|

|

|

报告导航:研究报告—

制造业—汽车

|

|

2014-2015年全球及中国汽车座椅行业研究报告 |

|

字数:2.7万 |

页数:110 |

图表数:85 |

|

中文电子版:8000元 |

中文纸版:4000元 |

中文(电子+纸)版:8500元 |

|

英文电子版:2150美元 |

英文纸版:2300美元 |

英文(电子+纸)版:2450美元 |

|

编号:ZYW202

|

发布日期:2015-03 |

附件:下载 |

|

|

|

《2014-2015年全球及中国汽车座椅行业研究报告》包含以下内容:

1、全球汽车市场与产业简介

2、中国汽车市场与产业分析

3、全球汽车座椅市场与产业分析

4、中国汽车座椅市场与产业分析

5、汽车座椅简介

6、15家汽车座椅厂家研究

看似简单的汽车座椅实际是一个国家机械加工能力的体现,汽车座椅的框架(Frame)是精密金属冲压(Stamping)打造的,全球能够胜任此项工作的企业不超过20家,而汽车发动机则有数百家乃至近千家公司有能力生产。

2010年全球轻型车产量大约7480万辆。平均每辆轻型车座椅所占的ASP大约为742美元。全球轻型车座椅的市场规模为538亿美元。2014年,平均每辆轻型车座椅ASP为786美元,比2013年的771美元微幅增长。全球轻型车座椅市场规模为668亿美元,预计2015年ASP达到800美元,整体市场规模达701亿美元,比2010年增长了30.3%。

全球汽车座椅厂家可以分为美、日、欧三大系。北美厂家占了全球市场的一半左右,日本厂家占据了30%左右的市场,欧洲厂家只有13%。日本厂家在2010年大约占据36%的市场,日系下滑并非因为日本厂家的竞争力下滑,而是日元贬值所导致的。

座椅领域并购频繁,大厂家为完善供应链,不断收购座椅零部件厂家,最近一次收购是Lear以8.5亿美元的价格收购了全球最大的汽车座椅Leather厂家Eagle Ottawa。在2012年Lear以2.57亿美元收购汽车座椅织物厂家Guilford Mills。Lear凭借并购成为座椅领域最具发展潜力的厂家,2014年收入大增10.8%。而Magna则连续下滑,座椅业务已经成为累赘,要不出售要不收购小厂来增加竞争力。

全球第一大汽车座椅厂家Johnson Control(下简称JCI)牢牢掌握中国市场,2014年中国市场为JCI贡献了61亿美元的收入,是JCI最主要的收入来源。JCI在中国拥有多达61个制造基地,所有的汽车厂家都是其客户,JCI的基地遍布中国30个城市,拥有近28000名员工。在这61个制造基地中有42个是和中资企业的合资企业。JCI在合资企业中占据绝对话语权,中资企业只是做一个财务投资者的角色。JCI在中国的市场占有率达到53%。

欧洲厂家对中国市场都非常感兴趣,Faurecia计划在未来3年内在中国新建7家工厂,其中6家合资工厂,1家独资。Brose也计划增加上海厂产能。Lear也在加大中国区投入。日本企业因为中日关系紧张,几乎没有新的投资计划。

The report highlights the following:

1, Global automotive market and industry

2, Chinese automotive market and industry

3, Global automotive seating market and industry

4, Chinese automotive seating market and industry

5, Brief introduction to automotive seating

6, 15 automotive seating manufacturers

The seemingly simple automotive seating actually reflects a country's machining ability. In the world, at most 20 companies are capable of producing automotive seating whose frames are made of precision metals via stamping, while nearly a thousand companies have the capability to produce automotive engines.

In 2010, the global light vehicle output amounted to about 74.8 million; averagely, the automotive seating of a light vehicle was tagged with the selling price of approximately USD742, so the global light vehicle seating market valued USD53.8 billion. In 2014, the average selling price was USD786, a slight increase over USD771 in 2013; the global market was worth USD66.8 billion. In 2015, the average selling price is expected to reach USD800 and the overall market size will grow 30.3% from 2010 to USD70.1 billion.

