|

报告导航:研究报告—

制造业—汽车

|

|

2016-2020年全球和中国混合动力汽车行业(Stop-Go,48V+BSG/ISG,HEV,PHEV)研究报告 |

|

字数:5.7万 |

页数:200 |

图表数:260 |

|

中文电子版:9000元 |

中文纸版:4500元 |

中文(电子+纸)版:9500元 |

|

英文电子版:2700美元 |

英文纸版:2900美元 |

英文(电子+纸)版:3000美元 |

|

编号:YS013

|

发布日期:2016-03 |

附件:下载 |

|

|

|

混合动力汽车是指采用传统燃料同时配以电动机和发动机,由电动机作为发动机的辅助动力,以改善低速动力输出和燃油消耗的车型。通过混合动力系统,可以减轻传统燃油车的油耗损失,降低整车油耗水平,起到节能减排的作用。

根据《乘用车燃料消耗量限值》(GB 19578)与《乘用车燃料消耗量评价方法及指标》(GB 27999)两项强制性国家标准修订稿,中国要求2015 年本土生产的乘用车平均燃料消耗量要降 6.9L/100km,2020 年要进一步降至 5.0L/100km。

此外,《乘用车企业平均燃料消耗量管理办法(草稿)》已经制定完成,草案中最重要的内容是企业平均燃料消耗量积分转结及交易制度,而且不达标企业将有巨额罚款。

全球范围内,欧盟2020年排放目标为3.8L/100km,美国和日本均为5L/100km,欧盟节能减排压力巨大,因此也对混合动力技术更加青睐。

市场上常见的混合动力系统,主要包括以下三种类型:

(1)12V+Stop-Start系统,作为混合动力车的入门技术(微混合动力),弱混汽车仅需在传统汽车上增加一套起停系统,在遇到红灯或交通堵塞的情况下能够停止发动机运行,只要重新踩下离合器发动机就会重新运转,能够减少 5%-15%的节能效果,减少 3%-6%的二氧化碳排放。

(2)48+ISG/BSG系统,2011年,由德国几个整车厂商联手推出了48V的概念,并制定了LV148标准。48V经过DC/DC转接器给12V供电,可改进原有的12V起停系统,并且48V在负载上可以进行扩展。48V是12V起停系统的一个升级,可以将燃油经济性提高到15%-20%,而与高压混合动力技术相比,成本不及其一半。

(3)强混合动力(PHEV和HEV),以应用最广泛的强混P2架构为例,是在电机和发动机之间通过离合器连接,电机与变速器也通过离合器连接,该系统可实现:怠速起停、制动能量回收、加速助力、纯电动行驶。

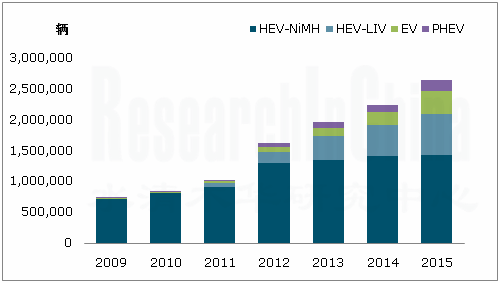

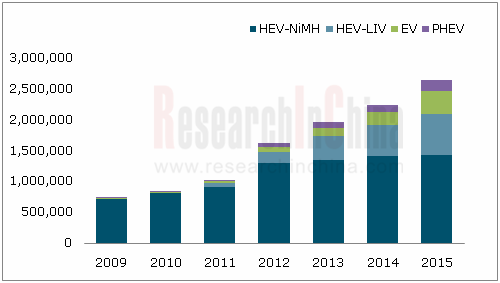

2015年全球电动乘用车(EV&PHEV)销量达54.9万辆,同比2014年增长67.4%,主要的增长点来自于中国和欧洲,尤其中国电动汽车市场出现井喷式增长。其中纯电动乘用车(EV)销量38.7万辆,插电式混合动力乘用车(PHEV)销量16.3万辆。除PHEV外,其他各混合动力细分市场发展情况如下:

(1)12V启停系统方面。最为积极的推进者是欧盟,2008年,欧洲仅有5%的新车装有起停系统,2014年,欧洲的汽车销售量为1255万辆,新车起停系统的装配率已超过了60%。预计2017前后这一市场将迎来爆发式增长,预计到2020年,全球新车搭载起停系统的销量将上升至3000万辆,占全球新车销量的27%左右。

(2)48V系统方面,全球范围内,2016年各大厂商的48伏系统会第一次进入量产,2020年会进一步提升产量。大陆集团预计到2025年,混合动力车的市场或将达到20%,其中50%都将搭载48V轻混系统。

(3)HEV市场方面,包括锂电池和镍氢电池版HEV车型在内,2014年全球销量超过190万辆,估计2015年达到205.6万辆。根据市场调查机构FOURIN 的数据,2014年普通混合动力(HEV)汽车生产厂商,丰田以118.3万辆遥遥领先,本田以27.98万辆位居第二,福特为87208辆,日产为84316辆,现代起亚为77473辆。

从未来各国发展趋势来看:

(1)欧洲将大规模推广主推12V起停系统和48V系统,逐渐将成为原装燃油汽车的标配,此外EV、PHEV和HEV也将得到适度发展;

(2)日本更加青睐HEV和燃料电池技术,EV和PHEV销量不振;

(3)美国则各种技术路线齐头并进,但同样受低油价影响,EV和PHEV销量不振,HEV受到青睐;

(4)中国将未来战略重心放在EV和PHEV上,而经济性更强的HEV也得到一定程度的鼓励,此外12V起停系统预装量也将逐年快速攀升,48V系统方面中国政府的态度尚不明确,未见整车厂商有这一技术路线的车型推出计划。

图:2009-2015年全球节能与电动汽车(EV/PHEV/HEV)销量

水清木华研究中心《2016-2020年全球和中国混合动力汽车行业(Stop-Go,48V+BSG/ISG,HEV,PHEV)研究报告》着重研究了以下内容:

混合动力汽车概述、分类方法、各技术路线的技术特点和应用; 混合动力汽车概述、分类方法、各技术路线的技术特点和应用;

全球和中国所制定的未来10年汽车节能减排的目标,行业补贴政策等; 全球和中国所制定的未来10年汽车节能减排的目标,行业补贴政策等;

混合动力汽车技术路线分析,各种架构的工作原理和应用案例,,混合动力汽车产业链及技术发展趋势; 混合动力汽车技术路线分析,各种架构的工作原理和应用案例,,混合动力汽车产业链及技术发展趋势;

全球混合动力汽车市场整体发展现状,主要分12V+起停微混系统、48V+BSG/ISG、强混合动力(HEV、PHEV)等几个主要细分市场,日本、美国、欧洲混合动力汽车市场发展现状和趋势; 全球混合动力汽车市场整体发展现状,主要分12V+起停微混系统、48V+BSG/ISG、强混合动力(HEV、PHEV)等几个主要细分市场,日本、美国、欧洲混合动力汽车市场发展现状和趋势;

中国混合动力汽车市场整体发展现状,各细分市场发展现状和趋势; 中国混合动力汽车市场整体发展现状,各细分市场发展现状和趋势;

全球和中国8家混合动力系统集成商在混合动力方面的经营情况、发展战略、产品和技术解决方案、客户、在华布局等; 全球和中国8家混合动力系统集成商在混合动力方面的经营情况、发展战略、产品和技术解决方案、客户、在华布局等;

全球和中国10家整车厂商在混合动力方面的经营情况、发展战略、产品和技术解决方案、客户、在华布局等。 全球和中国10家整车厂商在混合动力方面的经营情况、发展战略、产品和技术解决方案、客户、在华布局等。

Hybrid vehicles make use of traditional fuels while being accompanied by electric motors and engines. Electric motors function as the auxiliary power of engines to improve low-speed power output and fuel consumption. Hybrid system can reduce fuel loss of traditional fuel vehicles and level down fuel consumption so as to save energy and reduce emission.

