|

|

|

报告导航:研究报告—

金融与服务业—金融业

|

|

2015年中国互联网众筹及理财行业研究报告 |

|

字数:3.3万 |

页数:120 |

图表数:110 |

|

中文电子版:8000元 |

中文纸版:4000元 |

中文(电子+纸)版:8500元 |

|

英文电子版:2300美元 |

英文纸版:2500美元 |

英文(电子+纸)版:2600美元 |

|

编号:WLQ033

|

发布日期:2015-08 |

附件:下载 |

|

|

|

互联网金融主要商业模式包括(1)第三方支付;(2)网络借贷(包括P2P借贷和网络小额贷款);(3)众筹融资;(4)互联网理财;(5)互联网消费金融;(6)虚拟货币;(7)互联网金融门户;(8)担保;(9)征信等。本报告主要研究互联网众筹和互联网理财行业。

众筹融资行业

众筹指项目发起人通过互联网平台向投资人发布其创意,以实物、服务或股权等为回报募集资金的模式,主要包括奖励众筹、股权众筹平台、捐赠众筹。2011年7月,中国出现了第一家众筹平台,经过2012-2013年的探索孕育,从2014年开始,各类众筹平台数量大幅增长,2014年新增众筹平台142家。截至2015年6月底,中国众筹平台进一步增加至235家,主要分布在经济和互联网发达的北京、广东、上海、浙江等地。2015上半年,中国众筹平台筹资金额55.85亿元,相比2014年全年28.20亿元,增长98.0%。

在各类众筹中,股权众筹最受各路资本青睐,2014-2015年,互联网企业、券商、保险集团、股权交易中心、股权投资基金(公司)等加速布局股权众筹领域。2015上半年,中国股权众筹平台成功融资项目数量达658个,筹资金额37.46亿元(在众筹行业筹资额中占比67.1%),相比2014年全年23.50亿元增长59.4%。2015上半年,中国股权众筹融资额Top5的平台分别为天使汇、京东东家、人人投、创投圈、天天投。

互联网理财行业

互联网理财是指相关公司与金融机构合作,将金融理财产品(包括基金、保险、信托、票据等)引至线上,利用互联网技术和平台,实现金融理财互联网化。

从2013年6月阿里巴巴推出互联网理财产品以来,互联网企业、基金管理公司、银行、独立基金销售机构等纷纷推出了互联网理财产品,但这些产品基本上全部是货币基金。从资产规模来看,阿里关联公司蚂蚁金服旗下余额宝资产规模远远超过其他同类产品。截至2015年6月底,余额宝用户达到1.49亿人,资产规模达到6,133.81亿元,在货币基金中市场份额25.4%,在互联网理财产品中市场份额41.9%。

随着2014下半年以来,中国央行多次出台宽松的货币政策,互联网理财产品的收益率大幅下滑,单一的货币基金理财已经不能满足用户的理财需求。于是,互联网理财平台相继引入了其他理财产品,如债券基金、混合基金、股票基金、票据、保险、贷款、股票等。

目前,中国互联网理财平台主要包括蚂蚁金服招财宝,京东金融理财频道,腾讯理财汇,百度金融等。其中,招财宝凭借支付宝3亿实名用户基础在互联网理财中占据绝大部分市场份额,截至2015年7月底,招财宝平台投资用户超过7百万人,累计交易额达到2244.97亿元,环比增长29.0%,其中2015年7月单月交易额505.30亿元,环比增长26.9%。

随着居民收入水平提高,理财意识增强及满足不同人群需求的多种理财产品推出,未来,通过互联网理财的用户和市场规模将快速增长。

《2015年中国互联网众筹及理财行业研究报告》报告主要包括以下内容:

1,中国互联网金融概况(包括定义,商业模式,发展历程,融资案例,发展趋势等);

2,行业发展环境(相关政策,存款及融资,互联网用户,大数据及云计算等);

3,中国互联网众筹行业(包括商业模式,发展历程,市场规模,奖励众筹市场,房地产众筹市场,股权众筹市场,发展趋势等);

4,13家中国主要互联网众筹平台(简介,盈利模式,项目融资,风险控制等);

