|

|

|

报告导航:研究报告—

TMT产业—电子半导体

|

|

2014-2015年全球及中国存储器(Memory)行业研究报告 |

|

字数:1.3万 |

页数:95 |

图表数:148 |

|

中文电子版:8000元 |

中文纸版:4000元 |

中文(电子+纸)版:8500元 |

|

英文电子版:2100美元 |

英文纸版:2300美元 |

英文(电子+纸)版:2400美元 |

|

编号:ZYW207

|

发布日期:2015-05 |

附件:下载 |

|

|

|

《2014-2015年全球及中国存储器(Memory)行业研究报告》包含以下内容:

1、存储器(Memory)技术发展趋势

2、存储器(Memory)市场分析

3、存储器(Memory)产业分析

4、19家典型存储器(Memory)产业链厂家研究

经历两年衰退之后,2013和2014年全球存储器市场出现了飞跃,连续两年市场规模增幅超过20%,2013年增幅为20.5%,2014年为22.1%,是所有半导体产品中增幅最高的。2015年增幅大大放缓,预计2015年存储器市场规模达838亿美元,增幅只有2.3%。

增幅下滑的原因几点,首先是DRAM的价格下滑。DRAM价格自2012年10月开始上涨,一直持续到2014年6月,价格上涨刺激供应增加,供需越来越平衡,2014年7月DRAM现货价开始全面下跌。

其次是需求下滑,智能手机增幅放缓,平板电脑出货量明显下滑,Desktop PC出货量下滑。随着全球经济复苏再次陷入不明朗,中国经济增速大幅度放缓,需求将在2016年出现更大幅度的下滑,预计智能手机也会出现明显下滑。而各大存储器厂家的新产能陆续投产,特别是NAND领域,价格下滑程度将超出预期。预计2016年存储器行业再次衰退,下滑3.1%。

存储器产业可以分为两大阵营,一大阵营为韩国阵营,另一大阵营为日美台阵营。台湾拥有良好的科研基础,与日本关系很好,长期接受日本的技术支持,台湾得以形成了最完整的存储器产业链。尤其是封测领域,韩国厂家有时也要求助于台湾厂家。日本拥有最先进的技术,但缺乏强大的资金支持,于是多联合美国企业,而美国和日本企业都乐意和台湾企业合作。日美台形成联盟,东芝与SanDisk结盟,Micron与台塑结盟。韩国厂家在NAND技术领域仍然逊色于日本厂家,三星每年还要给东芝大约3%的专利费。韩国厂家的强项在于资金实力雄厚,生产技术优秀。

中国大陆一直是全球最大的存储器市场,中国每年要从韩国进口数百亿美元的存储器,中国试图改变这种状况,但困难重重。目前中国大陆基础工业和基础科研实力相对落后,中国大陆在半导体领域落后台湾10年以上。因为实业的回报率远远低于金融投机,大陆企业热衷于资本运作,实业投入较少。在大企业纷纷退出的NorFlash领域,中国大陆企业或许会有些成就,但在DRAM和NAND领域,还很难取得大的突破。

目前大部分新技术类内存都是低容量内存,一旦容量提高就面临成本过高或可靠性变差的瓶颈。预计到2020甚至到2025年,传统的DRAM和NAND还是会占据统治地位,在低容量内存领域可能会有新技术取代Nor Flash或SRAM,目前商业化速度最快的是STT –MRAM。

2014年10月前,Everspin就已经有4000万 STT MRAM出货,2014年10月开始,Everspin与GLOBAL FOUNDRIES合作生产STT MRAM,采用40纳米技术。

Intel、IBM、三星、SK Hynix、高通等公司都在投入研发MRAM储存技术,不过日本公司在这个领域实力也很强大。除了东芝外,TDK也是重要的参与者,这次他们在日本Ceatec博览会上首次公开了MRAM晶圆,还有实际的性能演示。

Global and China Memory Industry Report, 2014-2015 covers the followings:

1. Memory technology trends

2. Memory market

3. Memory industry

4. 19 typical memory industry chain vendors

After two years of recession, the global memory market went forward by leaps and bounds in 2013-2014, with scale up more than 20% for two consecutive years i.e. 20.5% in 2013, 22.1% in 2014, the highest growth rate among all semiconductor products. In 2015, the growth rate slows evidently, only 2.3%, and the memory market size is expected to reach USD83.8 billion.