Global automotive seating manufacturers can be divided into three camps, namely North America, Japan and Europe that held about 50%, about 30% and 13% market share in 2014 respectively. Compared with 36% in 2010, the market share of Japanese manufacturers in 2014 was lower because of the depreciation of the yen instead of their weakened competitiveness.

Mergers and acquisitions occur frequently in the seating field. Large manufacturers are keen on taking over seating parts producers to improve the supply chain. Recently, Lear has acquired the world's largest manufacturer of automotive leather seating -- Eagle Ottawa for USD850 million. In 2012, Lear spent USD257 million on purchasing Guilford Mills which is an automotive seating fabric manufacturer. By virtue of mergers and acquisitions, Lear has become the most promising player in the seating market, and saw its revenue surge 10.8% in 2014. By contrast, Magna suffers consecutive decline, and supposes seating business as a burden; therefore, it has to either sell the business or acquire small factories to enhance competitiveness.

Johnson Controls Inc (hereinafter referred to as JCI), as the world's largest automotive seating manufacturer, firmly grasps the Chinese market, from which JCI reaped the revenue of USD6.1 billion in 2014 being the largest origin of its proceeds. JCI boasts 61 production bases in 30 cities throughout China with nearly 28,000 employees, serving all of car makers. 42 ones of these bases are joint ventures in which JCI enjoys the absolute right to speak, while JCI’s Chinese partners only play the role of financial investors. JCI seizes 53% market share in China.

European manufacturers are a great deal interested in the Chinese market as well. Faurecia plans to build seven new plants in China in the next three years, including six joint ventures and a sole proprietorship. Besides, Brose intends to raise the capacity of its Shanghai Plant; and Lear makes more investments in China. However, Japanese companies almost have no new investment plan due to the tension of Sino-Japanese ties.

第一章、汽车座椅简介

1.1、汽车座椅结构

1.2、汽车座椅骨架

1.3、汽车座椅电机

1.4、汽车座椅面料

第二章、全球及中国汽车市场

2.1、全球汽车市场

2.2、全球汽车产业

2.2.1、大众

2.2.2、奔驰与宝马

2.2.3、沃尔沃、PSA、菲亚特

2.2.4、通用、现代

2.2.5、丰田

2.2.6、雷诺日产

2.3、中国汽车市场概况

2.4、中国汽车市场近况

2.5、中国汽车市场分析

2.6、中国典型汽车厂家销量

第三章、全球与中国汽车座椅产业

3.1、全球汽车座椅产业规模

3.2、全球汽车座椅产业排名

3.3、全球汽车座椅厂家与汽车厂家配套关系

3.4、全球主要汽车厂家座椅供应商供应比例

3.5、中国汽车座椅产业

3.6、中国汽车座椅厂家与整车厂配套关系

第四章、汽车座椅厂家研究

4.1、丰田纺织

4.1.1、长春富维丰田纺织汽车饰件有限公司

4.1.2、天津英泰汽车饰件有限公司

4.1.3、天津华丰汽车装饰有限公司

4.1.4、天津丰爱汽车座椅部件有限公司

4.1.5、天津丰田纺汽车部件有限公司

4.1.6、成都丰田纺汽车部件有限公司

4.1.7、上海丰田纺汽车部件有限公司

4.1.8、昆山丰田纺汽车部件有限公司

4.1.9、宁波亚乐克汽车部件有限公司

4.1.10、宁波丰田纺汽车部件有限公司

4.1.11、广州樱泰汽车饰件有限公司

4.1.12、丰爱(广州)汽车座椅部件有限公司

4.1.13、佛山丰田纺织汽车零部件有限公司

4.2、TS

4.2.1、广州提爱思汽车内饰系统

4.2.2、武汉提爱思全兴汽车零部件有限公司

4.3、泰极(TACHI-S)

