|

|

|

报告导航:研究报告—

TMT产业—电子半导体

|

|

2014-2015年全球及中国汽车照明行业研究报告 |

|

字数:2.5万 |

页数:147 |

图表数:149 |

|

中文电子版:8000元 |

中文纸版:4000元 |

中文(电子+纸)版:8500元 |

|

英文电子版:2500美元 |

英文纸版:2700美元 |

英文(电子+纸)版:2800美元 |

|

编号:ZYW216

|

发布日期:2015-09 |

附件:下载 |

|

|

|

《2014-2015年全球及中国汽车照明产业研究报告》包含以下内容:

1、全球汽车市场与产业分析

2、中国汽车市场与产业分析

3、LED产业与市场分析

4、汽车照明产业与市场分析

5、18家典型汽车照明厂家研究

2014年全球汽车照明市场规模为253亿美元,预计2015年达到280亿美元,增长10.8%,是自2010年以来增长幅度最高的一年,预计2016年达301亿美元,增长7.5%。

汽车照明市场大幅度增加的第一个原因主要是LED渗透率大幅度提高,由于LED Chip价格持续下滑,越来越多的厂家采用LED做Headlamps。虽然LED Chip价格持续下滑,但是LED Headlamps的价格仍然远高于传统的Halogen灯。2014年LED做Headlamps大约为4%,2015年达到7%,越来越多的厂家为了追求外形Emotional或Aesthetic而采用LED设计。预计2017年可达15%,2020年可达21%。第二个原因是ADB/AFS的使用,2015年AFS渗透率将达15%,ADB渗透率将达到3%,预计2020年可达10%,预计到2025年达25%。ADB大幅度提高车灯复杂度和成本。此外还有激光Headlamps和OLED尾灯的出现,预计2025年激光Headlamps渗透率可达15%,其价格异常昂贵。

但是随着全球经济的下滑,特别是中国经济的下滑,汽车照明市场增速也将下滑,特别是中国汽车市场未来几年都可能保持下滑态势,还有严重的通缩问题。

产业方面,大企业的优势也越来越明显。大企业的收入增速普遍高于小企业。预计2015年表现最好的是Valeo,增幅达19%。Vaelo拿下了大众Passat B6平台近90%的Headlamps订单,奥迪1/3的Headlamps订单。而对手Hella的市场份额受到了压缩。

Global and China Automotive Lighting Industry Report, 2014-2015 focuses on the followings:

1. Global automobile market and industry;

2. China automobile market and industry;

3. LED industry and market;

4. Automotive lighting industry and market;

5. 18 typical automotive lighting companies.

Global automotive lighting market size was USD25.3 billion in 2014, and is expected to grow by 10.8% to USD28 billion in 2015, the highest growth rate since 2010, and reach USD30.1 billion in 2016, a year-on-year rise of 7.5%.

There are two reasons for significant expansion of automotive lighting market. One is substantial improvement in the penetration of LED. As the price of LED chip continues to drop, more and more companies adopt LED to make headlamps. Despite the price of LED chip declines, LED headlamps are still more expensive than halogen lamps. About 4% of headlamps were made of LED in 2014. The figure rose to 7% in 2015 and is expected to hit 15% in 2017 and 21% in 2020, as a growing number of companies employ LED in the pursuit of emotional or aesthetic appearance. The other reason is the use of ADB/AFS. The penetration of AFS will arrive at 15% in 2015, and that of ADB 3% in the year and is predicted to stand at 10% in 2020 and 25% in 2025. The adoption of ADB makes headlamps more complicated and raises the cost. In addition, laser headlamps and OLED tail-lamps have come into being. The penetration of laser headlamps, which are extremely expensive, is expected to reach 15% in 2025.

Global economic downturn, especially the economic slowdown in China, will prolong the downward trend in the Chinese automobile market over the next couple years, thus slowing expansion of the automotive lighting market. Moreover, the deflation has been severe.