According to the revised versions of the mandatory national standards -- Passenger Car Fuel Consumption Limits (GB 19578) and Passenger Car Fuel Consumption Evaluation Methods and Indicators (GB 27999), China requires that the average fuel consumption of passenger cars produced locally in 2015 should drop to 6.9L / 100km, and further to 5.0L / 100km by 2020.

In addition, Management Measures for Average Fuel Consumption of Passenger Car Companies (Draft)" has been stipulated, in which the most important content is concerned about the average fuel consumption credit and trading system of enterprises as well as hefty fines on non-compliance companies.

Globally, the EU's 2020 emission goal is 3.8L / 100km, while the United States and Japan target 5L / 100km.The EU undertakes enormous pressure on energy saving and emission reduction, thus it prefers hybrid technology.

On the market, there are three types of common hybrid system:

(1) 12V + Stop-Start System (Micro Hybrid) acts as the entry technology of hybrid vehicles. Micro hybrid vehicles can be accomplished only by adding a set of start-stop system to traditional cars, so that engines can stop running in the case of a red light or traffic congestion and resume working as long as clutches are stamped again. By this means, 5%-15% of energy can be saved and 3%-6% of carbon dioxide emissions can be reduced.

(2) 48 + ISG / BSG System. In 2011, several German automakers jointly launched the concept of 48Vsystem, and constituted LV148 standards. 48V system supplies power to 12V system via DC / DC adapters so as to improve the existing 12V start-stop system. As an upgraded version of 12V start-stop system, 48V system supports extended load, enhances the fuel economy to 15%-20%, and only requires less than half of the costs of high-voltage hybrid technology.

(3) Full Hybrid (PHEV and HEV). The most widely used full hybrid P2 structure, for instance, connects motors and engines by clutches as well as links motors with transmissions through clutches as well. The system can enable idle speed start-stop, brake energy recovery, acceleration boost and battery electric driving.

In 2015, the global sales volume of electric passenger vehicles (EV & PHEV) soared 67.4% year on year to 549,000, mainly thanks to the growth in China and Europe, especially the radical growth in Chinese electric vehicle market. Specifically, 387,000 battery electric vehicles (BEV) and 163,000 plug-in hybrid electric vehicles (PHEV) were sold. Except PHEV, the development of hybrid market segments is shown as follows:

(1) 12V Start-Stop System. The most active promoter is the EU. Only 5% of new cars in Europe were equipped with start-stop system in 2008, while the proportion jumped to over 60% in 2014 when 12.55 million new cars were sold herein. This market will see explosive growth in 2017. By 2020, the global sales volume of new cars equipped with start-stop system will rise to 30 million, accounting for around 27% of the global new car sales.

(2) 48V System. Worldwide, major manufacturers will conduct the first mass production of 48V system in 2016 and will further raise the output in 2020. Continental AG predicts that the market share of hybrid vehicles will reach 20%, of which 50% will be powered by 48V micro hybrid system.

(3) HEV Market. In 2014, more than 1.9 million HEVs (including lithium battery HEVs and NiMH battery HEVs) were marketed globally; the figure was estimated at 2.056 million in 2015. According to the data of the market research agency FOURIN, Toyota became a HEV champion with the sales volume of 1.183 million in 2014, followed by Honda with 279,800, Ford with 87,208, Nissan with 84,316, and Hyundai Kia with 77,473.

The future development trends vary with countries:

(1) Europe will promote 12V start-stop system and 48V system aggressively, which will gradually become the standard configuration of original fuel vehicles. In addition, EV, PHEV and HEV will witness moderate development in Europe;

(2) Japan will prefer HEV and fuel cell technology, while the sales volume of EV and PHEV will remain at a low level;

(3) The United States are developinga variety of technologies simultaneously, but low oil prices will drag down the sales volume of EV and PHEV, whereas HEV will be favored;

(4) China will focus on EV and PHEV, and encourage more economical HEV. The pre-installation of 12V start-stop system will escalate fast. As for 48V system, Chinese government's attitude is ambiguous, and no vehicle manufacturers have made plans for the vehicle models involved with this technology.

Global Sales Volume of Energy-saving and Electric Vehicles (EV/PHEV/HEV), 2009-2015

Global and China Hybrid Vehicle Industry (Stop-Go, 48V + BSG / ISG, HEV, PHEV) Research Report 2016-2020 by ResearchInChina focuses on the followings:

Overview, classification, characteristics and applications of hybrid vehicle technology; Overview, classification, characteristics and applications of hybrid vehicle technology;

Global and China’s goals for automotive energy conservation and emission reduction, industrial subsidy policies and other aspects in the next decade; Global and China’s goals for automotive energy conservation and emission reduction, industrial subsidy policies and other aspects in the next decade;

Analysis on hybrid vehicle technology, working principles and applications of various structures, hybrid vehicle industry chain and development trends of technology; Analysis on hybrid vehicle technology, working principles and applications of various structures, hybrid vehicle industry chain and development trends of technology;

Status quo and market segments (embracing 12V + start-stop micro hybrid system, 48V + BSG / ISG, full hybrid (HEV, PHEV), etc. ) of global hybrid vehicle market; development and trends ofthe hybrid vehicle market in Japan, the United States and Europe; Status quo and market segments (embracing 12V + start-stop micro hybrid system, 48V + BSG / ISG, full hybrid (HEV, PHEV), etc. ) of global hybrid vehicle market; development and trends ofthe hybrid vehicle market in Japan, the United States and Europe;

Status quo of Chinese hybrid vehicle market, as well as development and trends of market segments; Status quo of Chinese hybrid vehicle market, as well as development and trends of market segments;

Hybrid operation, development strategies, products and technology solutions, customers and layout in China of 8 global and Chinese hybrid system integrators; Hybrid operation, development strategies, products and technology solutions, customers and layout in China of 8 global and Chinese hybrid system integrators;

Hybrid operation, development strategies, products and technology solutions, customers and layout in China of 10 global and Chinese vehicle manufacturers. Hybrid operation, development strategies, products and technology solutions, customers and layout in China of 10 global and Chinese vehicle manufacturers.

