|

|

|

报告导航:研究报告—

制造业—汽车

|

|

2015-2019年全球及中国汽车ADAS行业研究报告 |

|

字数:2.6万 |

页数:172 |

图表数:204 |

|

中文电子版:9500元 |

中文纸版:4750元 |

中文(电子+纸)版:10000元 |

|

英文电子版:2450美元 |

英文纸版:2600美元 |

英文(电子+纸)版:2750美元 |

|

编号:HJ005

|

发布日期:2015-07 |

附件:下载 |

|

|

|

《2015-2019年全球与中国汽车ADAS行业研究报告》主要包含以下内容:

汽车高级驾驶辅助系统(ADAS)概述,包括ADAS系统的分类、主要国家的法规和评级要求、消费者认知、主要ADAS系统的功能和技术方案; 汽车高级驾驶辅助系统(ADAS)概述,包括ADAS系统的分类、主要国家的法规和评级要求、消费者认知、主要ADAS系统的功能和技术方案;

全球高级驾驶辅助系统(ADAS)产业链分析,分别分析了传感器、芯片、系统集成等部分的市场规模、技术特点、厂商布局情况等; 全球高级驾驶辅助系统(ADAS)产业链分析,分别分析了传感器、芯片、系统集成等部分的市场规模、技术特点、厂商布局情况等;

全球与中国ADAS应用现状和竞争格局分析,包括全球和中国ADAS各系统的装配比例、市场规模,以及全球主要系统集成商的市场份额; 全球与中国ADAS应用现状和竞争格局分析,包括全球和中国ADAS各系统的装配比例、市场规模,以及全球主要系统集成商的市场份额;

全球ADAS主要芯片/解决方案提供企业和系统集成企业分析,包括运营和财务状况、ADAS技术和相关业务分析。 全球ADAS主要芯片/解决方案提供企业和系统集成企业分析,包括运营和财务状况、ADAS技术和相关业务分析。

高级驾驶辅助系统(Advanced Driver Assist System ,ADAS)是智能驾驶和自动驾驶的基础,同时也是主动安全技术的具体应用。ADAS总体可分为2大类:安全类辅助和便利/舒适类辅助,部分系统还兼具安全和便利性双重功能。

ADAS系统的应用可以大幅减少交通事故的数量和减轻事故伤害的严重程度。现阶段ADAS发展和应用的最大驱动力来自政府对汽车驾乘安全要求的提高。欧洲、美国、日本等发达国家已从立法和评级标准(NCAP)等方面对新车ADAS的配置做出规定,其中普遍要求ADAS系统应具备前方碰撞预警(FCA)、车道偏离预警(LDW)功能,走在全球最前列的欧盟还对自动紧急制动(AEB)、车道保持辅助(LKA)甚至行人检测功能等提出了要求。

ADAS是近年来汽车领域需求增长最快的部分之一,全球2014-2019年的复合增长率预计将达到32%。目前,欧美发达国家已有超过8%的新车已配备ADAS功能,而新兴市场这一比例仅为2%左右。预计到2019年,全球搭载高级驾驶辅助系统(ADAS)的新车出货量将占到总出货量的25%以上。

ADAS的主要组成部分包括传感器、芯片(核心是信号处理和数据运算芯片)、算法软件等。传感器一般由系统集成商研发提供;芯片和算法软件一般由半导体公司、系统集成商合作开发,整车厂亦会在具体车型的应用上参与开发。系统集成商与整车制造商有最直接和密切的关系,且是ADAS系统整体解决方案的提供者。

乘用车领域,ADAS系统集成商数量较多,且基本为大型汽车零配件企业。目前领先企业的技术方向均为主动安全和被动安全的联合与集成,以及数个ADAS系统之间的集成。这些集成在提高智能化和安全性的同时,可以减少所占空间并降低成本。分区域来看,目前在欧洲、北美、亚洲市场占有率最高的系统集成商分别是大陆集团、德尔福、电装。从全球来看,大陆集团市场占有率最高,且其在ADAS和自动驾驶技术方面的研发人员和资金投入也是全球第一。全球前五名的系统集成商占据超过65%的市场份额,其余份额基本为法雷奥(Valeo)、天合(TRW)、麦格纳(Magna)、海拉(Hella)、松下(Panasonic)、镜泰(Gentex)等企业占有。

相比乘用车,提供商用车ADAS的系统集成商集中度较高,威伯科、大陆集团、博世集团这三家企业占有全球60%的份额。

中国ADAS产业近年来也在高速发展,一些企业背靠高校等研究机构,拥有了核心算法的研发能力并得到市场的认同,同时一些传统汽车零部件厂商也在加速进入ADAS市场,并通过原有的整车厂资源实现了前装配套,代表企业如智华、恒润、锦恒等。另外,ADAS产业的迅速发展也得到了资本市场的青睐,一些老牌或新兴企业如智华、前向启创均被上市公司收购部分股权。但是国内企业整体的技术实力仍显不足,大部分ADAS集成企业核心算法或缺失或同国外大厂相比有较大差距,其产品多供应给自主车厂,现阶段想要进入合资车厂供应链仍比较困难。

Global and China Advanced Driver Assistance System (ADAS) Industry Report, 2015-2019 focuses on the following:

Overview of automotive ADAS, including classification of ADAS, laws, regulations and rating requirements in major countries, consumer cognition, functions and technical schemes of main ADASs. Overview of automotive ADAS, including classification of ADAS, laws, regulations and rating requirements in major countries, consumer cognition, functions and technical schemes of main ADASs.

