|

|

|

报告导航:研究报告—

TMT产业—电子半导体

|

|

2014-2015年全球及中国晶圆代工(Foundry)研究报告 |

|

字数:1.8万 |

页数:110 |

图表数:119 |

|

中文电子版:8000元 |

中文纸版:4000元 |

中文(电子+纸)版:8500元 |

|

英文电子版:2200美元 |

英文纸版:2350美元 |

英文(电子+纸)版:2500美元 |

|

编号:ZYW210

|

发布日期:2015-06 |

附件:下载 |

|

|

|

《2014-2015年全球及中国晶圆代工(Foundry)研究报告》包含以下内容:

1、全球半导体市场与产业分析

2、中国半导体市场与产业分析

3、全球与中国晶圆代工(Foundry) 产业分析

4、16家晶圆代工(Foundry)厂家研究

2014年全球晶圆代工(Foundry)市场规模大约为461亿美元,比2013年增长18.2%,预计2015年全球晶圆代工(Foundry)市场规模为528亿美元,比2014年增长14.5%。预计2016年全球晶圆代工(Foundry)市场规模为583亿美元,比2015年增长6.4%。2017年增幅更低,预计只有3.7%。

2016年晶圆代工市场增幅大幅度降低的原因有几点,首先是主要的电子产品如智能手机、平板电脑和笔记本电脑市场在2014年达到巅峰期,2015年市场出现停滞或下滑,平板电脑市场已经出现明显下滑。设备市场稍微滞后,因此2016年出现下滑。其次是全球范围内的通货紧缩,以石油铁矿石为首的大宗商品价格暴跌会引起连锁效应,同样会导致半导体设备价格下滑。再次是全球经济复苏态势恐停滞,美国2015年1季度GDP下滑0.7%,中国GDP增速也大大放缓。

尽管整体市场规模仍然是增长的,但是对于大多数企业,2016年以后可能是下滑的。增长主要来自龙头厂家TSMC。尽管面临三星、Global Foundries甚至Intel的竞争,TSMC未来的市场占有率会进一步提高。

最危险的莫过于Global Foundries,其背后支撑是阿联酋的主权基金。油价长期处于低位,对于依赖石油的阿联酋来说不是好事,其财政收入必然下滑。Global Foundries是个无底洞,亏损幅度越来越大,继续在Global Foundries近百亿美元的投资显然不会得到认同。如果油价长期跌破40美元,那么阿联酋主权基金肯定会出售Global Foundries,接盘者很有可能是中国投资者。

近期也有传言,中国投资者有意收购Global Foundries。如果中国投资者收购Global Foundries,那么TSMC将少一个强劲的竞争对手。三星的手机业务利润逐渐下滑,Memory领域内的利润成为三星主要的利润来源。而Foundry利润微薄,甚至是亏损的,三星只会把更多精力投入到Memory领域而非Foundry。至于Intel在Foundry领域一直处于摸索状态,虽然拥有最先进的技术,但得不到客户认同,最先进的未必是最好的。

三星在Foundry领域成功的可能性极低,因为三星与全球大多数电子企业都是直接或间接的竞争对手,没有人会长期支持竞争对手。还有三星与众多电子企业都有专利或者其他领域的诉讼,例如全球最大的Graphic IC厂家NVIDIA就与三星有专利纠纷。NVIDIA只会象征性地下单给三星,但订单数量少到可以忽略,只不过是用来和TSMC讨价还价的策略而已。这是大多数电子厂家的策略,越是经济不景气时,大家对TSMC的下单比例就会越高。

在Foundry领域,技术先进并不意味着业绩会好。以 Global Foundries为例,技术上与三星、IBM 在同一水平,然而Global Foundries 2014年净损失从2013年的9亿增加至15亿美金。它的EBITDA表现更糟糕,从2012年的10亿美元降至2014年的4亿多美金,税息折旧及摊销利润率(EBITDA margin)只有11%,低于业界平均水平。

Global and China Foundry Industry Report, 2014-2015 highlights the followings:

1. Analysis of global semiconductor market and industry

2. Analysis of Chinese semiconductor market and industry

3. Analysis of global and China foundry industry

4. Study of 16 foundry vendors

Global foundry industry was worth about USD46.1 billion in 2014, up 18.2% from 2013, and is expected to reach USD52.8 billion in 2015, a year-on-year growth of 14.5%, and USD58.3 billion in 2016, rising by 6.4% against 2015, and increase by just 3.7% in 2017.