5,中国互联网理财市场(包括定义,分类,相关政策,基金销售机构,基金销售支付机构,基金行业运营,理财产品市场规模,竞争格局,理财平台,手机理财APP等);

6,10家中国主要互联网理财平台(包括简介,互联网金融布局,平台业务,经营情况等)。

Main business models of Internet finance include: (1) third-party payment; (2) network lending (P2P and network microcredit); (3) crowdfunding; (4) Internet wealth management; (5) Internet consumer finance; (6) virtual currency; (7) Internet financial portal; (8) guarantee; (9) credit investigation system. The report focuses on Internet crowdfunding and Internet wealth management industries.

Crowdfunding Industry

Crowdfunding refers to the model that project sponsors release their creative ideas on Internet platforms to raise funds and, in return, give investors material objects, services or equities. It includes mainly rewards-based crowdfunding, equity-based crowdfunding, and donation-based crowdfunding. The first crowdfunding platform appeared in China in Jul 2011, and after two years (2012-2013) of exploration and cultivation, various crowdfunding platforms have mushroomed from 2014, adding 142 in 2014. By the end of Jun 2015, the number of crowdfunding platforms in China further rose to 235, mainly distributed in cities and provinces with developed economy and Internet, such as Beijing, Guangdong, Shanghai, Zhejiang, etc. In the first half of 2015, RMB5.585 billion was raised on crowdfunding platforms in China, an upsurge of 98.0% as compared with RMB2.82 billion for the full year 2014.

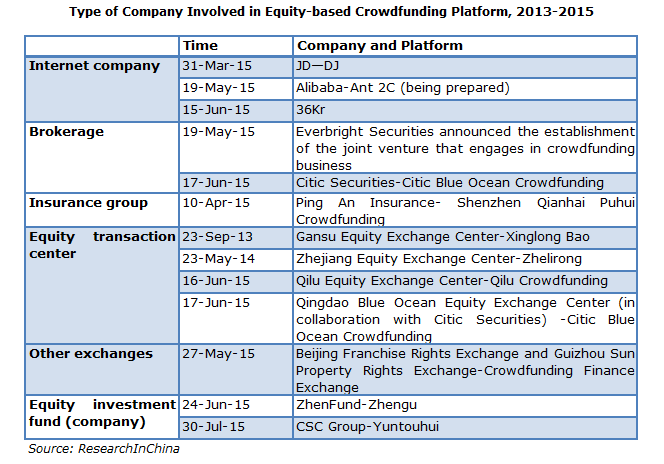

Among various kinds of crowdfunding, equity-based crowdfunding is favored by capitals. During 2014-2015, Internet companies, brokerages, equity transaction centers, and equity investment funds have sped up their layout in equity-based crowdfunding field. In the first half of 2015, the number of successful financing projects on equity-based crowdfunding platforms in China reached 658, raising RMB3.746 billion (67.1% of total amount of fund raised in crowdfunding industry), an increase of 59.4% compared with RMB2.35 billion throughout 2014. In the first half of 2015, top five equity-based crowdfunding platforms by amount of financing were angelcrunch.com, dj.jd.com, renrenchou.com, vc.cn, and evervc.com.

Internet Wealth Management Industry

Internet wealth management refers to the service pattern in which relevant companies carry out cooperation with financial institutions to put provide wealth management products (including funds, insurance, trust, bills) online through internet technology and platform, thus realizing Internet-based wealth management.

Since Alibaba launched Internet wealth management products in Jun 2013, Internet companies, fund management companies, banks, and independent fund sales institutions have launched their own Internet wealth management products, basically all money funds. By asset size, Yu’ebao managed by Ant Financial under Alibaba is far bigger than other competing products. By the end of Jun 2015, Yu’ebao users hit 149 million, and asset size amounted to RMB613.381 billion, seizing 25.4% of the money fund market share and 41.9% of the Internet wealth management product market share.

With introduction of easy monetary policies by China’s central bank in the second half of 2014, the yields of Internet wealth management products have fallen sharply, and a single money fund cannot fulfill peoples’ demand for wealth management. Accordingly, Internet wealth management platforms introduced other wealth management products, such as bond funds, blend funds, equity funds, bills, insurance, loans, stocks, etc.

