|

|

|

报告导航:研究报告—

制造业—工业机械

|

|

2016-2020年全球及中国工业激光器行业研究报告 |

|

字数:2.6万 |

页数:121 |

图表数:172 |

|

中文电子版:8800元 |

中文纸版:4400元 |

中文(电子+纸)版:9300元 |

|

英文电子版:2250美元 |

英文纸版:2400美元 |

英文(电子+纸)版:2550美元 |

|

编号:ZHP034

|

发布日期:2016-02 |

附件:下载 |

|

|

|

工业激光器由增益介质、泵浦源、光学谐振腔组成,是激光加工设备的核心部件,被广泛应用在激光焊接、激光切割、激光微加工、打标等领域。

近几年,全球工业激光器市场稳步发展,2015年其销售收入达到27.6亿美元,同比增长4.9%。预计在汽车、3D打印等市场发展的推动下,2016-2020年全球工业激光器销售收入年均复合增长率可达7.7%左右。

中国工业激光器市场起步较晚,市场规模较小,2015年其销售收入约5.3亿美元(汇率1:6.2284),全球占比19.2%,但市场增速较快,2015年同比增长了18.9%。中国工业激光器市场增速快于全球主要原因:一、2010年以后,中国出台多项政策鼓励激光产业及下游新兴领域(如增材制造)的发展;二、中国企业逐渐实现相关技术突破,打破了国外企业垄断,市场竞争力不断提高。

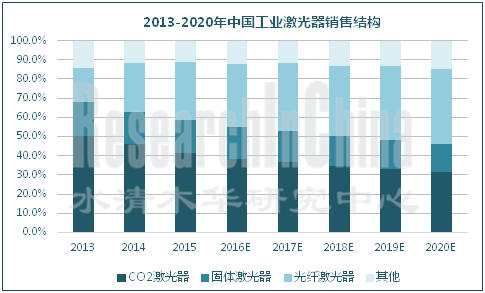

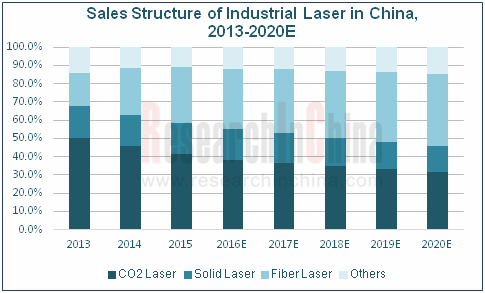

工业激光器主要包括CO2激光器、固体激光器、光纤激光器等,其中光纤激光器性能优异,在打标、金属切割等领域逐渐替代CO2激光器和普通固体激光器,是未来行业的发展趋势。预计2020年中国光纤激光器的市场份额将从2015年的34.5%增长至44.3%。

与发达国家相比,中国工业激光器研发能力较弱,高功率工业激光器产品大量依赖进口。2015年中国激光器贸易逆差额为6.1亿美元,同比增长10.0%。未来3-5年内,这一局面难以逆转,但逆差额有望收窄。

全球工业激光器主要制造商包括美国Coherent、IPG、Rofine、Nufern,德国Trumpf,意大利Prima,中国大族激光、华工科技、武汉锐科等。其中,Trumpf以15%的市场份额稳居行业第一,大族激光以8%的占有率紧随其后。随着企业之间的不断兼并重组,工业激光器行业强者恒强的局面短期内不会改变。

Trumpf:全球最大的工业激光器制造商,近年积极推进新产品的研发。2015年7月,推出用于铜的高效焊接的脉冲绿光激光器——TruDisk 421 pulse;2015年10月,投资7,000万欧元建设新大楼,用于研发新一代EUV光刻设备所需的高功率激光器。

大族激光:中国最大工业激光器制造商,拥有从光学设备、激光器到自动控制系统的垂直产业链优势。2016年开始建设“高功率半导体器件、特种光纤及光纤激光器产业化项目”,进一步完善光纤激光器产业链,该项目预计2018年建成。

华工科技:掌握了包括光纤激光器、全固态激光器、高功率CO2横流激光器在内的核心激光器技术。2015年旗下子公司华日激光又成功收购了加拿大工业级超快激光器制造商Attodyne Laser Inc.,有利于进一步提高欧美市场占有率。

武汉锐科:中国国内少数几家能制造千瓦级光纤激光器的厂商之一。目前主要进行2000W及4000W产品的品质及可靠性的提升,以及光纤激光器的核心器件及材料的研发。

水清木华研究中心《2016-2020年全球及中国工业激光器行业研究报告》着重研究了以下内容:

