|

报告导航:研究报告—

制造业—化工

|

|

2015-2018年全球及中国针状焦行业研究报告 |

|

字数:2.2万 |

页数:70 |

图表数:84 |

|

中文电子版:6500元 |

中文纸版:3250元 |

中文(电子+纸)版:7000元 |

|

英文电子版:2000美元 |

英文纸版:2150美元 |

英文(电子+纸)版:2300美元 |

|

编号:ZHP029

|

发布日期:2015-10 |

附件:下载 |

|

|

|

针状焦具有电阻率小、耐冲击性能强、抗氧化性能好等优点,已被广泛应用在超高功率石墨电极、核反应堆减速材料及锂电池负极材料等领域。其主要分为煤系针状焦和油系针状焦。

2006-2014年,全球针状焦产能扩张速度较慢,仅为3.6%。主要因为各大巨头为了维持较高的行业利润,纷纷控制产能扩张。相比之下,全球针状焦需求增长较快,致使供需缺口逐年增大,2014年达到29.0万吨,同比增长62.9%

中国的针状焦产业发展始于上世纪七八十年代,但直至近几年实现技术突破后,产能才得以快速增长。2006-2014年,中国针状焦产能从6万吨增长至26万吨,年均复合增长率达20.1%。2015年,随着华航能源针状焦项目的投产,中国针状焦产能已达28万吨。

尽管针状焦产能逐年增长,但仍不能满足国内市场需求(2014年供需缺口为7.2万吨),中国每年需从美国、日本、英国等地进口针状焦。2014年,中国针状焦进口量为4.7万吨。

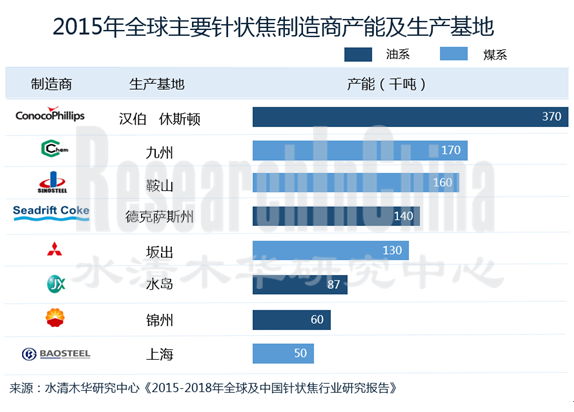

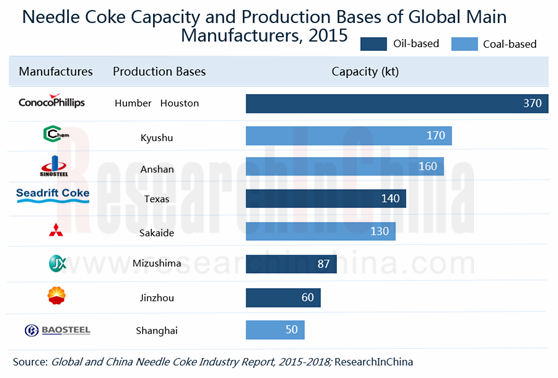

全球针状焦生产企业主要集中在美国、日本和中国。其中美国的ConocoPhillips是全球最大的油系针状焦生产商,2015年产能约37万吨/年;日企C-Chem是全球最大的煤系针状焦生产商,2015年产能为17万吨/年。中国生产商起步较晚,但为了提高国际竞争力,近年纷纷加大针状焦项目的投资。

中钢热能:2012年将“年产8万吨针状焦项目”二期产能由4万吨/年调整至12万吨/年后,总产能超过宏特化工成为中国第一。2015年1月,公司的煤系针状焦产业化工程项目通过国家科技部审核,正式入选《国家火炬计划产业化示范项目》。

宝泰隆:2015年9月,与淮北华醇化工有限公司签署合作协议,共同出资9.3亿元,在安徽(淮北)新型煤化工合成材料基地建设18万吨/年煤焦油加氢及5万吨/年针状焦联产项目。

金州集团:2010年开工建设“10万吨煤系针状焦项目”,并分两期建设。项目一期5万吨/年已于2013年完工,二期工程于2015年4月开始招标。

水清木华研究中心《2015-2018年全球及中国针状焦行业研究报告》着重研究了以下内容:

