|

|

|

报告导航:研究报告—

TMT产业—电子半导体

|

|

2014-2015年中国半导体产业研究报告 |

|

字数:2.2万 |

页数:120 |

图表数:148 |

|

中文电子版:9000元 |

中文纸版:4500元 |

中文(电子+纸)版:9500元 |

|

英文电子版:2300美元 |

英文纸版:2450美元 |

英文(电子+纸)版:2600美元 |

|

编号:ZYW212

|

发布日期:2015-07 |

附件:下载 |

|

|

|

《2014-2015年中国半导体产业研究报告》包含以下内容:

1、全球半导体市场与产业分析

2、中国半导体市场与产业分析

3、11家中国IC设计企业研究

4、5家中国晶圆代工企业研究

5、4家中国封测企业研究

根据中国半导体协会的数据,2014年整个半导体产业链的总值超过3000亿人民币,但与产品相关的产值只有1047亿人民币(不包含外资企业),占三分之一。集成电路出口量还比较乐观,不过细化分到具体公司,就能够发现主力军是在华外资企业,而非本土企业。

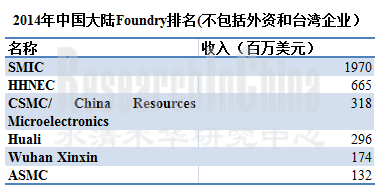

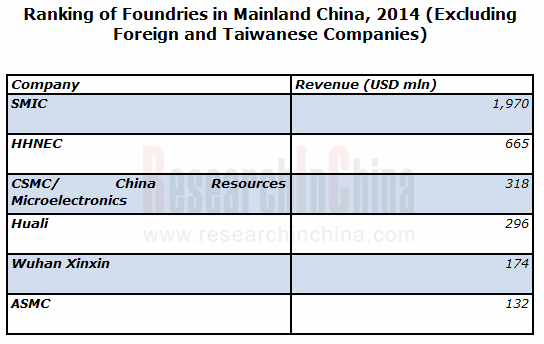

如果排除外资企业、台湾企业和软件业务,中国大陆半导体产业的真实格局是这样的:2014年中国半导体产业产值大约125亿美元,其中IC设计占大约50亿美元,IC制造占大约37亿美元,封测占大约38亿美元。表面上看,IC设计所占比例较高,实际上IC设计企业主要的Foundry还是台湾的TSMC或UMC,特别是大的IC设计企业,大约80%的Wafer都来自台湾的TSMC。也就是说中国大陆的IC设计企业跟Foundry之间并无多少联系。

2014年以来中国金融机构或企业在全球范围内大肆展开半导体企业收购。中国企业或机构最擅长资本运作,资金量巨大。中国正试图以资本收购的方式快速拓展中国的半导体产业,然而半导体产业是需要长期的人才和技术积累,即使通过资本运作的方式,中国的半导体产业仍然还有较长的路需要走。

中国政府在半导体行业大力气扶植的是Memory产业,因为中国是全球最大的Memory市场,全球75%的Memory都销售到了中国。中国政府打算在Memory领域至少投入100亿美元以上的投资。如果全球Memory产业格局不发生大的变化,中国每年就需要进口数百亿美元的Memory。

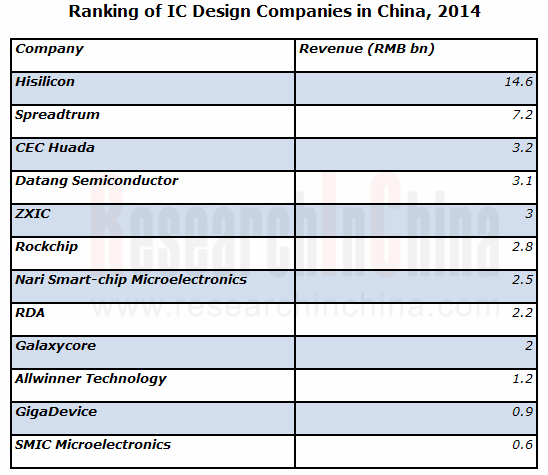

中国的IC设计公司大部分是依靠背后强大的母公司支持而获得成功的,几乎没有独立的IC设计公司。而这些母公司当中一部分是占据垄断地位的国企,是非市场化运作的。如南瑞智芯微电子,其母公司是国家电网下属公司,该公司主要产品是智能电表IC,具备垄断地位。再比如华大半导体,其母公司是中国电子信息产业集团,垄断了身份证用IC市场。另一类是非国有的大企业,如海思依靠华为,中兴微电子依靠中兴通讯。联芯科技则依靠母公司大唐电信拥有的TD-SCDMA技术。格科微电子则依靠中芯国际的鼎力支持。