At present, main Internet wealth management platforms in China include Ant Financial’s Zhao Cai Bao, JD Finance’s financial channel, Tencent’ Li Cai Hui, and Baidu Finance. Zhao Cai Bao gets the lion’s share in Internet wealth management market based on 300 million real-name Yu’ebao users. By the end of Jul 2015, the number of investors on Zhao Cai Bao exceeded 7 million, and cumulative transactions reached RMB224.497 billion, up 29.0% on a month-on-month basis. Transactions in Jul 2015 arrived at RMB50.53 billion, rising 26.9% month on month.

With rising income, growing awareness of wealth management and introduction of multiple wealth management products meetings needs of different groups of people, the number of Internet wealth management users and market size will expand rapidly.

China Internet Crowdfunding and Wealth Management Industry Report, 2015 highlights the followings:

Overview of Internet finance in China (definition, business models, development history, case of financing, trends); Overview of Internet finance in China (definition, business models, development history, case of financing, trends);

Development environments for industry (relevant policies, deposit and financing, Internet user, big data, cloud computing); Development environments for industry (relevant policies, deposit and financing, Internet user, big data, cloud computing);

China’s Internet crowdfunding industry (business models, development history, market size, rewards-based crowdfunding market, real estate crowdfunding market, equity-based crowdfunding market, trends); China’s Internet crowdfunding industry (business models, development history, market size, rewards-based crowdfunding market, real estate crowdfunding market, equity-based crowdfunding market, trends);

13 major Chinese Internet crowdfunding platforms (profile, profit models, project financing, risk control, etc.); 13 major Chinese Internet crowdfunding platforms (profile, profit models, project financing, risk control, etc.);

Chinese Internet wealth management market (definition, classification, relevant policies, fund sales institutions, fund sales payment institutions, operation of fund industry, market size of wealth management products, competitive landscape, wealth management platforms, mobile wealth management APP, etc.); Chinese Internet wealth management market (definition, classification, relevant policies, fund sales institutions, fund sales payment institutions, operation of fund industry, market size of wealth management products, competitive landscape, wealth management platforms, mobile wealth management APP, etc.);

10 major Chinese Internet wealth management platforms (profile, layout in Internet finance, businesses, operation, etc.) 10 major Chinese Internet wealth management platforms (profile, layout in Internet finance, businesses, operation, etc.)

