|

|

|

报告导航:研究报告—

制造业—工业机械

|

|

2014-2018年全球及中国高压变频器行业研究报告 |

|

字数:2.4万 |

页数:71 |

图表数:86 |

|

中文电子版:7000元 |

中文纸版:3500元 |

中文(电子+纸)版:7500元 |

|

英文电子版:1800美元 |

英文纸版:1900美元 |

英文(电子+纸)版:2100美元 |

|

编号:ZHP022

|

发布日期:2015-05 |

附件:下载 |

|

|

|

变频器是一种用于电机变频调速的设备,通常情况下中国把驱动3-10kv交流电动机的变频器称之为高压变频器。高压变频器与大功率高压电机配套构成变频调速系统,可以达到调速、节能(一般可实现30%-60%的节能效果)、软启动的目的。 变频器是一种用于电机变频调速的设备,通常情况下中国把驱动3-10kv交流电动机的变频器称之为高压变频器。高压变频器与大功率高压电机配套构成变频调速系统,可以达到调速、节能(一般可实现30%-60%的节能效果)、软启动的目的。

近年,随着节能环保需求的增加以及装备升级改造步伐的加快,中国高压变频器行业呈现稳步增长态势,市场规模从2005年的11亿元增至2014年的77亿元,年复合增长率达到24.1%。

未来,为了保障能源安全,提高能源使用率,解决雾霾等问题,高压变频器将成为国家重点发展的对象,预计2015-2018年中国高压变频器的市场规模将以15%以上速度继续增长。

目前高压变频器在风机、水泵、压缩机、轧钢机等装备中都有使用。风机和泵类是中国高压变频器主要消费领域,2014年中国高压变频器用于风机和泵类市场的份额达67%;用于压缩机的份额为7%;其余26%用于冶金轧钢、矿井提升、皮带传输、船舶推进等专业负载上。

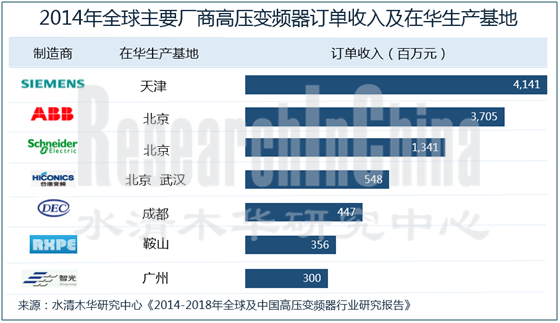

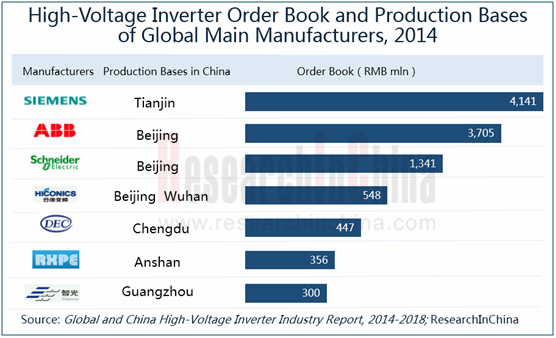

高压变频器可细分为通用和高性能两种。其中,通用高压变频器市场80%以上的份额被合康变频、智光电气等内资企业占据;而高性能高压变频器市场则以西门子、ABB、罗克韦尔等外资企业为主。由于高性能高压变频器的毛利率比通用高压变频器高50%左右,因此研发、生产高性能高压变频器将成为未来内资企业发展的重点。

西门子:全球最大的高压变频器生产商,1872年进入中国市场。2014财年在中国区营业收入为64.4亿欧元,占全球业务收入的8.9%。2015年1月,西门子SINAMICS G120C变频器投入使用,额定功率为0.55kw-18.5kw;与传统变频器相比,其空间占用小30%,能量密度高40%。

罗克韦尔:1988年进入中国市场,至今已设立1个研发中心,3个生产基地以及37个销售基地。2015年4月与三一重装国际控股有限公司合作开发矿用高压防爆变频器,进一步拓展公司产品在煤炭领域的应用。