Substantial decline in growth rate of global foundry market in 2016 can be attributable to following aspects. First, markets for main electronic products like smartphone, tablet PC and laptop computer peaked in 2014 and has stalled or slid in 2015, with notable drop having been seen in tablet PC market. Device market lags slightly and will experience slowdown in 2016. Second, worldwide deflation and price slump of bulk commodities led by oil and iron ore may trigger a ripple effect, causing a fall in prices of semiconductor equipment. Third, global economic recovery could come to a standstill, as US Q1 GDP contracted 0.7% and China’s GDP growth slowed down sharply.

Despite expansion in overall market size, for most companies, the market maybe contract after 2016. Growth comes mainly from the industry leader- TSMC. In spite of competition from Samsung, Global Foundries and even Intel, TSMC will further raise its market share.

The one that is in the most dangerous situation is Global Foundries, which is backed by UAE’s sovereign fund. Prolonged low oil price is not a good thing for UAE that relies heavily on oil, and it is inevitable that the country’s fiscal revenue will go down. Global Foundries will finally become an abyss, as its losses are widening. Nearly ten billion dollar investment in Global Foundries will not be appreciated obviously. If oil price remains below USD40 for a long time, UAE’s sovereign fund will surely sell Global Foundries and buyers are likely to be Chinese investors.

It was rumored recently that Chinese investors intended to acquire Global Foundries. If this became true, TSMC will have one less tough competitors. As Samsung's profit from mobile phone business drops, Memory has become main source of Samsung’s profit. Moreover, Foundry makes meager profits or even losses, so Samsung will be more focused on Memory rather than Foundry. As to Intel, it has been groping in Foundry field with technologies that are the most advanced but not recognized by customers, showing that the most advanced is not necessarily the best.

It is very unlikely that Samsung will succeed in Foundry, as most of global electronics companies are direct or indirect rivals of Samsung, and no one will support its competitor for a long time. Furthermore, Samsung gets involved in legal battles with a large number of electronics companies over patent or other aspects, like patent dispute between the world’s largest Graphic IC vendor NVIDIA and Samsung. NVIDIA only symbolically places orders with Samsung, but the number of orders to Samsung could be ignored, just a strategy for NVIDIA to bargain with TSMC, which is adopted by majority of electronic companies, especially during economic downturn, when they put more orders with TSMC.

In Foundry field, advanced technology doesn’t always deliver good business performance. Take Global Foundries for example, technologically staying at same level with Samsung and IBM, Global Foundries recorded a widened net loss from USD900 million in 2013 to USD1.5 billion in 2015. EBITDA was much worse, down from USD1 billion in 2012 to more than USD400 million in 2014. EBITDA margin stood at only 11%, below the industry average.