第一章 混合动力汽车介绍

1.1 混合动力汽车简介

1.2 混合动力汽车分类

第二章 行业政策背景

2.1 能源供应

2.2 汽车排放标准

2.3 电动汽车补贴政策

2.3.1 购置税减免政策

2.3.2 购置环节财政补贴政策

2.3.3 使用环节财政补贴政策

2.3.4 产业推广政策

第三章 混合动力汽车技术路线分析

3.1 混合动力系统(按动力结构)

3.1.1 串联式混合动力Series Hybrid Electric Vehicle (SHEV)

3.1.2 并联式混合动力 Parallel Hybrid Electric Vehicle (PHEV)

3.1.3 混联式混合动力 Power-Split Hybrid Electric Vehicle (PSHEV)

3.2 混合动力系统(按驱动电机功率比例)

3.2.1 微混(汽车起停系统12V)

3.2.2 轻混(48V系统)

3.2.3 中混(ISG架构)

3.2.4 强混(HEV、PHEV)

3.2.5 总结

3.3 混合动力汽车产业链技术路线

3.3.1 电池

3.3.2 电驱动系统

3.3.3 电机控制器

3.3.4 变速器

3.3.5 混合动力系统控制策略

3.4 混合动力技术发展趋势

第四章 全球混合动力汽车市场

4.1 电动汽车整体市场

4.2 微混市场(汽车起停系统12V)

4.3 轻/中混市场(48V+BSG/ISG系统)

4.4 强混市场(HEV、PHEV 150V+)

4.5 总结

4.6 主要国家或地区混合动力汽车市场

4.6.1 日本

4.6.2 美国

4.6.3 欧洲

第五章 中国混合动力汽车市场

5.1 电动汽车整体市场

5.1.1 整体市场

5.1.2 电动乘用车

5.1.3电 动商用车

5.2 微混市场(汽车起停系统12V)

5.3 轻/中混市场(48V+BSG/ISG系统)

5.4 强混市场(HEV、PHEV 150V+)