第一章 中国互联网金融概况

1.1 定义及商业模式

1.1.1 定义

1.1.2 商业模式

1.2 发展历程

1.3 融资案例

1.4 发展趋势

第二章 行业发展环境

2.1 相关政策

2.2 存款及融资

2.2.1 金融机构存款

2.2.2 社会融资

2.3 互联网用户

2.3.1 网民

2.3.2 手机网民

2.3.3 网上支付用户

2.4 大数据及云计算

第三章 中国互联网众筹行业

3.1 商业模式

3.2 发展历程及相关政策

3.2.1 发展历程

3.2.2 相关政策

3.3 市场规模

3.3.1 平台数量

3.3.2 项目数量

3.3.3 筹资金额

3.4 奖励众筹

3.5 房产众筹

3.5.1 商业模式

3.5.2 竞争格局

3.6 股权众筹

3.6.1 概况

3.6.2 盈利模式

3.6.3 退出机制

3.6.4 竞争格局

3.7 发展趋势

第四章 中国主要互联网众筹平台

4.1京东众筹

4.1.1 奖励众筹

4.1.2 股权众筹

4.1.3 盈利模式

4.2 淘宝众筹

4.2.1 简介

4.2.2 项目情况

4.2.3 风险控制

4.3 众筹网

4.3.1简介

4.3.2 盈利模式

4.4 天使汇

4.4.1 简介

4.4.2 盈利模式

4.4.3 项目融资

4.4.4 风险控制

4.5 人人投

4.5.1 简介

4.5.2 项目融资

4.6 创投圈

4.6.1 简介

4.6.2 商业模式

4.6.3 项目融资

4.7 原始会

4.7.1 简介

4.7.2 盈利模式

4.7.3 风险控制

4.8 路演吧

4.8.1 简介

4.8.2 盈利模式

4.8.3 最新动态

4.9 众投帮

4.9.1 简介

4.9.2 盈利模式

4.9.3 风险控制

4.10 大家投

4.10.1 简介

4.10.2 项目融资

4.10.3 盈利模式

4.10.4 风险控制

4.11 房产众筹平台

4.11.1 快钱支付清算信息有限公司

4.11.2 平安好房

4.11.3 北京房宝宝科技股份有限公司

第五章 中国互联网理财市场

5.1 定义和分类

5.1.1 定义

5.1.2 分类

5.2 相关政策及机构

5.2.1 相关政策

5.2.2 基金销售机构

5.2.3 互联网基金销售机构

5.2.4 基金销售支付机构

5.2.5 基金行业运营

5.3 理财产品

5.3.1 市场规模

5.3.2 竞争格局

5.4 理财平台

5.4.1国外互联网理财平台

5.4.2 中国互联网理财平台

5.5 手机理财APP

5.5.1 概况

5.5.2 挖财

5.5.3 铜板街

5.6 发展趋势

第六章 主要互联网理财平台

6.1 蚂蚁金融服务集团(阿里关联公司)