全球针状焦供需现状、技术现状、竞争格局等情况; 全球针状焦供需现状、技术现状、竞争格局等情况;

中国针状焦行业发展环境、供需现状、竞争格局、进出口等情况; 中国针状焦行业发展环境、供需现状、竞争格局、进出口等情况;

针状焦主要下游行业(石墨电极)生产、需求、市场格局等情况; 针状焦主要下游行业(石墨电极)生产、需求、市场格局等情况;

全球7家、中国9家针状焦生产商经营情况、营收构成、针状焦业务等情况。 全球7家、中国9家针状焦生产商经营情况、营收构成、针状焦业务等情况。

Needle coke with low electrical resistance, strong shock resistance and good anti-oxidation ability has been widely used in ultra high power graphite electrode, nuclear reactor deceleration materials and LIB anode materials. There are coal-based needle coke and oil-based needle coke.

From 2006 to 2014, the global needle coke capacity was expanded slowly at 3.6%, mainly because of the capacity expansion control by the industry’s giants to maintain high profit margins. By contrast, the global demand for needle coke is growing rapidly, making the demand-supply gap increase year by year. In 2014, the demand rose 62.9% from a year earlier, to 290 kilotons.

The Chinese needle coke industry began in the 1970s and '80s, however, the capacity has surged in recent years along with the technical breakthrough. In 2006-2014, China’s needle coke capacity increased from 60 kilotons to 260 kilotons, at a compound annual growth rate of 20.1%. In 2015, as the Huahang Energy’s needle coke project went into operation, China’s needle coke capacity has reached 280 kilotons.

Needle coke capacity can’t meet the domestic market demand despite the increase year by year e.g. the demand-supply gap was 72 kilotons in 2014, China needs to import needle coke from the United States, Japan, Britain and other countries every year. In 2014, China recorded an import volume of 47 kilotons.

Global needle coke production enterprises are mainly concentrated in the United States, Japan and China. The US-based ConocoPhillips as the world’s largest oil-based needle coke producer registers capacity of about 370 kt/a in 2015; the Japan-based C-Chem as the world’s largest coal-based needle coke producer registers capacity of 170 kt/a in 2015. Chinese companies started relatively late, but in order to enhance the international competitiveness, they all have been increasing investment in needle coke projects over the years.

The total capacity of Sinosteel Anshan Research Institute of Thermo-Energy Co., Ltd. tops China by surpassing Shanxi Hongte Coal Chemical Industry Co., Ltd. after it adjusted the 80 kt/a needle coke project phase II capacity from 40 kt/a to 120 kt/a in 2012. In January 2015, the company’s coal-based needle coke industrialization project passed the MOST (Ministry of Science and Technology) review and was officially included in the National Torch Program projects.

Qitaihe Baotailong Coal & Coal Chemicals Public Co., Ltd. signed a cooperation agreement with Huaibei Huachun Chemical Co., Ltd. in September 2015. The two sides invested RMB930 million in the 180 kt/a coal tar hydrogenation and 50 kt/a cogeneration project in Anhui (Huaibei) new coal chemical synthetic material base.

Jinzhou Coal and Coke Group started the construction of 100 kt/a coal-based needle coke project in 2010, divided into two phases. The first phase (50 kt/a) was completed in 2013, and the second phase began bidding in April 2015.

This report mainly highlights the following:

Supply and demand, technical status, competition pattern, etc. of global needle coke industry; Supply and demand, technical status, competition pattern, etc. of global needle coke industry;

Development environment, supply and demand, competition pattern, import and export, etc. of China’s needle coke industry; Development environment, supply and demand, competition pattern, import and export, etc. of China’s needle coke industry;

Production, demand, market pattern of major downstream industries (graphite electrode) of needle coke; Production, demand, market pattern of major downstream industries (graphite electrode) of needle coke;

Operation, revenue structure, needle coke business, etc. of 7 global and 9 Chinese needle coke producers. Operation, revenue structure, needle coke business, etc. of 7 global and 9 Chinese needle coke producers.