第六章 全球和中国混合动力系统供应商

6.1 Johnson Controls

6.1.1 公司简介

6.1.2 基本经营情况

6.1.3 混合动力业务战略

6.1.4 混合动力产品和技术方案

6.1.5 混合动力业务客户分析

6.1.6 在华新能源布局

6.2 大陆集团

6.2.1公司简介

6.2.2 基本经营情况

6.2.3 混合动力业务战略

6.2.4 混合动力产品和技术方案

6.2.5 在华新能源布局

6.3 德尔福

6.3.1 公司简介

6.3.2 基本经营情况

6.3.3 混合动力业务战略

6.3.4 混合动力产品和技术方案

6.3.5 在华新能源布局

6.4 博世

6.4.1 公司简介

6.4.2 运营情况

6.4.3 混合动力业务战略

6.4.4 混合动力产品和技术方案

6.4.5 在华新能源布局

6.5 舍弗勒

6.5.1 公司简介

6.5.2 运营情况

6.5.3 混合动力业务战略

6.5.4 混合动力产品和技术方案

6.5.5 在华新能源布局

6.6 法雷奥

6.6.1 公司简介

6.6.2 运营情况

6.6.3 混合动力业务战略

6.6.4 混合动力产品和技术方案

6.6.5 在华新能源布局

6.7 吉凯恩

6.7.1 公司简介

6.7.2 运营情况

6.7.3 混合动力业务战略

6.7.4 混合动力产品和技术方案

6.7.5 华布局

6.8 科力远

6.8.1 公司简介

6.8.2 镍氢电池业务

6.8.3 混合动力业务战略

6.8.4 混合动力产品和技术方案

第七章 全球和中国混合动力汽车制造商

7.1 丰田汽车

7.1.1 公司简介

7.1.2 经营分析

7.1.3 混合动力业务战略

7.1.4 混合动力技术

7.1.5 在华新能源布局

7.2 大众汽车

7.2.1 公司简介

7.2.2 混合动力技术

7.2.3 在华新能源布局

7.3 通用汽车

7.3.1 公司简介

7.3.2 混合动力技术

7.3.3 在华新能源布局

7.4 三菱汽车

7.4.1 公司简介

7.4.2 混合动力技术

7.4.3 在华新能源布局

7.5 沃尔沃汽车

7.5.1 公司简介

7.5.2 混合动力技术

7.5.3 在华新能源布局

7.6 宝马汽车

7.6.1 公司简介

7.6.2 混合动力技术

7.6.3 在华新能源布局

7.7 比亚迪

7.7.1 公司简介

7.7.2 经营分析

7.7.3 混合动力业务战略

7.7.4 混合动力技术

7.8 吉利汽车

7.8.1 公司简介

7.8.2 经营情况

7.8.3 混合动力业务战略

7.8.4 混合动力技术

7.9 上汽集团

7.9.1 公司简介

7.9.2 经营分析

7.9.3 混合动力业务战略

7.9.4 混合动力技术

7.10 广汽集团

7.10.1 公司简介

7.10.2 经营情况

7.10.3 混合动力业务战略

7.10.4 混合动力技术

1 Overview of Hybrid Vehicles

1.1 Introduction

1.2 Classification

2 Policy

2.1 Energy Supply

2.2 Vehicle Emission Standards

2.3 Electric Vehicle Subsidies

2.3.1 Purchase Tax Relief

2.3.2 Financial Subsidies for Purchase

2.3.3 Financial Subsidies for Use

2.3.4 Industrial Promotion Policy

3 Hybrid Vehicle Technology Roadmap

3.1 Hybrid System (by Power Structure)

3.1.1 Series Hybrid Electric Vehicle (SHEV)

3.1.2 Parallel Hybrid Electric Vehicle (PHEV)

3.1.3 Power-Split Hybrid Electric Vehicle (PSHEV)

3.2 HybridSystem (by Drive Motor Power Ratio)

3.2.1 Micro Hybrid (12V Start-Stop System)

3.2.2 Light Hybrid (48V System)

3.2.3 Moderate Hybrid (ISG Structure)

3.2.4 Full Hybrid (HEV, PHEV)

3.2.5 Summary

3.3 Technology Roadmap of Hybrid Vehicle Industry Chain

3.3.1 Battery

3.3.2 Electric Drive System

3.3.3 Motor Controller

3.3.4 Transmission

3.3.5 Hybrid System Control Strategy

3.4 Development Trend of Hybrid Technology

4 Global Hybrid Vehicle Market

4.1 Overall Electric Vehicle Market

4.2 Micro Hybrid Market (12V Start-Stop System)

4.3 Light /Moderate Hybrid Market (48V+BSG/ISG System)

4.4 Full Hybrid Market (HEV, PHEV 150V+)

4.5 Summary

4.6 Hybrid Vehicle Market in Main Countries or Regions

4.6.1 Japan

4.6.2 USA

4.6.3 Europe

5 Chinese Hybrid Vehicle Market

5.1 Overall Electric Vehicle Market

5.1.1 Overview

5.1.2 Electric Passenger Vehicle

5.1.3 Electric Commercial Vehicle

5.2 Micro Hybrid Market (12V Start-Stop System)

5.3 Light/Moderate Hybrid Market(48V+BSG/ISGSystem)

5.4 Full HybridMarket (HEV, PHEV 150V+)

6 Global and Chinese Hybrid System Suppliers

6.1 Johnson Controls

6.1.1 Profile

6.1.2 Operation

6.1.3 Hybrid Business Strategy

6.1.4 Hybrid Products and Technical Solutions

6.1.5 Hybrid Customers

6.1.6 New Energy Layout in China

6.2 Continental AG

6.2.1 Profile

6.2.2 Operation

6.2.3 Hybrid Business Strategy

6.2.4 Hybrid Products and Technical Solutions

6.2.5 New Energy Layout in China

6.3 Delphi

6.3.1 Profile

6.3.2 Operation

6.3.3 Hybrid Business Strategy

6.3.4 Hybrid Products and Technical Solutions

6.3.5 New Energy Layout in China

6.4 Bosch

6.4.1 Profile

6.4.2 Operation

6.4.3 Hybrid Business Strategy

6.4.4 Hybrid Products and Technical Solutions

6.4.5 New Energy Layout in China

6.5 Schaeffler

6.5.1 Profile

6.5.2 Operation

6.5.3 Hybrid Business Strategy

6.5.4 Hybrid Products and Technical Solutions

6.5.5 New Energy Layout in China

6.6 Valeo

6.6.1 Profile

6.6.2 Operation

6.6.3 Hybrid Business Strategy

6.6.4 Hybrid Products and Technical Solutions

6.6.5 New Energy Layout in China

6.7 GKN

6.7.1 Profile

6.7.2 Operation

6.7.3 Hybrid Business Strategy

6.7.4 Hybrid Products and Technical Solutions

6.7.5 Layout in China

6.8 Corun

6.8.1 Profile

6.8.2 NiMH Battery Business

6.8.3 Hybrid Business Strategy

6.8.4 Hybrid Products and Technical Solutions

7 Global and Chinese Hybrid Vehicle Manufacturers

7.1 Toyota

7.1.1 Profile

7.1.2 Operation

7.1.3 Hybrid Business Strategy

7.1.4 Hybrid Technology

7.1.5 New Energy Layout in China

7.2 Volkswagen

7.2.1 Profile

7.2.2 Hybrid Technology

7.2.3 New Energy Layout in China

7.3 General Motors

7.3.1 Profile

7.3.2 Hybrid Technology

7.3.3 New Energy Layout in China

7.4 Mitsubishi Motors

7.4.1 Profile

7.4.2 Hybrid Technology

7.4.3 New Energy Layout in China

7.5 Volvo Cars

7.5.1 Profile

7.5.2 Hybrid Technology

7.5.3 New Energy Layout in China

7.6 BMW

7.6.1 Profile

7.6.2 Hybrid Technology

7.6.3 New Energy Layout in China

7.7 BYD

7.7.1 Profile

7.7.2 Operation

7.7.3 Hybrid Business Strategy

7.7.3 Hybrid Technology

7.8 Geely

7.8.1 Profile

7.8.2 Operation

7.8.4 Hybrid Business Strategy

7.8.3 Hybrid Technology

7.9 SAIC

7.9.1 Profile

7.9.2 Operation

7.9.3 Hybrid Business Strategy

7.9.4 Hybrid Technology

7.10 GAC

7.10.1 Profile

7.10.2 Operation

7.10.3 Hybrid Business Strategy

7.10.4 Hybrid Technology

图:油电混合动力汽车工作原理

图:低速-中速行驶时油电混合动力汽车工作原理图

图:一般行驶时油电混合动力汽车工作原理图

图:全速前进时油电混合动力汽车工作原理图

图:减速、能量再生时油电混合动力汽车工作原理图

图:停车时油电混合动力汽车工作原理图

图:混合动力汽车分类

图:三种混合动力系统结构对比

表:三种混动动力系统性能比较

图:2010-2014 年中国石油消费量

图:传统燃油车油耗损失比例

表:2015-2025年全球主要国家/地区乘用车燃料消耗量标准对比

图:2010-2020年中国乘用车平均油耗法规趋势

图:2011-2025年全球主要国家乘用车油耗或CO2排放法规(含预测数据)

图:《中国制造2025》节能汽车重点产品

图:节能减排技术节油率对比

图:汽车电气化程度不断提升

图:汽车低压电气化将面临重大发展机遇

图:汽车节能减排技术路线性价比分析

图:工信部前三批免购置税目录车型统计

表:2009-2012年十米以上城市公交客车示范推广补助标准(单位:万元/辆)

表:2009-2012年公共服务用乘用车和轻型商用车示范推广补助标准(单位:万元/辆)

表:2013-2015年中国电动乘用车补贴标准

表:2013-2015年中国电动客车补贴标准

表:2016年中国纯电动乘用车、插电式混合动力(含增程式)乘用车补助标准

表:2016年中国纯电动、插电式混合动力等客车补助标准

表:2016年中国燃料电池汽车推广应用补助标准

表:中国新能源汽车纯电动续驶里程要求

表:2013-2019年电动乘用车中央财政补贴

表:2013-2019年新能源客车、货车中央财政补贴

表:节能与新能源公交车运营补助标准(2015-2019年)

表:2013-2015中国城市(群)电动汽车推广计划及完成进度

图:2014-2015年中国电动汽车推广计划(公共交通和私人消费)

表:2014年全年中国城市(群)电动汽车推广数量

图:串联式混合动力系统结构图

图:增程式和插电式混合动力系统对比

图:并联式混合动力系统结构图

图:并联式混合动力系统技术方案(P0-P4)

图:并联式混合动力系统—P2系统原理和系统边界

图:混联式混合动力系统结构图

图:混合动力系统演进过程

图:Start–Stop、BSG、ISG三种架构系统结构对比

图:分离式起动机/发电机起停系统结构图

图:博世分离式起动机/发电机起停系统解决方案

图:集成起动机/发电机起停系统结构图

图:法雷奥i-Start系统工作原理图

图:Mazda SISS智能起停系统

图:Mazda SISS智能起停系统工作原理图

图:12V系统升级为48V系统原理图

图:12V架构和48V架构

图:48V ISG 功能框图(微/中混)

图:48V BSG 功能框图(微/中混)

图:48V系统全球核心参与者

图:中混ISG电机架构示意图

图:强混P2系统架构

图:插电式强混P2系统架构

表:燃油车、混合动力、插电式混动汽车技术性能参数对比

表:12V,48V,强混,插电等各系统解决方案成本对比

图:混合动力汽车主要部件

图:汽车储能电池技术

图:汽车起停电池技术

图:锂电池成本结构

图:2011-2018年中国磷酸铁锂电池价格趋势

图:全球电动汽车动力锂电池价格趋势

图:2014年中国锂电池分应用领域份额

图:2010-2018年全球锂电池(分需求)出货量

Market Share of Global Small Lithium Battery Companies, 2014

图:2014年全球电动乘用车配套电池厂商份额

图:2015年各车型产量及电池产量

图:2015年上半年主力电池厂商市场份额

图:2015年上半年主力电池厂商出货量(MWh)