第一章、全球半导体产业

1.1、半导体市场概况

1.2、半导体产业供应链

1.3、 半导体产业概况

第二章、FOUNDRY下游市场

2.1、手机市场

2.2、全球手机产业

2.3、中国手机市场

2.4、笔记本电脑市场

2.5、平板电脑市场

2.6、服务器市场

第三章、FOUNDRY产业分析

3.1、晶圆代工产业规模

3.2、晶圆代工行业竞争分析

3.3、晶圆代工产业排名

3.4、7NM FOUNDRY

3.5、中国IC市场

3.6、中国半导体产业

3.7、中国政府扶植半导体产业政策

3.8、中国近期半导体领域内并购

3.9、中国IC产业发展预测

3.10、中国晶圆代工产业发展目标

3.11、中国本土LOCAL半导体设备产业

第四章、FOUNDRY厂家研究

4.1、TSMC

4.2、UMC

4.3、SMIC

4.4、VIS

4.5、POWERCHIP

4.6、HHGRACE

4.7、DONGBU HITEK

4.8、TOWER

4.9、X-FAB

4.10、ASMC

4.11、三星

4.12、MAGNACHIP

4.13、GLOBALFOUNDRIES

4.14、富士通

4.15、华力微电子

4.16、武汉新芯集成电路制造

1 Global Semiconductor Industry

1.1 Overview of Semiconductor Market

1.2 Semiconductor Industry Supply Chain

1.3 Overview of Semiconductor Industry

2 Foundry Downstream Market

2.1 Mobile Phone Market

2.2 Global Mobile Phone Industry

2.3 Chinese Mobile Phone Market

2.4 Laptop Computer Market

2.5 Tablet PC Market

2.6 Server Market

3 Foundry Industry

3.1 Industry Size

3.2 Industry Competition

3.3 Industry Ranking

3.4 7nm Foundry

3.5 Chinese IC Market

3.6 China Semiconductor Industry

3.7 Chinese Government’s Supportive Policies for Semiconductor Industry

3.8 Recent M&As in China’s Semiconductor Field

3.9 Forecast of China IC Industry Development

3.10 Development Goals of China Foundry Industry

3.11 China’s Local Semiconductor Device Industry

4 FOUNDRY Vendors

4.1 TSMC

4.2 UMC

4.3 SMIC

4.4 VIS

4.5 POWERCHIP

4.6 HHGRACE

4.7 DONGBU HITEK

4.8 TOWER

4.9 X-FAB

4.10 ASMC

4.11Samsung

4.12 MAGNACHIP

4.13 GLOBALFOUNDRIES

4.14 Fujitsu

4.15 Huali Microelectronics

4.16 XMC

2013-2019年全球半导体市场规模

2013-2016年全球半导体市场产品分布

2013-2016年全球半导体产品增幅

Semiconductor Outsourced Supply Chain

Semiconductor Company Systems

Semiconductor Outsourced Supply Chain Example

Food Chain IC CAD Design Industry

1Q14 Top25 Semiconductor Sales Leaders

1Q15 Top25 Semiconductor Sales Leaders

1990-2013 Worldwide IC Sales by Company Headquarters Location

2013 Fabless IC Sales Marketshare by Company Headquarters Location

2008-2013 Top 10 IC Manufacturers in China

2011-2018 Mainstream tech-node on Typical Smartphone IC

2008-2016年平均每部手机IC成本

2000-2018年Frequency bands per mobile handset device

2000-2018 Cellular terminal shipment forecast by cellular standard

2011-2018 LTE-enabled cellular terminal forecast

2015年1季度主要手机厂家出货量

2015年1季度主要手机厂家市场占有率

2015年1季度主要手机OS市场占有率

Worldwide Smartphone Sales to End Users by Vendor in 2014 (Thousands of Units)

Worldwide Smartphone Sales to End Users by Operating System in 2014 (Thousands of Units)

2014年全球前十大手机厂家出货量

2014年中国智能手机市场主要厂家市场占有率

2014年中国4G手机市场主要厂家市场占有率

2008-2015年笔记本电脑出货量

2010-2014年全球主要笔记本电脑ODM厂家出货量

2011-2016年全球平板电脑出货量

Top Five Tablet Vendors, Shipments Fourth Quarter 2014

Top Five Tablet Vendors, Shipments, Market Share, and Growth, Calendar Year 2014

2013-2018年全球服务器市场规模

2013 Top 5 Corporate Family, Worldwide Server Systems Factory Revenue

Top 5 Corporate Family, Worldwide Server Systems Factory Revenue, Fourth Quarter of 2014

