|

报告导航:研究报告—

制造业—工业机械

|

|

2015-2017年中国运动控制器行业研究报告 |

|

字数:2.8万 |

页数:71 |

图表数:77 |

|

中文电子版:6600元 |

中文纸版:3300元 |

中文(电子+纸)版:7100元 |

|

英文电子版:1700美元 |

英文纸版:1800美元 |

英文(电子+纸)版:2000美元 |

|

编号:BXM085

|

发布日期:2015-11 |

附件:下载 |

|

|

|

运动控制器是以实现预定运动轨迹为目标,对以电机驱动的各类执行机构进行控制的装置,主要用在机床、纺织机械、塑料机械、印刷机械、包装机械、医疗设备等行业。

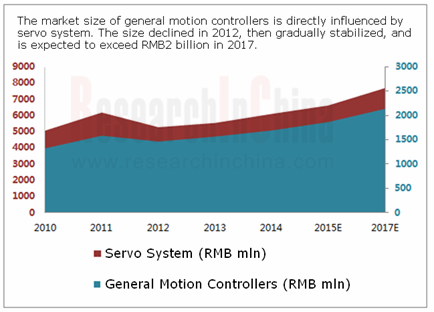

受中国产业升级、设备制造业产品结构调整等因素影响,2012年以来中国运动控制器市场低位徘徊,2014年基本回稳,市场规模达到71.3亿元,同比增长8.5%。

随着《中国制造2025》等政策出台,工业机器人、数控机床等成为发展重点,运动控制器作为智能装备领域的核心部件,未来将迎来快速发展,预计到2017年中国运动控制市场规模将达到100亿元左右。

运动控制器分为通用运动控制器和专用运动控制器两类,其中通用运动控制器又分为PC-based、PLC-based和嵌入式控制器三种。目前,PLC-based为传统主流控制器,PC-based是近年发展起来的开放式控制器,未来两者将在竞争中逐渐走向融合。

中国运动控制器市场主要以国际知名厂商为主,本土品牌厂商多为中小型企业,且产品主要定位中低端。目前,中国本土企业中,以运动控制器为核心且能够为客户提供系统解决方案的供应商有乐创技术、固高科技、雷赛智能、维宏电子、众为兴等。

固高科技:中国最大的运动控制器生产商,在PC-Based 运动控制器领域拥有近一半的市场份额。2014年公司在重庆永川成立了重庆固高自动化应用技术开发有限公司和固高科技长江智能制造技术研究院;2015年正在松山湖建设固高科技园,有望年底建成。届时将成为中国最早一批工业4.0的无人全智能化工厂。

乐创技术:中国较早自主研发通用运动控制器的企业之一,产品主要应用于光雕刻机、点胶机等行业。2015年上半年,公司两款新产品——交流伺服驱动器和乐创网络化控制器进入市场验证阶段,下半年有望小批量生产。

众为兴:中国领先的运动控制解决方案提供商,主要客户为富士康、歌尔声学等。2014年公司被上海新时达电气股份有限公司收购,全年运动控制器/卡实现营业收入8032.8万元,占公司营业收入比例达到52%。

水清木华研究中心《2015-2017年中国运动控制器行业研究报告》重点研究了以下内容:

中国运动控制器产业环境和政策环境等; 中国运动控制器产业环境和政策环境等;

中国运动控制器市场供需、竞争情况等; 中国运动控制器市场供需、竞争情况等;

中国通用运动控制器和专用运动控制器市场现状等; 中国通用运动控制器和专用运动控制器市场现状等;

中国运动控制器下游产业发展情况等; 中国运动控制器下游产业发展情况等;

中国16家运动控制器重点企业经营情况、营收构成及发展战略等。 中国16家运动控制器重点企业经营情况、营收构成及发展战略等。

Motion controllers are the devices that control all kinds of motor-driven actuators to follow the predetermined trajectory, and they find key application in machine tool, textile machinery, plastic machinery, printing machinery, packaging machinery, medical equipment and other industries.

Affected by factors such as industry upgrading and product structure adjustment of equipment manufacturing, Chinese motion controller market hovered at a low level since 2012, and then basically stabilized in 2014 with the market size of RMB7.13 billion which went up 8.5% year on year.