Analysis on global ADAS industry chain, covering market size, technical features, companies of sensor, chip, system integration, etc.; Analysis on global ADAS industry chain, covering market size, technical features, companies of sensor, chip, system integration, etc.;

Analysis on global and China’s ADAS application and competition pattern, involving installation ratio, market size, as well as market share of major system integrators in the world; Analysis on global and China’s ADAS application and competition pattern, involving installation ratio, market size, as well as market share of major system integrators in the world;

Analysis on major ADAS chip/solution suppliers and system integrators worldwide, including operation and financial conditions, ADAS technologies and relevant business. Analysis on major ADAS chip/solution suppliers and system integrators worldwide, including operation and financial conditions, ADAS technologies and relevant business.

ADAS, short for Advanced Driver Assistance System, is not only the basis of intelligent driving and automatic driving, but the concrete application of active safety technology. ADAS can be generally divided into two categories: safety assistance and convenience and comfort assistance, with some systems integrating the pair of them.

The application of ADAS can significantly reduce the number of traffic accidents and the severity of injuries. At present, the greatest motivation to develop and use ADAS comes from more stringent requirements on safe driving from governments. Europe, the United States, Japan, and other developed countries have made provisions on ADAS configuration in new vehicles with respect to legislation and rating standard (NCAP), generally requiring ADAS to have functions of forward collision avoidance (FCA) and lane departure warning (LDW). The forerunner EU also put forward requirementson automatic emergency braking (AEB), lane keeping assistance (LKA) and even pedestrian detection system (PDS).

ADAS has been one of the fastest-growing sectors in automotive field and is expected to register a CAGR of 32% during 2014-2019. Currently, developed countries in Europe and America have had nearly 8% of new vehicles equipped with ADAS, in contrast to about 2% in emerging markets. It is predicted that over 25% of new vehicles will carry ADAS by 2019 globally.

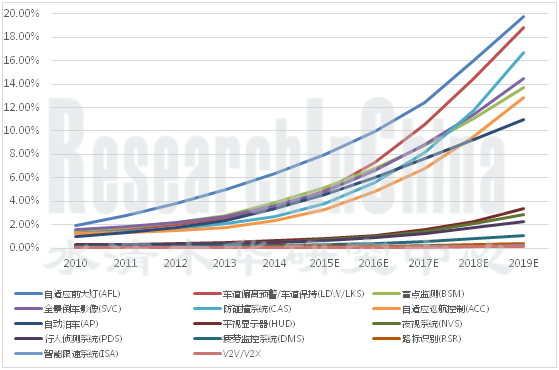

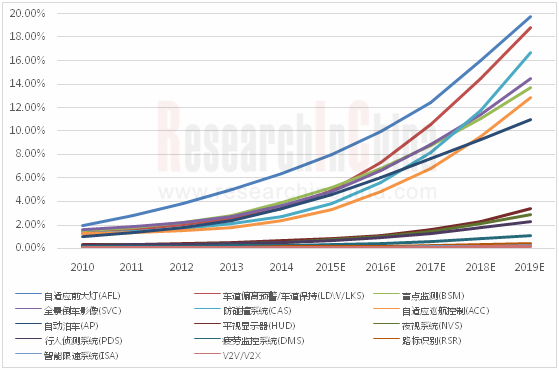

Global Penetration Rate of Main ADASs, 2010-2019E

ADAS consists mainly of sensors, chips (with signal processing and data computing chips as its core), algorithm software, etc. Sensors are usually developed and supplied by system integrators; chips and algorithm software are generally co-developed by semiconductor companies and system integrators, as well as complete vehicle makers when it comes to application in specific models. System integrators not only have the most direct and close relationship with complete vehicle makers, but also are the suppliers of integrated ADAS solutions.

In passenger vehicle field, ADAS integrators are large in number, mostly being large auto parts companies. At present, the leading companies are technologically developing toward combination and integration of active safety with passive safety and integration of multiple ADASs. These integrations, while improving intelligentization and safety, can reduce space used and costs. By region, Continental AG, Delphi and Denso Corporation are system integrators holding the highest market share in Europe, America and Asia, respectively. Globally, Continental AG boasts the largest market share, as well as No. 1 as concerns researchers and capital investment in ADAS and automated driving technology. The world’s top 5 system integrators make up more than 65% of market share, with the remaining occupied by Valeo, TRW, Magna, Hella, Panasonic, Gentex, etc.

Compared with passenger vehicles, the system integrators that are supplying ADAS for commercial vehicles are highly concentrated, with WABCO, Continental AG and Bosch eyeing 60% global market share.