图:2014年全球镍氢电池主要应用领域市场份额

图:2010-2015年全球小型镍氢电池市场出货量和规模

图:2010-2015年全球大型(HEV用)镍氢电池市场出货量和规模

图:混合动力汽车电驱动系统工作原理图

EVALUATION MATRIX FOR DIFFERENT E-MOTOR TECHNOLOGIES

图:丰田普锐斯的动力分配单元

图:丰田汽车三代THS单行星排结构

图:通用Volt电驱动系统结构

图:福特行星机构动力总成

图:吉利强混合动力系统

图:本田汽车单轴并联核心总成技术

图:长安汽车PII-双离合器单轴并联系统

图:奔驰S500eL 插电混动(7挡自动箱+Emotor)

图:BMW 530Le(2.0T+8AT+E-motor)

图:比亚迪“秦”功率分流结构

图:上汽EDU gen1电驱动变速箱系统结构

图:上汽EDU gen1电驱动系统结构及EDU参数

图:本田飞度(1.3T+6DCT)

图:轴间耦合式电驱动系统结构示意图

图:沃尔沃S60L Plugin轴间耦合式电驱动系统

图:宝马I8插电混动轴间耦合式电驱动系统

图:不同类型混合动力系统电压等级

图:各整车厂混合动力汽车选用的变速器

图:某中度混合动力系统控制示意图

表:2013-2015年全球电动乘用车销量对比(主要国家或地区)

图:2014-2015年全球新能源车(EV&PHEV)月度销量

表:2013-2015年全球前20大电动乘用车销量对比

图:2011-2020年全球电动乘用车(EV&PHEV)销量

图:2014-2020年全球原装搭载起停系统的新车销量

表:全球整车厂商起停系统推广计划

图:全球12V起停系统、 48V系统装配车型的销售预测(2018/2020/2025年)

表:2010-2015年1-10月全球主要在售插电式混合动力乘用车销量

图:2009-2015年全球节能与电动汽车(EV/PHEV/HEV)销量

图:全球分系统电压 HEV/PHEV/EV销量预测(2018/2020/2025年)

表:全球分地区电动汽车技术政策动向,市场份额预期

表:2013-2015年日本EV、PHEV销量

表:2013-2015年日本HEV销量

图:2013-2015年美国EV、PHEV销量

图:2011-2015年美国HEV销量

表:2015年美国新能源汽车(EV&PHEV)销量排名(分车型)

图:2014-2020年欧洲汽车起停系统(前装+后装)出货量

图:2014-2020年欧洲原装搭载起停系统的汽车销量

图:2013-2015年欧洲EV、PHEV销量

图:2013-2015年欧洲HEV销量

表:2015年欧洲新能源汽车(EV&PHEV)销量排名(分车型)