With the promulgation of "Made in China 2025" and other policies, industrial robots and CNC machine tools have become the focus, which means motion controllers will see rapid development as the core components of intelligent equipment. It is expected that Chinese motion control market size will approximate RMB10 billion in 2017.

Motion controllers are divided into general motion controllers and special motion controllers, of which the former can fall into three categories: PC-based controllers, PLC-based controllers, and embedded controllers. Currently, PLC-based controllers prevail as traditional mainstream controllers, and will integrate with the emerging open-style PC-based controller amid competition.

Source: China Motion Controller Industry Report, 2015-2017 by ResearchInChina

Chinese motion controller market is mainly dominated by world-renowned giants, while local Chinese players are mostly small and medium-sized firms which target at medium and low-end markets. Among China's domestic enterprises, Leetro, Googol Technology, Leadshine Technology, Weihong Electronic Technology and Adtech give priority to motion controllers and provide customers with system solutions.

Googol Technology: As China's largest maker of motion controllers, Googol Technology holds nearly half of the market share in the field of PC-based motion controllers. In 2014, the company established Chongqing Googol Automation Applied Technology Development Co., Ltd. and Googol Yangtze River Intelligent Manufacturing Technology Research Institute in Yongchuan, Chongqing. In 2015, it is building Googol Park at Songshan Lake, which is expected to be completed by the end of this year. By then, Googol Park will become one of the first batch of industry 4.0 unmanned intelligent plants in China.

Leetro: The company has embarked on independent R & D of general motion controllers earlier than most of its rivals in China. Its products are mainly used in optical engraving machines, dispensers and other industries. In the first half of 2015, the company’s two new products - AC servo drivers and network controllers were launched for a trial; in the second half year, the small-lot production may be accomplished.

Adtech: This leading provider of motion control solutions in China serves Foxconn, GoerTek and the like. In 2014, the company was acquired by Shanghai STEP Electric Corporation; meanwhile, its annual motion controller/card revenue amounted to RMB80.328 million, accounting for 52% of company’s total revenue.

China Motion Controller Industry Report, 2015-2017 released by ResearchInChina highlights the following:

Development environments of motion controllers in China, including industrial environment and policy climate, etc.; Development environments of motion controllers in China, including industrial environment and policy climate, etc.;

Competition pattern, supply and demand of Chinese motion controller market; Competition pattern, supply and demand of Chinese motion controller market;

Market situation of general motion controllers and special motion controllers in China; Market situation of general motion controllers and special motion controllers in China;

Development of motion controller downstream industries in China; Development of motion controller downstream industries in China;

Operation, revenue structure and development strategies of 16 key motion controller companies in China. Operation, revenue structure and development strategies of 16 key motion controller companies in China.

