|

|

|

报告导航:研究报告—

TMT产业—电子半导体

|

|

2014-2015年全球及中国汽车HUD(Head-up Display)与仪表产业研究报告 |

|

字数:1.0万 |

页数:93 |

图表数:93 |

|

中文电子版:8000元 |

中文纸版:4000元 |

中文(电子+纸)版:8500元 |

|

英文电子版:2000美元 |

英文纸版:2200美元 |

英文(电子+纸)版:2300美元 |

|

编号:ZYW218

|

发布日期:2015-10 |

附件:下载 |

|

|

|

《2014-2015年全球及中国汽车HUD(Head-up Display)与仪表产业研究报告》包含以下内容:

1、全球与中国汽车市场与产业分析

2、全球汽车显示市场与产业

3、汽车HUD发展趋势

4、汽车HUD产业与市场分析

5、汽车仪表产业与市场分析

6、7家典型汽车HUD与仪表厂家研究

HUD(Head-up Display)厂家与汽车仪表(Instrument Cluster)厂家完全重合,因此把它们放在一起研究。HUD可以分为两大类,一类是Windshield上显示,简称W型,另一类是Combiner,简称C型。后者显示内容贫乏,显示对比度很低,实用价值低,其价格低廉,利润不高。可以说C型HUD市场前景黯淡,无论是消费者还是厂家对其都兴趣不大。

W型一般采用HB-LED 做光源Light Source,1.5-3.1英寸TFT-LCD做Picture Source,使用复杂的光学引擎将图像投射在Windshield上,由于环境亮度的变化范围大,HUD 需具有极高的亮度和精确的亮度控制,以形成可轻松读取的图像。显示器将以电子方式纠正任何通过挡风玻璃产生的光学扭曲。W型技术门槛极高,不仅需要精通电子,同样需要精通光学,目前只有和日本和德国厂家能够制造。W型显示对比度高,亮度高,内容丰富,实用性很强,市场前景非常好。

预计2015年W型HUD出货量大约190万Units,C型为70万Units。到2019年W型会大增到1030万套,而C型只有100万套。未来HUD会采用DLP投影加激光二极管(Laser Diode),并且又是Augmented Reality型HUD,能够与ADAS完美配合。这需要采用Quad-core处理器,处理器主频不低于1.5GHz,同时还要有极其复杂的软件系统,其价格可能会超过2000美元。即便如此,因为实用性强,且科技感足,足以得到厂家和消费者的认同。因此市场规模会飞速成长,预计2015年市场规模为431百万美元,2019年达到1420百万美元,是汽车电子领域增长最迅速的产品。

目前HUD主要供应商只有寥寥数家,这些厂家包括日本的Nippon Seiki、Denso;德国的Continental、Bosch等。Denso的主要客户是丰田,Nippon的主要客户是BMW,大约占BMW HUD 80%的订单。Continental主要客户是Benz、BMW和奥迪。

HUD 98%的市场由汽车仪表厂家占据,因此可以把HUD归为汽车仪表行业。HUD也将刺激汽车仪表行业发展。

Global and China Automotive Head-up Display (HUD) and Instrument Cluster Industry Report, 2014-2015 is primarily concerned with the following:

1 Global and China automobile market and industry

2 Global automotive display market and industry

3 Development trends in auto HUD

4 Auto HUD industry and market

5 Instrument cluster industry and market

6 Seven key auto HUD and instrument cluster manufacturers

Now that Head-up Display (HUD) manufacturers and instrument cluster manufacturers are completely coincident, we put and study them together. HUD is divided into two categories: one is display in Windshield (shortened to W-type), the other is Combiner (abbreviated as C type). The latter has poor display content and low practical value, thus leading to lower price and narrow profit. C type HUD market, as it were, has a bleak prospect, which did not appeal to both consumers and manufacturers.

W-type generally applies HB-LED as light source, and 1.5-3.1-inch TFT-LCD as picture source. Meanwhile, using complex optical engine, it projects pictures on the Windshield. Due to the large dynamic range of ambient brightness, extreme luminance and excellent brightness control are required for the HUD (depending on the brightness of the background of the virtual display) in order to produce an image that can be easily read. Any optical distortions through the shield are electronically corrected on the display. W-type has so much higher technical threshold that enterprises are required to master the knowhow of both electronics and optics. At present, only Japanese and German producers have the manufacturing capabilities. W-type display has high contrast ratio and brightness, rich content, and good practicability, hence embracing broad market prospects.