6.1.1 互联网金融布局

6.1.2 淘宝理财

6.1.3 淘宝基金网店

6.1.4 余额宝

6.1.5 招财宝

6.1.6 存金宝

6.2 京东金融

6.2.1 互联网金融布局

6.2.2 京东金融

6.3 腾讯理财平台

6.3.1 互联网金融布局

6.3.2 理财通

6.3.3 理财汇

6.3.4 理财超市

6.4 百度

6.4.1 互联网金融布局

6.4.2 百度金融

6.4.3 百度财富

6.5 91金融

6.5.1 简介

6.5.2 盈利模式

6.5.3 风险控制

6.5.4 发展战略

6.6天天基金网

6.6.1 简介

6.6.2 理财产品

6.6.3 销售模式

6.6.4 经营业绩

6.7 数米基金网

6.8 好买基金网

6.9 基金买卖网

6.10 爱基金网

1 Overview of Internet Finance in China

1.1 Definition and Business Model

1.1.1 Definition

1.1.2 Business Model

1.2 Development History

1.3 Case of Financing

1.4 Trends

2 Development Environments for Industry

2.1 Relevant Policies

2.2 Deposit and Financing

2.2.1 Deposits of Financial Institutions

2.2.2 Social Financing

2.3 Internet User

2.3.1 Netizen

2.3.2 Mobile Internet User

2.3.3 Online Payment User

2.4 Big Data and Cloud Computing

3 China Internet Crowdfunding Industry

3.1 Business Model

3.2 Development History and Relevant Policies

3.2.1 Development History

3.2.2 Relevant Policies

3.3 Market Size

3.3.1 Number of Platforms

3.3.2 Number of Projects

3.3.3 Amount of Financing

3.4 Rewards-based Crowdfunding

3.5 Real Estate Crowdfunding

3.5.1 Business Model

3.5.2 Competitive Landscape

3.6 Equity-based Crowdfunding

3.6.1 Overview

3.6.2 Profit Model

3.6.3 Exit Mechanism

3.6.4 Competitive Landscape

3.7 Trends

4 Major Internet Crowdfunding Platforms

4.1 JD Crowdfunding

4.1.1 Rewards-based Crowdfunding

4.1.2 Equity-based Crowdfunding

4.1.3 Profit Model

4.2 Taobao Crowdfunding

4.2.1 Profile

4.2.2 Project

4.2.3 Risk Control

4.3 ZhongChou

4.3.1 Profile

4.3.2 Profit Model

4.4 AngelCrunch

4.4.1 Profile

4.4.2 Profit Model

4.4.3 Project Financing

4.4.4 Risk Control

4.5 Renrentou

4.5.1 Profile

4.5.2 Project Financing

4.6 vc.cn

4.6.1 Profile

4.6.2 Business Model

4.6.3 Project Financing

4.7 Yuanshihui

4.7.1 Profile

4.7.2 Profit Model

4.7.3 Risk Control

4.8 Luyanba

4.8.1 Profile

4.8.2 Profit Model

4.8.3 Latest Development

4.9 Zhongtoubang

4.9.1 Profile

4.9.2 Profit Model

4.9.3 Risk Control

4.10 Dajiatou

4.10.1 Profile

4.10.2 Project Financing

4.10.3 Profit Model

4.10.4 Risk Control

4.11 Real Estate Crowdfunding Platform

4.11.1 Kuaiqian Payment and Settlement Information Co., Ltd

4.11.2 Pinganfang.com

4.11.3 Beijing Housebaby Technology Co., Ltd.

5 Chinese Internet Wealth Management Market

5.1 Definition and Classification

5.1.1 Definition

5.1.2 Classification

5.2 Relevant Policies and Institutions

5.2.1 Relevant Policies

5.2.2 Fund Sales Institutions

5.2.3 Internet Fund Sales Institutions

5.2.4 Fund Sales Payment Institutions

5.2.5 Operation of Fund Industry

5.3 Wealth Management Products

5.3.1 Market Scale

5.3.2 Competitive Landscape

5.4 Wealth Management Platform

5.4.1 Foreign Internet Wealth Management Platform

5.4.2 Chinese Wealth Management Platforms

5.5 Mobile Wealth Management APP

5.5.1 Overview

5.5.2 Wa Cai

5.5.3 Tong Ban Jie

5.6 Trends

6 Major Internet Wealth Management Platforms

6.1 Zhejiang Ant Small & Micro Financial Services Group (Alibaba-related Company)

6.1.1 Layout in Internet Finance

6.1.2 Taobao Licai

6.1.3 Taobao Fund Online Store

6.1.4 Yu’ebao

6.1.5 Zhaocaibao

6.1.6 Cun Jinbao

6.2 JD Finance

6.2.1 Layout in Internet Finance

6.2.2 JD Finance

6.3 Tencent’s Financial Platforms

6.3.1 Layout in Internet Finance

6.3.2 Li Cai Tong

6.3.3 Li Cai Hui

6.3.4 Financial Supermarket

6.4 Baidu

6.4.1 Layout in Internet Finance

6.4.2 Baidu Finance

6.4.3 Baidu Caifu

6.5 91JinRong.com

6.5.1 Profile

6.5.2 Profit Model

6.5.3 Risk Control

6.5.4 Development Strategy

6.6 fund.eastmoney.com

6.6.1 Profile

6.6.2 Wealth Management Products

6.6.3 Sales Model

6.6.4 Business Performance

6.7 fund123.cn

6.8 howbuy.com

6.9 jjmmw.com

6.10 5ifund.com

表:中国互联网金融商业模式、盈利来源及代表企业

图:中国互联网企业进入金融领域发展模式

表:中国互联网金融发展历程

图:2014-2015年中国互联网金融融资案例数及融资金额(分月)

表:2014-2015年中国互联网金融融资案例数及融资金额(分领域)

表:2014-2015年中国互联网金融融资案例数(分投资机构)

表:2014-2015年中国互联网金融融资案例数及融资额(分投资轮次)

表:2014-2015年中国互联网金融融资案例数及融资额(分区域)

表:2013-2015年中国互联网金融行业相关政策

图:2007-2014年中国金融机构存款余额及同比增长

表:2011-2014年中国金融机构存款余额构成(分类别)

图:2007-2015年中国社会融资规模及同比增长

表:2007-2015年中国社会融资规模构成

图:2007-2015年中国网民数量、同比增长及互联网渗透率

表:截至2014年底中国网民数量(分省市)

图:2007-2015年中国手机网民数量、同比增长及其在网民中占比

图:2007-2015年中国网上支付用户数量、同比增长及其在网民中占比

图:2013-2015年中国手机支付用户数量、同比增长及其在网上支付用户中占比

图:众筹平台业务流程

表:众筹主要模式对比

表:2014-2015年中国互联网众筹行业相关政策

图:2011-2015年中国众筹平台数量

图:截至2015年6月中国正常运营的众筹平台数量(分类别)