全球工业激光器市场规模、市场结构、应用现状、竞争格局等情况; 全球工业激光器市场规模、市场结构、应用现状、竞争格局等情况;

中国工业激光器政策环境、市场规模、市场结构、进出口、竞争格局等情况; 中国工业激光器政策环境、市场规模、市场结构、进出口、竞争格局等情况;

工业激光器主要细分产品市场概述、市场规模、市场结构、竞争格局等情况; 工业激光器主要细分产品市场概述、市场规模、市场结构、竞争格局等情况;

工业激光器上游产业现状,下游市场规模、市场格局等情况 工业激光器上游产业现状,下游市场规模、市场格局等情况

国外12家、国内13家工业激光器制造商经营情况、营收结构、工业激光器业务等情况。 国外12家、国内13家工业激光器制造商经营情况、营收结构、工业激光器业务等情况。

An industrial laser consists of gain media, pumping source and optical resonator. As the core part of laser processing equipment, industrial lasers are widely used in laser welding, laser cutting, laser micromachining, marking and other fields.

In recent years, the global industrial laser market has been developing steadily. The revenue herein jumped by 4.9% year on year to USD2.76 billion in 2015. Under the impetus of cars, 3D printing and other markets, the global industrial laser revenue is expected to grow at a CAGR of about 7.7% in 2016-2020.

Chinese industrial laser market started late, showing a small size. In 2015, the revenue herein fetched about USD530 million (USD1=RMB6.2284), accounting for 19.2% of the global; however, the market grew radically with the year-on-year growth rate of 18.9% in 2015, faster than the global market because: First, China introduced a number of policies to encourage the development of the laser industry and its downstream emerging fields (such as material increase manufacturing) after 2010; second, Chinese enterprises gradually realized technological breakthroughs to break the monopoly of foreign enterprises and intensify the market competitiveness.

Industrial lasers primarily embrace CO2 lasers, solid lasers and fiber lasers, in which fiber lasers featured with excellent performance have replaced CO2 lasers and ordinary solid-state lasers in the fields of marking, metal cutting and so forth gradually, as well as represent the future development trend of the industry. The market share of fiber lasers is expected to escalate from 34.5% in 2015 to 44.3% in 2020 in China.

Compared with developed countries, China is weak at R & D of industrial lasers, and heavily dependent on imported high-power industrial lasers. China’s laser trade deficit amounted to USD610 million in 2015, an increase of 10.0% over last year. In the next 3-5 years, this situation is difficult to reverse, but the deficit is expected to narrow.

Globally, major industrial laser manufacturers include the US-based Coherent, IPG, Rofine and Nufern, Germany-based Trumpf, Italy-based Prima, China-based Han's Laser, Huagong Tech, Wuhan Raycus and the like. Wherein, Trumpf ranks first with a 15% market share, followed by Han's Laser with 8%. In the wake of mergers and acquisitions between companies, the Matthew effect of the industrial laser industry will not fade out in the short term.

Trumpf, the world's largest industrial laser manufacturer, has been actively promoting R & D of new products. In July 2015, it launched TruDisk 421 pulse suitable for efficient welding of copper as a pulse green laser. In October 2015, it invested EUR70 million in constructing a new building to develop high-power lasers used in the new generation of EUV lithographic equipment.

Han's Laser, China’s largest industrial laser manufacturer, holds a vertical industrial chain covering optical devices, lasers and automatic control systems. In 2016, it starts the construction of "High-power Semiconductor Devices, Specialty Optical Fiber and Fiber Laser Industrialization Project" to further improve the fiber laser industrial chain. The project is expected to be fulfilled in 2018.

Huagong Tech masters core laser technologies concerning fiber lasers, all-solid-state lasers and high-power CO2 cross-flow lasers. In 2015, the subsidiary Huaray Precision Laser successfully acquired Attodyne Laser Inc. – a Canadian industrial ultrafast laser manufacturer, which was conducive to further raising the market share in Europe and America.

Wuhan Raycus is one of the few Chinese manufacturers that are capable of producing kilowatt fiber lasers. At present, it focuses on enhancing quality and reliability of 2000W and 4000W products, and R & D of core devices and materials of fiber lasers.