合康变频:中国本土最大的高压变频器制造商,高压变频器生产基地位于北京和武汉。2014年高压变频器销量为909台,累计销量超过10,000台。

利德华福:其大功率变频技术在中国处于领先地位,2011年被施耐德全资收购。2014年其高压变频器销量累计突破11,000台。

水清木华研究中心《2014-2018年全球及中国高压变频器行业研究报告》着重研究了以下内容:

全球高压变频器市场规模、竞争格局等情况; 全球高压变频器市场规模、竞争格局等情况;

中国高压变频器产业环境、政策环境、技术环境等情况; 中国高压变频器产业环境、政策环境、技术环境等情况;

中国高压变频器市场规模、市场供需、市场前景、市场价格等情况; 中国高压变频器市场规模、市场供需、市场前景、市场价格等情况;

国外5家高压变频器厂商经营情况、在华布局等情况; 国外5家高压变频器厂商经营情况、在华布局等情况;

中国9家高压变频器厂商经营情况、营收结构、高压变频器业务等情况。 中国9家高压变频器厂商经营情况、营收结构、高压变频器业务等情况。

An inverter is a device that makes motors operate at variable speed. Customarily, China defines an inverter driving a AC motor with a rated voltage of 3-10kV as a high-voltage inverter. The frequency control system consisting of high-voltage inverters and high-power & high-voltage motors can realize the goals of speed adjustment, energy saving (typically 30%-60% energy is saved) and soft start.

As the demand for energy saving and environmental protection increases and the equipment upgrading speeds up, China’s high-voltage inverter industry has achieved steady growth, and the market size jumped from RMB1.1 billion in 2005 to RMB7.7 billion in 2014, with the CAGR of 24.1%.

In future, China will prioritize the development of high-voltage inverters in order to ensure energy security, improve energy utilization and solve the haze problem. In 2015-2018, China's high-voltage inverter market size is expected to grow at 15% or above.

Currently, high-voltage inverters are used in fans, pumps, compressors, rolling mills and other equipment. Especially, fans and pumps are key consumption areas of high-voltage inverters in China and utilized 67% of such inverters in 2014, followed by compressors with 7%; the remaining 26% was applied to metallurgy, steel rolling, mine hoists, belt transmission, ship propulsion and other professional loads.

High-voltage inverters can be divided into general-purpose and high-performance ones. More than 80% shares of the general-purpose high-voltage inverter market is held by domestic enterprises such as Hiconics Drive Technology and Guangzhou Zhiguang Electric; while the high-performance high-voltage inverter market is mostly dominated by Siemens, ABB, Rockwell and other foreign companies. Because high-performance high-voltage inverters trigger higher gross margin than general-purpose ones by 50%, domestic Chinese enterprises will give priority to the R & D and production of high-performance high-voltage inverters in the future.

Siemens: The world's largest high-voltage inverter manufacturer entered the Chinese market in 1872. In FY2014, it achieved the revenue of EUR6.44 billion in China, accounting for 8.9% of its global revenue. In January 2015, Siemens launched SINAMICS G120C inverter with the rated power of 0.55kw-18.5kw, which can save the space by 30% and raise energy density by 40% compared with conventional inverters.

Rockwell: It stepped in the Chinese market in 1988 and has set up an R & D center, three production bases and 37 sales bases there. In April 2015, the company cooperated with SANY Heavy Equipment Co., Ltd to develop mine-use high-voltage explosion-proof inverters jointly to further expand the application of its products in the coal field.

Hiconics Drive Technology: China's largest local high-voltage inverter manufacturer has set up its high-voltage inverter production bases in Beijing and Wuhan. It sold 909 high-voltage inverters in 2014, so that the cumulative sales volume exceeded 10,000.

Beijing Leader & Harvest Electric Technologies: It is a leader in China in terms of high-power frequency conversion technology. In 2011, it was wholly acquired by Schneider. In 2014, its high-voltage inverter sales volume broke 11,000 cumulatively.

The report focuses on the following:

Size, competitive landscape, etc. of the global high-voltage inverter market; Size, competitive landscape, etc. of the global high-voltage inverter market;

Environments, policies, technology and the like of China high-voltage inverter industry; Environments, policies, technology and the like of China high-voltage inverter industry;

Size, supply and demand, prospect, price and so forth of Chinese high-voltage inverter market; Size, supply and demand, prospect, price and so forth of Chinese high-voltage inverter market;

Operation and layout in China of five foreign high-voltage inverter manufacturers; Operation and layout in China of five foreign high-voltage inverter manufacturers;

Operation, revenue structure and high-voltage inverter business of nine Chinese high-voltage inverter manufacturers. Operation, revenue structure and high-voltage inverter business of nine Chinese high-voltage inverter manufacturers.