Causes for the decline in growth rate are the followings. The first comes to the falling prices of DRAM. DRAM price began to rise from October 2012, a trend lasting till June 2014, resulting in increased supply and a balance between supply and demand. However, spot prices of DRAM started falling in July 2014.

Second, the demand dropped. Smartphone growth slowed down, the shipment of tablet PC dived and that of desktop PC fell as well. As the world is just stuck in an ill-defined “economic recovery”, China’s economy has seen a slowdown in growth rate, with a sharper decline to occur in its demand in 2016, and so will smartphones then. With the commissioning of new capacities of major memory vendors, especially in the NAND field, the price will fall more than expected. The memory industry will probably suffer another recession in 2016, down 3.1%.

The memory industry can be divided into two camps: South Korean camp and Japanese/American/Taiwanese camp. Taiwan has good scientific research base, enjoying a sound relationship with Japan; technologically supported by the latter for a long time, Taiwan has the most complete industry chain of memory, especially in packing & testing, it sometimes helps South Korean peers. Japan boasts the most advanced technology but lacks strong financial support, mostly in association with US companies, and the two are willing to cooperate with Taiwanese companies. Japan, the United States and Taiwan formed an alliance – Toshiba with SanDisk, and Micron with Formosa Plastics. South Korean vendors still fade next to Japanese ones e.g. Samsung pays an about 3% patent fee to Toshiba each year, but they are competitive in financial strength and production technology.

Mainland China has been the world’s largest memory market, annually importing memory worth tens of billions of dollars from South Korea. China is trying to change this situation but beset with difficulties. The basic industry and basic scientific research strength are relatively backward in Chinese Mainland, even falling behind Taiwan by more than 10 years in field of semiconductor. Since the rate of return on industry is far lower than the monetary speculation, companies in the mainland are keen on capital operation instead of industrial investment. Chinese mainland enterprises may have some achievements in NorFlash sector from which large companies have retreated, but it is hard to make a big breakthrough in DRAM and NAND.

Currently, most of the new technical memories have low capacity, or else they may face bottlenecks of high costs and poor reliability when capacity is raised. It is projected that traditional DRAM and NAND will still occupy the dominant position from 2020 to 2025, NorFlash or SRAM may be replaced by new technologies in the low-capacity memory field. STT-MRAM now moves up fastest in commercialization.

Everspin had shipped 40 million STT MRAM before October 2014. Since then, it worked with GlobalFoundries in making STT MRAM (40 nm technology).

Intel, IBM, Samsung, SK Hynix and Qualcomm are developing MRAM storage technology while Japanese companies are pretty competitive in this area. In addition to Toshiba, TDK is also an important participant who showcased MRAM wafer with practical performance demonstration at CEATEC JAPAN for the first time.