图:2010-2018年中国汽车保有量与产销量

图:2010-2015中国电动汽车产销量

表:2015年1-12月中国电动汽车(EV&PHEV)产量

图:2011-2020年中国电动汽车(EV&PHEV)销量

图:2012-2020年中国普通混合动力汽车(HEV)销量

图:2011-2020年中国电动乘用车(EV&PHEV)销量

表:2015年1-12月中国电动乘用车(EV、PHEV)销量

图:2015年1-12月中国电动商用车产量

图:2014-2015年中国电动汽车推广计划

图:2015年1-12月中国电动客车产量

图:2015年1-12月中国纯电动货车产量

图:2011-2020年中国电动商用车(EV&PHEV)销量

图:2013-2018年中国前装汽车起停电池系统出货量及渗透率

图:中国装载起停电池汽车品牌比例

图:2013-2018年中国汽车起停用铅酸电池市场规模

表:比亚迪唐、宝马X5、沃尔沃SC90三款插电式混动车型性能参数对比

表:中国整车厂商混合动力汽车发展规划

图:2015.1—2015.12丰田四款混合动力车型(国产)销量

表:2015年1-12月中国节能与电动乘用车(EV、PHEV、HEV)进口量

图:2012-2020年中国强混合动力汽车(HEV、PHEV)销量

图:2011-2015年江森自控主要财务指标

表:FY2013-2015江森自控各部门营业收入

图:江森自控汽车起停电池性能参数及技术方案

图:江森自控微混汽车电池性能参数及技术方案

图:江森自控混合动力汽车高压电池系统性能参数与技术方案

图:江森自控插电式混合动力及纯电动车电池系统性能参数与技术方案

图:江森自控在华汽车AGM铅酸电池工厂

表:江森自控电池业务在华分布及产能

图:2011-2015年大陆集团主要财务指标

表:FY2014大陆集团各部门营业收入

图:大陆集团48V轻混系统构成

图:大陆三种48V系统技术对比

图:大陆集团BSG(发电启动一体化)电机性能参数

图:大陆集团48V系统及高压系统

图:大陆集团起停、48V+BSG、HEV+BSG系统预期节油率对比

图:大陆集团第三代驱动电机

图:2011-2015年德尔福主要财务指标

表:FY2013-FY2015德尔福各部门营业收入

图:德尔福混合动力汽车全球设计中心

图:德尔福混合动力汽车全球研发和制造中心

图:德尔福电动汽车产品和系统组合

图:德尔福高压连接器

图:德尔福高压/屏蔽线束总成

图:德尔福高压电气控制中心

图:德尔福无线充电系统

图:德尔福集成式48伏微混动力控制器

图:德尔福高压逆变器

图:德尔福便携式车载充电器

图:德尔福交流充电插座

图:德尔福直流充电插座

图:德尔福GDi发动机管理系统

图:2011-2015年Bosch主要财务指标

图:FY2012-FY2014年Bosch各部门营收占比

图:博世-PSA液压混合动力总成系统结构图

图:博世固态锂电池与液态锂电池对比

图:博世seo固态锂电池单体和模组

图:下一代电池技术厂商竞争矩阵

图:2011-2015年舍弗勒主要财务指标

图:FY2013-FY2015年舍弗勒各部门营收占比

图:舍弗勒P2混合动力系统结构

图:舍弗勒P2混合动力系统实物图

图:舍弗勒两档低压电桥:同轴式设计

图:2011-2015年法雷奥主要财务指标

图:法雷奥改进燃油经济性的五个主要产品线

图:法雷奥12V i-StARS起停系统主要零部件

图:法雷奥i-BSG混合动力系统

图:法雷奥48V轻混合动力系统主要零部件

图:法雷奥的混合动力技术路线

图:法雷奥在中国生产的混合动力总成系统部件

图:2011-2015年吉凯恩主要财务指标

图:GKN“eAxles”混合动力传动系统

图:科力美汽车动力电池有限公司股权图

图:科力远混合动力汽车动力技术有限公司股权图

表:1997-2015年丰田混合动力汽车销量

图:第一、二、三代普锐斯混合动力技术特点

图:丰田2.4L前置后驱车用混合动力变速器L210

表:各代普锐斯动力系统参数

表:普锐斯 THS-II 混动系统结构

表:普锐斯 THS-II 混动系统动力分配单元

图:丰田混联式混合动力系统工作原理图

图:丰田混合动力系统镍氢电池组

图:丰田混合动力系统驱动电机

图:丰田混合动力系统再生制动器

图:丰田混合动力系统动力控制单元

图:丰田混合动力系统汽油发动机

图:丰田混合动力系统动力分离装置

图:丰田混合动力系统动力发电机

图:丰田混合动力系统动力电子控制系统

图:丰田(中国)上市的燃油车和混合动力汽车价格对比

图:2015.1—2015.12丰田四款混合动力车型(国产)销量

图:高尔夫GTE PHEV采用了P2混动系统

图:高尔夫GTE PHEV动力总成

图:高尔夫GTE PHEV油电混合模块结构图

图:高尔夫GTE PHEV整车结构图

图:奥迪A3 etron混合动力系统结构图

图:奥迪A3 etron混合动力系统主要部件

图:奥迪A3 etron动力系统主要部件

图:A6Le-tron插电式混合动力汽车

图:大众C Coupe GTE插电式混合动力汽车

图:通用凯迪拉克CT6插电式混动系统结构图

图:通用凯迪拉克CT6插电式混动e-CVT变速箱

图:通用凯迪拉克CT6插电式混动电池模块单元

图:通用Volt插电式混动系统结构图

图:2016款通用Voltec动力总成系统结构图

图:通用Volt动力分配系统结构图

图:通用Voltec和丰田THS混合动力系统动力分配机构对比图

图:2016款沃蓝达Voltex电力驱动桥结构图

图:通用Voltec混合动力系统工作原理图

图:2016款沃蓝达核心零部件供应商及产地

图:欧蓝德插电式混动系统结构图

图:欧蓝德动力系统结构图

图:沃尔沃T8混合动力总成结构图

图:沃尔沃SX60 T8混动与奔驰GLC 350e混动技术对比

图:宝马ActiveHybrid技术

图:宝马IMA混合动力总成结构图

图:宝马5系动力电池位于汽车尾部

图:宝马i8 插电式混合动力系统结构图

图:2010-2015年比亚迪汽车产销量

图:2007-2015年比亚迪营业收入,净利润和毛利率

图:比亚迪“秦”DM二代混合动力系统结构图

图:比亚迪“秦”发动机舱布局

表:比亚迪秦和丰田普锐斯纯电动续航里程和油耗对比

图:比亚迪“秦”插电式混合动力系统结构图

图:比亚迪“唐”电驱动系统结构图

图:比亚迪“唐”前桥驱动单元结构图

图:比亚迪“唐”电池系统位于底盘中部

图:比亚迪“唐”后桥电驱动单元结构图

表:2010-2015年吉利集团汽车产销量

图:2009-2014年吉利集团营业收入及净利润

图:2010-2015年上汽集团汽车产销量

图:2010-2014年上汽集团营业收入及净利润

图:上汽“荣威e550”插电式混合动力系统结构图

图:上汽荣威550plugin动力总成结构

图:上汽自主研发的Gen 1 EDU电驱动变速箱原理图

图:上汽自主研发的Gen 1 EDU电驱动变速箱系统结构图

图:上汽EDU电驱动变速箱综合性能参数

图:上汽荣威550plugin发动机、ISG电机、TM电机工作原理和性能参数

图:上汽荣威550Plugin动力控制单元

图:上汽荣威550Plugin动力系统主要零部件

图:上汽荣威550Plugin主要零部件供应商

图:2010-2015年广汽集团汽车产销量

图:2011-2015年广汽集团营业收入及净利润

图:广汽集团新能源汽车产品阵容

Operating Principle of HEV

Operating Principle Diagram of HEV at Low and Moderate Speed

Operating Principle Diagram of HEV at General Speed

Operating Principle Diagram of HEV at Full Speed

Operating Principle Diagram of HEV While Slowdown/Energy Regeneration

Operating Principle Diagram of HEV While Parking

Classification of Hybrid Vehicles

Structure Comparison of Three Hybrid Power Systems

Performance Comparison of Three Hybrid Power Systems

China’s Oil Consumption, 2010-2014

Fuel Consumption Loss Ratio of Traditional Fuel Vehicles

Standards for Fuel Consumption of Passenger Vehicle in the World’s Major Countries/Regions, 2015-2025E

Trend of Laws and Regulations on Average Fuel Consumption of Passenger Vehicle in China, 2010-2020E

Laws and Regulations on Fuel Consumption or CO2 Emission of Passenger Vehicle in the World’s Major Countries/Regions (including Estimates), 2011-2025E

Major Fuel-efficient Vehicles in Made in China 2025

Rate of Fuel Saving of Energy-saving and Emission Reduction Technologies

Constant Improvement in Vehicle Electrification

Major Development Opportunity for Vehicle Low-voltage Electrification

Price/Performance Ratio of Vehicle Energy-saving and Emission Reduction Technology Roadmap

Models on the Catalogues of First Three Batches of New Energy Vehicles Exempt from Purchase Tax

Standard of Subsidies for 10m-above Urban Public Bus Demonstration & Promotion, 2009-2012 (RMB10k/Vehicle)

Standard of Subsidies for Public Service-oriented Passenger Vehicle and Light Commercial Vehicle Demonstration & Promotion, 2009-2012 (RMB10k/Vehicle)

Standard of Subsidies for Electric Passenger Vehicle in China, 2013-2015

Standard of Subsidies for Electric Bus in China, 2013-2015

Standard of Subsidies for Battery Electric Passenger Vehicle and Plug-in Hybrid (including Range-extended) Passenger Vehicle, 2016

Standard of Subsidies for Battery Electric/Plug-in Hybrid Bus, 2016

Standard of Subsidies for Fuel-cell Vehicle Promotion & Application, 2016

Requirements on Electric Mileage of New Energy Vehicle in China

Central Financial Subsidies for Electric Passenger Vehicle in China, 2013-2019E

Central Financial Subsidies for New Energy Bus and Truck, 2013-2019E

Standard of Subsidies for Energy-saving and New Energy Public Bus Operation, 2015-2019E

Electric Vehicle Promotion Plans and Progress of Chinese Cities (Clusters), 2013-2015

Electric Vehicle Promotion Plans in China (Public Transport & Private Consumption), 2014-2015

Number of Electric Vehicles under Promotion Plans in Chinese Cities (Clusters), 2014

Structural Diagram of Series Hybrid System

Comparison of Range-extended and Plug-in Hybrid Systems

Structural Diagram of Parallel Hybrid System

Technical Solutions for Parallel Hybrid System (P0-P4)

