《2016年全球及中国汽车照明行业研究报告》包含以下内容:

1、头灯设计现状与趋势

2、激光/OLED/AFS/ADB/夜视系统技术分析

3、全球及中国汽车照明市场规模与预测

4、全球及中国汽车照明产业竞争格局

5、全球及中国汽车LED产业竞争格局

6、全球刹车系统和EPS厂家研究

2015年全球汽车照明市场规模大约270亿美元,比2014年增长3.8%,预计2016年为275亿美元,比2015年增长1.9%。增速放缓的原因如下:

中美市场增速都放缓

中美市场增速都放缓

欧元和日元大幅度贬值

欧元和日元大幅度贬值

LED颗粒价格持续下跌,LED灯的价格也持续下滑

LED颗粒价格持续下跌,LED灯的价格也持续下滑

油价下跌,车灯的原材料之一有机玻璃的价格下跌

油价下跌,车灯的原材料之一有机玻璃的价格下跌

2015全球OEM汽车照明市场大约240亿美元,维修和改装市场各15亿美元左右。维修市场规模稳定,改装市场随着原配氙灯比例增加而逐渐下滑。

Adaptive Driving Beam (ADB)功能必须使用LED 大灯,同时LED低功耗,设计相对HID简化,同时LED的价格持续下降,使得LED头灯使用比例快速增加,预计将从2015年的9%增加到2020年的27%。同时氙灯因为高亮度在中高端市场仍然有一席之地,会稳定在14%左右。特别是在中国,人们追求时尚与炫丽,氙灯是他们最热衷的,中国的中高端市场氙灯的比例依然会高过LED。而激光大灯成本太高,预计到2019年才有1%的比例。预计ADB的渗透率将从2015年的5%增加到2020年的25%,AFS则从2015年的10%增加到2020年的23%,并且中国区的比例会到30%。

Global and China Automotive Lighting Industry Report, 2016 focuses on the followings:

1, Status quo and trend of headlight design

2, Technical analysis on laser/OLED/AFS/ADB/night vision system

3, Global and Chinese automotive lighting market size and forecast

4, Competitive landscape of global and China automotive lighting industry

5, Competitive landscape of global and China automotive LED industry

6, Global brake system and EPS manufacturers

Global automotive lighting market size was USD27 billion in 2015, up 3.8% from a year earlier, and is expected to grow by 1.9% year on year to USD27.5 billion in 2016. The reasons for the slowdown are as follows:

Slowdown in both Chinese and American markets

Slowdown in both Chinese and American markets

Drastic devaluation of the euro and the yen

Drastic devaluation of the euro and the yen

Continued decline in prices of LED dies and LED lamps

Continued decline in prices of LED dies and LED lamps

Falling prices of oil and plexiglass (a raw material of headlights)

Falling prices of oil and plexiglass (a raw material of headlights)

In 2015, the global OEM automotive lighting market valued about USD24 billion, while the maintenance and modification markets fetched about USD1.5 billion each. The maintenance market remained stable, but the modification market witnessed gradual decline with the growth of pre-installed xenon lamps.

Adaptive Driving Beam (ADB) must be with LED headlights. Low power consumption, simple design (compared with HID) and dropping prices of LED propel the application of LED headlights quickly as the share may increase from 9% in 2015 to 27% in 2020. At the same time, xenon lamps still occupy a place in the medium and high-end market because of the high brightness, and the share herein will stabilize at around 14%. Especially in China, people are enthusiastic about xenon lamps because they meet their pursuit for fashion and dazzling, so such lamps will still be more popular than LED in Chinese medium and high-end market. Due to high costs, laser headlights are expected to seize the share of only 1% in 2019. The ADB penetration rate will jump from 5% in 2015 to 25% in 2020, the AFS penetration rate will escalate from 10% in 2015 to 23% in 2020, and China will see 30%.