第一章、内存技术发展趋势

1.1、TLC

1.2、3D NAND

1.3、新兴NVM内存EMERGING NVM

第二章、MEMORY市场

2.1、全球MEMORY市场

2.2、DRAM供求分析

2.3、NAND供需分析

2.4、全球手机市场与产业

2.5、中国手机市场

2.6、笔记本电脑市场

2.7、平板电脑市场

2.8、服务器

2.8.1、服务器市场

2.8.2、服务器产业

2.9、企业级SSD市场

第三章、内存产业

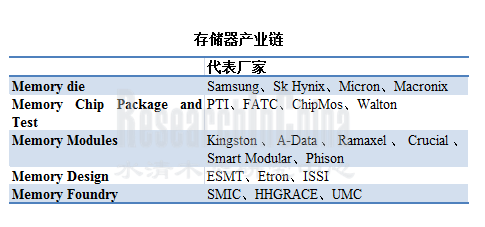

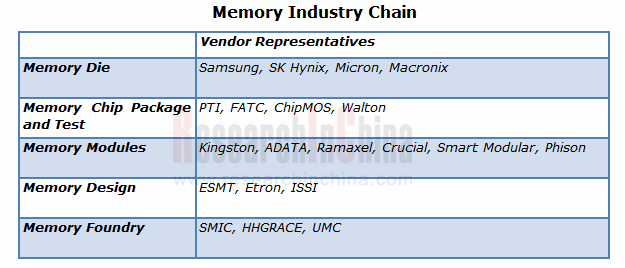

3.1、内存产业链

3.2、内存厂家市场占有率

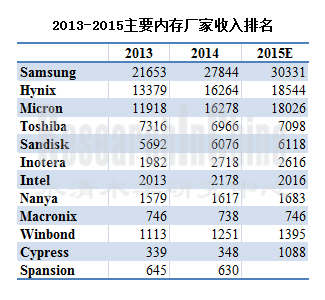

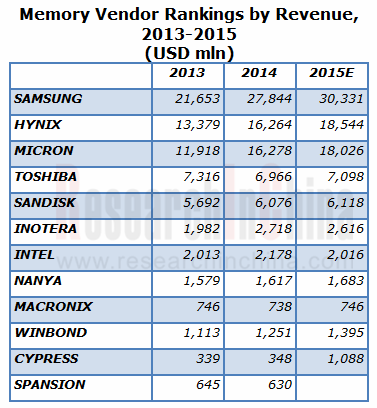

3.3、内存厂家排名

3.4、NORFLASH厂家市场占有率

3.5、中国大陆厂商进入主流内存领域困难重重

第四章、内存厂家研究

4.1、三星

4.2、SK HYNIX

4.3、MICRON

4.4、INOTERA

4.5、NANYA TECHNOLOGY

4.6、SANDISK

4.7、MACRONIX

4.8、ESMT

4.9、ETRON

4.10、ISSI

4.11、WINBOND ELECTRONIC

4.12、CYPRESS

4.13、兆易创新

4.14、东芝

第五章、内存产业链厂家研究

5.1、PTI

5.2、南茂CHIPMOS

5.3、福懋科技FATC

5.4、ADATA

5.5、慧荣SILICON MOTION TECHNOLOGY

1. Memory Technology Trends

1.1 TLC

1.2 3D NAND

1.3 Emerging NVM

2. Memory Market

2.1 Global Memory Market

2.2 DRAM Supply & Demand

2.3 NAND Supply & Demand

2.4 Global Mobile Phone Market and Industry

2.5 China Mobile Phone Market

2.6 Notebook Computer Market

2.7 Tablet PC Market

2.8 Server

2.8.1 Server Market

2.8.2 Server Industry

2.9 Enterprise SSD Market

3. Memory Industry

3.1 Memory Industry Chain

3.2 Memory Vendor Market Share

3.3 Memory Vendor Rankings

3.4 NorFlash Vendor Market Share

3.5 Chinese Mainland Vendors Beset with Difficulties into Mainstream Memory Areas

4. Memory Vendors

4.1 SAMSUNG

4.2 SK HYNIX

4.3 MICRON

4.4 INOTERA

4.5 NANYA TECHNOLOGY

4.6 SANDISK

4.7 MACRONIX

4.8 ESMT

4.9 ETRON

4.10 ISSI

4.11 WINBOND ELECTRONIC

4.12 CYPRESS

4.13 GIGADEVICE

4.14 TOSHIBA

5. Memory Industry Chain Vendors

5.1 PTI

5.2 CHIPMOS

5.3 FATC

5.4 ADATA

5.5 SILICON MOTION

Memory分类

各种Memory对比

2014-2020 Emerging NVM Time to market by Application

新旧内存对比

2009-2016年全球Memory市场规模

2014年Global Memory Market by type