真正独立自主的IC设计公司有展讯、锐迪科、瑞芯微、全志科技等少数企业。而展讯和锐迪科又被国有企业收购了。之所以被收购,主要是这些企业融资渠道狭窄,而这些企业又需要大量的资金。还有一类实际上是台湾企业,如汇顶和敦泰,大股东和技术来源都是标准的台湾企业。

大陆的IC设计公司高度依赖手机和平板电脑市场。还有一部分企业则是完全依赖智能卡市场,如南瑞智芯微电子、复旦微电子、华虹集成。

台湾的IC设计公司技术能力高于大陆,且大部分是独立企业;有些即便是创业初依靠母公司,后来也慢慢摆脱对母公司的依赖,如奇景、联咏。台湾的IC设计公司依靠的多是上游产业链,而非下游终端。台湾前18大IC设计公司中LCD Driver就占了5家,这是因为台湾的LCD面板产业出货量全球第一。此外,大陆的IC设计公司除RDA外都是Digital领域的,而台湾有多家Analog和Mixed IC设计公司。台湾还有两家具备一定规模的高技术的ASIC设计公司。

The report covers the followings:

1. Global Semiconductor Market and Industry;

2. China Semiconductor Market and Industry;

3. Eleven Chinese IC Design Companies

4. Five Chinese Foundries

5. Four Chinese Packaging and Testing Companies

According to China Semiconductor Industry Association, the total value of the entire semiconductor industry chain exceeded RMB300 billion in 2014, of which only RMB104.7 billion or one-third was concerned with products (excluding foreign companies). The IC export volume is still optimistic in a relative sense, but it is mostly contributed by foreign companies in China, rather than local enterprises.

Without foreign companies, Taiwanese enterprises and software business, Chinese semiconductor industryturns to be a real pattern like this: the output value of China semiconductor industry approximated USD12.5 billion in 2014, of which USD5 billion came from IC design, USD3.7 billion from IC fabrication, USD3.8 billion from IC packaging and testing. Apparently, IC design accounted for a higher proportion, in fact, the foundries of IC design companies mainly referred to Taiwanese TSMC or UMC, especially large IC design companies; about 80% of wafers were produced by Taiwanese TSMC. This means the irrelevance between IC design companies and foundries in Mainland China.

Since 2014, Chinese financial institutions or enterprises which are adept at capital operation and have huge capitalhave acquired semiconductor companies worldwide vigorously. China is trying to expand its semiconductor industry rapidly through acquisitions. However, the semiconductor industry requires long-term accumulation of talents and technologies, the semiconductor industry of China still has a long way to go even if it renders capital operation.

Chinese government makes great efforts to support the memory sector of the semiconductor industry with the investment of at least USD10 billion, because China is the largest memory market and buys 75% of the global memory. If the global memory industry structure remains stable, China will import tens of billions in USD of memory each year.

Most of Chinese IC design companies rely on their powerful parent companies which are partly state-owned enterprises with dominating positions and non-market-oriented operation to thrive and almost no independent IC design companies exist. For example, the parent company of Nari Smart-chip Microelectronics is a subsidiary of State Grid with main products -- smart meter IC and a monopoly position. The parent company of CEC Huada is China Electronics Corporation (CEC) which monopolizes the ID card-use IC market. Non-state-owned large enterprises Huawei, ZTE, Datang Telecom (with TD-SCDMA technology) and SMIC Microelectronics act as the backers of Hisilicon, ZXIC, Leadcore Technology and Galaxycore respectively.

Independent IC design companies include Spreadtrum, RDA, Rockchip and Allwinner Technology. Spreadtrum and RDA which need a lot of money but hold limited financing channels have been acquired by state-owned enterprises. Major shareholders and technology sources of Goodix and FocalTech are actually Taiwanese companies.