图:截至2015年6月中国众筹平台数量(分类别和省市)

图:2015上半年中国众筹项目数量(分类别)

图:2015上半年中国众筹平台筹资金额(分类别)

图:2015上半年中国每个众筹项目平均融资金额(分类别)

图:2015上半年中国众筹平台融资金额(分省市)

表:2015年中国奖励众筹平台成功融资项目数量、融资额及市场份额

表:中国主要奖励众筹平台对比

表:房产众筹商业模式

图:2015上半年中国房产众筹平台市场份额(按成功融资额)

图:股权众筹业务流程

图:2011-2015年中国股权众筹平台数量

表:股权众筹平台盈利模式

表:股权众筹资本退出方式

表:中国股权众筹市场主要参与者及其布局

表:中国股权众筹市场主要参与者优势及劣势

表:2015上半年中国主要股权众筹平台成功融资项目数量、融资额及市场份额

表:截至2015年7月底京东奖励众筹项目构成(分行业)

表:京东股权众筹对融资人及投资人主要要求

图:截至2015年7月底淘宝众筹项目构成

表:众筹网盈利模式

表:天使汇自身获得融资情况

表:天使汇主要产品和服务盈利模式

图:2012-2015年天使汇平台成功融资项目数量及融资额

表:2015上半年天使汇平台上已发布项目和成功融资项目(分行业)

表:天使汇对合格投资人的资金要求

表:2014-2015年人人投成功融资项目数量及融资额

表:创投圈众筹商业模式

表:创投圈对投资者资金要求

表:原始会盈利模式

表:2014-2015年众投邦发展大事

表:众投帮对众筹项目、领投人要求

表:大家投平台上投资流程

表:大家初创板及启动板业务特点

图:2013-2015年大家投平台众筹项目数量及融资额

图:2013-2015年大家投平台众筹项目累计融资额(分行业)

表:大家投盈利模式

表:2014年大家投主要财务指标

表:万达房产众筹众筹项目

表:2014-2015年平安好房众筹项目融资额

表:2014年房宝宝财务指标

表:截至2015年5月末中国获得基金销售牌照的机构

表:截至2015年5月末中国获得基金销售牌照的独立基金销售机构

表:截至2015年5月获得基金销售的第三方电子商务平台

图:中国基金互联网销售渠道

表:中国开放式基金相关费率

表:中国基金销售互联网渠道与其他销售渠道模式对比

表:截至2015年5月中国获得基金销售支付牌照的第三方支付公司

图:2007-2015年中国基金管理公司数量

图:2007-2015年中国公募基金发行数量及构成

图:2012-2015年中国开放式基金发行量构成(分基金类型)

表:2012-2015年中国基金净值(分基金类型)

表:2009-2015年中国基金收益(分基金类型)

图:2013-2014年中国互联网理财产品新增数量(分产品推出机构)

图:2014-2015年中国互联网理财产品收益率(分月)

图:2013-2015年中国互联网理财产品资产规模及环比增长(分季度)

图:截至2015年6月底中国互联网理财产品资产规模(分产品推出机构)

表:截至2015年6月底中国Top10互联网理财产品(按资产规模)

表:国外主要互联网理财平台经营模式

表:中国主要互联网理财平台及其支付工具

表:挖财产品介绍、融资情况及盈利模式

表:铜板街产品介绍、融资情况及盈利模式

表:阿里互联网金融布局

图:2013-2015年余额申购额、赎回额及净资产

图:2013-2015年余额宝七日年化收益率

图:2013-2015年余额宝基金净收益及环比增长(分季度)

表:招财宝平台主要产品

表:招财宝盈利模式

表:招财宝与余额宝对比

图:2014年8月-2015年7月招财宝平台累计交易额及环比增长(分月)

表:京东互联网金融布局

表:京东金融平台频道及业务

表:腾讯互联网金融布局

表:2014-2015年理财通平台上线的理财产品及收益率

表:腾讯理财汇主要频道

表:百度互联网金融布局

表:百度金融平台频道及相关业务

表:2013-2015年百度金融平台“投资”频道推出的理财产品及特点

表:91金融主要业务

表:2011-2014年91金融获得融资情况

图:2009-2015年东方财富网营业收入及同比增长

图:2009-2015年东方财富网净利润及同比增长

图:2009-2015年东方财富营收构成(分业务)