第一章 针状焦概述

1.1 产品介绍

1.2 分类及应用

1.3 产业链

第二章 全球针状焦行业发展现状

2.1 发展概述

2.2 供需现状

2.2.1 供给

2.2.2 需求

2.3 技术现状

2.4 市场格局

2.4.1 美国

2.4.2 日本

2.4.3 英国

第三章 中国针状焦行业发展现状

3.1 发展环境

3.1.1 政策环境

3.1.2 技术环境

3.1.3 贸易环境

3.2 供需现状

3.2.1 供给

3.2.2 需求

3.2.3 供需缺口

3.3 市场格局

3.4 进出口

3.5 价格走势

3.6 重点项目

第四章 中国石墨电极行业发展情况

4.1 发展环境

4.2 供需现状

4.2.1 供给

4.2.2 需求

4.3 市场格局

第五章 全球针状焦重点生产企业

5.1 ConocoPhillips

5.1.1 公司介绍

5.1.2 经营情况

5.1.3 营收构成

5.1.4 针状焦业务

5.1.5 在华发展

5.2 C-Chem

5.2.1 公司介绍

5.2.2 针状焦业务

5.3 Seadrift

5.3.1 公司介绍

5.3.2 针状焦业务

5.4 Mitsubishi Chemical

5.4.1 公司介绍

5.4.2 经营情况

5.4.3 营收构成

5.4.4 针状焦业务

5.5 JX Holdings Inc

5.5.1 公司介绍

5.5.2 经营情况

5.5.3 营收构成

5.5.4 针状焦业务

5.6 Indian OilCorporation Limited

5.6.1 公司介绍

5.6.2 经营情况

5.6.3 营收构成

5.6.4 针状焦业务

5.7 Petrocokes Japan Limited

5.7.1 公司介绍

5.7.2 针状焦业务

第六章 中国针状焦重点生产企业

6.1 中钢热能

6.1.1 公司介绍

6.1.2 针状焦业务

6.2 锦州石化

6.2.1 公司介绍

6.2.2 经营情况

6.2.3 针状焦业务

6.3 宝钢化工

6.3.1 公司介绍

6.3.2 经营情况

6.3.3 针状焦业务

6.4 宏特化工

6.4.1 公司介绍

6.4.2 经营情况

6.4.3 重点项目

6.4.4 针状焦业务

6.5 方大炭素

6.5.1 公司介绍

6.5.2 经营情况

6.5.3 营收构成

6.5.4 针状焦业务

6.6 宝泰隆

6.6.1 公司介绍

6.6.2 经营情况

6.6.3 营收构成

6.6.4 针状焦业务

6.7 三元炭素

6.7.1 公司介绍

6.7.2 针状焦业务

6.8 其他企业

6.8.1 金州集团

6.8.2 首山焦化

第七章 总结与预测

7.1 市场

7.2 企业

1. Overview of Needle Coke

1.1 Product Introduction

1.2 Classification and Application

1.3 Industry Chain

2. Development of Global Needle Coke Industry

2.1 Overview

2.2 Supply and Demand

2.2.1 Supply

2.2.2 Demand

2.3 Technical Status

2.4 Market Pattern

2.4.1 USA

2.4.2 Japan

2.4.3 UK

3. Development of Needle Coke Industry in China

3.1 Development Environment

3.1.1 Policy Environment

3.1.2 Technical Environment

3.1.3 Trade Environment

3.2 Supply and Demand

3.2.1 Supply

3.2.2 Demand

3.2.3 Demand-Supply Gap

3.3 Market Pattern

3.4 Import and Export

3.5 Price Trend

3.6 Key Projects

4. Development of Graphite Electrode Industry in China

4.1 Development Environment

4.2 Supply and Demand

4.2.1 Supply

4.2.2 Demand

4.3 Market Pattern

5. Major Needle Coke Companies Worldwide

5.1 ConocoPhillips

5.1.1 Profile

5.1.2 Operation

5.1.3 Revenue Structure

5.1.4 Needle Coke Business

5.1.5 Development in China

5.2 C-Chem

5.2.1 Profile

5.2.2 Needle Coke Business

5.3 Seadrift

5.3.1 Profile

5.3.2 Needle Coke Business

5.4 Mitsubishi Chemical

5.4.1 Profile

5.4.2 Operation

5.4.3 Revenue Structure

5.4.4 Needle Coke Business

5.5 JX Holdings Inc

5.5.1 Profile