2008-2015 Auotomotive Memory Market Size

2010-2015 Auotomotive Memory Market By Technology

2008-2015 DRAM Industry Capex

2013-2016 DRAM Oversupply Ratio

2013-2015 DRAM Demand by Devices

2013-2015 DRAM GB/SystemDRAM GB/System

2014年1季度-2016年4季度 DRAM Oversupply Ratio

2008-2015 NAND Industry Capex

2007-2015年全球手机出货量

2011-2014年全球3G/4G手机出货量地域分布

Worldwide Smartphone Sales to End Users by Vendor in 2014 (Thousands of Units)

Worldwide Smartphone Sales to End Users by Operating System in 2014 (Thousands of Units)

2014年全球前十大手机厂家出货量

2013年1月-2014年12月中国手机市场月度出货量

2014年中国智能手机市场主要厂家市场占有率

2014年中国4G手机市场主要厂家市场占有率

2008-2015年笔记本电脑出货量

2010-2014年全球主要笔记本电脑ODM厂家出货量

2011-2016年全球平板电脑出货量

Top Five Tablet Vendors, Shipments Fourth Quarter 2014

Top Five Tablet Vendors, Shipments, Market Share, and Growth, Calendar Year 2014

2013-2018年全球服务器市场规模

2013 Top 5 Corporate Family, Worldwide Server Systems Factory Revenue

Top 5 Corporate Family, Worldwide Server Systems Factory Revenue, Fourth Quarter of 2014

Worldwide: Server Vendor Shipments , 4Q14 (Units)

Worldwide: Server Vendor Revenue 4Q14 (U.S. Dollars)

EMEA Server Vendor Revenue 4Q14 (U.S. Dollars)

EMEA Server Shipment , 4Q14 (Units)

2015年全球服务器品牌市场占有率

2015年全球服务器生产厂家市场占有率

代工厂与服务器品牌厂供应关系

Memory Industry Chain

2014年1-4季度 Branded DRAM Vendor Market share

2014年1-4季度 Branded NAND Vendor Market share

2014年1-4季度 Mobile DRAM Vendor Market share

2013-2015主要内存厂家收入排名

内存设计公司收入与营业利润率

2013-2014主要内存厂家营业利润率

2012年主要NorFlash厂家市场占有率

2014年主要NorFlash厂家市场占有率

2010-2015年三星Memory事业部收入与营业利润率

2010-2015年三星Memory事业部收入breakdown by product

2014年三星Memory事业部收入breakdown by Application

2010-2015年三星DRAM/NAND 营业利润率

2012-2015年三星DRAM出货量

2012-2015年三星DRAM ASP

2013-2015 三星DRAM Fab Input(12inch Wafer)

2012-2015 三星NAND出货量

2012-2015 三星NAND ASP

2013-2015 三星NAND Fab Input(12inch Wafer)