China’s ADAS industry is also in rapid development over the years. Some companies backed by colleges, universities and other research institutions have the research and development ability of core algorithm and have received market recognition. At the same time, some traditional auto parts manufacturers represented by INVO Automotive Electronics, Jinzhou Jinheng Automotive Safety System and HiRain Technologiesare flooding into the ADAS market and have realizedOEM installation by virtue of resources from the original vehicle manufacturers. In addition, the booming ADAS industry is also favored by capital market, some established or emerging companies such as INVO Automotive Electronics and Forward Innovation Corporation sold partial stake to listed companies. However, the technological gap is still obvious, with a majority of ADAS integration companies deficient of core algorithm or lagged far behind foreign rivals. With most products supplied to independent vehicle factories, it’s rather difficult for them to enter the supply chain of joint venture factories at this stage.

第一章汽车ADAS系统概述

1.1 ADAS的分类

1.2 ADAS发展前景

1.2.1 相关评级规范的促进

1.2.2 自动驾驶发展的要求

1.3 主要ADAS系统

1.3.1 消费者对ADAS的认知

1.3.2 主要ADAS系统功能和技术方案

第二章全球ADAS产业链

2.1 产业链概述

2.2 传感器

2.2.1 雷达/Radar

2.2.2 激光雷达/Lidar

2.2.3 摄像机/Camera

2.2.4 超声波传感器/Ultrasonic sensor

2.2.5 车载传感器的综合应用和全球市场需求

2.3 系统解决方案/处理芯片/SOC

2.4 系统集成

第三章全球及中国ADAS系统应用现状与竞争格局

3.1 全球高级驾驶辅助系统(ADAS)市场

3.1.1 市场规模

3.1.2 全球ADAS细分市场

3.1.3 竞争格局

3.2 中国高级驾驶辅助系统(ADAS)市场

3.2.1 市场规模

3.2.2 中国ADAS细分市场

第四章全球ADAS芯片/解决方案主要企业

4.1 Mobileye

4.1.1 企业简介

4.1.2 运营情况

4.1.3 营收构成

4.1.4 ADAS先进技术

4.1.5 客户与供应商

4.2 德州仪器(TI)

4.2.1 企业简介

4.2.2 运营情况

4.2.3 营收构成

4.2.4 ADAS业务

4.2.5 最新发布的ADAS应用产品

4.3 瑞萨电子(Renesas)

4.3.1 企业简介

4.3.2 运营情况

4.3.3 营收构成

4.3.4 ADAS业务

4.4 飞思卡尔(Freescale)

4.4.1 企业简介

4.4.2 运营情况

4.4.3 营收构成

4.4.4 ADAS业务

4.4.5 ADAS的技术合作

第五章全球ADAS系统集成主要企业

5.1 威伯科(WABCO)

5.1.1 企业简介

5.1.2 运营情况

5.1.3 营收构成

5.1.4 主要客户

5.1.5 ADAS业务

5.2 奥托立夫(Autoliv)

5.2.1 企业简介

5.2.2 运营情况

5.2.3 营收构成

5.2.4 成本与客户构成

5.2.5 ADAS业务

5.2.6 ADAS技术发展

5.3 大陆集团(Continental AG)

5.3.1 企业简介

5.3.2 运营情况

5.3.3 ADAS业务

5.3.4 ADAS的集成和新技术

5.4 罗伯特博世(Robert Bosch)

5.4.1 企业简介

5.4.2 运营情况

5.4.3 营收构成

5.4.4 ADAS业务

5.5 德尔福(Delphi)

5.5.1 企业简介

5.5.2 运营情况

5.5.3 营收构成

5.5.4 ADAS业务

5.5.5 ADAS的集成和新技术

5.6 电装(Denso)

5.6.1 企业简介

5.6.2 运营情况

5.6.3 营收构成

5.6.4 ADAS业务

5.6.5 ADAS业务规划

5.7 其他企业

5.7.1 麦格纳(Magna)

5.7.2 法雷奥(Valeo)

5.7.3 天合(TRW)