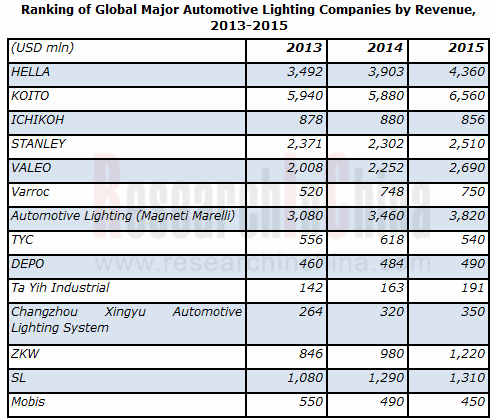

From the perspective of industry, big companies hold an increasingly dominant position, finding a higher rate than small ones in terms of revenue growth. Valeo is expected to be the one performing best in 2015 with a growth rate of up to 19%. Valeo won nearly 90% of headlamp orders of Volkswagen’s Passat B6 platform and 1/3 of Audi’s headlamp orders. The competitor- Hella is suffering market share contraction.

第一章 全球与中国汽车市场

1.1、全球汽车市场

1.2、中国汽车市场概况

1.3、中国汽车市场近况

第二章 汽车照明技术

2.1、HID氙气灯简介

2.2、典型汽车头灯设计

2.3、头灯设计趋势

2.4、激光汽车照明

2.5、OLED 车灯

2.6、ADB/AFS

第三章 LED产业

3.1、LED汽车照明市场

3.2、汽车内饰LED 照明

3.3、汽车外饰(Exterior)LED照明

3.4、LED产业链

3.5、LED产业地域分布

3.6、2012-2014年全球前30大LED厂家收入排名

3.7、台湾LED产业

3.8、2014年中国大陆LED产业总结

第四章 汽车照明产业与市场

4.1、汽车照明市场简介

4.2、汽车照明市场规模

4.3、全球汽车照明产业

4.4、全球汽车照明配套体系

4.5、中国汽车照明产业

4.6、中国汽车照明OEM配套情况

第五章 汽车照明厂家研究

5.1、海拉

5.1.1、长春海拉车灯有限公司

5.2、小糸Koito

5.2.1、上海小糸车灯有限公司

5.2.2、广州小糸车灯有限公司

5.3、市光Ichikoh

5.4、斯坦雷Stanley

5.4.1、广州斯坦雷

5.4.2、天津斯坦雷电气有限公司

5.5、法雷奥Valeo

5.6、Varroc

5.6.1、常州大茂伟世通

5.7、Automotive Lighting(马瑞利,Magneti Marelli)