图:2009-2015年东方财富毛利率(分业务)

图:2012-2015年天天基金网营业收入及净利润

表:2012-2015年天天基金网基金交易笔数及销售额

图:2012-2015年数米基金网营业收入及净利润

图:2012-2015年爱基金网营业收入及净利润

Business Model, Profit Source and Representative Firms in China’s Internet Financial Industry

Development Model of Chinese Internet Companies in Financial Industry

Development History of China’s Internet Finance

Number of Financing Cases and Amount of Financing in China's Internet Financial Industry by Month, 2014-2015

Number of Financing Cases and Amount of Financing in China's Internet Financial Industry by Field, 2014-2015

Number of Financing Cases in China's Internet Financial Industry by Investment Institution, 2014-2015

Number of Financing Cases and Amount of Financing in China's Internet Financial Industry by Round of Investment, 2014-2015

Number of Financing Cases and Amount of Financing in China's Internet Financial Industry by Region, 2014-2015

Relevant Policies on Internet Financial Industry in China, 2013-2015

Deposit Balance of China’s Financial Institutions and YoY Growth, 2007-2014

Deposit Balance Structure of China’s Financial Institutions by Category, 2011-2014

China’s Social Financing Scale and YoY Growth, 2007-2015

China’s Social Financing Structure, 2007-2015

Number of Internet Users, YoY Growth, and Internet Penetration in China, 2007-2015

Number of Internet Users in China by Province as of the end of 2014

Number of Mobile Netizens, YoY Growth and % of Internet Users in China, 2007-2015

Number of Online Payment Users, YoY Growth and % of Internet Users in China, 2007-2015

Number of Mobile Payment Users, YoY Growth and % of Online Payment Users, 2013-2015

Business Process of Crowdfunding Platform

Comparison of Main Crowdfunding Models

Relevant Policies on Internet Crowdfunding Industry in China, 2014-2015

Number of Crowdfunding Platforms in China, 2011-2015

Number of Operational Crowdfunding Platforms in China by Category as of Jun 2015

Number of Crowdfunding Platforms in China by Category and Province as of Jun 2015

Number of Crowdfunding Projects in China by Category in China, 1H2015

Amount of Financing by Crowdfunding in China by Category, 1H2015

Average Amount of Financing of Each Crowdfunding Project in China by Category, 1H2015

Amount of Financing by Crowdfunding in China by Province, 1H2015

Number of Successful Financing Projects, Amount of Financing and Market Share on China’s Rewards-based Crowdfunding Platforms, 2015

Comparison of Major Crowdfunding Platforms in China

Business Models of Real Estate Crowdfunding

Market Share of Real Estate Crowdfunding Platforms in China by Amount of Financing, 1H2015

Business Process of Equity-based Crowdfunding

Number of Equity-based Crowdfunding Platforms in China, 2011-2015

Profit Model of Equity-based Crowdfunding Platform

Exit Mechanism of Equity-based Crowdfunding Capital

Major Participants in Chinese Equity-based Crowdfunding Market and Their Layout

Advantages and Disadvantages of Major Participants in Chinese Equity-based Crowdfunding Market

Number of Successful Financing Projects, Amount of Financing and Market Share in China’s Major Equity-based Crowdfunding Platforms, 1H2015

Structure of JD’s Rewards-based Crowdfunding Projects by Industry as of the end of Jul 2015

Major Requirements of JD’s Rewards-based Crowdfunding on Financiers and Investors

Structure of Taobao’s Crowdfunding Projects as of the end of Jul 2015

Profit Model of zhongchou.com

Financing Received by AngelCrunch

Major Product and Service Profit Models of AngelCrunch

Number of Successful Financing Projects and Amount of Financing on AngelCrunch, 2012-2015

Released Projects and Successful Financing Projects on AngelCrunch by Industry, 1H2015

Requirements on Eligible Investors’ Capital by AngelCrunch

Number of Successful Financing Projects and Amount of Financing on Renrentou, 2014-2015