第六章中国ADAS系统集成主要企业

6.1 智华

6.1.1 企业简介

6.1.2 ADAS业务

6.2 锦恒

6.2.1 企业简介

6.2.2 ADAS业务

6.3 经纬恒润

6.3.1 企业简介

6.3.2 ADAS业务

6.4 纵目科技

6.4.1 企业简介

6.4.2 ADAS业务

6.5 辉创电子

6.5.1 企业简介

6.5.2 ADAS业务

6.6 前向启创

6.6.1 企业简介

6.6.2 ADAS业务

1. Overview of ADAS

1.1 Classification

1.2 Development Prospect

1.2.1 Promotion of Relevant Rating Requirements

1.2.2 Requirements from Development of Automated Driving

1.3 Main ADASs

1.3.1 ConsumerCognition

1.3.2 Functions and Technical Schemes

2. Global ADAS Industry Chain

2.1 Overview

2.2 Sensor

2.2.1 Radar

2.2.2 Lidar

2.2.3 Camera

2.2.4 Ultrasonic Sensor

2.2.5 Comprehensive Application and Global Market Demand of Vehicle Sensor

2.3 System Solutions/Processing Chip/SOC

2.4 System Integration

3. Global and China ADAS Application and Competition Pattern

3.1 Global ADAS Market

3.1.1 Market Size

3.1.2 Market Segments

3.1.3 Competition Pattern

3.2 China ADAS Market

3.2.1 Market Size

3.2.2 Market Segments

4. Major Global ADAS Chip/Solutions Companies

4.1 Mobileye

4.1.1 Profile

4.1.2 Operation

4.1.3 Revenue Structure

4.1.4 Advanced Technologies for ADAS

4.1.5 Customers and Suppliers

4.2 TI

4.2.1 Profile

4.2.2 Operation

4.2.3 Revenue Structure

4.2.4 ADAS Business

4.2.5 Newly-released ADAS Applications

4.3 Renesas

4.3.1 Profile

4.3.2 Operation

4.3.3 Revenue Structure

4.3.4 ADAS Business

4.4 Freescale

4.4.1 Profile

4.4.2 Operation

4.4.3 Revenue Structure

4.4.4 ADAS Business

4.4.5 Technological Cooperation on ADAS

5. Major Global ADAS Integrators

5.1 WABCO

5.1.1 Profile

5.1.2 Operation

5.1.3 Revenue Structure

5.1.4 Major Customers

5.1.5 ADAS Business

5.2 Autoliv

5.2.1 Profile

5.2.2 Operation

5.2.3 Revenue Structure

5.2.4 Costs and Customer Structure

5.2.5 ADAS Business

5.2.6 Technological Development of ADAS

5.3 Continental AG

5.3.1 Profile

5.3.2 Operation

5.3.3 ADAS Business

5.3.4 Integration and New Technologies for ADAS

5.4 Robert Bosch

5.4.1 Profile

5.4.2 Operation

5.4.3 Revenue Structure

5.4.4 ADAS Business

5.5 Delphi

5.5.1 Profile

5.5.2 Operation

5.5.3 Revenue Structure

5.5.4 ADAS Business

5.5.5 Integration and New Technologies of ADAS

5.6 Denso

5.6.1 Profile

5.6.2 Operation

5.6.3 Revenue Structure

5.6.4 ADAS Business

5.6.5 ADAS Business Planning

5.7 Other Players

5.7.1 Magna

5.7.2 Valeo

5.7.3 TRW

6 Major Chinese ADAS Integrators

6.1 INVO Automotive Electronics

6.1.1 Profile

6.1.2 ADAS Business

6.2 Jinzhou Jinheng Automotive Safety System

6.2.1 Profile

6.2.2 ADAS Business

6.3 HiRain Technologies

6.3.1 Profile

6.3.2 ADAS Business

6.4 ZongMu Technology

6.4.1 Profile

6.4.2 ADAS Business

6.5 HuiChuang Electronic Technology

6.5.1 Profile

6.5.2 ADAS Business

6.6 Forward Innovation Corporation

6.6.1 Profile

6.6.2 ADAS Business

图:欧洲NCAP各领域权重系数

表:各国NCAP机构对装配ADAS的相关规定

表:2011-2013美国装配LDW/FCW的车型数量

图:各国对卡车和客车的相关法规(安全和能效方面)