5.8、堤维西TYC

5.9、帝宝工业DEPO

5.10、大亿交通Tayih-ind

5.11、常州星宇

5.12、江苏彤明

5.13、ZKW

5.14、燎旺车灯

5.15、三立

5.16、浙江天翀

5.17、丽清科技

5.18、Fiem

第六章 汽车照明LED厂家研究

6.1、日亚化工

6.2、丰田合成

6.3、OSRAM

1. Global and Chinese Automotive Market

1.1 Global Automotive Market

1.2 Overview of Chinese Automotive Market

1.3 Recent Development of Chinese Automotive Market

2 Automotive Lighting Technology

2.1 Profile of HID Xenon Lamps

2.2 Typical Automotive Headlight Design

2.3 Headlight Design Trends

2.4 Laser Automotive Lighting

2.5 OLED Automotive Light

2.6 ADB/AFS

3 LED Industry

3.1 LED Automotive Lighting Market

3.2 Automotive Interior LED Lighting

3.3 Automotive Exterior LED Lighting

3.4 LED Industry Chain

3.5 Geographical Distribution of LED Industry

3.6 Ranking of Global Top 30 LED Companies by Revenue, 2012-2014

3.7 Taiwan LED Industry

3.8 Summary of LED Industry in Mainland China, 2014

4. Automotive Lighting Industry and Market

4.1 Automotive Lighting Market Overview

4.2 Automotive Lighting Market Size

4.3 Global Automotive Lighting Industry

4.4 Global Automotive Lighting OEM System

4.5 China Automotive Lighting Industry

4.6 China's Automotive Lighting OEM System

5. Automotive Lighting Companies

5.1 Hella

5.1.1 Changchun Hella

5.2 Koito

5.2.1 Shanghai Koito

5.2.2 Guangzhou Koito

5.3 Ichikoh

5.4 Stanley

5.4.1 Guangzhou Stanley

5.4.2 Tianjin Stanley Electric Co., Ltd.

5.5 Valeo

5.6 VARROC

5.6.1 Changzhou Damao Visteon

5.7 Automotive Lighting (Magneti Marelli)

5.8 TYC

5.9 DEPO

5.10 Ta Yih Industrial

5.11 Changzhou Xingyu

5.12 Jiangsu Tongming

5.13 ZKW

5.14 Liaowang Automotive Lamp

5.15 SL

5.16 Zhejiang Tianchong

5.17 Laster Tech

5.18 FIEM

6. Automotive Lighting LED Companies

6.1 Nichia Chemical

6.2 Toyoda Gosei

6.3 OSRAM

2010-2015年全球汽车销量

2003-2015年全球LightVehicles 产量地域分布

2005-2015年中国汽车销量

2008-2015年中国各类型汽车年产量同比增幅

奥迪A6 3.5 FSI Headlamp

BMW 730Li Headlamp

奔驰S320L Headlamp

本田9代雅阁Headlamps

Peugeot 508 Headlamps

2009-2016年全球轿车前照灯照明光源分布

2009-2016年中国轿车前照灯照明光源分布

Audi Sport Quattro Laserlight Concept

Audi OLED Swarm System

2010-2025 ADB/AFS Penetration Rates

AFS System Architecture of the Reference Design

2010-2016年全球LED汽车照明市场规模

2013、2014年全球LED 产值地域分布

2012-2014年全球前30大LED厂家收入排名

台湾LED 厂家2012-2014年营业利润率

2013-2014年中国LED行业总产值情况(亿元,%)

2010-2014年中国LED行业MOCD保有量情况(台,%)

2010-2014年中国LED外延芯片行业产值情况(亿元,%)

2010-2014年中国LED封装产值变化情况(亿元,%)

2010-2014年中国LED应用领域市场产值变化情况(亿元,%)

2013-2014年中国各领域LED应用产值规模及占比情况(亿元,%)

2014年中国LED应用各细分行业产值规模及增速情况情况(亿元,%)

