|

报告导航:研究报告—

制造业—工业机械

|

|

2014-2015年全球及中国船用柴油机行业研究报告 |

|

字数:4.2万 |

页数:102 |

图表数:73 |

|

中文电子版:8000元 |

中文纸版:4000元 |

中文(电子+纸)版:8500元 |

|

英文电子版:2050美元 |

英文纸版:2200美元 |

英文(电子+纸)版:2350美元 |

|

编号:BXM080

|

发布日期:2015-04 |

附件:下载 |

|

|

|

船用柴油机是核心的船舶配套设备,按转速可分为低速、中速、高速船用柴油机。

目前,韩、日、中拥有全球船用柴油机市场80%左右的份额。其中,韩国在低速柴油机市场处于垄断地位;日本、中国在中速柴油机市场处于领先地位。

全球船用柴油机企业大量采用技术许可证的方式进行生产、销售,其中曼恩、瓦锡兰为全球最著名的两家许可证授权商。2014年,这两大品牌在全球船用低速柴油机和船用中速柴油机市场的份额分别为99%和77%。

中国是全球最大的船舶制造国,但是船舶配套能力滞后,绝大多数中低速船用柴油机都是采用曼恩、瓦锡兰、三菱重工的专利。截至2014年底,曼恩在中国船用柴油机市场的授权生产商接近20家,瓦锡兰为10家,三菱重工为3家。

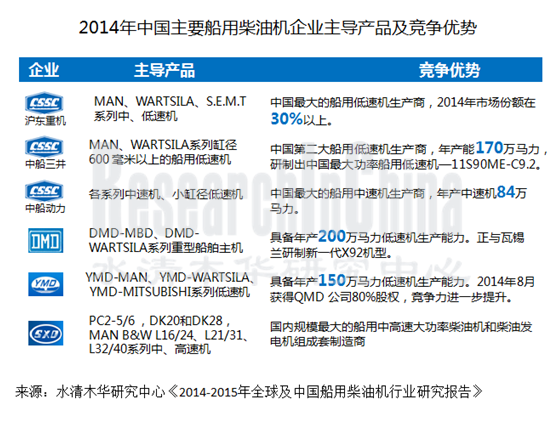

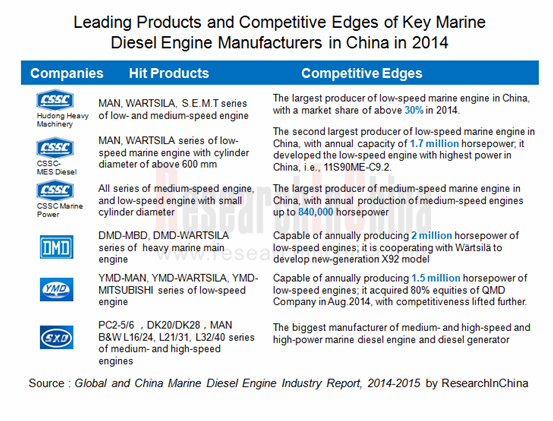

通过引进、消化、吸收,中国船用柴油机生产水平较快提升,并涌现出沪东重机、中船三井、大连船柴、宜柴、青岛海西等船用低速柴油机领军企业,2014年这5家企业的低速机产能合计达到850万马力。同时,形成了以中船动力、陕柴等为代表的船用中速柴油机企业。

MAN:全球最大的低速船用柴油机品牌。2014年实现销售额 142.86亿欧元,其中MAN Diesel & Turbo为32.73亿欧元。2015年2月,与中国船舶和中国重工旗下多家企业签订低速二冲程柴油机10年许可协议。

瓦锡兰:全球最大的中速船用柴油机品牌。在中国拥有上海瓦锡兰齐耀(WQDC)、瓦锡兰南通公司、瓦锡兰玉柴、温特图尔发动机4家船用柴油机合资企业。其中,温特图尔发动机为瓦锡兰(持股30%)与中船集团(持股70%)合资公司,拥有瓦锡兰二冲程发动机技术所有权,于2015年1月19日正式投产。