Parallel Hybrid System- P2 System Principle and Boundary

Structural Diagram of Series-Parallel Hybrid System

Evolution of Hybrid System

Structure Comparison of Start–Stop, BSG, and ISG

Structural Diagram of Separated Starter/Generator Start-Stop System

Bosch Separated Starter/Generator Start-Stop System Solutions

Structural Diagram of Integrated Starter/Generator Start-Stop System

Operating Principle Diagram of Valeo i-Start System

Mazda SISS Smart Start-Stop System

Operating Principle Diagram of Mazda SISS Smart Start-Stop System

Schematic Diagram of 12V System Upgraded to 48V System

12V Architecture and 48V Architecture

Functional Block Diagram of 48V ISG (Micro/Mild Hybrid)

Functional Block Diagram of 48V BSG (Micro/Mild Hybrid)

Global Core Participants in 48V System

Diagram of Mild-hybrid ISG Motor Architecture

Full-hybrid P2 System Architecture

Plug-in Full-hybrid P2 System Architecture

Technical Performance Parameters of Fuel/Hybrid/Plug-in Hybrid Vehicles

Costs of 12V/48V/Full Hybrid/Plug-in System Solutions

Main Parts of Hybrid Vehicle

Automotive Energy Storage Battery Technology

Automotive Start-Stop Battery Technology

Cost Structure of Lithium Battery

Price Trend of LiFePO4 Battery in China, 2011-2018E

Global Price Trend of EV Power Lithium Battery

Application Structure of Lithium Battery in China, 2014

Global Shipments of Lithium Battery by Demand, 2010-2018E

Market Share of Global Small Lithium Battery Companies, 2014

Market Share of Global Electric Passenger Vehicle Battery Companies, 2014

Output of Auto by Models and Battery, 2015

Market Share of Major Battery Companies, 2015H1

Shipments of Major Battery Companies, 2015H1 (MWh)

Global Market Share of Ni-MH Battery in Main Applications, 2014

Global Small Ni-MH Battery Shipments and Market Size, 2010-2015

Global Large Ni-MH Battery (for HEV) Shipments and Market Size, 2010-2015

Operating Principle Diagram of Hybrid Vehicle E-drive System

Evaluation Matrix for Different-Motor Technologies

Power Distribution Unit of Toyota Prius

Toyota THS III Single Planetary Gear Set Structure

E-drive System Structure of GM Volt

Planetary Mechanism Powertrain of Ford

Full Hybrid System of Geely

Single-axle Parallel Core Assembly Technology of Honda

PII-Dual Clutch Single-axle Parallel System of Changan Automobile

Mercedes-Benz S500eL Plug-in Hybrid (7-spd Automatic Gearbox + Emotor)

BMW 530Le (2.0T+8AT+E-motor)

Power Dividing Mechanism of BYD Qin

Structure of SAIC EDU gen1 E-drive Gearbox System

SAIC EDU gen1 E-drive System Structure and EDU Parameters

Honda Fit (1.3T+6DCT)

Structural Diagram of Inter-axial Coupled E-drive System

Inter-axial Coupled E-drive System of Volvo S60L Plug-in

Inter-axial Coupled E-drive System of BMW i8 Plug-in Hybrid

Voltage class of Different Hybrid Systems

Transmissions Adopted by OEMs for Hybrid Vehicles

Diagram of A Mild Hybrid System Control

Global Electric Passenger Vehicle Sales in Major Countries/Regions, 2013-2015

Global Monthly Sales of New Energy Vehicles (EV&PHEV), 2014-2015

Sales of Global Top20 Electric Passenger Vehicles, 2013-2015

Global Electric Passenger Vehicle (EV&PHEV) Sales, 2011-2020E

Global Sales of New Vehicles Originally Carrying Start-Stop System, 2014-2020E

Global OEMs’ Start-Stop System Promotion Plans

Global Auto Model (Carrying 12V Start-Stop System and 48V System) Sales, 2018/2020/2025E

Global Sales of Main Available Plug-in Hybrid Passenger Vehicles, 2010-Jan-Oct 2015

Global Sales of Energy-saving and Electric Vehicles (EV/PHEV/HEV), 2009-2015

Global HEV/PHEV/EV Sales by System Voltage, 2018/2020/2025E

Global Moves of Technical Policies on Electric Vehicle and Market Share Forecast by Region

EV/PHEV Sales in Japan, 2013-2015

HEV Sales in Japan, 2013-2015

EV/PHEV Sales in the United States, 2013-2015

HEV Sales in the United States, 2011-2015

Sales Ranking of New Energy Vehicles (EV&PHEV) by Model in the United States, 2015

Automotive Start-Stop System (OEM + AM) Shipments in Europe, 2014-2020E

Sales of Vehicles Originally Carrying Start-Stop System in Europe, 2014-2020E

EV/PHEV Sales in Europe, 2013-2015

HEV Sales in Europe, 2013-2015

Sales Ranking of New Energy Vehicles (EV&PHEV) by Model in Europe, 2015

Car Ownership and Output & Sales in China, 2010-2018E

EV Output & Sales in China, 2010-2015

Electric Vehicles (EV&PHEV) Output in China, Jan-Dec 2015

Electric Vehicles (EV&PHEV) Sales in China, 2011-2020E

Conventional Hybrid Vehicle (HEV) Sales in China, 2012-2020E

Electric Passenger Vehicle (EV&PHEV) Sales in China, 2011-2020E

Electric Passenger Vehicle (EV&PHEV) Sales in China, Jan-Dec 2015

Electric Commercial Vehicle Output in China, Jan-Dec 2015

EV Promotion Plans in China, 2014-2015

Electric Bus Output in China, Jan-Dec 2015

Battery Electric Truck Output in China, Jan-Dec 2015

Electric Commercial Vehicle (EV&PHEV) Sales in China, 2011-2020E

OEM Start-Stop Battery System Shipments and Penetration in China, 2013-2018E

Ratio of Auto Brands Carrying Start-Stop Battery in China

Market Size of Lead-Acid Battery for Start-Stop System in China, 2013-2018E

Performance Parameters of Three Plug-in Hybrids (BYD Tang, BMW X5 and Volvo SC90)

Chinese OEMs’ Hybrid Vehicle Development Plans

Sales of Four Toyota Hybrid Models (Domestically-made), Jan-Dec 2015

China’s Energy-saving and Electric Passenger Vehicle (EV/PHEV/HEV) Imports, Jan-Dec 2015

China’s Full Hybrid Vehicle (HEV/PHEV) Sales, 2012-2020E

Main Financial Indices of Johnson Controls, 2011-2015

Revenue Breakdown of Johnson Controls by Division, FY2013-FY2015

Automotive Start-Stop Battery Performance Parameters and Technical Solutions of Johnson Controls

Mild-hybrid Vehicle Battery Performance Parameters and Technical Solutions of Johnson Controls

Hybrid Vehicle High-voltage Battery System Performance Parameters and Technical Solutions of Johnson Controls

Plug-in Hybrid Vehicle and Battery Electric Vehicle Battery Performance Parameters and Technical Solutions of Johnson Controls