第一章 头灯设计

1、奔驰新一代LED头灯

2、卡迪拉克CTS 头灯设计

3、奥迪与宝马头灯设计

4、本田与雷克萨斯头灯设计

第二章 激光/OLED/AFS/ADB/夜视系统

5、宝马激光大灯

6、奥迪Sport Quattro激光大灯

7、奥迪R8 LMX激光大灯

8、OLED尾灯

9、奥迪OLED尾灯

10、2015-2020年AFS/ADB渗透率

11、AFS简介与系统构成

12、AFS ECU

13、AFS动作原理

14、OSRAM 开发的LED PIXELATED AFS

15、HBA(high beam assist)/ Adaptive Driving Beam (ADB)

16、HBA(high beam assist)必须LED大灯

17、HBA(high beam assist)Image Sensor

18、Gentex Smart Beam Overview

19、HW-Architecture of SmartBeam

20、Night Vision Overview

21、FLIR PathfindIR and Lens

22、Night Vision Static

23、BMW Night Vision

24、Night Vision Trend

25、2012-2020 FIR Camera Market Volume and ASP

26、FLIR简介

第三章 汽车照明市场与产业

27、2010-2020年全球汽车照明市场规模

28、2015-2020全球头灯出货量技术分布

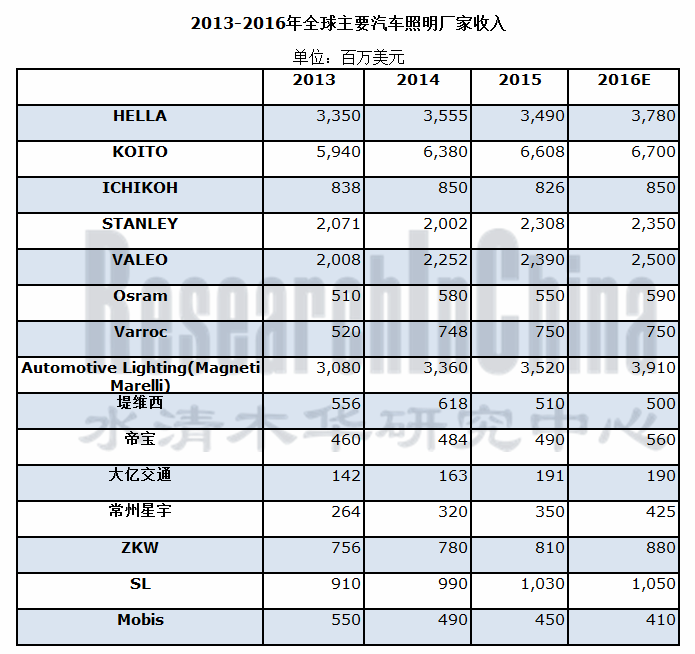

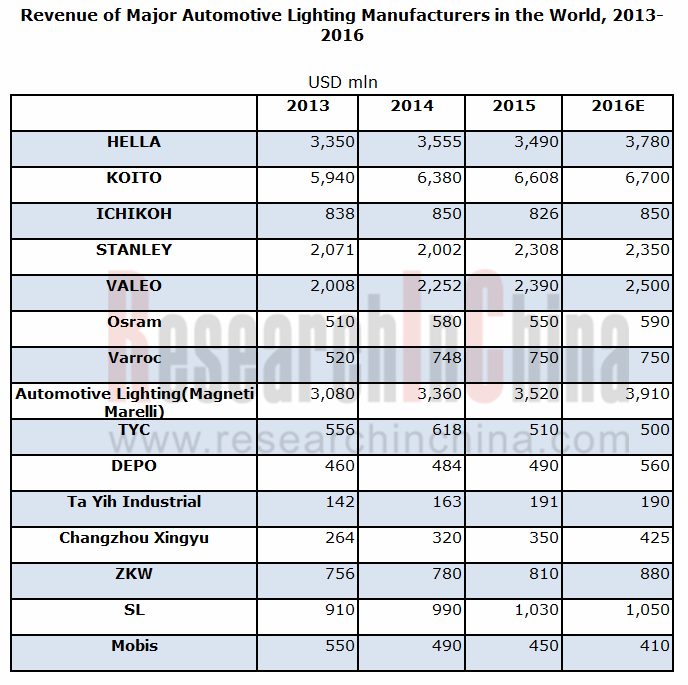

29、2013-2016年全球主要汽车照明厂家收入

30、2015年全球头灯主要厂家市场占有率(出货量)