沪东重机:中国生产规模最大的船用柴油机企业。2013年,控股中船三井(持股51%),2014年完工船用柴油机194台/410万马力,位居行业之首。2015年1月交付全球首台应用于WinGD低速机的SCR系统。

中船动力:2013年9月由原镇江中船设备和安庆中船柴油机合并而成,为中国船用中速柴油机领军者。 目前公司已经形成年产缸径320mm以下中速柴油机500台/84万马力和年产低速机30台/30万马力的能力。

大连船柴:生产瓦锡兰和曼集团两大系列大功率船用低速柴油机,具备年产200万马力的能力。2013年12月,大连船柴和瓦锡兰集团签订协议,共同研制新一代X92绿色环保型船用主机。

水清木华研究中心《2014-2015年全球及中国船用柴油机行业研究报告》重点研究了以下内容:

全球船用柴油机市场规模、区域结构、企业格局等; 全球船用柴油机市场规模、区域结构、企业格局等;

中国船用柴油机政策环境、产业环境等; 中国船用柴油机政策环境、产业环境等;

中国船用柴油机市场供需、进出口情况及竞争格局等; 中国船用柴油机市场供需、进出口情况及竞争格局等;

中国船用低速柴油机、船用中速柴油机发展情况等; 中国船用低速柴油机、船用中速柴油机发展情况等;

全球6家、中国17家重点船用柴油机企业经营情况、研发状况及发展战略等。 全球6家、中国17家重点船用柴油机企业经营情况、研发状况及发展战略等。

As the core of the ship equipment, marine diesel engine can be divided into low-speed, medium-speed and high-speed types according to the rotational speed.

Currently, South Korea, Japan and China enjoy about 80% share of the global marine diesel engine market. Among them, South Korea monopolizes the low-speed marine engine market, while Japan and China act as leaders in the medium-speed marine engine market.

A large number of marine diesel engine companies worldwide make use of technology licenses for production and sale, particularly MAN and Wärtsilä are the world's foremost license providers. In 2014, MAN and Wärtsilä shared 99% of the global low-speed marine engine market and 77% of the world’s medium-speed marine engine market.

Although as the world's largest shipbuilding country, China is weak in ship supporting capabilities and has to apply the patents of MAN, Wärtsilä and Mitsubishi Heavy Industries to the vast majority of low-speed marine diesel engines. As of the end of 2014, MAN had authorized nearly 20 companies in China, while Wärtsilä authorized 10 ones and Mitsubishi Heavy Industries 3 ones.

Through introduction, digestion and assimilation, China has raised its marine diesel engine production level rapidly, and witnessed the emergence of Hudong Heavy Machinery, CSSC-MES Diesel, Dalian Marine Diesel, Yichang Marine Diesel Engine, Qingdao Haixi Heavy-duty Machinery and other low-speed marine engine protagonists. In 2014, the above five companies boasted total capacity of low-speed marine engines up to 8.5 million horsepower. At the same time, medium-speed marine engine enterprises represented by CSSC Marine Power and Shaanxi Diesel Engine Heavy Industry have also arisen.

MAN is the world's largest low-speed marine diesel engine brand. In 2014, its sales reported €14.286 billion, of which €3.273 billion stemmed from MAN Diesel & Turbo. In February 2015, MAN signed the 10-year agreements about low-speed two-stroke diesel engine license with China State Shipbuilding Corporation (CSSC) and China Shipbuilding Industry Corporation (CSIC).

Wärtsilä is known as the world's largest medium-speed marine diesel engine brand. Wärtsilä runs four marine diesel engine joint ventures in China, namely Shanghai Wartsila Qiyao Diesel Company (WQDC), Wärtsilä Nantong, Wärtsilä Yuchai and Winterthur Gas & Diesel (Win GD). Win GD is a joint venture co-founded by Wärtsilä (holding 30% stake) and CSSC (70% stake), which grasps Wärtsilä’s two-stroke engine technology, and formally went into operation on January 19, 2015.

