Sales by Destination, FY2014

Johnson Matthey’s Structure

Revenue and Operating Income of Johnson Matthey's Environmental Technologies Segment, FY2009-FY2015

Revenue of Johnson Matthey's Environmental Technologies Segment (Excluding Precious Metals), FY2009-FY2015

Revenue of Johnson Matthey’s Environmental Technologies Segment by Business, FY2012

Revenue of Johnson Matthey’s Environmental Technologies Segment by Business, FY2013

Revenue of Johnson Matthey’s Environmental Technologies Segment by Business, FY2014

Revenue of Johnson Matthey’s Environmental Technologies Segment by Region, FY2014

Johnson Matthey's Global Market Position in LDV Catalyst

Umicore's Organizational Structure

Umicore's Revenue and EBIT Margin, 2005-2014

Umicore's Revenue (Excluding from Metal) by Business, 2013-2014

Umicore's EBIT by Business, 2013-2014

Umicore’s Catalyst Revenue and EBITDA, 2008-2014

Global Presence of Umicore’s Automotive Catalyst Business

Organizational Structure of Umicore in China

Presence of Umicore in China

Revenue of Umicore by Product in China

Revenue of BSAF’s Transportation Catalyst, 2009-2014

Revenue of BSAF’s Moving Catalyst by Region, 2011

Global Presence of BASF’s Automotive Catalyst Business

Global R&D Platforms of BASF’s Automotive Catalyst Business

Cataler's Revenue, FY2002-FY2014

Assets and Liabilities of Wuxi Weifu Lida Catalytic Converter, 2010-2014

Revenue and Net Income of Wuxi Weifu Lida Catalytic Converter, 2005-2014

如果这份报告不能满足您的要求,我们还可以为您定制报告,请 留言说明您的详细需求。

|