第一章 运动控制器简介

1.1 定义与分类

1.2 产业链

第二章 中国运动控制器发展环境

2.1 产业环境

2.2 政策环境

第三章 中国运动控制器市场分析

3.1 发展概况

3.2市场供需

3.2.1 供应情况

3.2.2 需求情况

3.3竞争格局

第四章 中国运动控制器细分市场分析

4.1 概述

4.2 通用运动控制器

4.3 专用运动控制器

第五章 中国运动控制器应用行业分析

5.1概述

5.2 数控机床

5.2.1 市场现状

5.2.2 运动控制器在数控机床的应用

5.3 纺织机械

5.3.1 市场现状

5.3.2 运动控制器在纺织机械的应用

5.4 医疗设备

5.5 电子设备

5.6 塑料机械

5.7 印刷机械

5.8 机器人

第六章 中国运动控制器行业重点企业分析

6.1 雷赛智能

6.1.1 企业简介

6.1.2 经营情况

6.1.3 营收构成

6.1.4 毛利率

6.1.5 主要客户及供应商

6.2 众为兴

6.2.1 企业简介

6.2.2 经营情况

6.2.3 运动控制器业务

6.3 乐创技术

6.3.1 企业简介

6.3.2 经营情况

6.3.3 营收构成

6.3.4 主要客户

6.3.5 技术优势

6.4 固高科技

6.4.1 企业简介

6.4.2 经营情况

6.4.3 研发能力

6.4.4 发展战略

6.5 凌华科技

6.5.1 企业简介

6.5.2 经营情况

6.5.3营收构成

6.5.4 运动控制器业务

6.6 研华

6.6.1 企业简介

6.6.2 经营情况

6.6.3 营收构成

6.6.4运动控制器业务

6.6.5 发展战略

6.7 科远股份

6.7.1 企业简介

6.7.2 经营情况

6.7.3 营收构成

6.7.4 毛利率

6.7.5 研发情况

6.7.6 运动控制器业务

6.8 维宏电子

6.8.1 公司简介

6.8.2 经营情况

6.8.3 营收构成

6.8.4 毛利率

6.8.5 主要客户

6.8.6 重点项目

6.9 多普康

6.9.1 企业简介

6.9.2运动控制器业务

6.10 太控科技

6.10.1 企业简介

6.10.2运动控制器业务

6.11 海川数控

6.11.1 企业简介

6.11.2运动控制器业务

6.12 和利时

6.12.1 企业简介

6.12.2 经营情况

6.13 锐志天宏

6.13.1 企业简介

6.13.2 运动控制器业务

6.14 海外企业在中国

6.14.1 泰道(Delta Tau)

6.14.2 翠欧(Trio)

6.14.3加利尔(Galil )