31、2015年丰田汽车照明系统主要供应商供应比例

32、2015年本田汽车照明系统主要供应商供应比例

33、2014年日产雷诺汽车照明系统主要供应商供应比例

34、2015年通用汽车照明系统主要供应商供应比例

35、2015年福特汽车照明系统主要供应商供应比例

36、2015年大众汽车照明系统主要供应商供应比例

37、2015年现代汽车照明系统主要供应商供应比例

38、2010-2020年中国汽车照明市场规模

39、中国主要车灯厂家市场占有率

40、中国车灯厂家与品牌厂家供应关系

第四章 汽车LED产业

41、2014-2020年全球LED市场应用分布

42、2013-2015年全球十大LED厂家收入排名

43、2015年汽车LED供应商市场占有率

44、2003-2015年日亚化学收入与运营利润率

45、Osram简介

46、Osram主打高端和售后市场

47、2008-2016财年丰田合成LED业务收入

48、Lumileds

第五章 汽车照明厂家研究

1、小糸

2、Hella

3、Automotive Lighting

4、斯坦雷

5、ZKW

6、Valeo

7、市光

9、韩国SL

10、Varroc

11、TYC

12、帝宝

13、大亿交通

14、常州星宇

15、江苏彤明车灯

16、南宁燎旺车灯

17、丽清科技

1 Headlight Design

1.1 Benz's New-generation LED Headlight

1.2 Cadillac's CTS Headlight

1.3 Audi’s and BMW’s Headlight

1.4 Honda’s and Lexus’ Headlight

2 Laser/OLED/AFS/ADB/Night Vision System

2.1 BMW’s Laser Headlight

2.2 Audi’s Sport Quattro Laser Headlight

2.3 Audi’s R8 LMX Laser Headlight

2.4 OLED Taillight

2.5 Audi’s OLED Taillight

2.6 AFS/ADB Penetration Rate in 2015-2020

2.7 Introduction to AFS and System Structure

2.8 AFS ECU

2.9 AFS WorkingPrinciple

2.10 OSRAM’s LED PIXELATED AFS

2.11 HBA (high beam assist) / Adaptive Driving Beam (ADB)

2.12 HBA (high beam assist) Must Be withLED Headlights

2.13 HBA (high beam assist) Image Sensor

2.14 Gentex Smart Beam Overview

2.15 HW-Architecture of SmartBeam

2.16 Night Vision Overview

2.17 FLIR PathfindIR and Lens

2.18 Night Vision Static

2.19 BMW’s Night Vision

2.20 Night Vision Trend

2.21 FIR Camera Market Volume and ASP in 2012-2020E

2.22 Introduction to FLIR

3. Automotive Lighting Market and Industry

3.1 Global Automotive Lighting Market Size, 2010-2020E

3.2 Global Headlight Shipment by Technology, 2015-2020E

3.3 Revenue of Major Automotive Lighting Manufacturers in the World, 2013-2016

3.4 Market Share of Global Major Headlight Manufacturers (by Shipment), 2015

3.5 Automotive Lighting System Supply Structure of Toyota, 2015

3.6 Automotive Lighting System Supply Structure of Honda, 2015

3.7 Automotive Lighting System Supply Structure of Nissan Renault, 2014

3.8 Automotive Lighting System Supply Structure of GM, 2015

3.9 Automotive Lighting System Supply Structure of Ford, 2015

3.10 Automotive Lighting System Supply Structure of VW, 2015

3.11 Automotive Lighting System Supply Structure of Hyundai, 2015

3.12 Chinese Automotive Lighting Market Size, 2010-2020E

3.13 Market Share of Chinese Major Headlight Manufacturers

3.14 Supply Relationship between Chinese Headlight Manufacturers and Car Makers

4 Automotive LED Industry

4.1 Global LED Applications, 2014-2020E

4.2 Ranking of Global Top 10 LED Manufacturers by Revenue, 2013-2015

4.3 Market Share of Automotive LED Suppliers, 2015

4.4 Nichia’s Revenue and Operating Margin, 2003-2015

4.5 Profile of Osram

4.6 Osram Targets High-end Market and Aftermarket

4.7 LED Revenue of Toyoda Gosei , FY2008-FY2016

4.8 Lumileds

5. Automotive Lighting Companies

5.1 Koito

5.2 Hella

5.3 Automotive Lighting

5.4 Stanley

5.5 ZKW

5.6 Valeo

5.7 Ichikoh

5.8 South Korea SL

5.9 Varroc

5.10 TYC

5.11 DEPO

5.12 Ta Yih Industrial

5.13 Changzhou Xingyu Automotive Lighting Systems

5.14 Jiangsu Tongming

5.15 Liaowang Automotive Lamp

5.16 Laster Tech