In Mainland China, IC design companies are highly dependent on mobile phone and tablet PC markets. Some companies are even completely dependent on the smart card market, such as Nari Smart-chip Microelectronics, Fudan Microelectronics and Hua Hong Integrated Circuit.

Taiwanese IC design companies which are mostly independent firms are superior in technology to their counterparts in Mainland China; even if some Taiwanese companies relied on the parent companies at early stages, they have become dependent slowly, such as Himax and Novatek. Taiwanese IC design companies largely rely on the upstream industry chain instead of the downstream. Five of Taiwan's top 18 IC design companies focus on LCD driver because Taiwan's LCD panel industry ranks first in the world by shipment. In Chinese Mainland, IC design companies specialize in the digital field except RDA; in contrast, there are many Analog and Mixed IC design companies as well as two high-tech ASIC design companies of a certain scale in Taiwan.

第一章、全球半导体产业

1.1、全球半导体产业概况

1.2、半导体产业供应链

1.3、 半导体产业概况

1.4、半导体测试

1.5、全球封测厂家排名

1.6、晶圆代工产业规模

第二章、半导体产业下游市场

2.1、全球Memory市场

2.2、DRAM供求分析

2.3、NAND供需分析

2.4、全球手机市场

2.5、全球手机产业

2.6、中国手机市场

2.7、笔记本电脑市场

2.8、平板电脑市场

2.9、服务器市场

第三章、中国半导体产业与市场

3.1、中国IC市场

3.2、中国半导体产业

3.3、中国政府扶植半导体产业政策

3.4、中国近期半导体领域内并购

3.5、中国IC产业发展预测

3.6、中国晶圆代工产业发展目标

3.7、中国半导体封测产业

3.8、中国半导体封测企业排名

3.9、中国IC设计产业分析

第四章、中国典型IC设计公司研究

4.1、海思半导体

4.2、展讯

4.3、大唐半导体

4.4、北京南瑞智芯微电子

4.5、格科微电子

4.6、瑞芯微电子

4.7、全志科技

4.8、士兰微电子

4.9、北京中电华大电子设计

4.10、深圳市中兴微电子技术

4.11、兆易创新

4.12、中芯微电子

4.13、锐迪科

第五章、晶圆代工企业

5.1、SMIC

5.2、HHGrace

5.3、华力微电子

5.4、武汉新芯集成电路制造

5.5、ASMC

第六章、半导体封测企业

6.1、江苏长电科技JECT

6.2、南通富士通微电子

6.3、天水华天科技

6.4、晶方科技

1 Global Semiconductor Industry

1.1 Global Overview

1.2 Supply Chain

1.3 Semiconductor Industry Overview

1.4 Semiconductor Testing

1.5 Ranking of Global Packaging and Testing Companies

1.6 Scale of Foundry Industry

2 Downstream Markets of Semiconductor Industry

2.1 Global Memory Market

2.2 DRAM Supply and Demand

2.3 NAND Supply and Demand

2.4 Global Mobile Phone Market

2.5 Global Mobile Phone Industry

2.6 Chinese Mobile Phone Market

2.7 Laptop Computer Market

2.8 Tablet PC Market

2.9 Server Market

3 China's Semiconductor Industry and Market

3.1 IC Market

3.2 Semiconductor Industry

3.3 Government’s Policies Incentive to Semiconductor Industry

3.4 Recent M&As in Semiconductor Industry