第一章 高压变频器简介

1.1 定义

1.2 产品特性

1.3 产业链

第二章 高压变频器发展环境

2.1 产业环境

2.2 政策环境

2.3 技术环境

第三章 高压变频器行业发展现状

3.1 全球高压变频器发展概况

3.1.1 市场规模

3.1.2 竞争格局

3.2 中国高压变频器发展现状

3.2.1 发展历程

3.2.2 发展现状

第四章 中国高压变频器市场分析

4.1 市场规模

4.2 市场供需

4.2.1 市场供应

4.2.2 市场需求

4.2.3 市场前景

4.3 市场价格

4.3.1 成本构成

4.3.2 价格走势

4.3.3 重点企业价格

第五章 全球高压变频器重点企业

5.1 西门子

5.1.1 企业简介

5.1.2 经营情况

5.1.3 营收构成

5.1.4 在华业务

5.2 罗克韦尔

5.2.1 企业简介

5.2.2 经营情况

5.2.3 营收构成

5.2.4 在华业务

5.3 ABB

5.3.1 公司简介

5.3.2 经营情况

5.3.3 营收构成

5.3.4 在华业务

5.4 SCHNEIDER

5.4.1 公司简介

5.4.2 经营情况

5.4.3 营收构成

5.4.4 在华业务

5.5 东芝三菱

5.5.1 企业简介

5.5.2 在华业务

第六章 中国高压变频器重点企业

6.1 合康变频

6.1.1 企业简介

6.1.2 经营情况

6.1.3 营收构成

6.1.4 毛利率

6.1.5 研发和投资

6.1.6 高压变频器业务

6.2 智光电气

6.2.1 企业简介

6.2.2 经营情况

6.2.3 营收构成

6.2.4 毛利率

6.2.5 研发和投资

6.2.6 高压变频器业务

6.3 九洲电气

6.3.1 企业简介

6.3.2 经营情况

6.3.3 营收构成

6.3.4 毛利率

6.3.5 研发和投资

6.3.6 高压变频器业务

6.4 荣信股份

6.4.1 企业简介

6.4.2 经营情况

6.4.3 主要客户及供应商

6.4.4 营收构成

6.4.5 毛利率

6.4.6 研发和投资

6.4.7 高压变频器业务

6.5 利德华福

6.5.1 企业简介

6.5.2 企业经营

6.5.3 研发能力

6.6 东方日立

6.6.1 企业简介

6.6.2 经营情况

6.7 其他企业

6.7.1 湖北三环

6.7.2 山东新风光

6.7.3 明阳龙源

第七章 总结与预测

7.1 市场

7.2 企业

1. Profile of High-voltage Inverter

1.1 Definition

1.2 Product Characteristics

1.3 Industry Chain

2. Development Environment of High-voltage Inverter

2.1 Industry Environment

2.2 Policy Environment

2.3 Technology Environment

3. Current Development of High-voltage Inverter Industry

3.1 Global High-voltage Inverter Industry

3.1.1 Market Size

3.1.2 Competition Pattern

3.2 Chinese High-voltage Inverter Industry

3.2.1 Development History

3.2.2 Status Quo

4. Chinese High-voltage Inverter Market

4.1 Market Size

4.2 Supply and Demand

4.2.1 Supply

4.2.2 Demand

4.2.3 Market Prospect

4.3 Market Price

4.3.1 Cost Structure

4.3.2 Price Trend

4.3.3 Prices of Key Enterprises

5. Global Key High-voltage Inverter Manufacturers

5.1 Siemens

5.1.1 Profile

5.1.2 Operation

5.1.3 Revenue Structure

5.1.4 Business in China

5.2 Rockwell

5.2.1 Profile

5.2.2 Operation

5.2.3 Revenue Structure

5.2.4 Business in China

5.3 ABB

5.3.1 Profile

5.3.2 Operation

5.3.3 Revenue Structure

5.3.4 Business in China

5.4 Schneider

5.4.1 Profile

5.4.2 Operation