图:全球消费者自动驾驶使用意愿调查

图:中日德美驾驶员中曾发生过交通事故的比例

车主调查:增加的交通量加重驾驶压力

车主调查:ADAS系统的接受度

表:主要ADAS系统的功能

表:主要ADAS系统技术方案

图:ADAS重要传感器

图:Major ADAS sensor types and typical vehicle positions

图:各类雷达探测范围及ADAS应用类型

图:Audi A8各传感器及探测范围

图:Significant milestones in camera-based applications

表:立体和单眼摄像机解决方案对比

图:Ultrasonic sensor对障碍物的探测

图:ADAS Applications for Ultrasonic Sensors

图:2010-2019年全球ADAS用传感器需求量

图:2010-2019年全球ADAS用半导体器件市场规模

图:Example of ADAS Vision Processing

表:解决方案/芯片厂商布局现状

图:ADAS的组成和工作流程

图:Decision system的两类输出

图:2011-2019年全球ADAS市场规模

图:2010-2019年全球主要ADAS系统渗透率

图:2010-2019年全球附ADAS汽车出货量

图:2010-2019年全球附ADAS汽车占乘用车整体出货量比例

图:2014、2019年全球汽车ADAS细分市场占比

图:2010-2019年全球自适应巡航控制(ACC)出货量

图:2010-2019年全球自适应前大灯(AFL)出货量

图:2010-2019年全球盲点监测(BSM)出货量

图:2010-2019年全球疲劳监控系统(DMS)出货量

图:2010-2019年全球防碰撞系统(CAS)出货量

图:2010-2019年全球平视显示器(HUD)出货量

图:2010-2019年全球智能限速系统(ISA)出货量

图:2010-2019年全球车道偏离预警/车道保持(LDW/LKS)出货量

图:2010-2019年全球夜视系统(NVS)出货量

图:2010-2019年全球自动泊车(AP)出货量

图:2010-2019年全球行人侦测系统(PDS)出货量

图:2010-2019年全球路标识别(RSR)出货量

图:2010-2019年全球全景倒车影像(SVC)出货量

图:2010-2019年全球V2V/V2X出货量

图:全球基于传感器的ADAS主要系统集成商

图:欧洲地区ADAS集成商前三名及市场份额

图:北美地区ADAS集成商前三名及市场份额

图:亚太地区ADAS集成商前三名及市场份额

图:全球ADAS集成商前五名及市场份额

图:2011-2019年中国ADAS市场规模

图:2015年1-4月中国市场在售车型主要ADAS系统配置情况

图:2015年1-4月中国市场主要ADAS系统渗透率

图:2015年4月国内乘用车在售车型盲点侦测(BSM)配置情况

图:2015年1-4月国内乘用车厂盲点侦测(BSM)预装量

表:2015年4月国内新上市车型盲点侦测(BSM)配置情况

图:2015年4月国内乘用车在售车型车道偏离预警(LDW)配置情况

图:2015年1-4月国内乘用车厂车道偏离预警(LDW)预装量

表:2015年4月国内新上市车型车道偏离预警(LDW)配置情况

图:2015年4月国内乘用车在售车型车道保持系统(LKS)配置情况

图:2015年1-4月国内乘用车厂车道保持系统(LKS)预装量

表:2015年4月国内新上市车型车道保持系统(LKS)配置情况

图:2015年4月国内乘用车在售车型全景倒车影像系统(SVC)配置情况

图:2015年1-4月国内乘用车厂全景倒车影像系统(SVC)预装量

表:2015年4月国内新上市车型全景倒车影像系统(SVC)配置情况

图:2015年4月国内乘用车在售车型自动泊车系统(AP)配置情况

图:2015年1-4月国内乘用车厂自动泊车系统(AP)预装量

表:2015年4月国内新上市车型自动泊车系统(AP)配置情况

图:2015年4月国内乘用车在售车型自适应巡航控制(ACC)配置情况

图:2015年1-4月国内乘用车厂自适应巡航控制(ACC)预装量

表:2015年4月国内新上市车型自适应巡航控制(ACC)配置情况

图:2015年4月国内乘用车在售车型主动紧急制动(AEB)配置情况

图:2015年1-4月国内乘用车厂主动紧急制动(AEB)预装量

表:2015年4月国内新上市车型主动紧急制动(AEB)配置情况

图:2015年4月国内乘用车在售车型前碰撞预警(FCW)配置情况

图:2015年1-4月国内乘用车厂前碰撞预警(FCW)预装量

图:2007-2016E Mobileye ADAS系统装配车型数量

图:2011-2015Q1 Mobileye营业收入及净利润

图:2011-2015Q1 Mobileye毛利率

表:Mobileye提供的ADAS产品

图:2011-2015Q1 Mobileye分部门营业收入

图:2011-2014年Mobileye分部门营业利润

表:MobileyeEyeQ® 组成结构

图:Mobileye前装市场合作厂商及流程

表:2012-2014年Mobileye来自OEM收入中占比超10%的客户

图:2010-2015Q1 TI营业收入及净利润

图:2010-2015Q1 TI毛利率

图:2010-2014H1 TI分部门营收占比

表:2010-2014年TI分部门营业利润

图:2010-2014年 TI分地区营收占比

表:TI产品在汽车领域的应用

图:TI模拟和嵌入式处理器件在ADAS中的应用

图:TI AFE5401

图:Block diagram for TDA2x SoC

图:TDA2x Evaluation Module

图:Renesas三大类产品和应用领域

图:FY2011-FY2015 Renesas销售额及营业利润

图:FY2011-FY2015 Renesas净利润

图:Renesas的产品和组织改革进程

图:FY2011-FY2015 Renesas半导体部分占总营收比例

图:FY2012-FY2014 Renesas分产品营收占比(半导体部分)

图:FY2012-FY2014 Renesas MCU业务各应用领域销售额

图:FY2012-FY2014 Renesas analog and Power Devices业务各应用领域销售额

图:FY2012-FY2014 RenesasSoc业务各应用领域销售额

图:FY2015Renesas销售数据的统计项变化

图:FY2014-FY2015 Renesas汽车领域销售情况(半导体部分)

图:FY2014-FY2015 Renesas通用领域销售情况(半导体部分)