2010-2015 三星SystemLSI收入与营业利润率

2008-2015 Sk Hynix Revenue vs Operation Margin

Q1/2013-Q4/2014 Sk Hynix 季度EBITDA、Net Margin

2008-2014 Sk Hynix Assets and Liabilities

2008-2014 Sk Hynix Revenue Mix by Product

Q1/2015 Sk Hynix Revenue Mix by Application

2013-2016 Sk Hynix DRAM Shipments vs ASP

2013-2016 Sk Hynix NAND Shipments vs ASP

FY2008-FY2015 Micron Revenue vs operation margin

FY2008-FY2015 Micron Revenue vs net income

FY2012-FY2015 Micron Revenue mix by segment

FY2012-FY2015 Micron 各部门毛利率

FY2012-FY2015 Micron Revenue mix by Location

Micron主要客户

Micron Roadmap

2008-2015 Inotera收入与毛利率

2015年1季度Inotera Balance Sheet & Key Indices

2015年1季度Inotera Cash Flow

2013年3月-2015年3月Inotera月度收入

Framework of Nanya, Micron & Inotera

2008-2015 Nanya 收入与毛利率

2012年2季度-2015年1季度Nanya 季度收入与毛利率

2013年1季度-2015年1季度Nanya Mix By Application

2012-2015 Nanya Mix By Application

2011-2015 Nanya Capex

2011-2015 Nanya Shipments

2009-2015 SanDisk Revenue vs Gross Margin

2009-2015 Sandisk Revenue Mix by Application

2011-2013 SanDisk Revenue by Location

Macronix Organization

2008-2015 Macronix收入与毛利率

2013-2015 Macronix收入 by segment

2011年1季度-2015年1季度Macronix ROM出货量

2013-2015 Macronix ROM Revenue mix by tech

2011年1季度-2015年1季度Macronix NOR出货量

2013-2015 Macronix NOR Revenue mix by tech

2015Q1 Macronix NOR Revenue breakdown

2013-2015 Macronix SLC NAND Shipment

2009-2015年 ESMT收入与毛利率

2013年3月-2015年3月ESMT月度收入

2009-2015 Etron 收入与毛利率

2013年3月-2015年3月Etron月度收入

2008-2015 ISSI收入与毛利率

2014 ISSI 收入by segment

ISSI主要客户

FY2009\FY2014 ISSI 收入by product

FY2009\FY2014 ISSI Automotive Market Reveune

Winbond Organization

2009-2015 Winbond收入与毛利率

2013年2季度2015年1季度Winbond季度收入与毛利率

2014-2015年Winbond收入By Application

2013-2015 Winbond Revenue by geometry

2010-2015 Winbond Capex

2011-2015 Winbond Revenue by Segment

2007-2014年Cypress收入与运营利润率

2009-2014年 Cypress收入业务分布

2009-2014年Cypress收入地域分布

2009-2013 Spansion 收入与毛利率

2011-2013 Spansion收入地域分布

新Cypress收入by application

2011-2013 GigaDevice资产负债表

2011-2013 GigaDevice 收入与营业利润

2011-2013 GigaDevice现金流

2011-2013 GigaDevice财务指标

2013年 GigaDevice客户分布

2013年 GigaDevice供应商分布

FY2011-2015 Toshiba Electronic Devices & Components Segment Revenue by product

PTI组织结构

2008-2015 PTI收入与毛利率

2013年3月-2015年3月PTI月度收入

2014年1季度-2015年1季度PTI收入mix by application

2003-2014年南茂科技收入与毛利率

2009-2014年南茂收入与营业利润率

2010-2014年南茂科技收入业务分布

2010-2014年南茂科技收入产品分布

2010-2014年南茂科技Utilization Rate 和EBITDA Margin

2009-2014年南茂科技Cash Flow 和CAPEX

2014-2016 ChipMOS Technology Roadmap

ChipMOS Technology Development & Business Alignment

台塑集团组织结构

福懋科技组织结构

2006-2015年福懋科技收入与运营利润率

2009-2015年福懋科技收入与毛利率

2013年3月-2015年3月福懋科技月度收入

2008-2015 A-DATA收入与毛利率

2013年3月-2015年3月A-DATA月度收入

2011-2015 A-DATA 收入by segment

A-DATA全球分布

2010-2015年SIMO收入与毛利率

Classification of Memory

Comparison between Various Types of Memory

Emerging NVM Time to Market by Application, 2014-2020

Comparison of Emerging Memory and Established Memory

Global Memory Market Size, 2009-2016E

Global Memory Market by Type, 2014

Automotive Memory Market Size, 2008-2015

Automotive Memory Market by Technology, 2010-2015

DRAM Industry CAPEX, 2008-2015

DRAM Oversupply Ratio, 2013-2016

DRAM Demand by Devices, 2013-2015

DRAM GB/SystemDRAM GB/System, 2013-2015

DRAM Oversupply Ratio, Q1/2014-Q4/2016

NAND Industry CAPEX, 2008-2015

Global Mobile Phone Shipments, 2007-2015

Global 3G/4G Mobile Phone Shipments by Region, 2011-2014

Worldwide Smartphone Sales to End Users by Vendor in 2014 (Thousands of Units)