Global and China Industrial Laser Industry Report, 2016-2020 by ResearchInChina covers the followings:

Global industrial laser market size, market structure, applications, competitive pattern, etc.; Global industrial laser market size, market structure, applications, competitive pattern, etc.;

Chinese industrial laser policies, market size, market structure, import & export, competitive pattern, etc.; Chinese industrial laser policies, market size, market structure, import & export, competitive pattern, etc.;

Overview, market size, market structure, competitive pattern, etc. of main industrial laser market segments; Overview, market size, market structure, competitive pattern, etc. of main industrial laser market segments;

Industrial laser upstream industry status, downstream market size, market pattern, etc.; Industrial laser upstream industry status, downstream market size, market pattern, etc.;

Operation, revenue structure, industrial laser business, etc. of 12 foreign and 13 Chinese industrial laser manufacturers. Operation, revenue structure, industrial laser business, etc. of 12 foreign and 13 Chinese industrial laser manufacturers.

第一章 工业激光器行业概述

1.1 行业简介

1.2 分类

1.3 产业链

第二章 全球工业激光器产业现状

2.1 市场规模

2.2 市场结构

2.3 应用现状

2.3.1 材料加工

2.3.2 激光微加工

2.3.3 打标机

2.4 竞争格局

第三章 中国工业激光器产业现状

3.1 政策环境

3.2 市场规模

3.3 市场结构

3.4 进出口

3.4.1 出口

3.4.2 进口

3.5 竞争格局

第四章 工业激光器细分市场

4.1 CO2激光器

4.1.1 概述

4.1.2 市场规模

4.1.3 应用现状

4.1.4 竞争格局

4.2 固体激光器

4.2.1 概述

4.2.2 市场规模

4.2.3 竞争格局

4.3 光纤激光器

4.3.1 概述

4.3.2 市场规模

4.3.3 市场结构

4.3.4 竞争格局

4.4 半导体激光器

第五章 工业激光器上游产业

5.1 增益介质

5.1.1 二氧化碳

5.1.2 光纤

5.1.3 晶体材料

5.2 泵浦源

第六章 激光加工设备市场

6.1 市场规模

6.2 重点企业

6.2.1 全球

6.2.2 中国

6.3 细分市场

6.3.1 激光切割设备

6.3.2 激光焊接设备

6.3.3 激光标记设备

6.3.4 激光雕刻设备

第七章 国外主要工业激光器制造商

7.1 通快

7.1.1 公司简介

7.1.2 经营情况

7.1.3 工业激光器业务

7.1.4 在华布局

7.2 Coherent

7.2.1 公司简介

7.2.2 经营情况

7.2.3 营收构成

7.2.4 工业激光器业务

7.2.5 在华布局

7.3 IPG

7.3.1 公司简介

7.3.2 经营情况

7.3.3 营收构成

7.3.4 工业激光器业务

7.3.5 在华布局

7.4 Rofin-Sinar

7.4.1 公司简介

7.4.2 经营情况

7.4.3 营收构成

7.4.4 工业激光器业务

7.4.5 在华布局

7.5 Prima

7.5.1 公司简介

7.5.2 经营情况

7.5.3 营收构成

7.5.4 工业激光器业务

7.6 其他企业

7.6.1 GSI

7.6.2 Nufern

7.6.3 NKT Photonics

7.6.4 IMRA

7.6.5 Fianium

7.6.6 Bystronic

7.6.7 大通激光

第八章 中国主要工业激光器制造商

8.1 大族激光

8.1.1 公司简介

8.1.2 经营情况

8.1.3 营收构成

8.1.4 工业激光器业务

8.1.5 发展战略

8.2 华工科技

8.2.1 公司简介

8.2.2 经营情况

8.2.3 营收构成

8.2.4 工业激光器业务

8.2.5 发展战略

8.3 大恒科技

8.3.1 公司简介

8.3.2 经营情况

8.3.3 营收构成

8.3.4 工业激光器业务

8.4 天弘激光

8.4.1 公司简介

8.4.2 经营情况

8.4.3 营收构成

8.4.4 主要客户及供应商

8.4.5 工业激光器业务

8.4.6 发展战略

8.5 金运激光

8.5.1 公司简介

8.5.2 经营情况

8.5.3 营收构成

8.5.4 工业激光器业务

8.5.5 发展战略

8.6 新松

8.6.1 公司简介

8.6.2 经营情况

8.6.3 营收构成

8.6.4 工业激光器业务

8.7 创鑫激光

8.7.1 公司简介

8.7.2 工业激光器业务