5.5.2 Operation

5.5.3 Revenue Structure

5.5.4 Needle Coke Business

5.6 IndianOil Corporation Ltd

5.6.1 Profile

5.6.2 Operation

5.6.3 Revenue Structure

5.6.4 Needle Coke Business

5.7 Petrocokes Japan Limited

5.7.1 Profile

5.7.2 Needle Coke Business

6. Major Needle Coke Companies in China

6.1 Sinosteel Anshan Research Institute of Thermo-Energy Co., Ltd. (RDTE)

6.1.1 Profile

6.1.2 Needle Coke Business

6.2 Jinzhou Petrochemical Co., Ltd.

6.2.1 Profile

6.2.2 Operation

6.2.3 Needle Coke Business

6.3 Shanghai Baosteel Chemical Co., Ltd. (Baochem)

6.3.1 Profile

6.3.2 Operation

6.3.3 Needle Coke Business

6.4 Shanxi Hongte Coal Chemical Industry Co., Ltd.

6.4.1 Profile

6.4.2 Operation

6.4.3 Key Projects

6.4.4 Needle Coke Business

6.5 Fangda Carbon New Material Technology Co., Ltd.

6.5.1 Profile

6.5.2 Operation

6.5.3 Revenue Structure

6.5.4 Needle Coke Business

6.6 Qitaihe Baotailong Coal & Coal Chemicals Public Co., Ltd.

6.6.1 Profile

6.6.2 Operation

6.6.3 Revenue Structure

6.6.4 Needle Coke Business

6.7 Shanxi Sanyuan Carbon Co., Ltd.

6.7.1 Profile

6.7.2 Needle Coke Business

6.8 Others

6.8.1 Jinzhou Coal and Coke Group

6.8.2 China Pingmei Shenma Group Shoushan Coking Co., Ltd.

7. Summary and Forecast

7.1 Market

7.2 Enterprise

图:针状焦实物

图:针状焦产业链

图:2006-2018年全球针状焦产能

图:2006-2018年全球针状焦(分产品)产能结构

图:2014年中国针状焦需求结构

表:2007-2018年全球及中国电炉钢产量及石墨电极需求量

图:2007-2018年全球针状焦需求量

表:全球煤系针状焦生产工艺及其特点

图:不同原料生产针状焦的工艺流程

表:2015年全球(不含中国)主要针状焦制造商产能

表:2015年美国针状焦生产企业产能及生产基地

表:2015年日本主要针状焦生产企业产能及产品类型

表:2015年英国针状焦生产企业产能及生产基地

表:中国针状焦技术发展进程

图:2006-2018年中国针状焦产能

图:2006-2018年中国针状焦(分产品)产能结构

图:2014年中国针状焦需求结构

图:2006-2018年中国针状焦需求量

图:2006-2018年中国针状焦产品供给缺口

表:2015年中国主要针状焦生产企业产能

图:2015年中国针状焦生产企业市场份额

图:2006-2015年中国针状焦产品进口量及增速

图:2006-2015年中国针状焦(分产品)进口量

图:2009-2014年中国煤系及油系针状焦进口均价

表:2015年中国重点针状焦拟/在建项目

图:2006-2018年中国电炉钢产量及在粗钢中占比

图:2006-2018年中国石墨电极产量

图:2006-2015年中国石墨电极(分产品)产量

图:2006-2015年中国石墨电极产品结构变化趋势

图:2006-2018年中国石墨电极销量

图:2006-2015年中国石墨电极(分产品)销量构成

表:2015年中国前10名生产企业超高功率石墨电极产能

表:2015年中国前10名生产企业高功率石墨电极产能

图:ConocoPhillips全球布局

图:2008-2015年ConocoPhillips公司营业收入及净利润

图:2012-2014年康菲石油(分业务)主营业务收入

图:2012-2014年康菲石油(分地区)主营业务收入

表:ConocoPhillips英国Humber生产基地针状焦性能指标

表:2015年ConocoPhillips针状焦生产基地产能

图:ConocoPhillips在华布局

图:2015年C-Chem针状焦产业链

表:C-Chem针状焦性能指标

表:Seadrift SSP™高级石油焦及Seadrift SNP™ 普通石油焦特性

图:2010-2015财年三菱化学营业收入及净利润

图:2011-2015财年三菱化学(分部门)营业收入

图:2011-2014财年三菱化学(分地区)营业收入