4.3.1、广州泰李汽车座椅有限公司

4.4、佛吉亚(FAURECIA)

4.5、LEAR

4.5.1、东风李尔汽车座椅有限公司

4.5.2、江西江铃李尔内饰系统有限公司

4.5.3 沈阳李尔汽车座椅内饰系统有限公司

4.5.4 重庆李尔长安汽车内饰件有限责任公司

4.5.5 李尔汽车系统有限公司芜湖公司

4.5.6 李尔汽车面料有限公司

4.5.7 南京新迪李尔汽车内饰系统有限公司

4.5.8 广州泰李汽车座椅有限公司

4.5.9 李尔长春汽车内饰件系统有限公司

4.5.10北京李尔岱摩世汽车座椅有限公司

4.5.11上海李尔实业交通汽车部件有限公司

4.6、江森自控

4.6.1、KEIPER

4.6.2、上海延锋江森座椅有限公司

4.6.3、南京延锋江森座椅有限公司

4.6.4、芜湖江森云鹤汽车座椅有限公司

4.6.5、重庆延锋江森座椅有限公司

4.6.6、广州东风江森座椅有限公司

4.6.7、长春富维-江森自控汽车饰件系统有限公司

4.6.8、长春一汽富维江森自控汽车金属零部件有限公司

4.7、Magna

4.8、Brose

4.9、DYMOS

4.10、Sitech

4.11、长春旭阳

4.12、武汉新云鹤

4.13、中航精机

4.14、全兴工业

4.15、NHK发条(NHK Spring)