8.7.3 发展战略

8.8 武汉锐科

8.8.1 公司简介

8.8.2 工业激光器业务

8.8.3 发展战略

8.9 武汉光谷科威晶

8.9.1 公司简介

8.9.2 经营情况

8.9.3 工业激光器业务

8.10 其他企业

8.10.1 中科中美

8.10.2 国科激光

8.10.3 西安中科梅曼

8.10.4 天元激光

第九章 总结与预测

9.1 市场

9.2 企业

1 Overview of Industrial Laser Industry

1.1 Introduction

1.2 Classification

1.3 Industrial Chain

2 Status Quo of Global Industrial Laser Industry

2.1 Market Size

2.2 Market Structure

2.3 Applications

2.3.1 Material Processing

2.3.2 Laser Micromachining

2.3.3 Marking Machine

2.4 Competitive Pattern

3 Status Quo of China Industrial Laser Industry

3.1 Policies

3.2 Market Size

3.3 Market Structure

3.4 Import & Export

3.4.1 Export

3.4.2 Import

3.5 Competitive Pattern

4 Industrial Laser Market Segments

4.1 CO2 Laser

4.1.1 Overview

4.1.2 Market Size

4.1.3 Applications

4.1.4 Competitive Pattern

4.2 Solid Laser

4.2.1 Overview

4.2.2 Market Size

4.2.3 Competitive Pattern

4.3 Fiber Laser

4.3.1 Overview

4.3.2 Market Size

4.3.3 Market Structure

4.3.4 Competitive Pattern

4.4 Diode Laser System

5 Upstream Industrial Laser Industry

5.1 Gain Medium

5.1.1 Carbon Dioxide

5.1.2 Fiber

5.1.3 Crystal Materials

5.2 Pumping Sources

6 Laser Processing Equipment Market

6.1 Market Size

6.2 Key Enterprises

6.2.1 Global

6.2.2 China

6.3 Market Segments

6.3.1 Laser Cutting Equipment

6.3.2 Laser Welding Equipment

6.3.3 Laser Marking Equipment

6.3.4 Laser Engraving Equipment

7 Major Foreign Industrial Laser Manufacturers

7.1 TRUMPF

7.1.1 Profile

7.1.2 Operation

7.1.3 Industrial Laser Business

7.1.4 Layout in China

7.2 Coherent

7.2.1 Profile

7.2.2 Operation

7.2.3 Revenue Structure

7.2.4 Industrial Laser Business

7.2.5 Layout in China

7.3 IPG

7.3.1 Profile

7.3.2 Operation

7.3.3 Revenue Structure

7.3.4 Industrial Laser Business

7.3.5 Layout in China

7.4 Rofin-Sinar

7.4.1 Profile

7.4.2 Operation

7.4.3 Revenue Structure

7.4.4 Industrial Laser Business

7.4.5 Layout in China

7.5 Prima

7.5.1 Profile

7.5.2 Operation

7.5.3 Revenue Structure

7.5.4 Industrial Laser Business

7.6 Other Enterprises

7.6.1 GSI

7.6.2 Nufern

7.6.3 NKT Photonics

7.6.4 IMRA

7.6.5 Fianium

7.6.6 Bystronic

7.6.7 Access Laser

8 Major Chinese Industrial Laser Manufacturers

8.1 Han’s Laser

8.1.1 Profile

8.1.2 Operation

8.1.3 Revenue Structure

8.1.4 Industrial Laser Business

8.1.5 Development Strategy

8.2 Huagong Tech

8.2.1 Profile

8.2.2 Operation

8.2.3 Revenue Structure

8.2.4 Industrial Laser Business

8.2.5 Development Strategy

8.3 Daheng New Epoch Technology

8.3.1 Profile

8.3.2 Operation

8.3.3 Revenue Structure

8.3.4 Industrial Laser Business

8.4 Tianhong Laser

8.4.1 Profile

8.4.2 Operation

8.4.3 Revenue Structure

8.4.4 Major Customers and Suppliers