Hudong Heavy Machinery is the largest manufacturer of marine diesel engines in China. It enjoyed 51% stake in CSSC-MES Diesel in 2013 and produced 194 marine diesel engines with 4.1 million horsepower in 2014, ranking first in the industry. In January 2015, it delivered the world's first SCR system applied to Win GD’s low-speed engines.

CSSC Marine Power is grown from the merger between Zhenjiang CSSC Equipment and Anqing CSSC Diesel Engine in September 2013. As a leader in Chinese medium-speed marine engine market, the company is capable of annually producing 500 medium-speed marine engines with the bore (cylinder diameter) size of below 320mm and 840,000 horsepower as well as 30 low-speed engines with 300,000 horsepower.

Dalian Marine Diesel produces high-power marine engines for Wärtsilä and MAN, with annual capacity of 2 million horsepower. In December 2013, Dalian Marine Diesel and Wärtsilä signed an agreement to jointly develop new-generation X92 green marine engines.

The report highlights the followings:

Global marine diesel engine market size, regional structure, corporate structure, etc; Global marine diesel engine market size, regional structure, corporate structure, etc;

Policies on marine diesel engine and industrial environment in China;

Supply and demand, import & export and competitive landscape of Chinese marine diesel engine market; Supply and demand, import & export and competitive landscape of Chinese marine diesel engine market;

Development of low-speed and medium-speed marine engines in China; Development of low-speed and medium-speed marine engines in China;

Operation, R & D and development strategies of six global marine diesel engine companies and 17 Chinese counterparts. Operation, R & D and development strategies of six global marine diesel engine companies and 17 Chinese counterparts.

第一章 船用柴油机简介

1.1 定义

1.2 分类及特点

1.2.1 分类

1.2.2 特点

第二章 全球船用柴油机发展现状

2.1 市场规模

2.2 竞争格局

2.2.1 分国家

2.2.2 分企业

第三章 中国船用柴油机发展环境

3.1 产业环境

3.2 政策环境

3.2.1 行业规划

3.2.2 贸易政策

第四章 中国船用柴油机市场现状

4.1 市场供需

4.1.1 市场供应

4.1.2 市场需求

4.2 进出口

4.2.1 进口

4.2.2 出口

4.3 竞争格局

4.3.1 区域格局

4.3.2 企业格局

第五章 中国船用柴油机细分市场

5.1船用低速柴油机

5.1.1 市场现状

5.1.2 重点企业

5.2船用中速柴油机

5.2.1 市场现状

5.2.2 重点企业

第六章 国际船用柴油机重点企业研究

6.1 MAN Group

6.1.1 企业简介

6.1.2 经营情况

6.1.3 船用柴油机业务

6.1.4 在华发展

6.2 Wärtsilä

6.2.1 企业简介

6.2.2 经营情况

6.2.3 船用柴油机业务

6.2.3 在华发展

6.3 Caterpillar

6.3.1 企业简介

6.3.2 经营情况

6.3.3 在华发展

6.4 Hyundai Heavy Industries

6.4.1 企业简介

6.4.2 经营情况

6.4.3 在华发展

6.5 Mitsubishi Heavy Industries

6.5.1 企业简介

6.5.2 经营情况

6.5.3 在华发展

6.6 Doosan Engine

6.6.1 企业简介

6.6.2 经营情况

6.6.3 在华发展

第七章 中国船用柴油机重点企业研究

7.1 沪东重机(Hu Dong Heavy Machinery Co.,Ltd.)

7.1.1 企业简介

7.1.2 经营情况

7.1.3 研发能力

7.2 大连船柴(Dalian Marine Diesel Co., Ltd.)

7.2.1 企业简介

7.2.2 经营情况

7.2.3 研发能力

7.3 宜柴(Yichang Marine Diesel Engine Co., Ltd.)