表:2015年三菱化学针状焦相关原料产能

表:JX Holdings Inc主要下属企业及主营业务

图:2008-2015财年JX Holdings营业收入及净利润

图:2008-2015财年JX控股(分部门)营业收入占比

图:2010-2014财年JX控股(分地区)营业收入

表:2015年JX Holdings针状焦生产基地及产能

图:印度石油产业布局

图:2009-2015财年印度石油营业收入及净利润

图:2009-2015年印度石油(分部门)营业收入

表:2015年Petrocokes Japan Limited针状焦产能及生产基地

表:2015年中钢热能针状焦性能指标

表:中钢热能针状焦发展进程

图:2008-2015年锦州石化销售收入

表:2015年锦州石化针状焦性能指标

图:2015年锦州石化针状焦实际产能

图:宝钢化工生产基地分布

图:2007-2015年宝钢化工营业收入及增速

图:2015年宏特化工股权结构

图:2005-2015年宏特化工营业收入及增速

表:2011-2015年宏特化工针状焦相关项目

图:2015年宏特化工针状焦产能

表:2015年宏特化工针状焦性能指标

图:2015年方大炭素股权结构

图:2008-2015年方大炭素营业收入及净利润

图:2009-2015年方大碳素(分产品)主营业务收入

图:2009-2015年方大碳素(分地区)主营业务收入

表:2015年方大炭素针状焦项目

图:2015年宝泰隆股权结构

图:2008-2015年宝泰隆营业收入及净利润

图:2013-2015年宝泰隆(分产品)营业收入构成

图:2014-2015年宝泰隆(分地区)营业收入构成

表:2014-2015年宝泰隆针状焦项目

图:2015年三元炭素股权结构

表:2015年三元碳素主要产品产能

表:2015年金州集团针状焦项目

图:2007-2018年全球针状焦产能及需求增速

图:2008-2018年中国针状焦产能及需求增速

图:2015年全球针状焦生产企业竞争格局

Physical Needle Coke

Needle Coke Industry Chain

Global Needle Coke Capacity, 2006-2018E

Global Needle Coke Capacity Structure (by Product), 2006-2018E

Structure of China’s Demand for Needle Coke, 2014

Global and China Electric Furnace Steel Production and Demand for Graphite Electrode, 2007-2018E

Global Demand for Needle Coke, 2007-2018E

Global Coal Based Needle Coke Production Process and Its Characteristics

Needle Coke Production Process by Different Raw Materials

Capacity of Major Global (Exclude Chinese) Needle Coke Manufacturers, 2015

Capacity and Production Base of U.S. Needle Coke Manufacturers, 2015

Capacity and Product Type of Major Japanese Needle Coke Manufacturers, 2015

Capacity and Production Base of British Needle Coke Manufacturers, 2015

Process of Needle Coke Technology in China

China’s Needle Coke Capacity, 2006-2018E

China’s Needle Coke Capacity Structure (by Product), 2006-2018E

Structure of China’s Demand for Needle Coke, 2014

China’s Demand for Needle Coke, 2006-2018E

Supply Gap of Needle Coke Products in China, 2006-2018E

Capacity of Major Chinese Needle Coke Manufacturers, 2015

Market Share of Chinese Needle Coke Manufacturers, 2015

China’s Needle Coke Product Import Volume and Growth, 2006-2015

China’s Needle Coke Import Volume (by Product), 2006-2015

China’s Average Import Price of Coal/Oil Based Needle Coke, 2009-2014

China’s Key Needle Coke Projects Planned and Under Construction, 2015

Proportion of China’s Electric Furnace Steel Production in Crude Steel, 2006-2018E