8.4.5 Industrial Laser Business

8.4.6 Development Strategy

8.5 Wuhan Golden Laser

8.5.1 Profile

8.5.2 Operation

8.5.3 Revenue Structure

8.5.4 Industrial Laser Business

8.5.5 Development Strategy

8.6 Siasun

8.6.1 Profile

8.6.2 Operation

8.6.3 Revenue Structure

8.6.4 Industrial Laser Business

8.7 Maxphotonics

8.7.1 Profile

8.7.2 Industrial Laser Business

8.7.3 Development Strategy

8.8 Wuhan Raycus

8.8.1 Profile

8.8.2 Industrial Laser Business

8.8.3 Development Strategy

8.9 Wuhan Co-Walking Laser

8.9.1 Profile

8.9.2 Operation

8.9.3 Industrial Laser Business

8.10 Other Enterprises

8.10.1 ZKZM

8.10.2 Beijing GK Laser Technology

8.10.3 Xi’an Zhongke Meiman

8.10.4 Skyera Laser

9 Summary and Forecast

9.1 Market

9.2 Enterprises

图:激光器结构

表:气体、固体、光纤激光器性能对比

表:主要工业激光器所适用的加工工艺

表:工业激光器的分类

图:工业激光加工产业链

图:全球激光系统应用结构

图:2011-2020全球激光系统市场规模

图:2011-2020年全球激光材料加工及光刻市场规模及增速

图:2013-2020年全球工业激光器市场规模(销售收入)及增速

图:2013-2020年全球工业激光器(分产品)销售收入构成

图:2015/2020年全球工业激光器(分功率)销售收入构成

图:2015年全球工业激光器(分领域)应用现状

图:2013-2020年全球材料加工用激光器销售收入及增速

图:2013-2020年全球材料加工用激光器(分领域)销售收入构成

图:2013-2020年全球材料加工用激光器(分产品)销售收入构成

图:2013-2020年激光微加工用激光器销售收入及增速

图:2013-2020年全球激光微加工用激光器(分领域)销售收入构成

图:2013-2020年全球打标机用激光器销售收入及增速

图:2013-2020年全球打标机用激光器(分产品)销售收入构成

图:2014年全球主要企业在工业激光器领域的研发投入

图:2014年全球工业激光器市场竞争格局

表:2015年全球激光器行业并购事件

表:中国激光产业相关政策

图:2015年中国激光产业结构

图:2013-2020年中国工业激光器销售收入

图:2013-2020年中国工业激光器销量及增速

图:2015年中国工业激光器(分领域)应用现状

图:2015/2020年中国工业激光器(分产品)销量构成

图:2015/2020年中国工业激光器(分产品)销售收入构成

表:2015年中国激光器关税税率

表:2009-2015年中国激光器出口数量及金额

图:2015年中国激光器(分地区)出口量构成

图:2015年中国激光设备出口结构

表:2009-2015年中国激光器进口数量及金额

图:2015年中国激光器(分地区)进口量构成

图:2015年中国工业激光器市场竞争格局

表:CO2激光器发展历程

图:2011-2020年全球工业用CO2激光器销售收入及增速

图:2011-2020年中国工业用CO2激光器销售收入及增速

图:2011-2020年中国工业用CO2激光器销量及增速

表:CO2激光器应用现状

图:CO2激光器价值链

图:固体激光器结构

图:2011-2020年全球工业用固体激光器销售收入及增速

图:2011-2020年中国工业用固体激光器销售收入及增速

图:2011-2020年中国工业用固体激光器销量及增速

图:半导体泵浦固体激光器价值链

图:光纤激光器结构

图:光纤激光器功率发展历程

图:2011-2020年全球工业用光纤激光器销售收入及增速

图:2013-2020年中国工业用光纤激光器销售收入及增速

图:2013-2020年中国工业用光纤激光器销量及增速

图:2015年全球工业用光纤激光器(分地区)销量构成

图:2015年中国工业用光纤激光器(分产品)销量构成

图:光纤激光器价值链

图:2015年全球光纤激光器市场竞争格局

图:直接半导体激光器价值链

图:激光器组成部件

图:2015年中国CO2企业装置开工率

图:2014-2015年中国CO2市场价格走势

图:2009-2016年中国光纤光缆行业销售收入及增速

表:中国主要光纤制造商

表:全球激光晶体材料发展历程

表:全球主要YAG激光晶体材料制造商

表:主要激光器泵浦方式

图:2008-2014年全球激光器占激光设备成本比重

图:2011-2020年全球激光设备销售收入及增速

图:2013-2020年中国激光设备销售收入及增速

表:全球主要综合类激光设备公司

图:2014年全球激光设备市场竞争格局

表:中国主要激光设备企业

图:2014年中国激光设备市场竞争格局

表:全球中小功率激光设备主要公司

表:激光设备在各行业的应用特点

图:2015/2020年中国激光加工设备市场结构

图:2013-2020年中国激光切割设备市场规模

图:2015年中国大功率切割设备市场份额

图:2015年中国中小功率切割设备市场份额

图:2013-2020年中国激光焊接设备市场规模

图:2015年中国激光焊接设备市场结构

图:2013-2020年中国激光标记设备市场规模

图:2013-2020年中国激光雕刻设备市场规模

图:通快全球布局

图:2009-2015财年通快销售额及增速

图:2015财年通快(分产品)销售额构成

