|

|

|

报告导航:研究报告—

制造业—工业机械

|

|

2014-2016年全球及中国农业机械行业研究报告 |

|

字数:5.8万 |

页数:139 |

图表数:130 |

|

中文电子版:9000元 |

中文纸版:4500元 |

中文(电子+纸)版:9500元 |

|

英文电子版:2400美元 |

英文纸版:2600美元 |

英文(电子+纸)版:2700美元 |

|

编号:BXM081

|

发布日期:2015-07 |

附件:下载 |

|

|

|

自2004年实行农机购置补贴政策以来,中国农机行业一直保持两位数增长,2011年其主营业务收入增速甚至高达 33.8%。然而,随着产业结构深度调整的加速,2014年中国农机行业进入“新常态”,全年主营业务收入同比仅增8.8%,增速较2013年下滑7.5个百分点。

在结束了多年的高速增长后,2014年中国拖拉机,小麦、水稻收割机,插秧机等市场均出现了不同程度的下滑,其中拖拉机市场跌幅最为明显,特别是小型拖拉机。

尽管中国农机行业出现滑坡,但是农机补贴总量和农机化水平继续攀升。2014年中国农机补贴额达到237.55亿元,再创历史新高;农机总动力达到10.76亿千瓦,同比增长3.6%;农机化水平达到61.0%,提前一年实现“十二五”规划目标。

与此同时,三大农作物机械化水平也有了大幅提升,特别是玉米、水稻。2014年中国玉米机收率从2008年的10.6%提升至55%;水稻机收率从51.2%提升至81.0%。相比之下,马铃薯、棉花、油菜、花生等农作物机收率还很低,未来将成为行业发展的重点。

此外,受国家产业政策的扶持、良好的市场潜力等因素影响,国外几乎所有知名农机企业和国内实力雄厚的机械装备制造商纷纷进入中国农机市场。

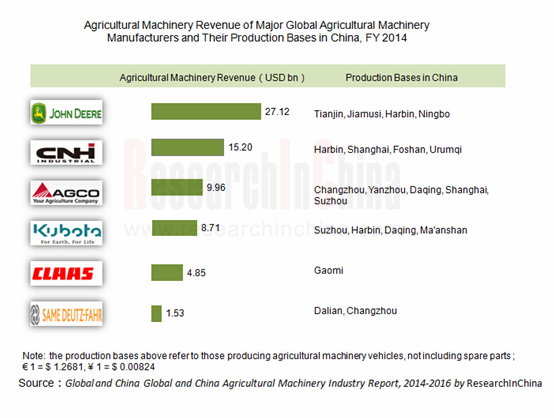

约翰迪尔:全球领先的农机制造商,2014财年销售额为329.6亿美元,其中农机收入为271.2亿美元。目前在中国天津、哈尔滨、宁波、佳木斯等地均有分厂,并且已与天拖、徐挖等合资建厂;主要生产20-120马力拖拉机、75-203马力联合收割机。

凯斯纽荷兰:截至2015年6月,已经在中国建立了8家公司,包括4个制造工厂,分别位于哈尔滨、上海、佛山和乌鲁木齐。其中哈尔滨新基地于2014年7月正式投运,为东北地区最大的农机制造厂。

一拖集团:中国最大的拖拉机生产商,旗下业务主要来自上市子公司即一拖股份。受国内拖拉机市场迅速下滑影响,2014年,一拖股份拖拉机销量同比下降 22.6%,至82,037 台;全年农业机械产品收入同比下降18.7%,至73.8亿元。

福田雷沃:2014年,福田雷沃重工实现销售收入219.8亿元,其中雷沃农业装备业务销售收入再次突破100亿元。2015年其发力中高端农机具业务:1月,全资收购欧洲高端农机具企业马特马克公司;3月,总投资20亿元,以打捆机、粮食烘干机等为主的高端农机具项目一期正式投产。

中联重机:中联重科旗下农机公司(母公司持股67.51%),前身为奇瑞重工,2014年10月更名。2014年2月,中联重科亳州工业园开工建设,同年12月竣工投产,年规划生产大型青饲料收获机1500台、自走式玉米收获机10000台、大型农机具6500台及农业装备核心零部件14500套。

水清木华研究中心《2014-2016年全球及中国农业机械行业研究报告》重点研究了以下内容:

全球农业机械市场现状及主要国家农机发展情况; 全球农业机械市场现状及主要国家农机发展情况;

中国农业机械主要政策及农机补贴情况; 中国农业机械主要政策及农机补贴情况;