3.5 Development Forecast for IC Industry

3.6 Development Goals of Foundries

3.7 China Semiconductor Packaging and Testing Industry

3.8 Ranking of Semiconductor Packaging and Testing Companies

3.9 IC Design Industry

4 Typical IC Design Companies in China

4.1 Hisilicon

4.2 Spreadtrum

4.3 Datang Semiconductor

4.4 Beijing Nari Smart-chip Microelectronics Technology

4.5 Galaxycore Microelectronics

4.6 Rockchip

4.7 Allwinner Technology

4.8 Silan Microelectronics

4.9 CEC Huada Electronic Design

4.10 ZXIC

4.11 GigaDevice

4.12 SMIC Microelectronics

4.13 RDA Microelectronics

5 Foundries

5.1 SMIC

5.2 HHGrace

5.3 Huali Microelectronics

5.4 XMC

5.5 ASMC

6 Semiconductor Packaging and Testing Companies

6.1 JCET

6.2 Nantong Fujitsu Microelectronics

6.3 Tianshui Huatian Technology

6.4 China Wafer Level CSP

2013-2019年全球半导体市场规模

2013-2016年全球半导体市场产品分布

2013-2016年全球半导体产品增幅

Semiconductor Outsourced Supply Chain

Semiconductor Company Systems

Semiconductor Outsourced Supply Chain Example

Food Chain IC CAD Design Industry

1Q14 Top25 Semiconductor Sales Leaders

1Q15 Top25 Semiconductor Sales Leaders

1990-2013 Worldwide IC Sales by Company Headquarters Location

2013 Fabless IC Sales Marketshare by Company Headquarters Location

2008-2013 Top 10 IC Manufacturers in China

2013年FIQFN厂家排名

2013年FOWLP厂家排名

2013年Stacked Package厂家排名

2013-2015全球封测前24大企业收入排名 Global Top24 OSAT Company Ranking by Revenue

2013-2015年全球主要OSAT厂家营业利润率与毛利率对比

2008-2017年全球Foundry市场规模

2009-2016年全球Memory市场规模

2014年Global Memory Market by type

2008-2015 Auotomotive Memory Market Size

2010-2015 Auotomotive Memory Market By Technology

2008-2015 DRAM Industry Capex

2013-2016 DRAM Oversupply Ratio

2013-2015 DRAM Demand by Devices

2013-2015 DRAM GB/SystemDRAM GB/System

2014年1季度-2016年4季度 DRAM Oversupply Ratio

2008-2015 NAND Industry Capex

2011-2018 Mainstream tech-node on Typical Smartphone IC

2008-2016年平均每部手机IC成本

2000-2018年Frequency bands per mobile handset device

2000-2018 Cellular terminal shipment forecast by cellular standard

2011-2018 LTE-enabled cellular terminal forecast

2007-2015年全球手机出货量

2011-2014年全球3G/4G手机出货量地域分布

2014年全球前十大手机厂家出货量

2015年1季度主要手机厂家出货量

2015年1季度主要手机厂家市场占有率

2015年1季度主要手机OS市场占有率

Worldwide Smartphone Sales to End Users by Vendor in 2014 (Thousands of Units)

Worldwide Smartphone Sales to End Users by Operating System in 2014 (Thousands of Units)