图:FY2015 Renesas半导体业务各应用领域销售占比

图:FY2015Q1 Renesas汽车领域各应用销售占比

图:FY2015Q1 Renesas通用领域各应用销售占比

图:Renesas R-Car V2H SoC

图:Renesas Sensor Fusion框图

表:Renesas ADAS方案推荐产品

图:Renesas ADAS产品路线图

图:2010-2015Q1 Freescale营业收入及净利润

图:2010-2015Q1 Freescale毛利率

图:2011-2015Q1 Freescale分产品营收占比

图:2014年Freescale分地区营收占比

图:Freescale ADAS Applications

表:Freescale ADAS MCU的4代产品

图:Freescale 77GHz Radar系统

表:Freescale Radar系统解决方案和目标应用

图:Freescale基于Power Architecture®技术的Qorivva 32位MCU系列

表:Freescale视觉系统解决方案

图:WABCO产品的两大目标

图:2010-2015Q1 WABCO营业收入及营业利润

图:2010-2015Q1 WABCO毛利率

图:WABCO全球工厂布局

图:2011年WABCO各细分产品营收占比

图:2011-2014年WABCO分市场类型(by End-Markets)营收占比

图:2011-2014年WABCO分地区营收占比

表:WABCO各类市场的主要客户

表:WABCO ADAS功能的产品

图:WABCO ADAS产品路线图

图:WABCO OptiPace™

图:AutolivIn Numbers

图:Autoliv Milestone

图:Autoliv汽车安全系统产品

图:2010-2015Q1 Autoliv营业收入&营业利润

图:2010-2014年Autoliv毛利率

图:Autoliv全球分布

图:Autoliv全球工厂分布

图:2011-2015Q1 Autoliv(分产品)营收占比

图:2013年1季度-2015年1季度奥托立夫各项产品产量

图:2009-2014年奥托立夫各项产品产量

图:2009-2014年Autoliv(分地区)营收占比

图:Autoliv成本结构及变化

图:2011-2014年Autoliv销售占比超过10%的客户

图:2014年Autoliv客户销售占比

图:Autoliv Active Safety发展路径和战略

图:2009-2013年Autoliv Active Safety产品出货量与装配车型数量

表:Autoliv Active Safety主要客户

图:2009-2013年Autoliv Active Safety产品销售额

图:Autoliv主动安全系统支持功能

表:Autoliv主动安全系统产品系列和应用

图:Autoliv夜视系统Dynamic Spot Light功能

图:2009-2015Q1 Continental营业收入&EBIT

图:2011-2015Q1 Continental分部门营收占比

图:2011-2014年Continental分地区营收占比

图:2011-2015Q1 Continental底盘与安全事业部销售收入

图:2013-2018年Continental细分行业销售复合增长率

图:2011-2014年Continental ADAS产品销售量与增长率

表:Continental ADAS全球生产基地&研发中心

表:大陆集团自动驾驶路线图

图:ContiGuard集成主、被动安全系统功能

图:Continental集成安全算法

图:2009-2014年Bosch营业收入&EBIT

图:2012-2014年Bosch移动解决方案部门销售收入&EBIT

表:Bosch汽车底盘控制系统部门经营领域

图:2012-2014年Bosch分部门营收占比

图:2012-2014年Bosch分地区营收占比

表:Bosch汽车底盘控制系统部门产品

图:Bosch紧急制动系统(2个类型)

表:Bosch驾驶员疲劳监测系统

表:Bosch ACC系统(2个类型)

表:Bosch传感器系统&ADAS应用

图:2010-2015Q1 Delphi营业收入&营业利润

图:2013-2016年Delphi各部门主要增长领域

图:Delphi主要客户及区域分布

图:2014年Delphi(分客户)销售占比

图:2012-2015Q1 Delphi分部门营收占比

表:2011-2014年Delphi(分地区)销售收入

图:2014-2017年Delphi主动安全业务增长预测

图:截至2013年Delphi主动安全产品的客户

表:Delphi传感器系统&ADAS应用

图:Delphi集成安全和联网技术的方案

图:Delphi实现智能驾驶的路线

图:FY2011-FY2015 Denso营业收入

图:FY2011-FY2015 Denso营业利润&净利润

图:FY2011-FY2015 Denso分部门营收占比

表:FY2011-FY2015 Denso汽车领域分部门销售收入

表:FY2011-FY2015 Denso(分地区)销售收入

图:FY2014-FY2015 Denso(分客户)销售收入

图:Denso驾驶安全技术路线

图:Denso驾驶员状态监测系统

图:Denso车道辅助系统

图:Denso Pre-Crash Safety System

表:Delphi传感器系统&ADAS应用

图:各驾驶状态Denso提供的安全功能和产品

图:Denso三个等级(入门、标准、高级)的ADAS产品包

图:苏州智华主要合作伙伴

图:经纬恒润全球分布

图:经纬恒润AFS

图:纵目科技SVC系统架构

图:纵目科技路安视主要功能

图:辉创电子ADAS产品

Weight Coefficients of Euro NCAP in Various Fields

Relevant Requirements on ADAS Configuration by NCAP Organizations in Various Countries

Number of Models Carrying LDW/FCW in USA, 2011-2013

Relevant Laws and Regulations on Trucks and Buses in Various Countries (Safety and Energy Efficiency)

Survey on Global Consumers’ Intension to Use Automated Driving

Percentage of Drivers with Traffic Accidents in China, Japan, Germany and USA

Survey on Vehicle Owners: Increased Traffic Volume Adds Pressure to Driving

Survey on Vehicle Owners: Acceptability of ADAS

Functions of Main ADASs

Technical Schemes of Main ADASs

Key Sensors of ADAS

Major ADAS Sensor Types and Typical Vehicle Positions

Detection Range of Various Radars and Application Types of ADAS

Sensors and Detection Ranges of Audi A8

Significant Milestones in Camera-based Applications

Comparison between Stereoscopic Camera and Mono-camera Solutions

Ultrasonic Sensor’s Detection of Barriers

ADAS Applications for Ultrasonic Sensors

Global ADAS Sensor Demand, 2010-2019E

Global ADAS Semiconductor Device Market Size, 2010-2019E

Example of ADAS Vision Processing

Solutions/Chip Companies Layout

Composition and Working Procedures of ADAS

Two Types of Output of Decision System

Global ADAS Market Size, 2011-2019E

Global Penetration Rate of Main ADASs, 2010-2019E

Global Shipments of Vehicles with ADAS, 2010-2019E

Proportion of Global Vehicles with ADAS in Overall Shipments of Passenger Vehicles, 2010-2019E