第七章 总结与预测

7.1 总结

7.1.1 市场

7.1.2 企业

7.2 趋势

1. Profile of Motion Controller

1.1 Definition and Classification

1.2 Industry Chain

2 Development Environment of Motion Controller Industry in China

2.1 Industry Environment

2.2 Policy Environment

3 Motion Controller Market in China

3.1 Development

3.2 Supply & Demand

3.2.1 Supply

3.2.2 Demand

3.3 Competition Pattern

4 Chinese Motion Controller Market Segments

4.1 Overview

4.2 General Motion Controllers

4.3 Special Motion Controllers

5 Motion Controller Application Industry in China

5.1 Overview

5.2 CNC Machine Tools

5.2.1 Market Situation

5.2.2 Application of Motion Controllers in CNC Machine Tool

5.3 Textile Machinery

5.3.1 Market Situation

5.3.2 Application of Motion Controllers in Textile Machinery

5.4 Medical Equipment

5.5 Electronic Devices

5.6 Plastic Machinery

5.7 Printing Machinery

5.8 Robotics

6 Major Motion Controller Manufacturers in China

6.1 Leadshine Technology

6.1.1 Profile

6.1.2 Operation

6.1.3 Revenue Structure

6.1.4 Gross Margin

6.1.5 Clients and Suppliers

6.2 ADTECH

6.2.1 Profile

6.2.2 Operation

6.2.3 Motion Controller Business

6.3 Leetro Automation Co., Ltd.

6.3.1 Profile

6.3.2 Operation

6.3.3 Revenue Structure

6.3.4 Key Clients

6.3.5 Technical Superiority

6.4 Googol Technology (HK) Limited

6.4.1 Profile

6.4.2 Operation

6.4.3 R & D Capability

6.4.4 Development Strategy

6.5 ADLINK

6.5.1 Profile

6.5.2 Operation

6.5.3 Revenue Structure

6.5.4 Motion Controller Business

6.6 Advantech

6.6.1 Profile

6.6.2 Operation

6.6.3 Revenue Structure

6.6.4 Motion Controller Business

6.6.5 Development Strategy

6.7 Sciyon

6.7.1 Profile

6.7.2 Operation

6.7.3 Revenue Structure

6.7.4 Gross Margin

6.7.5 R&D

6.7.6 Motion Controller Business

6.8 Shanghai Weihong Electronic Technology Co., Ltd.

6.8.1 Profile

6.8.2 Operation

6.1.3 Revenue Structure

6.1.4 Gross Margin

6.8.5 Major Clients

6.8.6 Key Projects

6.9 TOPCNC Automation Technology Co., Ltd.

6.9.1 Profile

6.9.2 Motion Controller Business

6.10 Tankon

6.10.1 Profile

6.10.2 Motion Controller Business

6.11 Haichuan Numerical Control Technology Co., Ltd.

6.11.1 Profile

6.11.2 Motion Controller Business

6.12 HollySys

6.12.1 Profile

6.12.2 Operation

6.13 RichAuto S&T

6.13.1 Profile

6.13.2 Motion Controller Business

6.14 Overseas Companies in China

6.14.1 Delta Tau

6.14.2 Trio

6.14.3 Galil

7 Summary and Forecast

7.1 Summary

7.1.1 Market

7.1.2 Enterprises

7.2 Trend

图:运动控制系统构成

表:运动控制器的分类

图:运动控制器产业链

图:2010-2017年中国伺服系统市场规模

图:2010-2017年中国交流伺服系统市场规模

图:2014年中国交流伺服系统(分品牌)市场份额

图:2014年中国伺服系统(分行业)市场份额

表:2006-2015年中国运动控制器相关政策

图:2008-2015年中国运动控制市场规模

图:2006-2015年中国运动控制器产量

图:2006-2015年中国运动控制器市场需求量

图:2014年中国运动控制器主要企业市场份额

图:2014年中国PC-based运动控制器主要企业市场份额

图:2006-2015年中国通用运动控制器市场规模

图:2013-2015年中国通用运动控制器(分类型)市场份额

表:2010-2015年中国CNC领域运动控制市场规模

图:2014年中国运动控制器(分行业)市场份额

图:2006-2015年中国机床工具行业市场规模

表:2006-2015年中国数控机床产量及数控化率

图:2008-2017年中国数控机床用运动控制器市场规模

图:2008-2017年中国雕刻雕铣行业运动控制市场规模

图:2008-2017年中国纺织机械行业市场规模

表:2015年中国运动控制产品在纺织机械行业的运用情况

图:2008-2017年中国医疗设备行业市场规模

图:2006-2017年中国电子设备制造行业市场规模

图:2006-2017年中国塑料加工机械行业市场规模

图:2006-2017年中国印刷机械行业市场规模

图:2006-2017年中国工业机器人销量

表:国内外主要机器人控制器企业及产品系列

表:雷赛智能主要产品系列

图:2011-2015年雷赛智能营业收入及净利润

表:2011-2014年雷赛智能(分产品)产能、产量及销量

表:2011-2014年雷赛智能(分产品)主营业务收入

表:2011-2014年雷赛智能(分地区)主营业务收入

表:2011-2014年雷赛智能(分产品)毛利率

图:2011-2015年众为兴营业收入及净利润

表:众为兴主要运动控制器产品

图:2011-2015年乐创技术营业收入及净利润

表:乐创技术运动控制器产品系列

图:2011-2015年乐创技术主营业务收入(分业务)构成

图:2011-2015年乐创技术TOP5客户收入及占比

表:固高科技主要运动控制器产品

图:固高科技运动控制器应用领域

图:2009-2015凌华科技营业收入及净利润

图:2010-2015年凌华科技(分业务)营业收入构成

表:凌华科技运动控制卡系列产品

图:2009-2015年研华营业收入及净利润

表:2009-2015年研华毛利率

表:2013-2015年研华(分业务)主营业务收入

表:2013-2014年研华(分地区)主营业务收入

表:研华运动控制器产品

图:2009-2015年科远股份营业收入及净利润

表:2012-2015年科远股份(分业务)主营业务收入

表:2012-2015年科远股份(分地区)主营业务收入

表:2009-2015年科远股份(分业务)毛利率

图:2009-2015年科远股份研发支出及占比

表:科远股份运动控制器产品

表:2014-2015年科远股份运动控制器子公司营业收入及净利润

图:2011-2015年维宏电子营业收入及净利润

表:2012-2014年维宏电子(分产品)主营业务收入及占比

表:2012-2014年维宏电子(分产品)销量及产销率

表:2012-2014年维宏电子(分地区)主营业务收入及占比

表:2011-2014年维宏电子(分产品)毛利率

表:2014年维宏电子TOP5 客户及收入

表:2015年维宏电子募投资金建设项目及进度

表:多普康主要运动控制器产品

表:太控科技主要运动控制器

表:海川数控主要运动控制器

图:2013-2015财年和利时营业收入及净利润

表:和利时主要业务

表:2013-2015财年和利时(分业务)营业收入及营业利润

表:锐志天宏主要运动控制器产品系列

表:Delta Tau 公司主要运动控制器产品

图:Trio公司全球网络

表:Trio公司主要运动控制器产品及特征

图:Galil 主要运动控制器产品

表:2013-2017年中国CNC和GMC运动控制器市场规模