2015年1季度全球十大智能手机厂家出货量

2014年中国智能手机市场主要厂家市场占有率

2014年中国4G手机市场主要厂家市场占有率

2015年1季度中国智能手机主要厂家市场占有率

2008-2015年笔记本电脑出货量

2010-2014年全球主要笔记本电脑ODM厂家出货量

2011-2016年全球平板电脑出货量

2014年四季度Top Five Tablet Vendors,Shipments

2014年Top Five Tablet Vendors,Shipments,Market Share,and Growth

2013-2018年全球服务器市场规模

2013 Top 5 Corporate Family, Worldwide Server Systems Factory Revenue

2014年四季度Top 5 Corporate Family, Worldwide Server Systems Factory Revenue

2015年全球服务器生产厂家市场占有率

2011-2017年中国IC市场规模

2006-2014年中国IC进口额

2006-2014年中国IC出口额

2008-2014年中国IC产业销售额

2008-2014年中国IC产业 Capex

2004、2014年中国十大IC设计公司销售额排名

2002-2018年China foundry sales share of the pure-play IC foundry market

中国集成电路基金会结构

2009-2015年中国半导体封测产业规模

2010-2014年中国半导体封测企业数量与产能

2014年中国IC封测业收入排名前30企业

2014年台湾Top 18 IC设计公司

2013年中国前30大IC设计公司排名

2007-2015年华为收入与营业利润率

2010-2014年华为主要财务数据

2011-2014年华为收入地域分布

2011-2014年华为收入业务分布

2003-2014年展讯收入

2014年大唐半导体主要财务数据

2012-2014年联芯科技主要财务数据

2011-2014年Galaxycore收入与毛利率

2011-2014年Galaxycore收入产品分布

2011-2014年Galaxycore收入像素分布by pixel

2011-2014年Galaxycore产品出货量

2011-2014年Galaxycore资产、负债与现金流

全志科技2012-2014资产负债表

全志科技2012-2014收入与利润

全志科技2012-2014主要财务指标

2012-2014 全志科技收入下游分布

2014年全志科技主要供应商

2013年全志科技主要供应商

2012年全志科技主要供应商

2010-2014年士兰微电子收入业务分布

兆易创新产品结构

2011-2013 GigaDevice资产负债表

2011-2013 GigaDevice 收入与营业利润

2011-2013 GigaDevice现金流

2011-2013 GigaDevice财务指标

2013年 GigaDevice客户分布

2013年 GigaDevice供应商分布

2009-2015年中芯微电子收入与营业利润率

2009-2014年中芯微电子收入业务分布

2009-2014年中芯微电子收入产品分布

RDA Product Roadmap

RDA Main Customer

RDA收入产品分布

SMIC Milestones

SMIC Fab Capacity

2007-2015年SMIC收入与营业利润率

2008-2014年SMIC Capacity

2008-2014年SMIC毛利率

1Q15 SMIC Balance Sheet

1Q15 SMIC Cash Flow

3Q11-1Q15 SMIC Net Profit and Gross Margin

3Q11-1Q15 SMIC EBITDA

3Q11-1Q15 SMIC Utilization Rate

2010-2014年SMIC收入地域分布

2013Q2-2015Q1 SMIC Quarterly Revenue Breakdown by Geography

2010-2014年SMIC收入应用分布

2013Q2-2015Q1 SMIC Quarterly Revenue Breakdown by Application

2010-2014 SMIC Revenue Breakdown by Node

2013Q2-2015Q1 SMIC Quarterly Revenue Breakdown by Node

2013Q2-2015Q1 SMIC Quarterly Capacity

SMIC Technology Migration on Application

2011-2015年华虹宏力收入、毛利、营业利润

2011-2014年华虹集团收入、净利润、资产负债率

2011-2014华虹宏力Revenue Breakdown by Product

2011-2014华虹宏力Revenue Breakdown by Node

2011-2014华虹宏力产能利用率

2011-2014华虹宏力Revenue Breakdown by Clients

2011-2014华虹宏力Revenue Breakdown by Region

2011-2014华虹宏力Revenue Breakdown by Application

武汉新芯集成电路制造 Roadmap

XMC’s 3D IC technology Platform

2008-2015年上海先进半导体收入与毛利率

2013年2季度-2015年1季度ASMC收入应用分布

2013年2季度-2015年1季度ASMC收入地域分布

2013年2季度-2015年1季度ASMC收入客户分布

2013年2季度-2015年1季度ASMC收入by Fab

2013年2季度-2015年1季度ASMC UTILRate(%)