Share of Global Automotive ADAS Market Segments, 2014 VS 2019

Global Shipments of Adaptive Cruise Control (ACC), 2010-2019E

Global Shipments of Adaptive Forward Lighting (AFL), 2010-2019E

Global Shipments of Blind Spot Monitoring (BSM), 2010-2019E

Global Shipments of Driver Monitoring System (DMS), 2010-2019E

Global Shipments of Collision Avoidance System (CAS), 2010-2019E

Global Shipments of Head-up Display (HUD)

Global Shipments of Intelligent Speed Adaptation (ISA), 2010-2019E

Global Shipments of Lane Departure Warning / Lane Keeping System (LDW/LKS), 2010-2019E

Global Shipments of Night Vision System (NVS), 2010-2019E

Global Shipments of Automatic Parking (AP), 2010-2019E

Global Shipments of Pedestrian Detection System (PDS), 2010-2019E

Global Shipments of Road Sign Recognition (RSR), 2010-2019E

Global Shipments of SVC, 2010-2019E

Global Shipments of V2V/V2X, 2010-2019E

Major Global Sensor-based ADAS Integrators

Top 3 ADAS Integrators and Their Market Shares in Europe

Top 3 ADAS Integrators and Their Market Shares in North America

Top 3 ADAS Integrators and Their Market Shares in Asia Pacific

Global Top 5 ADAS Integrators and Their Market Shares

Market Size of Chinese ADAS Market, 2011-2019E

Main ADAS Configurations for Cars Sold in China, Jan-Apr 2015

Penetration Rate of Main ADASs in the Chinese Market, Jan-Apr 2015

BSM Configuration for Passenger Cars Sold in China, Apr 2015

BSM Pre-installation of Passenger Car Factories in China, Jan-Apr 2015

BSM Configuration for New Cars in China, Apr 2015

LDW Configuration for Passenger Cars Sold in China, Apr 2015

LDW Pre-installation of Passenger Car Factories in China, Jan-Apr 2015

LDW Configuration for New Cars in China, Apr 2015

LKS Configuration for Passenger Cars Sold in China, Apr 2015

LKS Pre-installation of Passenger Car Factories in China, Jan-Apr 2015

LKS Configuration for New Cars in China, Apr 2015

SVC Configuration for Passenger Cars Sold in China, Apr 2015

SVC Pre-installation of Passenger Car Factories in China, Jan-Apr 2015

SVC Configuration for New Cars in China, Apr 2015

AP Configuration for Passenger Cars Sold in China, Apr 2015

AP Pre-installation of Passenger Car Factories in China, Jan-Apr 2015

AP Configuration for New Cars in China, Apr 2015

ACC Configuration for Passenger Cars Sold in China, Apr 2015

ACC Pre-installation of Passenger Car Factories in China, Jan-Apr 2015

ACC Configuration for New Cars in China, Apr 2015

AEB Configuration for Passenger Cars Sold in China, Apr 2015

AEB Pre-installation of Passenger Car Factories in China, Jan-Apr 2015

AEB Configuration for New Cars in China, Apr 2015

FCW Configuration for Passenger Cars Sold in China, Apr 2015

FCW Pre-installation of Passenger Car Factories in China, Jan-Apr 2015

Number of Models Carrying Mobileye’s ADAS, 2007-2016E

Revenue and Net Income of Mobileye, 2011-2015Q1

Gross Margin of Mobileye, 2011-2015Q1

ADAS Products Provided by Mobileye

Revenue Breakdown of Mobileye by Division, 2011-2015Q1

Operating Profit Breakdown of Mobileye by Division, 2011-2015Q1

Composition of Mobileye EyeQ®

Cooperative Companies of Mobileye in OEM Market and Procedures

Customers Accounting for More Than 10% of Mobileye’s OEM Revenue, 2012-2014

Revenue and Net Income of TI, 2010-2015Q1

Gross Margin of TI, 2010-2015Q1

Revenue Structure of TI by Division, 2010-2014H1

Operating Profit Breakdown of TI by Division, 2010-2014

Revenue Structure of TI by Region, 2010-2014

Application of TI’s Products in Automotive Sector

Application of TI’s Analog and Embedded Processors in ADAS

TI AFE5401

Block Diagram for TDA2x SoC

TDA2x Evaluation Module

Three Categories of Products and Their Application Fields of Renesas

Revenue and Operating Profit of Renesas, FY2011-FY2015

Net Income of Renesas, FY2011-FY2015

Products and Organization Evolution of Renesas

Proportion of Semiconductor Revenue to Total Revenue of Renesas, FY2011-FY2015

Semiconductor Revenue Structure of Renesas by Product, FY2012-FY2014

MCU Revenue Breakdown of Renesas by Application Field, FY2012-FY2014

Analog and Power Devices Revenue Breakdown of Renesas by Application Field, FY2012-FY2014