中国农业机械行业概况、主要产品、主要企业现状以及农机化发展程度; 中国农业机械行业概况、主要产品、主要企业现状以及农机化发展程度;

中国拖拉机、收获机械、插秧机、农用车等细分市场现状; 中国拖拉机、收获机械、插秧机、农用车等细分市场现状;

中国农机大省(含黑龙江、山东、河南等7个)农机产业发展现状; 中国农机大省(含黑龙江、山东、河南等7个)农机产业发展现状;

全球6家、中国14家重点农机企业经营情况、研发状况及发展战略等。 全球6家、中国14家重点农机企业经营情况、研发状况及发展战略等。

Since the implementation of policy of subsidies for purchasing agricultural machinery in 2004, China agricultural machinery industry has maintained double-digit growth, even with the operating revenue growth rate of 33.8% in 2011. However, China agricultural machinery industry transferred to a new situation (“New Normal”) in 2014 as the in-depth adjustment of industrial structure accelerated. In 2014, the operating revenue only went up by 8.8% year on year, and the growth rate fell by 7.5 percentage points from 2013.

After years of rapid growth, China’s tractor, wheat& rice harvester, transplanter and other markets declined to varied extent in 2014, in which the tractor market slumped most evidently, especially small tractors.

Although China agricultural machinery industry witnesses landslide, the total subsidies and agricultural mechanization level continue to rise. In 2014, the subsidies amounted to RMB23.755 billion, setting a new record high; the total power of agricultural machinery reached 1.076 billion kilowatts, representing a year-on-year increase of 3.6%; the agricultural mechanization level hit 61.0%, fulfilling the goal of "Twelfth Five-year" Plan in advance.

At the same time, the mechanization level of three major crops (wheat, corn and rice) has improved significantly, especially corn and rice. The mechanization rate of corn harvesting jumped from 10.6% in 2008 to 55% in 2014; and that of rice harvesting soared from 51.2% to 81.0%. In contrast, the mechanization of potato, cotton, rapeseed, peanut and other crops still stays at a low level, which will be the development focus of the industry in future.

In addition, national industrial policies, market potentials and other factors have propelled almost all of well-known foreign agricultural machinery enterprises and powerful Chinese machinery and equipment manufacturers to successively access into the Chinese agricultural machinery market.

John Deere: This leading agricultural machinery manufacturer in the world achieved the sales of USD32.96 billion in FY2014, of which USD27.12 billion came from agricultural machinery. Currently, it has set up plants in Tianjin, Harbin, Ningbo, Jiamusi and other places of China as well as established joint ventures with Tianjin Tractor Manufacturing Co., Ltd. and XCG to produce 20-to-120 horsepower tractors and 75-to-203 horsepower combine harvesters.

CNH: As of June 2015, it has established eight companies in China, including four manufacturing plants located in Harbin, Shanghai, Foshan and Urumqi. Harbin Base was officially put into operation in July 2014 as Northeast China's largest manufacturing base of agricultural machinery.

YTO Group: The business of the largest tractor producer in China is mainly conducted by its listed subsidiary -- First Tractor Company Limited. Impacted by the fast-declining domestic tractor market, the tractor sales volume of YTO fell by 22.6% year on year to 82,037 in 2014; the annual revenue from agricultural machinery dropped 18.7% year on year to RMB7.38 billion.

FotonLovol: In 2014, FotonLovol gained the revenue of RMB21.98 billion, wherein Lovol agricultural equipment revenue exceeded RMB10 billion. In 2015, the company develops medium and high-end agricultural machinery aggressively. In January, it acquired Matt Mark which is an European high-end agricultural machinery enterprise; in March, the phase I of its high-end agricultural machinery (mainly balers, grain dryers and the like) project with the total investment of RMB2 billion was officially put into operation.

Zoomlion Heavy Machinery: Formerly known as Chery Heavy Industry, ZoomlionHeavy Machinery changed its name in October 2014.The parent company Zoomlion holds 67.51% stake. The construction of ZoomlionBozhou Industrial Park commenced in February 2014 and ended in December of the same year, with the planned annual capacity of 1,500 large-scale forage harvesters, 10,000 self-propelled corn harvesters, 6,500 sets of large-sized agricultural machinery and 14,500 sets of key agricultural equipment parts.