Business Model of Crowdfunding on vc.cn

Requirements on Investors’ Capital by vc.cn

Profit Model of Yuanshihui

Milestones of Zhongtoubang, 2014-2015

Requirements on Crowdfunding Project and Lead Investor by Zhongtoubang

Investment Process on Dajiatou

Business Features of Start-up Section and Launching Section on Zhongtoubang

Number of Crowdfunding Project and Amount of Financing on Dajiatou, 2013-2015

Cumulative Amount of Crowdfunding Projects on Dajiatou by Industry, 2013-2015

Profit Model of Dajiatou

Main Financial Indexes of Dajiatou, 2014

Crowdfunding Projects of Wanda’s Real Estate Crowdfunding

Amount of Financing via Crowdfunding Projects on pinganfang.com

Financial Indexes of Housebaby, 2014

Chinese Institutions Securing Fund Sales License by the end of May 2015

Independent Chinese Fund Sales Institutions Securing Fund Sales License by the end of May 2015

Third-party E-commerce Platforms Securing Fund Sales License by May 2015

Online Fund Distribution Channels in China

Open-end Fund-related Rates in China

Model Comparison between Online Fund Distribution Channel and Other Distribution Channels in China

Third-party Payment Companies Securing Fund Sales Payment License in China by May 2015

Number of Fund Management Companies in China, 2007-2015

Issuance of Public Offering of Fund and Composition in China, 2007-2015

Issuance Structure of Open-end Funds in China by Type of Fund, 2012-2015

Net Value of Funds in China by Type of Fund, 2012-2015

Earnings of Funds in China by Type of Fund, 2009-2015

Addition of New Internet Wealth Management Products in China by Institutions Launching Products, 2013-2014

Rate of Return of Internet Wealth Management Products in China by Month, 2014-2015

Asset Size and QoQ Growth of Internet Wealth Management Products in China by Quarter, 2013-2015

Asset Size of Internet Wealth Management Products in China by Institutions Launching Products as of the end of Jun 2015

Top10 Internet Wealth Management Products in China by Asset Size as of the end of Jun 2015

Business Model of Major Foreign Internet Wealth Management Platforms

Major Internet Wealth Management Platforms and Payment Tools in China

Product Introduction, Financing and Profit Model of Wa Cai

Product Introduction, Financing and Profit Model of Tong Ban Jie

Alibaba’s Layout in Internet Finance

Subscription Amount, Redemption Amount and Net Asset of Yu’ebao, 2013-2015

7-day Annualized Rate of Return of Yu’ebao, 2013-2015

Net Earnings and QoQ Growth of Yu’ebao Joint Funds, 2013-2015

Main Products on Zhao Cai Bao

Profit Model of Zhao Cai Bao

Comparison of Yu’ebao and Zhao Cai Bao

Monthly Cumulative Transactions and QoQ Growth on Zhao Cai Bao, Aug 2014-Jul 2015

JD’s Layout in Internet Finance

JD’s Financial Platform and Business

Tencent’s Layout in Internet Finance

Wealth Management Products and Their Rates of Return on Li Cai Tong, 2014-2015

Main Channels of Tencent’s Li Cai Hui

Baidu’s Layout in Internet Finance

Channels and Relevant Businesses on Baidu’s Financial Platform

Financial Products and Their Features Introduced on “Investment” Channel of Baidu’s Financial Platform, 2013-2015

Main Businesses of 91Jinrong

Financing Received by 91Jinrong, 2011-2014

Revenue and YoY Growth of eastmoney.com, 2009-2015

Net Income and YoY Growth of eastmoney.com, 2009-2015

Revenue Structure of eastmoney.com by Business, 2009-2015

Gross Margin of eastmoney.com by Business, 2009-2015

Revenue and Net Income of fund.eastmoney.com, 2012-2015

Fund Transactions and Sales on fund.eastmoney.com, 2012-2015

Revenue and Net Income of fund123.cn, 2012-2015

Revenue and Net Income of 5ifund.com, 2012-2015

如果这份报告不能满足您的要求,我们还可以为您定制报告,请 留言说明您的详细需求。

|