5.4.3 Revenue Structure

5.4.4 Business in China

5.5 TMEIC

5.5.1 Profile

5.5.2 Business in China

6. Key High-voltage Inverter Manufacturers in China

6.1 Hiconics Drive Technology Co., Ltd.

6.1.1 Profile

6.1.2 Operation

6.1.3 Revenue Structure

6.1.4 Gross Margin

6.1.5 R&D and Investment

6.1.6 High-voltage Inverter Business

6.2 Guangzhou Zhiguang Electric Co., Ltd.

6.2.1 Profile

6.2.2 Operation

6.2.3 Revenue Structure

6.2.4 Gross Margin

6.2.5 R&D and Investment

6.2.6 High-voltage Inverter Business

6.3 Harbin Jiuzhou Electric Co., Ltd.

6.3.1 Profile

6.3.2 Operation

6.3.3 Revenue Structure

6.3.4 Gross Margin

6.3.5 R&D and Investment

6.3.6 High-voltage Inverter Business

6.4 Rongxin Power Electronic Co., Ltd.

6.4.1 Profile

6.4.2 Operation

6.4.3 Customers and Suppliers

6.4.4 Revenue Structure

6.4.5 Gross Margin

6.4.6 R&D and Investment

6.4.7 High-voltage Inverter Business

6.5 Beijing Leader & Harvest Electric Technologies Co., Ltd.

6.5.1 Profile

6.5.2 Operation

6.5.3 R & D Capabilities

6.6 Dongfang Hitachi (Chengdu) Electric Control Equipment Co., Ltd.

6.6.1 Profile

6.6.2 Operation

6.7 Other Enterprises

6.7.1 Hubei Sanhuan Development Corporation Ltd.

6.7.2 Shandong Xinfengguang Electronic Technology Development Co., Ltd.

6.7.3 Guangdong Mingyang Longyuan Power & Electronic Co., Ltd.

7. Summary and Forecast

7.1 Market

7.2 Enterprise

表:高压变频器(分行业)节电效果

图:高压变频器产业链

图:2014年中国高压变频器应用领域及占比

表:三种电机节能方式对比

图:2006-2014年中国新增电动机变频化率

图:2006-2018年中国变频器市场规模

图:2004-2014年中国可调速高压大功率电机容量及增速

表:变频器三种控制方式特性比较

表:主要高压变频器企业技术路线比较

图:2006-2018年全球高压变频器市场规模

图:2014年全球高压变频器竞争格局

图:中国高压变频器生命周期分析

图:2004-2014年中国高压变频器国内外品牌份额

图:2014年中国高压变频器市场竞争格局

图:2005-2014年中国高压变频器市场规模及增速

表:2014年中国变频器主要企业工业总产值

图:2014年中国高压变频器主要企业产能

图:2008-2014年中国高压变频器销量

图:2014年中国(分电压等级)高压变频器市场分布

图:2014年中国(分负载)高压变频器市场分布

表:2011-2015年中国高压变频器潜在市场规模

表:2011-2018年中国高压变频器应用市场潜在需求

图:2014年中国高压变频器成本构成

表:IGBT主要供应商

图:2008-2014年中国IGBT市场规模

图:2006-2014年中国IGBT市场平均价格

图:2000-2014年中国高压变频器价格走势

图:2014年主要厂商高压变频器单价对比

图:2013-2014财年Siemens员工数量

图:2009-2014财年Siemens营业收入及净利润

图:2013-2014财年Siemens(分地区)营业收入

图:2012-2013财年Siemens(分地区)订单额与营业收入

图:2009-2014财年西门子中国区营业收入及增幅