2015 Automotive Lighting Market by type

2007-2015 LED Penetration

2013-2015 Automotive Headlamp Source by technology

2013-2015 Automotive Taillamp Source by technology

2010-2018年全球汽车照明市场规模

2010-2016 全球汽车照明市场by end market

全球主要汽车照明厂家2013-2015收入排名

2014年丰田汽车照明系统主要供应商供应比例

2014年本田汽车照明系统主要供应商供应比例

2014年日产雷诺汽车照明系统主要供应商供应比例

2014年通用汽车照明系统主要供应商供应比例

2014年福特汽车照明系统主要供应商供应比例

2014年大众汽车照明系统主要供应商供应比例

2014年现代汽车照明系统主要供应商供应比例

2014年中国轿车照明主要厂家市场占有率

2013年中国车灯前20强收入

2014年小糸制造所客户分布

中国车灯厂家主要客户

1899-2014 Hella Milestone

2007-2015财年HELLA收入与EBIT

FY2015 Hella Quarterly Comparison

FY2014-FY2015 Hella Gross Profit Margin Bridge

HELLA组织结构

FY2010-FY2015 HELLA收入部门分布

2007-2012财年HELLA收入地域分布

2013-2015财年HELLA收入地域分布

FY 2014 Favorabke customer mix and regional exposure

Hella员工数量全球分布

Hella 2007-2013年全球布局

FY2015 Hella Automotive Lighting Revenue Segment By Product

FY2015 Hella Automotive Electronics Revenue Segment By Product

FY2015 Hella Aftermarket Revenue Segment By Business

FY2006-FY2016小糸收入与运营利润率

2011-2015 Koito Assets 、Equity

2008-2013财年小糸收入地域分布

2014-2015财年小糸收入地域分布

中国区工厂一览

Koito的ADB

2007-2015 Koito LED Roadmap

小糸车灯有限公司主要配套车型

2005-2009年上海小糸车灯公司LED车灯销售额

上海小糸车灯有限公司2004-2013年收入与运营利润率

FY2006-FY2016年Ichikoh收入与运营利润率

2007-2014财年市光收入地域分布

市光工业全球机构分布

市光工业日本机构分布

市光主要配套车型

斯坦雷主要产品

FY2006-FY2016斯坦雷收入与运营利润率

FY2010-FY2014 Stanley资产与负债

FY2006-FY2015斯坦雷汽车照明事业部收入与运营利润率

FY2008-FY2014斯坦雷(Stanley)收入地域分布

2004-2013年广州斯坦雷收入与运营利润率

2005-2014年法雷奥收入与毛利率

2009-2015H1法雷奥收入部门分布

2012-2014年法雷奥EBITDA部门分布

2007-2014法雷奥客户地域分布

Valeo Automotive Lighting Main Customer

2013财年Varroc收入产品分布

2007-2014 Varroc REVENUE

2014年Varroc收入by segment

伟世通汽车照明部门技术中心全球分布

伟世通汽车照明部门生产基地全球分布

伟世通汽车照明部门主要应用车型

Magneti Marelli全球分布

2013年Magneti Marelli收入产品分布

2006-2015年Magneti Marelli收入与EBIT率

2007-2015 Auotomotive Lighting 收入

使用Automotive Lighting车灯的车

Mercedes-Benz S使用车灯

宝马4系列车灯

2005-2015年堤维西收入与运营利润率

2013年7月-2015年7月堤维西月度收入与增幅

2010年堤维西大陆子公司财务状况

2011年堤维西大陆子公司财务状况

2012年堤维西大陆子公司财务状况

2013年堤维西大陆子公司财务状况

2014年堤维西大陆子公司财务状况

2006-2015年帝宝收入与运营利润率

2013年7月-2015年7月帝宝工业月度收入

2009-2012帝宝收入地域分布

DEPO Global Distribution Network

帝宝大陆子公司2012年财务数据

2004-2015年大亿交通收入与运营利润率

2013年7月-2015年7月大亿交通月度收入与增幅

大亿集团企业分布

大亿交通工业产品

大亿交通客户

常州星宇股权结构

常州星宇2013-2014年产量

2007-2015年常州星宇收入与运营利润率

2007-2014年常州星宇客户分布

2014年常州星宇员工岗位分布

江苏彤明车灯主要客户

ZKW组织结构

2014-2015年ZKW员工地域分布

2008-2014年三立收入与运营利润率

2010-2014年三立收入产品分布

丽清公司结构

2008-2015年丽清科技收入与毛利率

2013年7月-2015年7月丽清科技月度收入

2011-2013年丽清科技收入业务分布

丽清产品实例

FY2011-FY2014 Fiem Revenue and Profit

FY2014 Revenue Product Mix

Fiem Manufacturing Unit

Fiem Major Clients

2003-2014年日亚化学收入与运营利润率

2004-2014年日亚化学LED部门收入与运营利润率

2006-2015财年丰田合成收入与营业利润率

2006-2015财年丰田合成收入产品分布

2006-2015财年丰田合成收入地域分布

2006-2015财年丰田合成亚太地区收入与营业利润率

2008-2015财年丰田合成LED业务收入与运营利润率

2012年1季度-2015年1季度OSRAM季度收入与EBITA Margin

2012-2014年OSRAM收入部门分布

2014-2015年OSRAM收入部门分布

2013年3季度-2015年1季度Osram SP事业部收入与EBITA率

2013年3季度-2015年1季度Osram OS事业部收入与EBITA率

2012-2014年OSRAM收入地域分布

Sales Volume of Major Global Automobile Brands, 2010-2015

Production of Light Vehicles by Region , 2013-2015

Sales Volume of Automobile in China, 2005-2015

China's Automobile Output YoY Growth Rate by Type, 2008-2015

Audi A6 3.5 FSI Headlamp

BMW 730Li Headlamp

Mercedes-Benz S320L Headlamp

Honda 9-generation Accord Headlamp

Peugeot 508 Headlamp

Global Sedan Headlamp Light Source Distribution, 2009-2016E

China’s Sedan Headlamp Light Source Distribution, 2009-2016E

Audi Sport Quattro Laserlight Concept

Audi OLED Swarm System

ADB/AFS Penetration Rates, 2010-2025E

AFS System Architecture of the Reference Design