Worldwide Smartphone Sales to End Users by Operating System in 2014 (Thousands of Units)

Shipments of Top 10 Mobile Phone Vendors Worldwide, 2014

Monthly Shipments of China Mobile Phone Market, Jan 2013-Dec 2014

Market Share of Major Smartphone Vendors in China, 2014

Market Share of Major 4G Mobile Phone Vendors in China, 2014

Notebook Computer Shipments, 2008-2015

Shipments of Major Notebook ODM Vendors Worldwide, 2010-2014

Global Tablet PC Shipments, 2011-2016E

Shipments of Top 5 Tablet PC Vendors, Q4/2014

Shipments, Market Share and Growth of Top 5 Tablet PC Vendors, 2014

Global Server Market Size, 2013-2018E

Top 5 Corporate Family, Worldwide Server Systems Factory Revenue, 2013

Top 5 Corporate Family, Worldwide Server Systems Factory Revenue, Q4/2014

Worldwide: Server Vendor Shipments, Q4/2014 (Units)

Worldwide: Server Vendor Revenue, Q4/2014 (U.S. Dollars)

EMEA Server Vendor Revenue, Q4/2014 (U.S. Dollars)

EMEA Server Shipment, Q4/2014 (Units)

Market Share of Server Brand Vendors Worldwide, 2015

Market Share of Server OEMs Worldwide, 2015

Supply Relationship between OEMs and Server Brand Vendors

Memory Industry Chain

Market Share of Branded DRAM Vendors, Q1-Q4/2014

Market Share of Branded NAND Vendors, Q1-Q4/2014

Market Share of Mobile DRAM Vendors, Q1-Q4/2014

Memory Vendor Rankings by Revenue, 2013-2015

Revenue and Operating Margin of Memory Design Companies

Operating Margin of Major Memory Vendors, 2013-2014

Market Share of Major NorFlash Vendors, 2012

Market Share of Major NorFlash Vendors, 2014

Revenue and Operating Margin of Samsung Memory Division, 2010-2015

Revenue Breakdown of Samsung Memory Division by Product, 2010-2015

Revenue Breakdown of Samsung Memory Division by Application, 2014

Samsung DRAM/NAND Operating Margin, 2010-2015

Samsung DRAM Shipments, 2012-2015

Samsung DRAM ASP, 2012-2015

Samsung DRAM Fab Input (12inch Wafer), 2013-2015

Samsung NAND Shipments, 2012-2015

Samsung NAND ASP, 2012-2015

Samsung NAND Fab Input (12inch Wafer), 2013-2015

Samsung System LSI Revenue vs Operating Margin, 2010-2015

SK Hynix Revenue vs Operating Margin, 2008-2015

SK Hynix EBITDA vs Net Margin, Q1/2013-Q4/2014

SK Hynix Assets vs Liabilities, 2008-2014

SK Hynix Revenue Mix by Product, 2008-2014

SK Hynix Revenue Mix by Application, Q1/2015

SK Hynix DRAM Shipments vs ASP, 2013-2016

SK Hynix NAND Shipments vs ASP, 2013-2016

Micron Revenue vs Operating Margin, FY2008-FY2015

Micron Revenue vs Net Income, FY2008-FY2015

Micron Revenue Mix by Segment, FY2012-FY2015

Micro Gross Margin by Segment, FY2012-FY2015

Micron Revenue Mix by Location, FY2012-FY2015

Micro Customers

Micron Roadmap

Inotera Revenue vs Gross Margin, 2008-2015

Inotera Balance Sheet & Key Indices, Q1/2015

Inotera Cash Flow, Q1/2015

Inotera Monthly Revenue, Mar 2013-Mar 2015

Framework of Nanya, Micron & Inotera