China’s Graphite Electrode Output, 2006-2018E

China’s Graphite Electrode Output (by Product), 2006-2015

China’s Graphite Electrode Product Mix Trends, 2006-2015

China’s Graphite Electrode Sales Volume, 2006-2018E

China’s Graphite Electrode Sales Volume Structure (by Product), 2006-2015

Ultra High Power Graphite Electrode Capacity of China’s Top 10 Manufacturers, 2015

High Power Graphite Electrode Capacity of China’s Top 10 Manufacturers, 2015

Global Distribution of ConocoPhillips

Revenue and Net Income of ConocoPhillips, 2008-2015

Operating Revenue of ConocoPhillips (by Business), 2012-2014

Operating Revenue of ConocoPhillips (by Region), 2012-2014

Needle Coke Performance Index of CONOCO INC Humber Production Base

Capacity of CONOCO INC Needle Coke Production Base, 2015

ConocoPhillips’ Layout in China

Needle Coke Industry Chain of C-Chem, 2015

Needle Coke Performance Index of C-Chem

Characteristics of Seadrift SSP? Senior Petroleum Coke and Seadrift SSP? Ordinary Petroleum Coke

Revenue and Net Income of Mitsubishi Chemical, FY2010-FY2015

Revenue of Mitsubishi Chemical (by Division), FY2011-FY2015

Revenue of Mitsubishi Chemical (by Region), FY2011-FY2014

Needle Coke Related Raw Material Capacity of Mitsubishi Chemical, 2015

Affiliated Companies and Main Business of JX Holdings

Revenue and Net Income of JX Holdings, FY2008-FY2015

Revenue Structure of JX Holdings (by Division), FY2008-FY2015

Revenue of JX Holdings (by Region), FY2010-FY2014

Needle Coke Capacity and Production Base of JX Holdings, 2015

Industrial Layout of IndianOil

Revenue and Net Income of IndianOil, FY2009-FY2015

Revenue of IndianOil (by Division), 2009-2015

Needle Coke Capacity and Production Base of Petrocokes Japan Limited, 2015

Needle Coke Performance Index of RDTE, 2015

Needle Coke Development Course of RDTE

Sales of Jinzhou Petrochemical, 2008-2015

Needle Coke Performance Index of Jinzhou Petrochemical, 2015

Needle Coke Capacity (Actual) of Jinzhou Petrochemical, 2015

Production Base Distribution of Baochem

Revenue and Growth Rate of Baochem, 2007-2015

Ownership Structure of Shanxi Hongte Coal Chemical Industry, 2015

Revenue and Growth Rate of Shanxi Hongte Coal Chemical Industry, 2005-2015

Needle Coke Related Projects of Shanxi Hongte Coal Chemical Industry, 2011-2015

Needle Coke Capacity of Shanxi Hongte Coal Chemical Industry, 2015

Needle Coke Performance Index of Shanxi Hongte Coal Chemical Industry, 2015

Ownership Structure of Fangda Carbon New Material Technology, 2015

Revenue and Net Income of Fangda Carbon New Material Technology, 2008-2015

Operating Revenue of Fangda Carbon New Material Technology (by Product), 2009-2015

Operating Revenue of Fangda Carbon New Material Technology (by Region), 2009-2015

Needle Coke Projects of Fangda Carbon New Material Technology, 2015

Ownership Structure of Qitaihe Baotailong Coal & Coal Chemicals Public, 2015

Revenue and Net Income of Qitaihe Baotailong Coal & Coal Chemicals Public, 2008-2015

Revenue Structure of Qitaihe Baotailong Coal & Coal Chemicals Public (by Product), 2013-2015

Revenue Structure of Qitaihe Baotailong Coal & Coal Chemicals Public (by Region), 2014-2015

Needle Coke Projects of Qitaihe Baotailong Coal & Coal Chemicals Public, 2014-2015

Ownership Structure of Shanxi Sanyuan Carbon, 2015

Main Product Capacity of Shanxi Sanyuan Carbon, 2015

Needle Coke Projects of Jinzhou Coal and Coke Group, 2015

Global Needle Coke Capacity and Demand Growth, 2007-2018E

China’s Needle Coke Capacity and Demand Growth, 2008-2018E

Competition Pattern of Global Needle Coke Manufacturers, 2015

如果这份报告不能满足您的要求,我们还可以为您定制报告,请 留言说明您的详细需求。

|