表:通快主要工业激光器产品

图:SPI主要客户

图:通快在华布局

图:2010-2015财年Coherent营业收入及毛利率

图:2012-2015财年Coherent(分产品)营业收入构成

图:2012-2015财年Coherent(分地区)收入构成

表:Coherent主要激光器生产基地

表:Coherent主要激光器产品及应用

图:2010-2015年IPG营业收入及毛利率

图:2012-2015年IPG(分地区)营收构成

图:2011-2015年IPG高功率激光器销售收入及占比

表:IPG产品线

图:2013-2015年IPG激光器应用结构

图:IPG光纤激光器核心竞争力

图:2011-2015年IPG中国区销售收入及占比

图:Rofine-Sinar全球布局

表:Rofine-Sinar发展历程

图:2010-2015财年Rofine-Sinar营业收入及毛利率

图:Rofine-Sinar主要客户

图:2012-2015财年Rofine-Sinar(分产品)营收构成

图:2012-2015年Rofine-Sinar(分地区)营收构成

图:Rofine-Sinar主要激光器产品

表:Rofine-Sinar激光器生产基地

图:2012-2015财年Rofine-Sinar激光器产品应用结构

图:2012-2015财年Rofine-Sinar中国区利润总额及占比

图:2015年Prima股权结构

图:普瑞玛业务部门

图:2010-2015年Prima营业收入及毛利率

图:2014年普瑞玛营业收入结构

图:2013-2015年Prima(分地区)营收构成

图:Prima Power主要客户

图:GSI全球布局

表:GSI激光产品线

图:Nufern主要产品线

图:NKT Phoyonics主要激光器产品

图:Fianium主要激光器应用情况

图:2014年Bystronic经营情况

图:大通激光主要工业激光器产品

图:2015年大族激光股权结构

图:大族激光全球布局

图:2007-2015年大族激光营业收入及毛利率

图:2013-2015年大族激光(分产品)营业收入构成

图:2013-2015年大族激光(分地区)营业收入构成

图:2006-2017年大族激光不同功率激光器收入构成

表:大族激光工业激光器产业链优势

表:2016年大族激光主要项目投资

图:2015年华工科技股权结构

图:华工科技全球布局

图:2007-2015年华工科技营业收入及毛利率

图:2012-2015年华工科技(分产品)营业收入构成

图:2007-2015华工科技海外业务收入及毛利率

图:华工科技业务布局

图:2015年大恒科技股权结构

图:2010-2015年大恒科技营业收入及毛利率

图:2013-2015年大恒科技(分产品)营业收入构成

图:2010-2015年大恒科技(分地区)营业收入构成

图:大恒科技激光设备销售网络

表:大恒科技激光器配套

图:2015年天弘激光股权结构

图:2012-2015年天弘激光营业收入及毛利率

图:2013-2015年天弘激光(分产品)营业收入构成

图:2014年天弘激光主要客户

图:2014年天弘激光主要供应商

图:2015年金运激光股权结构

图:金运激光全球布局

图:2007-2015年金运激光营业收入和毛利率

图:2013-2015年金运激光(分产品)营业收入构成

图:2013-2015年金运激光(分地区)营业收入构成

表:金运激光主要激光器产品应用

图:2015年新松股权结构

图:2007-2015年新松营业收入及毛利率

图:2012-2015年新松(分产品)营业收入构成

图:2014年新松(分地区)营业收入构成

图:新松激光业务格局

图:2015年创鑫激光股权结构

表:创鑫激光主要工业激光器产品及应用

图:2015年武汉锐科股权结构

表:武汉锐科激光器研发历程

图:2015年武汉光谷科威晶股权结构

图:2007-2015年武汉光谷科威晶激光器销量

表:中科中美激光器主要参数

图:西安中科梅曼主要客户

图:2014-2020年全球及中国工业激光器市场增速

表:全球主要工业激光器产品应用现状与发展趋势

图:2009-2020年中国工业激光器贸易逆差

图:2010-2016年全球主要工业激光器制造商毛利率

图:2016/2020年全球主要工业激光器市场份额

Structure of Laser

Performance Comparison of Gas Laser, Solid State Laser and Fiber Laser

Applicable Processing Technologies of Major Industrial Lasers

Classification of Industrial Laser

Industrial Laser Processing Industry Chain

Application Structure of Laser System Worldwide

Market Size of Global Laser System, 2011-2020E

Market Size and Growth of Global Laser Materials Processing and Lithography, 2011-2020E

Market Size and Growth of Global Industrial Laser, 2013-2020E

Sales Structure of Global Industrial Laser by Product, 2013-2020E

Sales Structure of Global Industrial Laser by Power, 2015/2020E

Applications of Global Industrial Laser, 2015

Sales and Growth of Material-processing Lasers Worldwide, 2013-2020E

Sales Structure of Material-processing Lasers Worldwide by Application, 2013-2020E