The report focuses on the followings:

Status quo of global agricultural machinery market and agricultural machinery development in major countries; Status quo of global agricultural machinery market and agricultural machinery development in major countries;

China’s major policies and subsidies for agricultural machinery; China’s major policies and subsidies for agricultural machinery;

Overview, main products, major enterprises and agricultural mechanization of China's agricultural machinery industry; Overview, main products, major enterprises and agricultural mechanization of China's agricultural machinery industry;

Development of major agricultural machinery segments including tractors, harvesters, rice transplanters and agricultural vehicles; Development of major agricultural machinery segments including tractors, harvesters, rice transplanters and agricultural vehicles;

Development of agricultural machinery industry in seven major provinces including Shandong, Henan and Heilongjiang; Development of agricultural machinery industry in seven major provinces including Shandong, Henan and Heilongjiang;

Operation, R & D and development strategy of six global and 14 key Chinese agricultural machinery enterprises. Operation, R & D and development strategy of six global and 14 key Chinese agricultural machinery enterprises.

第一章 全球农机发展现状

1.1 市场概况

1.1.1 生产情况

1.1.2 进出口情况

1.2 主要国家发展情况

1.2.1 美国

1.2.2 加拿大

1.2.3 德国

1.2.4 意大利

1.2.5 日本

第二章 中国农机政策环境

2.1主要政策

2.2农机购置补贴

第三章 中国农机行业发展现状

3.1 农机工业现状

3.1.1 行业综述

3.1.2 主要产品市场

3.1.3 主要企业

3.2 农业机械化现状

3.2.1 农机总动力及结构

3.2.2 农机保有量及结构

3.2.3 农机化水平

3.2.4 农机化服务

第四章 中国农机主要产品分析

4.1 拖拉机

4.1.1 发展现状

4.1.2 产品结构

4.1.3企业格局

4.2 收获机械

4.2.1 产销情况

4.2.2 主要农作物机收情况

4.3 插秧机

4.3.1 市场需求

4.3.2 需求结构

4.3.3 出口情况

4.3.4 重点企业

4.4 农用车

4.4.1 市场现状

4.4.2 竞争格局

第五章 中国农机主要省市分析

5.1 山东省

5.1.1 农机装备总量

5.1.2 农机化水平

5.1.3 农机企业

5.1.4 发展规划

5.2 黑龙江

5.2.1 农机装备总量

5.2.2 农机化水平

5.2.3 农机企业

5.3 河南

5.3.1 农机装备总量

5.3.2 农机化水平

5.3.3 发展规划

5.4 河北

5.4.1 农机装备总量

5.4.2 农机化水平

5.4.3 发展规划

5.5 安徽

5.5.1 农机装备总量

5.5.2 农机化水平

5.5.3 农机经营情况

5.5.4 发展规划

5.6 湖南

5.6.1 农机装备总量

5.6.2 农机化水平

5.6.3 发展规划

5.7 江苏

5.7.1 农机装备总量

5.7.2 农机化水平

5.7.3 农机企业

第六章 全球重点农机企业研究

6.1约翰.迪尔(John Deere)

6.1.1企业简介

6.1.2 经营情况

6.1.3 在华发展

6.2纽荷兰工业(CNH Industrial)

6.2.1 企业简介

6.2.2 经营情况

6.2.3 在华发展

6.3爱科(AGCO)

6.3.1 企业简介

6.3.2 经营情况

6.3.3 在华发展

6.4克拉斯(Claas)

6.4.1 企业简介

6.4.2 经营情况

6.4.3 在华发展

6.5赛迈道依兹-法尔(Same Deutz-Fahr)

6.5.1 企业简介

6.5.2 经营情况

6.5.3 在华发展

6.6久保田(Kubota)

6.6.1 企业简介

6.6.2 经营情况

6.6.3 在华发展

第七章 中国重点农机企业研究

7.1 中国一拖集团

7.1.1 企业简介

7.1.2 经营情况

7.1.3 一拖股份

7.1.4 发展战略

7.2 福田雷沃重工.

7.2.1 企业简介

7.2.2 经营情况

7.2.3 研发能力

7.2.4 发展战略

7.3东风农机

7.3.1 企业简介

7.3.2 经营情况

7.3.3 发展战略

7.3.4 重点项目

7.4 山东常林.

7.4.1 企业简介

7.4.2 经营情况

7.4.3 农机子公司——常林农装

7.4.4 发展战略

7.5 常发集团

7.5.1 企业简介

7.5.2 经营情况

7.5.3 农机子公司——常发农装

7.6时风集团

7.6.1 企业简介

7.6.2 经营情况

7.6.3 发展战略

7.7五征集团.