7.3.1 企业简介

7.3.2 经营情况

7.3.3 研发能力

7.3.4 发展战略

7.4 潍柴重机(Weichai Heavy Machinery Co., Ltd.)

7.4.1 企业简介

7.4.2 经营情况

7.4.3 项目进展

7.5 中船三井(CSSC-MES Diesel Co.,Ltd.)

7.5.1 企业简介

7.5.2 经营情况

7.5.2 研发情况

7.6 陕柴重工(Shanxi Diesel Engine Heavy Industry Co., Ltd.)

7.6.1 企业简介

7.6.2 经营情况

7.6.3 研发能力

7.6.4 发展战略

7.7 中船动力(CSSC Marine Power Co.,Ltd.)

7.7.1 企业简介

7.7.2 经营情况

7.7.3 子公司——安柴(Anqing CSSC Marine Diesel Co., Ltd.)

7.7.4 发展战略

7.8 淄柴(Zibo Diesel Engine Parent Company)

7.8.1 企业简介

7.8.2 经营情况

7.8.3 研发能力

7.9 河柴重工(Henan Diesel Engine Industry Co., Ltd.)

7.9.1 企业简介

7.9.2 经营情况

7.9.3 研发能力

7.10 其他

7.10.1 安泰动力(Jiangsu Antai Power Machinery Co., Ltd.)

7.10.2 上海新中动力(Shanghai Xinzhong Power Machine Co., Ltd.)

7.10.3 熔安动力(Hefei RongAn Power Machinery Co., Ltd.)

7.10.4 广州中柴(CSSC Guangzhou Marine Diesel Co., Ltd.)

7.10.5 中高柴油机重工有限公司(ZGPT Diesel Heavy Industry Co. Ltd.)

7.10.6 宁波中策动力机电集团有限公司(Ningbo C.S.I. Power&Machinery Group Co.,Ltd.)

7.10.7 中基日造重工有限公司(ZhongJi Hitachi Zosen Diesel Engine Co.,Ltd.)

7.10.8 玉柴船舶动力股份有限公司(Yuchai Marine Power Co., Ltd)