2015年全球服务器生产厂家市场占有率

2008-2017年全球Foundry市场规模

2012-2018 Global Foundry capacity by node

2012-2018 Global Foundry revenue by node

2005-2014 Global ranking by foundry

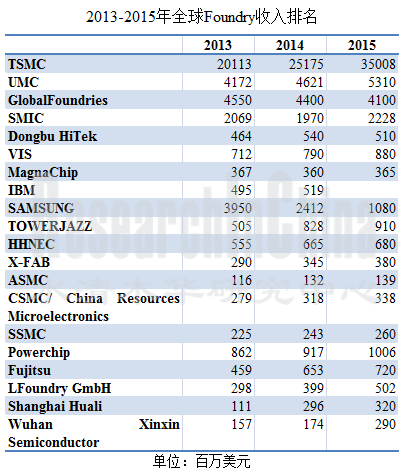

2005-2014年全球晶圆代工厂销售额排名

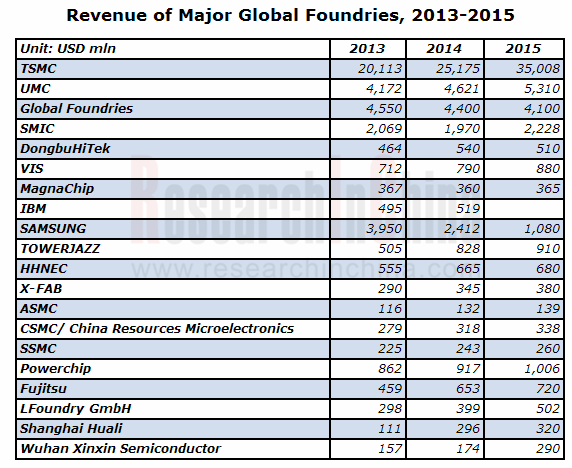

2013-2015年全球主要Foundry厂家营业利润率

2011-2017年中国IC市场规模

2006-2014年中国IC进口额

2006-2014年中国IC出口额

2008-2014年中国IC产业销售额

2008-2014年中国IC产业 Capex

2004、2014年中国十大IC设计公司销售额排名

2002-2018 China foundry sales share of the pure-play IC foundry market

中国集成电路基金会结构

TSMC 组织结构

2005-2015 年TSMC收入、毛利率、营业利润率

2004-2011年TSMC Wafers Shipments and utilization

2012-2014年TSMC Wafers Shipments and utilization

2012-2014 TSMC Consolidated Statements of Financial Position Data

2013Q1-2015Q1 TSMC Quarterly Revenues VS Gross Margin

2013Q1-2015Q1 TSMC Quarterly Revenues VS Net Margin

2013Q1-2015Q1 TSMC Quarterly Shipment VS Operation Margin

2012Q1-2015Q1 TSMC Quarterly Revenues by Node

2012Q1-2015Q1 TSMC Quarterly Revenues by Application

2012Q1-2014Q2 TSMC Quarterly Revenues by Region

2013Q1-2015Q1 TSMC Quarterly Wafer Shipments and ASP

TSMC Fab List

TSMC上海厂2013年财务数据

2004-2015 UMC 收入与营业利润率

2004-2014 UMC出货量与产能利用率

1Q13-1Q15 UMC Quarterly Shipment VS utilization

3Q12-1Q15 UMC Quarterly Revenues and Gross Margin

2012Q3-2015Q1 UMC Quarterly Revenues by Node

2012Q3-2015Q1 UMC Quarterly Revenues by Region

2012Q3-2015Q1 UMC Quarterly Revenues by Application

2006Q1-2015Q2 UMC Quarterly Capacity

UMC operating revenues in 2012 - 2014 by the location of customers.

SMIC Milestones

SMIC Fab Capacity

2003-2015年SMIC收入与营业利润率

2008-2014年SMIC Capacity

2008-2014年SMIC毛利率

1Q15 SMIC Balance Sheet

1Q15 SMIC Cash Flow

3Q11-1Q15 SMIC Net Profit and Gross Margin

3Q11-1Q15 SMIC EBITDA

3Q11-1Q15 SMIC Utilization Rate

2010-2014年SMIC收入地域分布

2013Q2-2015Q1 SMIC Quarterly Revenue Breakdown by Geography

2010-2014年SMIC收入应用分布

2013Q2-2015Q1 SMIC Quarterly Revenue Breakdown by Application

2010-2014 SMIC Revenue Breakdown by Node

2013Q2-2015Q1 SMIC Quarterly Revenue Breakdown by Node

2013Q2-2015Q1 SMIC Quarterly Capacity

SMIC Technology Migration on Application

ORGANIZATION OF VIS

2005-2015年VIS收入与营业利润率

1Q12-1Q15 VIS Quarterly Revenue And Gross Margin

1Q12-1Q15 VIS Quarterly Revenue And UTILRate

4Q12-1Q15 VIS Quarterly Revenue Breakdown by Node

1Q12-1Q15 VIS Quarterly Revenue Breakdown by Application

1Q12-1Q15 VIS Quarterly Revenue Breakdown by Product

Powerchip组织结构

2013年5月-2015年5月Powerchip月度收入

2011-2015年华虹宏力收入、毛利、营业利润

2011-2014年华虹集团收入、净利润、资产负债率

2011-2014华虹宏力Revenue Breakdown by Product

2011-2014华虹宏力Revenue Breakdown by Node

2011-2014华虹宏力产能利用率

2011-2014华虹宏力Revenue Breakdown by Clients

2011-2014华虹宏力Revenue Breakdown by Region

2011-2014华虹宏力Revenue Breakdown by Application

2005-2015年Dongbu HiTek收入与营业利润率

2003-2015 TowerSemi收入与毛利率

Tower Semiconductor Shareholders Structure

2013年2季度-2015年1季度ASMC UTILRate(%)