It is expected that in 2015 the shipments of W–type HUD approximate 1.9 million units and C–type 700,000 units. By 2019, W–type will surge to 10.3 million units while C-type will total only 1 million units. In the future, HUD will adopt DLP projection + Laser Diode. Moreover, HUD, or the Augmented Reality-type HUD, can perfectly match up with ADAS, which is required to use Quad-core processor, whose master frequency is not less than 1.5 GHz. At the same time, it needs extremely complicated software system, whose price will probably exceed USD2,000. Even so, it has high practicability and technological content so much so that it can be accepted by manufacturers and consumers. Therefore, the market size will balloon. It is projected that the market size will reach USD431 million in 2015 and USD1.42 billion in 2019, being the fastest-growing product in automotive electronics.

At present, there are only a few key HUD suppliers, including Japan’s Nippon Seiki and Denso and Germany’s Continental and Bosch. Denso’s major client is Toyota whereas Nippon’s client is BMW, which accounted for 80% of BMW HUD orders. Continental’s major clients consist of Benz, BMW, and Audi.

Up to 98% of HUD market is dominated by instrument cluster manufacturers, so HUD can be categorized in instrument cluster industry. HUD will also stimulate the development of instrument cluster industry.

第一章、全球与中国汽车市场

1.1、全球汽车市场

1.2、中国汽车市场概况

1.3、中国汽车市场近况

第二章、汽车显示产业与市场

2.1、汽车显示趋势

2.2、汽车显示市场

2.3、汽车显示产业

2.4、Infotainment LCD Panel

2.5、汽车仪表市场

2.6、汽车仪表产业

2.7、中国汽车仪表市场

第三章、Head-up Display(HUD)市场与产业

3.1、HUD简介

3.2、HUD趋势

3.3、Continental HUD

3.4、Augmented Reality Head-Up Display Overview

3.5、Continental Augmented Reality Head-Up Display

3.6、Head-Up Display Market Size

3.7、Head-Up Display Market Player

第四章、汽车仪表与HUD厂家研究

4.1、大陆集团(Continetal)

4.2、NipponSeiki

4.3、伟世通Visteon

4.3.1、延锋伟世通(YFV)

4.4、电装Denso

4.5、MagnetiMarelli

4.6、上海德科电子仪表

4.7、Bosch

第五章、Automotive LCD厂家研究

5.1、Japan Display

5.2、群创

5.3、友达

1 Global and China Automobile Market

1.1 Global Automotive Market

1.2 Overview of Chinese Automotive Market

1.3 Latest Development of Chinese Automotive Market

2 Automotive Display Industry and Market

2.1 Trends in Automotive Display

2.2 Automotive Display Market

2.3 Automotive Display Industry

2.4 Infotainment LCD Panel

2.5 Automotive Instrument Market

2.6 Automotive Instrument Industry

2.7 China’s Automotive Instrument Market

3 Head-up Display (HUD) Market and Industry

3.1 Overview of HUD

3.2 Trend of HUD

3.3 Continental HUD

3.4 Augmented Reality Head-Up Display Overview

3.5 Continental Augmented Reality Head-Up Display

3.6 Head-Up Display Market Size

3.7 Head-Up Display Market Player

4 Automotive Instrument and HUD Manufacturers

4.1 Continental

4.2 Nippon Seiki

4.3 Visteon

4.3.1 Yanfeng Visteon (YFV)

4.4 Denso

4.5 Magneti Marelli

4.6 Shanghai Delco

4.7 Bosch

5 Automotive LCD Manufacturers

5.1 Japan Display

5.2 Innolux

5.3 AUO

2010-2016年全球汽车销量

2003-2015年全球LightVehicles产量地域分布

2005-2015年中国汽车销量

2005-2014年中国各类型汽车年产量同比增幅

2013-2019汽车显示市场规模(出货量)

2013-2019汽车显示市场规模(收入)

2015-2019 Automotive Display Shipments Breakdown by Application

2015年全球车载显示屏主要厂家市场占有率(Shipments)

2015年全球车载显示屏主要厂家市场占有率(Revenue)