Sales Structure of Material-processing Lasers Worldwide by Product, 2013-2020E

Sales and Growth of Micromachining-used Lasers Worldwide, 2013-2020E

Sales Structure of Micromachining-used Lasers Worldwide by Application, 2013-2020E

Sales and Growth of Marking Machine-used Lasers Worldwide, 2013-2020E

Sales Structure of Marking Machine-used Lasers Worldwide by Product, 2013-2020E

R&D Investment in Industrial Laser of Global Major Players, 2014

Competitive Pattern of Global Industrial Laser Market, 2014

M&A Cases in Global Laser Industry, 2015

Related Policies in China Laser Industry

China Laser Industry Structure, 2015

Sales of Industrial Laser in China, 2013-2020E

Sales Volume and Growth of Industrial Laser in China, 2013-2020E

Application Structure of Industrial Laser in China, 2015

Sales Volume Structure of Industrial Laser in China by Product, 2015/2020E

Sales Structure of Industrial Laser in China by Product, 2015/2020E

Tariff of China Lasers, 2015

Export Volume and Amount of China Lasers, 2009-2015

Export Volume Structure of China Lasers by Region, 2015

Export Structure of China Laser Equipment, 2015

Import Volume and Amount of China Lasers, 2009-2015

Import Volume Structure of China Lasers by Region, 2015

Competitive Pattern of China Industrial Laser Market, 2015

Development Course of CO2 Laser

Sales and Growth of Global Industrial CO2 Lasers, 2011-2020E

Sales and Growth of China Industrial CO2 Lasers, 2011-2020E

Sales Volume and Growth of China Industrial CO2 Lasers, 2011-2020E

Applications of CO2 Laser

Value Chain of CO2 Laser

Structure of Solid State Laser

Sales and Growth of Global Industrial Solid State Lasers, 2011-2020E

Sales and Growth of China Industrial Solid State Lasers, 2011-2020E

Sales Volume and Growth of China Industrial Solid State Lasers, 2011-2020E

Value Chain of Diode Pump Solid State Laser

Structure of Fiber Laser

Development Course of Fiber Laser’s Power

Sales and Growth of Global Industrial Fiber Lasers, 2011-2020E

Sales and Growth of China Industrial Fiber Lasers, 2013-2020E

Sales Volume and Growth of China Industrial Fiber Lasers, 2013-2020E

Sales Volume Structure of Global Industrial Fiber Lasers by Region, 2015

Sales Volume Structure of China Industrial Fiber Lasers by Product, 2015

Value Chain of Fiber Laser

Competitive Pattern of Global Fiber Laser Market, 2015

Value Chain of Direct Diode Laser System

Components of Laser

Operating Rate of CO2 Facilities in China, 2015

CO2 Market Price Trend in China, 2014-2015

Sales and Growth of China Optical Fiber Industry, 2009-2016E

Major Fiber Manufacturers in China

Development Course of Laser Crystals Worldwide

Major YAG Laser Crystals Manufacturers Worldwide

Pumping Method of Lasers

Proportion of Laser Cost in Laser Equipment Worldwide, 2008-2014

Sales and Growth of Global Laser Equipment, 2011-2020E

Sales and Growth of China Laser Equipment, 2013-2020E

Major Laser Equipment Companies Worldwide

Competitive Pattern of Global Laser Equipment Market, 2014

Major Chinese Laser Equipment Companies

Competitive Pattern of China Laser Equipment Market, 2014

Major Medium and Small Power Laser Equipment Companies Worldwide

Application Characteristics of Laser Equipment in Various Industries

Market Structure of China Laser Machining Equipment, 2015/2020E

Market Size of China Laser Cutting Equipment, 2013-2020E

Market Share of China Large-power Cutting Equipment, 2015

Market Share of China Medium and Small-power Cutting Equipment, 2015

Market Size of China Laser Welding Equipment, 2013-2020E

Market Structure of China Laser Welding Equipment, 2015

Market Size of China Laser-Marking Equipment, 2013-2020E

Market Size of China Laser Engraving Equipment, 2013-2020E

Global Layout of TRUMPF

Sales and Growth of TRUMPF, FY2009-FY2015

Sales Structure of TRUMPF by Product, FY2015

Major Industrial Laser Products of TRUMPF

Major Clients of SPI

TRUMPF Layout in China

Revenue and Gross Margin of Coherent, FY2010-FY2015