2006-2015年JECT收入与运营利润率

2011-2014年JECT产量

2012-2013年JECT CHIP Packaging成本结构%

2013-2014年JECT收入产品分布

2012年全球CU Pilluar产能分布

2009-2014年JECT资产负债

07年1季度-15年1季度JECT季度收入

07年1季度-15年1季度JECT季度净利润

2013-2014 JECT主要子公司收入与利润

JCET路线图

2007-2015年南通富士通微电子收入与营业利润

2012-2014通富微电资产负债表

2012-2014通富微电Cash Flows

2012-2014通富微电Key Ratio

2006-2015年天水华天收入与运营利润率

2010-2015年晶方科技收入与营业利润

2014年晶方科技收入客户分布

Global Semiconductor Market Size, 2013-2019E

Product Distribution of Global Semiconductor Market, 2013-2016E

Growth Rate of Global Semiconductor Products by Market Size, 2013-2016E

Semiconductor Outsourced Supply Chain

Semiconductor Company Systems

Semiconductor Outsourced Supply Chain Example

Food Chain IC CAD Design Industry

Top25 Semiconductor Sales Leaders, 1Q2014

Top25 Semiconductor Sales Leaders, 1Q2015

Worldwide IC Sales by Company Headquarters Location, 1990-2013

Fabless IC Sales Marketshare by Company Headquarters Location, 2013

Top 10 IC Manufacturers in China, 2008-2013

Ranking of FIQFN Vendors, 2013

Ranking of FOWLP Vendors, 2013

Ranking of Stacked Package Vendors, 2013

Ranking of Global Top 24 Packaging and Testing Companies by Revenue, 2013-2015

Operating Margin and Gross Margin of Global Major OSAT Vendors, 2013-2015

Global Foundry Market Size, 2008-2017E

Global Memory Market Size, 2009-2016E

Global Memory Market by Type, 2014

Automotive Memory Market Size, 2008-2015

Automotive Memory Market by Technology, 2010-2015

DRAM Industry Capex, 2008-2015

DRAM Oversupply Ratio, 2013-2016E

DRAM Demand by Devices, 2013-2015E

DRAM GB/SystemDRAM GB/System, 2013-2015

DRAM Oversupply Ratio, Q1 2014-Q4 2016

NAND Industry Capex, 2008-2015E

Mainstream Tech-node on Typical Smartphone IC, 2011-2018E

Average IC Costs of a Mobile Phone, 2008-2016E

Frequency Bands per Mobile Handset Device, 2000-2018E

Cellular Terminal Shipment Forecast by Cellular Standard, 2000-2018E

LTE-enabled Cellular Terminal Forecast, 2011-2018E

Global Mobile Phone Shipment, 2007-2015

Global 3G/4G Mobile Phone Shipment by Region, 2011-2014

Major Mobile Phone Vendors’ Shipment, Q1 2015

Market Share of Major Mobile Phone Vendors, Q1 2015

Market Share of Major Mobile Phone OS, Q1 2015

Worldwide Smartphone Sales to End Users by Vendor, 2014

Worldwide Smartphone Sales to End Users by Operating System, 2014

Shipment of Global Top 10 Smartphone Vendors, Q1 2015

Share of Major Vendors in Chinese Smartphone Market, 2014

Share of Major Vendors in Chinese 4G Mobile Phone Market, 2014

Share of Major Vendors in Chinese Smartphone Market, Q1 2015

Laptop Computer Shipment, 2008-2015

Shipment of Global Major Laptop ODM Vendors, 2010-2014

Global Tablet PC Shipment, 2011-2016E

Shipment of Top Five Tablet Vendors, Q4 2014

Shipment, Market Share and Growth of Top Five Tablet Vendors, 2014

Global Server Market Size, 2013-2018E

Top 5 Corporate Family, Worldwide Server Systems Factory Revenue, 2013

Top 5 Corporate Family, Worldwide Server Systems Factory Revenue, Q4 2014

Market Share of Global Server Vendors, 2015

China's IC Market Size, 2011-2017E

China's IC Import Value, 2006-2013

China's IC Export Value, 2006-2013

Revenue of China IC Industry, 2008-2014

Capex of China IC Industry, 2008-2014

Ranking of Top 10 IC Design Companies in China by Revenue, 2004 vs 2014

China Foundry Sales Share of Pure-play IC Foundry Market, 2002-2018

Structure of China's IC Foundation

Size of China's Semiconductor Packaging and Testing Industry, 2009-2015

Number and Capacity of Semiconductor Packaging and Testing Enterprises in China, 2010-2014