第八章 中国船用柴油机行业发展趋势

8.1 存在的问题

8.2 发展趋势

第九章 总结与预测

9.1 市场

9.2 企业

9.2.1 全球

9.2.2 中国

1 Overview of Marine Diesel Engine

1.1 Definition

1.2 Classification & Features

1.2.1 Classification

1.2.2 Features

2 Development of Marine Diesel Engine Worldwide

2.1 Market Size

2.2 Competition Pattern

2.2.1 by Country

2.2.2 by Enterprise

3 Development Environment of Marine Diesel Engine in China

3.1 Industrial Environment

3.2 Policy

3.2.1 Industrial Planning

3.2.2 Trade Policy

4 Marine Diesel Engine Market in China

4.1 Supply & Demand

4.1.1 Supply

4.1.2 Demand

4.2 Import & Export

4.2.1 Import

4.2.2 Export

4.3 Competition Pattern

4.3.1 Regional Pattern

4.3.2 Corporate Pattern

5 Chinese Marine Diesel Engine Market Segments

5.1 Low-Speed Marine Diesel Engine

5.1.1 Status Quo

5.1.2 Key Players

5.2 Medium-Speed Marine Diesel Engine

5.2.1 Status Quo

5.2.2 Key Players

6 Key Companies Worldwide

6.1 MAN Group

6.1.1 Profile

6.1.2 Operation

6.1.3 Marine Diesel Engine Business

6.1.4 Development in China

6.2 Wärtsilä

6.2.1 Profile

6.2.2 Operation

6.2.3 Marine Diesel Engine Business

6.2.4 Development in China

6.3 Caterpillar

6.3.1 Profile

6.3.2 Operation

6.3.3 Development in China

6.4 Hyundai Heavy Industries

6.4.1 Profile

6.4.2 Operation

6.4.3 Development in China

6.5 Mitsubishi Heavy Industries

6.5.1 Profile

6.5.2 Operation

6.5.3 Development in China

6.6 Doosan Engine

6.6.1 Profile

6.6.2 Operation

6.6.3 Development in China

7 Key Enterprises in China

7.1 Hudong Heavy Machinery

7.1.1 Profile

7.1.2 Operation

7.1.3 R & D Capability

7.2 Dalian Marine Diesel

7.2.1 Profile

7.2.2 Operation

7.2.3 R & D Capability

7.3 Yichang Marine Diesel Engine

7.3.1 Profile

7.3.2 Operation

7.3.3 R & D Capability

7.3.4 Development Strategy

7.4 Weichai Heavy Machinery

7.4.1 Profile

7.4.2 Operation

7.4.3 Project Progress

7.5 CSSC-MES Diesel

7.5.1 Profile

7.5.2 Operation

7.5.3 R & D

7.6 Shaanxi Diesel Engine Heavy Industry

7.6.1 Profile

7.6.2 Operation

7.6.3 R & D Capability

7.6.4 Development Strategy

7.7 CSSC Marine Power

7.7.1 Profile

7.7.2 Operation

7.7.3 Subsidiary -- Anqing CSSC Marine Diesel Co., Ltd.

7.7.4 Development Strategy

7.8 Zibo Diesel Engine Parent Company

7.8.1 Profile

7.8.2 Operation

7.8.3 R & D Capability

7.9 Henan Diesel Engine Industry

7.9.1 Profile

7.9.2 Operation

7.9.3 R & D Capability

7.10 Others

7.10.1 Jiangsu Antai Power Machinery Co., Ltd.

7.10.2 Shanghai Xinzhong Power Machine Co., Ltd.

7.10.3 Hefei RongAn Power Machinery Co., Ltd.

7.10.4 CSSC Guangzhou Marine Diesel Co., Ltd.

7.10.5 ZGPT Diesel Heavy Industry Co. Ltd.

7.10.6 Ningbo C.S.I. Power&Machinery Group Co., Ltd.

7.10.7 ZhongJi Hitachi Zosen Diesel Engine Co., Ltd.

7.10.8 Yuchai Marine Power Co., Ltd

8 Development Trend of China Marine Diesel Engine Industry

8.1 Problems

8.2 Development Trend

9 Summary and Forecast

9.1 Market

9.2 Enterprises

9.2.1 Global

9.2.2 China

表:船用柴油机的分类

图:2005-2015年全球船用柴油机市场规模

图:2005-2015年全球低速船用柴油机市场规模

图:2013年全球低速船用柴油机(分国家)市场份额

图:2009-2014年日本船用柴油机产量及金额

表:2009-2014年日本低速船用柴油机产量及产值

表:2007-2014年全球主要低速船用柴油机品牌市场份额(按功率)

表:2007-2014年全球主要中速船用柴油机品牌市场份额(按功率)

图:2010-2014年全球造船三大指标

表:2011年中国船舶协会与曼恩、瓦锡兰签订的谅解协议

表:船用柴油机氮氧化物排放标准

表:2010-2014年中国符合Tier II标准的船用柴油机研制情况

表:2011-2014年中国船用柴油机相关政策

表:2009-2014年中国船用柴油机产量

图:2007-2015年中国造船完工量

图:2008-2014年中国船用柴油机进口量及金额

图:2014年中国船用柴油机TOP10进口来源国

图:2014年中国船用柴油机进口TOP10省市

表:2008-2014年中国船用柴油机出口量及金额

图:2014年中国船用柴油机出口TOP10省市

图:2014年中国船用柴油机Top10出口市场

表:中国船用柴油机重点地区及代表企业

表:2011-2015年中国船用低速柴油机产量

表:2013年中国主要低速船用柴油机企业产量及市场份额

表:中国低速船用柴油机厂商及技术合作对象

表:2011-2015年中国船用中速柴油机产量

表:2009-2014年中国主要中速船用柴油机企业产量

表:中国船用中速柴油机厂商及技术合作对象

图:2008-2014年曼恩订单额

图:2007-2014年曼恩营业收入和净利润

图:2013-2014年曼恩销售额(分业务)构成

表:2013-2014年曼恩MDT公司主要经营指标

图:2007-2014年瓦锡兰订单额及销售额

表:2009-2014年瓦锡兰(分业务)订单额及销售额

表:2009-2014年瓦锡兰(分地区)销售额)