7.7.1 企业简介

7.7.2 经营情况

7.7.3发展战略

7.8中联重机

7.8.1 企业简介

7.8.2 经营情况

7.8.3发展战略

7.9 山东巨明

7.9.1 企业简介

7.9.2 经营情况

7.9.3 发展战略

7.10沃得农机

7.10.1 企业简介

7.10.2 经营情况

7.11科乐收金亿

7.11.1 企业简介

7.11.2 经营情况

7.11.3 研发情况

7.12 现代农装

7.12.1 企业简介

7.12.2 经营情况

7.12.3 农机子公司——洛阳中收

7.13 新研股份

7.13.1 企业简介

7.13.2 经营情况

7.13.3 主要子公司

7.13.4 竞争优势

7.14 星光农机

7.14.1 企业简介

7.14.2 经营情况

7.14.3 主要客户

7.14.4 竞争优势

第八章 总结与预测

8.1 市场

8.2 企业

1. Status Quo of Agricultural Machinery Industry Worldwide

1.1 Market Overview

1.1.1 Production

1.1.2 Import and Export

1.2 Major Countries

1.2.1 The United States

1.2.2 Canada

1.2.3 Germany

1.2.4 Italy

1.2.5 Japan

2 Policy Environment of Agricultural Machinery Industry in China

2.1 Major Policies

2.2 Subsidies for Agricultural Machinery Purchase

3 Development of Agricultural Machinery Industry in China

3.1 Status Quo

3.1.1 Overview

3.1.2 Major Products

3.1.3 Major Enterprises

3.2 Agricultural Mechanization

3.2.1 Total Power and Structure of Agricultural Machinery

3.2.2 Ownership and Structure of Agricultural Machinery

3.2.3 Agricultural Mechanization Level

3.2.4 Agricultural Machinery Services

4 Key Agricultural Machinery in China

4.1 Tractor

4.1.1 Current Development

4.1.2 Product Structure

4.1.3 Enterprise Pattern

4.2 Harvester

4.2.1 Production and Sale

4.2.2 Mechanized Harvesting of Main Crops

4.3 Transplanter

4.3.1 Market Demand

4.3.2 Demand Structure

4.3.3 Export

4.3.4 Key Companies

4.4 Agricultural Vehicles

4.4.1 Market Situation

4.4.2 Competition Pattern

5 Key Provinces & Municipalities of Agricultural Machinery Industry in China

5.1 Shandong

5.1.1 Total Amount of Agricultural Machinery Equipment

5.1.2 Agricultural Mechanization Level

5.1.3 Agricultural Machinery Enterprises

5.1.4 Development Plan

5.2 Heilongjiang

5.2.1 Total Amount of Agricultural Machinery Equipment

5.2.2 Agricultural Mechanization Level

5.2.3 Agricultural Machinery Enterprises

5.3 Henan

5.3.1 Total Amount of Agricultural Machinery Equipment

5.3.2 Agricultural Mechanization Level

5.3.3 Development Plan

5.4 Hebei

5.4.1 Total Amount of Agricultural Machinery Equipment

5.4.2 Agricultural Mechanization Level

5.4.3 Development Plan

5.5 Anhui

5.5.1 Total Amount of Agricultural Machinery Equipment

5.5.2 Agricultural Mechanization Level

5.5.3 Agricultural Machinery Operation

5.5.4 Development Plan

5.6 Hunan

5.6.1 Total Amount of Agricultural Machinery Equipment

5.6.2 Agricultural Mechanization Level

5.6.3 Development Plan

5.7 Jiangsu

5.7.1 Total Amount of Agricultural Machinery Equipment

5.7.2 Agricultural Mechanization Level

5.7.3 Agricultural Machinery Enterprises

6 Key Agricultural Machinery Companies Worldwide

6.1 John Deere

6.1.1 Profile

6.1.2 Operation

6.1.3 Development in China