图:2011-2014财年罗克韦尔营业收入及净利润

图:2011-2014财年罗克韦尔(分产品)营业收入

图:2013-2014财年罗克韦尔(分地区)营业收入构成

图:2009-2014年ABB营业收入及净利润

图:2013-2014年ABB(分业务)营业收入构成

图:截至2014年ABB在中国业务分布

图:2009-2014年Schneider营业收入及净利润

图:2013-2014年Schneider(分业务)营业收入构成

图:2013-2014年Schneider(分地区)营业收入构成

图:Schneider在华布局

图:2009-2013年Schneider中国区营业收入及增速

图:东芝三菱全球营销网络

图:2014年合康变频股权结构

图:2008-2015年合康变频营业收入和净利润

图:2014年合康变频(分产品)营业收入构成

图:2009-2014年合康变频(分地区)营业收入构成

图:2009-2014年合康变频(分产品)毛利率

图:2008-2014年合康变频研发支出及占营业收入比例

图:2010-2014年合康变频(分产品)高压变频器收入

图:2009-2015年合康变频高压变频器订单情况

表:2011-2014年合康变频高压变频器(分行业)产销量

图:2014年智光电气股权结构

图:2008-2015年智光电气营业收入和净利润

图:2009-2014年智光电气前五名客户销售金额及占比

图:2009-2014年智光电气(分产品)营业收入

图:2009-2014年智光电气(分地区)营业收入

图:2009-2014年智光电气(分产品)毛利率

图:2009-2014年智光电气研发支出及占营业收入比例

图:2011-2014年智光电气电机系统控制与节能产品产销量

图:2014年九洲电气股权结构

图:2008-2015年九洲电气主营业收入和净利润

图:2009-2014年九洲电气(分产品)营业收入构成

图:2009-2014年九洲电气(分地区)主营业务收入

图:2009-2014年九洲电气(分产品)毛利率

图:2009-2014年九洲电气研发支出及占营业收入比例

图:2009-2014年年九洲电气高压变频器业务收入及增速

图:2014年荣信股份股权结构

图:2008-2015年荣信股份营业收入和净利润

表:2014年荣信股份前五名客户销售额及占比

表:2014年荣信股份前五名供应商采购额及占比

图:2009-2014年荣信股份(分产品)营业收入及占比

图:2009-2014年荣信股份(分地区)营业收入

图:2009-2014年荣信股份(分产品)毛利率

图:2009-2014年荣信股份研发支出及占营业收入比例

图:2011-2014年荣信股份高压变频调速装置及高压软启动装置订单额及占比

图:2005-2014年利德华福高压变频器累计销量及增速

图:2014年东方日立股权结构

表:湖北三环高压变频器产品

图:山东新风光营销网络

表:明阳龙源产品系列

图:2006-2014年全球及中国高压变频器市场规模增速

图:2014年中国高压变频器下游应用结构

图:2009-2014年全球主要高压变频器制造商营收增速

Power Saving Effect of High-voltage Inverter (by Sector)

High-voltage Inverter Industry Chain

Application Field and Proportion of High-voltage Inverter in China, 2014

Comparison among Three Motor Energy-Saving Modes

Frequency Conversion Rate of Newly-added Motors in China, 2006-2014

China Inverter Market Size (by Sales), 2006-2018E

Speed-control High-voltage High-power Motor Capacity and Growth Rate, 2004-2014

Caparison among Three Control Ways of Inverters

Comparison among Technology Roadmaps of Major High-Voltage Inverter Manufacturers

Global Market Size of High-voltage Inverter, 2006-2018E

Global High-voltage Inverter Competition Pattern, 2014

Lifecycle of China’s High-Voltage Inverters

Market Share of Domestic and Foreign Brands in China High-Voltage Inverter Market, 2004-2014