SoC Revenue Breakdown of Renesas by Application Field, FY2012-FY2014

Statistics Changes in Sales Data of Renesas, FY2015

Auto Sales (Semiconductor Part) of Renesas, FY2014-FY2015

General-Purpose Sales (Semiconductor Part) of Renesas, FY2014-FY2015

General-Purpose Revenue Structure of Renesas by Application, FY2014-FY2015

Semiconductor Revenue Structure of Renesas by Application Field, FY2015

Automotive Revenue Structure of Renesas by Application, FY2015Q1

General-Purpose Revenue Structure of Renesas by Application, FY2015Q1

R-Car V2H SoC of Renesas

Block Diagram for Renesas Sensor Fusion

Recommended Products of Renesas ADAS Solutions

Roadmap for Renesas ADAS Products

Revenue and Net Income of Freescale, 2010-2015Q1

Gross Margin of Freescale, 2010-2015Q1

Revenue Structure of Freescale by Product, 2011-2015Q1

Revenue Structure of Freescale by Region, 2014

Applications of Freescale’s ADAS

Four Generation Products of Freescale ADAS MCU

77GHz Radar System of Freescale

Radar System Solutions and Target Application of Freescale

Power Architecture®-based Qorivva 32-bit MCUs of Freescale

Vision System Solutions of Freescale

Two Goals of WABCO’s Products

Revenue and Operating Profit of WABCO, 2010-2015Q1

Gross Margin of WABCO, 2010-2015Q1

Global Factories of WABCO

Revenue Structure of WABCO by Product Segments, 2011

Revenue Structure of WABCO by End Market, 2011-2014

Revenue Structure of WABCO by Region,2011-2014

Major Customers of WABCO in Various Markets

WABCO’s ADAS Products

Roadmap for WABCO’s ADAS Products

WABCO’s OptiPace™

Autoliv in Numbers

Autoliv Milestone

Autoliv’s Automotive Safety System Products

Revenue and Operating Profit of Autoliv, 2010-2015Q1

Gross Margin of Autoliv, 2010-2014

Global Factories of Autoliv

Revenue Structure of Autoliv by Product, 2011-2015Q1

Output of Autoliv’s Products, 2013Q1-2015Q1

Output of Autoliv’s Products, 2009-2014

Revenue Structure of Autoliv by Region, 2009-2014

Autoliv’s Cost Structure and Changes

Customers Contributing More Than 10% of Autoliv’s Revenue, 2011-2014

Autoliv’s Major Customers and % of Revenue, 2014

Autoliv’s Active Safety Development Path and Strategy

Shipments of and Number of Models Carrying Autoliv’s Active Safety Products, 2009-2013

Major Customers of Autoliv’s Active Safety

Autoliv’s Revenue from Active Safety Products, 2009-2013

Functions of Autoliv’s Active Safety System

Autoliv’s Active Safety System Products and Their Applications

Dynamic Spot Light Function of Autoliv’s Night Vision System

Revenue and EBIT of Continental, 2009-2015Q1

Revenue Structure of Continental by Division, 2011-2015Q1

Revenue Structure of Continental by Region, 2011-2014

Continental’s Revenue from Chassis & Safety Division, 2011-2015Q1

Revenue CAGR in Sector Segments of Continental, 2013-2018E

ADAS Products Sales Volume and Growth Rate of Continental, 2011-2014

Global ADAS Production Bases and R&D Centers of Continental

Roadmap for Automated Driving of Continental

ContiGuard Integrating Active and Passive Safety Systems

Continental’s Integrated Safety Algorithm (ISA)

Sales & EBIT of Bosch Mobile Solutions, 2012-2014

Business Scope of Bosch’s Automotive Chassis Control System Division

Revenue Structure of Bosch by Division, 2012-2014

Revenue Structure of Bosch by Region, 2012-2014

Products of Bosch’s Automotive Chassis Control System Division

Bosch’s Emergency Braking Systems (Two Types)

Bosch’s Driver Drowsiness Detection System

Bosch’s ACC Systems (Two Types)

Applications of Bosch’s Sensor System and ADAS

Revenue and Operating Profit of Delphi, 2010-2015Q1

Main Growth Areas of Delphi’s Divisions, 2013-2016

Major Customers and Regional Distribution of Delphi

Revenue Structure of Delphi by Customer, 2014

Revenue Structure of Delphi by Division, 2012-2015Q1

Revenue Breakdown of Delphi by Region, 2011-2014

Growth of Delphi’s Active Safety Business, 2014-2017E

Customers of Delphi’s Active Safety Products as of 2013

Applications of Delphi’s Sensor System and ADAS

Delphi’s Integrated Safety and Networking Technology Solutions

Delphi’s Roadmap for Intelligent Driving

Revenue of Denso, FY2011-FY2015

Operating Profit and Net Income of Denso, FY2011-FY2015

Revenue Structure of Denso by Division, FY2011-FY2015

Auto Sales of Denso by Division, FY2011-FY2015

Revenue Structure of Denso by Region, FY2011-FY2015

Revenue Breakdown of Denso by Customer, FY2010-FY2014

Denso’s Technology Roadmap for Safe Driving

Denso’s Driver Status Monitor System

Denso’s Lane Keeping Assist System

Denso’s Pre-Crash Safety System

Applications of Delphi’s Sensor System and ADAS

Safety Functions and Products Supplied by Denso under Various Driving Situations

Three Levels (Entry, Standard, Advanced) of ADAS Products Suites of Denso

Major Partners of INVO Automotive Electronics

Global Distribution of HiRain Technologies

AFS of HiRain Technologies

SVC System Architecture of ZongMu Technology

Main Functions of ZongMu Technology

ADAS Products of HuiChuang Electronic Technology

如果这份报告不能满足您的要求,我们还可以为您定制报告,请 留言说明您的详细需求。

|