1. Brief Introduction to Automotive Seating

1.1 Structure

1.2 Frame

1.3 Motor

1.4 Fabric

2. Global and Chinese Automotive Market

2.1 Global Automotive Market

2.2 Global Automotive Industry

2.2.1 Volkswagen

2.2.2 Mercedes-Benz and BMW

2.2.3 Volvo, PSA and Fiat

2.2.4 GM and Hyundai

2.2.5 Toyota

2.2.6 Renault-Nissan

2.3 Overview of Chinese Automotive Market

2.4 Recent Developments of Chinese Automotive Market

2.5 Analysis on Chinese Automotive Market

2.6 Sales Volume of Typical Chinese Automakers

3 Global and China Automotive Seating Industry

3.1 Size of Global Automotive Seating Industry

3.2 Ranking of Global Automotive Seating Industry

3.3 Relation between Automotive Seating Manufacturers and Automakers Worldwide

3.4 Share of Automotive Seating Suppliers for Automakers Worldwide

3.5 China Automotive Seating Industry

3.6 Relation between Automotive Seating Manufacturers and Automobile Manufacturers in China

4. Automotive Seating Manufacturers

4.1 Toyota Boshoku

4.1.1 Changchun Faway Toyota Boshoku Auto Parts Co., Ltd.

4.1.2Tianjin Intex Auto Parts Co., Ltd

4.1.3 Tianjin Kahou Automotive Decoration Co., Ltd

4.1.4 Tianjin Feng'ai Automotive Seat Parts Co., Ltd.

4.1.5 Tianjin Toyota Boshoku Automotive Parts Co., Ltd

4.1.6 Chengdu Toyota Boshoku Automotive Parts Co., Ltd

4.1.7 Shanghai Toyota Boshoku Automotive Parts Co., Ltd

4.1.8 Kunshan Toyota Boshoku Automotive Parts Co., Ltd.

4.1.9 Ningbo ARACO Co., Ltd

4.1.10 Toyota Boshoku Ningbo Co., Ltd

4.1.11Guangzhou Intex Auto Parts Co., Ltd

4.1.12 Feng'ai (Guangzhou) Auto Seat Parts Co., Ltd.

4.1.13 Toyota Boshoku Foshan Co., Ltd.

4.2 TS

4.2.1 Guangzhou TS Automotive Interior Systems Co., Ltd.

4.2.2 Wuhan TS-GSK Auto Parts Co., Ltd.

4.3 TACHI-S

4.3.1 TACLE Guangzhou Automotive Seat Co., Ltd.

4.4 Faurecia

4.5 Lear

4.5.1 Lear Dongfeng Automotive Seating Co., Ltd

4.5.2 Jiangxi Jiangling Lear Interior Systems Co., Ltd.

4.5.3 Shenyang Lear Automotive Seating and Interior Systems Co., Ltd

4.5.4 Chongqing Lear Chang'an Automotive Interior Decoration Co. Ltd

4.5.5 Lear (Wuhu)

4.5.6 Lear Automotive Fabric Co., Ltd

4.5.7 Nanjing Lear Xindi Automotive Interiors System Co., Ltd

4.5.8 TACLE Guangzhou Automotive Seat Co., Ltd.

4.5.9 Lear Corporation Changchun Automotive Interior System Co., Ltd

4.5.10 Beijing Lear Dymos Automotive Systems Co., Ltd

4.5.11 Shanghai Lear STEC Automotive Parts Co., Ltd

4.6 Johnson Controls

4.6.1 KEIPER

4.6.2 Shanghai YFJC

4.6.3 Nanjing YFJC

4.6.4 Wuhu Johnson Controls Yunhe Automotive Seating Co., Ltd

4.6.5 Chongqing YFJC

4.6.6 Guangzhou Dongfeng Johnson Controls Automotive Seating

4.6.7 Changchun Faway-Johnson Controls Automotive Systems Co., Ltd.

4.6.8 Changchun FAW Faway Johnson Controls Metal Components Co., Ltd.

4.7 Magna

4.8 Brose

4.9 DYMOS

4.10 Sitech

4.11 Changchun Xuyang

4.12 WuHan New Yunhe Automotive Seating Co., Ltd

4.13 Hubei Aviation Precision Machinery Technology Co., Ltd

4.14 GSK Industrial

4.15 NHK Spring