6.2 CNH Industrial

6.2.1 Profile

6.2.2 Operation

6.2.3 Development in China

6.3 AGCO

6.3.1 Profile

6.3.2 Operation

6.3.3 Development in China

6.4 Claas

6.4.1 Profile

6.4.2 Operation

6.4.3 Development in China

6.5 Same Deutz-Fahr

6.5.1 Profile

6.5.2 Operation

6.5.3 Development in China

6.6 Kubota

6.6.1 Profile

6.6.2 Operation

6.6.3 Development in China

7 Key Agricultural Machinery Companies in China

7.1 YTO Group Corporation

7.1.1 Profile

7.1.2 Operation

7.1.3 First Tractor Company Limited

7.1.4 Development Strategy

7.2 Foton Lovol International Heavy Industry Co., Ltd.

7.2.1 Profile

7.2.2 Operation

7.2.3 R&D Capabilities

7.2.4 Development Strategy

7.3 Changzhou Dongfeng Agricultural Machinery Group Co., Ltd.

7.3.1 Profile

7.3.2 Operation

7.3.3 Development Strategy

7.3.4 Key Projects

7.4 Shandong Changlin Machinery Group Co., Ltd.

7.4.1 Profile

7.4.2 Operation

7.4.3 Agricultural Machinery Subsidiary--Shandong Changlin Agricultural Equipment Co.,Ltd.

7.4.4 Development Strategy

7.5 Jiangsu Changfa Group

7.5.1 Profile

7.5.2 Operation

7.5.3 Agricultural Machinery Subsidiary --Jiangsu Changfa Agricultural Equipment Co., Ltd.

7.6 Shandong Shifeng (Group) Co., Ltd.

7.6.1 Profile

7.6.2 Operation

7.6.3 Development Strategy

7.7 Shandong Wuzheng (Group) Co. Ltd.

7.7.1 Profile

7.7.2 Operation

7.7.3 Development Strategy

7.8 Zoomlion Heavy Machinery

7.8.1 Profile

7.8.2 Operation

7.8.3 Development Strategy

7.9 Shandong Juming

7.9.1 Profile

7.9.2 Operation

7.9.3 Development Strategy

7.10 World Agricultural Machinery

7.10.1 Profile

7.10.2 Operation

7.11CLAAS Jinyee

7.11.1 Profile

7.11.2 Operation

7.11.3 R&D

7.12 Modern Agricultural Equipment Co., Ltd.

7.12.1 Profile

7.12.2 Operation

7.12.3 Agricultural Machinery Subsidiary --Luoyang Zhongshou Machinery Equipment Co., Ltd.

7.13 Xinjiang Machinery Research Institute Co., Ltd.

7.13.1 Profile

7.13.2 Operation

7.13.3 Major Subsidiaries

7.13.4 Competitive Edge

7.14 Xingguang Agricultural Machinery

7.14.1 Profile

7.14.2 Operation

7.14.3 Major Clients

7.14.4 Competitive Edge

8 Summary and Forecast

8.1 Market

8.2 Enterprises

图:2005-2016年全球农机总产值

图:2007-2013年全球主要地区农业机械产值占比

表:2011-2013年欧洲主要国家农机产值

表:2010-2013年全球农机进出口额

表:2011-2013年主要地区农机出口额

表:2011-2013年主要地区农机进口额

表:2005-2014年美国主要农机销量

表:2005-2014年加拿大主要农机销量

表:2010-2013年德国农机产业主要指标

表:2010-2013年德国农机(分产品)销量

表:2010-2013年意大利农机产业主要指标

表:2010-2015年日本农机产值及销售额

表:2013-2014年日本农机(分产品)产值及销售额

表:2012-2015年中国农机行业主要政策

图:2004-2016年中国农机具补贴资金

表:2010-2015年中国农业机械主要经济指标

表:2012-2014年中国骨干企业拖拉机产量

表:2012-2014年中国骨干企业收获机械产量

表:2010-2014年中国主要农机产品产量

表:2014年中国(分省市)拖拉机产量及同比增长

表:2014年中国(分省市)收获机械产量及同比增长

图:2004-2016年中国农机总动力

图:2007-2016年中国每公顷耕地拥有农机动力

表:2005-2015年中国主要农机装备总动力

表:2014年中国主要省市农机总动力

表:2005-2015年中国主要农机产品保有量