Revenue Structure of Coherent by Product, FY2012-FY2015

Revenue Structure of Coherent by Region, FY2012-FY2015

Major Laser Production Bases of Coherent

Major Laser Products and Application of Coherent

Revenue and Gross Margin of IPG, 2010-2015

Revenue Structure of IPG by Region, 2012-2015

Revenue from High-Power Laser and its Proportion in Total of IPG, 2011-2015

IPG Product Portfolio

Laser Application Structure of IPG, 2013-2015

Core Competitiveness of IPG’s Fiber Laser

Revenue from China and its Proportion in Total of IPG, 2011-2015

Global Layout of Rofine-Sinar

Development Course of Rofine-Sinar

Revenue and Gross Margin of Rofine-Sinar, FY2010-FY2015

Major Clients of Rofine-Sinar

Revenue Structure of Rofine-Sinar by Product, FY2012-FY2015

Revenue Structure of Rofine-Sinar by Region, FY2012-FY2015

Major Laser Products of Rofine-Sinar

Laser Production Bases of Rofine-Sinar

Application Structure of Rofine-Sinar’s Laser Products, FY2012-FY2015

Total Profits from China and its Proportion of Rofine-Sinar, FY2012-FY2015

Equity Structure of Prima, 2015

Business Segments of Prima

Revenue and Gross Margin of Prima, 2010-2015

Revenue Structure of Prima, 2014

Revenue Structure of Prima by Region, 2013-2015

Major Clients of Prima Power

Global Layout of GSI

Laser Product Line of GSI

Major Product Lines of Nufern

Major Laser Products of NKT Phoyonics

Application of Major Lasers of Fianium

Operation of Bystronic, 2014

Major Industrial Laser Products of Access Laser

Equity Structure of Han’s Laser, 2015

Global Layout of Han’s Laser

Revenue and Gross Margin of Han’s Laser, 2007-2015

Revenue Structure of Han’s Laser by Product, 2013-2015

Revenue Structure of Han’s Laser by Region, 2013-2015

Revenue Structure of Han’s Laser by Power, 2006-2017E

Industry Chain Advantage of Han’s Laser’s Industrial Laser

Major Projects Investment of Han’s Laser, 2016

Equity Structure of Huagong Tech, 2015

Global Layout of Huagong Tech

Revenue and Gross Margin of Huagong Tech, 2007-2015

Revenue Structure of Huagong Tech by Product, 2012-2015

Revenue and Gross Margin of Huagong Tech’s Overseas Business, 2007-2015

Business Layout of Huagong Tech

Equity Structure of Daheng New Epoch Technology, 2015

Revenue and Gross Margin of Daheng New Epoch Technology, 2010-2015

Revenue Structure of Daheng New Epoch Technology by Product, 2013-2015

Revenue Structure of Daheng New Epoch Technology by Region, 2010-2015

Sales Network of Laser Equipment of Daheng New Epoch Technology

Laser Supporting of Daheng New Epoch Technology

Equity Structure of Tianhong Laser, 2015

Revenue and Gross Margin of Tianhong Laser, 2012-2015

Revenue Structure of Tianhong Laser by Product, 2013-2015

Major Clients of Tianhong Laser, 2014

Major Suppliers of Tianhong Laser, 2014

Equity Structure of Wuhan Golden Laser, 2015

Global Layout of Wuhan Golden Laser

Revenue and Gross Margin of Wuhan Golden Laser, 2007-2015

Revenue Structure of Wuhan Golden Laser by Product, 2013-2015

Revenue Structure of Wuhan Golden Laser by Region, 2013-2015

Laser Products Application of Wuhan Golden Laser

Equity Structure of Siasun, 2015

Revenue and Gross Margin of Siasun, 2007-2015

Revenue Structure of Siasun by Product, 2012-2015

Revenue Structure of Siasun by Region, 2014

Laser Business Pattern of Siasun

Equity Structure of Maxphotonics, 2015

Major Industrial Laser Products and Application of Maxphotonics

Equity Structure of Wuhan Raycus, 2015

Laser R & D Course of Wuhan Raycus

Equity Structure of Wuhan Co-Walking Laser, 2015

Sales Volume of Lasers of Wuhan Co-Walking Laser, 2007-2015

Major Parameters of ZKZM’s Laser

Major Clients of Xi’an Zhongke Meiman

Global and China Industrial Laser Market Growth, 2014-2020E

Major Industrial Laser Products Applications and Development Trend Worldwide

Industrial Laser Trade Deficit in China, 2009-2020E

Gross Margin of Major Industrial Laser Players Worldwide, 2010-2016

Market Share of Major Industrial Laser Worldwide, 2016/2020E

如果这份报告不能满足您的要求,我们还可以为您定制报告,请 留言说明您的详细需求。

|