Global LED Automotive Lighting Market Size, 2010-2016E

Geographical Distribution of Global LED Output Value, 2013-2014

Rankin of Top 30 LED Companies Worldwide by Revenue, 2012-2014

Operating Margin of Taiwan LED Companies, 2012-2014

Gross Output Value of China LED Industry, 2013-2014

Ownership of MOCD in China LED Industry, 2010-2014

Output Value of LED Epitaxial Chip in China, 2010-2014

Output Value of LED Packaging in China, 2010-2014

LED Output Value by Application in China, 2010-2014

LED Application Structure by Output Value, 2013-2014

LED Output Value by Application in China, 2014

Automotive Lighting Market by type, 2015

LED Penetration, 2007-2015

Automotive Headlamp Source by technology, 2013-2015

Automotive Taillamp Source by technology, 2013-2015

Global Automotive Lighting Market Size, 2010-2018E

Global Automotive Lighting Market Size by End Market, 2010-2016E

Ranking of Global Major Automotive Lighting Companies by Revenue, 2013-2015

Automotive Lighting System Supply Structure of Toyota, 2014

Automotive Lighting System Supply Structure of Honda, 2014

Automotive Lighting System Supply Structure of Nissan Renault, 2014

Automotive Lighting System Supply Structure of GM, 2014

Automotive Lighting System Supply Structure of Ford, 2014

Automotive Lighting System Supply Structure of VW, 2014

Automotive Lighting System Supply Structure of Hyundai, 2014

Market Share of Major Sedan Lighting Companies in China, 2014

Top 20 Automotive Light Companies in China by Sales, 2013

Koito’s Client Distribution, 2014

Major clients of Chinese Automotive Light Companies

Hella’s Milestone, 1899-2014

Hella’s Revenue and EBIT, FY2007-FY2015

Hella Quarterly Comparison, FY2015

Hella Gross Profit Margin Bridge, FY2014-FY2015

Hella’s Organizational Structure

Hella’s Revenue by Division, FY2010-FY2015

Hella’s Revenue by Region, FY2007- FY 2012

Hella’s Revenue by Region, FY2013- FY 2015

Favorable Customer Mix and Regional Exposure of Hella, FY2014

Global Distribution of Hella's Staff

Global Layout of Hella, 2007-2013

Hella Automotive Lighting Revenue Segment by Product, FY2015

Hella Automotive Electronics Revenue Segment by Product, FY2015

Hella Aftermarket Revenue Segment by Business, FY2015

Koito’s Revenue and Operating Margin, FY2006- FY 2016

Assets and Equity of Koito, 2011-2015

Koito’s Revenue by Region, FY2008- FY2013

Koito’s Revenue by Region, FY2013- FY2015

Koito’s Plants in China

ADB of Koito

Koito LED Roadmap, 2007-2015

Major Vehicle Models Supported by Koito

LED light Sales of Shanghai Koito, 2005-2009

Shanghai Koito’s Revenue and Operating Margin, 2004-2013

Ichikoh’s Revenue and Operating Margin, FY2006- FY 2016

Ichikoh’s Revenue by Region, FY2007- FY2014

Ichikoh's Distribution in the World

Ichikoh's Distribution in Japan

Major Vehicle Models Supported by Ichikoh

Stanley’s Main Products

Stanley’s Revenue and Operating Margin, FY2006- FY 2016

Stanley’s Assets and Liabilities, FY2010- FY 2014

Stanley’s Automotive Lighting Revenue and Operating Margin, FY2006- FY 2015

Stanley’s Revenue by Region, FY2008- FY 2014

Guangzhou Stanley’s Revenue and Operating Margin, 2004-2013

Valeo’s Revenue and Gross Margin, 2005-2014

Valeo’s Revenue by Division, 2009-H1 2015

Valeo’s EBITDA by Division, 2012-2014

Valeo’s Clients by Region, 2007-2014

Valeo’s Automotive Lighting Main Customer

Varroc’s Revenue by Product, FY2013

Varroc’s Revenue by Segment, 2014

Global Distribution of Technical Centers of Visteon’s Automotive Lighting Division