图:2001-2016年中国小拖与大中拖保有量比例

图:2001-2016年大中拖机具配套比例

图:2001-2016年小拖机具配套比例

表:2010-2015年中国农机化作业面积

图:2004-2016年中国农作物耕种收综合机械化水平

图:2004-2015年中国农作物机耕、机播、机收水平

表:2014年中国主要省市农作物耕种收综合机械化水平

图:2008-2016年中国农机作业服务组织及农机专业合作社数量

图:2008-2016年中国农机化经营服务总收入

表:2012-2015年中国拖拉机行业主要经济指标

图:2009-2016年中国拖拉机产量及同比增长

图:2009-2015年中国拖拉机(分类型)产量

表:2014年中国大中拖市场Top5企业

表:2014年中国小轮拖市场Top5企业

表:2007-2015年中国收获机械保有量及结构

图:2008-2016年中国联合收获机产量和销量

图:2008-2015年中国三大作物机收水平

图:2010-2015年中国小麦收获机保有量

图:2008-2015年中国玉米收获机保有量

表:中国玉米收获机三大集群

表:2014年中国玉米收获机(分产品)主要企业

图:2005-2016年中国水稻插秧机销量

图:2009-2016年中国水稻插秧机保有量及机插率

表:2010-2014年中国插秧机销量及占比

图:2014年中国手扶式插秧机和乘坐式插秧机需求结构

表:2014年中国插秧机(分地区)销量及增速

表:2014年中国插秧机(分国家)出口额及同比增长

图:2014年中国插秧机市场竞争格局

表:2009-2015年中国低速汽车(农业运输车)产量

表:2013-2014年中国三轮汽车销量Top10企业

表:2013-2014年中国低速货车销量Top10企业

图:2008-2016年山东省农机总动力及农机总值

表:2009-2015年山东省主要农机保有量

图:2008-2016年山东省农机化综合水平

表:2014年山东省主要农机企业

图:2008-2016年黑龙江省农机总动力

表:2011-2014年黑龙江主要农机保有量

图:2008-2016年黑龙江农机化综合水平

图:2008-2016年河南省农机总动力

表:2008-2014年河南省主要农机产品拥有量

图:2008-2016年河南省耕种收综合机械化水平

图:2008-2016年河北省农机总动力

表:2008-2014年河北省主要农机产品保有量

图:2008-2016年河北省耕种收综合机械化水平

图:2008-2016年安徽省农机总动力

表:2010-2014年安徽省主要农机产品保有量

图:2008-2016年安徽省农机化耕种收综合水平

图:2004-2015年安徽省农机经营总收入

图:2008-2016年湖南省农机总动力

图:2008-2016年湖南省水稻耕种收综合机械化水平

图:2008-2016年江苏省农机总动力

表:2012-2014年江苏省主要农机产品拥有量

图:2008-2016江苏省农作物生产综合机械化水平

表:2015年江苏省主要农机企业

图:2009-2014财年迪尔公司净销售额及净利润

表:2009-2014财年John Dcere (分业务)净销售额及营业利润

表:2009-2014财年约翰迪尔(分地区)净销售额

图:2014年约翰迪尔在华生产基地

表:2012-2014年CNH Industiral 营业收入及利润

表:2013-2014年CNH Industiral(分业务)营业收入

图:2010-2014年AGCO净销售额及净利润

图:2014年AGCO 净销售额(分产品)构成

图:2014年AGCO(分地区)净销售额构成

表:爱科在华公司

图:2010-2014财年Claas 净销售额及净利润

图:2014财年Claas 净销售额(分地区)构成

图:2010-2014年Same Deutz-Fahr 净销售额及净利润

表:2013-2014年Same Deutz-Fahr净销售额构成

图:2011-2015财年Kubota营业收入及净利润

表:2011-2015财年Kubota(分地区)营业收入

表:2011-2015财年Kubota(分业务)营业收入

表:2015年久保田在华主要子公司

图:2010-2015年中国一拖集团营业收入

图:2010-2015年一拖股份营业收入及净利润

表:2011-2014年一拖股份(分业务)主营业务收入及毛利率

表:2013-2014年一拖股份农业机械(分产品)销量及营业收入

表:2012-2014年一拖股份主要产品产能及产量

表:2009-2014年一拖股份(分地区)主营业务收入

图:2009-2015年福田雷沃销售收入

图:2010-2015年雷沃重工农业装备产业销售收入

表:福田雷沃重工主要农机产品

图:2009-2015年东风农机销售收入

图:2009-2015年山东常林集团销售收入

图:2009-2015年常发集团营业收入

表:常发集团主要子公司

图:2009-2015年时风集团营业收入及利税

表:2009-2014年时风集团主要产品产量

图:2009-2015年五征集团销售收入

表:2009-2014年五征集团主要产品销量

图:2009-2015年山东巨明营业收入

图:2010-2015年沃得农机营业收入

表:现代农装旗下子公司及主营产品

图:2009-2015年现代农装营业收入

表:2011-2014年现代农机(分业务)主营业务收入

图:2009-2015年新研股份营业收入及净利润

表:2010-2014年新研股份(分地区)主营业务收入

表:2014年新研股份主要子公司经营指标

表:2012-2015年星光农机营业收入及净利润

图:2012-2014年星光农机(分产品)营业收入

图:2012-2014年星光农机(分地区)营业收入

表:2012-2014年公司前5大客户

表:2012-2014年星光农机经销商数量及收入

表:2014年世界主要农机企业销售额及同比增长

表:2013年度中国TOP30农机企业

Gross Output Value of Agricultural Machinery Worldwide, 2005-2016E

Output Value Proportion of Agricultural Machinery in Major Regions Worldwide, 2007-2013