Competition Pattern of China’s High-voltage Inverter Market, 2014

Chinese High-voltage Inverter Market Size, 2005-2014

Total Industrial Output Value of Major Chinese Inverter Manufacturers, 2014

Capacity of Major High-voltage Inverter Enterprises in China, 2014

China High-voltage Inverter Sales Volume, 2008-2014

Market Distribution of High-voltage Inverter in China (by Voltage Grade), 2014

Market Distribution of High-voltage Inverter in China (by Load), 2014

China High-voltage Inverter Potential Market Size, 2011-2015

Potential Demand of China High-voltage Inverter Application Market, 2011-2018E

Cost Structure of China High-voltage Inverter, 2014

Major Suppliers of IGBT

Market Size of IGBT in China, 2008-2014

Market Price of IGBT in China, 2006-2014

Price Trend of High-voltage Inverter in China, 2000-2014

Unit Price of Major High-voltage Inverter Manufacturers, 2014

Number of Employees of Siemens, FY2013-FY2014

Siemens’ Revenue and Net Income, FY2009-FY2014

Siemens’ Revenue (by Region), FY2013-FY2014

Siemens’ Order Value and Revenue, FY2012-FY2013

Siemens’ Revenue and YoY Growth in China, FY2009-FY2014

Rockwell’s Revenue and Net Income, FY2011-FY2014

Rockwell’s Revenue (by Product), FY2011-FY2014

Rockwell’s Revenue Structure (by Region), FY2013-FY2014

ABB’s Revenue and Net Income, 2009-2014

ABB’s Revenue Structure (by Business), 2013-2014

ABB’s Business Distribution in China as of 2014

Schneider’s Revenue and Net Income, 2009-2014

Schneider’s Revenue Structure (by Business), 2013-2014

Schneider’s Revenue Structure (by Region), 2013-2014

Schneider’s Layout in China

Schneider’s Revenue and YoY Growth in China, 2009-2013

Global Marketing Network of TMEIC

Equity Structure of Hiconics Drive Technology, 2014

Revenue and Net Income of Hiconics Drive Technology, 2008-2015

Revenue Structure of Hiconics Drive Technology by Product, 2014

Revenue Structure of Hiconics Drive Technology by Region, 2009-2014

Gross Margin of Hiconics Drive Technology by Product, 2009-2014

R&D Costs and % of Total Revenue of Hiconics Drive Technology, 2008-2014

High-voltage Inverter Revenue Breakdown of Hiconics Drive Technology by Product, 2010-2014

Orders for High-voltage Inverter of Hiconics Drive Technology, 2009-2015

Output and Sales Volume of High-voltage Inverter of Hiconics Drive Technology by Sector, 2011-2014

Equity Structure of Guangzhou Zhiguang Electric, 2014

Revenue and Net Income of Guangzhou Zhiguang Electric, 2008-2015

Guangzhou Zhiguang Electric’s Revenue from Top5 Customers and % of Total Revenue, 2009-2014

Revenue Breakdown of Guangzhou Zhiguang Electric by Product, 2009-2014

Revenue Breakdown of Guangzhou Zhiguang Electric by Region, 2009-2014

Gross Margin of Guangzhou Zhiguang Electric by Product, 2009-2014

R&D Costs and % of Total Revenue of Guangzhou Zhiguang Electric, 2009-2014

Output and Sales Volume of Electric Motor Controlling and Energy-saving Products of Guangzhou Zhiguang Electric, 2011-2014

Equity Structure of Jiuzhou Electric, 2014

Operating Revenue and Net Income of Harbin Jiuzhou Electric, 2008-2015

Revenue Structure of Harbin Jiuzhou Electric (by Product), 2009-2014

Operating Revenue of Harbin Jiuzhou Electric (by Region), 2009-2014

Gross Margin of Harbin Jiuzhou Electric (by Product), 2009-2014

R & D Costs and % of Total Revenue of Harbin Jiuzhou Electric, 2009-2014

High-voltage Inverter Revenue and Growth Rate of Harbin Jiuzhou Electric, 2009-2014

Equity Structure of Rongxin Power Electronic, 2014

Revenue and Net Income of Rongxin Power Electronic, 2008-2015

Revenue of Rongxin Power Electronic from Top 5 Clients and % of Total Revenue, 2014

Procurement of Rongxin Power Electronic from Top 5 Suppliers and % of Total Procurement,2014

Revenue of Rongxin Power Electronic (by Product), 2009-2014

Revenue of Rongxin Power Electronic (by Region), 2009-2014

Gross Margin of Rongxin Power Electronic (by Product), 2009-2014

R & D Costs and % of Total Revenue of Rongxin Power Electronic, 2009-2014

Value of Orders Received by Rongxin Power Electronic for High-voltage Frequency Control Devices and High-voltage Soft Starters and % of Total Revenue, 2011-2014

Accumulative Sales Volume and YoY of High-voltage Inverter of Beijing Leader & Harvest Electric Technologies, 2005-2014

Equity Structure of DHC, 2014

High-voltage Inverters of Hubei Sanhuan Development Corporation Ltd.

Marketing Network of Shandong Xinfengguang Electronic Technology Development

Product Line of Guangdong Mingyang Longyuan Power & Electronic

Global and China High-voltage Inverter Market Size and Growth Rate, 2006-2014

Downstream Application Structure of High-voltage Inverter in China, 2014

Growth Rate in Revenue of Major High-voltage Inverter Companies Worldwide, 2009-2014

如果这份报告不能满足您的要求,我们还可以为您定制报告,请 留言说明您的详细需求。

|