表:瓦锡兰船用柴油机及应用

表:2014年瓦锡兰在中国合资及独资公司

图:2008-2014年Caterpillar销售收入

表:2011-2014年Caterpillar(分业务)销售收入

表:2010-2014年卡特彼勒动力系统(分地区)销售收入

图:现代重工业务结构

图:现代重工全球网络

图:2010-2014年现代重工销售额及净利润

图:2013年现代重工发动机及机械事业部销售额构成

图:2006-2014年现代重工发动机及机械事业部销售额及订单额

图:2007-2014年现代重工发动机及机械事业部(分地区)新接订单构成

表:2010-2014财年三菱重工主要经济指标

图:2014年三菱重工业务结构

图:MHI能源与环境业务结构

表:三菱重工船用柴油机主要技术合作方

图:Doosan Engine公司竞争优势

图:2011-2013年Doosan Engine公司主要经济指标

图:2014年Doosan Engine在华机构

图:2007-2014年沪东重机柴油机产量

图:2009-2014年沪东重机营业收入及净利润

图:2010-2014年大连船柴船用柴油机产量

图:2009-2014年大连船柴销售收入和利润总额

表:2007-2013年宜柴主要经营指标

表:2014年潍柴重机船用柴油机产品

图:2009-2014年潍柴重机营业收入和净利润

表:2011-2014年潍柴重机(分业务)营业收入及毛利率

表:2009-2013年中船三井船用柴油机产量

表:2007-2013年陕柴重工主要经营指标

图:2010-2014年中船动力营业收入和利润总额

表:2009-2014年中船动力船用柴油机产量

表:2009-2012年安庆柴油机产量

表:河柴重工船用柴油机产品

表:2012-2013年河柴重工主要经济指标

表:2010-2014年熔安动力柴油机交付量

表:主要制造商推出的船用气体发动机

表:世界主要制造商推出的船用中速双燃料发动机

表:曼恩、瓦锡兰船用柴油机在中国的授权生产商

表:2013年中国主要船用柴油机企业产量及产能

Classification of Marine Diesel Engines

Global Marine Diesel Engine Market Size, 2005-2015

Global Low-Speed Marine Diesel Engine Market Size, 2005-2015

Global Low-Speed Marine Diesel Engine Market Share (by Country), 2013

Japan’s Marine Diesel Engine Output and Revenue, 2009-2014

Japan’s Low-speed Marine Diesel Engine Output and Output Value, 2009-2014

Market Share of Major Global Low-speed Marine Diesel Engine Brands (by Power), 2007-2014

Market Share of Major Global Medium-speed Marine Diesel Engine Brands (by Power), 2007-2014

Three Indicators of Global Shipbuilding, 2010-2014

Memorandum of Understanding Signed between China Association of the National Shipbuilding Industry, MAN and Wärtsilä, 2011

NOx Emission Standards for Marine Diesel Engines

Development of Marine Diesel Engines Complying with Tier II Standards in China, 2010-2014

Policies on Marine Diesel Engine in China, 2011-2014

China’s Output of Marine Diesel Engines, 2009-2014

Shipbuilding Completions in China, 2007-2015

Import Volume and Value of Marine Diesel Engines in China, 2008-2014

TOP 10 Import Sources of Marine Diesel Engines in China, 2014

TOP 10 Importers (Provinces/Municipalities) of Marine Diesel Engines in China, 2014

Export Volume and Value of Marine Diesel Engines in China, 2008-2014

TOP 10 Exporters (Provinces/Municipalities) of Marine Diesel Engines in China, 2014