2010-2015三星SystemLSI事业部收入与营业利润率

2011-2015 三星SystemLSI事业部收入业务分布

2005-2015年MAGNACHIP收入及毛利率

2005-2015年MAGNACHIP收入及运营利润率

2004-2014年MAGNACHIP分产品收入分布

2006-2014年MAGNACHIP分地域产品分布

MAGNACHIP各晶圆厂一览

2012/2013年GlobalFoundries财务数据

GlobalFoundries Milestone

GlobalFoundries Global Footprints

FY2006-FY2015 富士通 Devices Solution 收入与营业利润率

武汉新芯集成电路制造 Roadmap

XMC’s 3D IC technology Platform

Global Semiconductor Market Size, 2013-2019E

Global Semiconductor Market Breakdown by Product, 2012-2016E

Market Size Growth of Various Semiconductor Products, 2012-2016E

Semiconductor Outsourced Supply Chain

Semiconductor Company Systems

Semiconductor Outsourced Supply Chain Example

Food Chain IC CAD Design Industry

Top25 Semiconductor Sales Leaders, 2014Q1

Top25 Semiconductor Sales Leaders, 2015Q1

Worldwide IC Sales by Company Headquarters Location, 1990-2013

Fabless IC Sales Market Share by Company Headquarters Location, 2013

Top 10 IC Manufacturers in China, 2008-2013

Mainstream Tech-node on Typical Smartphone IC, 2011-2018E

Average IC Costs Per Mobile Phone, 2008-2016E

Frequency Bands Per Mobile Handset Device, 2000-2018E

Cellular Terminal Shipment Forecast by Cellular Standard, 2000-2018E

LTE-enabled Cellular Terminal Forecast, 2011-2018E

Shipments of Major Mobile Phone Vendors, 2015Q1

Market Share of Major Mobile Phone Vendors, 2015Q1

Market Share of Major Mobile Phone Operating Systems, 2015Q1

Worldwide Smartphone Sales to End Users by Vendor in 2014 (Thousands of Units)

Worldwide Smartphone Sales to End Users by Operating System in 2014 (Thousands of Units)