Infotainment Vendor vs LCD Panel Suppliers

2015年全球Infotainment显示屏主要厂家市场占有率

2015、2019 OEM-Infotainment Shipments Breakdown by Size

2015、2019 Instrument Cluster Shipments Breakdown by Size

2013-2019 汽车仪表市场规模

2015-2019 TFT-LCD Instrument Cluster Shipments

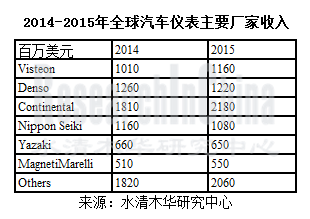

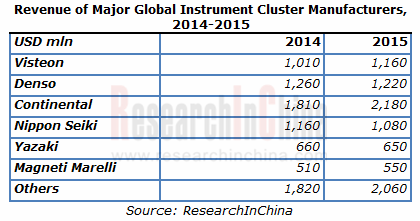

2014-2015年全球汽车仪表主要厂家收入

汽车仪表厂家主要客户

2015年中国汽车仪表厂家市场占有率

HUD结构

Basic HUD geometry

Audi A6 HUD结构

HUD趋势

HUD Block Diagram w/ DLP

Continental HUD 结构

Continental HUD application

2013-2019 汽车HUD显示市场规模

2013-2019 汽车HUD出货量

2015年汽车HUD主要厂家市场占有率

大陆汽车Interior全球分布

2007-2015年Continental Automotive Interior 收入与营业利润率

2009-2014年大陆汽车Interior部门收入地域分布

Continental Instrument Cluster Product List

Continental OLED Instrument Cluster

MultiViuProfessional12

Continental Instrument Cluster Market Position

Continental Combiner HUD

2008-2016财年NipponSeiki收入与营业利润

2010-2015财年NipponSeiki收入产品分布

2012-2015财年NipponSeiki收入地域分布

Nippon Seiki Global Location

FY2015 Nippon Seiki Sales mix by Customer

2013-2015 Visteon 收入与EBITDA

1Q/14-2Q/15 Visteon Quarterly Revenue Vs Gross Margin

1Q/14-2Q/15 Visteon Quarterly EBITDA

2013-2014年Visteon汽车电子业务收入产品分布

2015年Visteon汽车电子业务收入产品分布

2013-2015年Visteon汽车电子业务收入地域分布

2013-2014年Visteon汽车电子业务收入客户分布

Visteon 3D Instrument Cluster

YFV Organization

YFV 结构

Yanfeng Visteon Electronics Organization

YFVE生产基地分布

Visteon Electronics China 2015 Sales Breakdown by Customer

2006-2016财年电装收入与营业利润率

电装2008-2015财年OEM客户分布比例

2012-2015财年DENSO收入产品分布

2014、2015财年Denso收入、营业利润地域分布

2015、2016财年Denso收入、营业利润地域分布

Denso ADAS

2006-2015年MagnetiMarelli收入与EBIT率

2013年MagnetiMarelli收入产品分布

FY2013-FY2016 JDI 收入与营业利润

The JDI Group in Transition

2013年2季度-2015年2季度JDI季度收入业务分布

2013年2季度-2015年2季度JDI季度营业利润率

2010-2015年INNOLUX收入与营业利润率

3Q13-2Q15 INNOLUX Area Shipments and TFT LCD ASP Trends

3Q13-2Q15 INNOLUX Small& Medium Size Unit Shipments and Sales Trends

3Q13-2Q15 INNOLUX Sales Breakdown by Size

3Q13-2Q15 INNOLUX Sales Breakdown by Application

INNOLUX TFT-LCD Fabs Profile

Touch Sensor Fabs Profile

AUO组织结构

2009-2015年AUO收入与毛利率

2012-2014年AUO收入地域分布

2012-2014年AUO收入下游分布

2012-2014年AUO出货量下游分布

major suppliers of key raw materials and components关键原材料供应商

2Q14-2Q15 AUO Display Revenue Breakdown by Application

2Q14-2Q15 AUO Display Revenue Breakdown by Size

2Q14-2Q15 AUO Shipments and ASP

2Q14-2Q15 AUO Small& Medium Panel Shipments by Area & Revenues

友达各生产线List

友达LCM基地

AUO Automotive Panel List

Global Automobile Sales Volume, 2010-2016E

Output of Global Light-duty Vehicles by Region, 2003-2015

China’s Automobile Sales Volume, 2005-2015

China’s Automobile Sales Volume (by Type) and YoY Growth, 2005-2014

Market Size of Automotive Display by Shipments, 2013-2019E

Market Size of Automotive Display by Revenue, 2013-2019E

Automotive Display Shipments by Application, 2015-2019E

Market Share of Major Global In-vehicle Display Screen Manufacturers by Shipments, 2015

Market Share of Major Global In-vehicle Display Screen Manufacturers by Revenue, 2015