Top 10 Export Destinations of Marine Diesel Engines in China, 2014

Key Production Areas and Representative Companies of Marine Diesel Engines in China

China’s Output of Low-speed Marine Engines, 2011-2015

Output and Market Share of Major Low-speed Marine Diesel Engine Companies in China, 2013

Low-Speed Marine Diesel Engine Manufacturers and Their Technical Copartners in China

China's Output of Medium-speed Marine Engines, 2011-2015

Output of Major Medium-speed Marine Diesel Engine Companies in China, 2009-2014

Medium-speed Marine Diesel Engine Manufacturers and Their Technical Partners in China

MAN's Order Value, 2008-2014

MAN's Revenue and Net Income, 2007-2014

MAN's Revenue Structure (by Business), 2013-2014

Major Operating Indicators of MAN MDT, 2013-2014

Wärtsilä's Order Value and Revenue, 2007-2014

Wärtsilä's Order Value and Revenue (by Business), 2009-2014

Wärtsilä's Revenue (by Region), 2009-2014

Wärtsilä's Marine Diesel Engines and Applications

Wärtsilä's Joint Ventures and Sole Proprietorships in China, 2014

Caterpillar's Revenue, 2008-2014

Caterpillar's Revenue (by Business), 2011-2014

Caterpillar's Power System Revenue (by Region), 2010-2014

Business Structure of Hyundai Heavy Industries

Global Network of Hyundai Heavy Industries

Revenue and Net Income of Hyundai Heavy Industries, 2010-2014

Revenue Structure of Engine and Machinery Division of Hyundai Heavy Industries, 2013

Revenue and Order Value of Engine and Machinery Division of Hyundai Heavy Industries, 2006-2014

New Order Structure of Engine and Machinery Division of Hyundai Heavy Industries (by Region), 2007-2014

Major Economic Indicators of Mitsubishi Heavy Industries, FY 2010-2014

Business Structure of Mitsubishi Heavy Industries, 2014

Energy and Environment Business Structure of Mitsubishi Heavy Industries

Major Technical Copartners of Mitsubishi Heavy Industries in Marine Diesel Engines

Competitive Edges of Doosan Engine

Major Economic Indicators of Doosan Engine, 2011-2013

Organizations of Doosan Engine in China, 2014

Diesel Engine Output of Hudong Heavy Machinery, 2007-2014

Revenue and Net Income of Hudong Heavy Machinery, 2009-2014

Marine Diesel Engine Output of Dalian Marine Diesel, 2010-2014

Revenue and Total Profit of Dalian Marine Diesel, 2009-2014

Major Operating Indicators of Yichang Marine Diesel Engine, 2007-2013

Marine Diesel Engines of Weichai Heavy Machinery, 2014

Revenue and Net Income of Weichai Heavy Machinery, 2009-2014

Revenue and Gross Margin of Weichai Heavy Machinery (by Business), 2011-2014

Marine Diesel Engine Output of CSSC-MES Diesel, 2009-2013

Major Operating Indicators of Shaanxi Diesel Engine Heavy Industry, 2007-2013

Revenue and Total Profit of CSSC Marine Power, 2010-2014

Marine Diesel Engine Output of CSSC Marine Power, 2009-2014

Diesel Engine Output of Anqing CSSC Marine Diesel, 2009-2012

Marine Diesel Engines of Henan Diesel Engine Industry

Major Economic Indicators of Henan Diesel Engine Industry, 2012-2013

Diesel Engine Shipment of RongAn Power Machinery, 2010-2014

Marine Gas Engines Launched by World’s Major Manufacturers

Marine Medium-speed Dual-fuel Engines Launched by World’s Major Manufacturers

Marine Diesel Engine Manufacturers Authorized by MAN and Wärtsilä in China

Output and Capacity of Major Marine Diesel Engine Companies in China, 2013

如果这份报告不能满足您的要求,我们还可以为您定制报告,请 留言说明您的详细需求。

|