Output Value of Agricultural Machinery of Major European Countries, 2011-2013

Import and Export Value of Agricultural Machinery Worldwide, 2010-2013

Agricultural Machinery Export Value in Major Regions, 2011-2013

Agricultural Machinery Import Value in Major Regions, 2011-2013

Sales Volume of Major Agricultural Machinery in the United States, 2005-2014

Sales Volume of Major Agricultural Machinery in Canada, 2005-2014

Major Indicators of Agricultural Machinery Industry in Germany, 2010-2013

Sales Volume of Agricultural Machinery Industry in Germany by Product, 2010-2013

Major Indicators of Agricultural Machinery Industry in Italy, 2010-2013

Output Value and Sales of Agricultural Machinery in Japan, 2010-2015

Output Value and Sales of Agricultural Machinery Industry in Japan by Product, 2013-2014

Major Policies on Agricultural Machinery Industry in China, 2012-2015

Subsidies for Agricultural Machinery in China, 2004-2016E

Major Indicators of Agricultural Machinery Industry in China, 2010-2015

Tractor Output of Backbone Enterprises in China, 2012-2014

Harvester Output of Backbone Enterprises in China, 2012-2014

Output of Major Agricultural Machinery in China, 2010-2014

Tractor Output and YoY Growth in China by Provinces & Municipalities, 2014

Harvester Output and YoY Growth in China by Provinces & Municipalities, 2014

Total Power of Agricultural Machinery in China, 2004-2016E

Power of Agricultural Machinery per Hectare of Farmland in China, 2007-2016E

Total Power of Main Agricultural Machinery Equipment, 2005-2015

Total Power of Agricultural Machinery in Main Provinces & Municipalities, 2014

Ownership of Major Agricultural Machinery in China, 2005-2015

Ownership Ratio of Small-sized Tractors and Large-and Medium-sized Tractors in China, 2001-2016E

Supporting Ratio of Large-and Medium-sized Tractors in China, 2001-2016E

Supporting Ratio of Small-sized Tractors in China, 2001-2016E

Agricultural Mechanization Service Acreage in China, 2010-2015

Overall Level of Agricultural Mechanization in China, 2004-2016E

Mechanization Level of Crops in China by Ploughing, Sowing and Harvesting, 2004-2015

Overall Level of Agricultural Mechanization in Major Chinese Provinces & Municipalities, 2014

Quantity of Agricultural Machinery Service Organizations and Cooperatives in China, 2008-2016E

Total Revenue of Agricultural Machinery Services, 2008-2016E

Major Indicators of China Tractor Industry, 2012-2015

Output and YoY Growth Rate of Tractors in China, 2009-2016E

Output of Tractors in China by Type, 2009-2015

Top 5 Enterprises in Chinese Medium and Large-sized Wheel Tractor Market, 2014

Top 5 Enterprises in Chinese Small-sized Wheel Tractor Market, 2014

Ownership and Structure of Harvesters in China, 2007-2015

Output and Sales Volume of Combine Harvesters in China, 2008-2016E

Mechanization Level of Three Crops in China, 2008-2015

Ownership of Wheat Harvester in China, 2010-2015

Ownership of Corn Harvester in China, 2008-2015

Three Industrial Clusters of Corn Harvester in China

Main Companies of Corn Harvester in China by Product, 2014

Sales Volume of Rice Transplanters in China, 2005-2016E

Ownership and Planting Mechanization Rate of Rice Transplanters in China, 2009-2016E