Johnson Controls’ Automotive AGM Lead-Acid Battery Factories in China

Johnson Controls’ Battery Business and Capacity in China

Main Financial Indices of Continental, 2011-2015

Revenue Breakdown of Continental by Division, FY2014

48V Mild-hybrid System Composition of Continental

Technical Comparison of Three 48V Systems of Continental

Performance Parameters of Continental’s BSG (Belt Starter Generator) Motor

48V System and High-voltage System of Continental

Expected Rate of Fuel Saving of Start-Stop/48V+BSG/HEV+BSG Systems of Continental

Third-generation Drive Motors of Continental

Main Financial Indices of Delphi, 2011-2015

Revenue Breakdown of Delphi by Division, FY2013-FY2015

Delphi's Global Hybrid Vehicle Design Center

Delphi's Global Hybrid Vehicle R&D and Manufacturing Center

Electric Vehicle Products and System Portfolios of Delphi

High-voltage Connectors of Delphi

Delphi’s High-voltage/Shielded Wiring Harness Assembly

Delphi’s High-voltage Electrical Control Center

Delphi’s Wireless Charging System

Delphi’s Integrated 48V Mild-hybrid Controller

Delphi’s High Voltage Inverters

Delphi’s Portable On-board Chargers

Delphi’s AC Charging Sockets

Delphi’s DC Charging Sockets

Delphi’s GDi Engine Management System

Main Financial Indices of Bosch, 2011-2015

Revenue Structure of Bosch by Division, FY2012-FY2014

Structural Diagram of Bosch–PSA Hydraulic Hybrid Powertrain System

Comparison of Solid-state Lithium Batteries and Liquid Lithium Batteries of Bosch

Bosch Seeo Solid-state Lithium Battery Cell and Module

Competitive Matrix of Next-generation Battery Tech Companies

Main Financial Indices of Schaeffler, 2011-2015

Revenue Structure of Schaeffler by Division, FY2013-FY2015

Structure of Schaeffler’s P2 Hybrid System

Actual Picture of Schaeffler’s P2 Hybrid System

Schaeffler’s Two-gear Low-voltage Bridge: Coaxial Design

Main Financial Indices of Valeo, 2011-2015

Valeo’s Five Major Product Lines for Improving Fuel Economy

Main Parts for Valeo’s 12V i-StARS Start-Stop System

Valeo’s i-BSG Hybrid System

Main Parts for Valeo’s 48V Mild-hybrid System

Valeo’s Hybrid Technology Roadmap

Valeo’s Hybrid Powertrain System Parts Produced in China

Main Financial Indices of GKN, 2011-2015

GKN eAxles Hybrid Driveline

Equity Diagram of Corun PEVE Automotive Battery

Equity Diagram of CHS

Hybrid Vehicle Sales of Toyota, 1997-2015

Technical Characteristics of First/Second/Third-generation Prius Hybrids

Toyota 2.4L FR Automotive Hybrid Transmission L210

Parameters of Prius Hybrid Systems

Prius THS-II Hybrid System Structure

Power Distribution Unit of Prius THS-II Hybrid System

Operating Principle Diagram of Toyota Series-Parallel Hybrid System

Toyota Hybrid System- Ni-MH Battery Pack

Toyota Hybrid System- Drive Motor

Toyota Hybrid System- Regenerative Brake

Toyota Hybrid System- Power Control Unit

Toyota Hybrid System- Gasoline Engine

Toyota Hybrid System- Power Split Device

Toyota Hybrid System- Power Generator

Toyota Hybrid System- Power Electronic Control System

Prices of Toyota Fuel Vehicles and Hybrids in China

Sales of Four Toyota Hybrid Models (Domestically-made), Jan-Dec 2015

Golf GTE PHEV- P2 Hybrid System

Golf GTE PHEV- Powertrain

Structural Diagram of Hybrid Electric Module of Golf GTE PHEV

Structural Diagram of Golf GTE PHEV

Structural Diagram of Audi A3 e-tron Hybrid System

Main Parts of Audi A3 e-tron Hybrid System

Main Parts of Audi A3 e-tron Power System

Audi A6 L e-Tron Plug-in Hybrid

Volkswagen C Coupe GTE Plug-in Hybrid

Structural Diagram of GM Cadillac CT6 Plug-in Hybrid System

GM Cadillac CT6 Plug-in Hybrid- e-CVT Transmission

GM Cadillac CT6 Plug-in Hybrid- Battery Module Unit

Structural Diagram of GM Volt Plug-in Hybrid System

Structural Diagram of 2016 GM Voltec Powertrain System

Structural Diagram of GM Volt Power Distribution System

Diagram of GM Voltec/Toyota THS Hybrid System Power Distribution Mechanism

Structural Diagram of 2016 Chevrolet Volt Electric Drive Axle

Operating Principle Diagram of GM Voltec Hybrid System

Suppliers and Places of Origin of Core Parts for 2016 Chevrolet Volt

Structural Diagram of Outlander Plug-in Hybrid System

Structural Diagram of Outlander Power System

Structural Diagram of Volvo T8 Hybrid Powertrain

Comparison of Volvo SX60 T8 Hybrid and Mercedes Benz GLC 350e Hybrid

BMW ActiveHybrid

Structural Diagram of BMW IMA Hybrid Powertrain

BMW 5 Series with Power Batteries Mounted in the Rear of Vehicle

Structural Diagram of BMW i8 Plug-in Hybrid System

Car Output and Sales of BYD, 2010-2015

Revenue, Net Income and Gross Margin of BYD, 2007-2015

Structural Diagram of BYD Qin DM Second-generation Hybrid System

Engine Compartment Layout of BYD Qin

Electric Mileage and Fuel Consumption: BYD Qin VS. Toyota Prius

Structural Diagram of BYD Qin Plug-in Hybrid System

Structural Diagram of BYD Tang Electric Drive System

Structural Diagram of BYD Tang Front Axle Drive Unit

BYD Tang with Battery System Mounted in the Middle of Chassis

Structural Diagram of BYD Tang Rear Axle Electric Drive Unit

Car Output and Sales of Geely, 2010-2015

Revenue and Net Income of Geely, 2009-2014

Car Output and Sales of SAIC Motor, 2010-2015

Revenue and Net Income of SAIC Motor, 2010-2014

Structural Diagram of SAIC Roewe e550 Plug-in Hybrid System

Structure of SAIC Roewe 550 Plug-in Powertrain

Schematic Diagram of Gen 1 EDU Electric Drive Transmission Indigenously Developed by SAIC

Structural Diagram of Gen 1 EDU Electric Drive Transmission System Indigenously Developed by SAIC

Comprehensive Performance Parameters of SAIC EDU Electric Drive Transmission

Operating Principle and Performance Parameters of Engine, ISG Motor, and TM Motor of SAIC Roewe 550 Plug-in

SAIC Roewe 550 Plug-in Power Control Unit

Main Parts of SAIC Roewe 550 Plug-in Power System

Suppliers of Main Parts for SAIC Roewe 550 Plug-in

Car Output and Sales of GAC Group, 2010-2015

Revenue and Net Income of GAC Group, 2011-2015

New Energy Vehicle Lineup of GAC Group

如果这份报告不能满足您的要求,我们还可以为您定制报告,请 留言说明您的详细需求。

|