Structure of Motion Controller System

Classification of Motion Controllers

Motion Controller Industry Chain

Market Size of Servo System in China, 2010-2017E

Market Size of AC Servo System in China, 2010-2017E

Market Share of AC Servo System in China by Brand, 2014

Market Share of Servo System in China by Sector, 2014

Policies on Motion Controllers in China, 2006-2015

Market Size of Motion Controllers in China, 2008-2015

Output of Motion Controllers in China, 2006-2015

Demand for Motion Controllers in China, 2006-2015

Market Share of Major Motion Controller Companies in China, 2014

Market Share of Major PC-based Motion Controller Companies in China, 2014

Market Size of General Motion Controllers in China, 2006-2015

Market Share of General Motion Controllers in China by Type, 2013-2015

Market Size of Motion Controllers in CNC Field in China, 2010-2015

Market Share of Motion Controllers in China by Sector, 2014

Market Size of Machine Tools in China, 2006-2015

Output of CNC Machine Tools and CNC Rate in China, 2006-2015

Market Size of CNC Machine Tool-use Motion Controllers in China, 2008-2017E

Market Size of Motion Controllers in Engraving and Milling Industry in China, 2008-2017E

Market Size of Textile Machinery Industry in China, 2008-2017E

Application of Motion Controllers in Textile Machinery Industry in China, 2015

Market Size of Medical Device Industry in China, 2008-2017E

Market Size of Electronic Equipment Manufacturing Industry in China, 2006-2017E

Market Size of Plastic Processing Machinery Industry in China, 2006-2017E

Market Size of Printing Machinery Industry in China, 2006-2017E

Sales Volume of Industrial Robots in China, 2006-2017E

Major Domestic and Foreign Robot Controller Enterprises and Their Products

Main Products of Leadshine Technology

Revenue and Net Income of Leadshine Technology, 2011-2015

Capacity, Output and Sales Volume of Leadshine Technology by Product, 2011-2014

Operating Revenue of Leadshine Technology by Product, 2011-2014

Operating Revenue of Leadshine Technology by Region, 2011-2014

Gross Margin of Leadshine Technology by Product, 2011-2014

Revenue and Net Income of ADTECH, 2011-2015

Main Motion Controllers of ADTECH

Revenue and Net Income of Leetro, 2011-2015

Motion Controller Series of Leetro

Operating Revenue Structure of Leetro by Business, 2011-2015

Leetro’s Revenue from Top 5 Clients and % of Total Revenue, 2011-2015

Main Motion Controllers of Googol Technology

Applications of Motion Controllers of Googol Technology

Revenue and Net Income of ADLINK, 2009-2015

Revenue Structure of ADLINK by Business, 2010-2015

Motion Control Card Products of ADLINK

Revenue and Net Income of Advantech, 2009-2015

Gross Margin of Advantech, 2009-2015

Operating Revenue of Advantech by Business, 2013-2015

Operating Revenue of Advantech by Region, 2013-2014

Motion Controllers of Advantech

Revenue and Net Income of Sciyone, 2009-2015

Operating Revenue of Sciyone by Business, 2012-2015

Operating Revenue of Sciyone by Region, 2012-2015

Gross Margin of Sciyone by Business, 2009-2015

R&D Costs of Sciyon and % of Revenue, 2009-2015

Motion Controllers of Sciyon

Revenue and Net Income of Motion Controller Subsidiaries of Sciyone, 2014-2015

Revenue and Net Income of Weihong Electronic, 2011-2015

Operating Revenue and Breakdown of Weihong Electronic by Product, 2012-2014

Sales Volume and Sales-output Ratio of Weihong Electronic by Product, 2012-2014

Operating Revenue and Breakdown of Weihong Electronic by Region, 2012-2014

Gross Margin of Weihong Electronic by Product, 2011-2014

Weihong Electronic’s Revenue from Top 5 Clients and % of Total Revenue, 2014

Raised Fund Investment Projects of Weihong Electronic and Progress, 2015

Main Motion Controllers of TOPCNC

Main Motion Controllers of Tankon

Main Motion Controllers of Haichuan Numerical Control

Revenue and Net Income of HollySys, FY2013-FY2015

Main Business of HollySys

Revenue and Operating Income of HollySys by Business, FY2013-FY2015

Main Motion Controllers of RichAuto S&T

Main Motion Controllers of Delta Tau

Global Network of Trio

Main Motion Controllers of Trioand Characteristics

Main Motion Controllers of Galil

Market Size of CNC and GMC Motion Controllers in China, 2013-2017E

如果这份报告不能满足您的要求,我们还可以为您定制报告,请 留言说明您的详细需求。

|