2010-2015年全球汽车销量

2003-2015年全球LightVehicles 产量地域分布

2005-2015年中国汽车销量

2008-2015年中国各类型汽车年产量同比增幅

2011-2014年中国乘用车月度销量

2011-2014年中国商用车月度销量

2006-2014年中国乘用车销量

2006-2014年中国商用车销量

2011-2014年比亚迪月度销量

2011-2014年长城月度销量

2011-2014年吉利汽车月度销量

2011-2014年GAC乘用车月度销量

2011-2014年DFG乘用车月度销量

2012-2014年CNHTC月度销量

2011-2014年华晨宝马月度销量

2006-2016年全球乘用车座椅产业规模

2010、2014年全球乘用车座椅产值地域分布

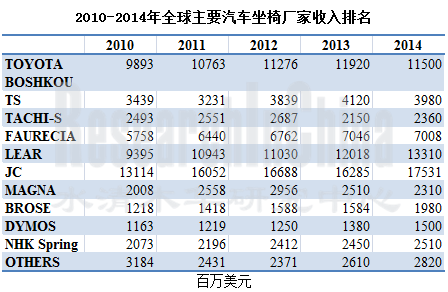

2010-2014年全球主要汽车坐椅厂家收入排名

2014年丰田汽车座椅供应商供应比例

2014年本田汽车座椅供应商供应比例

2014年RENAULT-NISSAN汽车座椅供应商供应比例

2014年VW汽车座椅供应商供应比例

2014年GM汽车座椅供应商供应比例

2014年FORD汽车座椅供应商供应比例

2014年HYUNDAI汽车座椅供应商供应比例

2014年PSA汽车座椅供应商供应比例

2014年中国汽车座椅市场主要厂家市场占有率

2010-2014年中国汽车座椅市场主要厂家收入排名

2006-2013财年丰田纺织收入与营业利润率

2011-2015财年丰田纺织出货量

2011-2015财年丰田纺织出货量地域分布

2006-2014财年丰田纺织收入地域分布

2010-2015财年丰田纺织营业利润地域分布

丰田纺织中国分布

天津英泰汽车饰件2013年财务状况

2006-2015财年TS收入与营业利润率

FY2014 TS 营业利润桥梁图

2011财年TS产品主要对应车型

2014财年TS产品主要对应车型

2015财年TS产品主要对应车型

2010-2011财年TS公司收入产品结构

2013-2014财年TS公司收入产品结构

2010-2015财年TS收入地域分布

2010-2015财年TS营业利润地域分布

FY2015 TS 营业利润桥梁图

FY2014-FY2015 TS TECH Capital Investment Depreciation by area

2006-2015财年泰极收入与营业利润率

2007-2015财年泰极客户分布

2013-2015财年泰极收入地域分布

FY2013-FY2015年泰极运营利润地域分布

泰极中国子公司一览

2005-2013年佛吉亚收入与营业利润率

2014年Faurecia收入客户分布

2009-2014年佛吉亚收入产品分布

2012-2014年佛吉亚收入地域分布

2014年佛吉亚中国区收入业务分布

2010-2014年Faurecia中国区座椅事业收入

Faurecia中国区座椅事业市场占有率与产能

Faurecia中国区座椅事业扩展计划

Faurecia座椅事业路线图

FAS China product plan on Mechanisms

2007-2014年 Lear收入与营业利润率

2010-2014年 Lear收入业务分布

2013-2014年LEAR收入地域分布

2014年LEAR收入客户分布

Eagle Ottawa收入地域和客户分布

LEAR全球分支

Johnson Controls 汽车座椅事业部收入地域分布

2006-2012财年江森自控汽车事业部收入与营业利润率

江森自控全球分支布局

2007-2010年KEIPER收入、员工数量

2005-2014年上海延锋江森座椅收入

2010-2015年富维-江森收入与净利润

2010-2013年富维-江森资产与负债

2010-2015年长春一汽富维江森自控汽车金属零部件公司收入与净利润

2010-2015年长春一汽富维江森自控汽车金属零部件公司资产与负债

2008-2014年DYMOS收入与净利率

DYMOS工厂分布

2006-2014年中航精机收入与营业利润

中航精机主要客户

2007-2015财年NHK Spring收入与运营利润率

2008-2015财年NHK Spring收入业务分布

2008-2015财年NHK Spring运营利润业务分布

2008-2015财年NHK Spring收入地域分布

2012-2014财年NHK发条汽车坐椅收入地域分布

Global Automobile Sales Volume, 2010-2015

Global Light Vehicle Output by Region, 2003-2015

Automobile Sales Volume in China, 2005-2015

Annual Sales Volume and YoY Growth Rate of Automobiles in China by Type, 2008-2015

Monthly Sales Volume of Passenger Cars in China, 2011-2014

Monthly Sales Volume of Commercial Vehicles in China, 2011-2014

Sales Volume of Passenger Cars in China, 2016-2014

Sales Volume of Commercial Vehicles in China, 2016-2014

Monthly Sales Volume of BYD, 2011-2014

Monthly Sales Volume of Great Wall Motor, 2011-2014

Monthly Sales Volume of Geely, 2011-2014

Monthly Sales Volume of Passenger Cars of GAC, 2011-2014

Monthly Sales Volume of Passenger Cars of DFG, 2011-2014

Monthly Sales Volume of CNHTC, 2012-2014

Monthly Sales Volume of BMW Brilliance, 2011-2014

Scale of Global Passenger Car Seating Industry, 2006-2016E

Output Value of Global Passenger Car Seating Industry by Region, 2010 vs 2014

Ranking of Major Automotive Seating Manufacturers Worldwide by Revenue, 2010-2014