Infotainment Vendors vs LCD Panel Suppliers

Market Share of Major Global Infotainment Display Screen Manufacturers, 2015

OEM-Infotainment Shipments by Size, 2015 vs 2019E

Instrument Cluster Shipments by Size, 2015 vs 2019E

Market Size of Instrument Cluster, 2013-2019E

TFT-LCD Instrument Cluster Shipments, 2015-2019E

Revenue of Major Global Instrument Cluster Manufacturers, 2014-2015

Key Customers of Instrument Cluster Manufacturers

Market Share of Chinese Instrument Cluster Manufacturers, 2015

Structure of HUD

Basic HUD Geometry

Structure of Audi A6 HUD

Trends in HUD

HUD Block Diagram w/ DLP

Structure of Continental HUD

Continental’s HUD Application

Market Size of Automotive HUD, 2013-2019E

Automotive HUD Shipments, 2013-2019E

Market Share of Major Automotive HUD Manufacturers, 2015

Global Distribution of Continental’s Automotive Interior

Revenue and Operating Margin of Continental’s Automotive Interior, 2007-2015

Revenue Breakdown of Continental’s Automotive Interior by Region, 2009-2014

Continental’s Instrument Cluster Product List

Continental’s OLED Instrument Cluster

Multi Viu Professional 12

Continental’s Instrument Cluster Market Position

Continental’s Combiner HUD

Revenue and Operating Income of Nippon Seiki, FY2008-FY2016

Revenue Breakdown of Nippon Seiki by Product, FY2010-FY2015

Revenue Breakdown of Nippon Seiki by Region, FY2012-FY2015

Global Location of Nippon Seiki

Sales Mix of Nippon Seiki by Customer, FY2015

Revenue and EBITDA of Visteon, 2013-2015

Visteon’s Quarterly Revenue and Gross Margin, 1Q/2014-2Q/2015

Visteon’s Quarterly EBITDA, 1Q/2014-2Q/2015

Revenue of Visteon’s Automotive Electronics by Product, 2013-2014

Revenue of Visteon’s Automotive Electronics by Product, 2015

Revenue of Visteon’s Automotive Electronics by Region, 2013-2015

Revenue of Visteon’s Automotive Electronics by Customer, 2013-2014

Visteon’s 3D Instrument Cluster

YFV’s Organization

Structure of YFV

Organization of Yanfeng Visteon Electronics

Distribution of YFVE Production Bases

Revenue Breakdown of Visteon Electronics in China by Customer, 2015

Revenue and Operating Margin of Denso, FY2006-FY2016

Distribution Proportion of Denso’s OEM Customers, FY2008-FY2015

Revenue of DENSO by Product, FY2012-FY2015

Revenue and Operating Income of Denso by Region, FY2014 vs FY2015

Revenue and Operating Income of Denso by Region, FY2015 vs FY2016

Denso’s ADAS

Revenue and EBIT Margin of Magneti Marelli, 2006-2015

Revenue Breakdown of Magneti Marelli by Product, 2013

Revenue and Operating Income of JDI, FY2013-FY2016

The JDI Group in Transition

Quarterly Revenue of JDI by Business, 2013Q2-2015Q2

Quarterly Operating Margin of JDI, 2013Q2-2015Q2

Revenue and Operating Margin of INNOLUX, 2010-2015

INNOLUX Area Shipments and TFT LCD ASP Trends, 3Q13-2Q15

INNOLUX’s Small & Medium Size Unit Shipments and Sales Trends, 3Q13-2Q15

INNOLUX Sales Breakdown by Size, 3Q2013-2Q2015

Revenue Breakdown of INNOLUX by Application, 3Q2013-2Q2015

Overview of INNOLUX’s TFT-LCD Fabs

Overview of Touch Sensor Fabs

Organization Structure of AUO

Revenue and Gross Margin of AUO, 2009-2015

Revenue of AUO by Region, 2012-2014

Revenue of AUO by Application, 2012-2014

Shipments of AUO by Application, 2012-2014

Major Suppliers of Key Raw Materials and Components

Revenue Breakdown of AUO Display by Application, 2Q14-2Q15

Revenue Breakdown of AUO Display by Size, 2Q14-2Q15

Shipments and ASP of AUO, 2Q14-2Q15

AUO’s Small & Medium-sized Panel Shipments by Region & Revenue, 2Q14-2Q15

AUO’s Production Line List

AUO’s LCM Base

AUO’s Automotive Panel List

如果这份报告不能满足您的要求,我们还可以为您定制报告,请 留言说明您的详细需求。

|