Shipments of Global Top10 Mobile Phone Vendors, 2014

Market Share of Major Chinese Smartphone Vendors, 2014

Market Share of Major Vendors in Chinese 4G Mobile Phone Market, 2014

Laptop Computer Shipments, 2008-2015

Shipments of Major Global Notebook PC ODM Vendors, 2010-2014

Global Tablet PC Shipments, 2011-2016E

Shipments of Top5 Tablet PC Vendors, 2014Q4

Shipments, Market Share and Growth of Top5 Tablet PC Vendors, 2014

Global Server Market Size, 2013-2018E

Worldwide Server Systems Factory Revenue of Top 5 Corporate Family, 2013

Worldwide Server Systems Factory Revenue of Top 5 Corporate Family, 2014Q4

Market Share of Global Server Vendors, 2015

Global Foundry Market Size, 2008-2017E

Global Foundry Capacity by Node, 2012-2018E

Global Foundry Revenue by Node, 2012-2018E

Global Foundry Ranking by Revenue, 2005-2014

Ranking of Global Foundries by Sales, 2005-2014

Operating Profit Margin of Major Global Foundries, 2013-2015

Chinese IC Market Size, 2011-2017E

China’s IC Imports, 2006-2013

China’s IC Exports, 2006-2013

Sales of China IC Industry, 2008-2014

Capex of China IC Industry, 2008-2014

Top 10 IC Design Houses in China by Sales, 2004&2014

China Foundry Sales Share of the Pure-play IC Foundry Market, 2002-2018E

China National IC Fund Structure

Organizational Structure of TSMC

Revenue, Gross Margin and Operating Margin of TSMC, 2005-2015

Wafer Shipments and Utilization of TSMC, 2012-2014

Consolidated Statement of Financial Position Data of TSMC, 2012-2014

Quarterly Revenue VS Gross Margin of TSMC, 2013Q1-2015Q1

Quarterly Revenue VS Net Margin of TSMC, 2013Q1-2015Q1

Quarterly Shipment VS Operation Margin of TSMC, 2013Q1-2015Q1

Quarterly Revenue of TSMC by Node, 2012Q1-2015Q1

Quarterly Revenue Breakdown of TSMC by Application, 2012Q1-2015Q1

Quarterly Revenue Breakdown of TSMC by Region, 2012Q1-2014Q2

Quarterly Wafer Shipments and ASP of TSMC, 2013Q1-2015Q1

Fab List of TSMC

Financial Figures of TSMC's Shanghai Factory, 2013

Revenue and Operating Margin of UMC, 2004-2015

Shipments and Capacity Utilization of UMC, 2004-2014

Quarterly Shipment VS utilization of UMC, 2013Q1-2015Q1

Quarterly Revenue and Gross Margin of UMC, 2012Q3-2015Q1

Quarterly Revenue Breakdown of UMC by Node, 2012Q3-2015Q1

Quarterly Revenue Breakdown of UMC by Region, 2012Q3-2015Q1

Quarterly Revenue Breakdown of UMC by Application, 2012Q3-2015Q1

Quarterly Capacity of UMC, 2006Q1-2015Q2

Operating Revenue Breakdown of UMC by Location of Customers, 2012-2014

Milestones of SMIC

Fab Capacity of SMIC

Revenue and Operating Margin of SMIC, 2003-2015

Capacity of SMIC, 2008-2014

Gross Margin of SMIC, 2008-2014

Balance Sheet of SMIC, 2015Q1

Cash Flow of SMIC, 2015Q1

Net Profit and Gross Margin of SMIC, 2011Q3-2015Q1

EBITDA of SMIC, 2011Q3-2015Q1

Utilization Rate of SMIC, 2011Q3-2015Q1

Revenue Breakdown of SMIC by Region, 2010-2014

Quarterly Revenue Breakdown of SMIC by Geography, 2013Q2-2015Q1

Revenue Breakdown of SMIC by Application, 2010-2014

Quarterly Revenue Breakdown of SMIC by Application, 2013Q2-2015Q1

Revenue Breakdown of SMIC by Node, 2010-2014

Quarterly Revenue Breakdown of SMIC by Node, 2013Q2-2015Q1

Quarterly Capacity of SMIC, 2013Q2-2015Q1

SMIC Technology Migration on Application

Organizational Structure of VIS

Revenue and Operating Margin of VIS, 2005-2015

Quarterly Revenue and Gross Margin of VIS, 2012Q1-2015Q1

Quarterly Revenue and Utilization Rate of VIS, 2012Q1-2015Q1

Quarterly Revenue Breakdown of VIS by Node, 2012Q4-2015Q1

Quarterly Revenue Breakdown of VIS by Application, 2012Q1-2015Q1

Quarterly Revenue Breakdown of VIS by Product, 2012Q1-2015Q1

Organizational Structure of Powerchip

Monthly Revenue of Powerchip, May 2013-May 2015

Revenue, Gross Profit and Operating Income of HHGrace, 2011-2015

Revenue, Net Income and Asset-liability Ratio of Huahong Group, 2011-2014

Revenue Breakdown of HHGrace by Product, 2011-2014

Revenue Breakdown of HHGrace by Node, 2011-2014

Capacity Utilization of HHGrace, 2011-2014

Revenue Breakdown of HHGrace by Client, 2011-2014

Revenue Breakdown of HHGrace by Region, 2011-2014

Revenue Breakdown of HHGrace by Application, 2011-2014

Revenue and Operating Margin of DongbuHiTek, 2005-2015

Fabs of DongbuHitek

Revenue and Gross Margin of TowerSemi, 2003-2015

Tower Semiconductor Shareholders Structure

Revenue and Gross Margin of ASMC, 2003-2015

Revenue Breakdown of ASMC by Application, 2013Q2-2015Q1

Revenue Breakdown of ASMC by Region, 2013Q2-2015Q1

Revenue Breakdown of ASMC by Client, 2013Q2-2015Q1

Revenue Breakdown of ASMC by Fab, 2013Q2-2015Q1

Utilization Rate of ASMC, 2013Q2-2015Q1

Revenue and Operating Margin of Samsung’s System LSI Division, 2010-2015

Revenue Breakdown of Samsung’s System LSI Division by Business, 2011-2015

Revenue and Gross Margin of MagnaChip, 2005-2015

Revenue and Operating Margin of MagnaChip, 2005-2015

Revenue Breakdown of MagnaChip by Product, 2004-2014

Revenue Breakdown of MagnaChip by Region, 2006-2014

Wafer Fabs of MagnaChip

Financial Figures for Global Foundries, 2012/2013

Milestones of Global Foundries

Global Footprints of Global Foundries

Revenue and Operating Margin of Fujitsu’s Devices Solution, FY2006-FY2015

Roadmap of XMC

XMC’s 3D IC Technology Platform

如果这份报告不能满足您的要求,我们还可以为您定制报告,请 留言说明您的详细需求。

|