Sales Volume and Proportion of Rice Transplanters in China, 2010-2014

Demand Structure of Handheld and Ride-on Transplanters in China, 2014

Sales Volume and Growth Rate of Transplanters in China by Region, 2014

Transplanter Export Value and YoY Growth in China by Destination, 2014

Transplanter Market Competition Patternin China, 2014

Output of Low-speed Vehicles (Agricultural Vehicles) in China, 2009-2015

Top 10 Three-wheeled Vehicle Enterprises in China by Sales Volume, 2013-2014

Top 10 Low-speed Truck Enterprises in China by Sales Volume, 2013-2014

Total Power and Value of Agricultural Machinery in Shandong, 2008-2016E

Ownership of Major Agricultural Machinery in Shandong, 2009-2015

Overall Level of Agricultural Mechanization in Shandong, 2008-2016E

Major Agricultural Machinery Enterprises in Shandong, 2014

Total Power of Agricultural Machinery in Heilongjiang, 2008-2016E

Ownership of Major Agricultural Machinery in Heilongjiang, 2011-2014

Overall Level of Agricultural Mechanization in Heilongjiang, 2008-2016E

Total Power of Agricultural Machinery in Henan, 2008-2016E

Ownership of Major Agricultural Machinery in Henan, 2008-2014

Overall Level of Agricultural Mechanization in Henan, 2008-2016E

Total Power of Agricultural Machinery in Hebei, 2008-2016E

Ownership of Major Agricultural Machinery in Hebei, 2008-2014

Overall Level of Agricultural Mechanization in Hebei, 2008-2016E

Total Power of Agricultural Machinery in Anhui, 2008-2016E

Ownership of Major Agricultural Machinery in Anhui, 2010-2014

Overall Level of Agricultural Mechanization in Anhui, 2008-2016E

Total Revenue from Agricultural Machinery Operation in Anhui, 2004-2015

Total Power of Agricultural Machinery in Hunan, 2008-2016E

Overall Level of Agricultural Mechanization of Rice in Hunan, 2008-2016E

Total Power of Agricultural Machinery in Jiangsu, 2008-2016E

Ownership of Major Agricultural Machinery in Jiangsu, 2012-2014

Overall Level of Agricultural Mechanization in Jiangsu, 2008-2016

Major Agricultural Machinery Enterprises in Jiangsu, 2015

Net Sales and Net Income of John Deere, FY2009-FY2014

Net Sales and Operating Income of John Deere by Business, FY2009-FY2014

Net Sales of John Deere by Region, FY2009-FY2014

Production Bases of John Deere in China, 2014

Revenue and Profit of CNH, 2012-2014

Revenue of CNH by Business, 2013-2014

Net Sales and Net Income of AGCO, 2010-2014

Net Sales Structure of AGCO by Product, 2014

Net Sales Structure of AGCO by Region, 2014

China-based Subsidiaries of AGCO

Net Sales and Net Income of Claas, FY2010-FY2014

Net Sales Structure of Claas by Region, FY2014

Net Sales and Net Income of Same Deutz-Fahr, 2010-2014

Net Sales Structure of Same Deutz-Fahr, 2013-2014

Revenue and Net Income of Kubota, FY2011-FY2015

Revenue of Kubota by Region, FY2011-FY2015

Revenue of Kubota by Business, FY2011-FY2015

Major Subsidiaries of Kubota in China, 2015

Revenue of YTO Group, 2010-2015

Revenue and Net Income of First Tractor, 2010-2015

Operating Revenue and Gross Margin of First Tractor by Business, 2011-2014

Sales Volume and Revenue of Agricultural Machinery of First Tractor by Product, 2013-2014

Capacity and Output of First Tractor's Main Products, 2012-2014

Operating Revenue of First Tractor by Region, 2009-2014

Revenue of FotonLovol, 2009-2015

Revenue of Agricultural Equipment Sector of FotonLovol, 2010-2015

Main Agricultural Machinery of FotonLovol

Revenue of Changzhou Dongfeng Agricultural Machinery Group, 2009-2015

Revenue of Shandong Changlin Machinery Group, 2009-2015

Revenue of Jiangsu Changfa Group, 2009-2015

Major Subsidiaries of Jiangsu Changfa Group

Revenue and Profit & Tax of Shandong Shifeng, 2009-2015

Output of Shandong Shifeng's Main Products, 2009-2014

Revenue of Shandong Wuzheng, 2009-2015

Sales Volume of Shandong Wuzheng's Main Products, 2009-2014

Revenue of Shandong Juming, 2009-2015

Revenue of World Agricultural Machinery, 2010-2015

Subsidiaries and Main Products of Modern Agricultural Equipment

Revenue of Modern Agricultural Equipment, 2009-2015

Operating Revenue of Modern Agricultural Equipment by Business, 2011-2014

Revenue and Net Income of Xinjiang Machinery Research Institute, 2009-2015

Operating Revenue of Xinjiang Machinery Research Institute by Region, 2010-2014

Operating Indicators of Major Subsidiaries of Xinjiang Machinery Research Institute, 2014

Revenue and Net Income of Xingguang Agricultural Machinery, 2012-2015

Revenue of Xingguang Agricultural Machinery by Product, 2012-2014

Revenue of Xingguang Agricultural Machinery by Region, 2012-2014

Top 5 Clients of Xingguang Agricultural Machinery, 2012-2014

Number of Dealers and Revenue of Xingguang Agricultural Machinery, 2012-2014

Revenue and YoY Growth of Main Agricultural Machinery Companies Worldwide, 2014

TOP 30 Agricultural Machinery Enterprises in China, 2013

如果这份报告不能满足您的要求,我们还可以为您定制报告,请 留言说明您的详细需求。

|