Ranking of Top 30 IC Packaging and Testing Enterprises in China by Revenue, 2014

Top 18 IC Design Companies in Taiwan, 2014

Ranking of Top 30 IC Design Companies in China, 2013

Huawei's Revenue and Operating Margin, 2007-2015

Huawei's Selected Financial Data, 2010-2014

Huawei's Revenue by Region, 2011-2014

Huawei's Revenue by Business, 2011-2014

Spreadtrum's Revenue, 2003-2014

Selected Financial Data of Datang Semiconductor, 2014

Selected Financial Data of Leadcore Technology, 2012-2014

Galaxycore's Revenue and Gross Margin, 2011-2014

Galaxycore's Revenue by Product, 2011-2014

Galaxycore's Revenue by Pixel, 2011-2014

Galaxycore's Product Shipment, 2011-2014

Galaxycore's Assets, Liabilities and Cash Flow, 2011-2014

Balance Sheet of Allwinner Technology, 2012-2014

Revenue and Profit of Allwinner Technology, 2012-2014

Selected Financial Indicators of Allwinner Technology, 2012-2014

Revenue of Allwinner Technology by Application, 2012-2014

Major Suppliers of Allwinner Technology, 2014

Major Suppliers of Allwinner Technology, 2013

Major Suppliers of Allwinner Technology, 2012

Silan's Revenue by Business, 2010-2014

GigaDevice's Product Structure

GigaDevice's Balance Sheet, 2011-2013

GigaDevice's Revenue and Operating Income, 2011-2013

GigaDevice's Cash Flow, 2011-2013

GigaDevice's Financial Indicators, 2011-2013

Distribution of GigaDevice's Clients, 2013

Distribution of GigaDevice's Suppliers, 2013

Revenue and Operating Margin of SMIC Microelectronics, 2009-2015

Revenue of SMIC Microelectronics by Business, 2009-2014

Revenue of SMIC Microelectronics by Product, 2009-2014

RDA's Product Roadmap

RDA's Main Customers

RDA's Revenue by Product

SMIC's Milestones

SMIC's Fab Capacity

SMIC's Revenue and Operating Margin, 2007-2015

SMIC's Capacity, 2008-2014

SMIC's Gross Margin, 2008-2014

SMIC's Balance Sheet, 1Q2015

SMIC's Cash Flow, 1Q2015

SMIC's Net Profit and Gross Margin, 3Q2011-1Q2015

SMIC's EBITDA, 3Q2011-1Q2015

SMIC's Utilization Rate, 3Q2011-1Q2015

SMIC's Revenue by Region, 2010-2014

SMIC's Quarterly Revenue Breakdown by Geography, 2013Q2-2015Q1

SMIC's Revenue by Application, 2010-2014

SMIC's Quarterly Revenue Breakdown by Application, 2013Q2-2015Q1

SMIC's Revenue Breakdown by Node, 2010-2014

SMIC's Quarterly Revenue Breakdown by Node, 2013Q2-2015Q1

SMIC’s Quarterly Capacity, 2013Q2-2015Q1

SMIC’s Technology Migration on Application

Revenue, Gross Profit and Operating Income of Huahong Grace, 2011-2015

Revenue, Net Income and Asset-Liability Ratio of Huahong Group, 2011-2014

Revenue Breakdown of Huahong Grace by Product, 2011-2014

Revenue Breakdown of Huahong Grace by Node, 2011-2014

Capacity Utilization of Huahong Grace, 2011-2014

Revenue Breakdown of Huahong Grace by Client, 2011-2014

Revenue Breakdown of Huahong Grace by Region, 2011-2014

Revenue Breakdown of Huahong Grace by Application, 2011-2014

XMC’s Roadmap

XMC’s 3D IC Technology Platform

Revenue and Gross Margin of Shanghai Advanced Semiconductor Manufacturing, 2008-2015

ASMC's Revenue by Application, Q2 2013-Q1 2015

ASMC's Revenue by Region, Q2 2013-Q1 2015

ASMC's Revenue by Client, Q2 2013-Q1 2015

ASMC's Revenue by Fab, Q2 2013-Q1 2015

ASMC's UTILRate (%), Q2 2013-Q1 2015

JCET's Revenue and Operating Margin, 2006-2015

JCET's Output, 2011-2014

JCET's CHIP Packaging Cost Structure, 2012-2013

JCET's Revenue by Product, 2013-2014

Global CU Pilluar Capacity Distribution, 2012

JCET's Assets and Liabilities, 2009-2014

JCET's Quarterly Revenue, Q1 2007-Q1 2015

JCET's Quarterly Net Income, Q1 2007-Q1 2015

Revenue and Profit of JCET's Major Subsidiaries, 2013-2014

JCET's Roadmap

Revenue and Operating Income of Nantong Fujitsu Microelectronics, 2007-2015

Balance Sheet of Nantong Fujitsu Microelectronics, 2012-2014

Cash Flow of Nantong Fujitsu Microelectronics, 2012-2014

Key Ratio of Nantong Fujitsu Microelectronics, 2012-2014

Revenue and Operating Margin of TianShuiHuaTian microelectronics, 2006-2015

Revenue and Operating Income of China Wafer Level CSP, 2010-2015

Revenue of China Wafer Level CSP by Client, 2014

如果这份报告不能满足您的要求,我们还可以为您定制报告,请 留言说明您的详细需求。

|