Nanya Revenue vs Gross Margin, 2008-2015

Nanya Quarterly Revenue vs Gross Margin, Q2/2012-Q1/2015

Nanya Mix by Application, Q1/2013-Q1/2015

Nanya Mix by Application, 2012-2015

Nanya CAPEX, 2011-2015

Nanya Shipments, 2011-2015

SanDisk Revenue vs Gross Margin, 2009-2015

Sandisk Revenue Mix by Application, 2009-2015

SanDisk Revenue by Location, 2011-2013

Macronix Organization

Macronix Revenue vs Gross Margin, 2008-2015

Macronix Revenue by Segment, 2013-2015

Macronix ROM Shipments, Q1/2011-Q1/2015

Macronix ROM Revenue Mix by Tech, 2013-2015

Macronix NOR Shipments, Q1/2011-Q1/2015

Macronix NOR Revenue Mix by Tech, 2013-2015

Macronix NOR Revenue Breakdown, Q1/2015

Macronix SLC NAND Shipments, 2013-2015

ESMT Revenue vs Gross Margin, 2009-2015

ESMT Monthly Revenue, Mar 2013-Mar 2015

Etron Revenue vs Gross Margin, 2009-2015

Etron Monthly Revenue, Mar 2013-Mar 2015

ISSI Revenue vs Gross Margin, 2008-2015

ISSI Revenue by Segment, 2014

ISSI Customers

ISSI Revenue by Product, FY2009\FY2014

ISSI Automotive Market Revenue, FY2009\FY2014

Winbond Organization

Winbond Revenue vs Gross Margin, 2009-2015

Winbond Quarterly Revenue vs Gross Margin, Q2/2013-Q1/2015

Winbond Revenue by Application, 2014-2015

Winbond Revenue by Geometry, 2013-2015

Winbond CAPEX, 2010-2015

Winbond Revenue by Segment, 2011-2015

Cypress Revenue vs Operating Margin, 2007-2014

Cypress Revenue by Business, 2009-2014

Cypress Revenue by Region, 2009-2014

Spansion Revenue vs Gross Margin, 2009-2013

Spansion Revenue by Region, 2011-2013

New Cypress Revenue by Application

GigaDevice Balance Sheet, 2011-2013

GigaDevice Revenue vs Operating Income, 2011-2013

GigaDevice Cash Flow, 2011-2013

GigaDevice Financial Indicators, 2011-2013

GigaDevice Customer Distribution, 2013

GigaDevice Supplier Distribution, 2013

Toshiba Revenue by Segment, FY2011-FY2015

Toshiba Electronic Devices & Components Segment Revenue by Product, FY2011-FY2015

PTI Organization

PTI Revenue vs Gross Margin, 2008-2015

PTI Monthly Revenue, Mar 2013-Mar 2015

PTI Revenue Mix by Application, Q1/2014-Q1/2015

ChipMOS Revenue vs Gross Margin, 2003-2014

ChipMOS Revenue vs Operating Margin, 2009-2014

ChipMOS Revenue by Business, 2010-2014

ChipMOS Revenue by Product, 2010-2014

ChipMOS Utilization Rate vs EBITDA Margin, 2010-2014

ChipMOS Cash Flow and CAPEX, 2009-2014

ChipMOS Roadmap, 2014-2016

ChipMOS Technology Development & Business Alignment

Formosa Plastics Organization

FATC Organization

FATC Revenue vs Operating Margin, 2006-2015

FATC Revenue vs Gross Margin, 2009-2015

FATC Monthly Revenue, Mar 2013-Mar 2015

ADATA Revenue vs Gross Margin, 2008-2015

ADATA Monthly Revenue, Mar 2013-Mar 2015

ADATA Revenue by Segment, 2011-2015

ADATA Worldwide

SIMO Revenue vs Gross Margin, 2010-2015

如果这份报告不能满足您的要求,我们还可以为您定制报告,请 留言说明您的详细需求。

|