Share of Automotive Seating Suppliers for Toyota, 2014

Share of Automotive Seating Suppliers for Honda, 2014

Share of Automotive Seating Suppliers for Renault-Nissan, 2014

Share of Automotive Seating Suppliers for VW, 2014

Share of Automotive Seating Suppliers for GM, 2014

Share of Automotive Seating Suppliers for Ford, 2014

Share of Automotive Seating Suppliers for Hyundai, 2014

Share of Automotive Seating Suppliers for PSA, 2014

Market Share of Major Manufacturers in Chinese Automotive Seating Market, 2014

Ranking of Major Automotive Seating Manufacturers in China by Revenue, 2010-2014

Revenue and Operating Margin of Toyota Boshkou, FY 2006-FY2013

Shipment of Toyota Boshkou, FY 2011-FY2015

Shipment of Toyota Boshkou by Region, FY 2011-FY2015

Revenue of Toyota Boshkou by Region, FY 2006-FY2014

Operating Income of Toyota Boshkou by Region, FY2010-FY2015

Presence of Toyota Boshkou in China

Financial Performance of Tianjin Intex Auto Parts, 2013

Revenue and Operating Margin of TS, FY2006-FY2015

Operating Income of TS, FY2014

Main Vehicle Models Supported by TS’ Products, FY2011

Main Vehicle Models Supported by TS’ Products, FY2014

Main Vehicle Models Supported by TS’ Products, FY2015

Revenue of TS by Product, FY2010-FY2011

Revenue of TS by Product, FY2013-FY2014

Revenue of TS by Region, FY2010-FY2015

Operating Income of TS by Region, FY2010-FY2015

Operating Income of TS, FY2015

TS TECH Capital Investment Depreciation by Region, FY2014-2015

Revenue and Operating Margin of TACHI-S, FY2006-FY2015

Customer Distribution of TACHI-S, FY2007-FY2015

Revenue of TACHI-S by Region, FY2013-FY2015

Operating Income of TACHI-S by Region, FY2013-FY2015

Subsidiaries of TACHI-S in China

Faurecia's Revenue and Operating Margin, 2005-2013

Faurecia's Revenue by Customer, 2014

Faurecia's Revenue by Product, 2009-2014

Faurecia's Revenue by Region, 2012-2014

Faurecia's Revenue in China by Business, 2014

Faurecia's Seating Revenue in China, 2010-2014

Faurecia's Seating Market Share and Capacity in China

Faurecia's Seating Business Expansion Plan in China

Faurecia's Seating Business Roadmap

FAS China Product Plan on Mechanisms

Lear’s Revenue and Operating Margin, 2007-2014

Lear's Revenue by Business, 2010-2014

Lear's Revenue by Region, 2013-2014

Lear's Revenue by Customer, 2014

Revenue of Eagle Ottawa by Region/Customer

Lear’s Global Branches

Revenue of Automotive Seating Division of Johnson Controls by Region

Revenue and Operating Margin of Automotive Division of Johnson Controls, FY2006-FY2012

Global Braches of Johnson Controls

Revenue and Workforce of KEIPER, 2007-2010

Seating Revenue of Shanghai YFJC, 2005-2014

Revenue and Net Income of Changchun Faway-Johnson Controls Automotive Systems, 2010-2015

Assets and Liabilities of Changchun Faway-Johnson Controls Automotive Systems, 2010-2013

Revenue and Net Income of Changchun FAW Faway Johnson Controls Metal Components, 2010-2015

Assets and Liabilities of Changchun FAW Faway Johnson Controls Metal Components, 2010-2015

Revenue and Net Profit Margin of DYMOS, 2008-2014

Plant Distribution of DYMOS

Revenue and Operating Income of Hubei Aviation Precision Machinery Technology, 2006-2014

Major Customers of Hubei Aviation Precision Machinery Technology

Revenue and Operating Margin of NHK Spring, FY2007-FY2015

Revenue of NHK Spring by Business, FY2008-FY2015

Operating Income of NHK Spring by Business, FY2008-FY2015

Revenue of NHK Spring by Region, FY2008-FY2015

Automotive Seating Revenue of NHK Spring by Region, FY2012-FY2014

如果这份报告不能满足您的要求,我们还可以为您定制报告,请 留言说明您的详细需求。

|