Global Distribution of Production Bases of Visteon’s Automotive Lighting Division

Major Vehicle Models Supported by Visteon’s Automotive Lighting Division

Global Distribution of Magneti Marelli

Revenue of Magneti Marelli by Product, 2013

Revenue and EBIT Margin of Magneti Marelli, 2006-2015

Auotomotive Lighting Revenue of Magneti Marelli, 2007-2015

Automobiles Equipped with Automotive Lighting

Lights Used by Mercedes-Benz S

Lights Used by BMW 4 Series

TYC’s Revenue and Operating Margin, 2005-2015

TYC’s Monthly Revenue and Growth Rate, July 2013-July 2015

Financial Status of TYC's Subsidiary in Mainland China, 2010

Financial Status of TYC's Subsidiary in Mainland China, 2011

Financial Status of TYC's Subsidiary in Mainland China, 2012

Financial Status of TYC's Subsidiary in Mainland China, 2013

Financial Status of TYC's Subsidiary in Mainland China, 2014

DEPO’s Revenue and Operating Margin, 2006-2015

DEPO’s Monthly Revenue, July 2013-July 2015

DEPO’s Revenue by Region, 2009-2012

DEPO Global Distribution Network

Financial Data of DEPO’s Subsidiary in Mainland China, 2012

Revenue and Operating Margin of Ta Yih Industrial, 2004-2015

Monthly Revenue and Growth Rate of Ta Yih Industrial, July 2013-July 2015

Distribution of Ta Yih Industrial

Industrial Products of Ta Yih Industrial

Clients of Ta Yih Industrial

Equity Structure of Changzhou Xingyu

Output of Changzhou Xingyu, 2013-2014

Revenue and Operating Margin of Changzhou Xingyu, 2007-2015

Client Structure of Changzhou Xingyu, 2007-2014

Distribution of Staff Positions of Changzhou Xingyu, 2014

Major Clients of Jiangsu Tongming

ZKW's Organizational Structure

Geographical Distribution of ZKW's Staff, 2014-2015

SL’s Revenue and Operating Margin, 2008-2014

SL’s Revenue by Product, 2010-2014

Structure of Laster Tech

Revenue and Gross Margin of Laster Tech, 2008-2015

Monthly Revenue of Laster Tech, July 2013-July 2015

Revenue of Laster Tech by Business, 2011-2013

Products of Laster Tech

Fiem’s Revenue and Profit, FY2011-FY2014

Revenue Structure of Fiem by Product, FY2014

Fiem’s Manufacturing Unit

Fiem’s Major Clients

Revenue and Operating Margin of Nichia Chemical, 2003-2014

Revenue and Operating Margin of Nichia Chemical LED Division, 2004-2014

Revenue and Operating Margin of Toyoda Gosei, FY2006-FY2015

Revenue of Toyoda Gosei by Product, FY2006-FY2015

Revenue of Toyoda Gosei by Region, FY2006-FY2015

Revenue and Operating Margin of Toyoda Gosei in Asia-Pacific, FY2006-FY2015

Revenue and Operating Margin of Toyoda Gosei LED Business, FY2008-FY2015

OSRAM’S Quarterly Revenue and EBITA Margin, Q1 2012-Q1 2015

Osram’s Revenue by Division, 20012-2014

Osram’s Revenue by Division, 20014-2015

Osram’s EBITA by Division, 20012-2014

Osram’s SP Revenue and EBIT, Q3 2013-Q1 2015

Osram’s OS Revenue and EBIT, Q3 2013-Q1 2015

Osram’s Revenue by Region, 20012-2014

如果这份报告不能满足您的要求,我们还可以为您定制报告,请 留言说明您的详细需求。

|